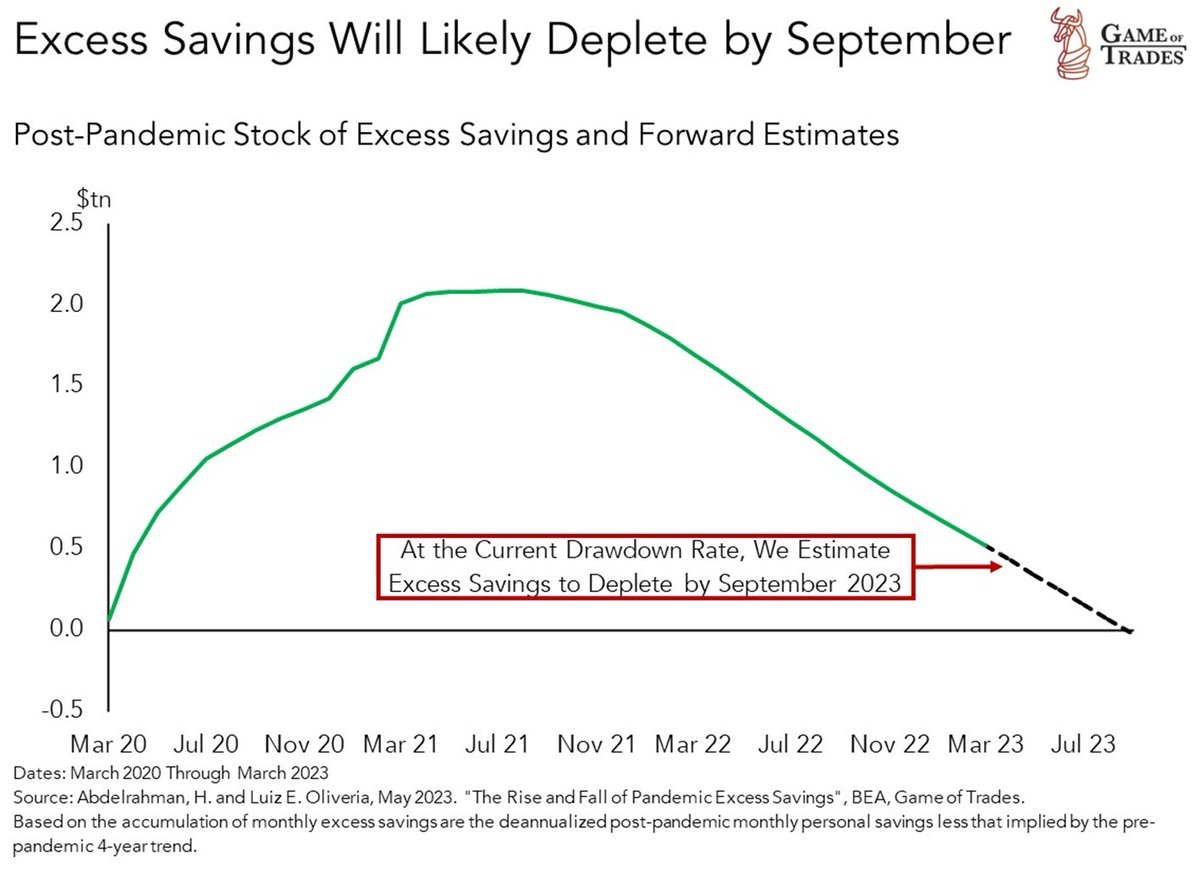

Consumer savings are expected to run out by Sept 2023

This might be the turning point for the US economy

A thread 🧵

This might be the turning point for the US economy

A thread 🧵

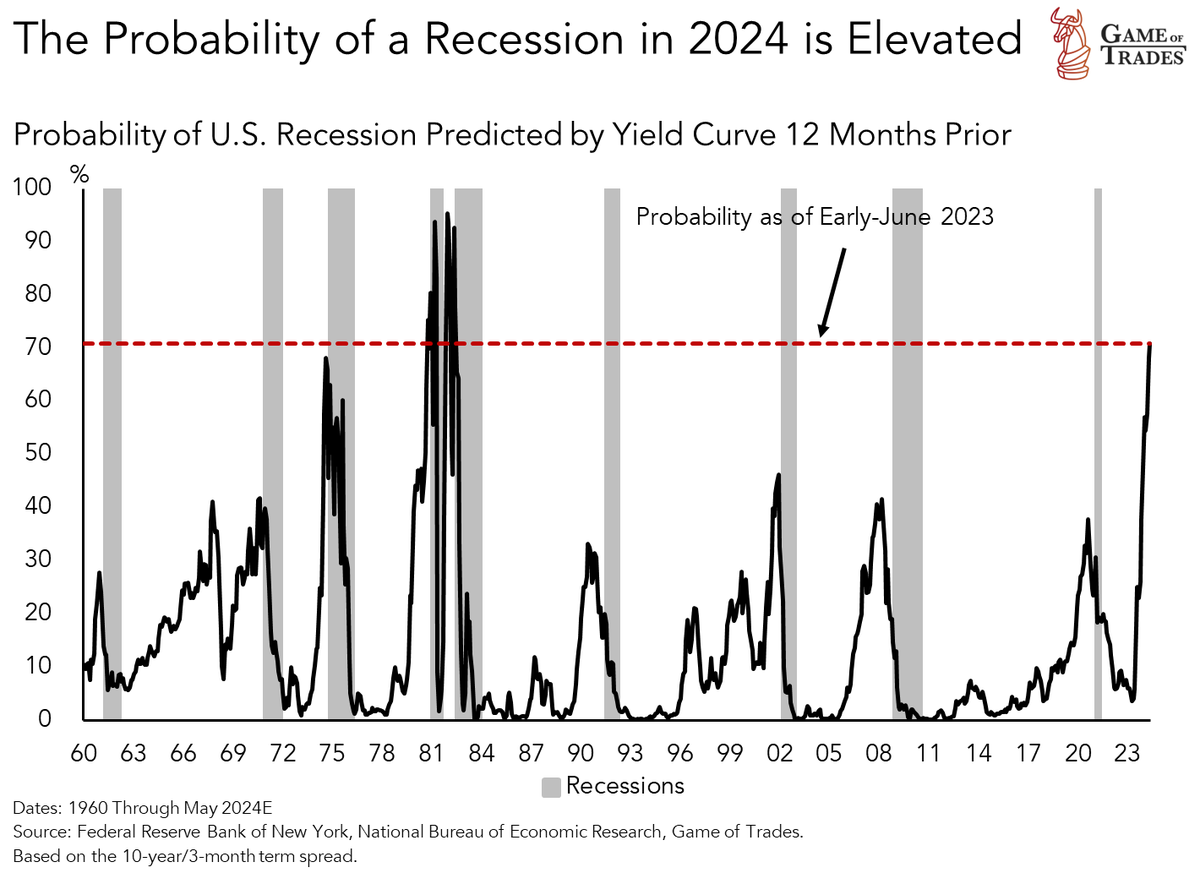

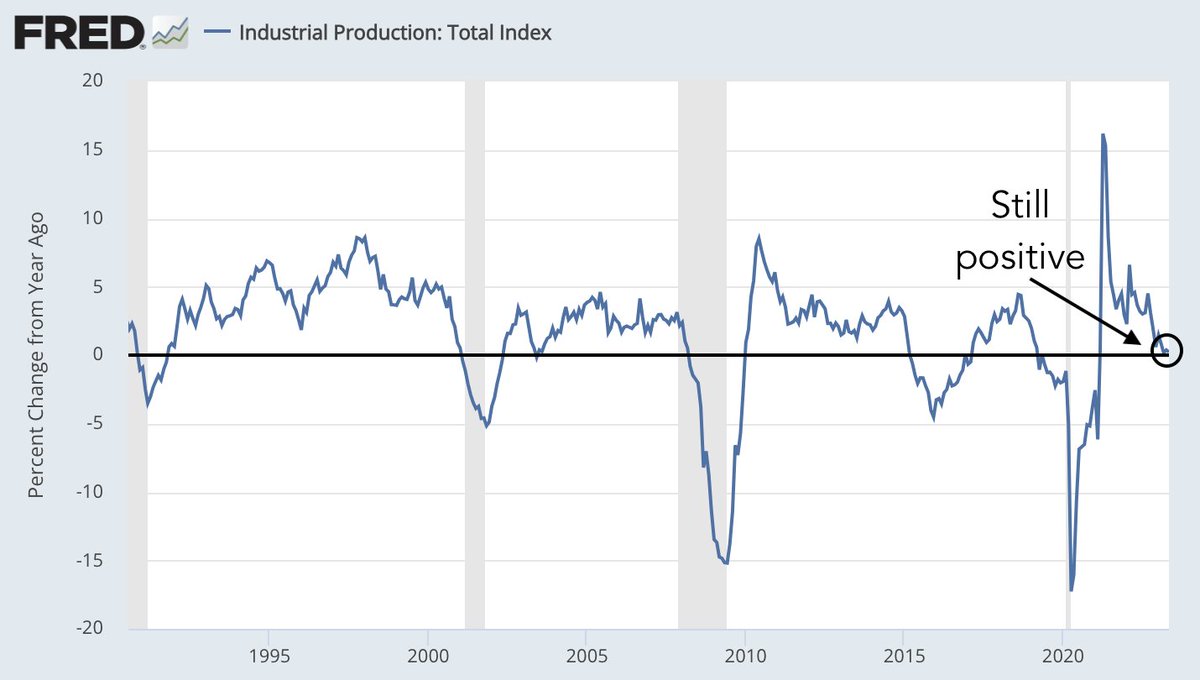

3/ Hard economic data indicates the U.S. has so far avoided a recession, with yearly economic production remaining positive

5/ 2 key factors have held up the U.S. economy:

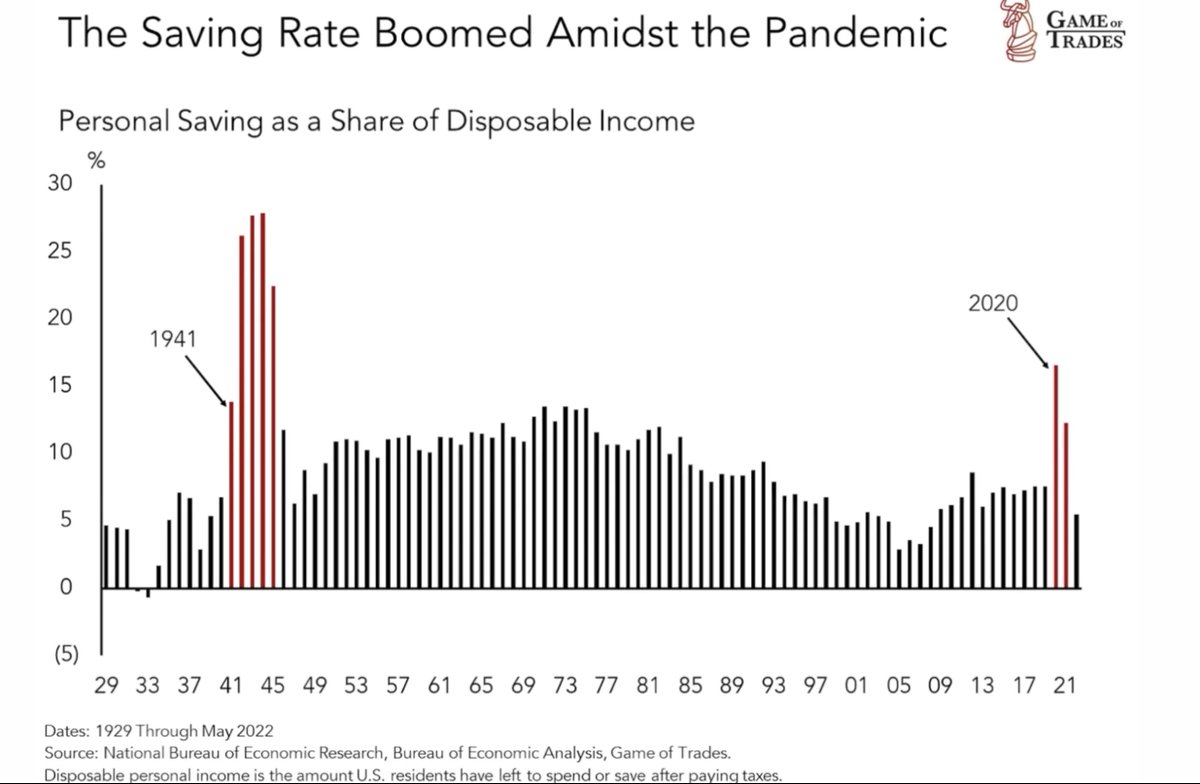

1. High post-pandemic consumer savings

2. Strong labor market

However, these are expected to weaken in H2 2023

1. High post-pandemic consumer savings

2. Strong labor market

However, these are expected to weaken in H2 2023

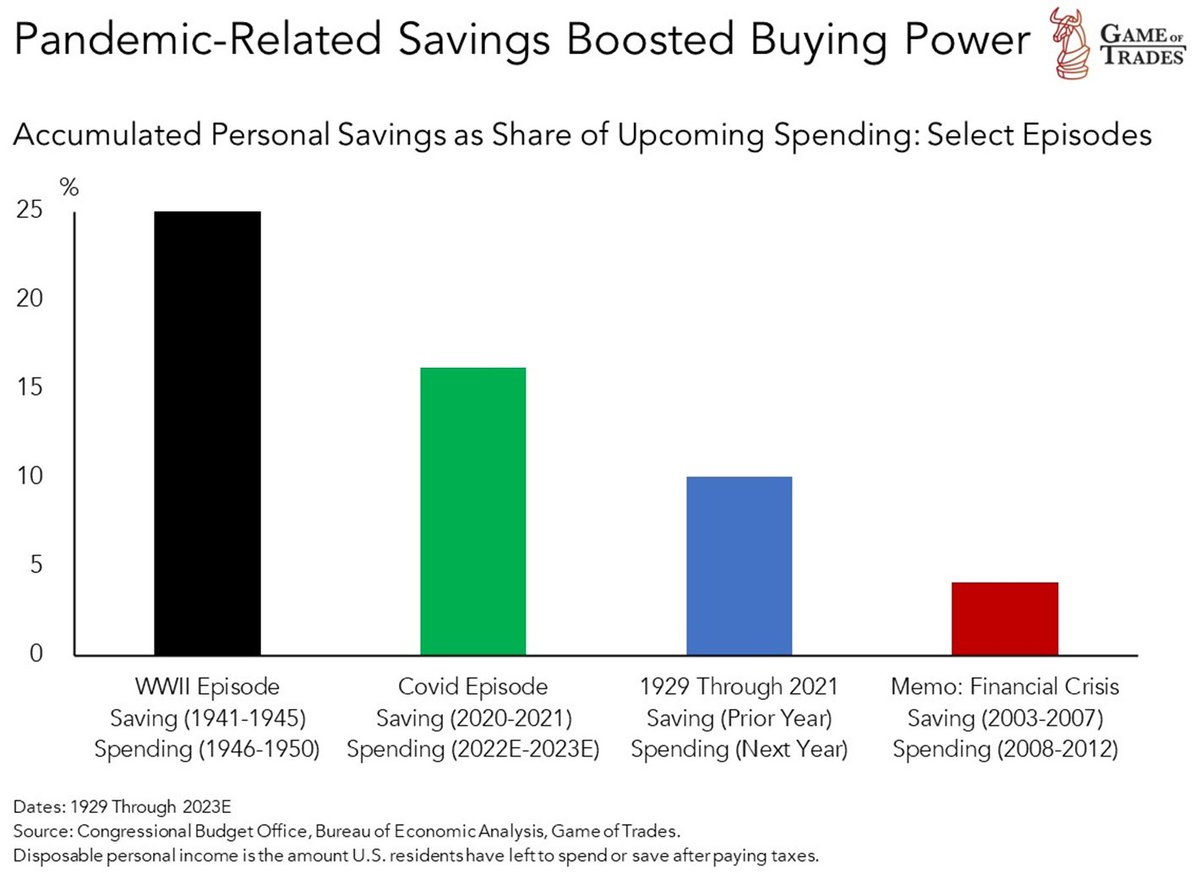

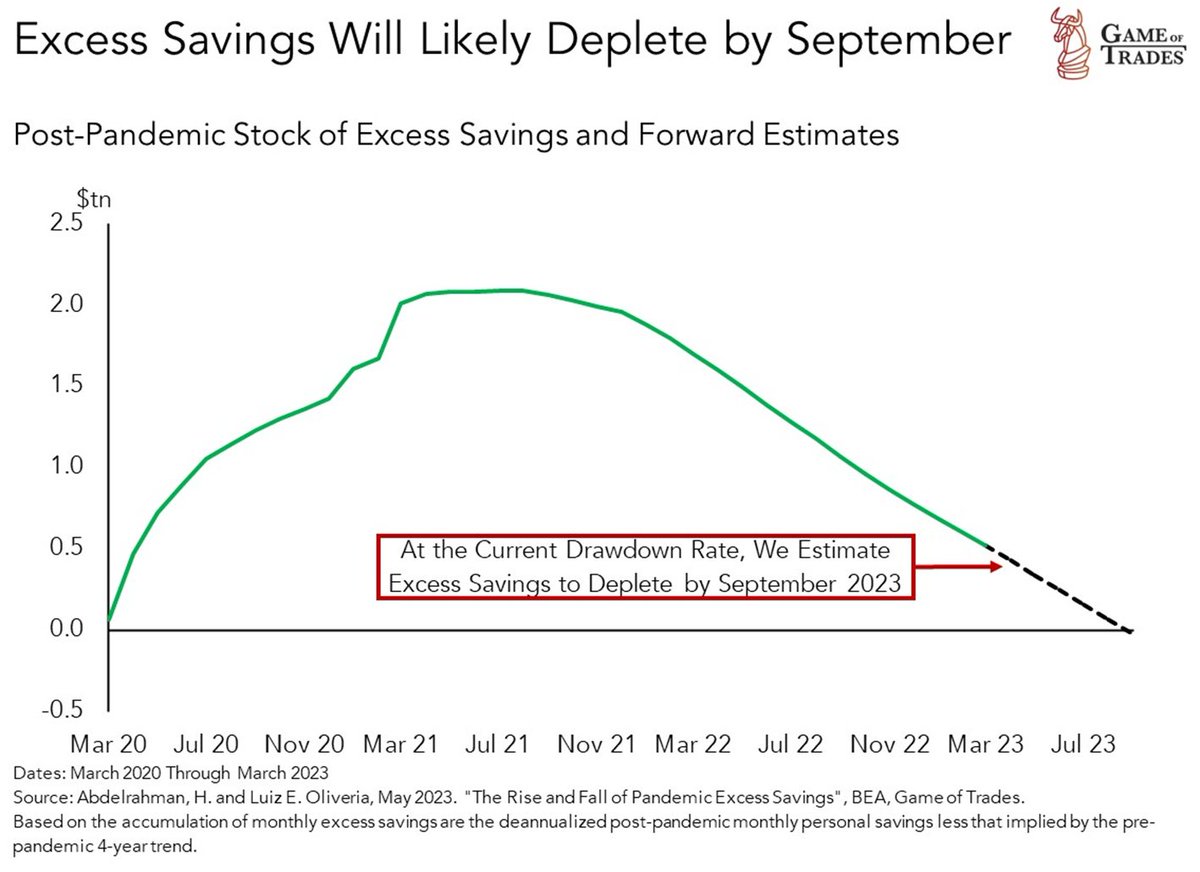

7/ High savings have helped consumers weather high inflation, tight monetary policy and economic weakening seen in 2022 and 2023

8/ In July 2022, we highlighted on that consumer savings in 2022 (green bar) were 50% higher than the 1929-2021 average (blue bar) https://t.co/oQRXBxWBaGgameoftrades.net

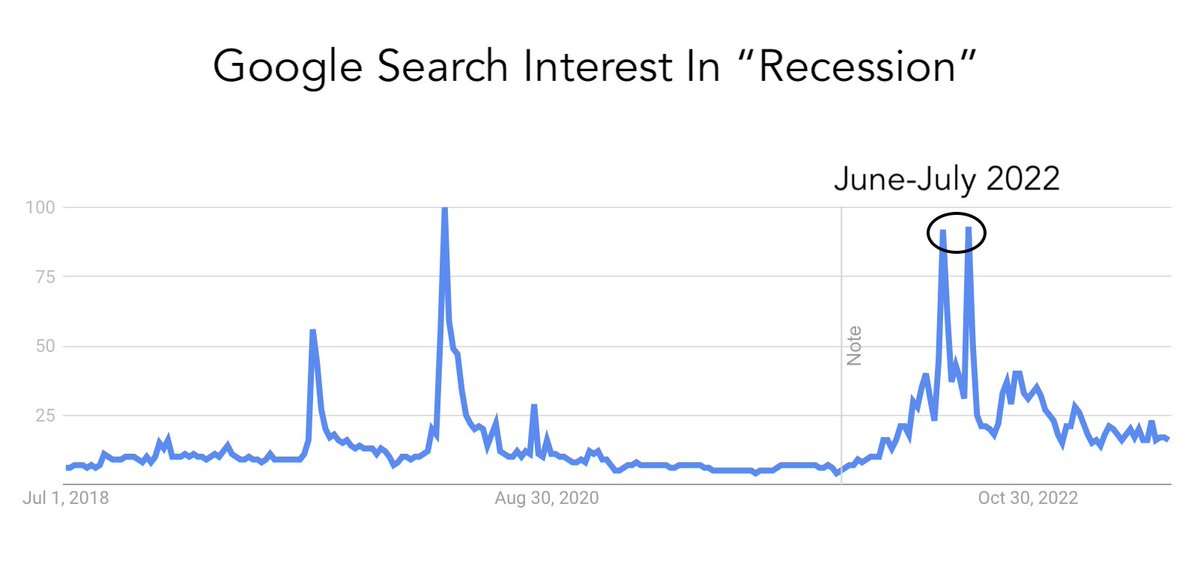

9/ During that period, retail interest spiked towards recessions, as most were expecting an imminent economic deterioration

The term "recession" hit record interest levels in June/July 2022

The term "recession" hit record interest levels in June/July 2022

10/ Despite retail expecting a recession, consumers were financially healthier in mid-2022

The situation has since changed, as we'll discuss next

The situation has since changed, as we'll discuss next

11/ By end of 2022, the savings rate dropped to historic lows as consumers tapped into savings due to a challenging macro environment

12/ Post-pandemic savings peaked at over $2tn in July 2021, but have been decreasing since

Current savings stand at $0.5tn and are expected to deplete by Sept 2023

Current savings stand at $0.5tn and are expected to deplete by Sept 2023

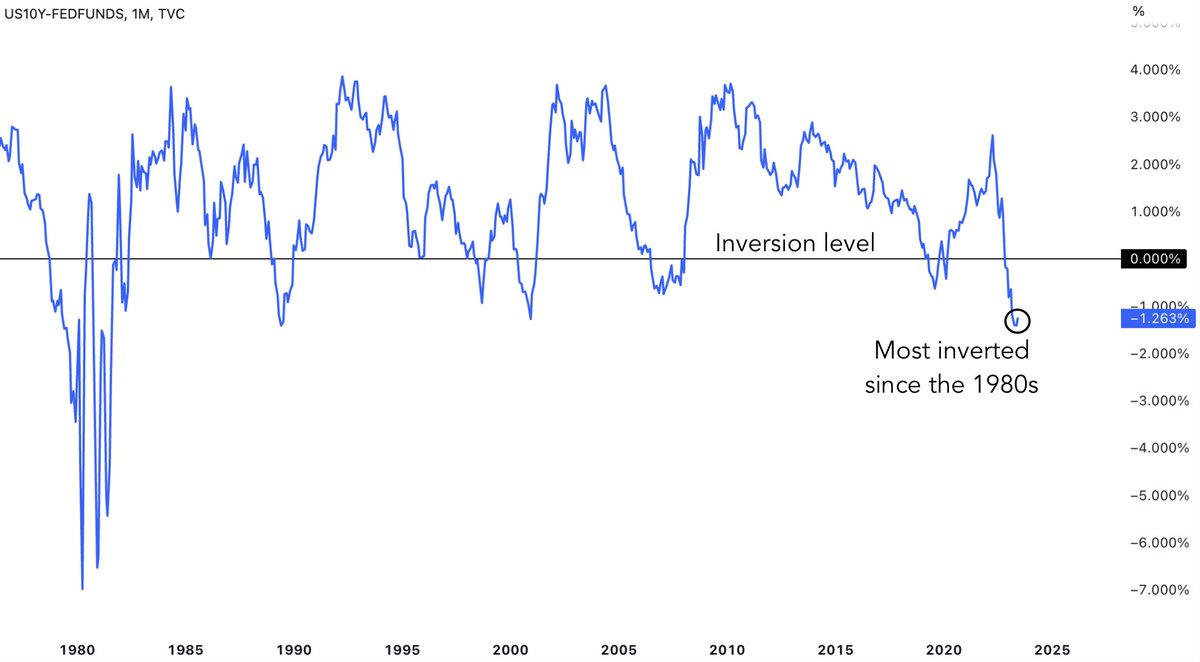

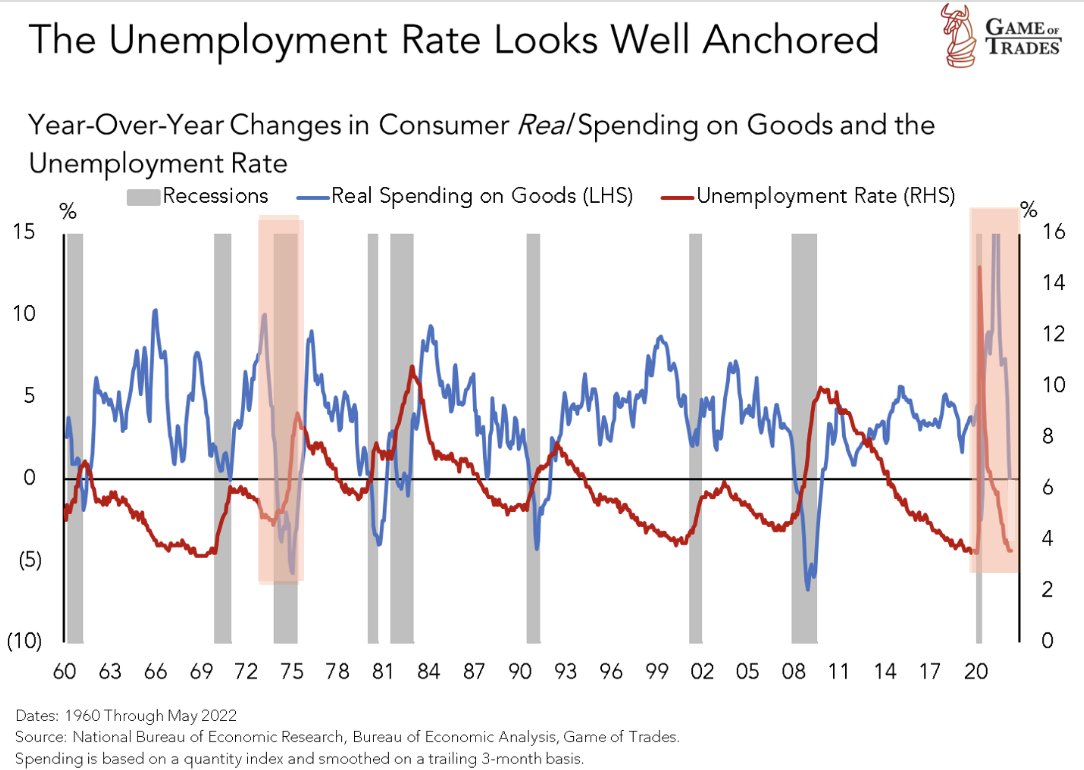

13/ The second factor preventing a recession so far is the robust labor market, with unemployment at historic lows

14/ A strong labor market usually boosts consumer spending

But as unemployment rises, consumer spending declines, often leading to a recession

But as unemployment rises, consumer spending declines, often leading to a recession

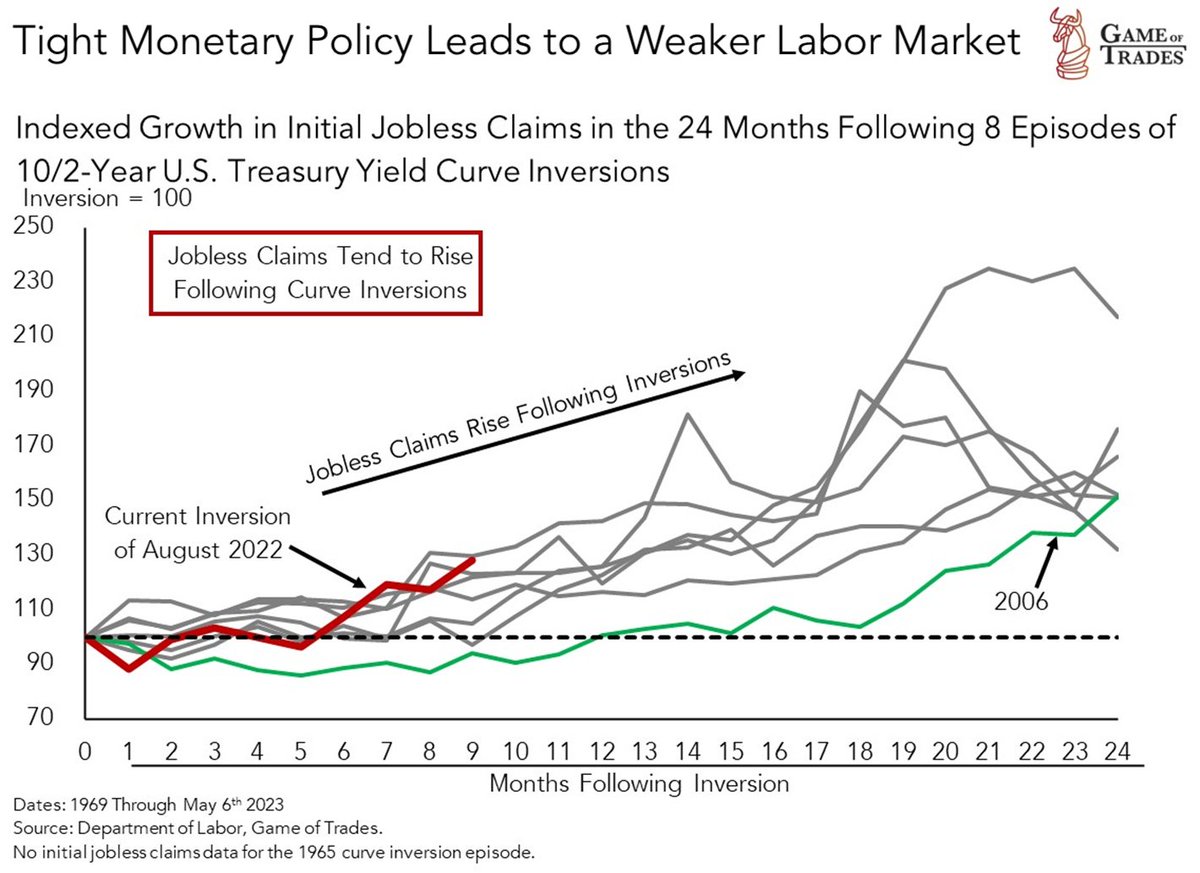

16/ After 8 inversions since 1969, jobless claims have typically risen for up to 24 months

Indicating that the labor market will likely weaken in the coming months, leading to a contraction in consumer spending - a typical recessionary development

Indicating that the labor market will likely weaken in the coming months, leading to a contraction in consumer spending - a typical recessionary development

17/ Despite economic uncertainties, there's one certainty you can bank on:

Our 20% OFF 4th of July sale!

Valid for a LIMITED time

Get a FREE trial at gameoftrades.net

Our 20% OFF 4th of July sale!

Valid for a LIMITED time

Get a FREE trial at gameoftrades.net

18/ Thanks for reading!

If you found this thread valuable, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

If you found this thread valuable, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

https://twitter.com/GameofTrades_/status/1676647064627974149

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter