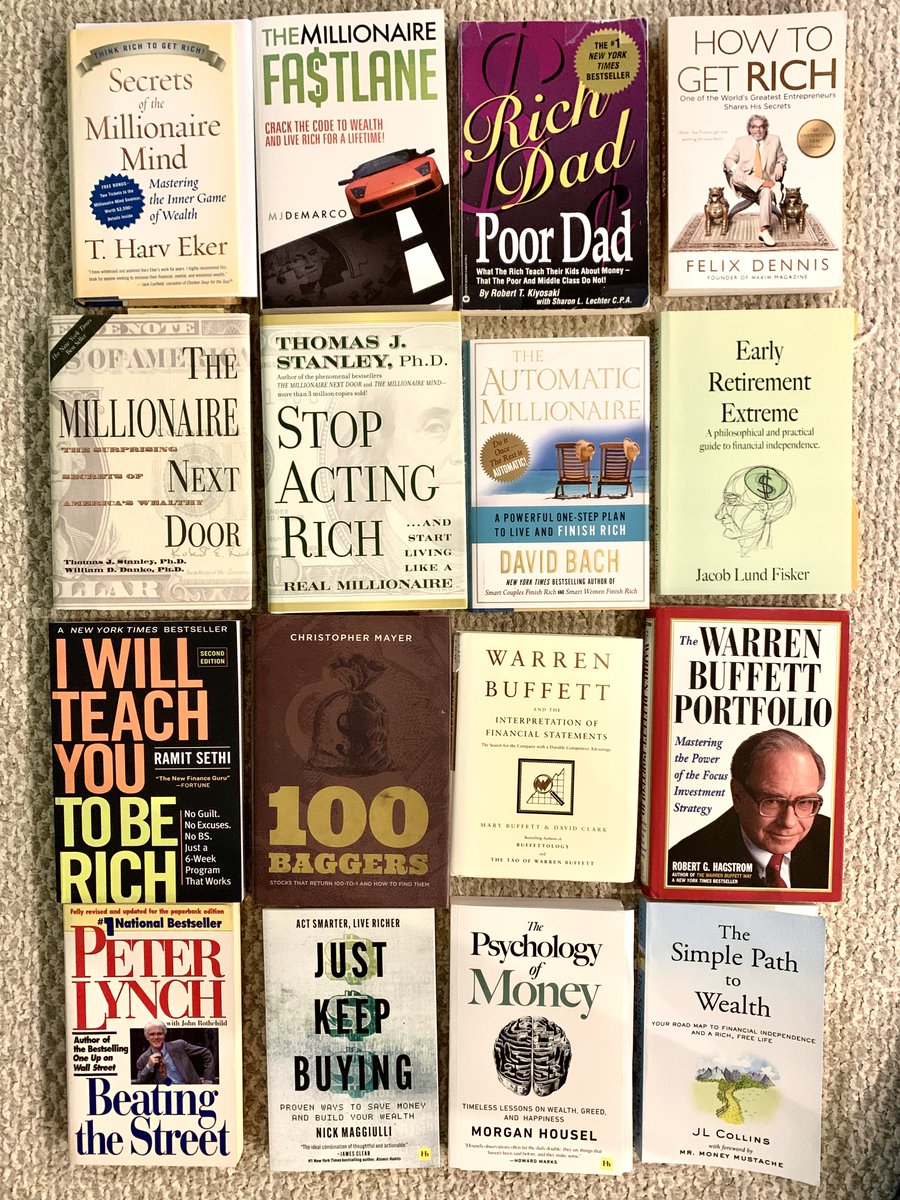

16 highly effective investing and money books.

These are the key ones that will help you get your financial shit together:

These are the key ones that will help you get your financial shit together:

1. MINDSET Books

Getting your head straight on how to build wealth is step #1 in your journey.

Secrets of the Millionaire Mind

Before you can become a millionaire, you have to think like one.

Here’s a thread I wrote on the book:

Getting your head straight on how to build wealth is step #1 in your journey.

Secrets of the Millionaire Mind

Before you can become a millionaire, you have to think like one.

Here’s a thread I wrote on the book:

https://twitter.com/fmarciano/status/1676639262609997845

The Millionaire Fastlane

MJ DeMarco made his first million at 31.

Multi-millionare at 33.

Retired at 37.

He believes you can Get Rich Quick.

Thread I wrote on the book:

MJ DeMarco made his first million at 31.

Multi-millionare at 33.

Retired at 37.

He believes you can Get Rich Quick.

Thread I wrote on the book:

https://twitter.com/fmarciano/status/1678452381544062981

Rich Dad Poor Dad (and Cashflow Quadrant)

You’ve heard of the book.

It gets recommended a LOT.

For me the importance of buying assets and not stupid crap hit home.

Plus the importance of your cash flow, not net worth.

amzn.to/3rIoKDH

You’ve heard of the book.

It gets recommended a LOT.

For me the importance of buying assets and not stupid crap hit home.

Plus the importance of your cash flow, not net worth.

amzn.to/3rIoKDH

How to Get Rich

Love this book.

Read the pinned thread on my profile about the book.

He’s sick in the head, but was fabulously wealthy & a party animal.

Not “how to live your life” advice, but a kick in the head to think differently / beyond your 9-5.

Love this book.

Read the pinned thread on my profile about the book.

He’s sick in the head, but was fabulously wealthy & a party animal.

Not “how to live your life” advice, but a kick in the head to think differently / beyond your 9-5.

https://twitter.com/fmarciano/status/1675231088254353409

2. PERSONAL FINANCE Books

Millionaire Next Door

1 Live well below their means

2 Financially literate

3 Prioritize FI over social status

4 Don’t economically support adult children

5 Kids are self-sufficient

6 Market opportunists

7 Choose great careers

amzn.to/44DF6fk

Millionaire Next Door

1 Live well below their means

2 Financially literate

3 Prioritize FI over social status

4 Don’t economically support adult children

5 Kids are self-sufficient

6 Market opportunists

7 Choose great careers

amzn.to/44DF6fk

Stop Acting Rich

Goes one step further on living below your means than MND.

Details how millionaires actually spend their money.

I adopted their frugal mindset and invested as much $ as possible.

amzn.to/47dWEjU

Goes one step further on living below your means than MND.

Details how millionaires actually spend their money.

I adopted their frugal mindset and invested as much $ as possible.

amzn.to/47dWEjU

The Automatic Millionaire

Helped me get over my shopping and spending habits.

Teaches you the power of saving as much as you can to become a millionaire.

amzn.to/3Y1Hp9v

Helped me get over my shopping and spending habits.

Teaches you the power of saving as much as you can to become a millionaire.

amzn.to/3Y1Hp9v

Early Retirement Extreme

This book smashed me in the face.

It made me realize that your savings rate is one of the most powerful numbers to keep track off.

If the idea lof-sufficient, minimalist lifestyle appeals t you, read this:

amzn.to/3OdiZFE

This book smashed me in the face.

It made me realize that your savings rate is one of the most powerful numbers to keep track off.

If the idea lof-sufficient, minimalist lifestyle appeals t you, read this:

amzn.to/3OdiZFE

I Will Teach You to Be Rich

If you asked me for one book on how to manage your personal finances, invest, etc, I would hand you this book.

Enough said.

amzn.to/3Y4aYqQ

If you asked me for one book on how to manage your personal finances, invest, etc, I would hand you this book.

Enough said.

amzn.to/3Y4aYqQ

3. STOCK INVESTING Books

100 Baggers - @chriswmayer

LOVE this book. If you’re a stock picker, just freaking buy it.

He shows you the power of finding stocks that 100x your money.

It’s not easy, but the payof is HUGE!

amzn.to/43DOxKn

100 Baggers - @chriswmayer

LOVE this book. If you’re a stock picker, just freaking buy it.

He shows you the power of finding stocks that 100x your money.

It’s not easy, but the payof is HUGE!

amzn.to/43DOxKn

@chriswmayer Warren Buffett and the Interpretation of Financial Statements

Worth reading to learn how to analyze financial statements.

They cover a high level overview of how Warren values companies.

Former daughter-in-law is the co-author.

amzn.to/43GY2bH

Worth reading to learn how to analyze financial statements.

They cover a high level overview of how Warren values companies.

Former daughter-in-law is the co-author.

amzn.to/43GY2bH

@chriswmayer The Warren Buffett Portfolio

I have read a dozen books on Uncle Warren.

This was the first that clicked for me.

It takes you through his investing philosophy with examples.

It’s a bit dated in terms of examples, published in 1999, but I love it.

amzn.to/45gD4Sn

I have read a dozen books on Uncle Warren.

This was the first that clicked for me.

It takes you through his investing philosophy with examples.

It’s a bit dated in terms of examples, published in 1999, but I love it.

amzn.to/45gD4Sn

@chriswmayer 4. INVESTING HABITS Books

I don’t know what to call these 3 gems, but after I built up my portfolio, had kids, career, family, etc, I went looking for something more.

I don’t know what to call these 3 gems, but after I built up my portfolio, had kids, career, family, etc, I went looking for something more.

@chriswmayer Just Keep Buying - @dollarsanddata

Nick backs up everything with data and

He gives compelling arguments:

• Why you need to save less than you think

• Use The 2x Rule to Eliminate Spending Guilt

• Debt Isn’t Good or Bad, It Depends on How You Use It

amzn.to/46ZCwSm

Nick backs up everything with data and

He gives compelling arguments:

• Why you need to save less than you think

• Use The 2x Rule to Eliminate Spending Guilt

• Debt Isn’t Good or Bad, It Depends on How You Use It

amzn.to/46ZCwSm

@chriswmayer @dollarsanddata The Psychology of Money - @morganhousel

Another smash bestseller. You probably have heard about the book.

If not, buy and read it. You’ll learn how emotions drive a lot of our money behavior.

Here’s a thread I wrote on the book.

Another smash bestseller. You probably have heard about the book.

If not, buy and read it. You’ll learn how emotions drive a lot of our money behavior.

Here’s a thread I wrote on the book.

https://twitter.com/fmarciano/status/1671154204017299457

@chriswmayer @dollarsanddata @morganhousel The Simple Path to Wealth

A great book to end this list on.

It shows you

• The power of long-term investing

• Why index funds make the most sense

• How to keep your finances and life simple

amzn.to/3OuwRN6

A great book to end this list on.

It shows you

• The power of long-term investing

• Why index funds make the most sense

• How to keep your finances and life simple

amzn.to/3OuwRN6

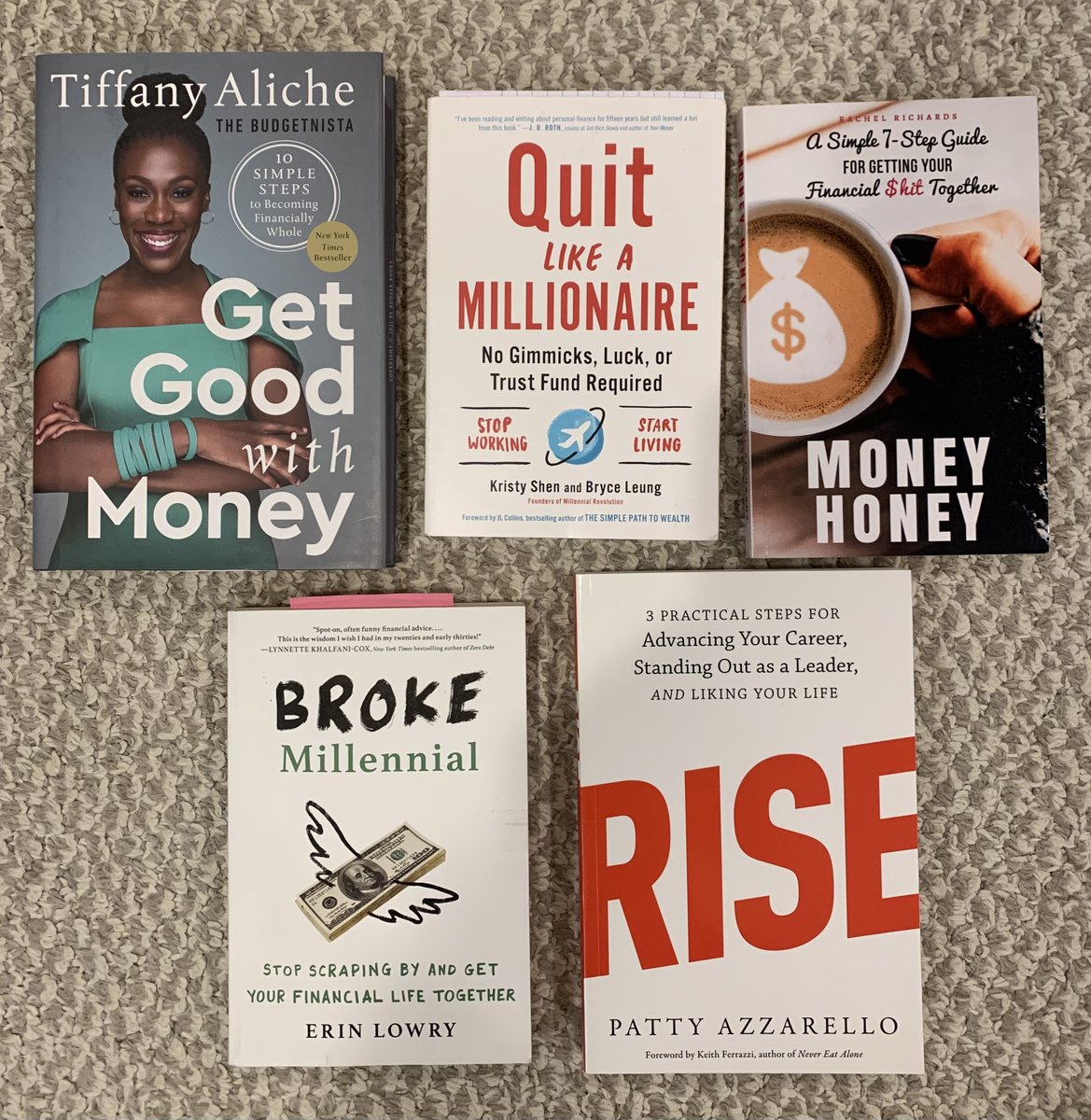

@chriswmayer @dollarsanddata @morganhousel Note: I’m PISSED there is just one woman on the list of books that influenced my financial journey.

Not acceptable, but these were the books I found, read, and transformed my life.

I will not lie to you and show you a different list, so...

Not acceptable, but these were the books I found, read, and transformed my life.

I will not lie to you and show you a different list, so...

@chriswmayer @dollarsanddata @morganhousel These are the amazing books that I love, love, love from women authors:

• Money Honey

• Broke Millennial

• RISE (career book)

• Get Good with Money

• Quit Like a Millionaire

• Your Money or Your Life (can’t find it)

• Money Honey

• Broke Millennial

• RISE (career book)

• Get Good with Money

• Quit Like a Millionaire

• Your Money or Your Life (can’t find it)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter