𝑌𝑜𝑢𝑟 𝑡𝑒𝑎𝑚 𝑖𝑠 𝑓𝑎𝑖𝑙𝑖𝑛𝑔. 𝑌𝑜𝑢 𝑑𝑖𝑑 𝑖𝑡 𝑎𝑙𝑙 𝑤𝑟𝑜𝑛𝑔!

GM! Relax, this is just a flashy title. But it's an important topic 💡 for teams & founders especially 💡 as that's a trap many fall into during prolonged bear markets.

Are you doing it all wrong? 🧵

GM! Relax, this is just a flashy title. But it's an important topic 💡 for teams & founders especially 💡 as that's a trap many fall into during prolonged bear markets.

Are you doing it all wrong? 🧵

Aka "scrape it all, let's change, a 180 degrees turn!" 🔫

As bear continues and all user metrics fall, it's hard to keep yourself both motivated and convinced. User metrics down, governance activity down, volumes down, your bonuses down, your industry prospectives down - it's all falling 🤔 Is it fine?!

Nuance 🤔 A known rule is that you should only be worried about the things you can actually influence and control. But in startups, you can kind of control everything. Your budget, your team, even the industry itself... But what do you NEED to control? Is there some rule book?

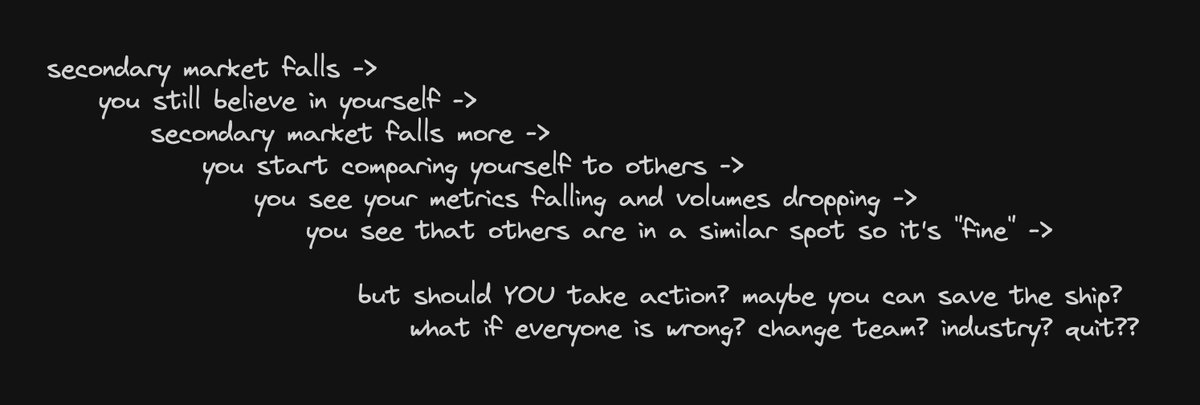

Firstly, let's step back a bit and see how teams arrive in such situations. It's a circular trend that goes a bit like this (pic below). And it's ok to doubt, change budgets, pivot, and so on... It's natural to all companies & human beings! But what if there are no clear reasons?

And that's the thing. If you see that within your segment competitors are doing better - then you can analyze "why" and adapt. And here it's vital ⚠️ to distinguish vanity metrics from your team actually underperforming or doing something wrong. Those metrics could be:

1⃣ Social stats

Nah. Gameable, unless you see it's coming from the people you know (not random accounts) & if they were not paid for it. For example, if there are a ton of likes, RTs - likely semi-bots. If they are paid low-level KOLs: also not relevant. It's temporary.

Nah. Gameable, unless you see it's coming from the people you know (not random accounts) & if they were not paid for it. For example, if there are a ton of likes, RTs - likely semi-bots. If they are paid low-level KOLs: also not relevant. It's temporary.

As such, you can almost conclude that it's not like their marketing is better or they are more popular. It's paid for. And it's okay to pay for to get a bootstrap effect if you can funnel it well (into a raise or product growth) but give it time to see if that attention sticks!

You don't need to act immediately, because you can't change things fast anyway. Blockchain apps are much slower in development: a ton more security things, audits, and so on. It's not like web2 apps with A-B testing. In crypto, you can only A-B test in prod like 2 times a year.

That's why conviction in crypto startups is even more imperative than elsewhere. From the time you raise to a working product and user acquisition funnel - takes much longer than in more simple web2 consumer products. We will come back to this again below...

2⃣ VC Funding

Nah. Primary market is always behind secondary market, so VCs will keep piling onto new yet same shit. You can often see your competitors getting more $$ while you are being short on funding simply because you are not a new bag. Nothing you can do about it. Ignore!

Nah. Primary market is always behind secondary market, so VCs will keep piling onto new yet same shit. You can often see your competitors getting more $$ while you are being short on funding simply because you are not a new bag. Nothing you can do about it. Ignore!

Let's debunk the above xeet (ew Elon u suck with your names). Firstly, to avoid the case above, you can try to be friends with many in the industry (VCs / angels) so they won't fund a copycat. It doesn't always work, but if your reputation is high enough - it will sometimes work!

The above actually is also relevant for the 1⃣ social stats point. If too many reputable people, incl. VC, devs, angels and so on - are on the train with your competitor - then it will make your life harder. Not a deal breaker, but in a small industry it will feel lonely af. BUT!

That "competition" again. If we talk about the market as right now, there is no competition. Not that "you are the best and unique" - no. But because everyone is SMALL. Everyone has like 1,000 active users at best, so a bull market + the right approach can 180 change the winners!

3⃣ Volumes

Make sure to check if they are based on temporary external subsidies or are organic. It's silly to show 1B total volumes when everyone else without incentives has 50M. Like... cmon bro. Becoming such an outlier by overspending $$ will only make people more suspicious.

Make sure to check if they are based on temporary external subsidies or are organic. It's silly to show 1B total volumes when everyone else without incentives has 50M. Like... cmon bro. Becoming such an outlier by overspending $$ will only make people more suspicious.

4⃣Other things like your product shipping timelines, and so on... those are more objective, so you can judge it yourself. That's something you can control without looking at many external factors. However, is fast = good? Or should you prioritize longevity?

💡 As it stems from all the points above, you are not in control of many things. You are in a cyclical market! Even more so than in web2, your priority is to stay around and be alive until an inflection point hits! This might sound like a lazy excuse, but please prove me wrong?

As conclusion, I guess can summarize it into:

1. Extend the budget to make your runway longer. In startups, market timing (when it comes to users wanting your product, not shitcoin related now) is very important. In crypto, which is more cyclical, it's magnitudes more important.

1. Extend the budget to make your runway longer. In startups, market timing (when it comes to users wanting your product, not shitcoin related now) is very important. In crypto, which is more cyclical, it's magnitudes more important.

2. Don't overstress your team and don't change things 180 degrees, unless you are SURE that others are doing better and you can put actionable items on the drawing board. Just changing everything because your current product doesn't stick doesn't mean the product is bad.

It's similar to web2 startups trying to make 100 new features based on 5 people feedback. That's not the way to go unless you can scale it. Sure, power users are important, but then make sure it's something people really need and want. How? The best you can do is just 1-1 chats.

3. Stay active with all the other industry participants! End of the day, web3 and crypto are very composable. Your popularity next cycle rests on you knowing others. The more you know, the higher the chances. Both for funding and for product integrations! (Your) brand matters.

4. As founders & public people, your extra job is to make sure you shine confidence 24/7. To your fellow contributors, to your backers, to everyone. You are supposed to be overly confident on the outside in what you do! Otherwise, if you don't belieb in yourself, who will?!

⚠️ One last things to say: I am not a guru, I don't know if the above is all correct. I just see teams doing 180 degrees when they think remaking products all the time is good during bear. Don't be lazy, try different things, work 24/7, but don't ruin the good you already have!

In @GearboxProtocol DAO, we do this exercise a few times a year. It might be a bit easier because leverage as TAM is more established, but you can do margin/perps/options/looping to achieve leverage. There are different approaches to this equation...

https://twitter.com/GearboxProtocol/status/1689981972431663104

Changing the product to "NFT finance" last year was one of the silliest moves from live DeFi protocols I have seen. Or pivoting to AI during the hype. Again, unless you have to do it to survive by getting new funding.

Narrative != product.

After raising, you should somehwat stop with the fugazi narrative chasing and take longer periods into account. Building products isn't just thinking and tweeting, because you actually need to ship things lol.

GLHF 💕

Narrative != product.

After raising, you should somehwat stop with the fugazi narrative chasing and take longer periods into account. Building products isn't just thinking and tweeting, because you actually need to ship things lol.

GLHF 💕

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter