If you trade, you lose.

If you invest, you win.

Why?

Let me share the hard-earned lessons from my 7-year crypto journey.

🧵 1/

If you invest, you win.

Why?

Let me share the hard-earned lessons from my 7-year crypto journey.

🧵 1/

With the ongoing Base craze and the recent Telegram bot frenzy, today is the ideal time for me to release this thread.

Take just 5 minutes to read this thread attentively and reflectively. I sincerely hope that the lessons you will learn from it will be worthwhile.

🧵 2

Take just 5 minutes to read this thread attentively and reflectively. I sincerely hope that the lessons you will learn from it will be worthwhile.

🧵 2

You may have heard the statistic that 90% of retail traders end up losing. Ever wonder why?

Trading is a PvP game, where individual traders compete against well-informed trading firms, advanced trading bots created by top analysts, and even AI algorithms.

🧵 3

Trading is a PvP game, where individual traders compete against well-informed trading firms, advanced trading bots created by top analysts, and even AI algorithms.

🧵 3

Let's face the truth: retail traders are not competitive in this arena.

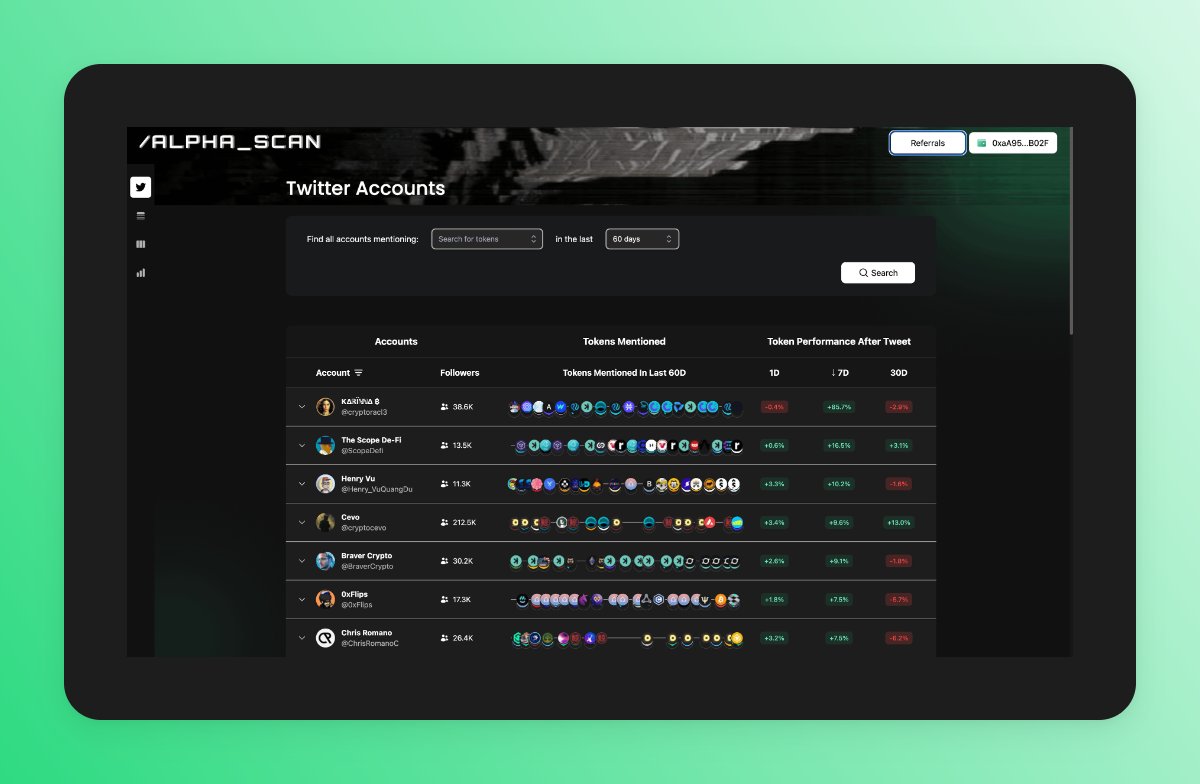

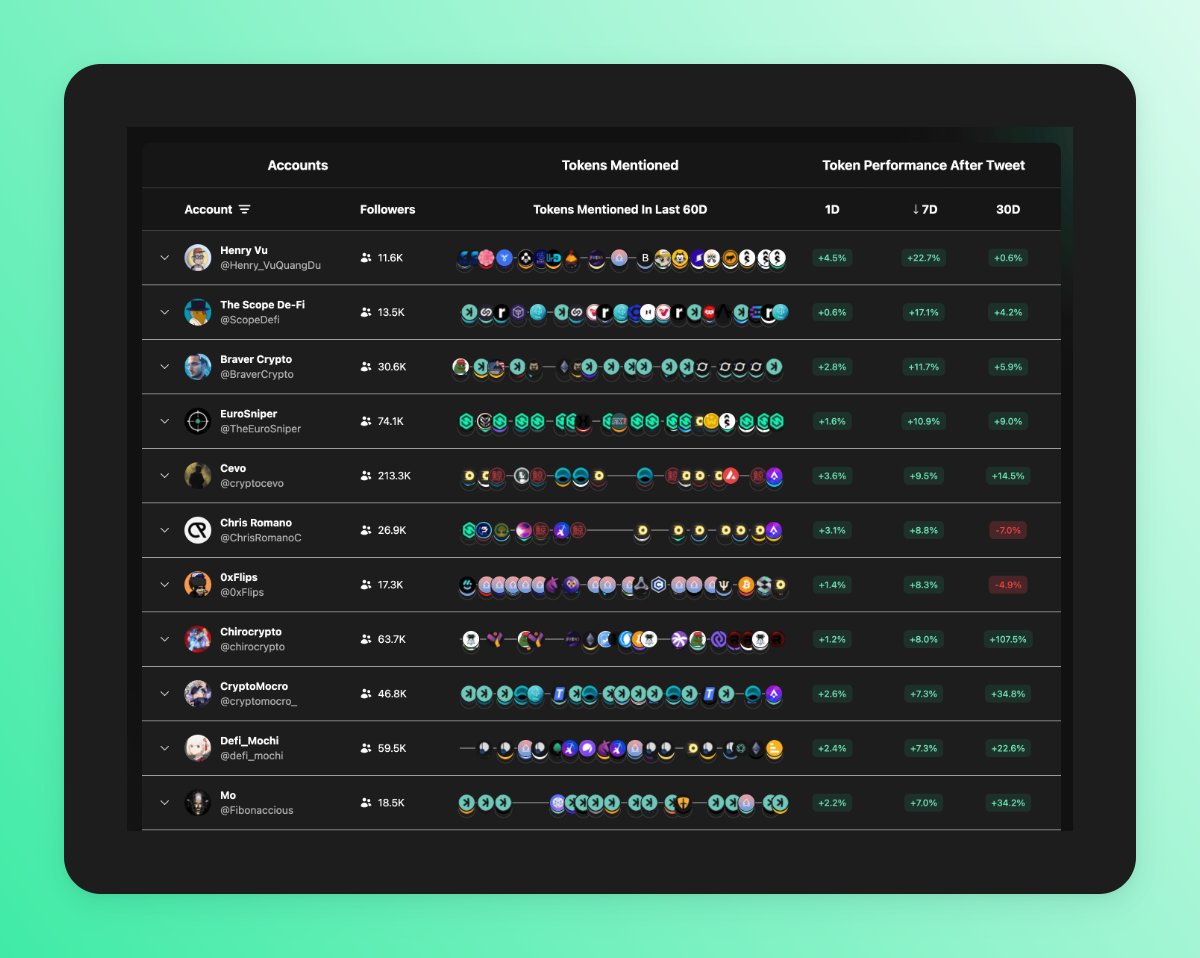

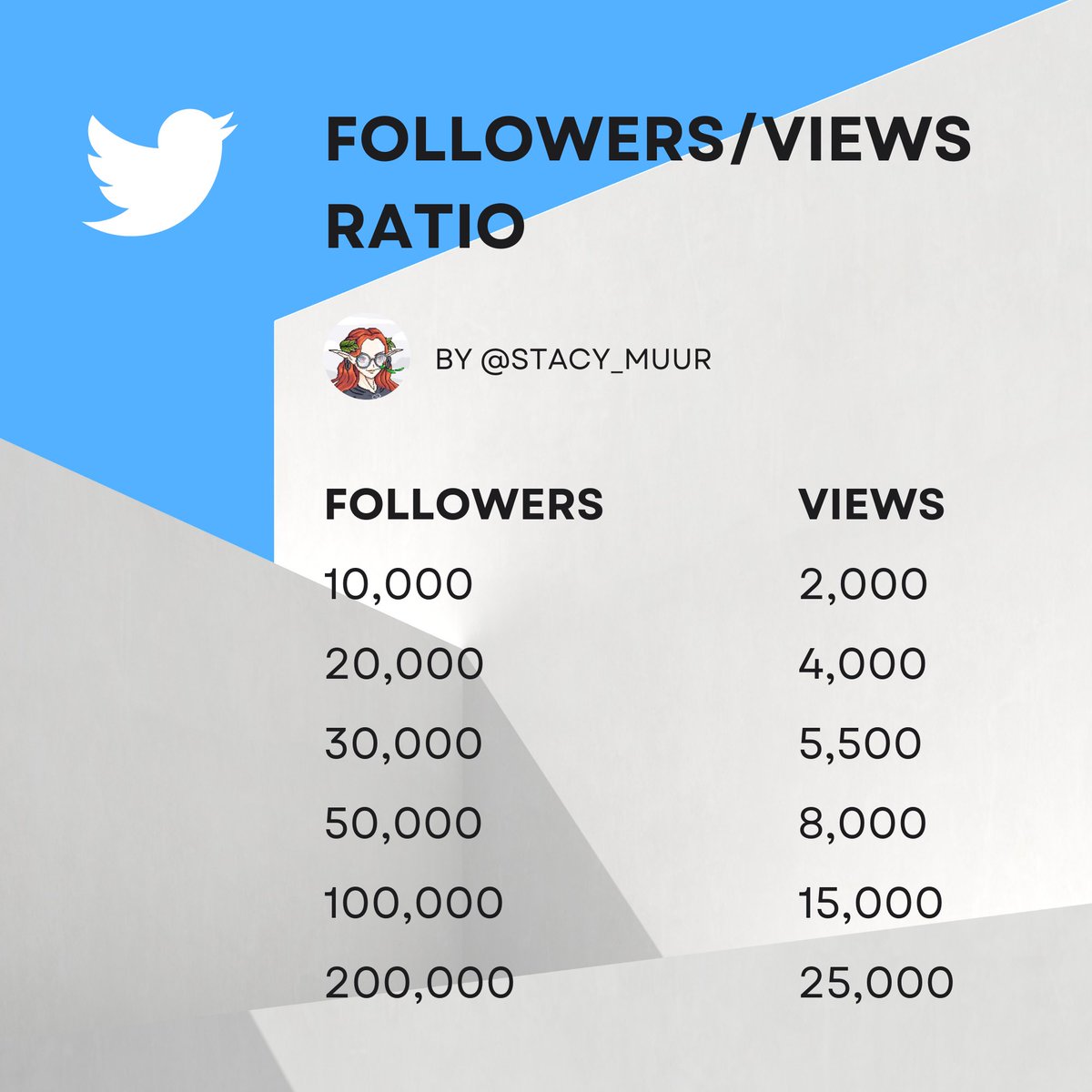

Where do you source your trading signals from? Twitter?

When an influencer promotes a token, it's highly likely that they have already purchased it at a lower price than your entry point.

🧵 4

Where do you source your trading signals from? Twitter?

When an influencer promotes a token, it's highly likely that they have already purchased it at a lower price than your entry point.

🧵 4

News?

Let's discuss the recent case involving $MKR and a16z and Paradigm moving a substantial amount of $MKR to a CEX. How many of you decided to short $MKR? However, no further action ensued.

🧵 5coindesk.com/markets/2023/0…

Let's discuss the recent case involving $MKR and a16z and Paradigm moving a substantial amount of $MKR to a CEX. How many of you decided to short $MKR? However, no further action ensued.

🧵 5coindesk.com/markets/2023/0…

The intentions behind fund movements are often uncertain. It's possible that they aim to create the illusion of an imminent sale.

It's important to recognize that they have control over the news feed, and it's crucial to comprehend this dynamic thoroughly.

🧵 6

It's important to recognize that they have control over the news feed, and it's crucial to comprehend this dynamic thoroughly.

🧵 6

What options do we have left? Alpha groups? Technical analysis?

I have extensive trading experience in both spot and perps markets, as well as working in trading firms. I know what's happening behind the scenes of asset management companies. They also get REKT.

🧵 7

I have extensive trading experience in both spot and perps markets, as well as working in trading firms. I know what's happening behind the scenes of asset management companies. They also get REKT.

🧵 7

Just FYI: funds that consistently hedge all their trades often end up losing money, consider achieving a 30% APR a successful win rate.

Do you still think you can end up generating 100x overnight?

🧵 8

Do you still think you can end up generating 100x overnight?

🧵 8

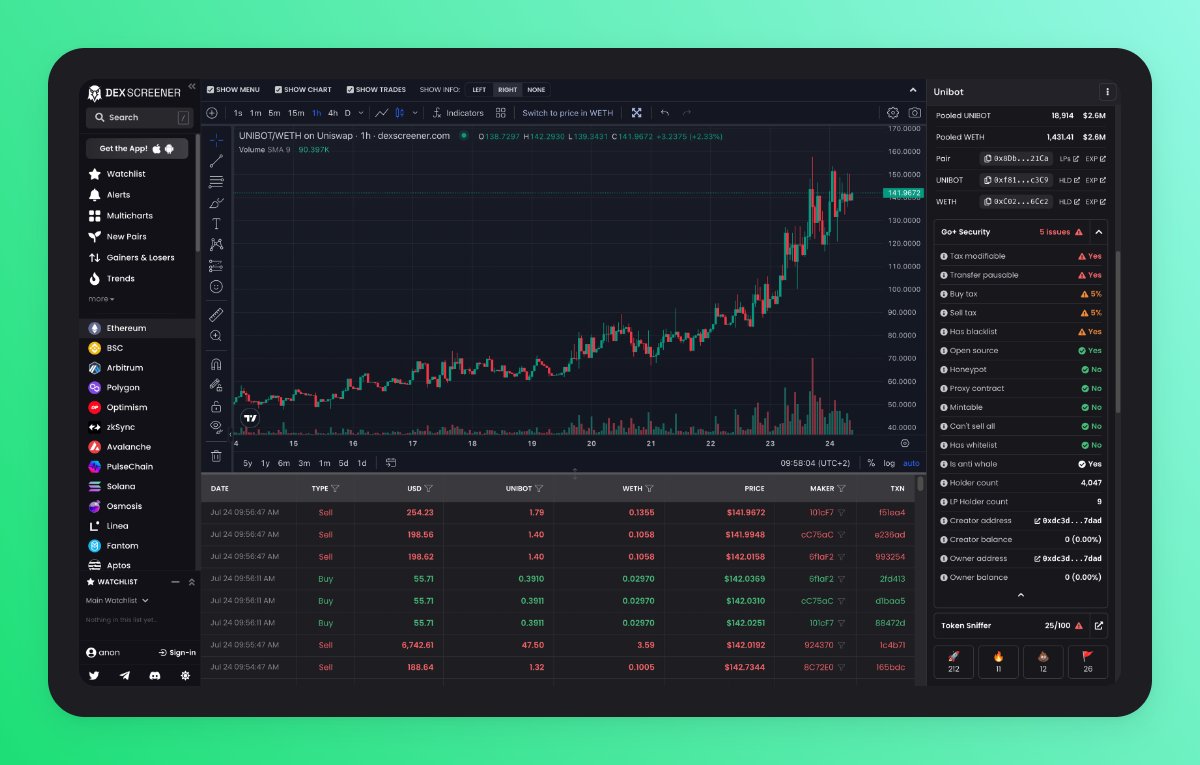

I'm not saying it's impossible. There have been cases of individuals earning life-changing money by investing in $PEPE or $UNIBOT.

However, what Twitter fails to mention is how much other traders lost to compensate for these gains.

That's a PvP game, remember.

🧵 9

However, what Twitter fails to mention is how much other traders lost to compensate for these gains.

That's a PvP game, remember.

🧵 9

Even in the case of $BALD, the guy who made 1,000x with a single trade wasn't just a random gambler. He searched for a contract deployed on the new network by a wealthy guy who could bootstrap its liquidity.

How many of you have tried this approach to degening before him?

🧵 10

How many of you have tried this approach to degening before him?

🧵 10

Now, the entire cryptocurrency community is speculating on how he achieved that feat and how others can replicate it.

This only adds to more FOMO, more emotions-driven decisions, and more scammers to capitalize on the hype.

Hype = You're late.

🧵 11

This only adds to more FOMO, more emotions-driven decisions, and more scammers to capitalize on the hype.

Hype = You're late.

🧵 11

In trading, there is a minimum risk/reward ratio of 1:2. Ideally, it should be 1:3, which means you risk $1 to potentially make $3.

If you bridged $100 to Base to ape in $BALD, your minimum yield should be x3.

So, if you aped in $BALD after 7:45 am yesterday, you ngmi.

🧵 12

If you bridged $100 to Base to ape in $BALD, your minimum yield should be x3.

So, if you aped in $BALD after 7:45 am yesterday, you ngmi.

🧵 12

The bad news doesn't stop here.

In 2018 and 2019, I was actively trading on BitMex. I even hired a trading analyst to help me. In 2018, I made $16,000 from trading.

However, in 2019, I ended up losing over $30,000.

This highlights the inherent trap of trading.

🧵 13

In 2018 and 2019, I was actively trading on BitMex. I even hired a trading analyst to help me. In 2018, I made $16,000 from trading.

However, in 2019, I ended up losing over $30,000.

This highlights the inherent trap of trading.

🧵 13

After a few successful trades, it's natural to feel confident in your ability to generate substantial profits. You may even start seeing yourself as a pro, given the evidence of your trading history.

🧵 14

🧵 14

However, the more confident you become, the greater the risk of losing money.

The same rule refers to degening: A few great degen trades don't make you a pro; instead, you are very likely to start degening in more risky assets (e.g. Base shitcoins).

🧵 15

The same rule refers to degening: A few great degen trades don't make you a pro; instead, you are very likely to start degening in more risky assets (e.g. Base shitcoins).

🧵 15

Once again, I want to clarify that I'm not saying it's impossible to earn money through trading.

However, if you don't have direct insights, if you rely on influencers to enter trades, and if you act based on FOMO, chances are you'll end up losing.

🧵 16

However, if you don't have direct insights, if you rely on influencers to enter trades, and if you act based on FOMO, chances are you'll end up losing.

🧵 16

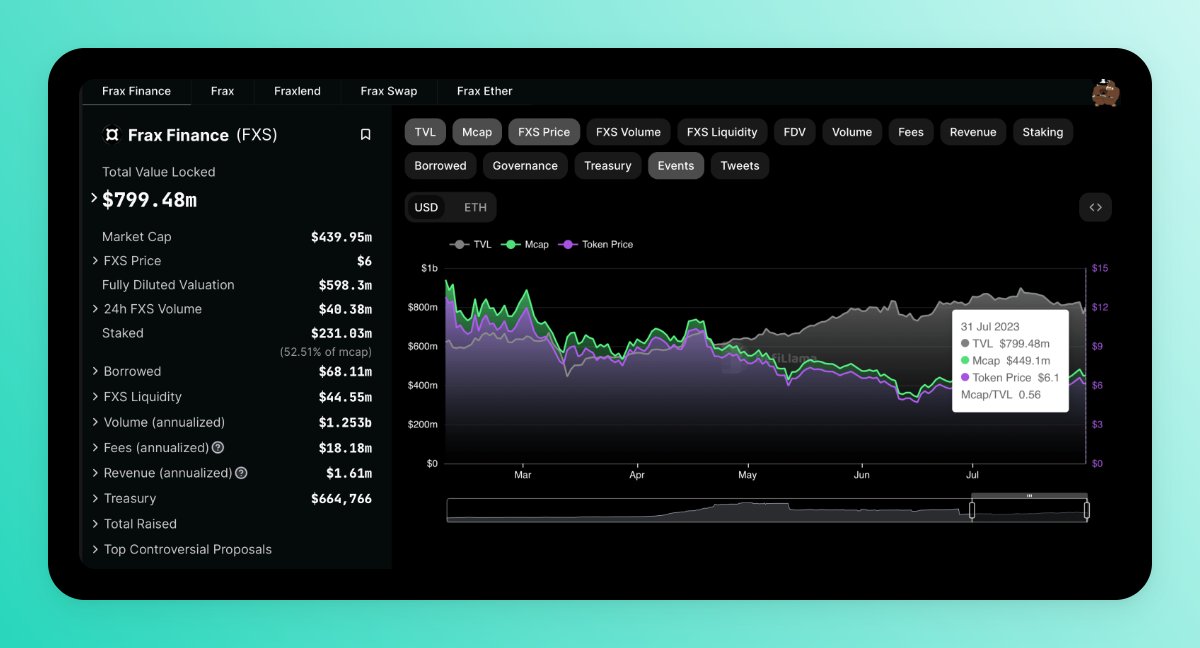

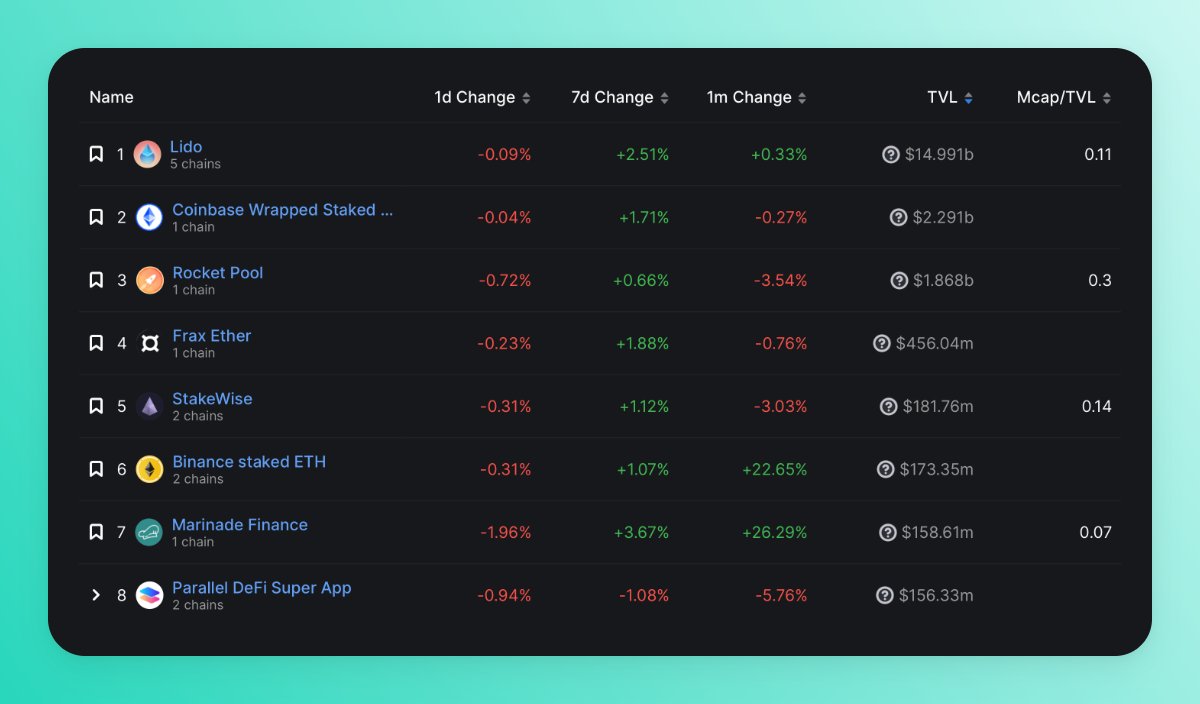

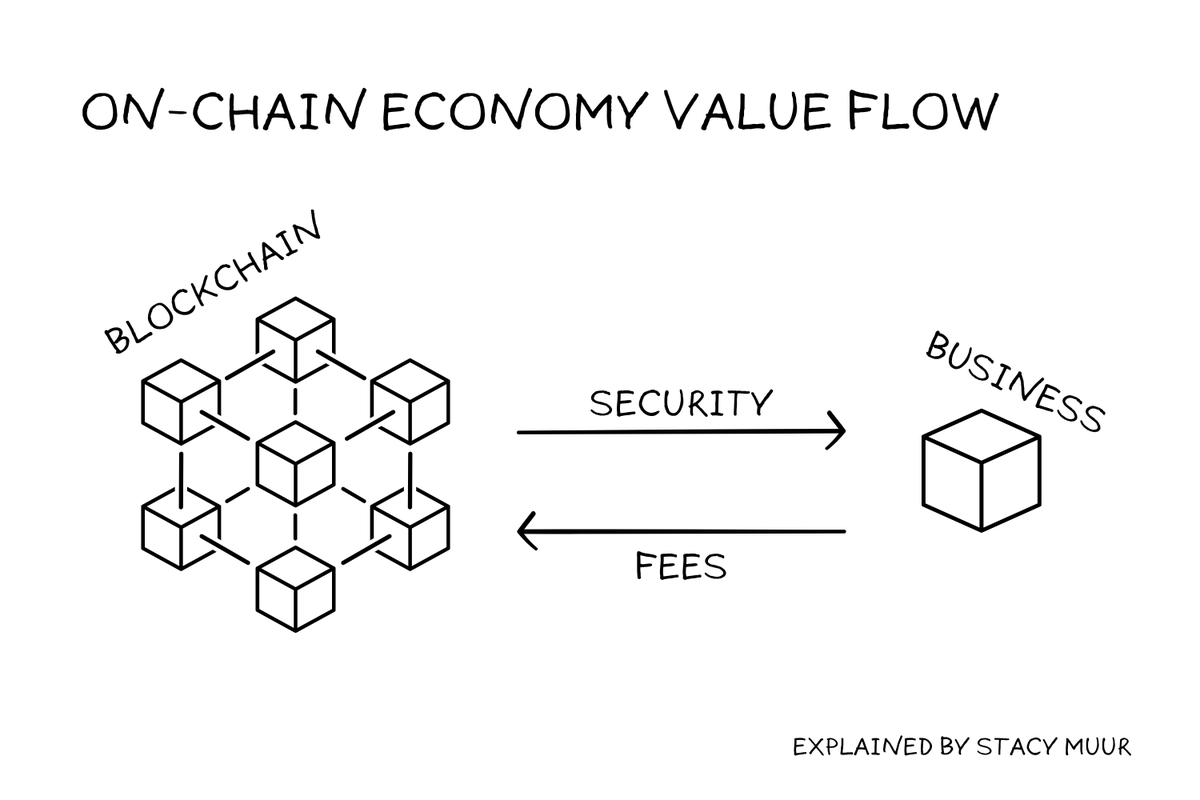

Long-term investments operate differently in this realm.

The upcoming bull run can easily bring $BTC back to $60K (tx2). Bluechip assets like $ETH, $SOL, $BNB, and others can triple in value. Emerging protocols with strong use cases, i.e. $FXS or $MKR, can generate x4-x5.

🧵 17

The upcoming bull run can easily bring $BTC back to $60K (tx2). Bluechip assets like $ETH, $SOL, $BNB, and others can triple in value. Emerging protocols with strong use cases, i.e. $FXS or $MKR, can generate x4-x5.

🧵 17

Personally, I've found this strategy to be much more effective than engaging in risky or speculative trading.

However, it's important to note that this approach takes considerably longer and demands a great deal of patience.

What's your choice?

🧵 18

However, it's important to note that this approach takes considerably longer and demands a great deal of patience.

What's your choice?

🧵 18

If you're feeling desperate because buying a Lambo in September seems unlikely, let me share a few tips that will help you improve your performance in both trading and investments.

Remember, I didn't tell that making yields from trading is absolutely impossible.

🧵 19

Remember, I didn't tell that making yields from trading is absolutely impossible.

🧵 19

Step #1: Segment your capital.

• I allocate 50% of my funds to stablecoins

• 40% is invested in long-term positions with different risk/reward profile.

• 5% is dedicated to trading with SL/TP options.

• The remaining 5% is left for degening/short-term trades.

🧵 20

• I allocate 50% of my funds to stablecoins

• 40% is invested in long-term positions with different risk/reward profile.

• 5% is dedicated to trading with SL/TP options.

• The remaining 5% is left for degening/short-term trades.

🧵 20

Step #2: Create a file to track your entry and exit points.

I personally use a spreadsheet to record all my entries, fees, and average entry price (in case I bought an asset multiple times).

The same sheet also displays the distribution of assets in my portfolio.

🧵 21

I personally use a spreadsheet to record all my entries, fees, and average entry price (in case I bought an asset multiple times).

The same sheet also displays the distribution of assets in my portfolio.

🧵 21

Step #3: Set goals.

When it comes to short-term trades, I always determine my exit price. It doesn't matter if the asset continues to grow. My strategy is to risk $100, generate x3 returns, and then exit.

🧵 22

When it comes to short-term trades, I always determine my exit price. It doesn't matter if the asset continues to grow. My strategy is to risk $100, generate x3 returns, and then exit.

🧵 22

Step #4: Analyze all trades.

Take special care in analyzing the actions that led to each outcome, whether positive or negative. The more you do this, the clearer the win patterns become.

🧵 23

Take special care in analyzing the actions that led to each outcome, whether positive or negative. The more you do this, the clearer the win patterns become.

🧵 23

Step #5: Don't allow others to influence your decisions.

Social hype is an important take-profits-signal to consider, while first mentions can be a good entry point. Once you separate your rational thinking from FOMO and emotions, you'll begin to read Twitter differently.

🧵 24

Social hype is an important take-profits-signal to consider, while first mentions can be a good entry point. Once you separate your rational thinking from FOMO and emotions, you'll begin to read Twitter differently.

🧵 24

What is your experience, frens? Am I mistaken in my conclusions?

• @Hercules_Defi

• @Deebs_DeFi

• @tomwanhh

• @Flowslikeosmo

• @Louround_

• @Flowslikeosmo

• @Defi0xJeff

• @Defi_Warhol

• @arndxt_xo

• @0xFinish

• @FarmerTuHao

• @0xsurferboy

• @Dynamo_Patrick

🧵 25

• @Hercules_Defi

• @Deebs_DeFi

• @tomwanhh

• @Flowslikeosmo

• @Louround_

• @Flowslikeosmo

• @Defi0xJeff

• @Defi_Warhol

• @arndxt_xo

• @0xFinish

• @FarmerTuHao

• @0xsurferboy

• @Dynamo_Patrick

🧵 25

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter