3 financial statements every investor needs to know:

• Balance Sheet

• Income Statement

• Cash Flow Statement

As the Head of Financial Reporting at Amalgamated Bank ($55 billion AUM) I worked with financials daily, so here are quick tips to understand & analyze each:

• Balance Sheet

• Income Statement

• Cash Flow Statement

As the Head of Financial Reporting at Amalgamated Bank ($55 billion AUM) I worked with financials daily, so here are quick tips to understand & analyze each:

1/ Financial statements are important because they provide insights into a company's financial health.

Understanding financial statements will help you to make better-informed decisions on buying or selling a stock.

Understanding financial statements will help you to make better-informed decisions on buying or selling a stock.

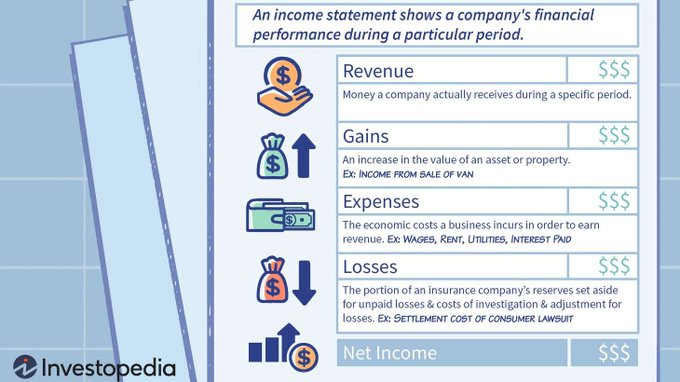

2/ The income statement shows a company's revenues, expenses, and net income.

It helps you better understand a company's profitability and ability to generate income.

It helps you better understand a company's profitability and ability to generate income.

3/ An income statement has 2 sections:

• The Income section covers revenues (sales, interest income, investment gains, etc)

• The expense section covers costs (costs of goods sold, selling & administrative expenses, interest expenses, etc)

• The Income section covers revenues (sales, interest income, investment gains, etc)

• The expense section covers costs (costs of goods sold, selling & administrative expenses, interest expenses, etc)

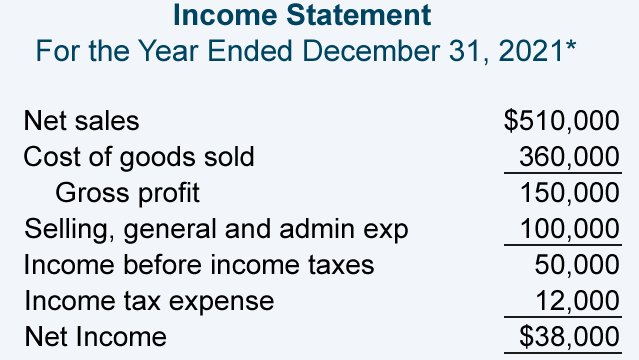

4/ Net income (or loss) is calculated by subtracting expenses from revenues and is reported at the bottom of the income statement, along with any taxes and net income (or loss) per share of common stock.

3 items to analyze in an income statement:

3 items to analyze in an income statement:

5/ Income Statement Analysis:

• Profit margins: Higher margins suggest efficient expense management

• Expense management: Expenses rising faster than revenues are a red flag

• Revenue growth: Observe if the company's revenue is increasing or decreasing over time

• Profit margins: Higher margins suggest efficient expense management

• Expense management: Expenses rising faster than revenues are a red flag

• Revenue growth: Observe if the company's revenue is increasing or decreasing over time

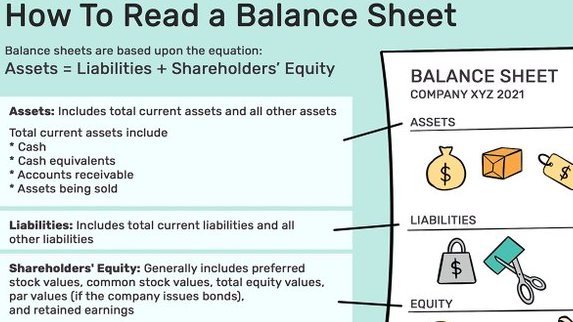

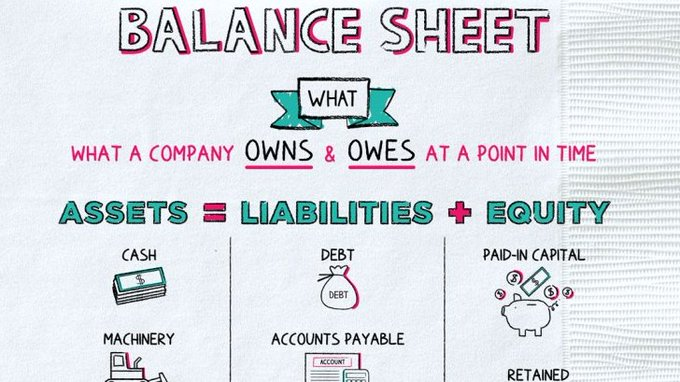

6/ The balance sheet shows a company's net worth to investors, displaying assets, liabilities, and equity.

• Assets include cash, accounts receivable, and property, plant, and equipment

• Liabilities consist of accounts payable, taxes payable, and long-term debt

• Assets include cash, accounts receivable, and property, plant, and equipment

• Liabilities consist of accounts payable, taxes payable, and long-term debt

7/ Equity represents shareholder ownership interests.

The balance sheet shows a company's financial position and helps investors assess a company's liquidity and solvency.

The balance sheet shows a company's financial position and helps investors assess a company's liquidity and solvency.

8/ Balance Sheet Analysis:

• Asset quality: A strong, diverse asset base supports growth

• Working capital: Ensure there are enough resources to cover short-term obligations

• Debt levels: Excessive debt increases financial risk and vulnerability during downturns

• Asset quality: A strong, diverse asset base supports growth

• Working capital: Ensure there are enough resources to cover short-term obligations

• Debt levels: Excessive debt increases financial risk and vulnerability during downturns

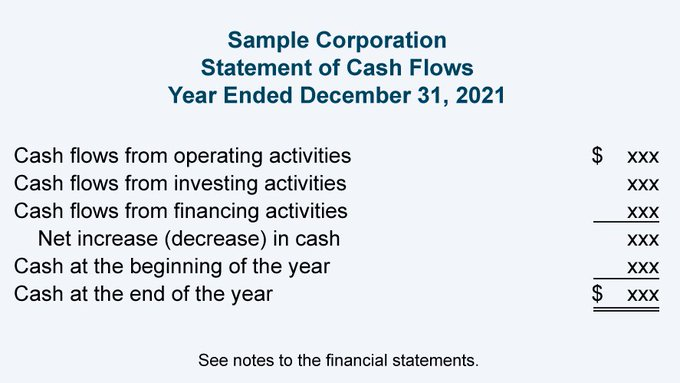

9/ The statement of cash flows tracks cash inflows and outflows, helping investors evaluate a company's liquidity, solvency, ability to pay debts, and generate cash.

It's divided into 3 sections:

• Operating activities

• Investing activities

• Financing activities

It's divided into 3 sections:

• Operating activities

• Investing activities

• Financing activities

10/ The statement of cash flows shows how a company generates & uses cash, helping assess financial health and ability to fulfill financial obligations

• Operating activities show cash flows from core business operations (customer payments, supplier or employee expenses, etc)

• Operating activities show cash flows from core business operations (customer payments, supplier or employee expenses, etc)

11/ Cash flow statement (cont.):

• Investing activities show cash flows from buying & selling long-term assets (investments in companies, property, plant & equipment, etc)

• Financing activities show cash flows related to debt & equity (issuing shares, loans, dividends, etc)

• Investing activities show cash flows from buying & selling long-term assets (investments in companies, property, plant & equipment, etc)

• Financing activities show cash flows related to debt & equity (issuing shares, loans, dividends, etc)

12/ Cash flow statement analysis:

• Capital expenditures: Investments in the business can suggest growth

• Financing activities: Examine new debt or equity issuance, as it affects the financial risk profile

• Operating cash flow: Cash from operations should cover expenses

• Capital expenditures: Investments in the business can suggest growth

• Financing activities: Examine new debt or equity issuance, as it affects the financial risk profile

• Operating cash flow: Cash from operations should cover expenses

Financial statements are essential for evaluating a company's financial performance. If you found this thread helpful, please:

• RT the FIRST tweet to share🔁

• Follow me @FluentInFinance for more

• Sign-up for my newsletter to learn more on finance: TheFinanceNewsletter.com

• RT the FIRST tweet to share🔁

• Follow me @FluentInFinance for more

• Sign-up for my newsletter to learn more on finance: TheFinanceNewsletter.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter