I went from making $0 a day trading to averaging $3,000 a day.

Throughout my journey the most important thing that helped me become profitable is understanding liquidity.

In this thread I’ll explain:

How To Read Market Structure & Identify Liquidity:👇

(1/16)

Throughout my journey the most important thing that helped me become profitable is understanding liquidity.

In this thread I’ll explain:

How To Read Market Structure & Identify Liquidity:👇

(1/16)

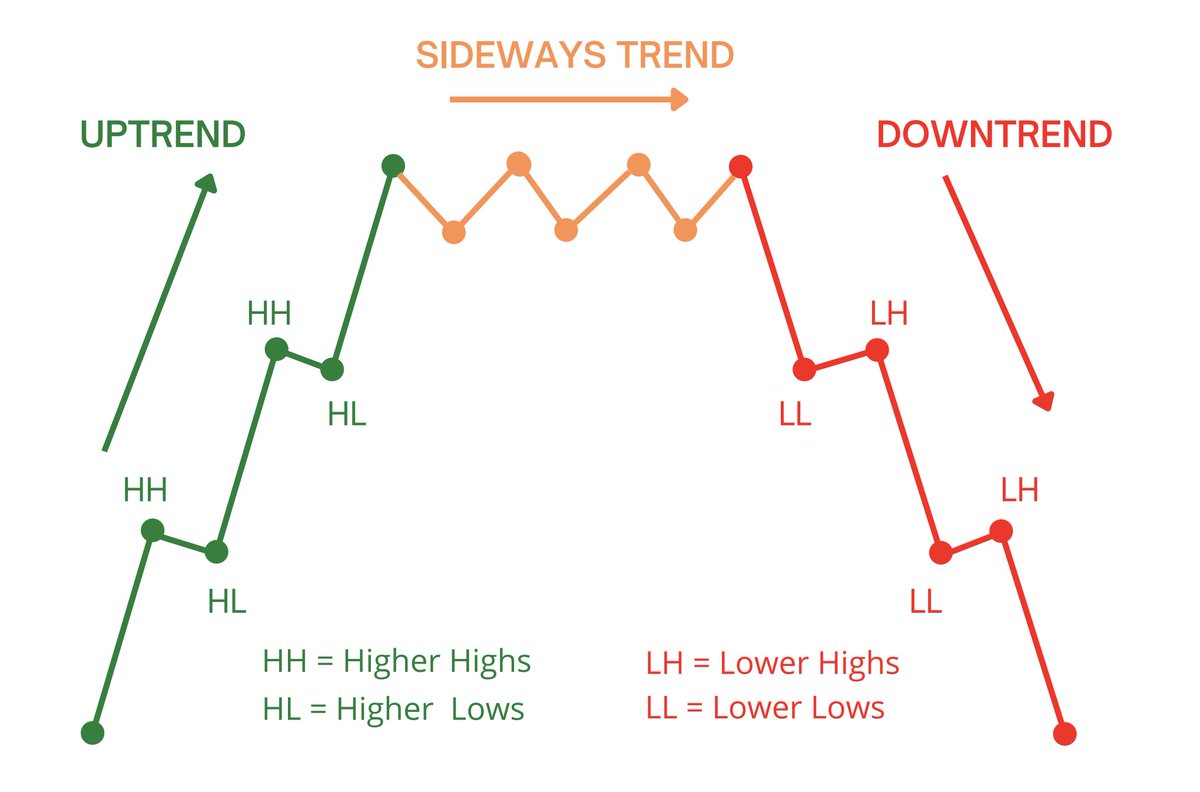

1) Types of Market Trends

When trading there are 3 trends you will notice.

Upwards, Downwards, Sideways.

(This is Easy)

Problems occur:

When you CAN’T identify the trend.

OR

When you trade OPPOSITE to the trend.

When trading there are 3 trends you will notice.

Upwards, Downwards, Sideways.

(This is Easy)

Problems occur:

When you CAN’T identify the trend.

OR

When you trade OPPOSITE to the trend.

2) How To Identify Trends

Here is a simple way to identify the trend.

For an upwards trend you need to look for the market to keep breaking highs and for the pullbacks to be higher than the previous pivot points.

For a downwards trend it’s the exact opposite of an uptrend.

Here is a simple way to identify the trend.

For an upwards trend you need to look for the market to keep breaking highs and for the pullbacks to be higher than the previous pivot points.

For a downwards trend it’s the exact opposite of an uptrend.

3) Multiple Time Frame Analysis

Traders often fail because they believe they have identified the trend.

On the 1 hour in this example we can see the stock in a clear downtrend making lower lows.

However on the 4hr this stock is really experiencing a pullback on an uptrend.

Traders often fail because they believe they have identified the trend.

On the 1 hour in this example we can see the stock in a clear downtrend making lower lows.

However on the 4hr this stock is really experiencing a pullback on an uptrend.

3.5) Multiple Timeframe Analysis

Therefore, to ensure you don’t get faked out due to lower timeframe analysis make sure you chart out key levels on the HTF.

I personally mark out higher timeframe levels the night prior of trading to ensure I understand the bigger picture.

Therefore, to ensure you don’t get faked out due to lower timeframe analysis make sure you chart out key levels on the HTF.

I personally mark out higher timeframe levels the night prior of trading to ensure I understand the bigger picture.

4) Change of Character vs Break of Structure

This is important.

These 2 concepts will help you identify if:

A stock is going to continue the trend it’s in

OR

Break the trend and reverse to the other side.

This is important.

These 2 concepts will help you identify if:

A stock is going to continue the trend it’s in

OR

Break the trend and reverse to the other side.

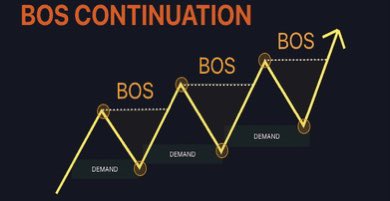

4.5) BOS

A break of structure indicates a stock will move in the direction it’s trend is already in.

It signifies the stock is breaking a new high (low) while in an uptrend (downtrend).

Whenever you mark a BOS, it signifies to enter in the direction of the existing trend.

A break of structure indicates a stock will move in the direction it’s trend is already in.

It signifies the stock is breaking a new high (low) while in an uptrend (downtrend).

Whenever you mark a BOS, it signifies to enter in the direction of the existing trend.

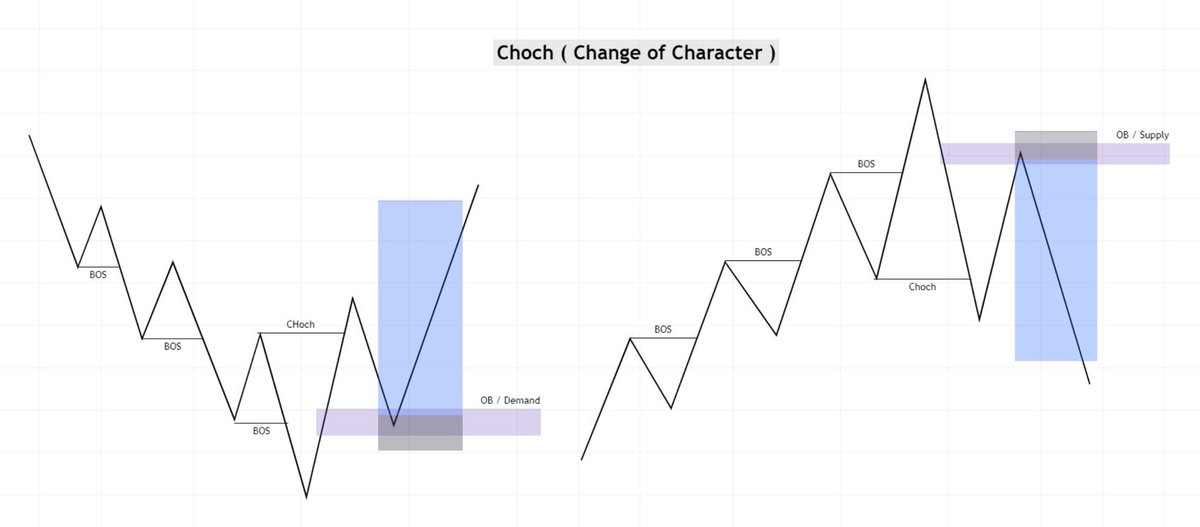

5) CHOCH

A change of character indicates when a stock might reverse its trend due to the break of pattern.

In this diagram we can see the stock was creating BOS until it broke that previous lower high.

This indicated buyers stepping in and signalled a reversal.

A change of character indicates when a stock might reverse its trend due to the break of pattern.

In this diagram we can see the stock was creating BOS until it broke that previous lower high.

This indicated buyers stepping in and signalled a reversal.

6) 3 Rules of Market Structure

- Identify Market Trend

- Identify BOS & CHOCH Levels

- Identify Liquidity Zones VIA Price Action

- Identify Market Trend

- Identify BOS & CHOCH Levels

- Identify Liquidity Zones VIA Price Action

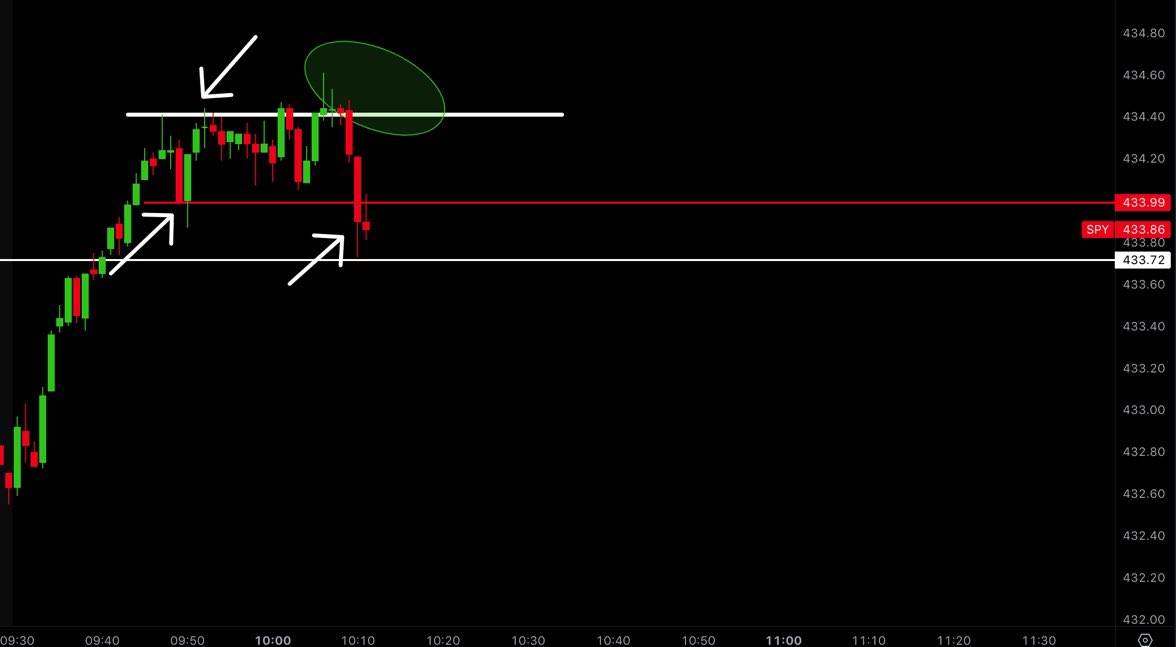

7) Real Example

In this example we see the stock having a clear trend to the upside and creating a higher low.

To continue the trend upwards we need to break the previous high we put in (BOS).

However, if we break the higher lows we just put in that would indicate CHOCH.

In this example we see the stock having a clear trend to the upside and creating a higher low.

To continue the trend upwards we need to break the previous high we put in (BOS).

However, if we break the higher lows we just put in that would indicate CHOCH.

8) Stock Took Liquidity

We see the stock broke the high but never closed a candle above that high.

This indicates sellers were stronger than buyers near the break and there is buyside liquidity there.

After this we broke the previous HL indicating we should look to short.

We see the stock broke the high but never closed a candle above that high.

This indicates sellers were stronger than buyers near the break and there is buyside liquidity there.

After this we broke the previous HL indicating we should look to short.

9) Trade Setup

The stock went and tested its previous low.

We can now confirm the stock is in a downtrend and also mark out the level we would want to enter for a short entry in the zone.

The stock went and tested its previous low.

We can now confirm the stock is in a downtrend and also mark out the level we would want to enter for a short entry in the zone.

10) Enter Trade

We enter the trade on this bearish candle looking for new low of of day with our stop loss above the previous higher low which now acts as CHOCH.

This is a 2.49R trade.

Therefore, if we risk $200 we would make $500.

We enter the trade on this bearish candle looking for new low of of day with our stop loss above the previous higher low which now acts as CHOCH.

This is a 2.49R trade.

Therefore, if we risk $200 we would make $500.

11) Play Out Trade

If we play this out we can see the stock swiftly made LOD.

This trade would have resulted in a $500 gain by simply understanding market structure & liquidity.

If we play this out we can see the stock swiftly made LOD.

This trade would have resulted in a $500 gain by simply understanding market structure & liquidity.

In Conclusion,

Understanding market structure & liquidity will take you time but I hope this thread helped simplify these concepts for you!

If this thread helped you:

- Like + Retweet Original Tweet!

- Follow For More Education!⚡️

Understanding market structure & liquidity will take you time but I hope this thread helped simplify these concepts for you!

If this thread helped you:

- Like + Retweet Original Tweet!

- Follow For More Education!⚡️

P.S-

I made a whole video detailing more examples and in depth guide to understand market structure & liquidity.

Watch Video HERE:👇

Daily Trade Reviews + EDU:👇

https://t.co/TVUK6UnVY3

instagram.com/scarfacetrades_

I made a whole video detailing more examples and in depth guide to understand market structure & liquidity.

Watch Video HERE:👇

Daily Trade Reviews + EDU:👇

https://t.co/TVUK6UnVY3

instagram.com/scarfacetrades_

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter