Memasuki 2nd year di Harvard Business School. If you want to rise from no-name upstart company to a global industry titan, how would you structure your curriculum as a founder using HBS electives & other resources? What should be the playbook? A thread

Kira-kira beginilah tahapan evolusi seorang founder dari awal hingga akhir:

A. Founding a company

B. Scaling a company

C. Exiting & liquidity events

D. Investments & wealth management

E. Becoming industry steward and building institutions, markets, and states

A. Founding a company

B. Scaling a company

C. Exiting & liquidity events

D. Investments & wealth management

E. Becoming industry steward and building institutions, markets, and states

A. Founding a company

Fokus di sini adlh reducing uncertainty & risk. Satu quote yang mengubah cara pandangku ttg ini: "Entrepreneurs are in the business of information-production" - gimana caranya kita bisa produksi informasi semurah mungkin karena resource kita terbatas?

Fokus di sini adlh reducing uncertainty & risk. Satu quote yang mengubah cara pandangku ttg ini: "Entrepreneurs are in the business of information-production" - gimana caranya kita bisa produksi informasi semurah mungkin karena resource kita terbatas?

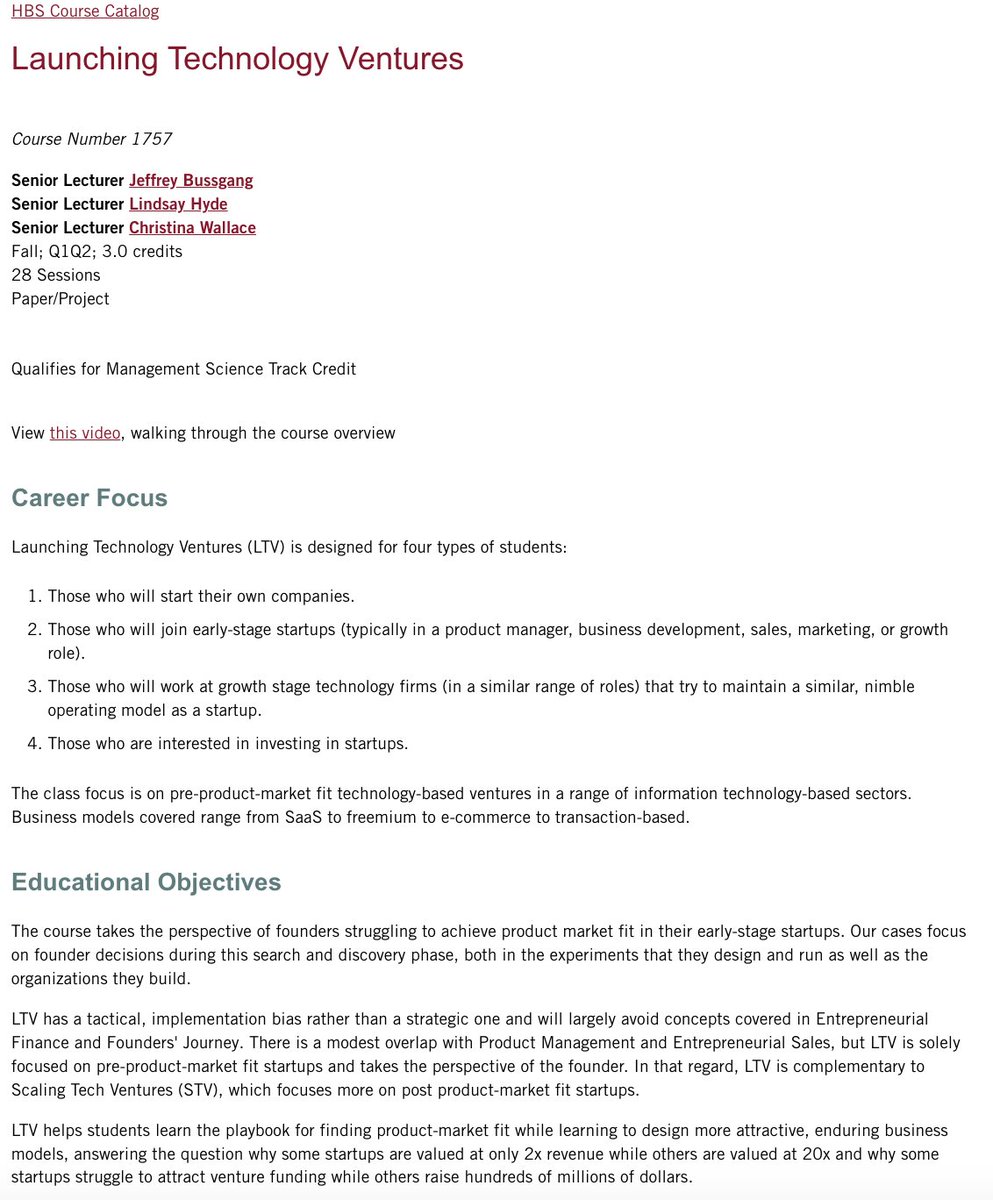

A1. Launching Technology Ventures membahas ttg designing experiments to reach product market fit untuk menjawab kebutuhan di atas. Very popular class

How many experiments are required? Well it can be a lot

https://twitter.com/scottastevenson/status/1657515040507830272

But also on the other hand, you should clearly define your scope of experiments to get the biggest bang of your limited bucks

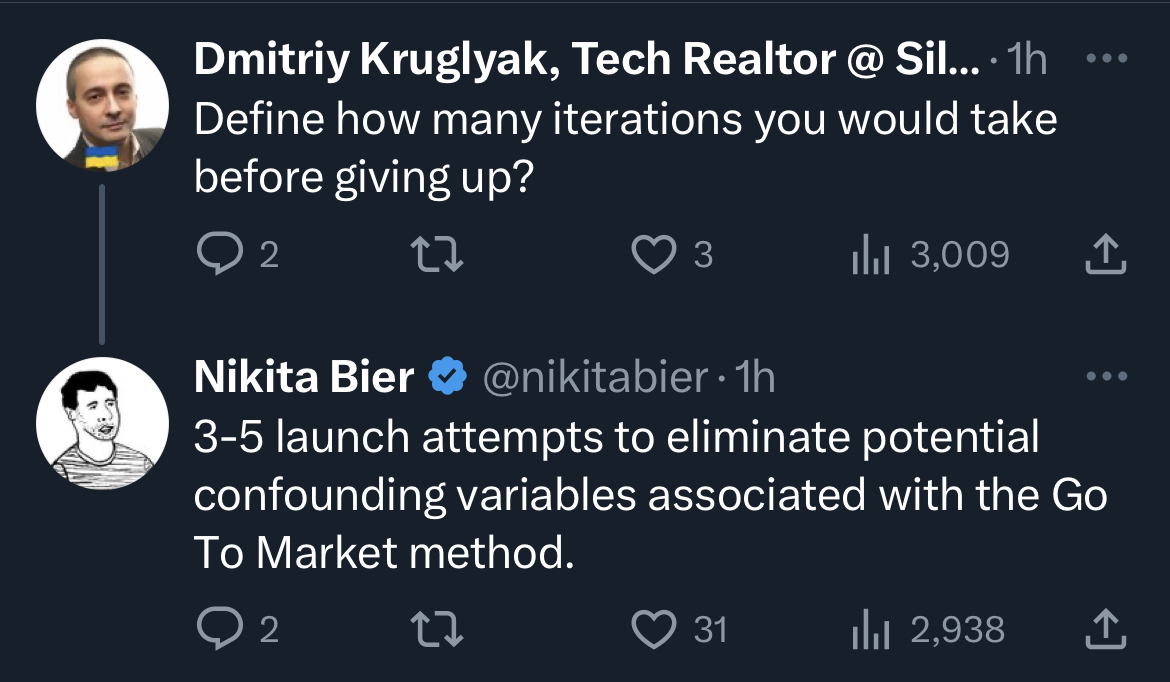

A2. Entrepreneurial Sales 101: Founder Selling

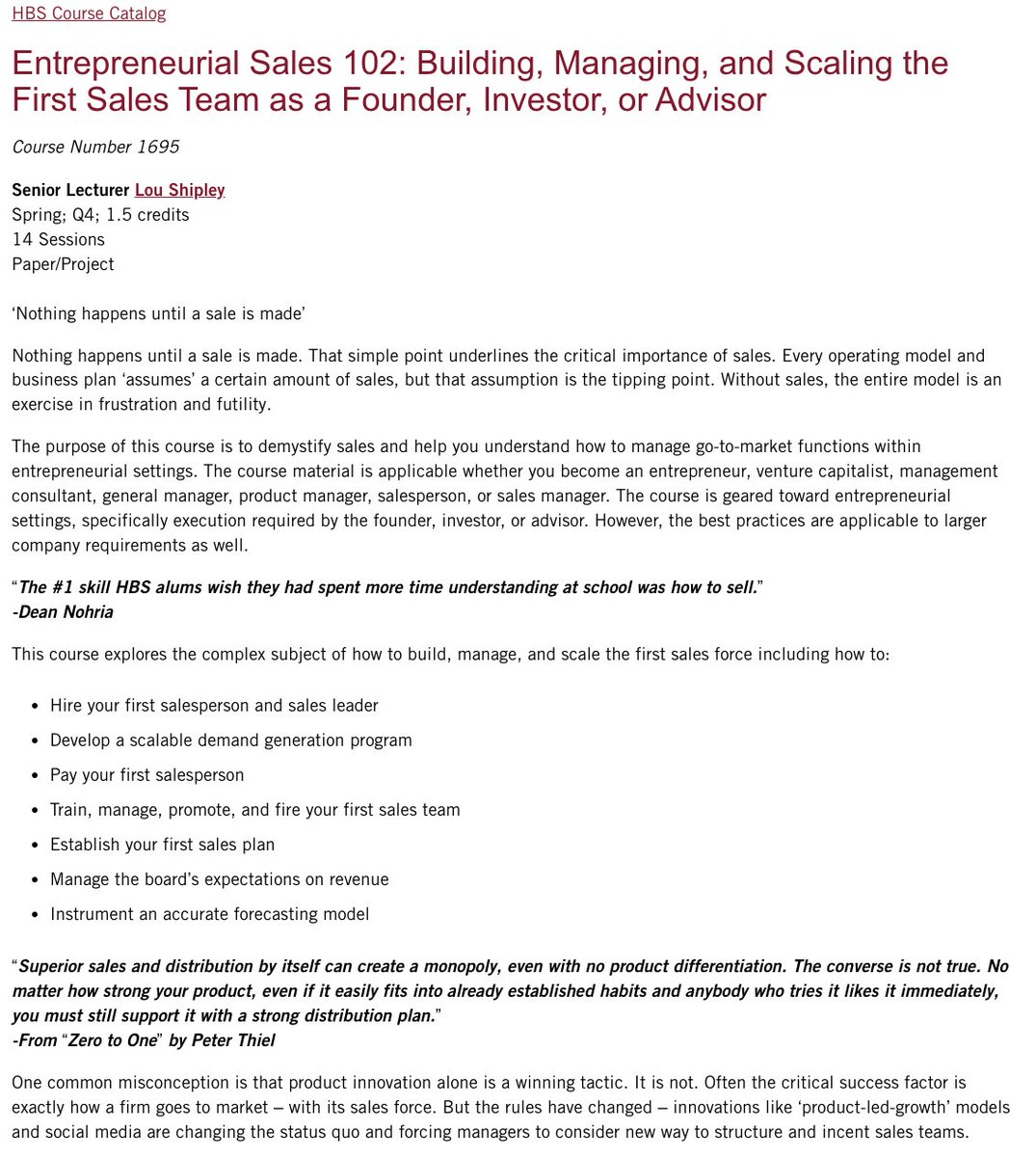

also: Entrepreneurial Sales 102: Building, Managing, and Scaling the First Sales Team as a Founder, Investor, or Advisor

Learn to sell at various company stages!

also: Entrepreneurial Sales 102: Building, Managing, and Scaling the First Sales Team as a Founder, Investor, or Advisor

Learn to sell at various company stages!

Related book (but geared towards B2B SaaS mostly I think) is this:

Founding Sales: The Early Stage Go-to-Market Handbook

amazon.com/Founding-Sales…

Founding Sales: The Early Stage Go-to-Market Handbook

amazon.com/Founding-Sales…

A3. Financial Management of Smaller Firms

You need to sort out your finances. If you are running small cashflow rich business, this will be useful. Mostly geared towards search fund / EtA (Entrepreneurship through Acquisition) - an emerging career path di US.

You need to sort out your finances. If you are running small cashflow rich business, this will be useful. Mostly geared towards search fund / EtA (Entrepreneurship through Acquisition) - an emerging career path di US.

A4. Entrepreneurial Finance

Useful if you decided to take VC investment. Brp duit yg perlu di raise? At what terms? Brp pre-money & post-money valuation? Kasih board seat ga ke investor? Apa itu liquidation preference? SAFE? MFN? etc etc etc. Avoid being screwed by investors

Useful if you decided to take VC investment. Brp duit yg perlu di raise? At what terms? Brp pre-money & post-money valuation? Kasih board seat ga ke investor? Apa itu liquidation preference? SAFE? MFN? etc etc etc. Avoid being screwed by investors

A5. Making Markets

Relevant if you are building some sort of marketplace. My friends who took econ in undergrad described this as "continuation of your auction theory in micro economics". I heard the professor is a genius.

Relevant if you are building some sort of marketplace. My friends who took econ in undergrad described this as "continuation of your auction theory in micro economics". I heard the professor is a genius.

Related resources here.

Look for "Marketplaces: Industry and Evolution" and "Marketplaces: Liquidity and Scaling"

danhock.com/long-form-reads

Look for "Marketplaces: Industry and Evolution" and "Marketplaces: Liquidity and Scaling"

danhock.com/long-form-reads

B. Scaling a company

At this stage, your concern should be: how would you create the machines that create the machines? Your role is shifting from product builder to organization builder - empowering others to do the work

At this stage, your concern should be: how would you create the machines that create the machines? Your role is shifting from product builder to organization builder - empowering others to do the work

B1. Systems to Scale Growth-Stage Ventures (SGSV)

Learn to become Chief Operating Officer (COO). You will deal with systems, processes, and people. Good to learn for Series B+ companies when you already hit product-market fit and ready to scale the hell out of it

Learn to become Chief Operating Officer (COO). You will deal with systems, processes, and people. Good to learn for Series B+ companies when you already hit product-market fit and ready to scale the hell out of it

Related book on scaling:

- Scaling People (by ex-COO of Stripe)

- High Growth Handbook: Scaling Startups from 10 to 10,000 People (by ex-VP of Corp. Strat. of Twitter)

- High Output Management (by former CEO of Intel)

- The Making of a Manager

- Scaling People (by ex-COO of Stripe)

- High Growth Handbook: Scaling Startups from 10 to 10,000 People (by ex-VP of Corp. Strat. of Twitter)

- High Output Management (by former CEO of Intel)

- The Making of a Manager

B2. Corporate Financial Operations (CFO)

Relevant for people going to be CFO or CEO who needs to manage their CFO . Learn how to manage cash, risk, capital allocation, and interface with capital market (debt & equity investors) e.g., how would you manage the IPO of your company?

Relevant for people going to be CFO or CEO who needs to manage their CFO . Learn how to manage cash, risk, capital allocation, and interface with capital market (debt & equity investors) e.g., how would you manage the IPO of your company?

B3. Digital Marketing Workshop

Learn about customer acquisitions (quite technical, some HBS students dislike things that are too hands-on LOL)

Learn about customer acquisitions (quite technical, some HBS students dislike things that are too hands-on LOL)

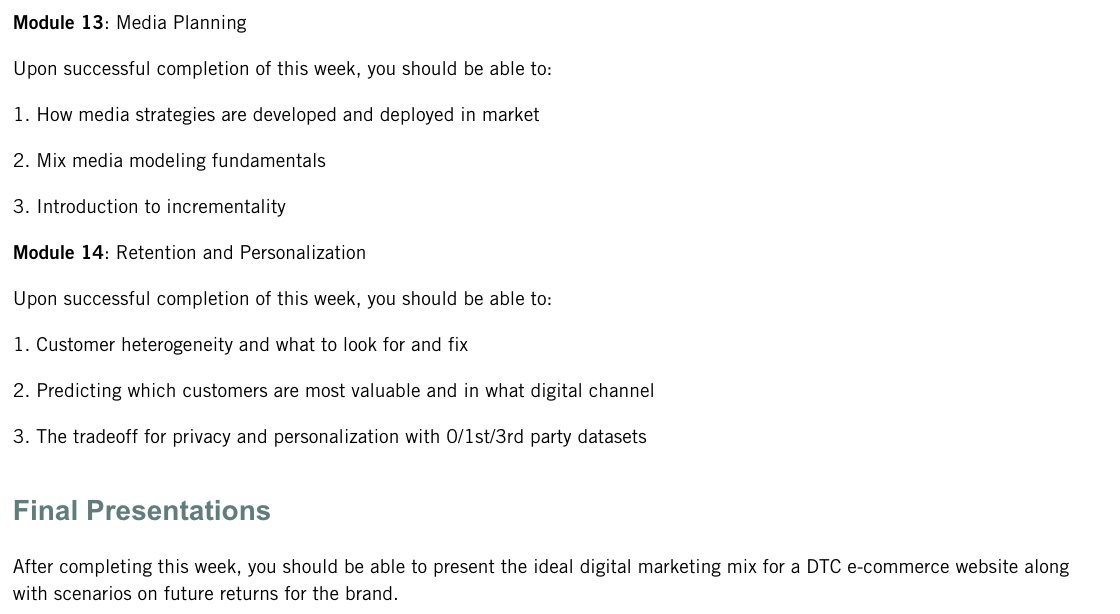

B4. Go To Market Strategies

Relevant to think about GTM across different industries, product categories, and company stages

Relevant to think about GTM across different industries, product categories, and company stages

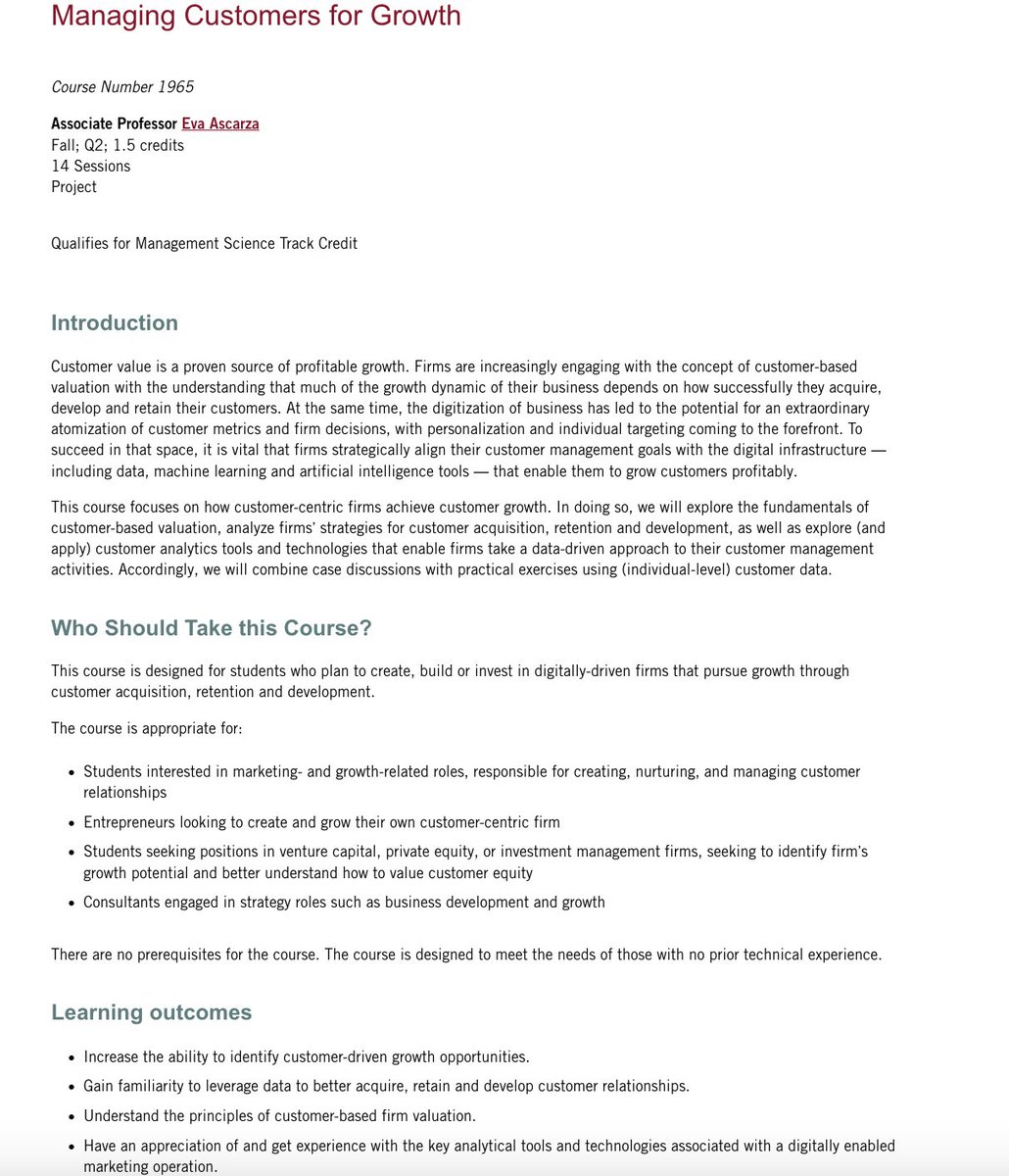

B5. Managing Customers for Growth

After you acquire customers at a certain CAC (customer acquisition cost), how would you maximize their LTV (lifetime value) and minimize churn? This data-intensive course is about those + touches on CBCV (Customer-based company valuation)

After you acquire customers at a certain CAC (customer acquisition cost), how would you maximize their LTV (lifetime value) and minimize churn? This data-intensive course is about those + touches on CBCV (Customer-based company valuation)

B6. Building and Sustaining a Successful Enterprise

Your company is thriving, but can it defend against competitors over time? How are the profit pools divided across value chain? So many startups started in the *wrong* part of the value chain, getting swallowed by incumbents

Your company is thriving, but can it defend against competitors over time? How are the profit pools divided across value chain? So many startups started in the *wrong* part of the value chain, getting swallowed by incumbents

C. Exiting & liquidity events

You have created a company as a sellable asset. If you choose to exit it selling partial chunk (e.g., to external investors), M&A, or IPO, how can you maximize its EV (Enterprise Value)?

You have created a company as a sellable asset. If you choose to exit it selling partial chunk (e.g., to external investors), M&A, or IPO, how can you maximize its EV (Enterprise Value)?

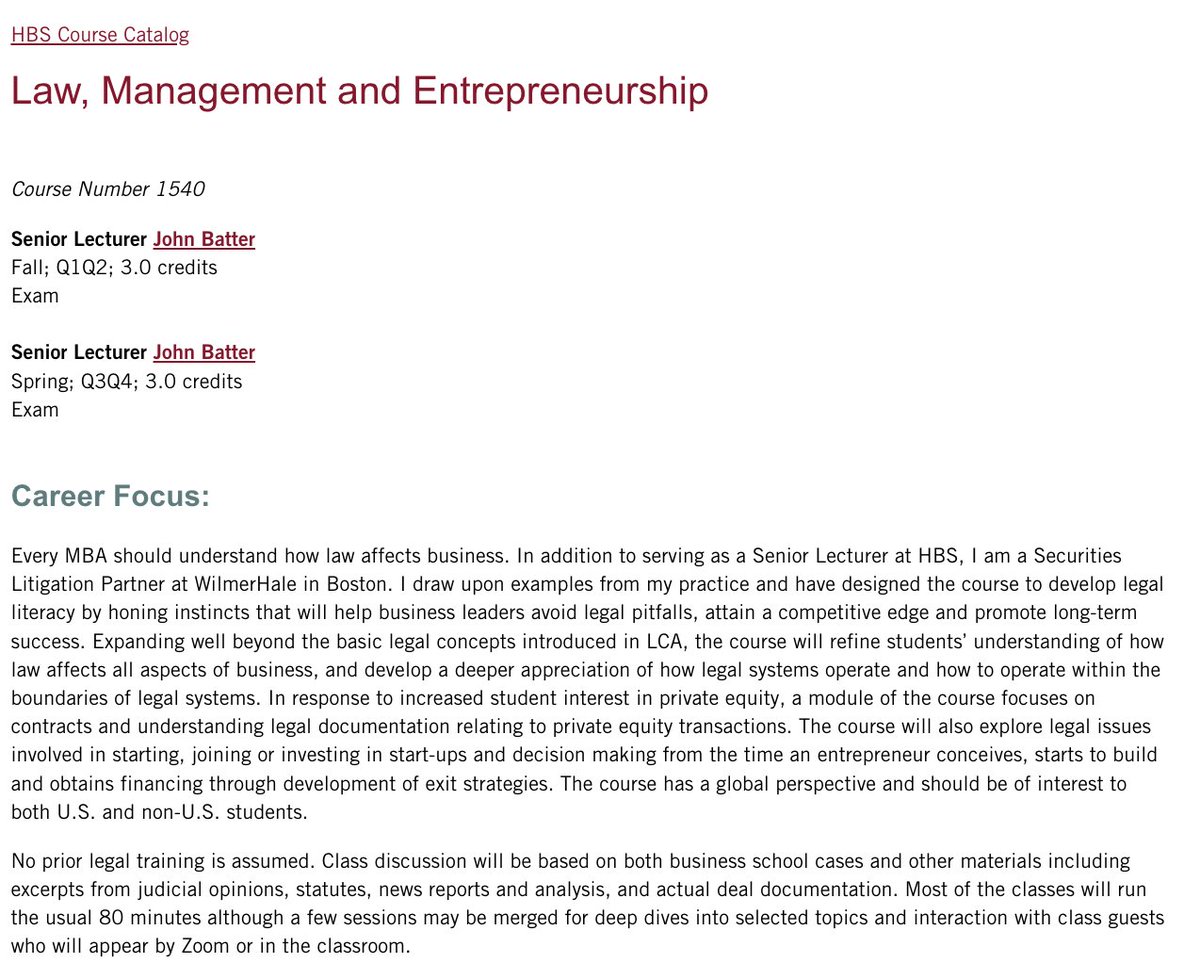

C1. Law, Management and Entrepreneurship

Understanding law is important to protect the value you have worked so hard to create. Learn things from basic contracts to complex blockbuster deals.

Understanding law is important to protect the value you have worked so hard to create. Learn things from basic contracts to complex blockbuster deals.

C2. Negotiation

A very practical & hands-on course with emphasis to live training of negotiations. Moving from simple (two-party, one-shot, price deals) to complex (multiple parties and issues, internal divisions, long time-frames, cross-border deals)

A very practical & hands-on course with emphasis to live training of negotiations. Moving from simple (two-party, one-shot, price deals) to complex (multiple parties and issues, internal divisions, long time-frames, cross-border deals)

Relevant resource:

amazon.com/Never-Split-Di…

amazon.com/Never-Split-Di…

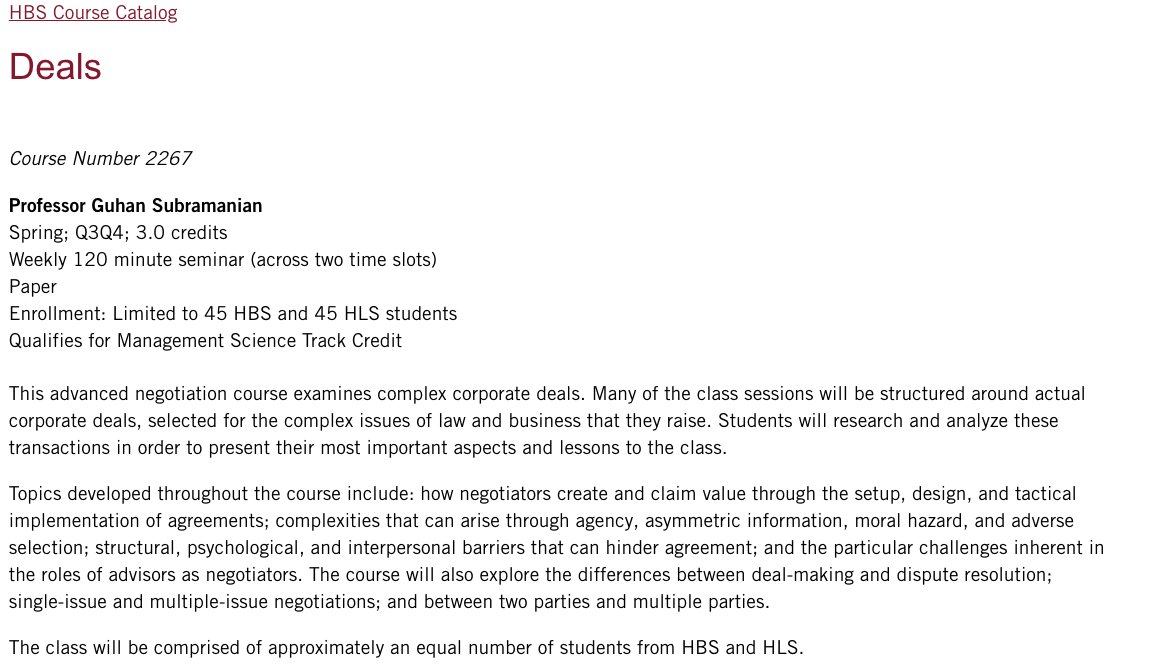

C3. Deals

Joint-class with Harvard Law School (arguably the most hardcore student in Harvard) on complex corporate deals (mostly on acquisitions). A more beefed up version of Negotiation class with more technical terms and legal perspectives

Joint-class with Harvard Law School (arguably the most hardcore student in Harvard) on complex corporate deals (mostly on acquisitions). A more beefed up version of Negotiation class with more technical terms and legal perspectives

Relevant: The professor actually has a book about the class

amazon.com/dp/B085SYPXFL/…

amazon.com/dp/B085SYPXFL/…

C4. Creating Value Through Corporate Restructuring

Covers bankruptcies and restructuring (*il*liquidity event?). Learn about managing inter-creditor conflicts, restructuring country /municipality debts, how vulture hedge funds work. Highest demand finance class among HBS fin bros

Covers bankruptcies and restructuring (*il*liquidity event?). Learn about managing inter-creditor conflicts, restructuring country /municipality debts, how vulture hedge funds work. Highest demand finance class among HBS fin bros

Relevant: The professor also has a book about the class

amazon.com/Creating-Value…

amazon.com/Creating-Value…

D. Investments & wealth management

You have sold your company and created generational wealth. Great, now what to do? You can rest, become an investor with your new money, or continue building the next thing as an entrepreneur. But you still need to manage your new wealth.

You have sold your company and created generational wealth. Great, now what to do? You can rest, become an investor with your new money, or continue building the next thing as an entrepreneur. But you still need to manage your new wealth.

D1. How to Not Bankrupt Your Family

This course teaches about how family office works to preserve and grow the wealth of High Net Worth Individuals and their families

This course teaches about how family office works to preserve and grow the wealth of High Net Worth Individuals and their families

Relevant:

amazon.com/Family-Office-…

amazon.com/Family-Office-…

D2. Investment Management and Capital Markets

Karena sudah kebanyakan uang, strategi investasi uangnya harus berubah. Learn about how to invest & construct portfolio for highest risk-adjusted return across different asset classes (equity, bond, credit, real estate, PE, VC, etc.)

Karena sudah kebanyakan uang, strategi investasi uangnya harus berubah. Learn about how to invest & construct portfolio for highest risk-adjusted return across different asset classes (equity, bond, credit, real estate, PE, VC, etc.)

D3. Business Analysis and Valuation Using Financial Statements

This course is about investing in publicly-traded companies using publicly available information. Public equities (US and Emerging Markets) are usually a big part of a well-constructed portfolio for HNWIs

This course is about investing in publicly-traded companies using publicly available information. Public equities (US and Emerging Markets) are usually a big part of a well-constructed portfolio for HNWIs

D4. Private Equity Finance

On the other hand, this course is about investing in privately-held companies. While your peers are fighting for return offers as MBA associates to PE megafunds /middle markets, you can learn this and create your own fund if you have enough money

On the other hand, this course is about investing in privately-held companies. While your peers are fighting for return offers as MBA associates to PE megafunds /middle markets, you can learn this and create your own fund if you have enough money

D5. Real Estate Private Equity

This is a deep dive for private equity with real estate as its only asset class. Might be more relevant in Indonesia as real estate is more readily available asset vs private equity historically has fewer deal flows.

This is a deep dive for private equity with real estate as its only asset class. Might be more relevant in Indonesia as real estate is more readily available asset vs private equity historically has fewer deal flows.

E. Becoming industry steward and building institutions, markets, and states

You are now a well-established individual with huge resource, battle-hardened with your experience running large & complex organizations. You can bend the world to your will. How exactly will you bend it?

You are now a well-established individual with huge resource, battle-hardened with your experience running large & complex organizations. You can bend the world to your will. How exactly will you bend it?

You live in a country with imperfect institutions, shallow market, and weak state. Will you:

(i) Exploit this to preserve your wealth, perpetuating the oligarchy because that's what you have observed from other people who succeeds before you? or...

amazon.com/Oligarchy-Jeff…

(i) Exploit this to preserve your wealth, perpetuating the oligarchy because that's what you have observed from other people who succeeds before you? or...

amazon.com/Oligarchy-Jeff…

(ii) Choose to do the right thing and contribute to develop & enhance institutions, markets, and the state because you feel the moral responsibility to do so

samoburja.com/gft/

samoburja.com/gft/

E1. Capitalism and the State (CATS)

They call HBS the Mecca of Capitalism for a reason. CATS is a class about philosophy of capitalism. Being aware of underlying value system & moral philosophies (the many flavors of capitalism/other value system) is important in doing reforms

They call HBS the Mecca of Capitalism for a reason. CATS is a class about philosophy of capitalism. Being aware of underlying value system & moral philosophies (the many flavors of capitalism/other value system) is important in doing reforms

E2. Corporate Governance and Boards of Directors

The early & typical manifestations of doing your role as steward is being in boards (company, non-profits, etc.). Learn how to be an effective board member and set up the right governance structure

The early & typical manifestations of doing your role as steward is being in boards (company, non-profits, etc.). Learn how to be an effective board member and set up the right governance structure

Related on governance models:

amazon.com/Pragmatists-Gu…

amazon.com/Pragmatists-Gu…

E3. The Role of Government in Market Economies

Debates between laissez faire vs government intervention - some people said this is US-centric (republican vs democrats), but interesting to study as "baseline" when institutions are working

Debates between laissez faire vs government intervention - some people said this is US-centric (republican vs democrats), but interesting to study as "baseline" when institutions are working

E4. Institutions, Macroeconomics, and the Global Economy

Teaches about linkage between institutional design and macroeconomic performance (incl. competing institutional models) across different countries

Teaches about linkage between institutional design and macroeconomic performance (incl. competing institutional models) across different countries

E5. Globalization and Emerging Markets

Talks about how textbook assumptions regarding how markets function in developed country (e.g, low/absent tariffs, govt acting as referees vs players, anti-trust laws, enforcement of contracts, etc.) often do not hold in emerging markets

Talks about how textbook assumptions regarding how markets function in developed country (e.g, low/absent tariffs, govt acting as referees vs players, anti-trust laws, enforcement of contracts, etc.) often do not hold in emerging markets

E6. Managing International Trade and Investment

How should firms engaging in international markets navigate across varieties of political, economic, & institutional arrangements that affect international trade & capital flows? Important when you want to go global.

How should firms engaging in international markets navigate across varieties of political, economic, & institutional arrangements that affect international trade & capital flows? Important when you want to go global.

E7. Business at the Base of the Pyramid

Majority of humanity in the world (5.0-7.5 Bn emerging middle class & low income people) are at the "base of the pyramid". How would you utilize market mechanism to deliver products & services to these underserved segments?

Majority of humanity in the world (5.0-7.5 Bn emerging middle class & low income people) are at the "base of the pyramid". How would you utilize market mechanism to deliver products & services to these underserved segments?

E8. Creating the Modern Financial System

Taught by expert in financial crises, the course explores development of financial systems, instruments, and institutions worldwide to understand the path dependencies & trade-offs taken to shape today's systems and where they should go.

Taught by expert in financial crises, the course explores development of financial systems, instruments, and institutions worldwide to understand the path dependencies & trade-offs taken to shape today's systems and where they should go.

E9. Managing and Innovating in Financial Services

How should financial services firms navigate the financial system and innovate to deliver value to customers? We explore banks, insurances, and fintechs looking to answer these questions.

How should financial services firms navigate the financial system and innovate to deliver value to customers? We explore banks, insurances, and fintechs looking to answer these questions.

Understanding point E is important in developing a company. My pet peeve with Indonesian tech bros and Southeast Asian VCs is that not all understand Indonesia-specific institutional voids, market dysfunctions, and govt deficiencies

As a result, they rely on "concept arbitrage", wholesale copying of concepts from US, China, or India market without much thinking & calibration.

Now that cheap money era is gone, we are seeing bankruptcies, markdowns, even misconduct across some of these companies

Now that cheap money era is gone, we are seeing bankruptcies, markdowns, even misconduct across some of these companies

If you want to be a hyper-competent operator in Indonesia, you need to build your own analytical lens from either formal education, reading massive literatures, or deep on-the-ground experience to guide your operational execution & capital allocation.

That's a wrap. More relevant links:

- List of HBS electives hbs.edu/coursecatalog/

- List of HBS electives hbs.edu/coursecatalog/

Also, FAQ & application tips in case anyone from Indonesia is interested in applying to HBS

bit.ly/HBS_Indo

bit.ly/HBS_Indo

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter