Before understanding inversions you need to know the difference between a BISI fvg vs SIBI fvg.

Here is a thread on FVGs:

Here is a thread on FVGs:

https://twitter.com/Dangstrat/status/1646094745796583424?s=20

Definition: Inversions or Inverse FVGs are failed fair value gaps which shows a change in orderflow.

Inversions can be used as a LTF or HTF entry or POI or treated as a market structure shift due to the change in orderflow.

Inversions can be used as a LTF or HTF entry or POI or treated as a market structure shift due to the change in orderflow.

A bullish inversion forms when price closes above a SIBI FVG. This shows a change in orderflow from bearish to bullish and now that SIBI FVG will act as a new support level.

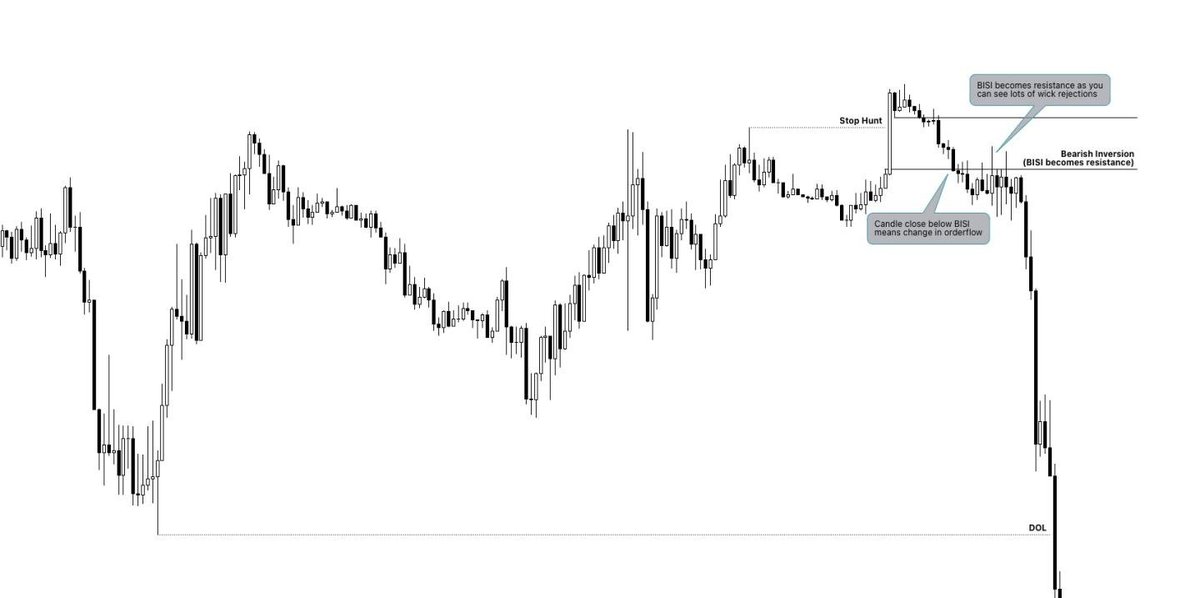

A bearish inversion forms when price closes below a BISI FVG. This shows a change in orderflow from bullish to bearish and now that BISI FVG will act as a new resistance level.

Ideally you want to see a mss before entering in the inversion but when there's an inversion it can act as a mss since there's already a change in orderflow.

Sign up for my Lifetime+ Membership to get live access to my real time trade signals & follow closely along my journey to 1M in funded capital. whop.com/dangstrat/

Here is my Notion link to access more free educational content from me. ossified-ground-684.notion.site/Dangstrat-Trad…

My Links bento.me/dangstrat

If this thread helped, please like and retweet the original tweet for more educational content and for others to see! Thank you for your support🧡

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter