Before I start going over these advanced concepts it's important to understand the basics first.

Here is a thread on basic market structure

https://twitter.com/Dangstrat/status/1640750954524934165?s=20

Here is a thread on liquidity raids

https://twitter.com/Dangstrat/status/1660030210920644608?s=20

A bullish 3 drive pattern forms when price creates 3 lower lows then has a shift in market structure which then creates a higher low. When the 3 drive patter forms you want to see a HTF liquidity or POI raid either on drive #1 or drive #3

Example of bullish 3 drive pattern with HTF raid on drive #1

🔸PDL raid + 3 drive raid

🔸M5 mss + fvg

🔸DOL = SIBI (TGIF setup)

🔸PDL raid + 3 drive raid

🔸M5 mss + fvg

🔸DOL = SIBI (TGIF setup)

Example of bullish 3 drive patter with HTF raid on drive #3

🔸3 drive raid + H1 fvg raid

🔸H1 mss

🔸DOL = PWH

🔸3 drive raid + H1 fvg raid

🔸H1 mss

🔸DOL = PWH

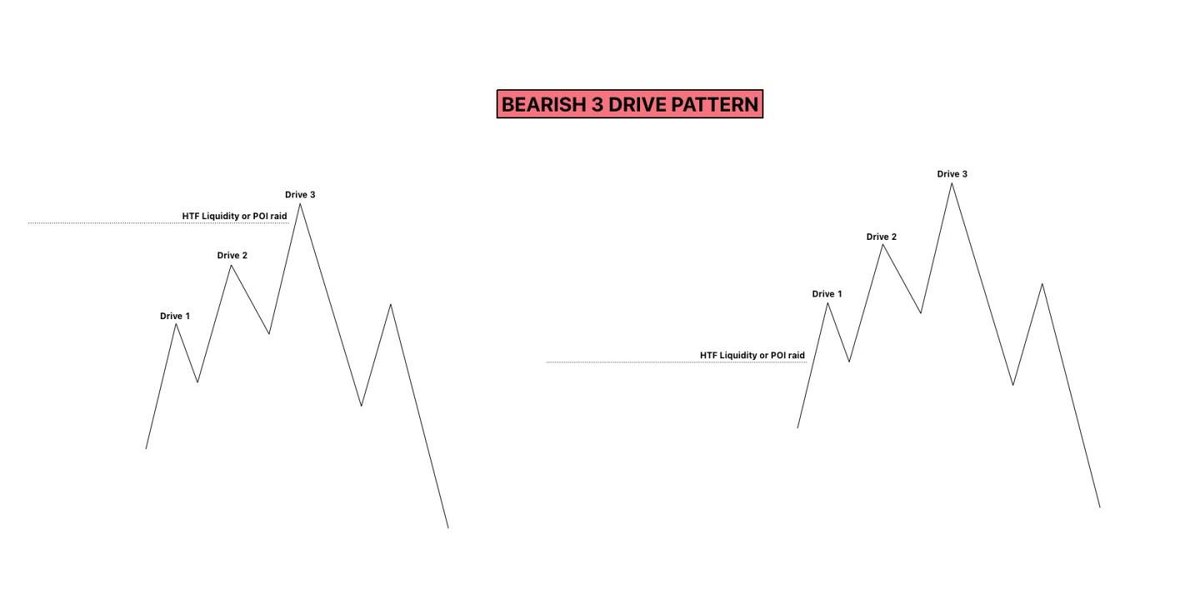

A bearish 3 drive pattern forms when price creates 3 higher highs then has a shift in market structure which creates a lower low. When the 3 drive patter forms you want to see a HTF liquidity or POI raid either on drive #1 or drive #3

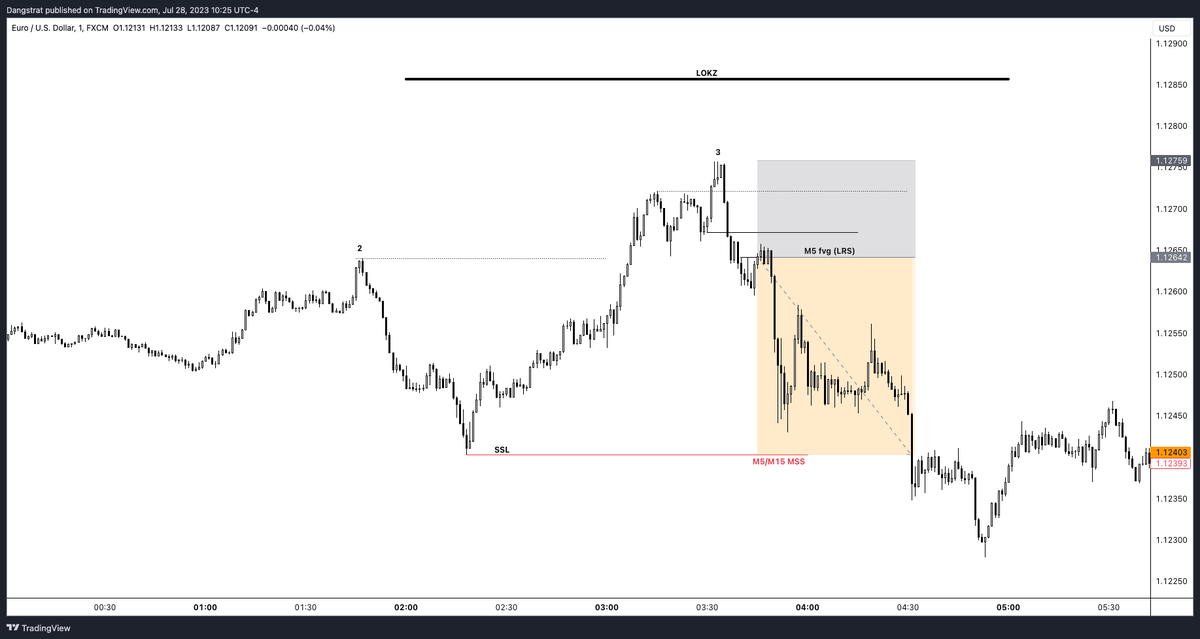

Example of a bearish 3 drive pattern with a HTF raid on drive #1

🔸PDH raid + 3 drive raid

🔸M15 mss + fvg

🔸DOL = BISI

🔸PDH raid + 3 drive raid

🔸M15 mss + fvg

🔸DOL = BISI

Example of a bearish 3 drive patter with a HTF raid on drive #3

🔸3 drive raid + old daily high raid

🔸Inversion = mss

🔸DOL = Original Consolidation

🔸3 drive raid + old daily high raid

🔸Inversion = mss

🔸DOL = Original Consolidation

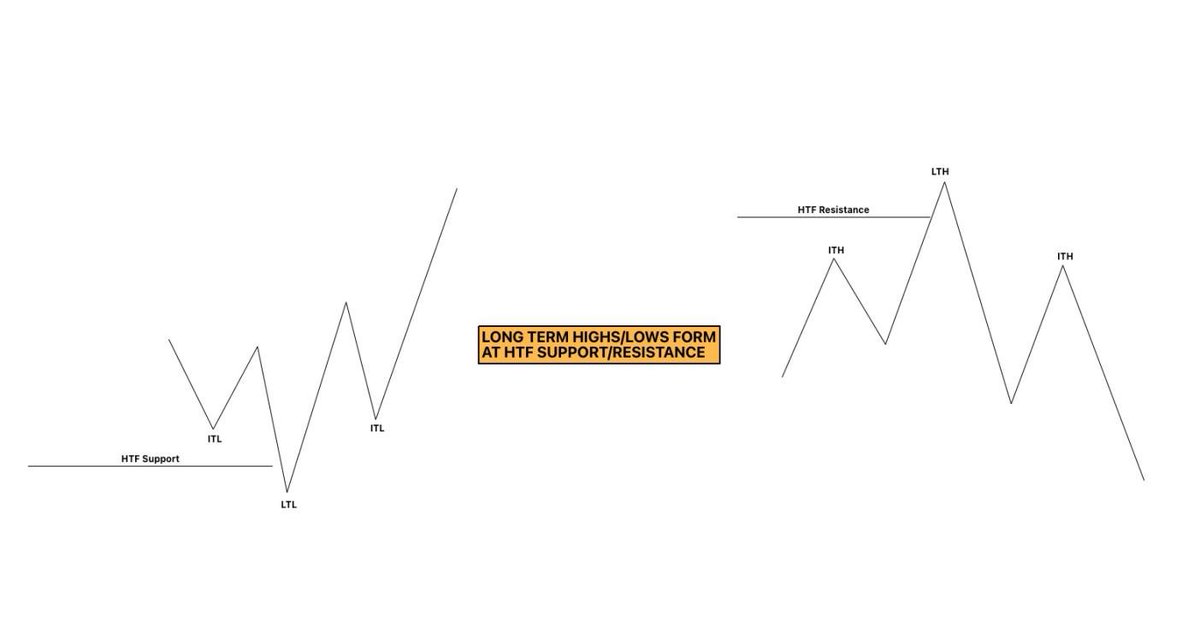

Advanced Market Structure | Long Term

🔸Long-Term High (LTH) - ITH that has lower ITH on both sides

🔸Long-Term Low (LTL) - ITL that has higher ITL on both sides

Long Term Highs/Lows form at HTF support/resistance levels and typically during a killzone.

🔸Long-Term High (LTH) - ITH that has lower ITH on both sides

🔸Long-Term Low (LTL) - ITL that has higher ITL on both sides

Long Term Highs/Lows form at HTF support/resistance levels and typically during a killzone.

Advanced Market Structure | Intermediate Term

🔸Intermediate Term Low (ITL) - STL that has higher STL on both sides

🔸Intermediate Term High (ITH) - STH that has lower STH on both sides

🔸Intermediate Term Low (ITL) - STL that has higher STL on both sides

🔸Intermediate Term High (ITH) - STH that has lower STH on both sides

Now we'll put it all together and include narrative:

https://twitter.com/Dangstrat/status/1654458625035739137?s=20

Narrative #1 | HTF PO3/AMD

🔸Accumulation of Monday range

🔸Manipulation above Monday high

🔸Distribution to Daily FVG

🔸Accumulation of Monday range

🔸Manipulation above Monday high

🔸Distribution to Daily FVG

https://twitter.com/Dangstrat/status/1643928026864910336?s=20

Narrative #2 | Monday Range & Deviation

🔸Deviation above Monday high to set classic Tuesday high of week

🔸Deviation above Monday high to set classic Tuesday high of week

https://twitter.com/Dangstrat/status/1638512776413863936?s=20

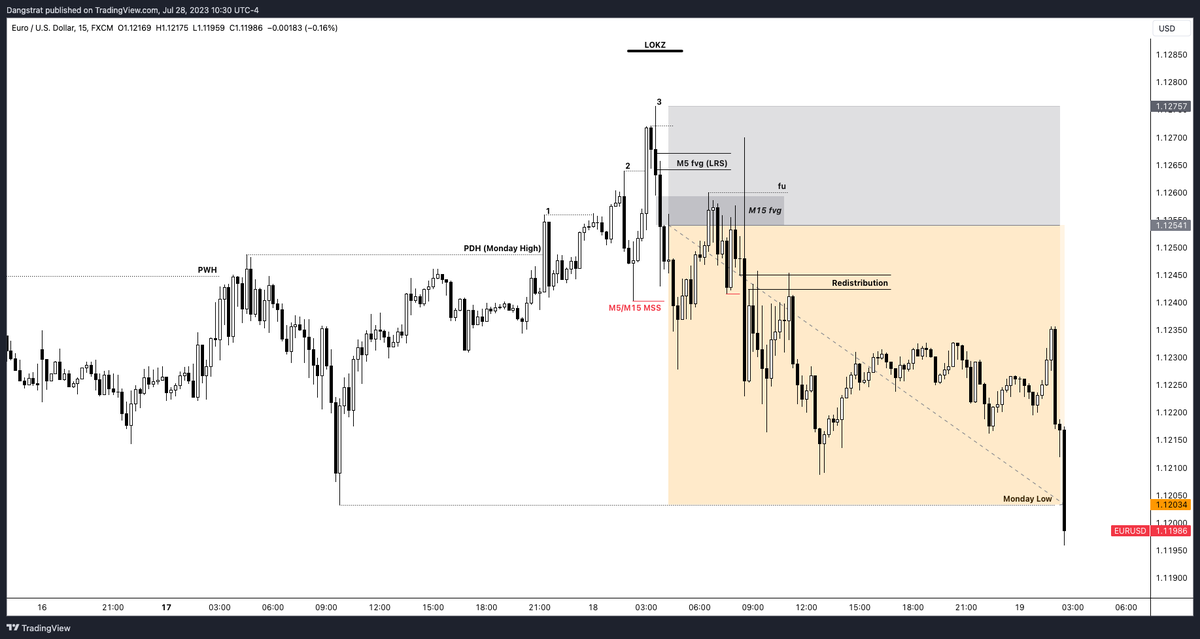

Liquidity:

- PWH raid

- PDH (Monday High) raid

- 3 drive pattern after PDH raid

- M15 fu raid after LTH formed

- PWH raid

- PDH (Monday High) raid

- 3 drive pattern after PDH raid

- M15 fu raid after LTH formed

Market Structure Shift

- Once the significant raids happened & a long term high was formed there was a market structure shift on M1 & M5/M15

- Once the significant raids happened & a long term high was formed there was a market structure shift on M1 & M5/M15

Entry: 1st Leg Distribution

- After M5/M15 mss the M15 fvg provides 1st leg distribution entry for 2r

- After M5/M15 mss the M15 fvg provides 1st leg distribution entry for 2r

Entry: 2nd Leg Redistribution

- After M15 bos another M15 fvg provides 2nd leg redistribution entry for over 3r to the weekly DOL which was the daily fvg

- After M15 bos another M15 fvg provides 2nd leg redistribution entry for over 3r to the weekly DOL which was the daily fvg

And just to be clear this is not hindsight analysis. All of it was called out in real time in my Discord. All you need is 1-2 of these setups a week and you can make a great living once you scale up capital.

Sign up for my Lifetime+ Membership to get live access to my real time trade signals & follow closely along my journey to 1M in funded capital. whop.com/dangstrat/

Here is my Notion link to access more free educational content from me. ossified-ground-684.notion.site/Dangstrat-Trad…

If this thread helped, please like and retweet the original tweet for more educational content and for others to see! Thank you for your support🧡bento.me/dangstrat

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter