#9 LayerZero α Dose – zkSync x LayerZero Exclusive

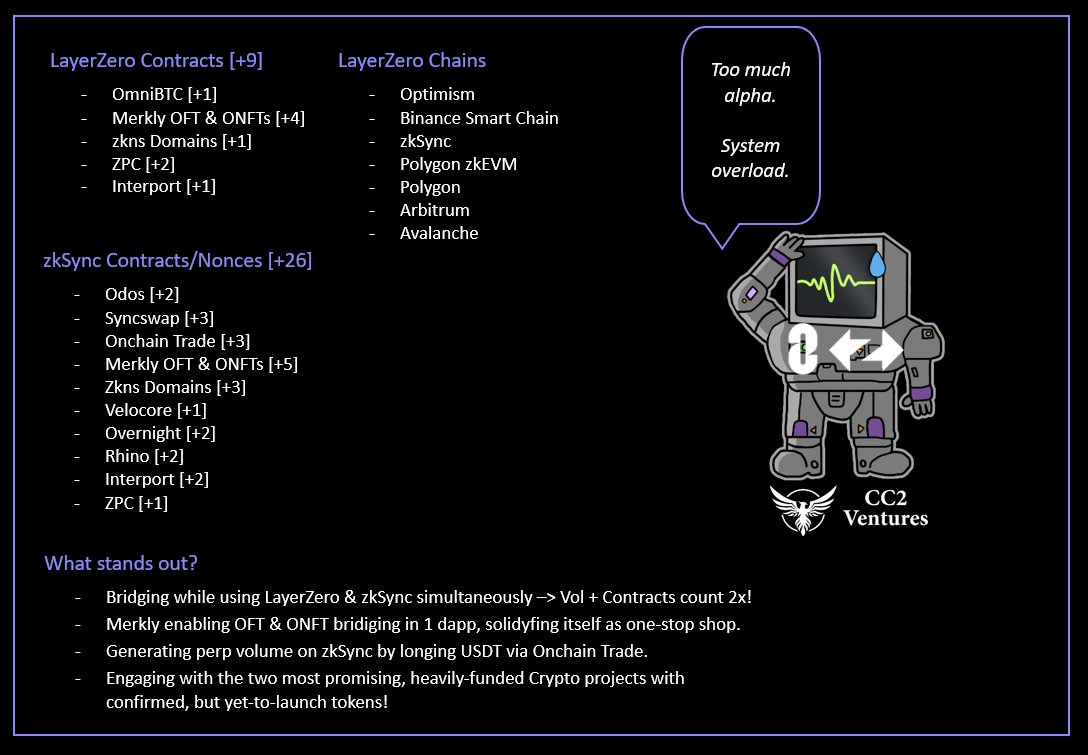

35 Contracts.

12 Dapps.

2 Airdrops.

1 Route.

I've crafted a comprehensive route that allows you to interact with the two best funded Crypto projects in one single rotation. 🪂

Qualify for $ZKS & $ZRO simultaneously.👇 https://t.co/6Iwlmrig8Mtwitter.com/i/web/status/1…

35 Contracts.

12 Dapps.

2 Airdrops.

1 Route.

I've crafted a comprehensive route that allows you to interact with the two best funded Crypto projects in one single rotation. 🪂

Qualify for $ZKS & $ZRO simultaneously.👇 https://t.co/6Iwlmrig8Mtwitter.com/i/web/status/1…

First, some info

[Skip 4 tweets for guide only]

Funding

LayerZero: $293M

zkSync: $458M

To put into perspective –– Arbitrum has $123.7M backing & the airdrop was lifechanging for many.

$ARB is the 🪂 posterchild and shares the same decentralization ethos as LayerZero & zkSync.

[Skip 4 tweets for guide only]

Funding

LayerZero: $293M

zkSync: $458M

To put into perspective –– Arbitrum has $123.7M backing & the airdrop was lifechanging for many.

$ARB is the 🪂 posterchild and shares the same decentralization ethos as LayerZero & zkSync.

$ARB executed the airdrop playbook perfectly:

• TVL is up-only

• Just the right amount of filtering [slightly too lenient]

• Token is holding up nicely

• Included smol fishes with limited funds

• Created a diehard community -> result is lifelong organic marketing

Cont.

• TVL is up-only

• Just the right amount of filtering [slightly too lenient]

• Token is holding up nicely

• Included smol fishes with limited funds

• Created a diehard community -> result is lifelong organic marketing

Cont.

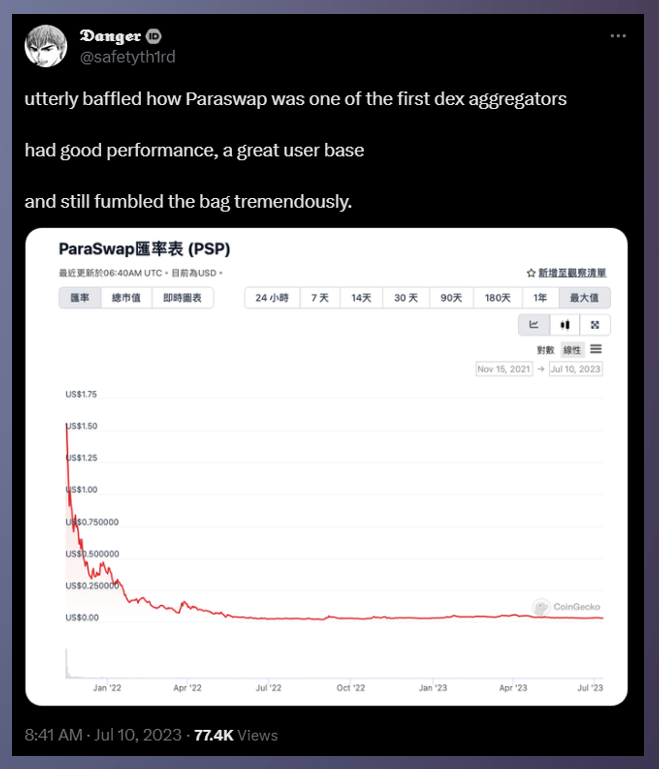

In stark contrast to @paraswap and @SuiNetwork.

Paraswap:

Way too strict.

1.3m wallets –> airdropped to only 20K [0.15% of all users!]

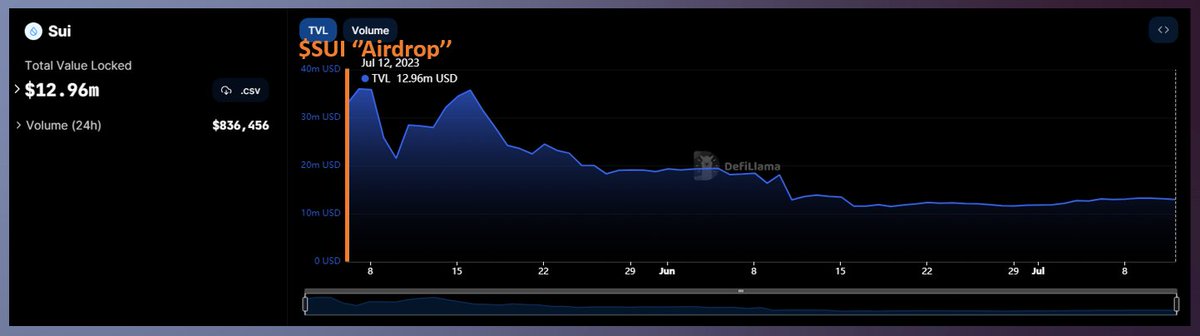

Sui:

Enforced KYC

Even Aptos did a much better job by rewarding testnet participants -> $APT still Top 40 and TVL is sustaining.

Paraswap:

Way too strict.

1.3m wallets –> airdropped to only 20K [0.15% of all users!]

Sui:

Enforced KYC

Even Aptos did a much better job by rewarding testnet participants -> $APT still Top 40 and TVL is sustaining.

We learned:

If done correctly, airdrops are a net positive for all participants involved.

High-profile projects w/ a similar ethos will thus study and try to replicate what Arbitrum achieved.

This is why main focus currently lies on $ZRO & $ZKS.

If done correctly, airdrops are a net positive for all participants involved.

High-profile projects w/ a similar ethos will thus study and try to replicate what Arbitrum achieved.

This is why main focus currently lies on $ZRO & $ZKS.

https://twitter.com/CC2Ventures/status/1658206273140039685

Long-winded intro –– let's get to work!

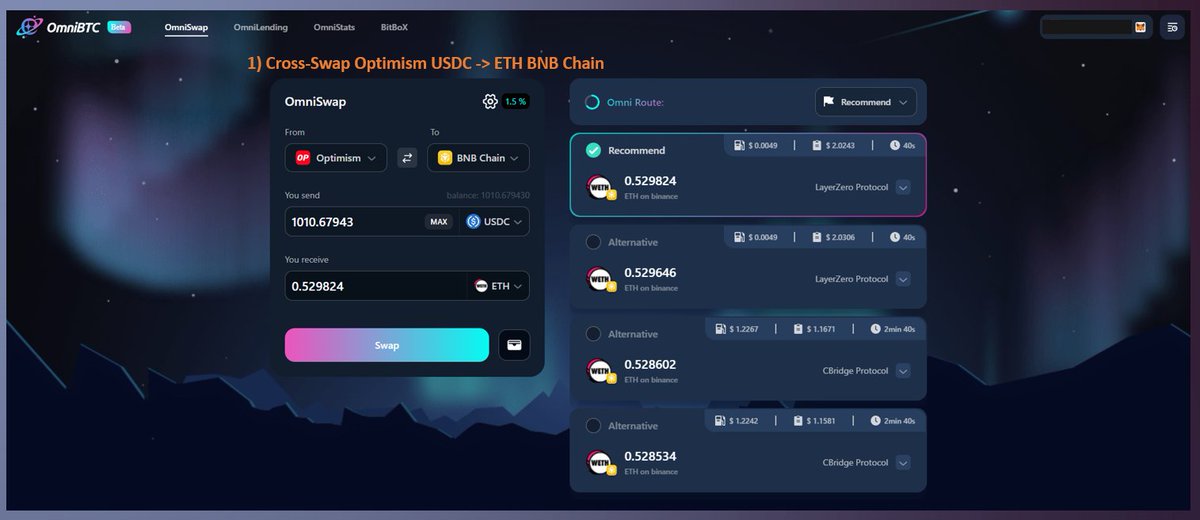

This time we'll start on Optimism w/ USDC.

ACTIONABLE STEPS

Open:

1) Cross-Swap Optimism USDC -> ETH BNB Chain

Open: https://t.co/S2N6y98E7W

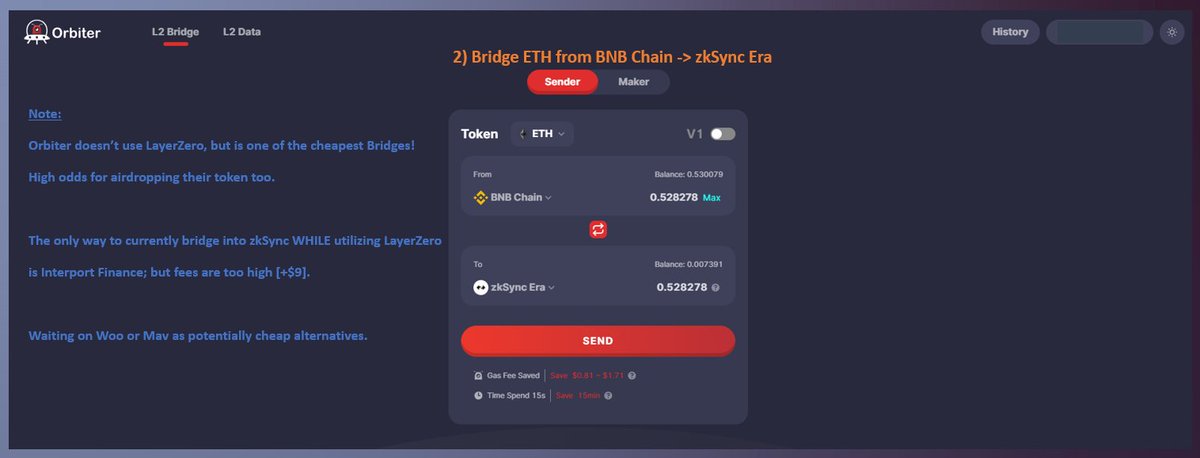

2) Bridge ETH -> zkSync Era

[See Screenshot on why we use Orbiter] https://t.co/wGvoL7w34Yapp.omnibtc.finance/swap

orbiter.finance

This time we'll start on Optimism w/ USDC.

ACTIONABLE STEPS

Open:

1) Cross-Swap Optimism USDC -> ETH BNB Chain

Open: https://t.co/S2N6y98E7W

2) Bridge ETH -> zkSync Era

[See Screenshot on why we use Orbiter] https://t.co/wGvoL7w34Yapp.omnibtc.finance/swap

orbiter.finance

Open:

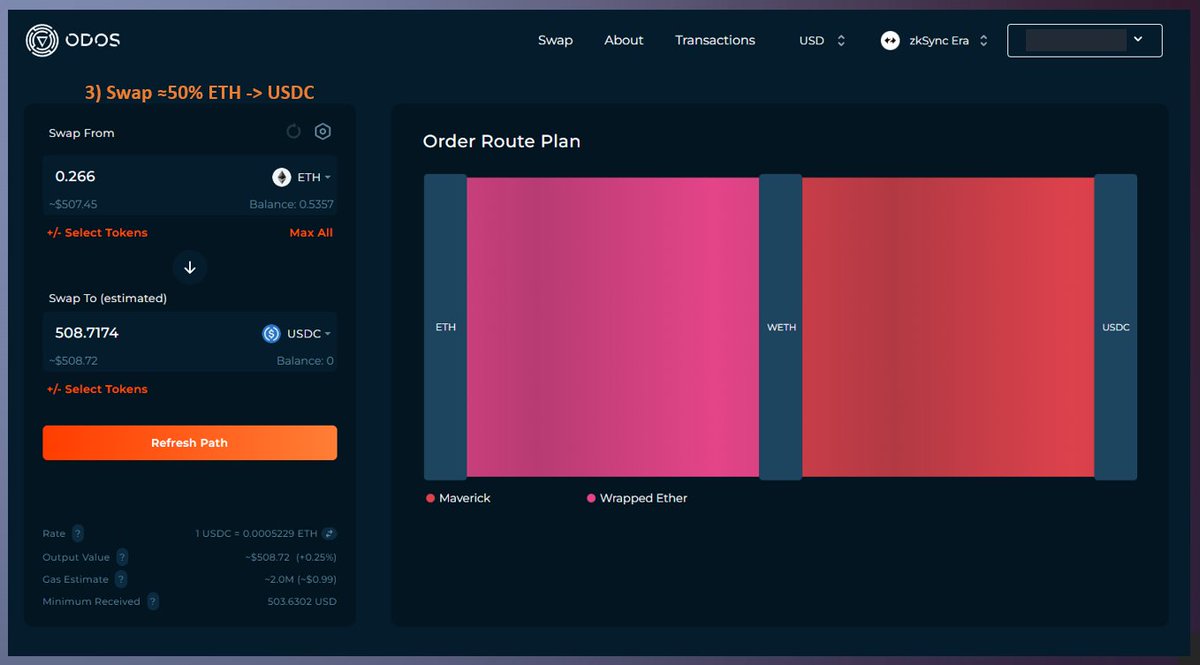

3) Swap ≈50% of ETH -> USDC

Fun fact you didn't know:

Semiotic AI created Odos, and they've received a $60M grant.👀

Aggregator is on par w/ DefiLlama.

Open: https://t.co/igRhpOT7Ys

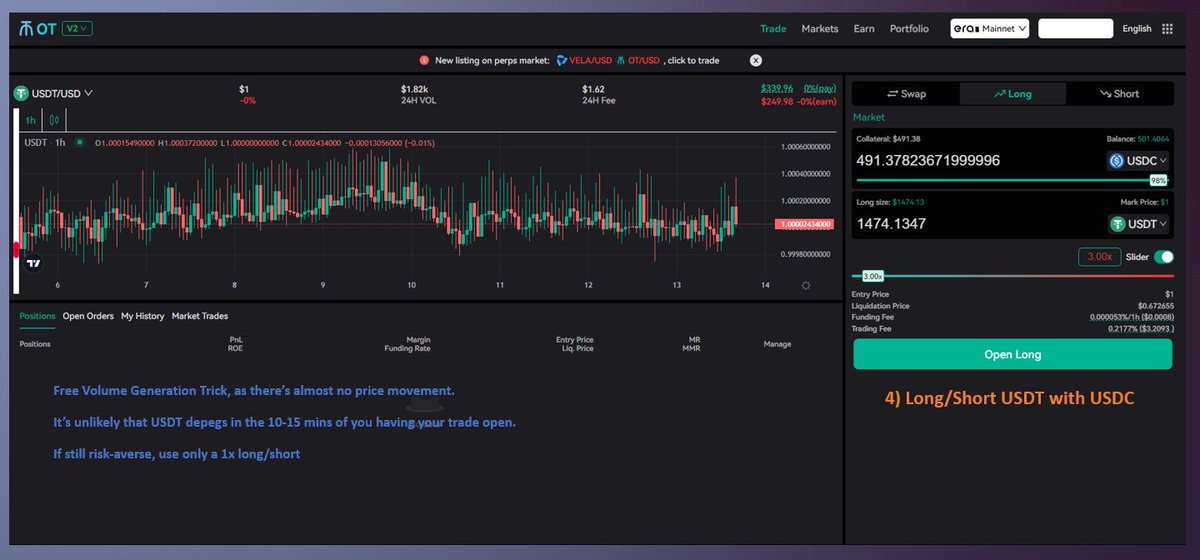

4) 2-3x Long USDT with USDC

Keep Position open for +10 min https://t.co/Ql9gKr5Kcaapp.odos.xyz

onchain.trade

3) Swap ≈50% of ETH -> USDC

Fun fact you didn't know:

Semiotic AI created Odos, and they've received a $60M grant.👀

Aggregator is on par w/ DefiLlama.

Open: https://t.co/igRhpOT7Ys

4) 2-3x Long USDT with USDC

Keep Position open for +10 min https://t.co/Ql9gKr5Kcaapp.odos.xyz

onchain.trade

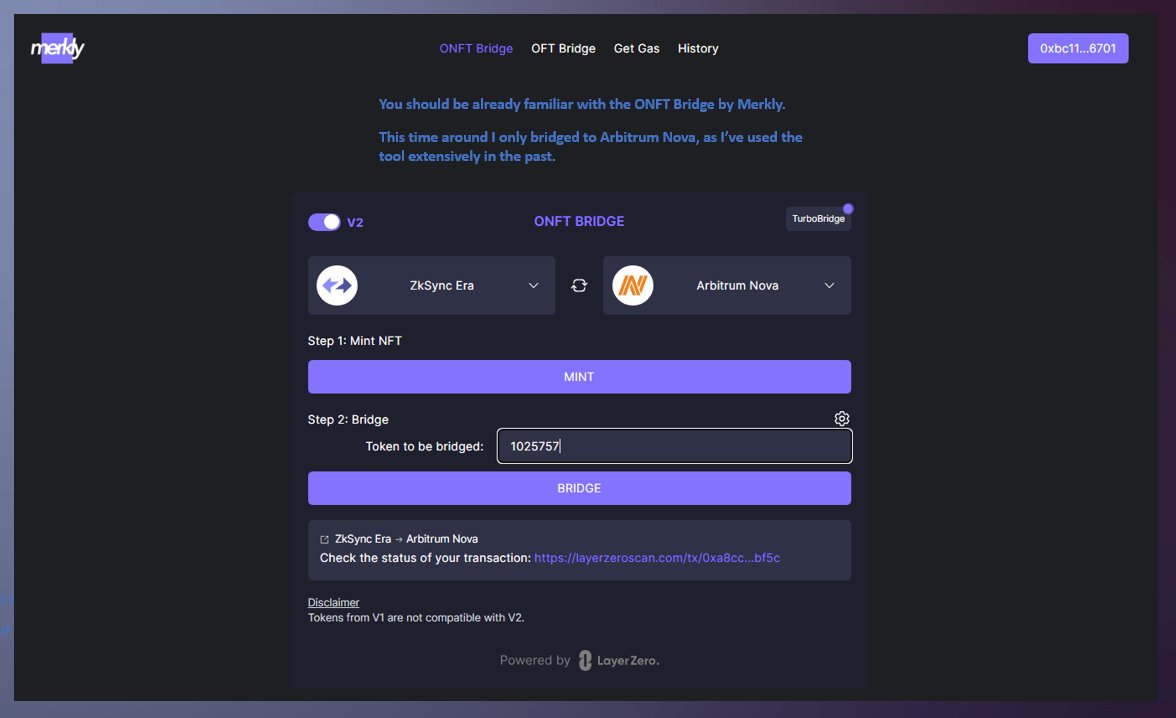

Let’s use tasks now that involve both $ZRO & $ZKS!

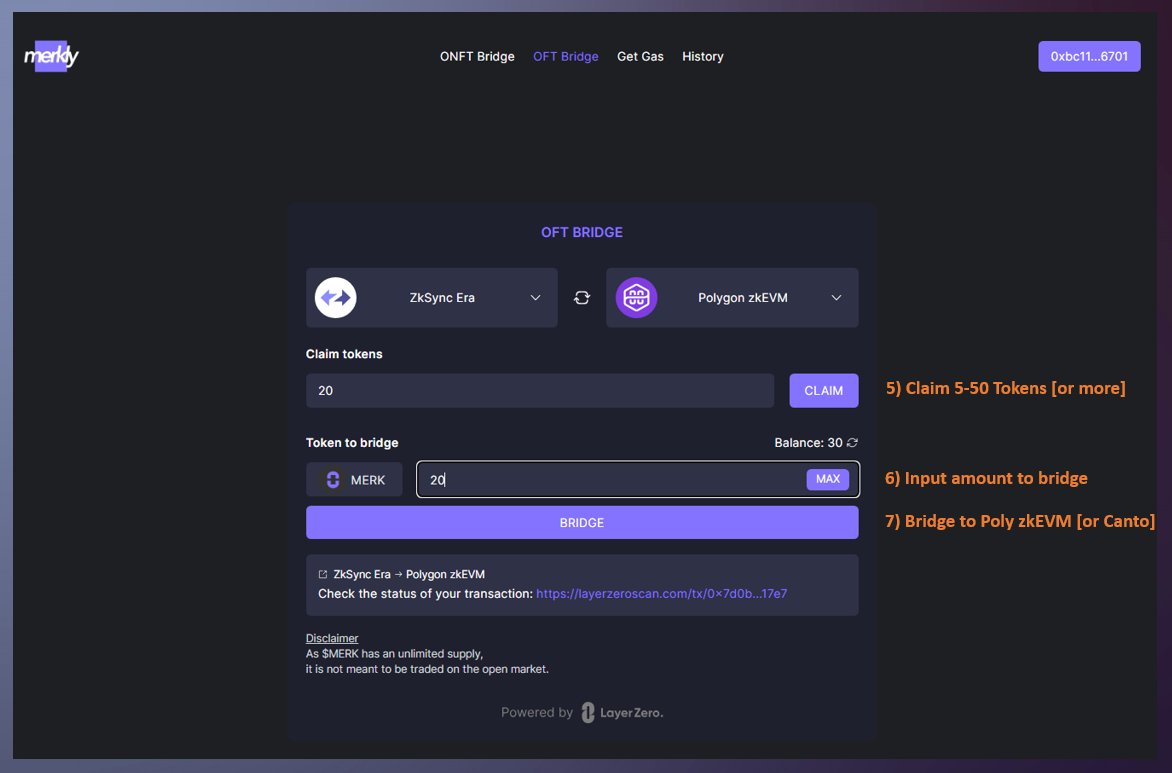

Open:

5) Claim at least 5 $MERK

6) Input amount to bridge

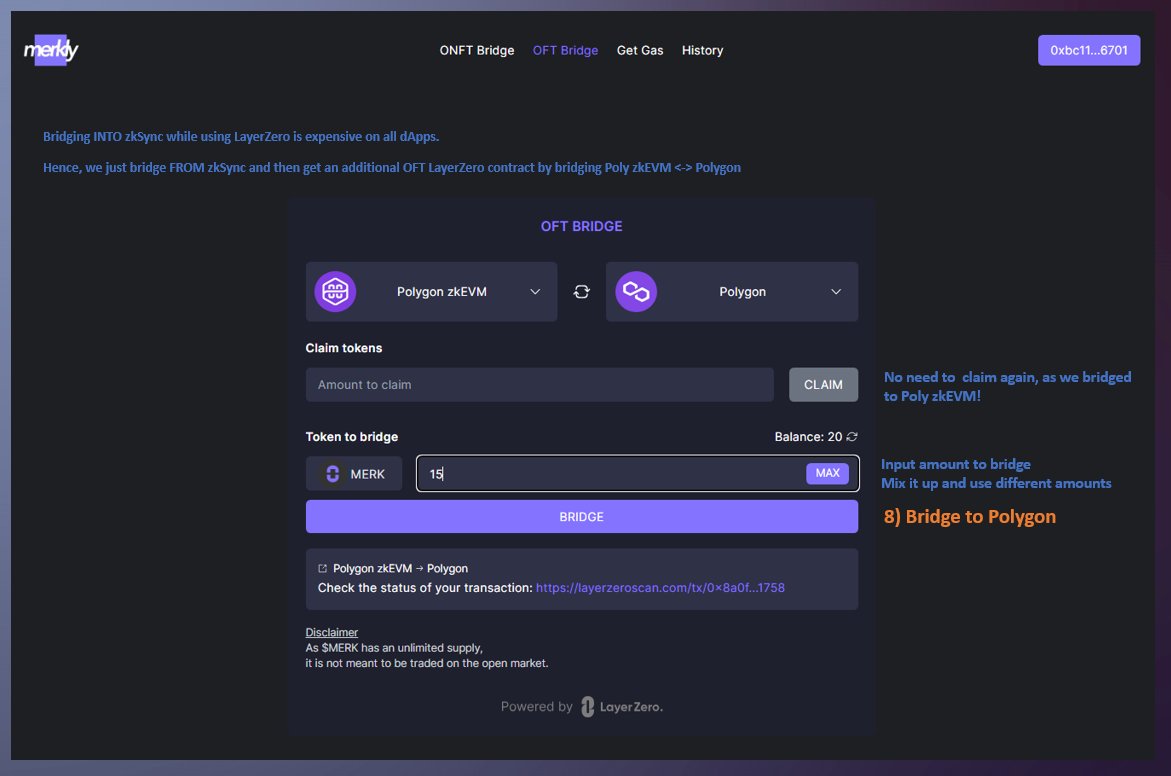

7) Bridge to Poly zkEVM

8) Now on zkEVM -> Bridge to Polygon

➣ If needed, use Gas Feature [counts as contract!]

➣ Also bridge ONFT from zkSync https://t.co/rB8JGJtxoVminter.merkly.com/oft

Open:

5) Claim at least 5 $MERK

6) Input amount to bridge

7) Bridge to Poly zkEVM

8) Now on zkEVM -> Bridge to Polygon

➣ If needed, use Gas Feature [counts as contract!]

➣ Also bridge ONFT from zkSync https://t.co/rB8JGJtxoVminter.merkly.com/oft

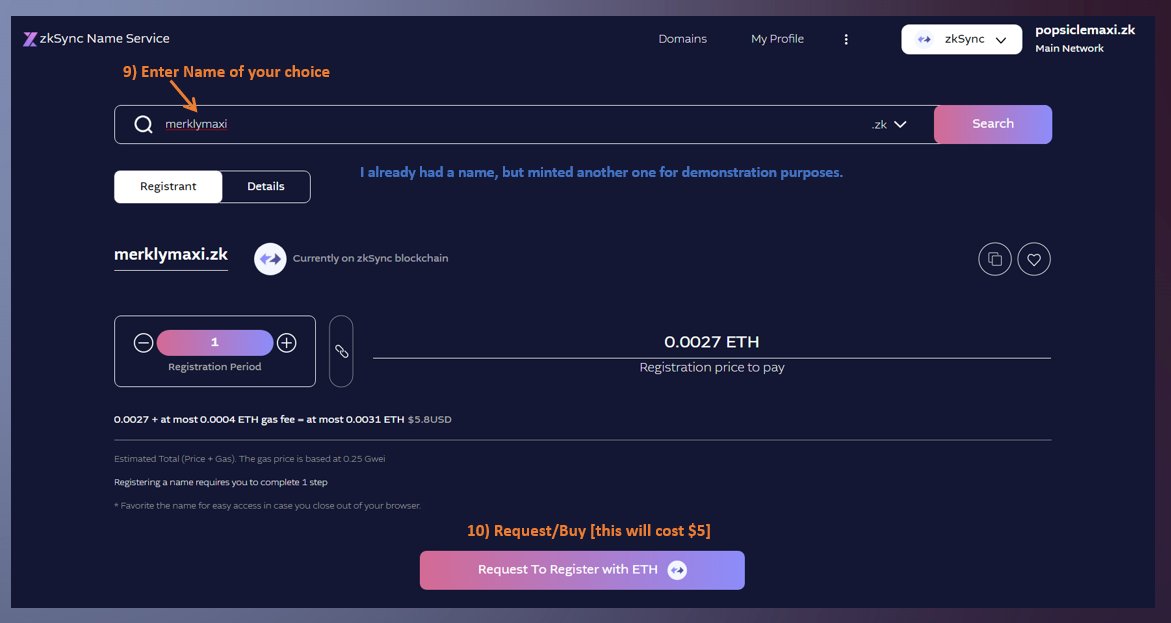

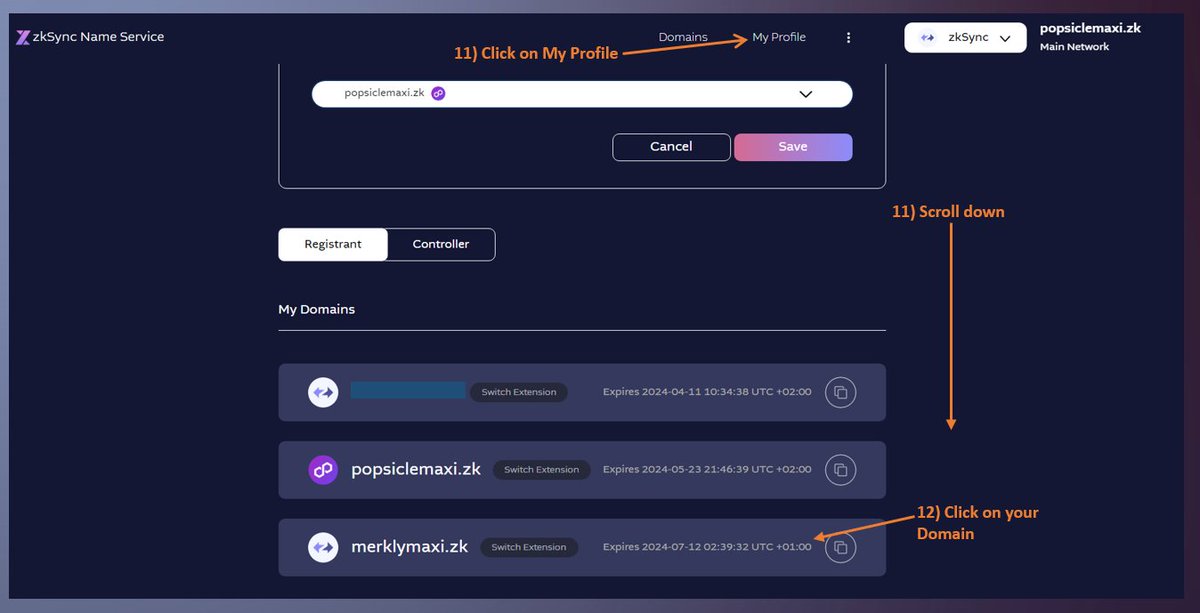

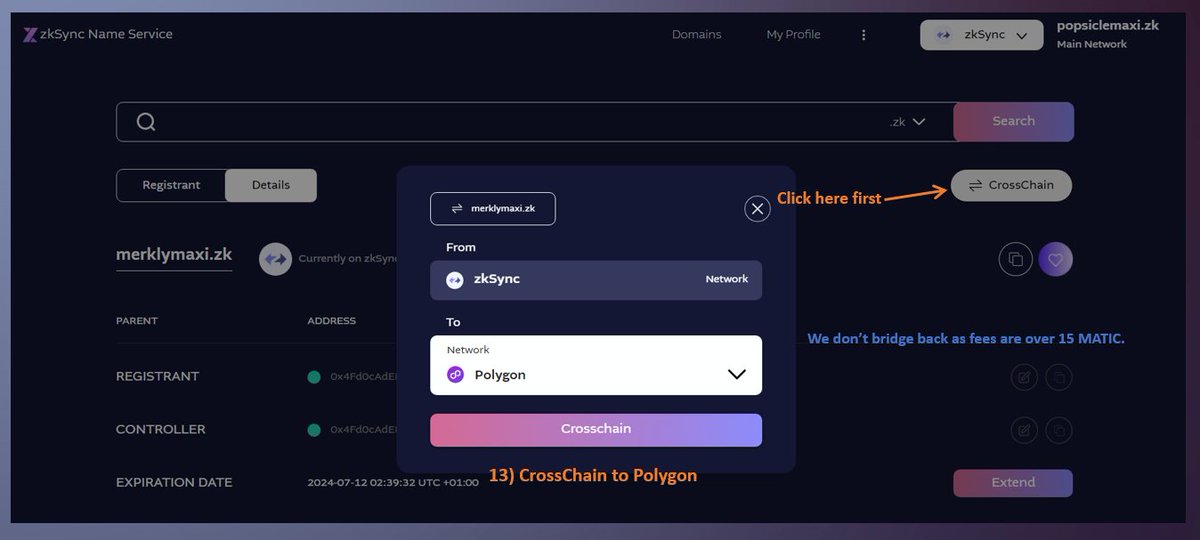

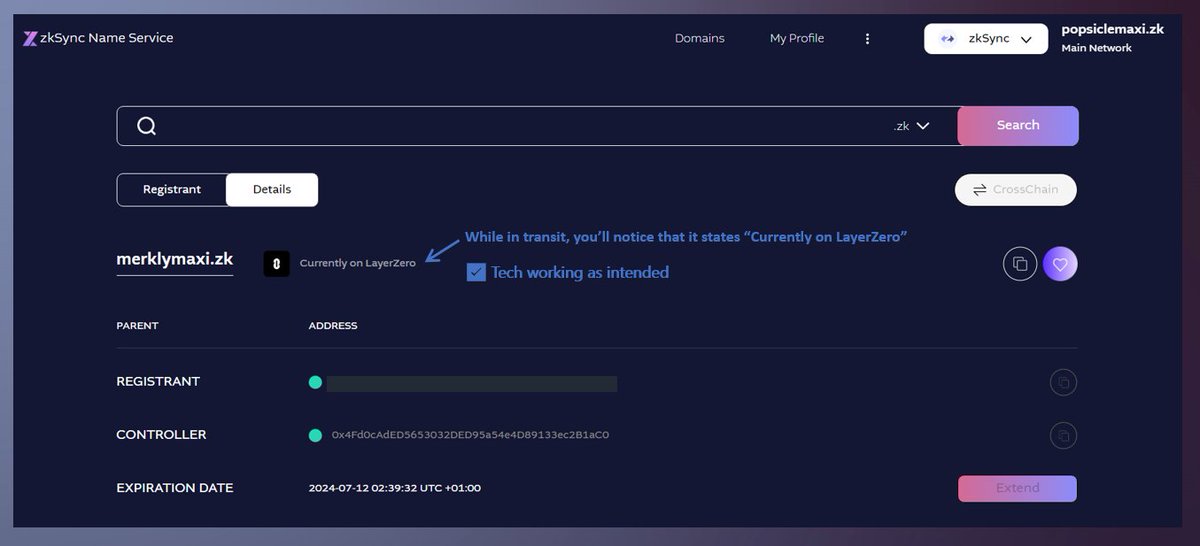

Task #2 that uses both $ZRO & $ZKS.

Open:

9) Enter Name of choice

10) Request to Register w/ ETH

11) Click on "My Profile", Scroll down

12) Click on your Domain

13) CrossChain to Polygon

Done ✅

Again, we don't bridge back due to high gas fees. https://t.co/ch4FWulDEBapp.zkns.domains

Open:

9) Enter Name of choice

10) Request to Register w/ ETH

11) Click on "My Profile", Scroll down

12) Click on your Domain

13) CrossChain to Polygon

Done ✅

Again, we don't bridge back due to high gas fees. https://t.co/ch4FWulDEBapp.zkns.domains

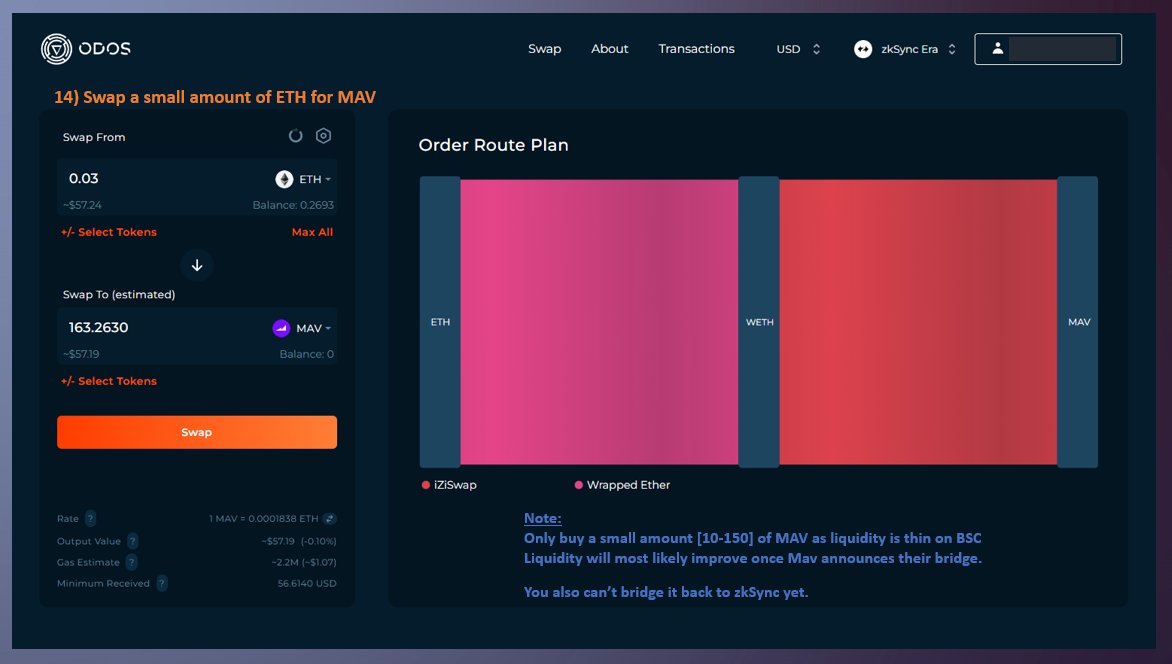

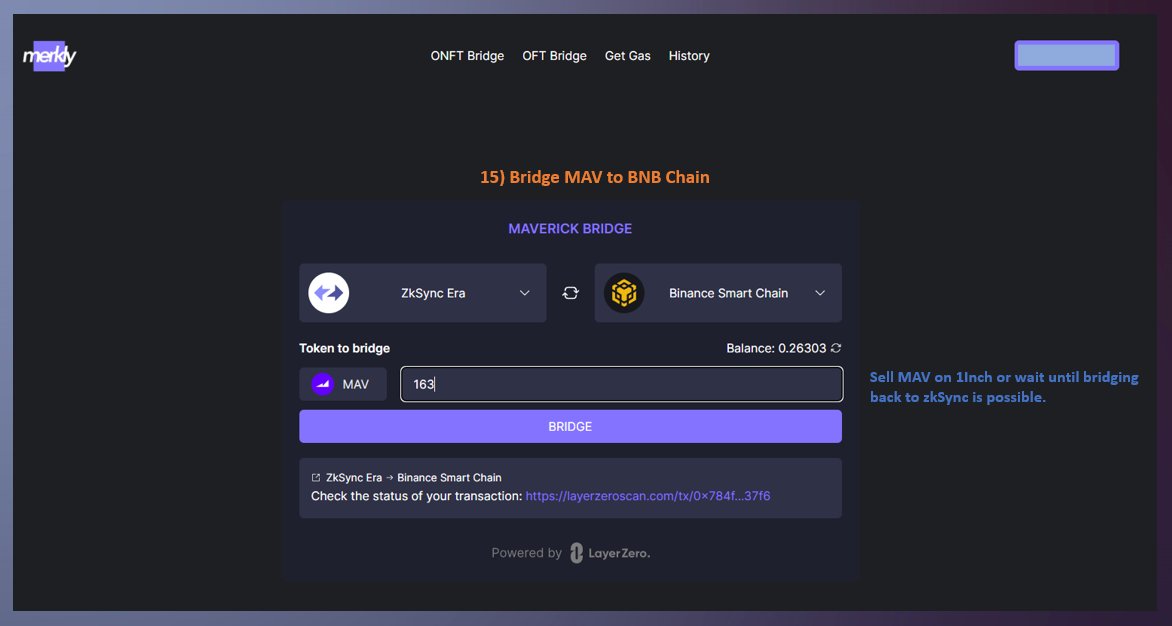

Revisit:

14) Swap small amount of ETH -> MAV

Open: https://t.co/22qhPP7hQl

15) Bridge MAV to BNB Chain

16) Sell on 1Inch or wait until bridging back to zkSync is possible

Task #3 Done. ✅ https://t.co/ZUpm9EpWZyapp.odos.xyz

minter.merkly.com/maverick

14) Swap small amount of ETH -> MAV

Open: https://t.co/22qhPP7hQl

15) Bridge MAV to BNB Chain

16) Sell on 1Inch or wait until bridging back to zkSync is possible

Task #3 Done. ✅ https://t.co/ZUpm9EpWZyapp.odos.xyz

minter.merkly.com/maverick

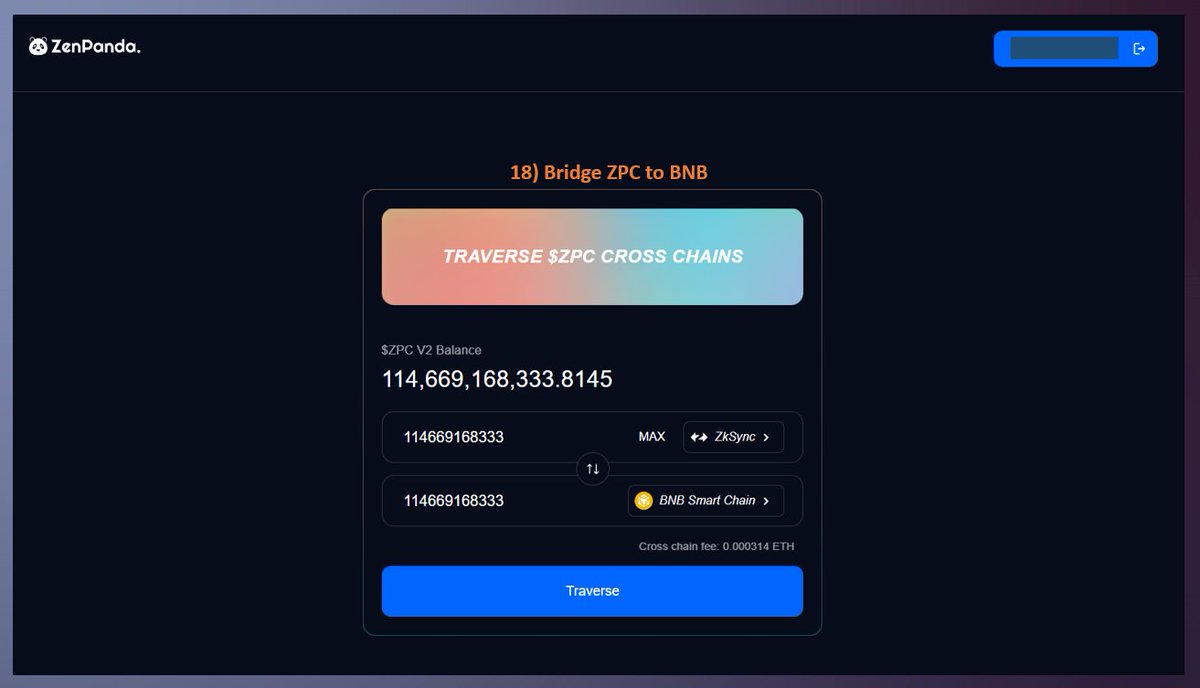

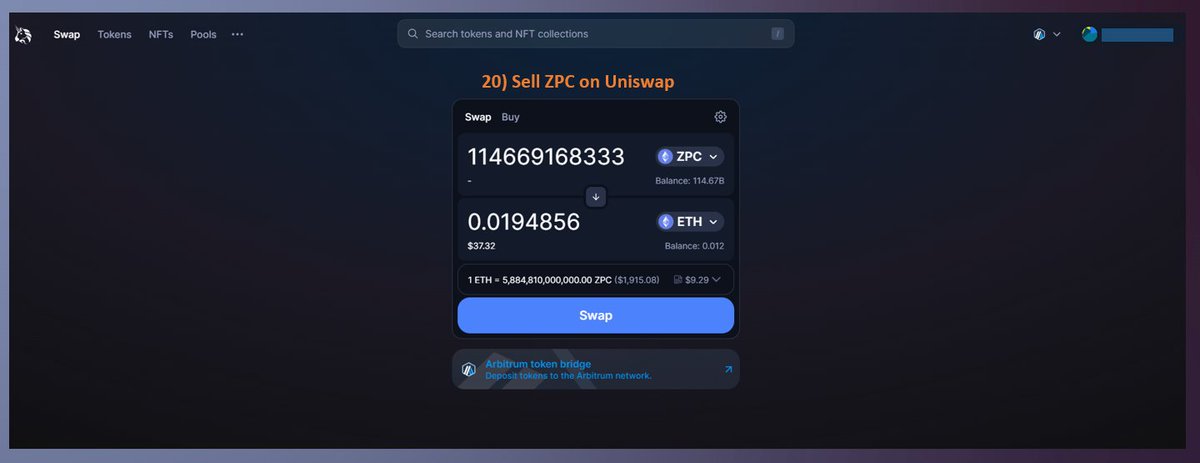

This one is quite degen, and only has a $400K MC.

It is an additional contract that uses $ZKS & $ZRO though.

Open:

17) Buy $10-$40 of ZPC

Open: https://t.co/AmmlAedEyZ

18) Bridge ZPC to BNB

19) Bridge to Arbitrum

20) Sell on Uniswap

Task #4 Done! ✅ https://t.co/ntDuaa1oXasyncswap.xyz

zenpanda.ai/traverse

It is an additional contract that uses $ZKS & $ZRO though.

Open:

17) Buy $10-$40 of ZPC

Open: https://t.co/AmmlAedEyZ

18) Bridge ZPC to BNB

19) Bridge to Arbitrum

20) Sell on Uniswap

Task #4 Done! ✅ https://t.co/ntDuaa1oXasyncswap.xyz

zenpanda.ai/traverse

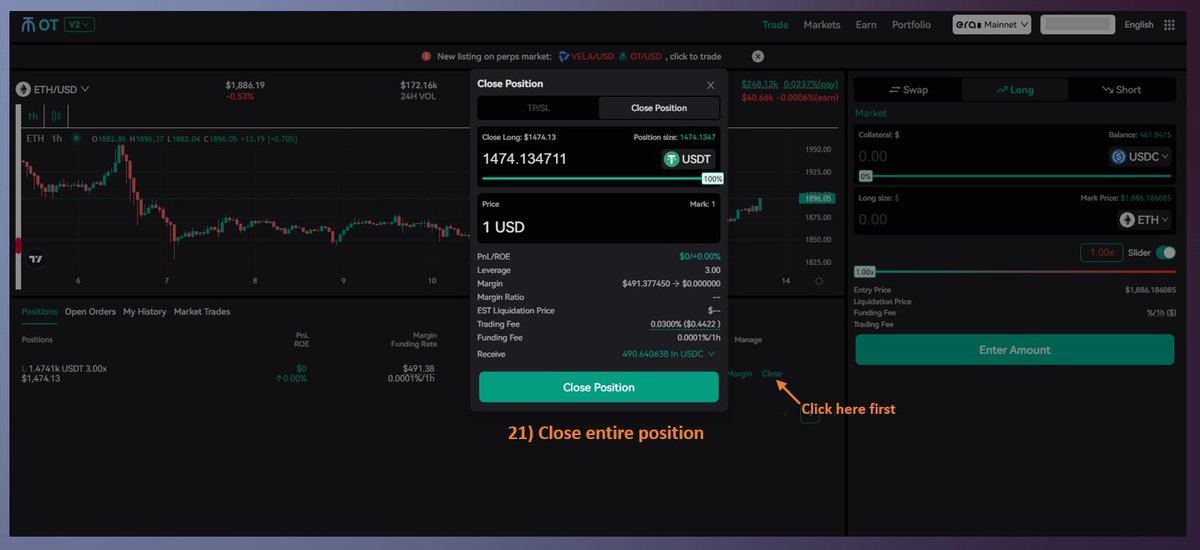

Remember that we still have an USDT Long open?

Time to continue our zkSync Route!

Revisit:

21) Close Position

Open: https://t.co/2MVHyox1M3

22) Swap USDC for USD+

Open: https://t.co/kb6H9cnx9w

23) Swap some ETH for USD+

Cont. https://t.co/YAnqf7CGewonchain.trade

syncswap.xyz

velocore.xyz

Time to continue our zkSync Route!

Revisit:

21) Close Position

Open: https://t.co/2MVHyox1M3

22) Swap USDC for USD+

Open: https://t.co/kb6H9cnx9w

23) Swap some ETH for USD+

Cont. https://t.co/YAnqf7CGewonchain.trade

syncswap.xyz

velocore.xyz

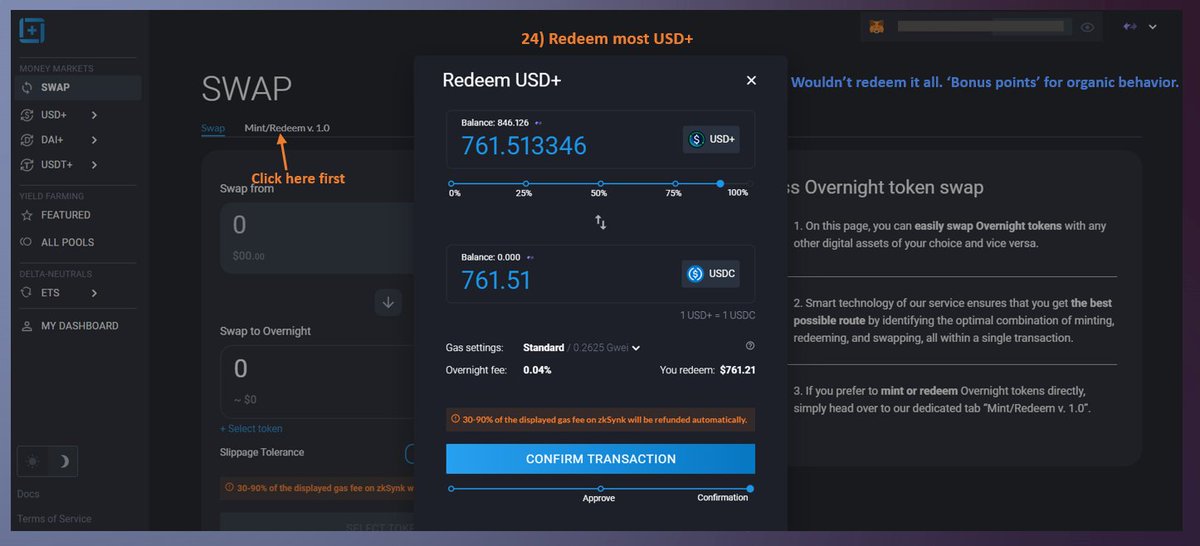

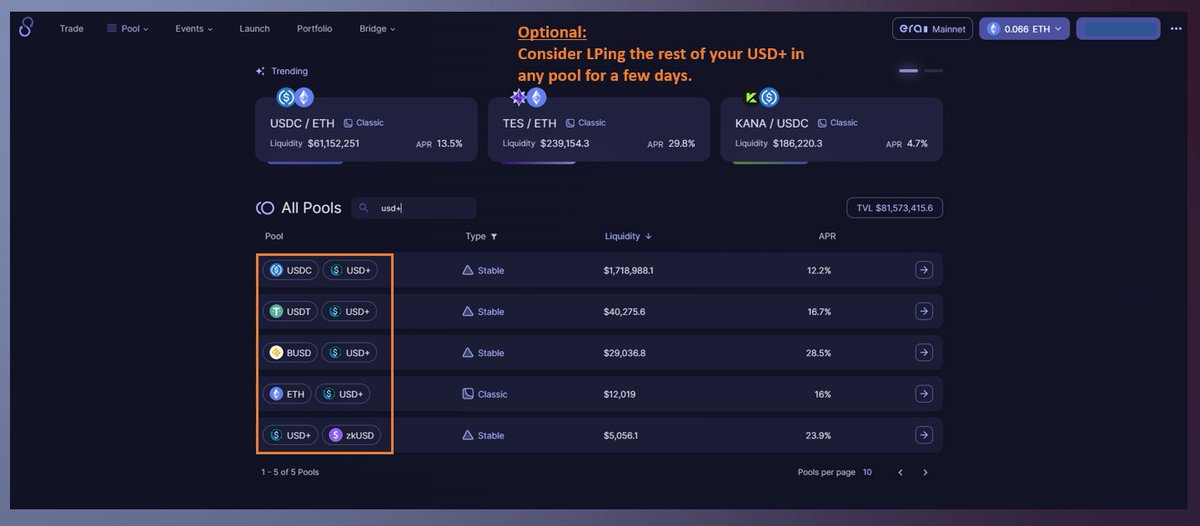

Open:

24) Redeem 60% or more USD+ for USDC

Optional:

LP a small amount on Syncswap for a few days.

Bonus points for organic behavior.

Almost done!

Now here's a way to bridge out of zkSync you didn't know existed...🌉

Cont. https://t.co/OMQf60EPNuapp.overnight.fi/swap

24) Redeem 60% or more USD+ for USDC

Optional:

LP a small amount on Syncswap for a few days.

Bonus points for organic behavior.

Almost done!

Now here's a way to bridge out of zkSync you didn't know existed...🌉

Cont. https://t.co/OMQf60EPNuapp.overnight.fi/swap

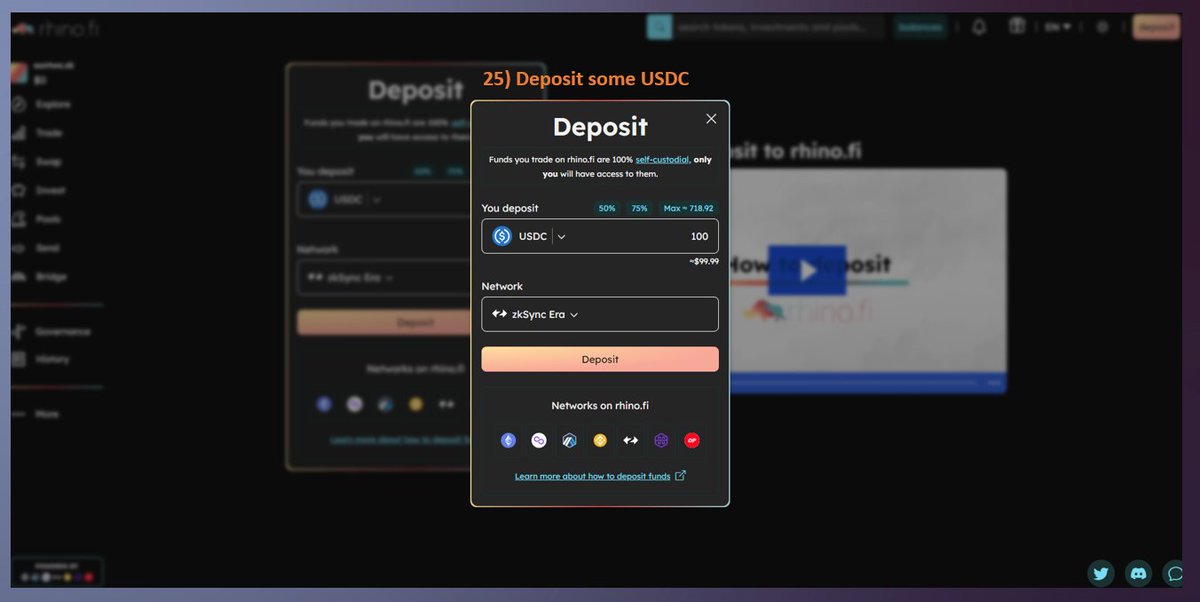

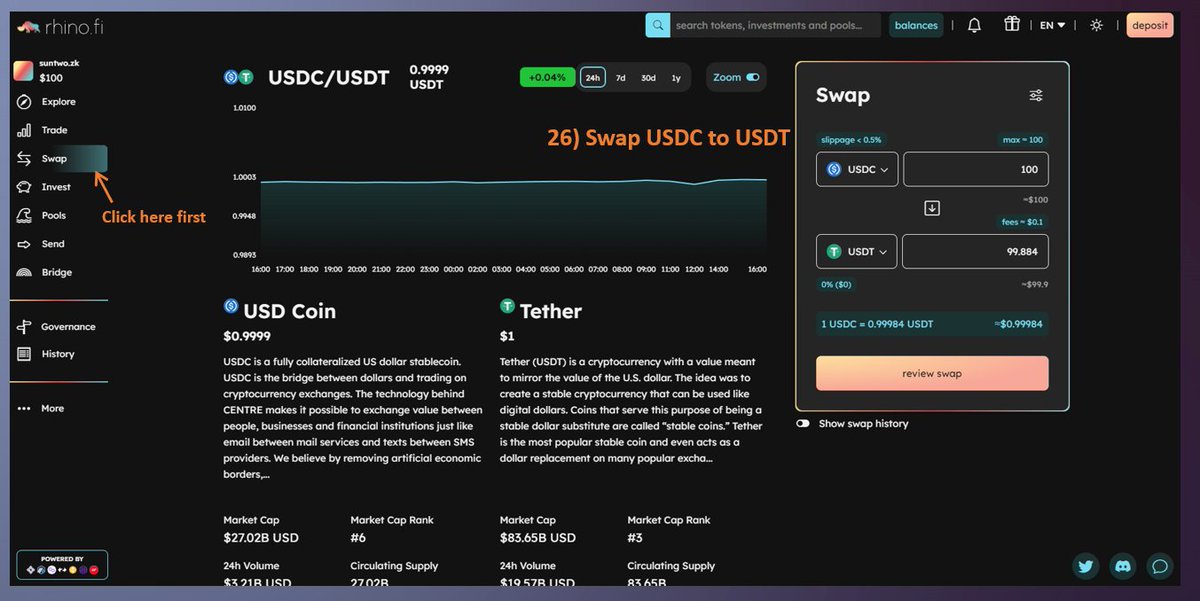

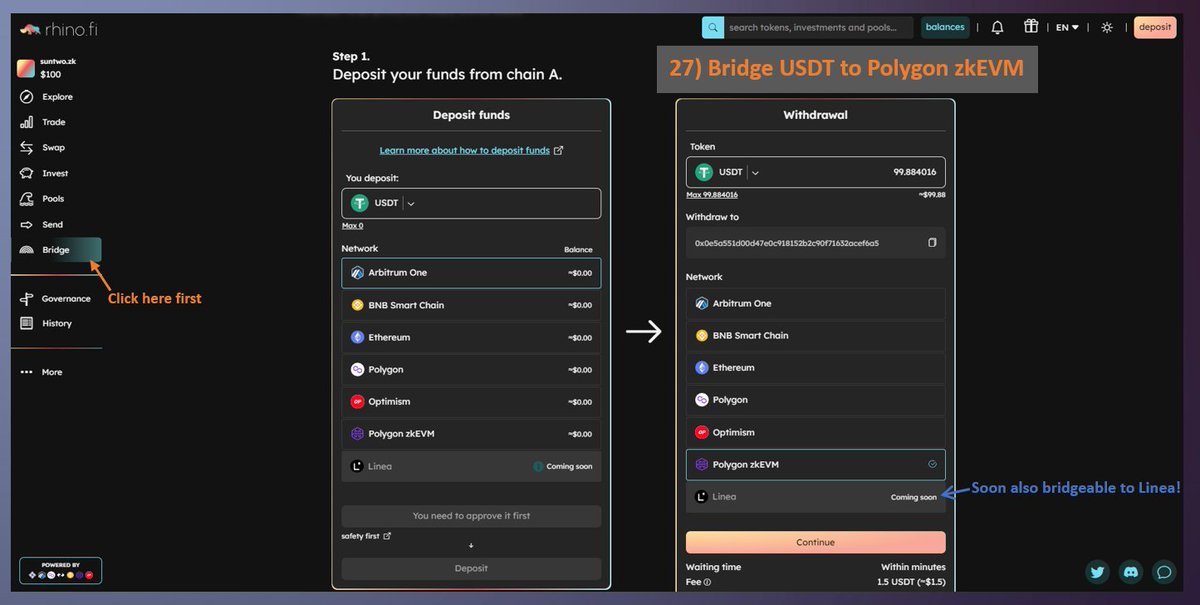

Open:

25) Deposit a small portion of your USDC

26) Swap USDC to USDT

27) Bridge to Polygon zkEVM [or any other chain]

Rhino doesn't utilize LayerZero, but is an underused zkSync dapp.

Cont. https://t.co/FNv6NTkfpLapp.rhino.fi

25) Deposit a small portion of your USDC

26) Swap USDC to USDT

27) Bridge to Polygon zkEVM [or any other chain]

Rhino doesn't utilize LayerZero, but is an underused zkSync dapp.

Cont. https://t.co/FNv6NTkfpLapp.rhino.fi

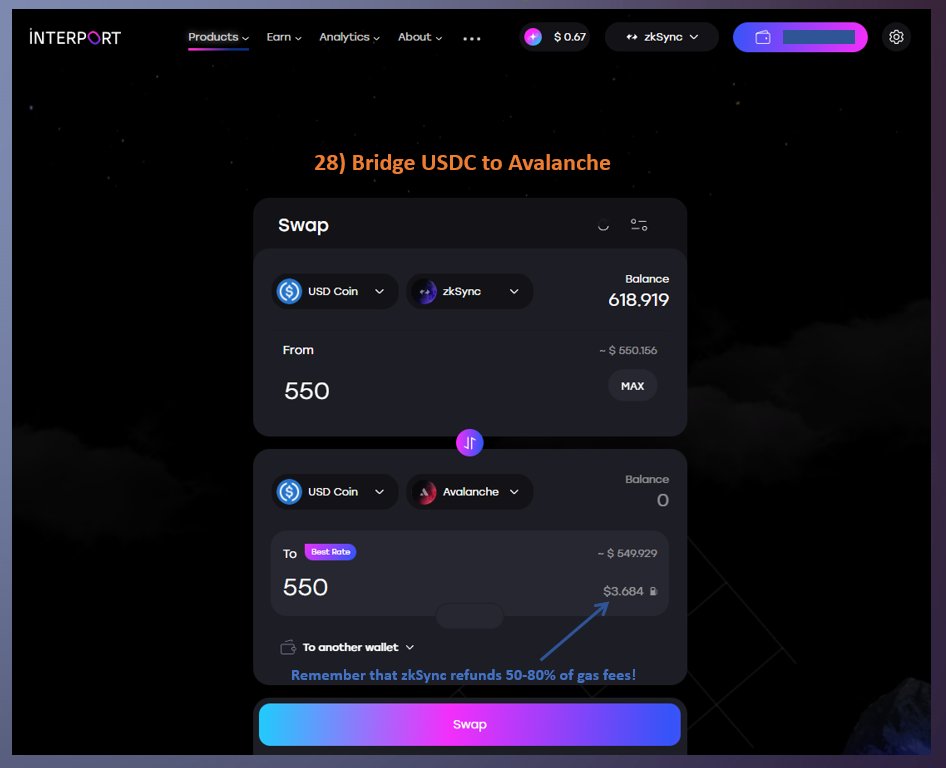

To finalize the route, we'll utilize yet another dapp that combines zkSync w/ LayerZero!

Open:

28) Bridge USDC from zkSync -> Avalanche

I'm using Avalanche as we used virtually any other chain. Bridging out of zkSync = cheap

$ZRO x $ZKS Task #5 DONE✅ https://t.co/VoOTmx5rAzapp.interport.fi

Open:

28) Bridge USDC from zkSync -> Avalanche

I'm using Avalanche as we used virtually any other chain. Bridging out of zkSync = cheap

$ZRO x $ZKS Task #5 DONE✅ https://t.co/VoOTmx5rAzapp.interport.fi

There you have it.

A comprehensive thread w/ ALL possible zkSync x LayerZero interactions as of 17 July.

We even integrated a small route on zkSync to ensure organic usage before bridging out again.

Plenty of interactions to follow as both ecosystems continue to mature.

A comprehensive thread w/ ALL possible zkSync x LayerZero interactions as of 17 July.

We even integrated a small route on zkSync to ensure organic usage before bridging out again.

Plenty of interactions to follow as both ecosystems continue to mature.

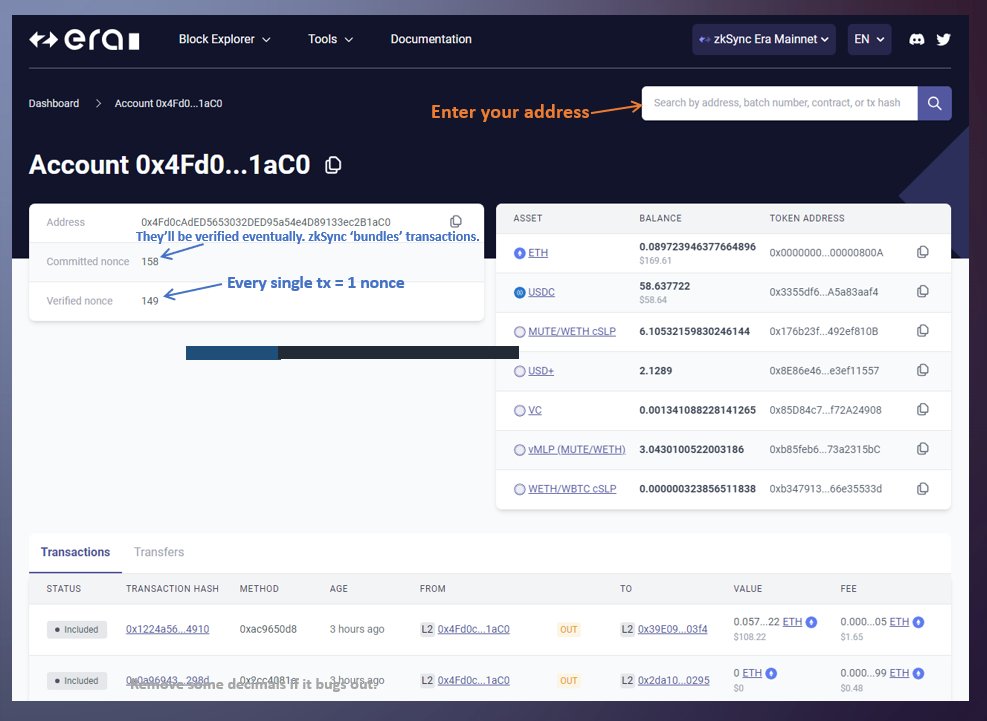

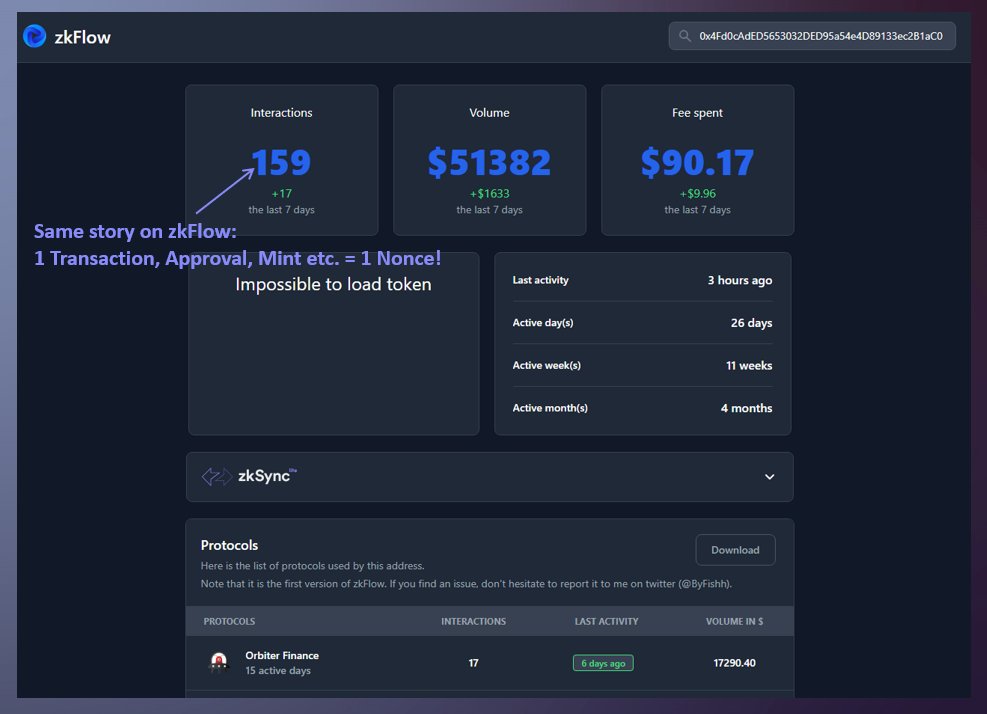

You may have noticed there being a lot more contracts for zkSync, for one simple reason:

Every single approval, swap, lend, mint etc. on zkSync counts as 'Nonce'.

While it's significantly harder to increase your contract count on LayerZero as they all have to be unique!

Every single approval, swap, lend, mint etc. on zkSync counts as 'Nonce'.

While it's significantly harder to increase your contract count on LayerZero as they all have to be unique!

This is just one of many reasons why I believe it is significantly easier to qualify for $ZKS than $ZRO.

Nonetheless, following my 'LayerZero α Dose' series should set you up nicely.

And remember:

We keep engaging until an official announcement. 🪂

Don't get psyoped.

Nonetheless, following my 'LayerZero α Dose' series should set you up nicely.

And remember:

We keep engaging until an official announcement. 🪂

Don't get psyoped.

Sources for those interested.

Paraswap Airdrop Filtering [it flopped]:

Semiotic AI $60M grant:

https://t.co/NC8kEPGtKM

Useful, but not 100% accurate zkSync tracker:

https://t.co/fGXeRUWtcg

Check your zkSync Nonces:

https://t.co/XG1ScsjaZltinyurl.com/2zrn4sym

tinyurl.com/mw9n8zny

byfishh.github.io/zk-flow/

explorer.zksync.io

Paraswap Airdrop Filtering [it flopped]:

Semiotic AI $60M grant:

https://t.co/NC8kEPGtKM

Useful, but not 100% accurate zkSync tracker:

https://t.co/fGXeRUWtcg

Check your zkSync Nonces:

https://t.co/XG1ScsjaZltinyurl.com/2zrn4sym

tinyurl.com/mw9n8zny

byfishh.github.io/zk-flow/

explorer.zksync.io

• • •

Missing some Tweet in this thread? You can try to

force a refresh