We heard you!

In our recent poll, some of you folks disclosed your concerns about investing in mining companies.

Top concerns were:

Unpredictability/volatility

Excessive government interference

Low return ratios.

In our recent poll, some of you folks disclosed your concerns about investing in mining companies.

Top concerns were:

Unpredictability/volatility

Excessive government interference

Low return ratios.

Let's tackle these concerns head-on by taking a deep dive into Sandur Manganese—a mining company that goes above and beyond just mining Manganese.

Before we begin, join the others & retweet this thread because we've put in 100+ hours creating it for all you nice people.

Your retweets keep us motivated to bring you even more value.

Spread the word to your investor friends for a chance to be known as Ultimate Retweeters! 😄

Your retweets keep us motivated to bring you even more value.

Spread the word to your investor friends for a chance to be known as Ultimate Retweeters! 😄

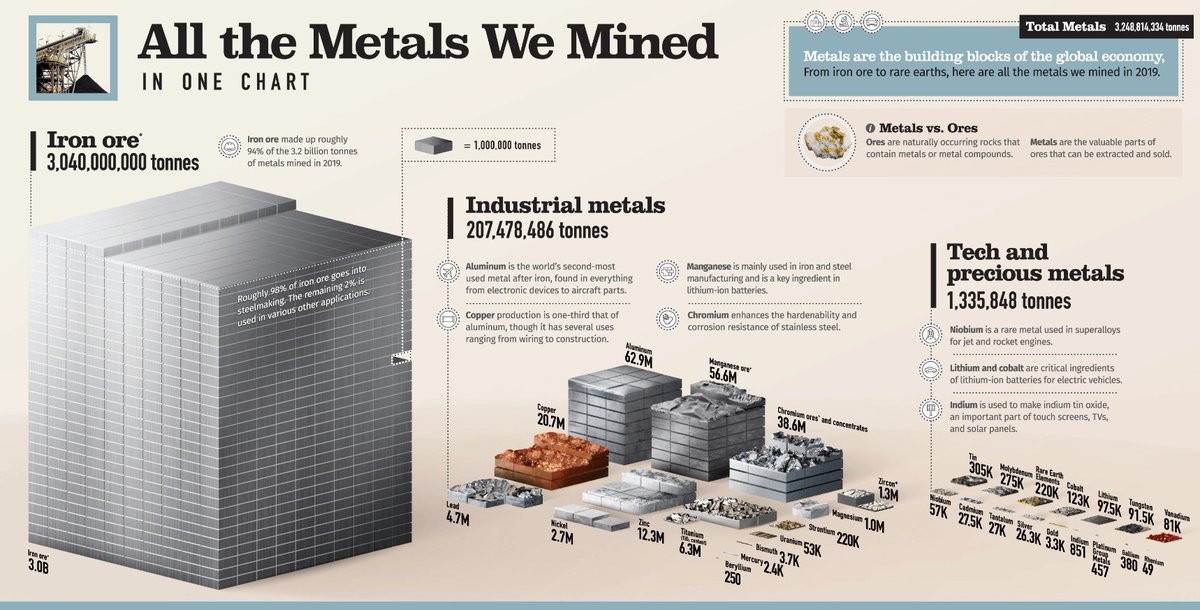

Let's begin with Iron Ore, which is the most crucial factor in this story.

Iron ore is undoubtedly the most mined metal globally. Industries such as construction, manufacturing, and transportation heavily rely on steel, which in turn requires iron ore for its production.

Iron ore is undoubtedly the most mined metal globally. Industries such as construction, manufacturing, and transportation heavily rely on steel, which in turn requires iron ore for its production.

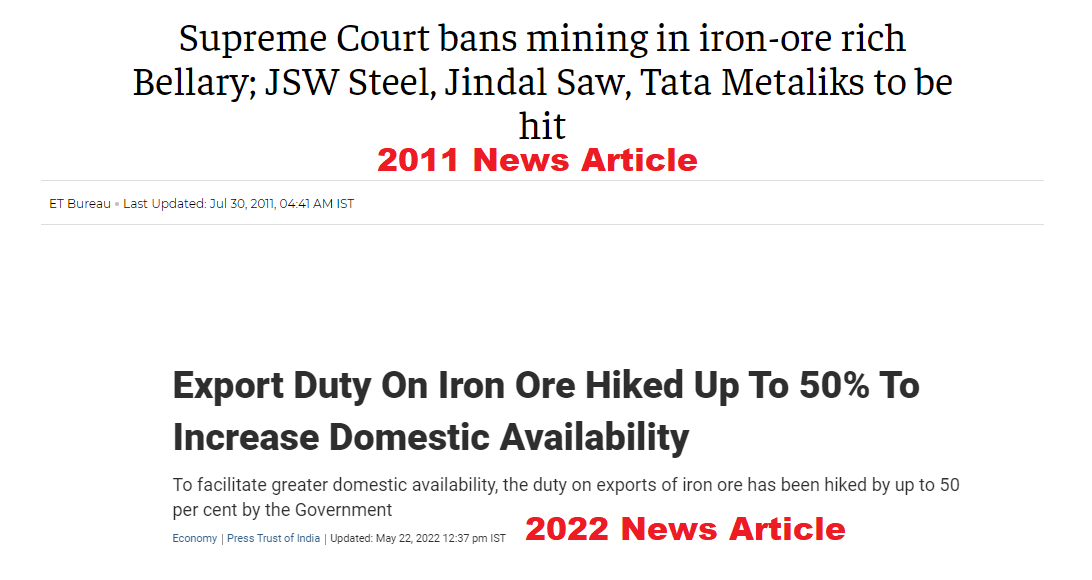

Excessive government regulation is a major concern when it comes to mining companies.

Export bans and Export duty hikes are just some of the many headaches they face.

Here are some examples

Export bans and Export duty hikes are just some of the many headaches they face.

Here are some examples

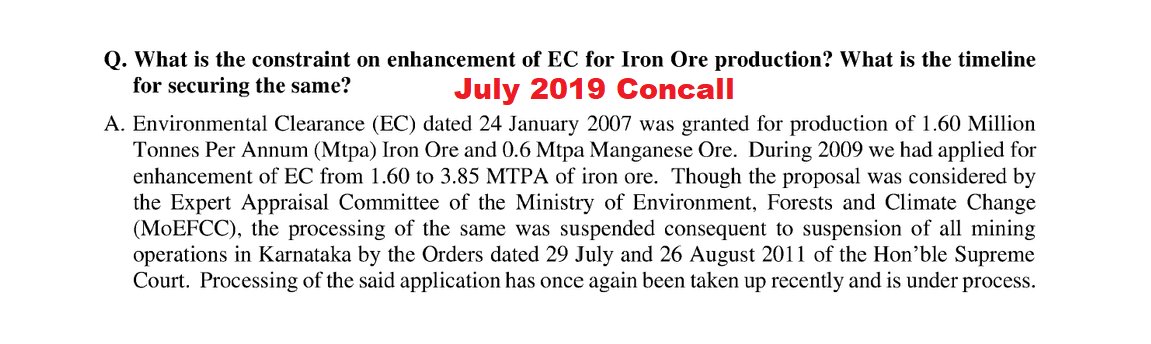

Obtaining approvals for expansions in such challenging circumstances is an enormous task.

Let's take the example of Sandur.

Back in 2009, they applied for permission to increase their iron ore mining capacities.

Let's take the example of Sandur.

Back in 2009, they applied for permission to increase their iron ore mining capacities.

Sandur fought for more than a decade to expand, despite their commendable mining practices - even recognized by the Supreme Court in 2012- a rare feat in an industry known for corruption, natural resource exploitation, and unlawful mining activities that disregard the ecosystem.

Contrary to the commonly held belief that mining companies harm the ecosystem, Sandur's management was actually appreciated by the Supreme Court. But why?

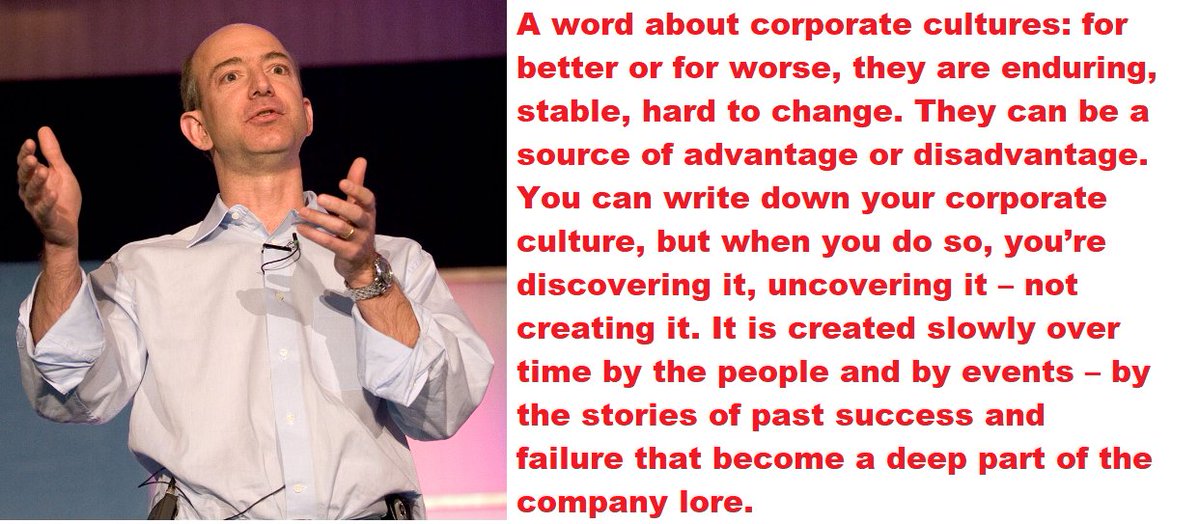

To answer this question, let's delve into the topic of corporate culture, accompanied by a powerful quote from Jeff Bezos.

To answer this question, let's delve into the topic of corporate culture, accompanied by a powerful quote from Jeff Bezos.

Jeff says, corporate cultures are shaped by people, events, failure stories, and success tales.

And here's how Sandur's top management defied industry misconduct to build a mining company rooted in fairness.

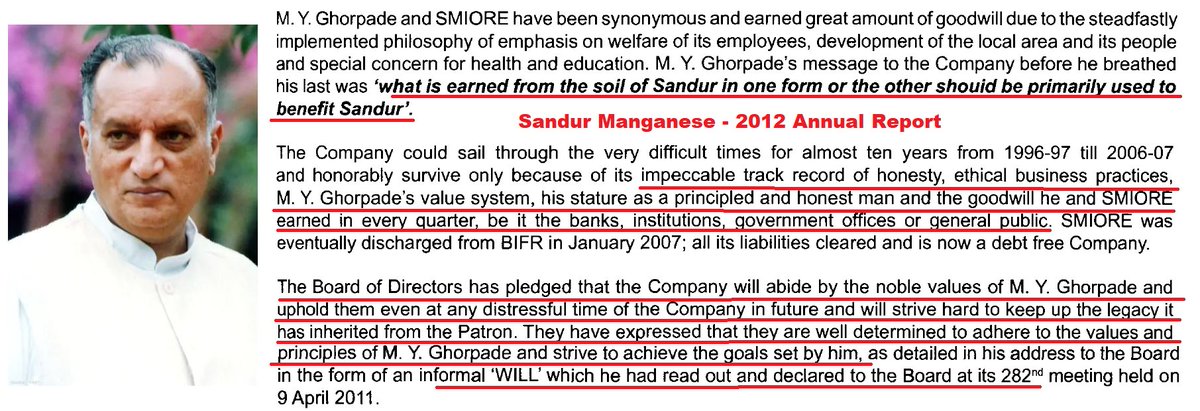

It all started with an informal will by the former promoter.

And here's how Sandur's top management defied industry misconduct to build a mining company rooted in fairness.

It all started with an informal will by the former promoter.

Take a look at this news article from 2011.

It reveals how Sandur successfully navigated a major industry crisis by making the conscious decision not to exploit natural resources.

The ex-promoter even offered to donate a part of his inheritance to nature conservation.

It reveals how Sandur successfully navigated a major industry crisis by making the conscious decision not to exploit natural resources.

The ex-promoter even offered to donate a part of his inheritance to nature conservation.

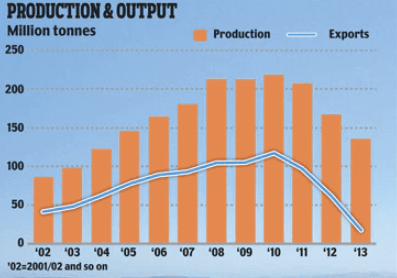

Due to the ban on Iron Ore exports, every mining company, regardless of their ethical standing, was painted with the same brush, during the crisis.

Iron exports Ore from India fell off a cliff.

Iron exports Ore from India fell off a cliff.

And Sandur's margins got impacted to the same degree.

Sandur still survived with professional management, until 2020.

Then, the ambitious next-gen promoter Mr. Bahirji Ghorpade took the driving seat.

After diving into the latest company reports, it seems likely that the culture will echo the values of its former leader.

Then, the ambitious next-gen promoter Mr. Bahirji Ghorpade took the driving seat.

After diving into the latest company reports, it seems likely that the culture will echo the values of its former leader.

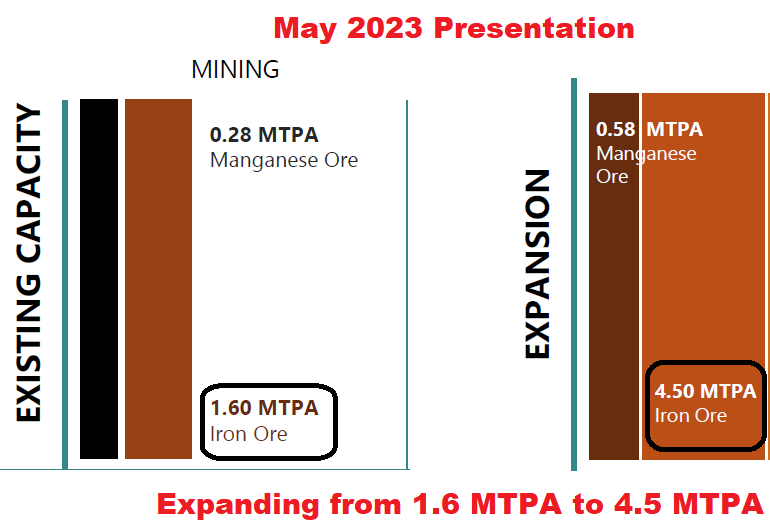

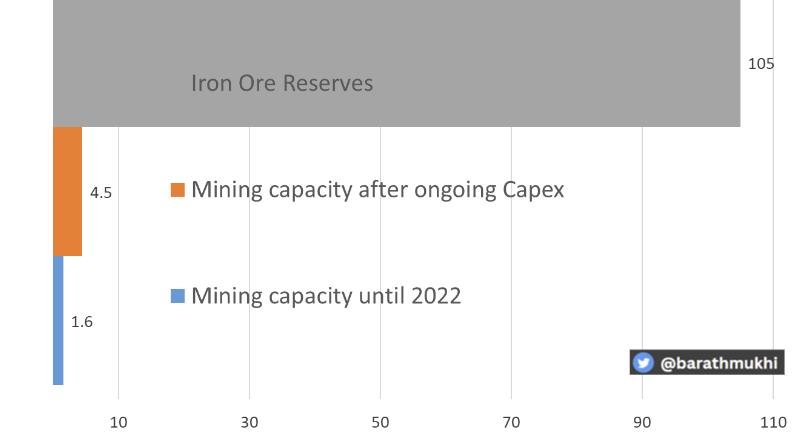

As stated earlier, in the coming years, Sandur Manganese plans to start with a 2.8x expansion of their Iron Ore Mining capacity from 16 Lac to 45 Lac Tons.

In their latest annual reports, we also sense a fresh surge of ambition in the company.

In their latest annual reports, we also sense a fresh surge of ambition in the company.

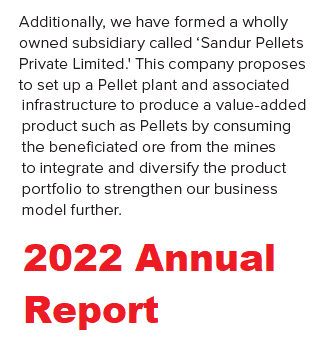

For example, in their July 2019 concall, the previous management team seems to have shot down the idea of beneficiation & pelletisation (more on these terms further down).

Since the next-gen promoter took charge, the thought process seems to have changed—and for the better.

Let's discuss future growth drivers now.

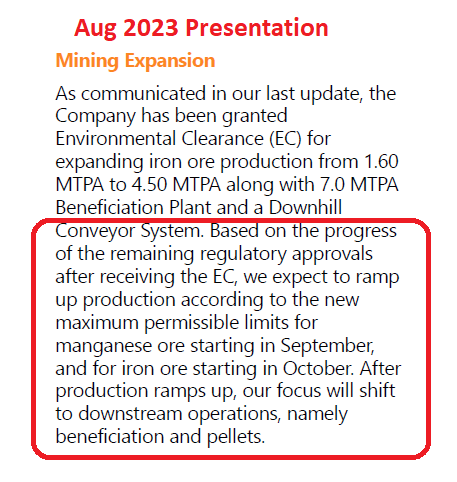

After years of delays, Sandur finally received an approval to expand their iron ore mining activities, in April 2023.

This will significantly increase their iron ore output, growing from 16 Lac to 45 Lac Tons, a remarkable 2.8x growth.

After years of delays, Sandur finally received an approval to expand their iron ore mining activities, in April 2023.

This will significantly increase their iron ore output, growing from 16 Lac to 45 Lac Tons, a remarkable 2.8x growth.

When will these boosted capabilities translate into earnings per share?

Mark your calendars: Management projects a surge in iron ore production beginning October 2023.

Skeptics may want to approach these timelines with caution.

Mark your calendars: Management projects a surge in iron ore production beginning October 2023.

Skeptics may want to approach these timelines with caution.

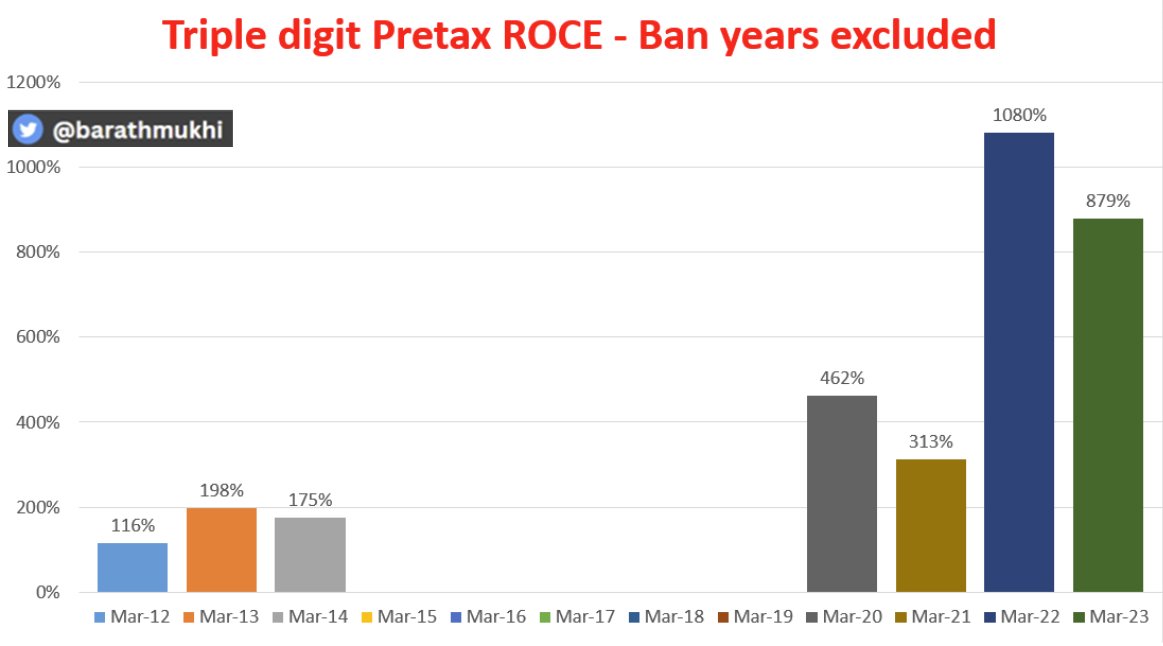

This expansion is crucial because mining is a high-ROCE cash cow for Sandur - This is one of the key concerns some of you had raised.

Mining operations have had triple-digit ROCE numbers across the board, excluding the mining ban years.

Mining operations have had triple-digit ROCE numbers across the board, excluding the mining ban years.

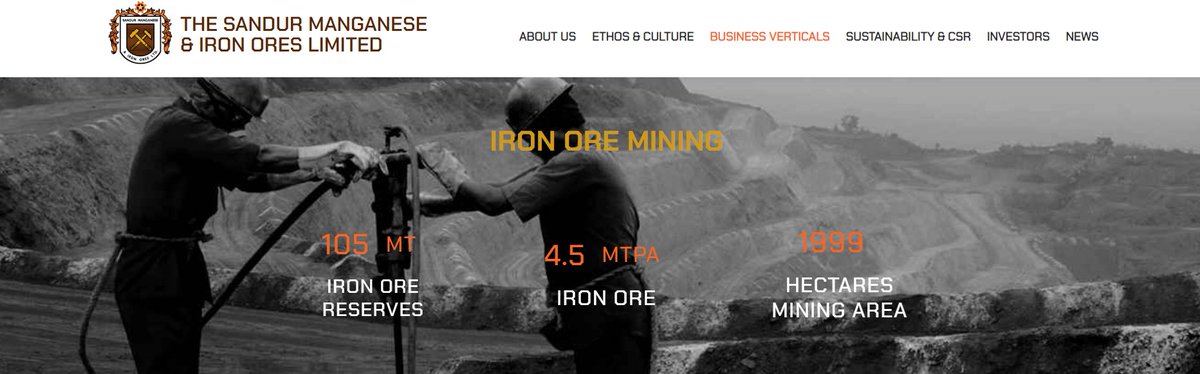

Sandur Manganese generates incredible returns with 105 MT of Iron Ore reserves because they'll be mining 45 Lac tons per year out of a total of 10.5 crore tons.

The government's lease renewal will decide if this goldmine can bring even more profits for shareholders after 2033.

The government's lease renewal will decide if this goldmine can bring even more profits for shareholders after 2033.

How did Sandur come to possess such a profitable mining asset?

The former Maharaja of Sandur, Karnataka, Shri. Y R Ghorpade granted Sandur Manganese (he was also the co's founder) a mining lease of 7511 hectares after establishing it in 1954.

The former Maharaja of Sandur, Karnataka, Shri. Y R Ghorpade granted Sandur Manganese (he was also the co's founder) a mining lease of 7511 hectares after establishing it in 1954.

Sandur gradually returned 73% of the land to the State/NMDC/Forest dept until 2014 when their mining lease was renewed under the Mines and Minerals Development and Regulation Act, a law regulating mineral extraction, mining activities, environmental protection & revenue sharing

The good news is Sandur has a lease from the Karnataka govt. to mine 45 Lac Tons of Iron Ore until 2033, which is still a highly lucrative asset.

With high return ratios and good execution in the future, Sandur can create significant value for all stakeholders.

With high return ratios and good execution in the future, Sandur can create significant value for all stakeholders.

Our upcoming threads on Sandur Manganese will cover:

1. Pelletization

2. Beneficiation

3. Risks

Before investing, carefully study the risks because there are quite a few.

If you liked this thread and for more updates, follow our Telegram channel: @ t.me/barathmukhi

1. Pelletization

2. Beneficiation

3. Risks

Before investing, carefully study the risks because there are quite a few.

If you liked this thread and for more updates, follow our Telegram channel: @ t.me/barathmukhi

• • •

Missing some Tweet in this thread? You can try to

force a refresh