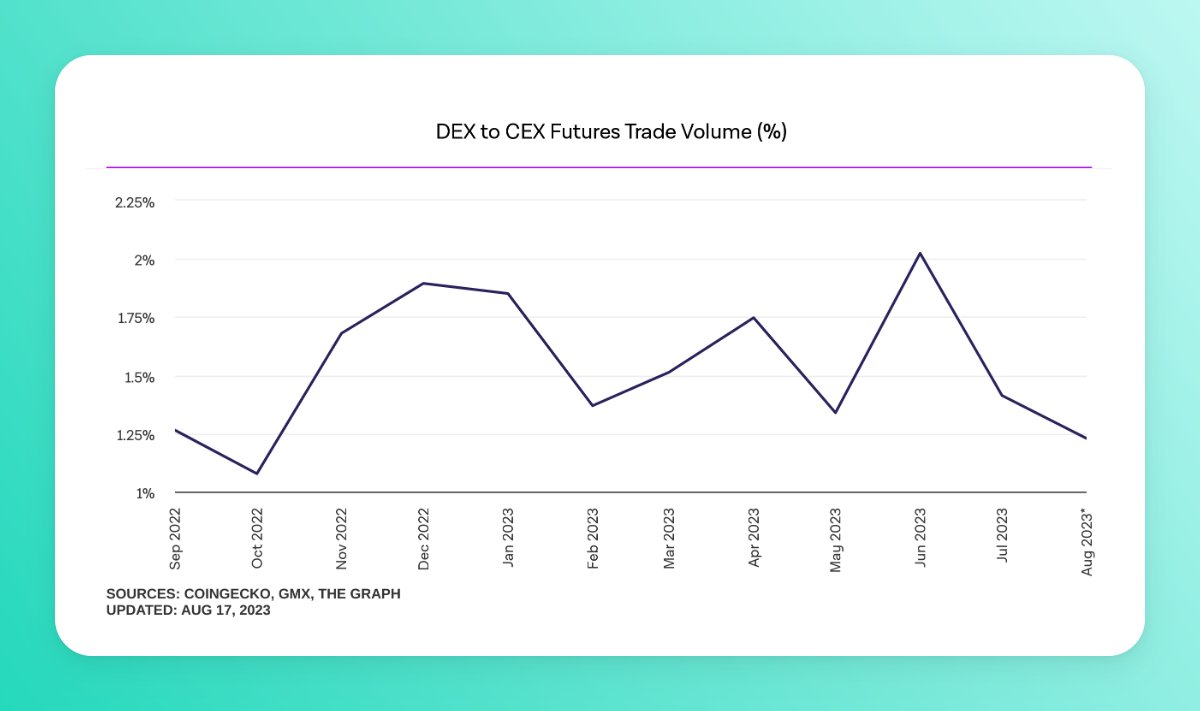

CT forgot a crucial revenue generator in DeFi: on-chain derivatives.

With DEX to CEX futures trading volume still below 1.5%, there's massive potential for future industry growth.

Let's have a closer look at a Derivatives DEX with a degen twist – @ApolloX_Finance.

🧵 1/17

With DEX to CEX futures trading volume still below 1.5%, there's massive potential for future industry growth.

Let's have a closer look at a Derivatives DEX with a degen twist – @ApolloX_Finance.

🧵 1/17

In traditional finance and CeFi, futures trading volumes surpass spot volumes by several times.

However, in DeFi, the derivatives industry has not yet developed enough to show the same trend. This makes it an undervalued sphere for long-term exposure.

🧵 2

However, in DeFi, the derivatives industry has not yet developed enough to show the same trend. This makes it an undervalued sphere for long-term exposure.

🧵 2

With the latest advancements in account abstraction and unification of liquidity layers, on-chain derivatives are poised for significant growth. Among them, @ApolloX_Finance stands out as one of the most Degen-style products.

🧵 3

🧵 3

With support from @BinanceLabs, @ResearchKronos, @3commas_io, and others, ApolloX is showing steady growth even during a time when DeFi is experiencing low retail activity.

🧵 4

🧵 4

So what makes it stand out from other perp DEXes out there?

• Offers order book and LP perpetuals

• Running on @BNBCHAIN, Ethereum, zkSync, and @Arbitrum;

• Up to 500x leverage (truly degen);

• Market-lowest slippage of 0.01%;

• A White Label DEX engine.

🧵 5

• Offers order book and LP perpetuals

• Running on @BNBCHAIN, Ethereum, zkSync, and @Arbitrum;

• Up to 500x leverage (truly degen);

• Market-lowest slippage of 0.01%;

• A White Label DEX engine.

🧵 5

If you're not familiar with how ApolloX works, my friend @eli5_defi shared a fantastic read on the ApolloX ecosystem earlier.

It includes some excellent infographics, so be sure to check it out!

🧵 6

It includes some excellent infographics, so be sure to check it out!

🧵 6

https://twitter.com/eli5_defi/status/1675947505165697024

Here's where it gets interesting: Enter ApolloX Degen Mode.

• 500x default leverage for crypto pairs ($BTC, $ETH)

• 0 slippage

• 0 opening position fee, 0.06% closing position fee

• All-or-nothing; maximum ROI +/- 100%

I hear PnL fee is in the works as a fee option.

🧵 7

• 500x default leverage for crypto pairs ($BTC, $ETH)

• 0 slippage

• 0 opening position fee, 0.06% closing position fee

• All-or-nothing; maximum ROI +/- 100%

I hear PnL fee is in the works as a fee option.

🧵 7

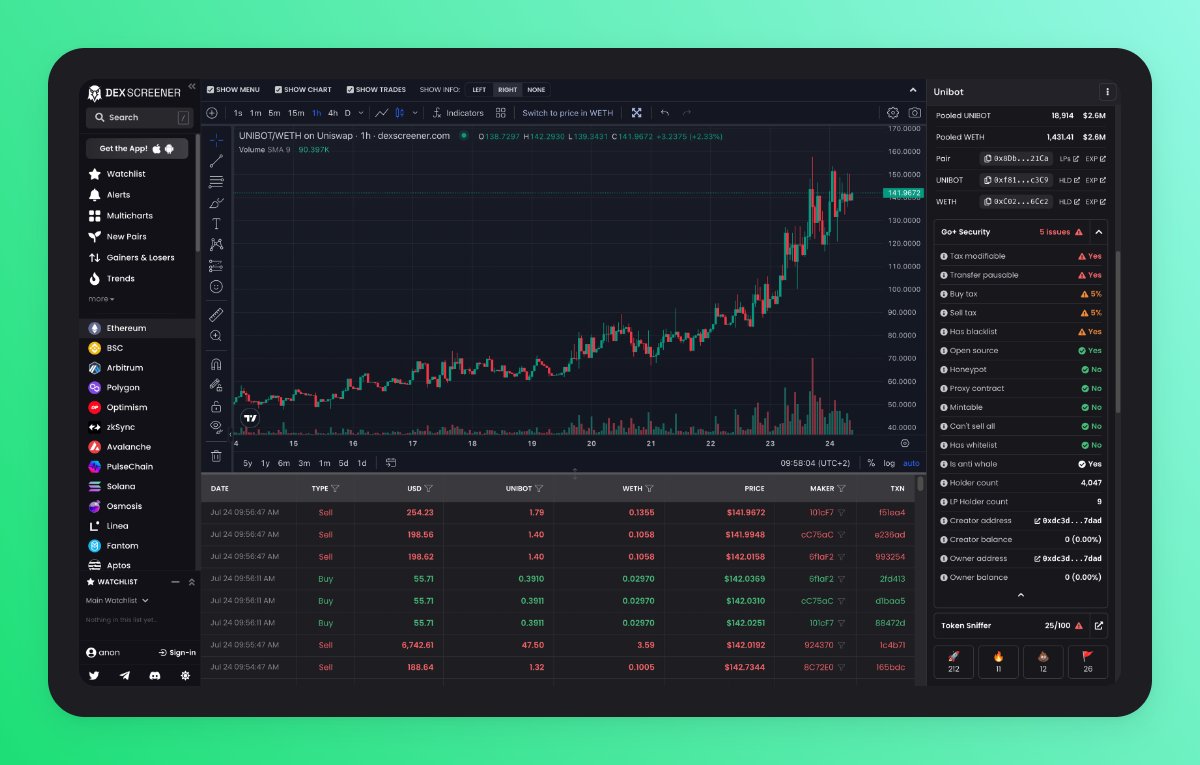

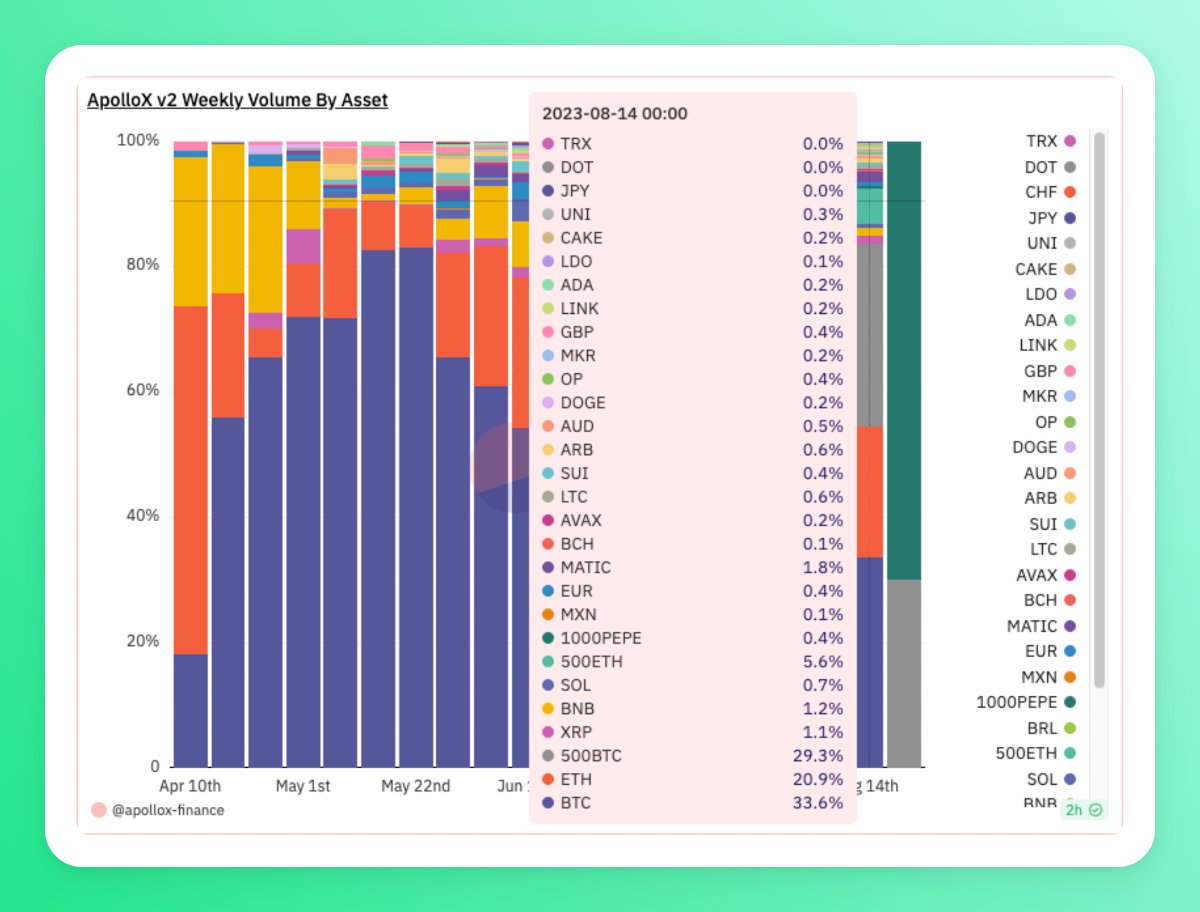

It’s common to offer high leverage for forex but 500x is unheard of for crypto perps.

Degen mode $BTC perp weekly vol: 29.3%

$BTC perp weekly vol: $33.6%

Despite only launching earlier this month, trading volumes are close.

🧵 8

Degen mode $BTC perp weekly vol: 29.3%

$BTC perp weekly vol: $33.6%

Despite only launching earlier this month, trading volumes are close.

🧵 8

Another innovation I haven’t seen with other exchanges: Perps DEX SDK.

ApolloX DEX Engine is a broker SDK that projects can integrate to offer perps to users. Liquidity, infrastructure and trading pairs provided by ApolloX. Frontend UI is customized to the project.

🧵 9

ApolloX DEX Engine is a broker SDK that projects can integrate to offer perps to users. Liquidity, infrastructure and trading pairs provided by ApolloX. Frontend UI is customized to the project.

🧵 9

With 3 security audits, ApolloX is a firmly established player in the on-chain derivatives industry, actively striving to expand its market share.

🧵 10

🧵 10

How so?

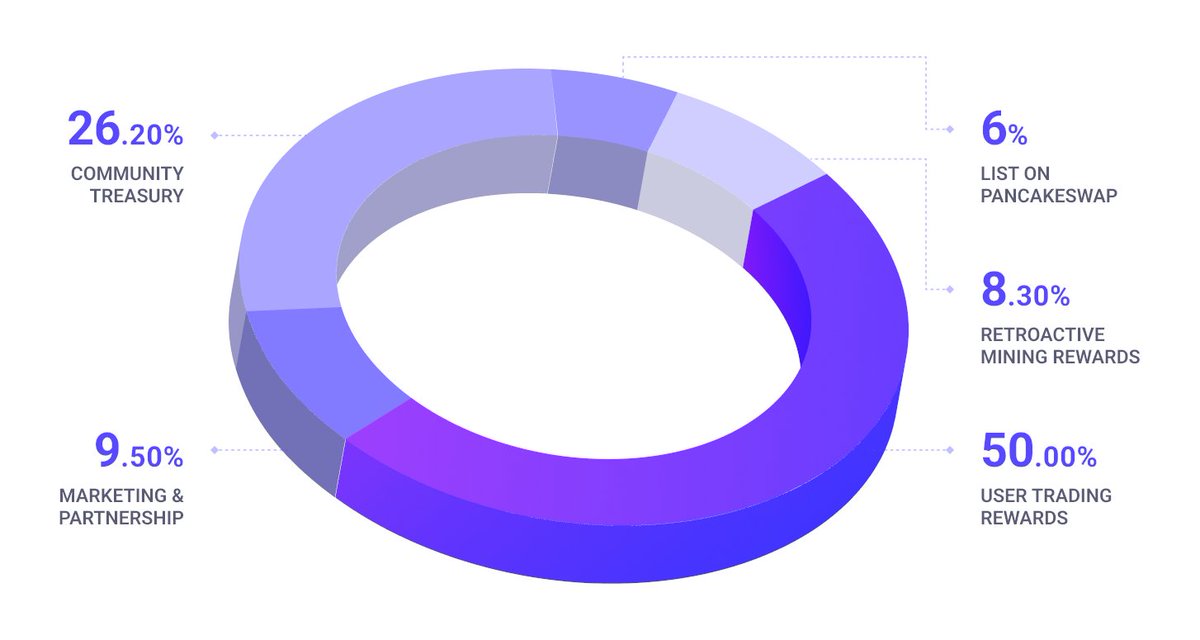

• 50% of the APX emission is streamed to the users who earn rewards as they trade.

• With the release of x500 leverage, ApolloX has become the exchange with the highest leverage for crypto perps.

• Regular trading tournaments and incentives are also offered.

🧵 11

• 50% of the APX emission is streamed to the users who earn rewards as they trade.

• With the release of x500 leverage, ApolloX has become the exchange with the highest leverage for crypto perps.

• Regular trading tournaments and incentives are also offered.

🧵 11

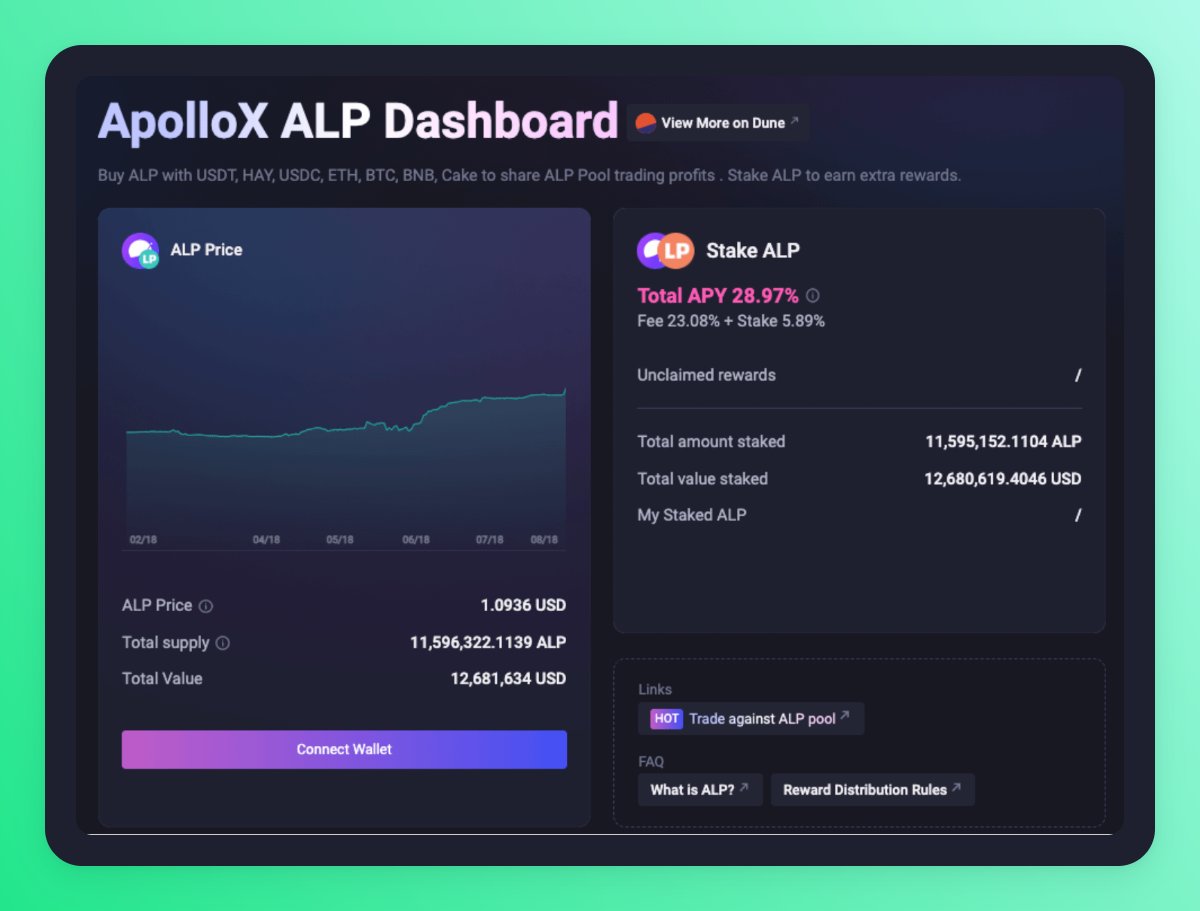

Users also have the opportunity to earn real yields from trading fees when they provide liquidity to the protocol pools.

ALP, the liquidity provider token composed of a pool of assets includes USDC, USDT, BNB, ETH, BTC, HAY, and CAKE.

🧵 12

ALP, the liquidity provider token composed of a pool of assets includes USDC, USDT, BNB, ETH, BTC, HAY, and CAKE.

🧵 12

Users have the option to become liquidity providers by utilizing any of the specified assets to purchase ALP. The ALP pool acts as the direct counterparty for V2 on-chain perpetual traders.

Additionally, users can stake ALP to earn APX rewards.

🧵 13

Additionally, users can stake ALP to earn APX rewards.

🧵 13

And finally, ApolloX leverages the benefits of the Ve(3,3) token model. Users are encouraged to lock their $APX tokens to participate in DAO proposals and earn rewards from protocol trading fees.

Holders with >5M voting power can create proposals for voting.

🧵 14

Holders with >5M voting power can create proposals for voting.

🧵 14

I'm confident that True Degens will absolutely love the advantages they are offered on ApolloX.

Depositing $100 as collateral to gain access to $50K in trading power is not a game for those who prioritize risk aversion, right?

🧵 15

Depositing $100 as collateral to gain access to $50K in trading power is not a game for those who prioritize risk aversion, right?

🧵 15

However, it's important to remember that high leverage can amplify both potential rewards and losses.

Even a small price movement can result in the trader losing all of their collateral. Therefore, it is crucial to choose the leverage size wisely.

🧵 16

Even a small price movement can result in the trader losing all of their collateral. Therefore, it is crucial to choose the leverage size wisely.

🧵 16

DISCLOSURE: This thread is sponsored by ApolloX. Personally, I am a strong supporter of the bright future of the on-chain derivatives industry and I am thrilled to witness the progress of dApps that make DeFi more diverse!

Remember to DYOR, always!

🧵 17/17

Remember to DYOR, always!

🧵 17/17

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter