Without wishing to stir the pot further... Nigel Farage's personal finances are not in the public domain unless he chooses to put them there, but his company finances very much are. I have been doing some digging... 1/

Companies House records show that he is director of three limited companies: Farage Media Ltd, Reform UK Party Ltd, and Thorn In The Side Ltd. …te.company-information.service.gov.uk/officers/tW56b…

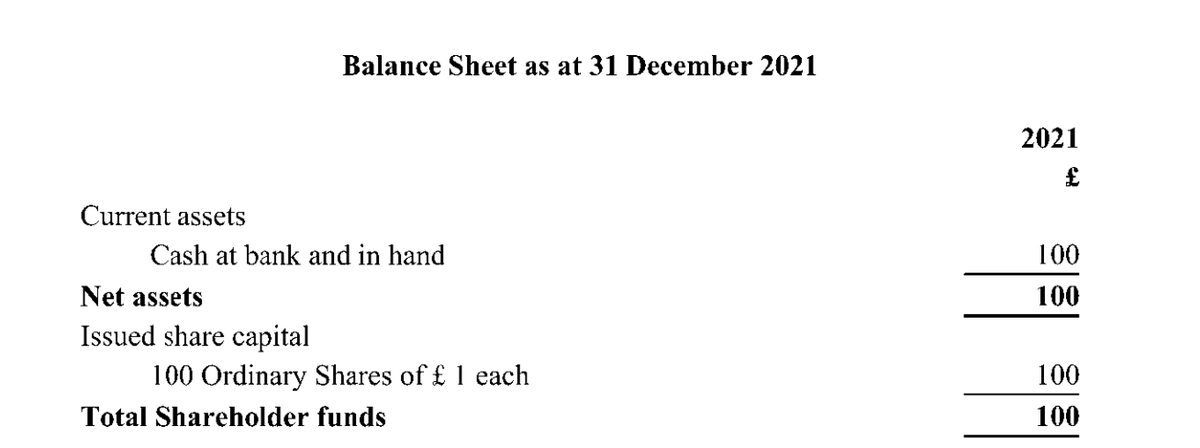

Farage Media Ltd. is a dormant company whose last accounts, as at December 2021, declared £100 in cash, £100 in issued shares, and no other assets or liabilities.

Reform UK Party Ltd. is a political party currently led by Richard Tice. But the only person listed by Companies House as being a "person with sigificant control" is Nigel Farage.

Farage, not Tice, controls Reform UK Party. Metro Bank terminated its relationship with Reform UK Party in 2021. Richard Tice went public with this story shortly after Farage's complaint about Coutts. news.sky.com/story/metro-ba…

The accounts filed with Companies House reveal that Reform Party UK's debts far exceeded its assets in both 2020 and 2021. This would imho be sufficient reason for Metro Bank to terminate the relationship.

@Towler Does Reform UK have a holding company?

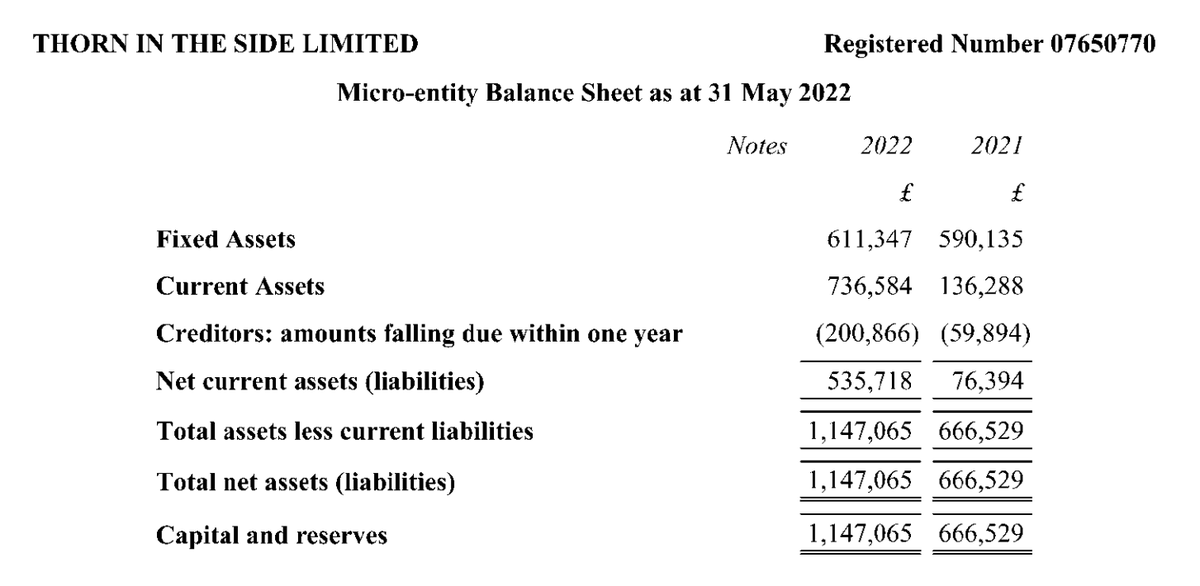

Moving on... The third company is Thorn In The Side Ltd. Between 2020 and 2021, this company saw an increase in its current assets from £136,288 to £736,584. GB News are paying Farage well, it seems. But...

£736,584 current assets, even if they consist entirely of cash, is WAY below the £3m liquid savings threshold for a Coutts account. And the borrowings of £200,866 are also far too low. So...

Unless Nigel Farage's personal wealth is sufficient for him to maintain a balance of over £2,263,416 in his current and savings accounts, he does not come anywhere near meeting the qualifying conditions for a Coutts accounts without considerable personal borrowing.

The company clearly doesn't qualify for a Coutts account. However, it appears to be in sound enough condition to qualify for a business account at an ordinary high street bank.

Do we actually know what kind of account NatWest offered him? Did they really refuse him an ordinary business bank account? Or are the reports that they did so simply another piece of Nigel spin?

Now let's look at the dissolved companies.

Go Movement Ltd was formed in February 2016 and voluntarily liquidated in February 2017. Other directors include Peter Bone, Richard Tice, Nigel Griffith. It never issued any accounts.

Go Movement Ltd was formed in February 2016 and voluntarily liquidated in February 2017. Other directors include Peter Bone, Richard Tice, Nigel Griffith. It never issued any accounts.

Farage Ltd. was incorporated in 2004. This appears to be a personal services company of a kind that might well now fall foul of IR35 rules. As is typical, it had high equity dividend payments relative to turnover, which were presumably Farage's personal drawings from the company.

In 2010, the annual return listed the shareholders as "Farage Family Educational Trust", which is probably an offshore trust fund, and Andrew Farage. Andrew Farage is Nigel's brother. He was declared bankrupt in 2018. dailymail.co.uk/news/article-3…

The February 2010 accounts reveal after-tax profits of £363,923, of which £270,000 were paid out in dividends.

But by February 2011, all the company's assets had been drained. All that was left was £496 in cash and £133,677 of debts. Where did this money go?

In August 2011, Farage Ltd. went into a CVA. It was dissolved in 2019.

Now to be fair, Nigel Farage resigned as director in 2006 - though note the creation of the trust. But he did not resign as company secretary until 2012, some months after the company went into a CVA.

In 2013, Farage apologised for setting up the offshore educational trust fund. He said he lost money on the venture. And he said he was "not rich enough to need one and never going to be". theguardian.com/politics/2013/…

That, to my mind, is the point. The picture painted by his corporate finances is not one of a wealthy person, though of course his personal finances might be different. Why he had Coutts accounts is unclear.

Taking out a very large mortgage with Coutts would have justified the relationship. But once the mortgage was gone, as far as I can see (within the limits of the information, of course) he just didn't meet the criteria and was never going to.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter