Earlier this month an Illinois physician learned her ER as getting a new boss. He called himself "Doctor George." And he was *deeply* unhappy with her failure to do Medicare fraud.

A thread on the chaotic collapse of a(nother) private equity ER operator prospect.org/health/2023-07…

A thread on the chaotic collapse of a(nother) private equity ER operator prospect.org/health/2023-07…

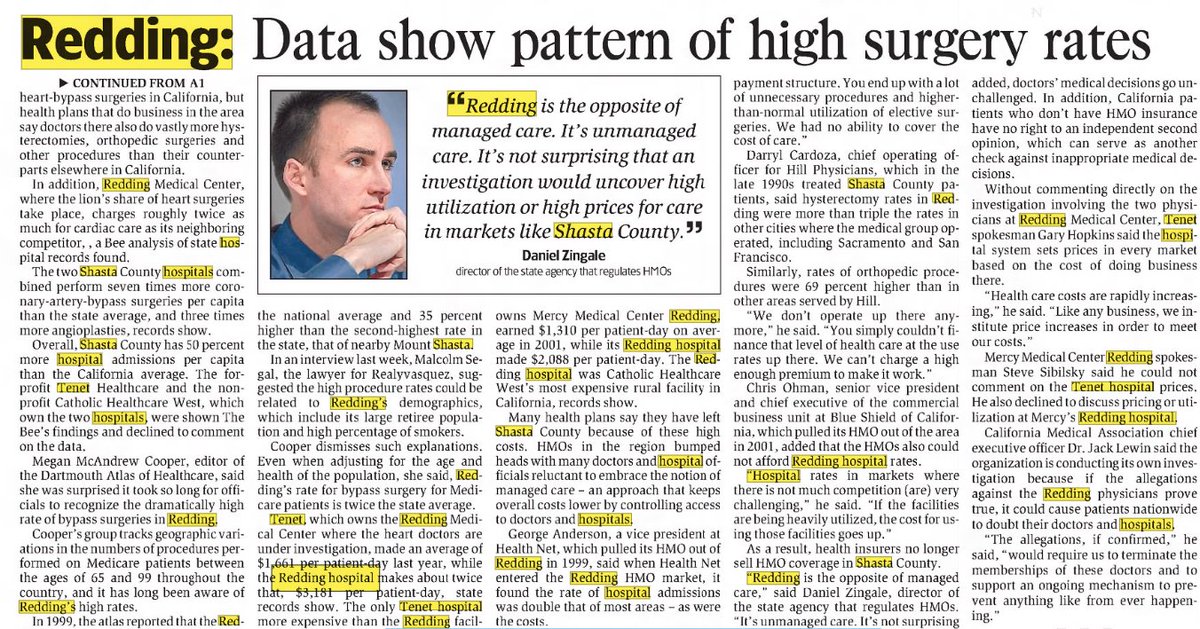

American Physician Partners was like 100 other PE medical rollups. It used debt to swallow small practices in a specialty, emergency med, promising investors it would make the $ back by billing more & paying docs less, thanks to an "oversupply" of ER docs levernews.com/private-equity…

APP's founders had fancy credentials. Mark Green is a special ops flight surgeon & GOP congressman, now 1 of the Hill's most prolific stock traders. John Rutledge rolled up 2 rural hospital chains that reaped $$$$ returns for GTCR & Warburg Pincus.

But...

But...

Everyone I interviewed said APP was an operational dumpster fire: It overpaid for TX practices *after* the state passed a surprise billing law, then allegedly used wage theft to offset shrinking reimbursements, alienating salaried docs it then replaced with $400/ hour temps.

Paying such bounties for temp docs then required APP to understaff ERs even more aggressively than typical PE-gutted emergency rooms. "They were behaving like someone with a gambling debt," one doctor explained. prospect.org/health/2023-07…

Then 2 weeks ago, APP announced it was shutting & transferring all contracts to...others. Different private equity owned ER operators, perhaps. Hospitals themselves, maybe. In Waukegan, Kelly Wren learned her new ER director would be...someone she'd heard of on TV news!

And the mysterious "Doctor George"? Yeah, no one seemed to know his actual name, including the COO of the hospital itself.

But Dr. Wren was lucky, actually. APP paid her for the month of June right on time July 20.

At Manatee Memorial Hospital, in lieu of a June paycheck, docs received a kind message from hospital CEO Tom McDougal:

At Manatee Memorial Hospital, in lieu of a June paycheck, docs received a kind message from hospital CEO Tom McDougal:

Meanwhile in Tennessee, a Canadian hospitalist said all of the APP docs working in their hospital on H1-B visas had to stop working immediately because their work visas were no longer valid.

Most insanely, the liberal malpractice insurance policies every physician requires to take a gig in a direly understaffed ER "supervising" way more PAs and NPs than any doctor feels is safe? Yeah so...

Wilder still, APP *still hasn't filed bankruptcy.* An attorney told me that unlike many PE firms APP owner Brown Brothers Harriman does not bankrupt portfolio companies often. But Cerberus, the firm named after Hell's 3-headed watchdog that is APP's biggest creditor, sure does!

Many docs suspect the lack of a bk filing suggests APP's owners/lenders are playing very dirty to avoid paying docs what they're owed.

A recent court filing in a wage theft case estimates APP stiffed 8 doctors by $13.99 MILLION over 5 years

A recent court filing in a wage theft case estimates APP stiffed 8 doctors by $13.99 MILLION over 5 years

Unruly corporate collapses invariably screw workers even more than rigged Chapter 11s.

Thanks to the unprecedented rate hikes our PE-operated central bank has inflicted we'll likely be seeing many more APPs.

(And just like that, a 100-year-old trucking firm went poof)

Alas..

Thanks to the unprecedented rate hikes our PE-operated central bank has inflicted we'll likely be seeing many more APPs.

(And just like that, a 100-year-old trucking firm went poof)

Alas..

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter