There is what might be described as an unfortunate side effect to the Bank of England’s policy of raising interest rates. It is that the UK’s main High Street banks might be paid £18 billion this year for sitting on money that the government quite literally gave them. A thread….

Way back in 2008, you might recall that there was a banking crisis. Without government intervention most of the UK’s banks would have failed. As it was many, including Lloyds and the Royal Bank of Scotland (now NatWest), plus others now long forgotten, did.

The whole UK commercial banking system was saved by the UK government injecting more than £400 billion (that’s 400 hundred thousand million pounds) into the banking system.

That was new money. It was electronically created out of nothing by the Bank of England (which governments can do whenever they like, even though most politicians deny it). The process involved was called quantitative easing (or QE) but the name does not matter much.

What does matter is that new money ended up in a special type of bank deposit account that only commercial banks, some other financial institutions and some foreign governments can have with the Bank of England.

These accounts are special because they include what is called ‘base money’.

All base money is government created.

There are two types of base money. One is notes and coins, now worth around £80 billion in total. The rest is these special deposit accounts.

All base money is government created.

There are two types of base money. One is notes and coins, now worth around £80 billion in total. The rest is these special deposit accounts.

These special deposit accounts - also called central bank reserve accounts - exist for two reasons. One is to let money flow from and too the government via the commercial banks. The other is to let the commercial banks pay each other.

Looking at that first purpose, it should come as no great surprise that ultimately all our money is government created. Notes and coin obviously are. But in essence so too is all the money recorded in commercial bank accounts.

That is because our money is either guaranteed directly by the government, which is what the £85,000 bank deposit guarantee scheme that so many people rely upon to have any confidence to save money with their banks is all about.

Or it’s because of the fact that since 2008 the UK’s commercial banks have been able to pay each other because the Bank of England created these special deposit accounts to make sure that they could do so.

What this means is that the money that we have in our bank accounts has value that we can rely on precisely because the government created the mechanism to ensure that the banks could always make payment to each other by gifting to them the means to ensure that they could do so.

When that ability of the banks to pay each other was threatened during the Covid crisis - as it was in March 2020 - the Bank of England stepped in again. It created more than £450 billion of extra cash as a result, at least partly for that reason.

Of course, that paid furlough and much else. But because new money was used to pay for those things and it has never been cancelled that money is still there in the banking system, sitting in the special deposit accounts that the commercial banks have with the Bank of England.

There are, incidentally, only two ways to cancel this money. One is for the government to run a surplus, which means it taxes more than it spends. This almost never happens and certainly will not be happening any time soon, so we can ignore that option.

The other is for the government to sell more bonds into financial markets than it needs to do to cover its deficits. The Bank of England has tried to do this over the last year or so, but whether that will be possible in the next year or so is currently unknown.

What this means is that these special deposit accounts - or central bank reserve accounts - are going to continue in existence for some considerable time to come. That’s good news because they keep the banking system stable and in operation. They are vital, in my opinion.

I would go a little further than that. Given that we have had inflation and so need more money supply simply to allow for the fact that the pound is not worth as much as it was we might, if anything, need more of these deposits to keep the system functioning now.

Instead, the Bank of England is trying to reduce them by seeking to reverse quantitative easing - a programme they call quantitative tightening - which I think inherently deeply risky because it reduces the amount of money available to the banks to make payment to each other.

So, we need these central bank reserve accounts or special bank deposit accounts that the commercial banks have that were gifted to them by the Bank of England.

But what we do not need to do is pay anything like the Bank of England base rate of interest on these accounts, which is what the Bank of England is also doing, a direct cost to the government, who funds these payments.

The Bank of England has justified this policy by saying that if the Bank base rate of interest was not paid on these deposits then the commercial banks could swap these special deposit balances into something like government bonds instead and still get risk-free interest.

This is not true. That would imply that these deposits can be switched into another form of asset at the commercial bank’s choice, but to a very large degree that is not true: unless they can persuade another commercial bank to take their deposit then any bank is stuck with them.

I stress that is because they are base money. That’s not normal money. Base money of this sort’s s uses are limited and in essence only permit inter-bank payments, and so to claim that the money can be used for any other purpose, as the Bank of England is doing, is just wrong.

In that case the Bank of England’s claim that these deposits could be swapped into gilts makes no sense at all because technically that simply cannot happen.

There is another reason why the Bank of England might claim that their base rate of interest must be paid, and that is to reinforce their interest rate policy. It is accepted that this might be true for some of these balances. But there is no reason to pay this rate on them all.

Importantly, other central banks do not pay their base rate of interest on all the central bank reserve account balances that they have created for commercial banks working in their currency. The is most especially true in Japan, but it’s also true for the European Central Bank.

Instead those banks pay tiered rates of interest. They pay in full on the first part of the deposit and then the rate fades away. I suggest that the Bank of England pay in full on 25% of the balance and then pay at 0.1% on the rest - the last being the rate paid for most of 2021.

Why get so worked up about this, meaning that I have already written a long thread just to get to this point? That is because the sums involved in making these interest payments to commercial banks on the special deposits that were gifted to them are enormous.

There are now about £800 billion in these accounts. And the Bank or England’s base interest rate is 5.25% per annum - and is still expected to rise. But just multiply those two together and the result is an interest cost of to the government of £42 billion a year.

Let me just put that in context. That’s enough to provide the NHS with all the money that it needs.

It would have permitted all the quite reasonable pay claims made by teachers, academics, doctors, nurses, and so many others to have been settled.

It could have reduced poverty.

It would have permitted all the quite reasonable pay claims made by teachers, academics, doctors, nurses, and so many others to have been settled.

It could have reduced poverty.

But, instead, it is being out by way of interest. So, the question is, who gets it? I did a bit of research to find out who some of the big recipients are.

To do that I read the accounts of the UK banking operations of the following five banks, covering 2022 and 2021:

- Barclays

- HSBC

- Lloyds

- NatWest (formerly Royal Bank of Scotland), and

- Santander.

I wanted to include Nationwide, but their accounts were not good enough.

- Barclays

- HSBC

- Lloyds

- NatWest (formerly Royal Bank of Scotland), and

- Santander.

I wanted to include Nationwide, but their accounts were not good enough.

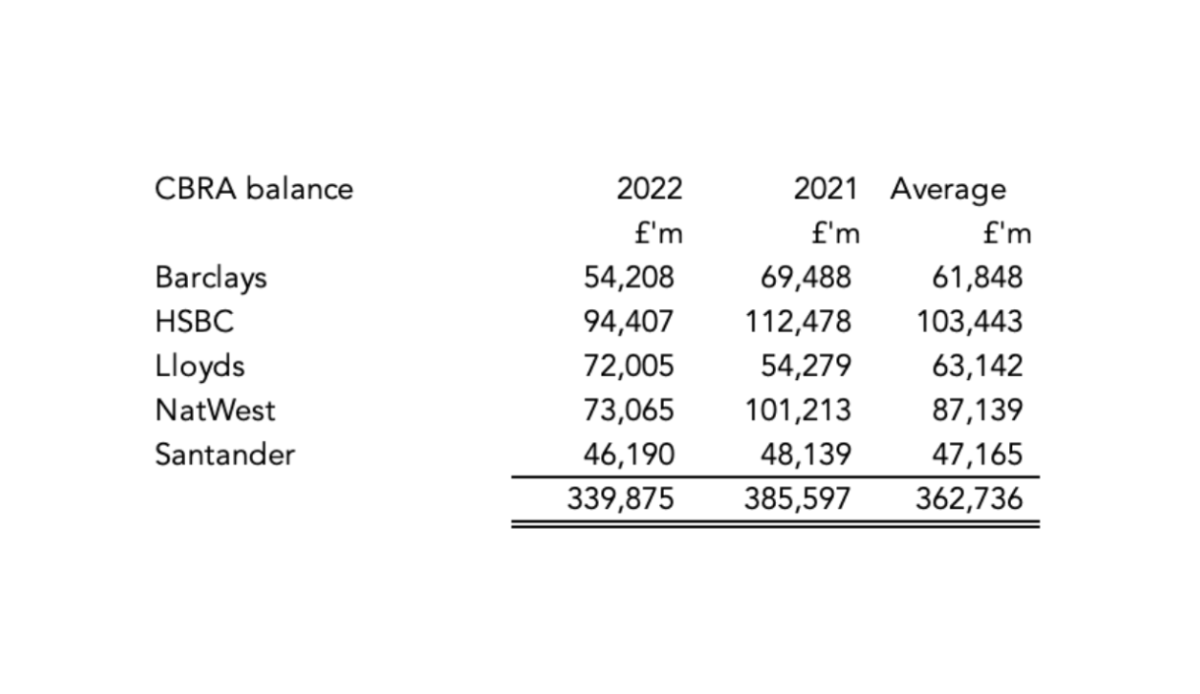

Then I created a summary of the average balance that they held on these special deposit accounts with the Bank of England in 2022 by simply averaging their opening and closing balances on these accounts for the year, and got this data:

These banks are likely to have around £360 billion in these accounts right now.

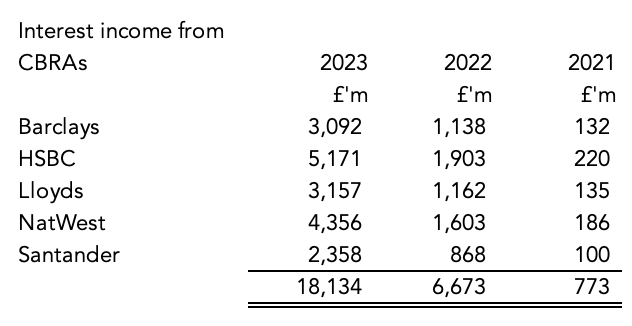

Then I assumed that their average balance held on these accounts will not change much in 2023, which is most likely to be a reasonable forecast.

Then I assumed that their average balance held on these accounts will not change much in 2023, which is most likely to be a reasonable forecast.

After that I then multiplied these balances with the average interest rate likely to be paid on these special deposit accounts in 2023, calculated on a daily basis.

The result was that this year these banks are likely to be paid, or have been paid, these amounts on these special deposit accounts that they hold with the Bank of England:

Note by how much these payments have increased whilst the rest of the country has been having a cost of living crisis.

Assuming that the balances stay the same in 2024 and that Bank of England base rate is 5.25% for that whole year, on average, the amount goes up. They will get:

Assuming that the balances stay the same in 2024 and that Bank of England base rate is 5.25% for that whole year, on average, the amount goes up. They will get:

And this is how the Bank of England wants to keep things: they want to keep interest rates high and for so long as they do the UK’s commercial banks will continue to be paid these massive additional sums each and every year unless something changes.

Now remember that the banks did not earn the money that is held on deposit in these accounts. They only have these sums because the Bank of England created new money to bail the banks out and to manage the Covid crisis.

If anything you would expect as a result that the commercial banks should be paying the Bank of England, and so the government, for the favour that they were given by being saved in 2008 and again in 2020.

That, though, in the crazy world of banking, is not how things work. Instead, our commercial banks are now being paid for having had the privilege of being saved by us.

And, to add to the offensive nature of these payments, not one penny of these sums paid to the banks by our government is being passed on by them to bank customers by way of extra interest on their accounts. The banks are, instead, keeping it all for themselves.

As my research shows, quite literally every single penny of this bung (I can’t think what else to call it) from our government is going straight to the bank’s bottom line, where it is recorded as extra profit to benefit their shareholders.

This money is being used to make the richest people in the country richer whilst everyone else suffers. There is no other way of putting it.

That’s because as a result of the vast sums that these banks are being paid we must suffer austerity and our public services must be trashed whilst some of those who work in them have to use food banks to feed their children.

What is even more offensive is that this is not necessary. We could reduce these payments by at least three quarters, and maybe more. It would be legal to do that. The Bank of England would operate just as effectively as now. The banking system would still be safe.

In fact, it might be safer than now because the inequality that payments of this sort are creating is fueling a private debt crisis that might cost the banks a great deal when loans cannot be repaid.

So, why is that deeply offensive interest payment still being made? The answer is simple. We have outsourced government economic policy wholesale from the Treasury to the Bank of England and they run that policy in the interests of their mates in the City of London, and not us.

So, Barclays, HSBC, Lloyds, NatWest and Santander win, as do their bosses - who take home millions as a result of this for making massive profits that they say prove how clever they are when they’ve simply fleeced us all - and we all suffer.

It’s time the government said that they were going to stop these hideous payouts to the banks.

It is most especially time that Labour did so.

If they don’t then you’ll know they are on the side of bankers.

That’s the dividing line in UK politics now. I know which side I am on.

It is most especially time that Labour did so.

If they don’t then you’ll know they are on the side of bankers.

That’s the dividing line in UK politics now. I know which side I am on.

• • •

Missing some Tweet in this thread? You can try to

force a refresh