There has been much discussion about the likely failure of Thames Water in the last day or so. I’ve been looking at the accounts of England’s water companies for the last twenty years. My conclusion is that they are all environmentally insolvent. So, a thread…..

[Please note this is a long thread. If it appears to stop midway just hit ‘See more replies’ and the rest should appear]

There are nine companies in England that take away sewage. There are more that supply water alone. But the crisis that the English water companies face largely relates to sewage so my work has looked at the ones that take our waste away.

Thames Water is one of those sewage companies. The others are Anglian Water, Northumbrian Water, Severn Trent, South West Water, Southern Water, United Utilities, Wessex Water and Yorkshire Water.

It’s important to say that although I used the accounts of each of these companies in my work, the results I am talking about here or for the industry as a whole. To get a proper picture of the water and sewage industry I combined their accounts into one single set.

Doing so produced some quite astonishing data. This is what the profit and loss accounts of the combined water and sewage companies of the UK looks like for 2022 in isolation, for 2003 to 2022 in total, and on average over that period:

There is a lot of data there. There are, however, some straightforward facts to concentrate on.

Firstly, the operating profit margin in this industry is 35%. That is staggeringly high, and it goes up to 38% when other income is taken into account. 38p in every pound you pay for water is operating profit i.e. profit before the cost of borrowing.

Second, note the cost of borrowing. I have generously offset interest received against interest paid. That still leaves interest costs representing an average 20% of income. 20p in every pound paid to these companies, on average, goes on interest.

That still leaves them profitable though. And they do pay tax. The average tax rate is 19%, but that is way below the expected tax rate for this period when the tax rate was as high as 30% for some of it. And much of that tax has not been paid: more than £8bn has been deferred.

Finally, of the almost £25 billion they have made in profit over the years they have paid out every penny, and more, in dividends. In other words, the shareholders have taken 15p in every pound paid for water. There was nothing left for reinvestment, at all.

No wonder the water industry is in trouble. The income statement shows that the public is being fleeced by these companies who are simply treating the fact that the English consumer has had no choice as to who to buy water from as a means to extract profit from them.

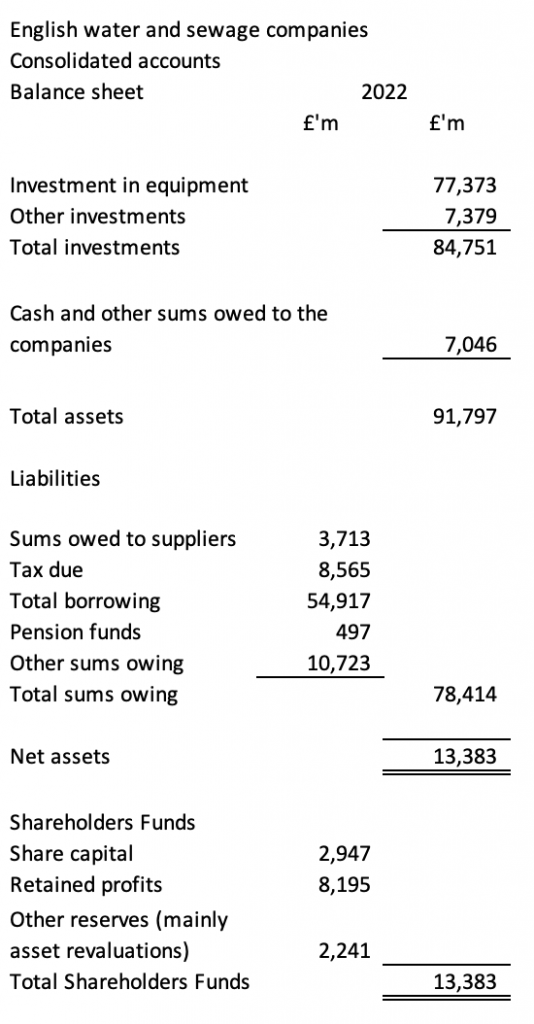

Things are if anything worse if I look at the balance sheets. Now I know these scare most people, so I will talk through the detail. This is a very summarised balance sheet for the industry in 2022:

The industry has £77 billion invested in equipment. The rest of its assets are some financial investments, a bit of cash and sums owing to it from customers. So far, so good.

What is scary is what the industry owes. The £77 billion of equipment is financed, in the main by borrowings of almost £55 billion, or more. It’s also funded by the tax not yet due of more than £8.5 billion, which brings down the cash-paid tax rate of the industry considerably.

Even the pension funds of those working for the industry are contributing to the funding, and there is more borrowing of various sorts in the other sums owing, totalling more than £10.7 billion.

What this means is that of the total near enough £91 billion invested in the sector more than £78 billion is funded by borrowing or sums owing of some sort and only just over £13 billion is funded by the shareholders.

What that also means is that the shareholders provide less than 15% of the overall funding for this industry. So much for the idea that private capital would fund water after privatisation. The reality is that borrowing is doing so.

When I began to look at the data in more depth things only began to get worse. What I was really interested in knowing was how much the water companies had invested in equipment over the twenty years reviewed.

The answer was, in my best estimate, that sum was £89.8 billion. Of course, some of that has now worn out and has long gone from the accounts. Assets like vans and computers do not last that long in use.

Then I worked out how that investment was funded. There were just two ways. One was out of operating income. For the technically minded this is possible using what is called the depreciation charge in the accounts. This sum amounted to £38.9 billion. Customers provide this money.

The rest of the funding came from the increase in borrowing over the period. That amounted to £40.5 billion. Other long-term liabilities, which are again mainly borrowing or pension fund liabilities, increased over the same period by £10.4 billion.

The net result is that of the £89.8bn invested, customers or borrowing of various sorts provided £89.8bn of the funding meaning the shareholders effectively made no investment in the assets of these businesses, at all.

This matters for one very good reason. As we all know these businesses are now routinely polluting England’s rivers and beaches with sewage. That sewage comes from what are called storm overflows, although that’s a misnomer now, as many release sewage even after modest rainfall.

That pollution cannot persist. Unless it is stopped we will end up without reliable clean water in England. The estimated costs of ending this pollution do, however, vary considerably.

The industry has offered to invest £10 billion over seven years, or £1.4 billion a year. The government has decided that £56 billion is required over 27 years, or just over £2 billion a year. The trouble is neither sum will come close to getting rid of the crap in England’s water

The House of Lords looked at this issue based on independent analysis and concluded that the most likely estimate of the cost of getting rid of all the pollution in our water was £260 billion. And that needs to be done as soon as possible. I suggest ten years.

If that investment of £260 billion was made, we might have clean water in ten years.

What the industry is offering is something quite different. Even if they meet the government’s demand of them, at best I estimate that based on officially published data they might cut the crap in water by two-thirds, at best, by 2050.

So why has the government set such a low investment target that still leaves us with polluted water? The only possible answer is that they wanted to make sure that the private water companies would not go bust by having to spend too much.

Let me put that another way. The government thinks that saving the private water companies is more important than them polluting our water, rivers and beaches with all the costs that will create.

The government has made the wrong decision. But if the required £260 billion was spent (with more required to become net zero compliant) then the water companies would go bust. What that means is that they are environmentally insolvent.

The concept of environmental insolvency applies to any business that cannot adapt to make its business environmentally friendly – as climate change and ending pollution requires – and still make a profit. What it means is that its business model is bankrupt.

That is where the English water industry is now. Thames Water might be facing environmental bankruptcy, but this industry as a whole is in my opinion incapable of funding the investment required to deliver clean water and be profitable.

The government might be making noises about taking Thames Water into temporary public ownership, but that is meaningless when Thames Water can never be profitable and deliver clean water. There is only one answer for this industry now, and that is nationalisation.

I would suggest that this nationalisation should be without any compensation to shareholders. That is because their businesses are environmentally insolvent. Providers of loans might also have to take a hit too: they made a bad decision lending to these companies.

The government will then have to support the industry using borrowed funds. I suggest it should issue water bonds via ISAs to the public to do this. Wouldn’t you want to save in a way that ensures we all get clean water in the future? I would.

And the way in which water is charged for might have to change. The idea that we all pay the same price per unit irrespective of the amount of water used seems absurd now and might need reconsideration.

But my essential point is that the water industry has to now be nationalised because it is not only failing us already but on the basis of current plans will probably do so forever, and that is not only not good enough, but is really dangerous to our wellbeing.

Our politicians have to now say it is time to end the shit in our water and take control of this industry to make sure that we get clean water. After all, if they cannot guarantee clean water – an absolute essential for life – what are they for?

Finally, a few technical notes. First, this analysis is based on the activities of the companies actually supplying both water and sewage services in England. It is not based on the groups of which they are members.

Second, the conclusions are based on aggregate data. They cannot be applied to any one company.

Third, the data used is extracted from databases but is correct to the best of my belief based on that limitation.

Third, the data used is extracted from databases but is correct to the best of my belief based on that limitation.

And, if you want to see the report on which this thread is based it is here. https://t.co/niYac92Tnftaxresearch.org.uk/Blog/2023/06/2…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter