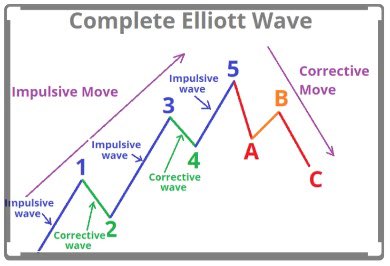

Elliott Five Wave Pattern:

Wave 1: Wave one is rarely obvious at the beginning. When the first wave of a new bull market begins, the fundamental news is almost universally negative. The previous trend is considered still strongly in force. Fundamental analysts continue to… https://t.co/qqaYHpKHsBtwitter.com/i/web/status/1…

Wave 1: Wave one is rarely obvious at the beginning. When the first wave of a new bull market begins, the fundamental news is almost universally negative. The previous trend is considered still strongly in force. Fundamental analysts continue to… https://t.co/qqaYHpKHsBtwitter.com/i/web/status/1…

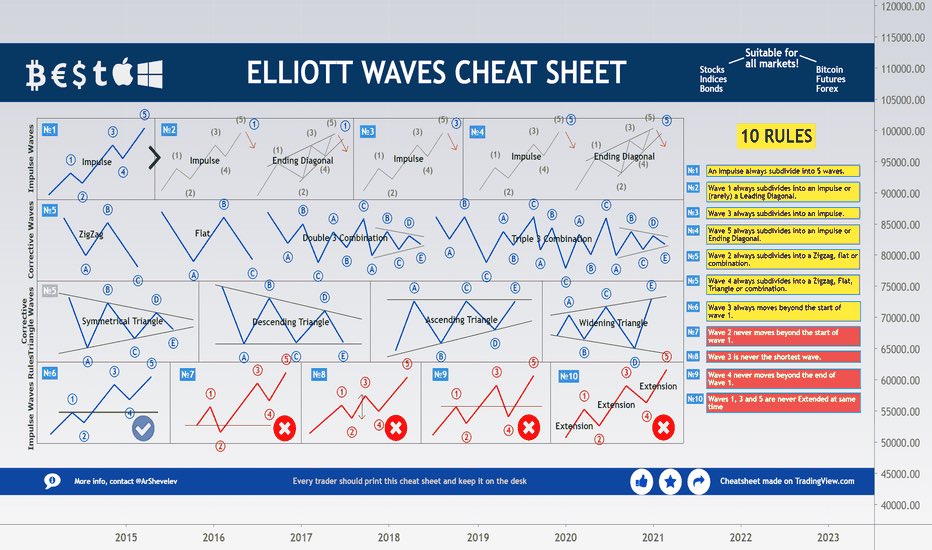

A correct Elliott wave count must observe three rules:

•Wave 2 never retraces more than 100% of wave 1.

•Wave 3 cannot be the shortest of the three impulse waves, namely waves 1, 3 and 5.

•Wave 4 does not overlap with the price territory of wave 1, except in the rare case of… https://t.co/TMgNuMWFLItwitter.com/i/web/status/1…

•Wave 2 never retraces more than 100% of wave 1.

•Wave 3 cannot be the shortest of the three impulse waves, namely waves 1, 3 and 5.

•Wave 4 does not overlap with the price territory of wave 1, except in the rare case of… https://t.co/TMgNuMWFLItwitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter