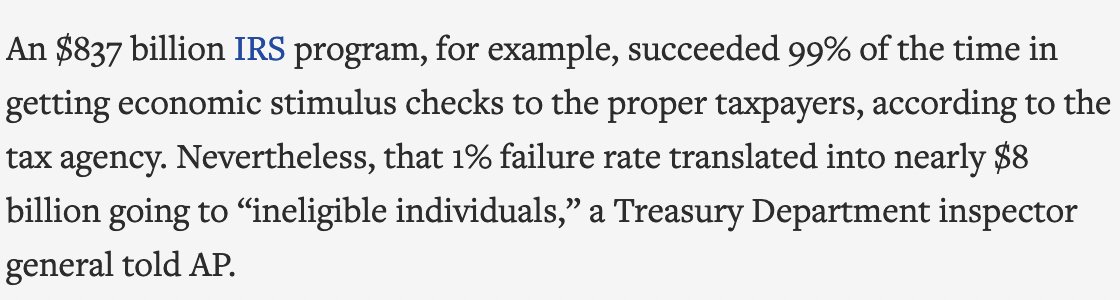

OK I've got a #longread today for our health care series about the godfather of modern health policy, responsible for Medicare Advantage, Medicare Part D, risk adjustment, physician payment schedules & more.

His name is Tom Scully.

prospect.org/health/2023-08…

His name is Tom Scully.

prospect.org/health/2023-08…

Once out of government, Scully became a partner at the leading health-focused private equity firm (Welsh, Carson, Anderson & Stowe), using his unparalleled knowledge of a system he helped create to exploit pockets of government support.

prospect.org/health/2023-08…

prospect.org/health/2023-08…

Scully reflects the trajectory of the modern healthcare system. He set in motion privatization, the revolving door, the role of private equity in the industry.

I watched every scrap of tape over 40 years and did a long interview with him. Here's my story.

prospect.org/health/2023-08…

I watched every scrap of tape over 40 years and did a long interview with him. Here's my story.

prospect.org/health/2023-08…

It's a very hard story to thread because it's really a 40-year history of healthcare: a gradual, ideological move to open public systems up to for-profit businesses, and the consequences of that ideology. I swear it's worth the read.

prospect.org/health/2023-08…

prospect.org/health/2023-08…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter