Capri, $CPRI, is up +56% after acquisition news.

Did someone know? Yup.

Someone put $700k in $CPRI 42.5c 9 expiring next month, bought last Friday/Monday at .87 and .80 respectively. CPRI is generally illiquid.

The closed at +1000% return, turning $700k into ~$10 million.

Did someone know? Yup.

Someone put $700k in $CPRI 42.5c 9 expiring next month, bought last Friday/Monday at .87 and .80 respectively. CPRI is generally illiquid.

The closed at +1000% return, turning $700k into ~$10 million.

Could you have followed it on unusual whales? Probably.

Say you looked at opening flow on $CPRI, interested due to upcoming earnings. You would have seen its net flow, elevated call side, puts being sold since Aug 3.

The OTM skew was heavily call side outside of normal vol.

Say you looked at opening flow on $CPRI, interested due to upcoming earnings. You would have seen its net flow, elevated call side, puts being sold since Aug 3.

The OTM skew was heavily call side outside of normal vol.

What is more weird is that $CPRI gets close to zero options activity.

Premiums and volumes jumped since Aug 3.

That would have raised suspicion. If you looked at the chain, you would have seen people hitting $42.5 and $45 calls since last month, expiring in Sept.

Weird...

Premiums and volumes jumped since Aug 3.

That would have raised suspicion. If you looked at the chain, you would have seen people hitting $42.5 and $45 calls since last month, expiring in Sept.

Weird...

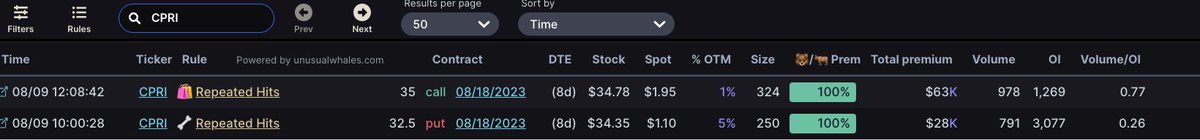

Say you kept searching, and you'd see the $42.5 call was heavily bet on for this September, you'd see the attached image of ALL opening trades.

Paired with flow alerts would have then shown repeated hits on $CPRI, thus confirming something is up.

Link: https://t.co/mUXHAHqVZhunusualwhales.com/live-options-f…

Paired with flow alerts would have then shown repeated hits on $CPRI, thus confirming something is up.

Link: https://t.co/mUXHAHqVZhunusualwhales.com/live-options-f…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter