Michael Saylor IS NOT a Spook

By @jerimican5445

Some #Bitcoin er's Conspiracy Theories:

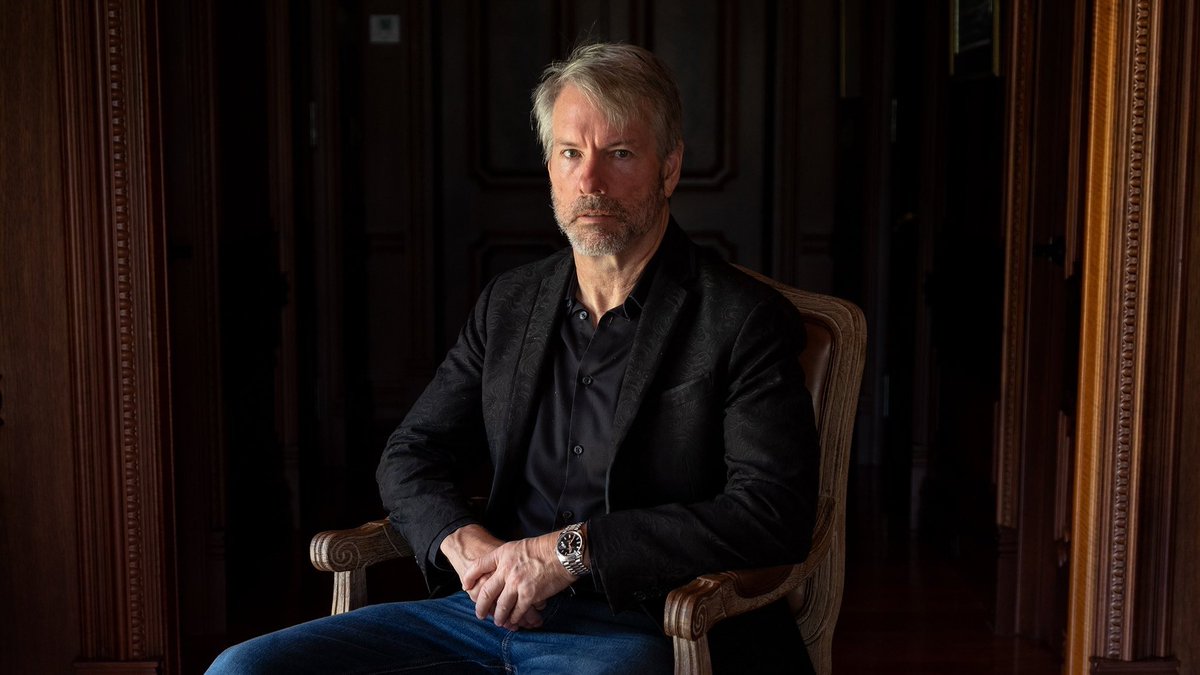

-Saylor works w/the Feds because his Microstrategy HQ's are near Washington D.C.

-Saylor will be the largest LN service provider & will require OFAC compliancy.

So who is @saylor?🧵1/

By @jerimican5445

Some #Bitcoin er's Conspiracy Theories:

-Saylor works w/the Feds because his Microstrategy HQ's are near Washington D.C.

-Saylor will be the largest LN service provider & will require OFAC compliancy.

So who is @saylor?🧵1/

Michael J. Saylor, grew up in a middle class family and lived on Air Force Bases throughout much of his childhood. Saylor was a voracious reader of science fiction novels. One of his favorite authors was Roger Heinlein and one of his favorite books was:

2/

2/

Saylor played Dungeons & Dragons. His vivid imagination of wizards & dragons helped shape him into a great Engineer, Inventor & Software Developer. Young Saylor was someday going to use the magical powers of software to "cast spells" on the world & make it a better place. 3/

Saylor has a double major in astronautical engineering and aeronautical engineering, along with studying the history of science & technology. He wanted to be what many young men in the 80's wanted to be; Rock Star, Top Gun Fighter Pilot, Astronaut, Professor, or CEO. 4/

Saylor's dream to become a fighter pilot was lost when he was falsely diagnosed with a benign heart tumor during his senior year at MIT. This setback forged his path to become a successful Entrepreneur and CEO. 5/

Saylor has 40 patents and is a Master Chess player. He is such a good chess player that one of his best friends, @Eric_BIGfund hired a Grand Master chess player to secretly tutor him because he could not beat him.

See Saylor's patents here:

6/ https://t.co/wVTcjj5MWfpatents.justia.com/inventor/micha…

See Saylor's patents here:

6/ https://t.co/wVTcjj5MWfpatents.justia.com/inventor/micha…

Saylor attended MIT on a full ROTC scholarship. He learned that his 1st semester at MIT had cost him as much as all the generational wealth his family had ever accumulated. This planted a seed in his head to wonder "why is education so expensive & not available to everyone?" 7/

That seed would grow into his non-profit, online education platform, , which provides education for free, for everyone, FOREVER! Personally, I believe that Saylor's #Bitcoin will perpetually fund his philanthropic passions. 8/Saylor.org

In college, Saylor was going to resign from a job where he was programming for DuPont. Saylor's program simulated DuPont's ROI on capital investment for ~$1Billion in titanium dioxide. DuPont needed the model to get $Billions from its board & when they heard Saylor was...9/

re-signing they were willing to give him anything. 24 yr old Saylor was paying $700/month in rent & living w/milk crates for bookshelves. He asked for $100k to start @MicroStrategy. He told himself, "I'll defer my PhD & when Microstrategy fails, I'll go back to college." 10/

Today, Microstrategy is one of the largest Business Intelligence Software companies & Saylor is the LONGEST tenured CEO of such a company. He employs 2000+ employees & provides business analytics to companies like McDonald's to help them figure out how to be more profitable. 11/

If you have found this 🧵 valuable thus far, please consider subscribing to my #Bitcoin educational website:

Also please LIKE and RETWEET this thread if you found it valuable.

Let's finish learning who Michael Saylor is...

12/satoshisjournal.com

Also please LIKE and RETWEET this thread if you found it valuable.

Let's finish learning who Michael Saylor is...

12/satoshisjournal.com

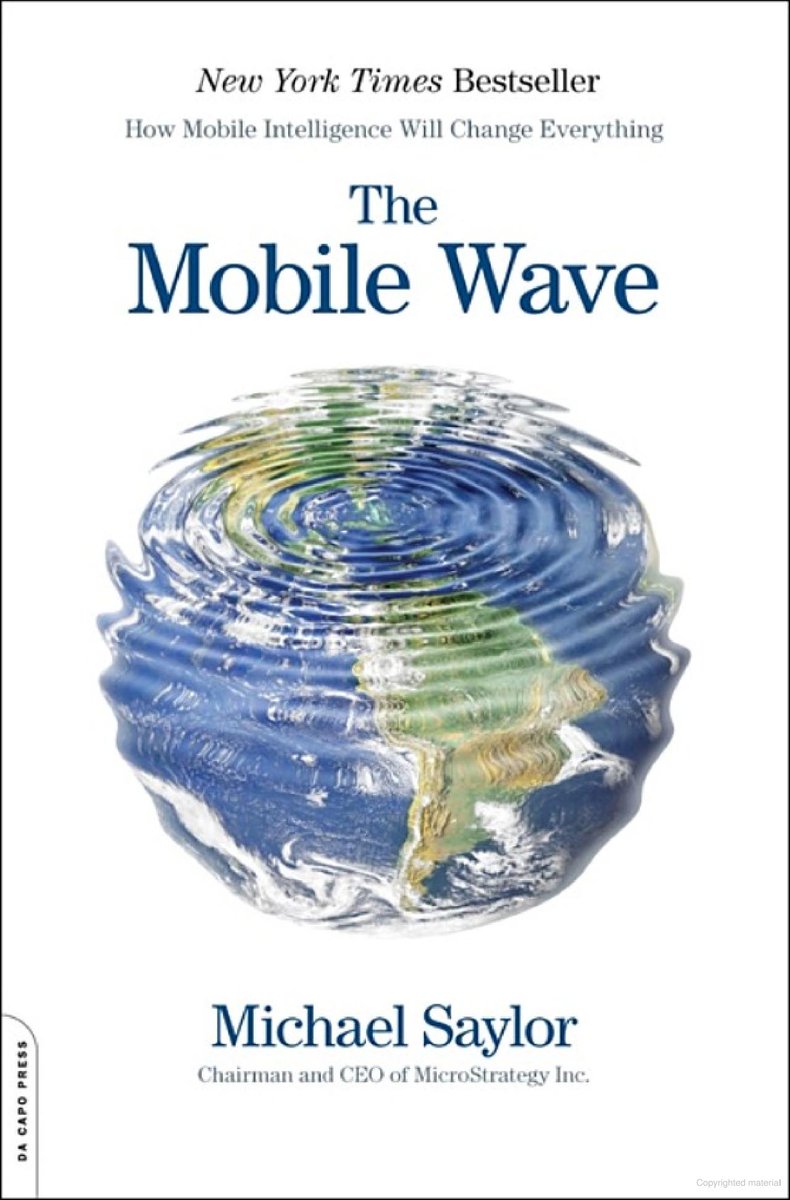

Saylor's lucid, vivid, science-fictional imagination allowed him to see the future of technology. This prompted him to write a book in 2012 about the future of technology called "The Mobile Wave." 13/

Saylor likes a quote from Arthur C. Clark, "Any sufficiently advanced technology is indistinguishable from magic." Saylor explains that science fiction predicts the future of technology. 14/

One example Saylor gives is through the story of Snow White & the 7 Dwarves. He explains that when the evil witch asks, "mirror mirror on the wall, who is the fairest one of all?"...that this was a prediction of using ZOOM today, where we talk to others "through a mirror." 15/

Saylor's company hit a huge problem in March 2020, inflation, AKA currency debasement, AKA legal counterfeiting. He had a positive cash flowing business but it was having trouble keeping up with its competitors, like Oracle, and the hidden, INSIDIOUS tax called INFLATION. 16/

Saylor's biggest problem was that he had $500,000.000 in his company's Treasury Reserve and it was losing purchasing power at a rate of 30%+ because the Federal Government decided to print 30%+ more currency in 2020 to keep the COVID economy from collapsing. 17/

Saylor frantically looked for something he could buy with his $500,000,000 worth of cash before it melted away. He looked at real estate, art, gold, silver, etc...but none of them were going to last the test of time due to inflation. Then he looked at #Bitcoin ...18/

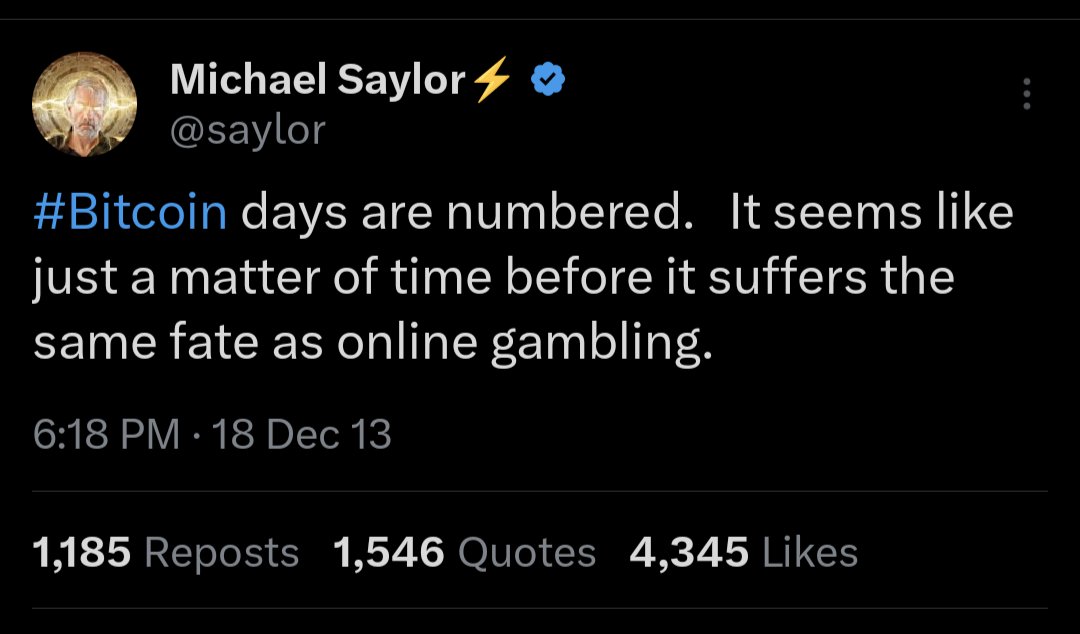

He remembered his friend, @ericWeiss, telling him about #Bitcoin. Saylor had discounted #Bitcoin over the years & even claimed it would just fail like online gambling. But this time Saylor dove down the #Bitcoin rabbit hole & quickly realized that Bitcoin would not... 19/

only save his company and $500,000,000 worth of cash... #Bitcoin was the greatest magical software that he could wield to make the world a better place. He has been falling down the 🐇 hole and buying like a Mad Hatter since then...

20/

20/

In a nutshell, Saylor is no different than you or I. He had humble beginnings and worked hard to become a man that sincerely wants to make the world a better place. I personally believe that Saylor is a good person and I believe that he is going to make the world a...21/

better place by making education free and accessible to everyone. He has even insinuated that he would die with his #Bitcoin! Don't trust me, VERIFY! I did my POW, will you? Remember, there is some Truth to Conspiracies. @GhostOfBekka wen pic with @saylor? Here is mine...😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh