I decided to write this brief thread going over STDV’s as I feel they can be used as a really valuable tool to add to your trading arsenal.

Helping give projected targets to add more confluence to your trades

Helping give projected targets to add more confluence to your trades

In this thread I will be going over

-Fib Settings for STDV

-How I use STDV for confluence

-Annotated Example

-Real Trade Examples

Let's get into it!

-Fib Settings for STDV

-How I use STDV for confluence

-Annotated Example

-Real Trade Examples

Let's get into it!

-Fib Settings for STDV

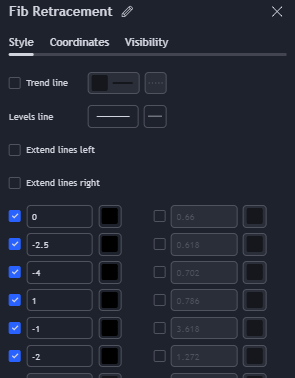

First and foremost, to set up coordinates for standard deviations

1. Select Fib Retracement from your TV toolbar

2. Select the settings icon

3. Turn on the 0 , -2.5 , -4 , 1 , -1 , -2 fibonacci levels

4. Once done it should look like this

First and foremost, to set up coordinates for standard deviations

1. Select Fib Retracement from your TV toolbar

2. Select the settings icon

3. Turn on the 0 , -2.5 , -4 , 1 , -1 , -2 fibonacci levels

4. Once done it should look like this

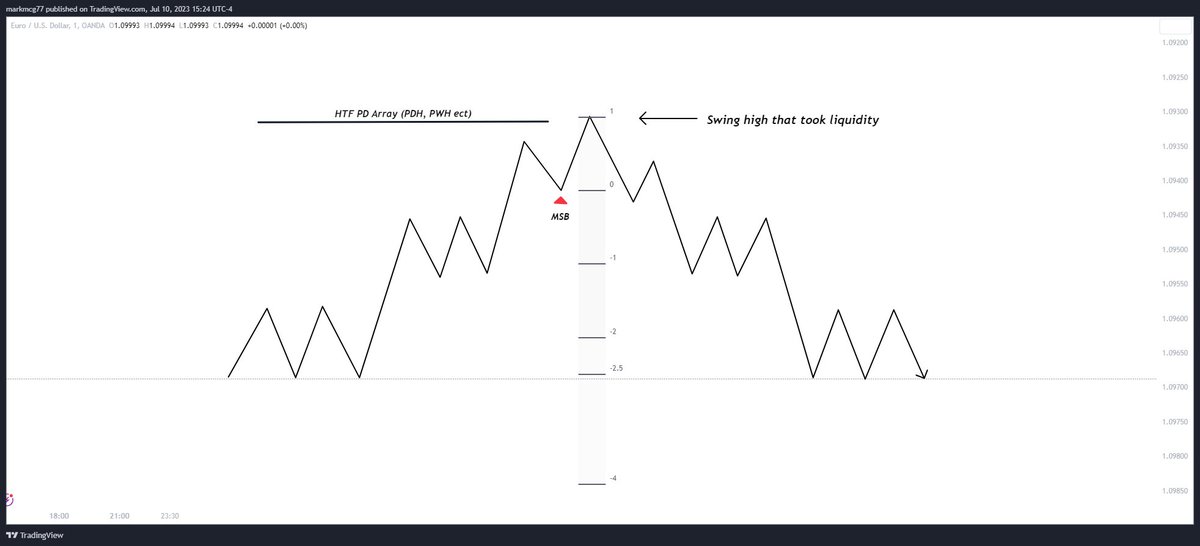

How I implement standard deviations

To implement STDV’s simply, wait for price to raid an old low/high, followed by a break of market structure, then drag your fib tool from,

The swing high/low that took liquidity to the candle that broke structure,

(Example Below)

To implement STDV’s simply, wait for price to raid an old low/high, followed by a break of market structure, then drag your fib tool from,

The swing high/low that took liquidity to the candle that broke structure,

(Example Below)

The sweet spot for me personally is between the -2 and -2.5 levels if there is confluence with liquidity or a fair value gap, I would look to TP most of my position there

I use -4 as an extended target if there is no clear PD array to aim for,

I use -4 as an extended target if there is no clear PD array to aim for,

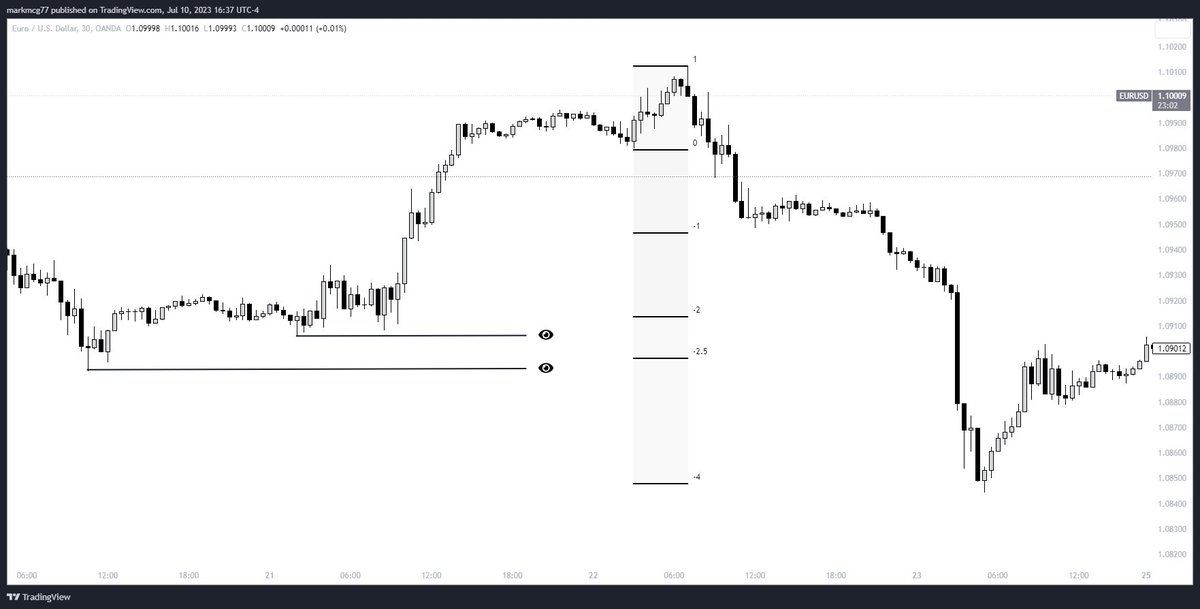

Here is an example on EU

Clear MMSM, STDV dragged from the high that took liquidity to the breaker

Look at how the -2 and -2.5 projections are in confluence with two key swing lows, this would be my TP level for this trade

Also note how the -4 projection marked the bottom

Clear MMSM, STDV dragged from the high that took liquidity to the breaker

Look at how the -2 and -2.5 projections are in confluence with two key swing lows, this would be my TP level for this trade

Also note how the -4 projection marked the bottom

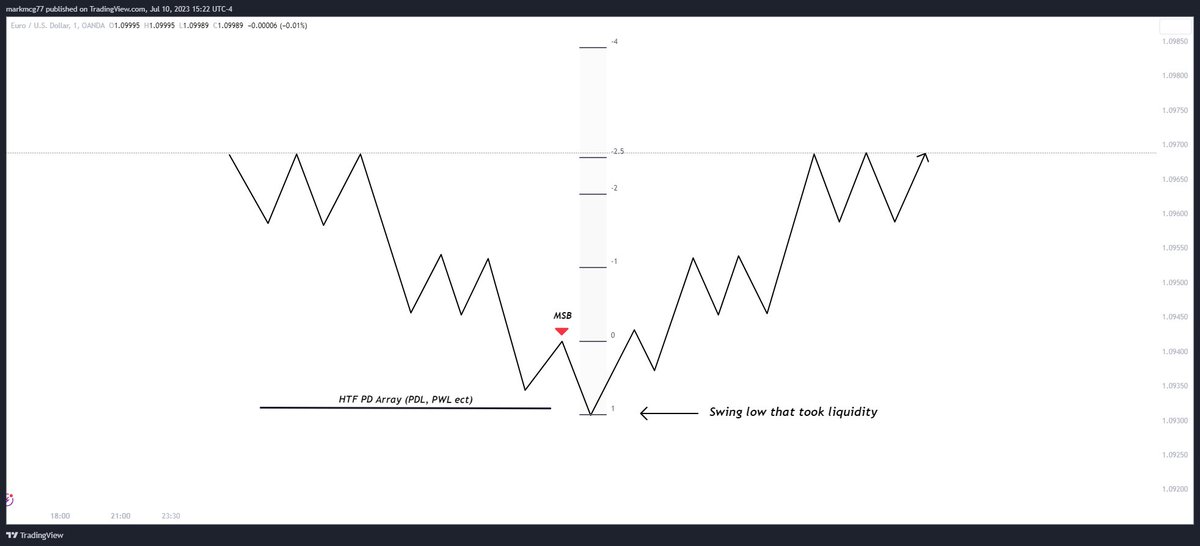

Another example here on GU,

MMBM framework, STDV dragged from low that took liquidity to the breaker which aligns perfectly with the OG consolidation of the MMBM. Beautiful confluence tool

MMBM framework, STDV dragged from low that took liquidity to the breaker which aligns perfectly with the OG consolidation of the MMBM. Beautiful confluence tool

I hope you enjoyed this short thread on STDV and will look to implement them into your own trading

Shout out to the amazing @jvlzloona for the intro graphic also, mans been killing it the last while on the trading side also, definitely worth a follow!

Shout out to the amazing @jvlzloona for the intro graphic also, mans been killing it the last while on the trading side also, definitely worth a follow!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter