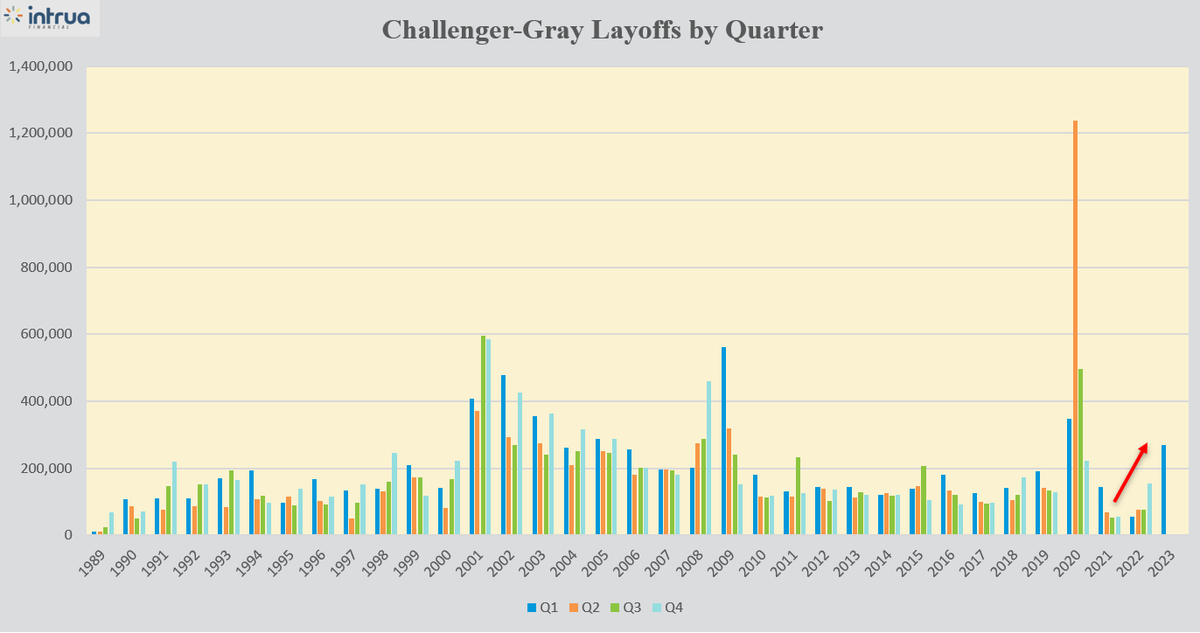

Despite the Fed tightening economic conditions, the economy has continued to power ahead, fueled by consumers with large excess savings. However, the dynamic is beginning to shift moving into the second half of the year

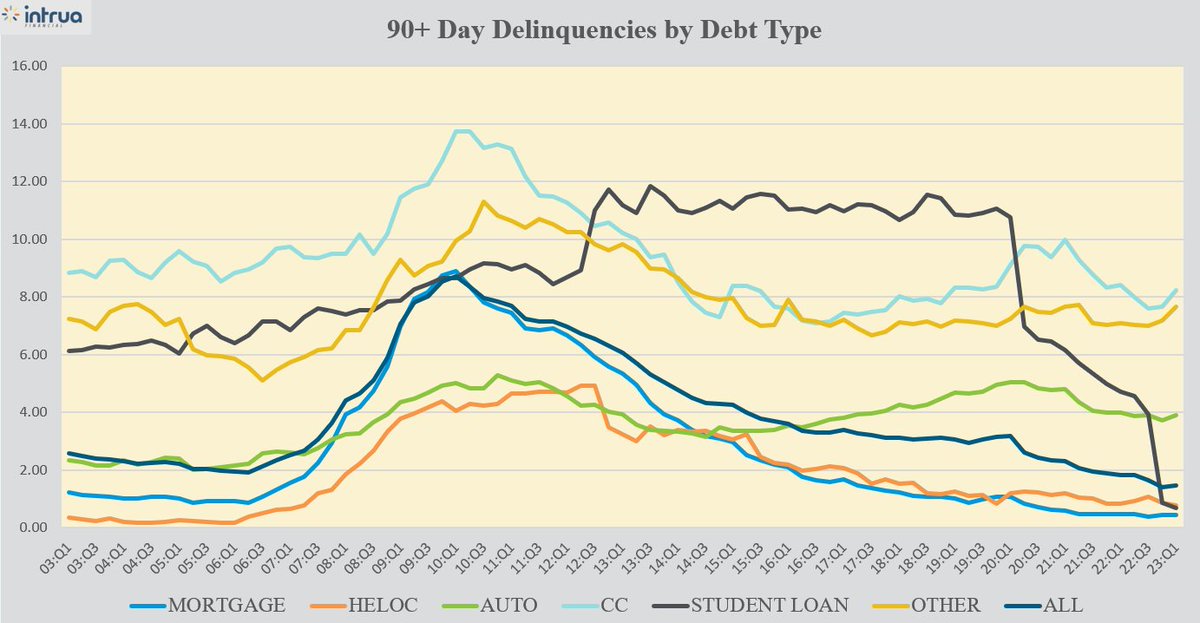

We are starting to see cracks in the consumer as rates become felt throughout the economy, particularly for those most exposed to inflation

While inflation has largely benefitted equities as they have been able to pass through prices to consumers, this dynamic is likely to shift moving into the second half of the year

Just as everyone is getting comfortable going long equities again, there is a potential trap ahead. Could equities continue to rally from here? Sure, meltups are common into a recession. But before you go all-in QQQ calls, be mindful of what is ahead.

• • •

Missing some Tweet in this thread? You can try to

force a refresh