1/ Yesterday, several @CurveFinance pools were exploited.

Curve founder, Michael Egorov, currently has a ~$100M loan backed by 427.5m $CRV (about 47% of the entire CRV circulating supply).

With $CRV down 10% over the past 24 hours, the health of Curve is in jeopardy. 🧵⬇️

Curve founder, Michael Egorov, currently has a ~$100M loan backed by 427.5m $CRV (about 47% of the entire CRV circulating supply).

With $CRV down 10% over the past 24 hours, the health of Curve is in jeopardy. 🧵⬇️

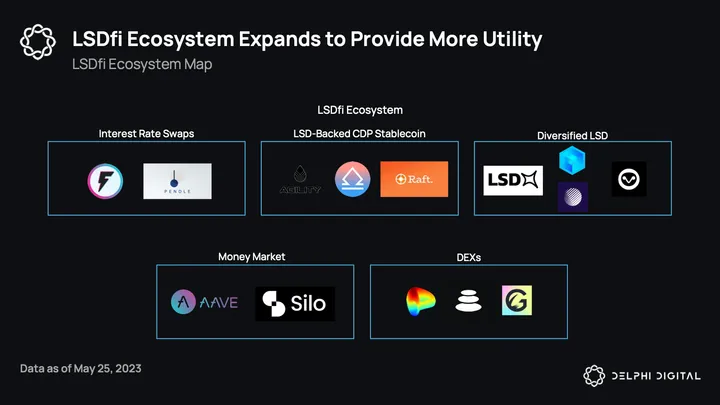

2/ On @AaveAave, Egorov has $305m CRV backing a 63.2m USDT loan.

At a liquidation threshold of 55%, his position is eligible for liquidation at 0.3767 CRV/USDT.

This would only require a ~33% drop in CRV price for this to occur. He is also paying ~4% APY for this loan.

At a liquidation threshold of 55%, his position is eligible for liquidation at 0.3767 CRV/USDT.

This would only require a ~33% drop in CRV price for this to occur. He is also paying ~4% APY for this loan.

3/ On @fraxfinance, Egorov currently has 59m $CRV supplied against 15.8m FRAX of debt.

Though this is much less CRV collateral and stablecoin debt than his Aave position, it poses a larger risk to CRV due to Fraxlend’s Time-Weighted Variable Interest Rate.

Though this is much less CRV collateral and stablecoin debt than his Aave position, it poses a larger risk to CRV due to Fraxlend’s Time-Weighted Variable Interest Rate.

4/ At 100% utilization, which it is currently at, the interest rate will double every 12* hours.

The current interest rate is 81.20%, but can be expected to increase to the maximum of nearly 10,000% APY after just 3.5 days.

The current interest rate is 81.20%, but can be expected to increase to the maximum of nearly 10,000% APY after just 3.5 days.

5/ This astronomical interest rate could lead to his eventual liquidation, regardless of $CRV price.

At a max LTV of 75%, his position’s liquidation price could reach 0.517 CRV/FRAX within 4.5 days, less than a 10% decrease from current prices.

At a max LTV of 75%, his position’s liquidation price could reach 0.517 CRV/FRAX within 4.5 days, less than a 10% decrease from current prices.

6/ Egorov has attempted to lower his debt and the utilization rate twice, repaying a total of 4m FRAX (3.5m, 500k) over the past 24 hours.

However, the market’s utilization rate remains at 100% as users rush to remove liquidity as soon as he repays.

However, the market’s utilization rate remains at 100% as users rush to remove liquidity as soon as he repays.

7/ With such large positions at risk, they pose serious concerns to the CRV price considering the low amount of liquidity that exists.

There is ~$10m worth of CRV liquidity on-chain and a -2% depth of $370k on Binance.

There is ~$10m worth of CRV liquidity on-chain and a -2% depth of $370k on Binance.

8/ These position sizes that are at risk of liquidation are in the 8 figure range.

Thus, the $CRV price could potentially tank to extreme lows, causing knock-on effects over a large part of the DeFi ecosystem.

Thus, the $CRV price could potentially tank to extreme lows, causing knock-on effects over a large part of the DeFi ecosystem.

9/ Today, Egorov deployed a new Curve pool & gauge: a 2 pool consisting of crvUSD & Fraxlend’s CRV/FRAX LP token, seeded with 100k of $CRV rewards.

This CRV/FRAX LP is the same liquidity that he is borrowing from on Fraxlend & poses the largest risk to his potential liquidation.

This CRV/FRAX LP is the same liquidity that he is borrowing from on Fraxlend & poses the largest risk to his potential liquidation.

10/ This is an attempt to incentivize liquidity towards the lending market in order to lower utilization rates and decrease the risk of his debt spiraling out of control.

4 hours after launch, this pool has attracted $2m in liquidity and decreased the utilization rate to 89%.

4 hours after launch, this pool has attracted $2m in liquidity and decreased the utilization rate to 89%.

11/ We will be actively monitoring the situation in this thread, so be sure to bookmark it.

Delphi Members can stay up to date with our latest Alpha Feed post by @easonwu_ ⬇️

members.delphidigital.io/feed/michael-e…

Delphi Members can stay up to date with our latest Alpha Feed post by @easonwu_ ⬇️

members.delphidigital.io/feed/michael-e…

@easonwu_ 12/ Our very own @larry0x has pulled some charts we wanted to share

Important to note: these assume the position isn't changed (no topping up collateral or repaying debt), CRV price doesn't change, and utilization remains at 100% all the time

interest rate vs hours

Important to note: these assume the position isn't changed (no topping up collateral or repaying debt), CRV price doesn't change, and utilization remains at 100% all the time

interest rate vs hours

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter