It's time to seriously make it – bear market or not.

LayerZero, zkSync, Linea, Base, StarkNet, Aptos.

26 Tokenless Projects.

$2.6B cumulative funding.

ALL IN 1 concise route.

Entirely for free.

One thread to rule them all.

CC2s MASTODON OF ALL AIRDROPS: PART 2

🧵⬇️ twitter.com/i/web/status/1…

LayerZero, zkSync, Linea, Base, StarkNet, Aptos.

26 Tokenless Projects.

$2.6B cumulative funding.

ALL IN 1 concise route.

Entirely for free.

One thread to rule them all.

CC2s MASTODON OF ALL AIRDROPS: PART 2

🧵⬇️ twitter.com/i/web/status/1…

The premise is simple.

Each transaction either interacts with:

• The big 6 [LayerZero, zkSync & co]

• A tokenless dApp w/ high airdrop odds

Ideally both.

It's best to split the route across a few days.

The sheer number of involved projects/synergies will blow you away.

⬇️

Each transaction either interacts with:

• The big 6 [LayerZero, zkSync & co]

• A tokenless dApp w/ high airdrop odds

Ideally both.

It's best to split the route across a few days.

The sheer number of involved projects/synergies will blow you away.

⬇️

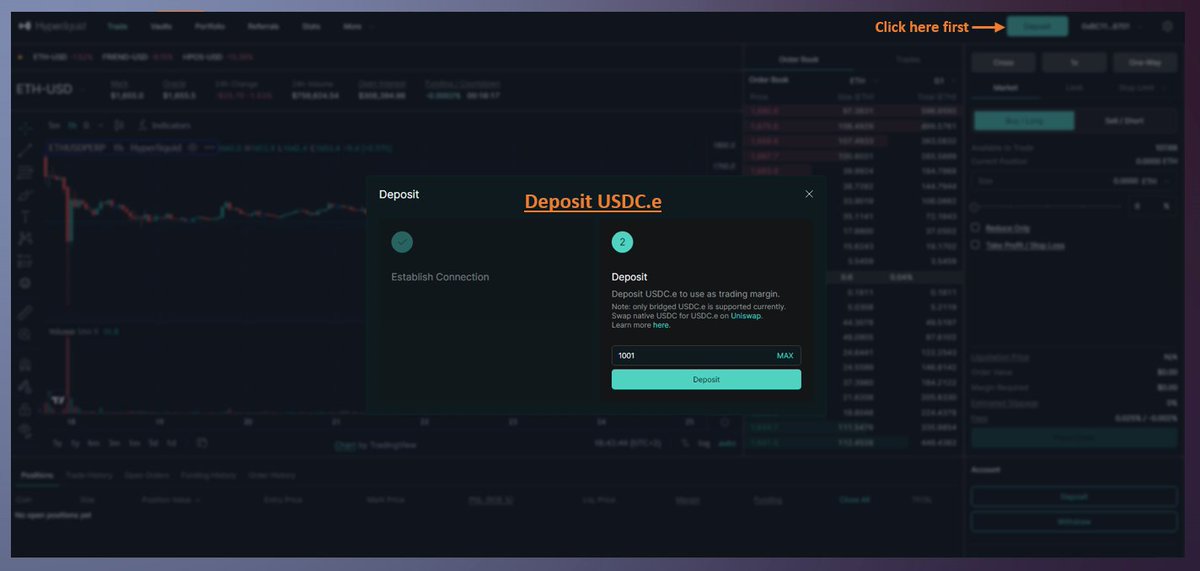

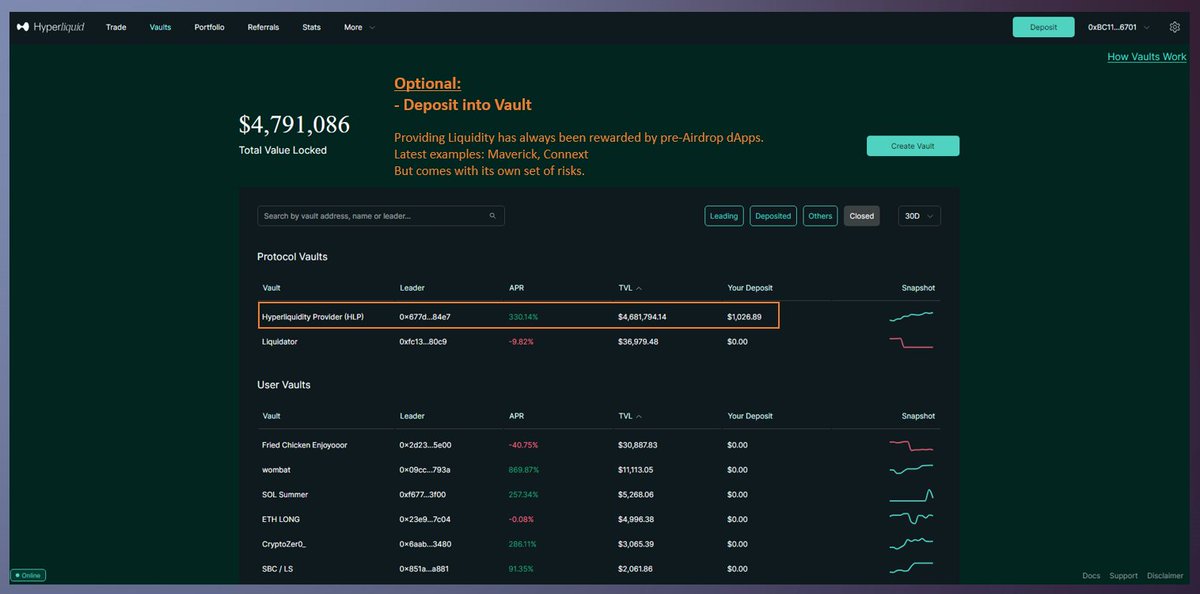

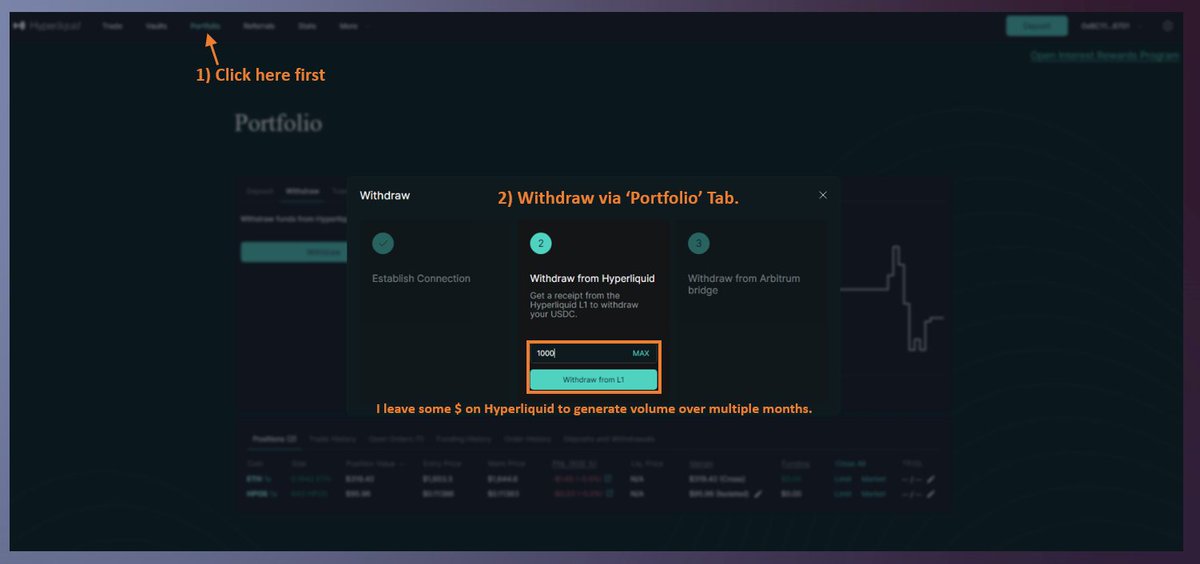

#1 Hyperliquid

🔗–

• Deposit USDC

• Trade

• Optional: Provide Liquidity

Repeat weekly

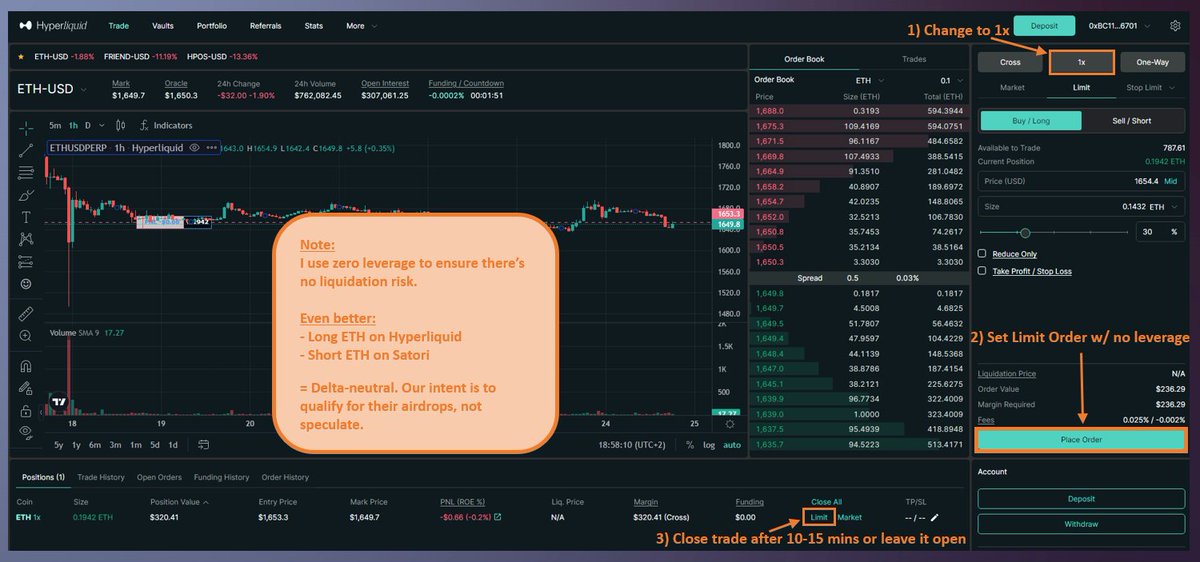

Delta Neutral Tip:

Long on HL

Short on Satori

💰Funding: Undisclosed

🪂Airdrop Odds: Every competitor has a token!

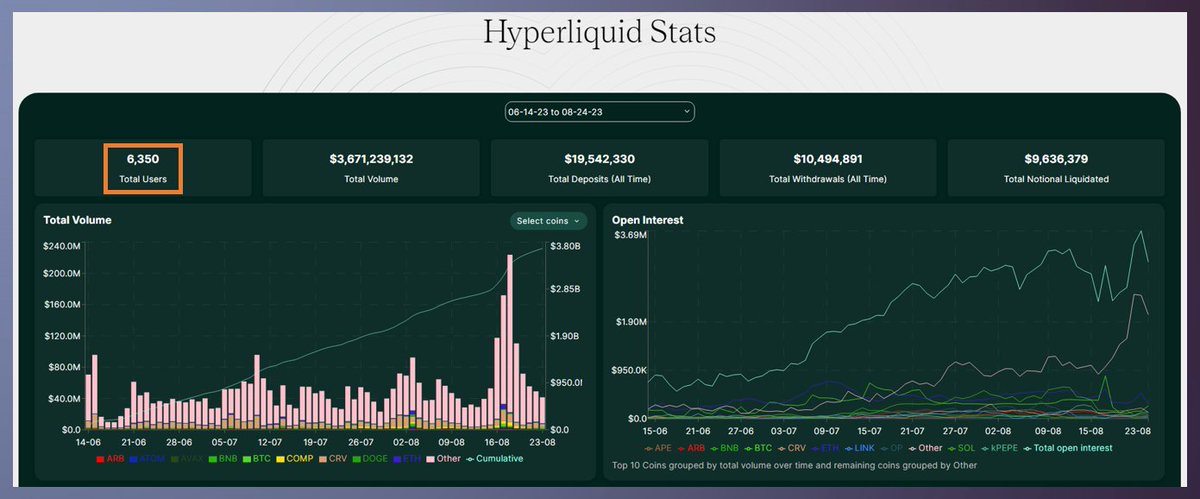

My #1 sleeper pick on this list: < 6400 users! app.hyperliquid.xyz/join/CC2VENTUR…

🔗–

• Deposit USDC

• Trade

• Optional: Provide Liquidity

Repeat weekly

Delta Neutral Tip:

Long on HL

Short on Satori

💰Funding: Undisclosed

🪂Airdrop Odds: Every competitor has a token!

My #1 sleeper pick on this list: < 6400 users! app.hyperliquid.xyz/join/CC2VENTUR…

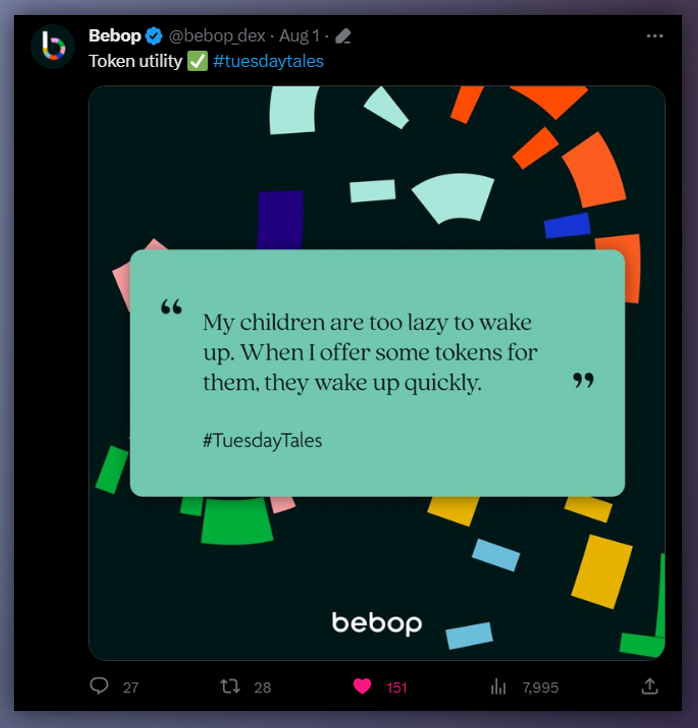

#2 Bebop

🔗–

• Withdraw USDC from Hyperliquid

• Swap USDC -> USDT

💰Funding: Undisclosed, incubated by Wintermute.

🪂Airdrop Odds: Critically high!

Mentioned Bebop back in March; still some time left to qualify. bebop.xyz/trade

🔗–

• Withdraw USDC from Hyperliquid

• Swap USDC -> USDT

💰Funding: Undisclosed, incubated by Wintermute.

🪂Airdrop Odds: Critically high!

Mentioned Bebop back in March; still some time left to qualify. bebop.xyz/trade

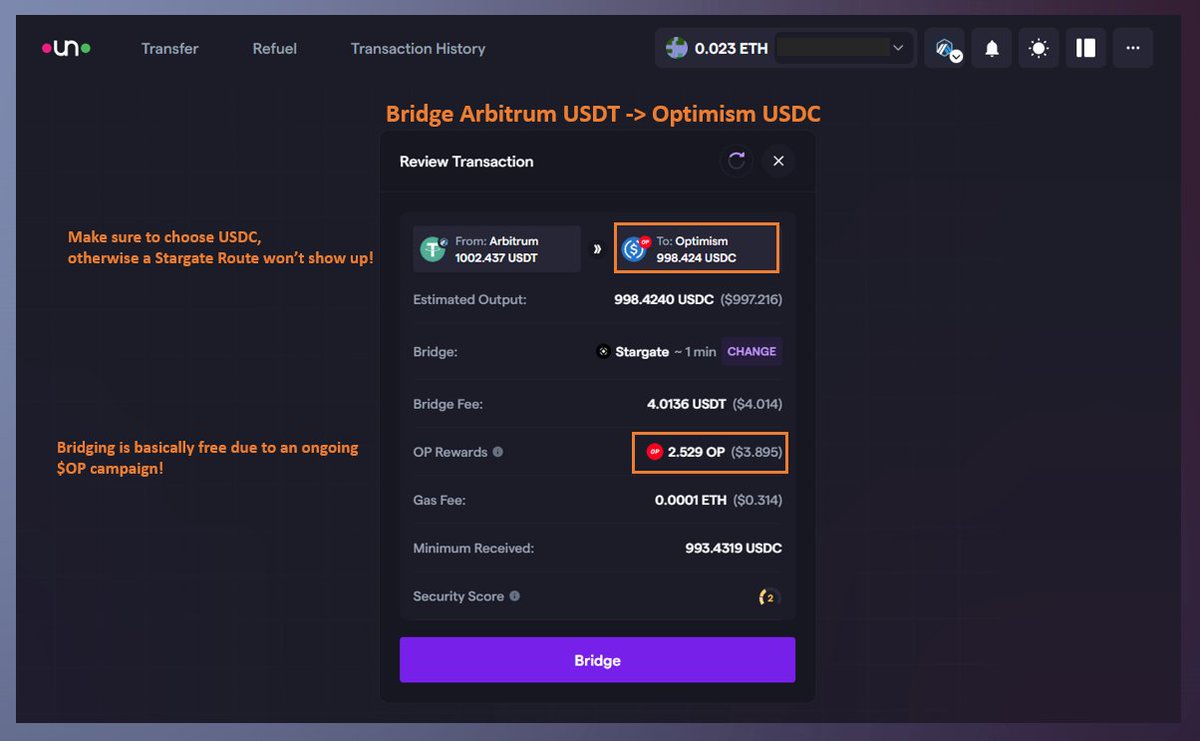

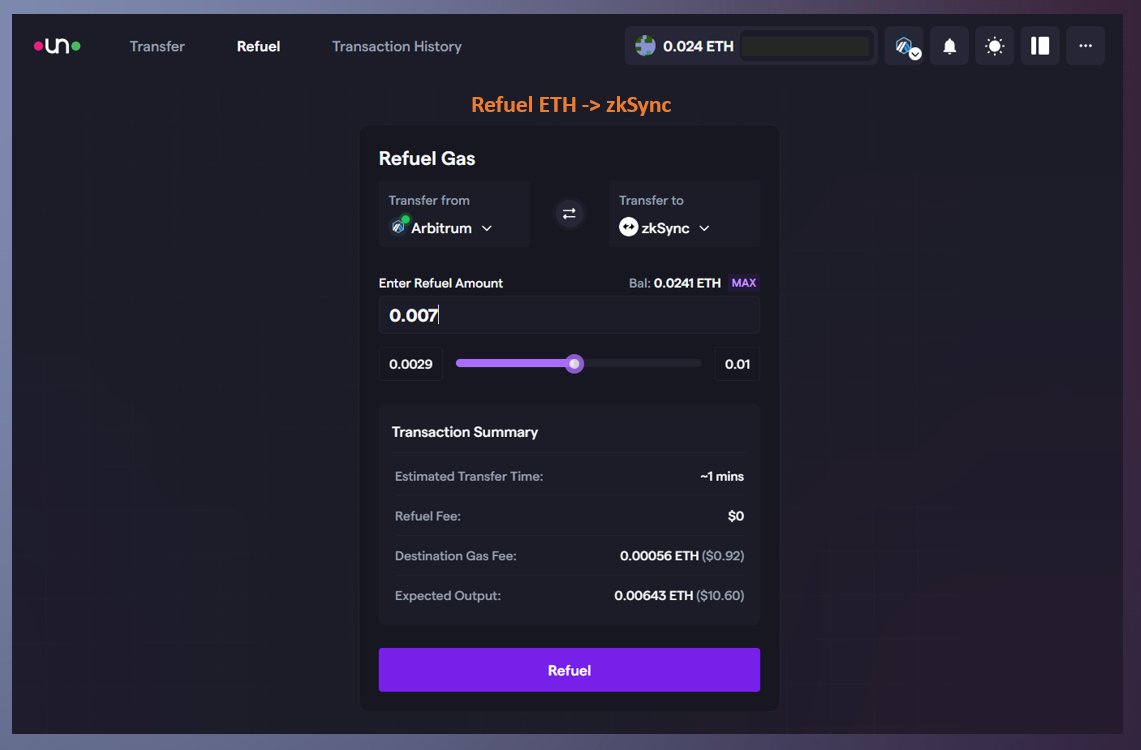

#3 Bungee

🔗–

• Bridge Arbitrum USDT -> Optimism USDC [via Stargate]

• Refuel ETH to zkSync [we need it later]

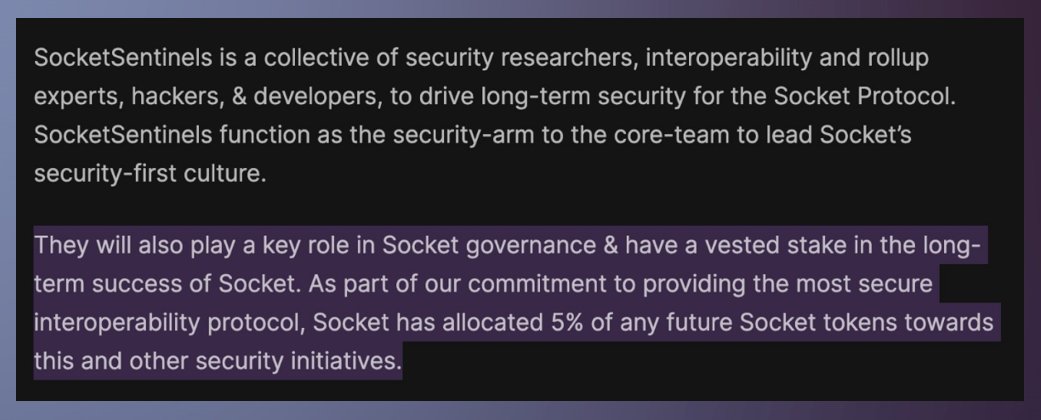

⚡Utilizes LayerZero, Socket

💰Funding: Undisclosed

🪂 Airdrop Odds: Hinted at a token!

More info on Bungee at the end of🧵 bungee.exchange

🔗–

• Bridge Arbitrum USDT -> Optimism USDC [via Stargate]

• Refuel ETH to zkSync [we need it later]

⚡Utilizes LayerZero, Socket

💰Funding: Undisclosed

🪂 Airdrop Odds: Hinted at a token!

More info on Bungee at the end of🧵 bungee.exchange

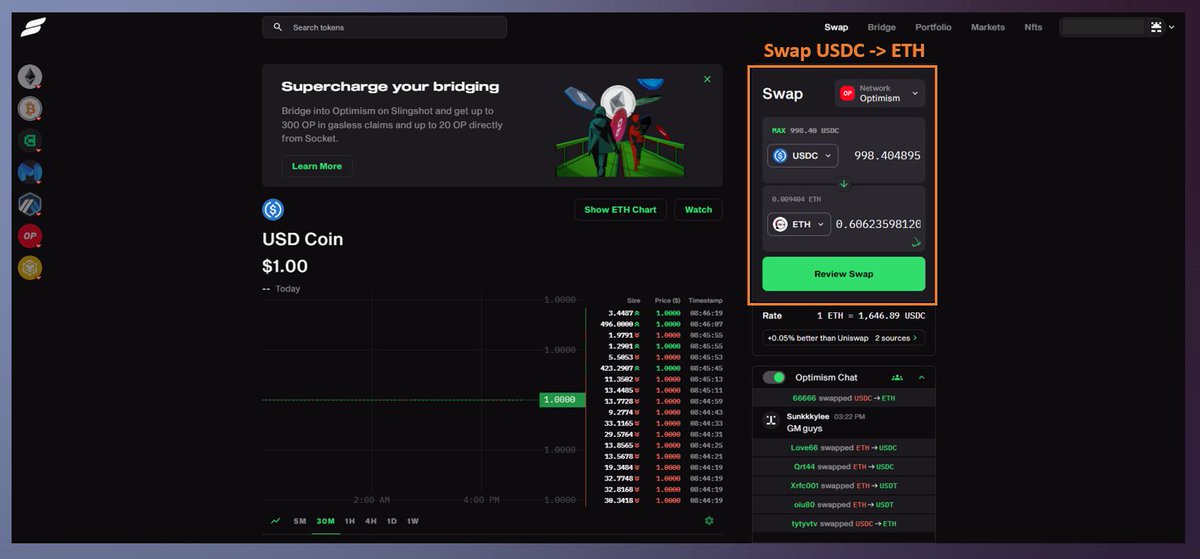

#4 Slingshot [on Optimism]

🔗–

• Swap USDT -> ETH

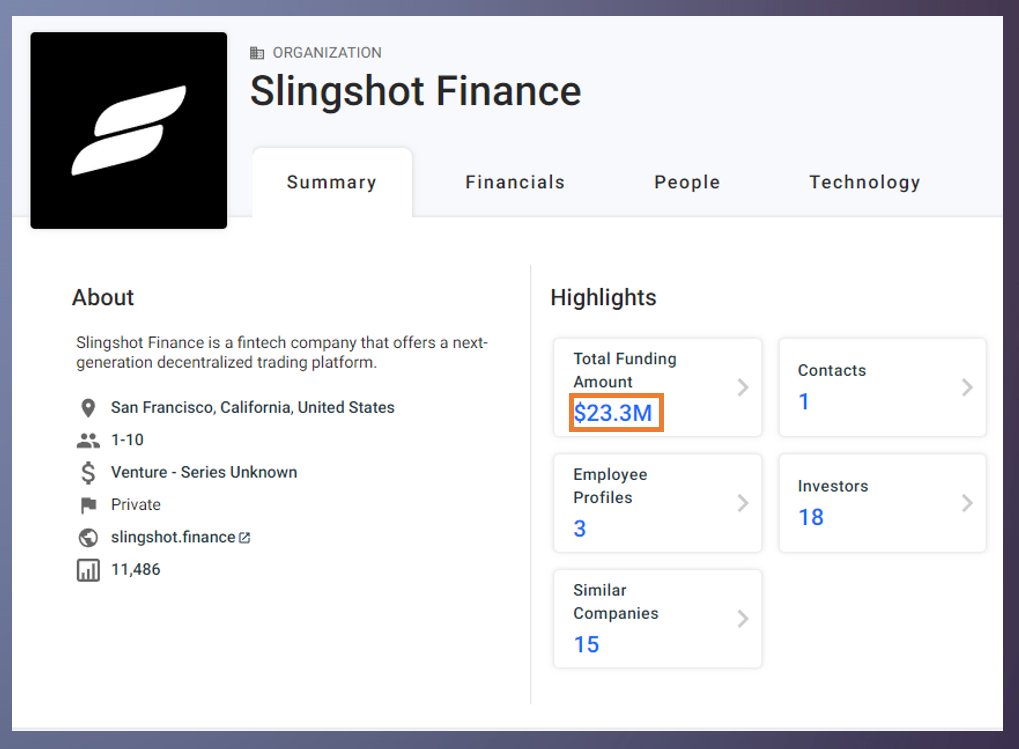

💰Funding: $23.3M

🪂 Airdrop Odds: Constantly denied by founders; but so did $ARB! app.slingshot.finance

🔗–

• Swap USDT -> ETH

💰Funding: $23.3M

🪂 Airdrop Odds: Constantly denied by founders; but so did $ARB! app.slingshot.finance

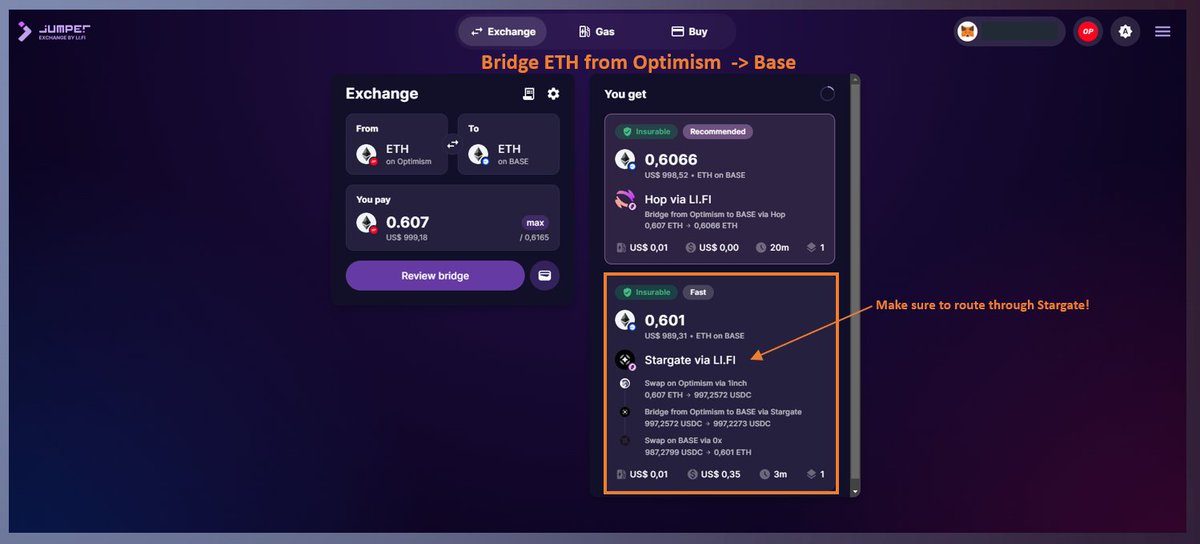

#5 Jumper/LiFi

🔗–

• Bridge ETH -> Base [pick Stargate Route]

⚡Utilizes LayerZero

💰Funding: $23M

🪂 Airdrop Odds: Github mentioned $LZRD token!

[Link doesn't work anymore]

More info on Jumper at the end of 🧵 jumper.exchange

🔗–

• Bridge ETH -> Base [pick Stargate Route]

⚡Utilizes LayerZero

💰Funding: $23M

🪂 Airdrop Odds: Github mentioned $LZRD token!

[Link doesn't work anymore]

More info on Jumper at the end of 🧵 jumper.exchange

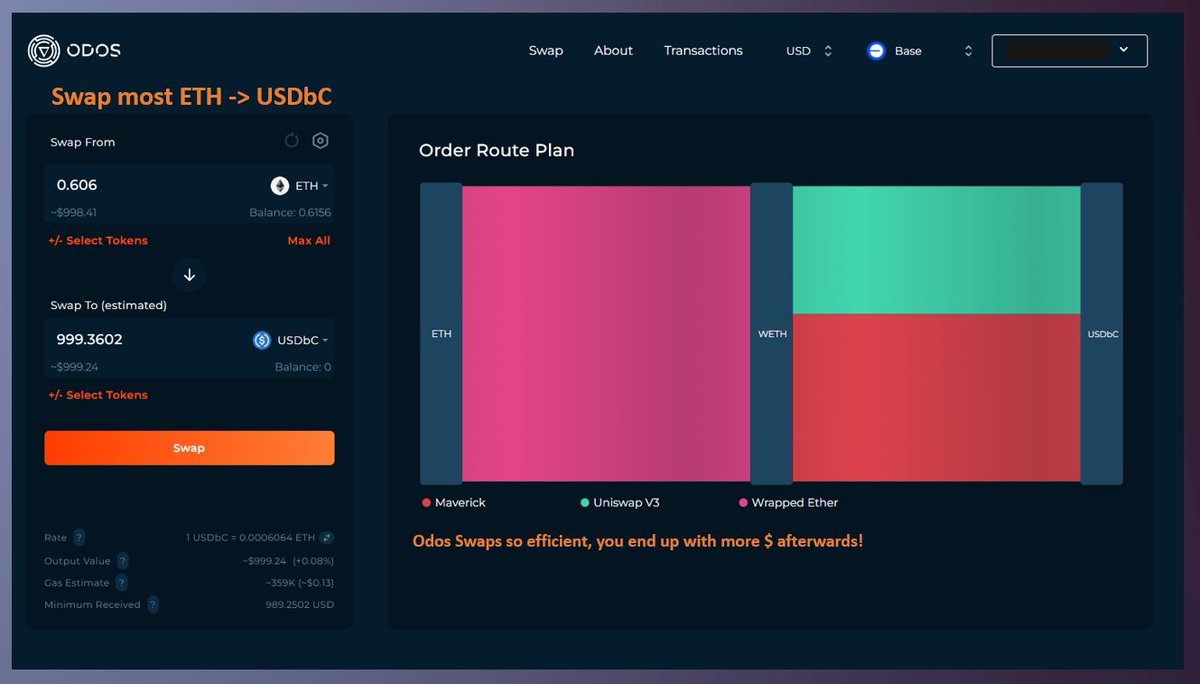

#6 Odos [on Base]

🔗–

• Swap ETH -> USDbC

⚡Transacting on Base

💰Funding: Parent Company received $60M Grant

🪂 Airdrop Odds: Unclear, but aggregator is best-in-class! app.odos.xyz

🔗–

• Swap ETH -> USDbC

⚡Transacting on Base

💰Funding: Parent Company received $60M Grant

🪂 Airdrop Odds: Unclear, but aggregator is best-in-class! app.odos.xyz

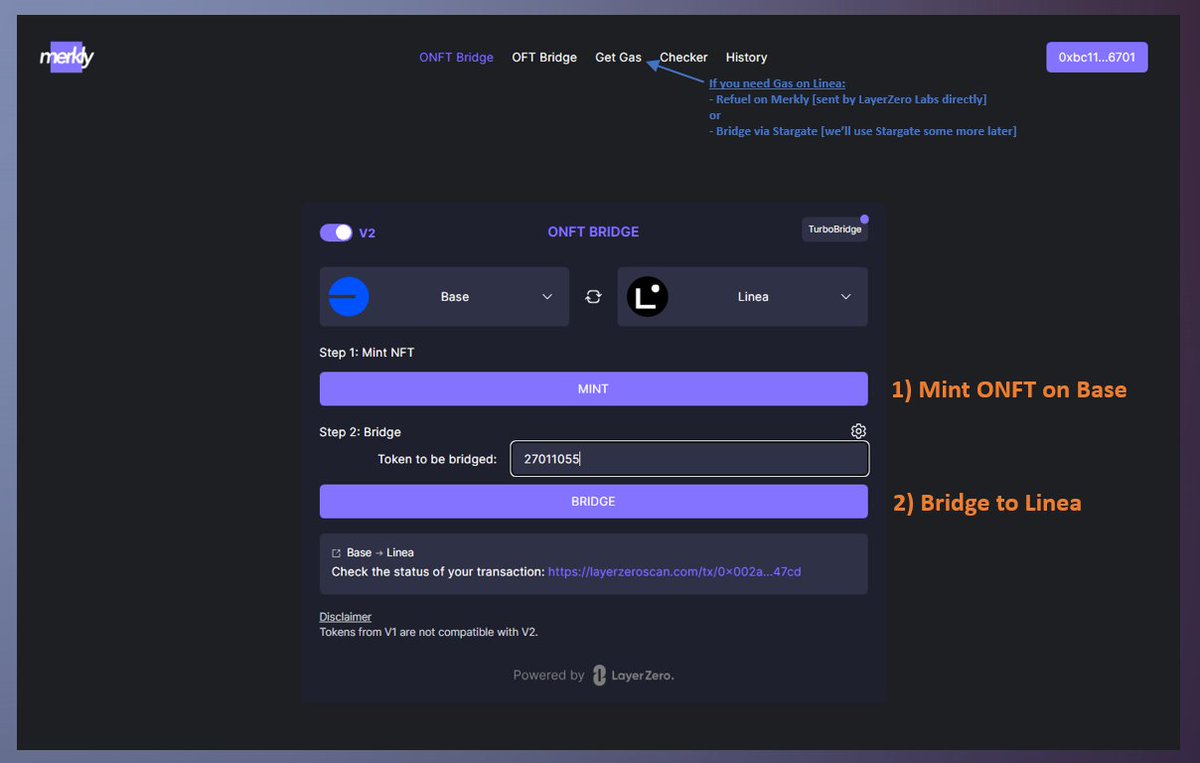

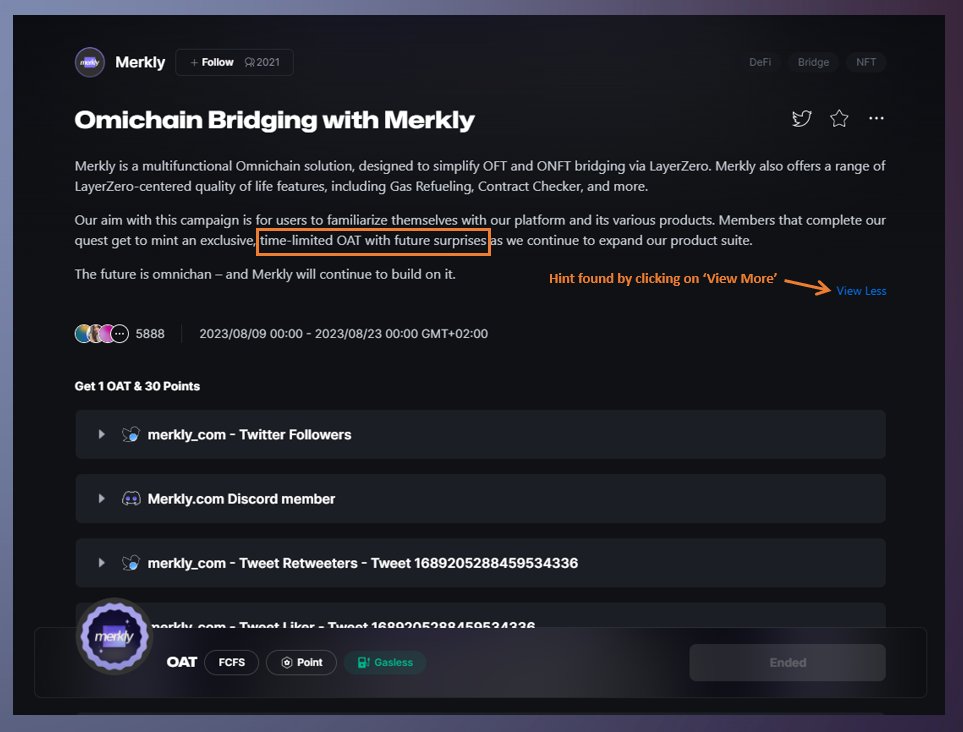

#7 Merkly

🔗–

• Mint ONFT on Base

• Bridge ONFT to Linea

⚡Transacting on Base, Linea. Bridge powered by LayerZero!

💰Funding: Undisclosed

🪂 Airdrop Odds: Hinted at in Galxe Campaign & some comments! minter.merkly.com

🔗–

• Mint ONFT on Base

• Bridge ONFT to Linea

⚡Transacting on Base, Linea. Bridge powered by LayerZero!

💰Funding: Undisclosed

🪂 Airdrop Odds: Hinted at in Galxe Campaign & some comments! minter.merkly.com

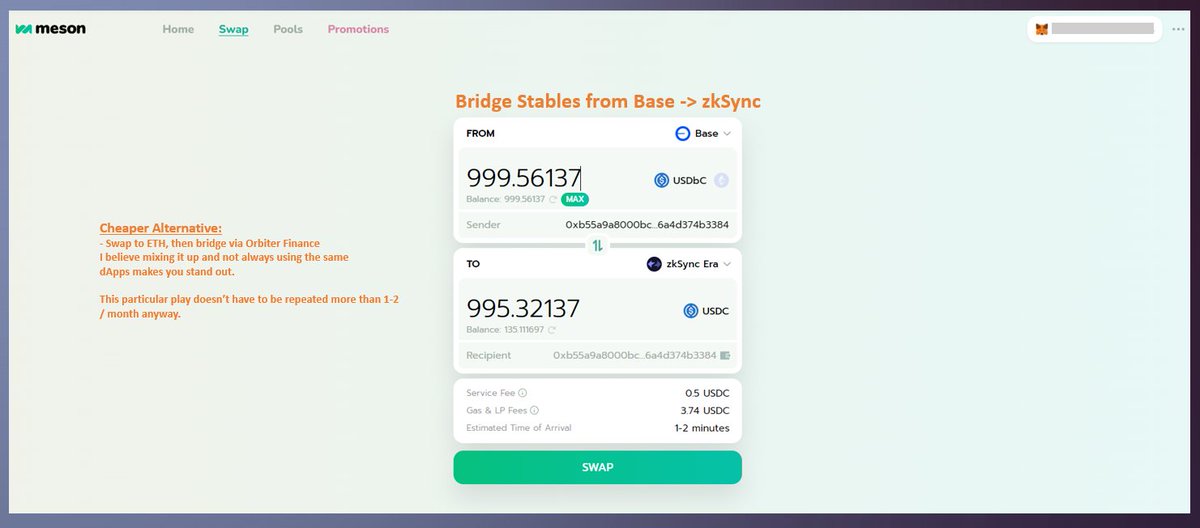

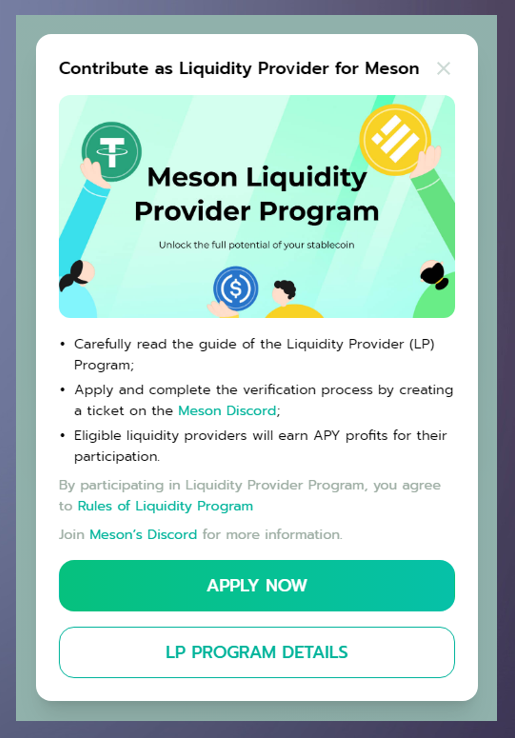

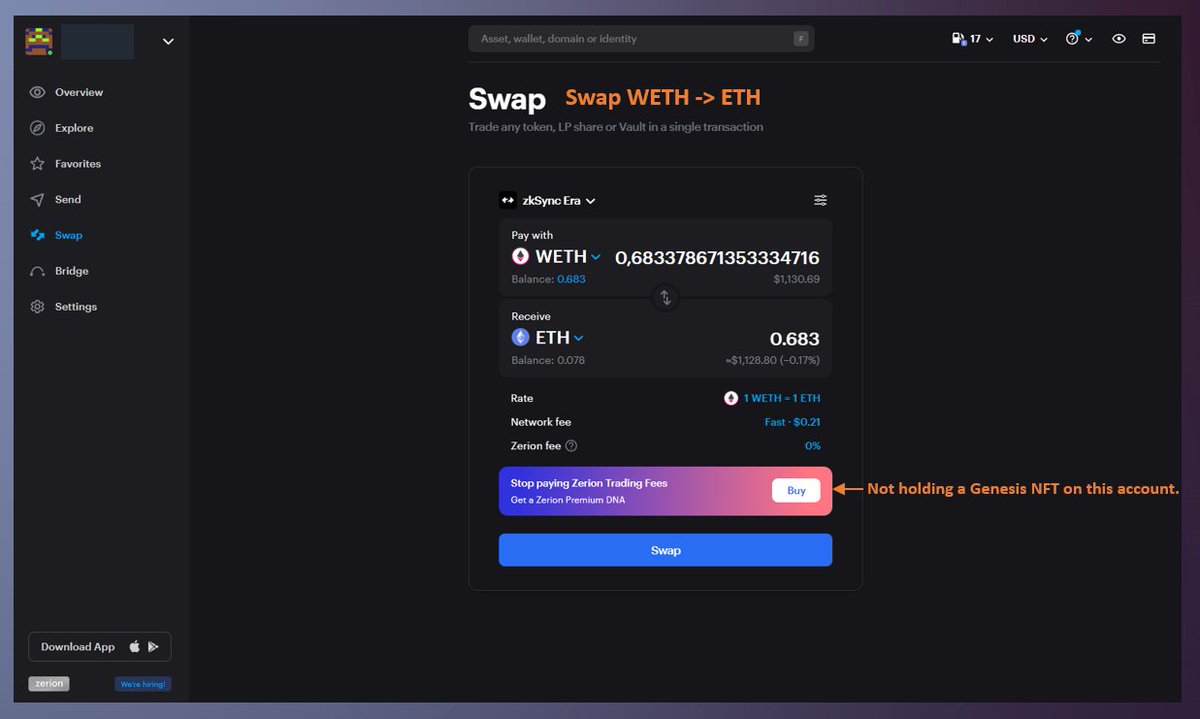

#8 Meson [still on Base]

🔗–

• Bridge USDbC -> zkSync

• Optional: Join Discord & Apply for LP Program

⚡Transacting on Base, zkSync

💰Funding: $4M

🪂 Airdrop Odds: No Hints, but a dApp that isn't used by many farmers! meson.fi

🔗–

• Bridge USDbC -> zkSync

• Optional: Join Discord & Apply for LP Program

⚡Transacting on Base, zkSync

💰Funding: $4M

🪂 Airdrop Odds: No Hints, but a dApp that isn't used by many farmers! meson.fi

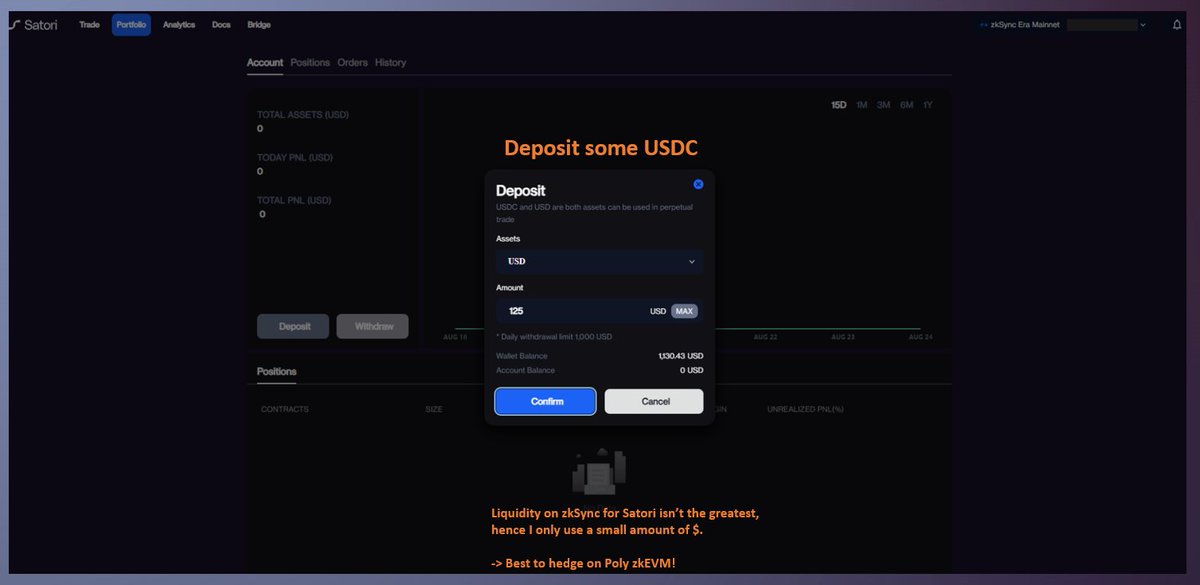

#9 Satori

🔗–

• Deposit USDC

• Long/Short

• Withdraw

Repeat a few times / month

Use in conjunction with Hyperliquid if you want to remain delta-neutral.

⚡Transacting on zkSync

💰Funding: $10M

🪂 Airdrop Odds: Gave various hints, almost confirmed! zksync.satori.finance

🔗–

• Deposit USDC

• Long/Short

• Withdraw

Repeat a few times / month

Use in conjunction with Hyperliquid if you want to remain delta-neutral.

⚡Transacting on zkSync

💰Funding: $10M

🪂 Airdrop Odds: Gave various hints, almost confirmed! zksync.satori.finance

#10 Syncswap

🔗–

• Swap USDC -> WETH

• Optional: Provide Liquidity

⚡Transacting on zkSync

💰Funding: Undisclosed

🪂 Airdrop Odds: $SYNC is confirmed! Only a matter of time. syncswap.xyz

🔗–

• Swap USDC -> WETH

• Optional: Provide Liquidity

⚡Transacting on zkSync

💰Funding: Undisclosed

🪂 Airdrop Odds: $SYNC is confirmed! Only a matter of time. syncswap.xyz

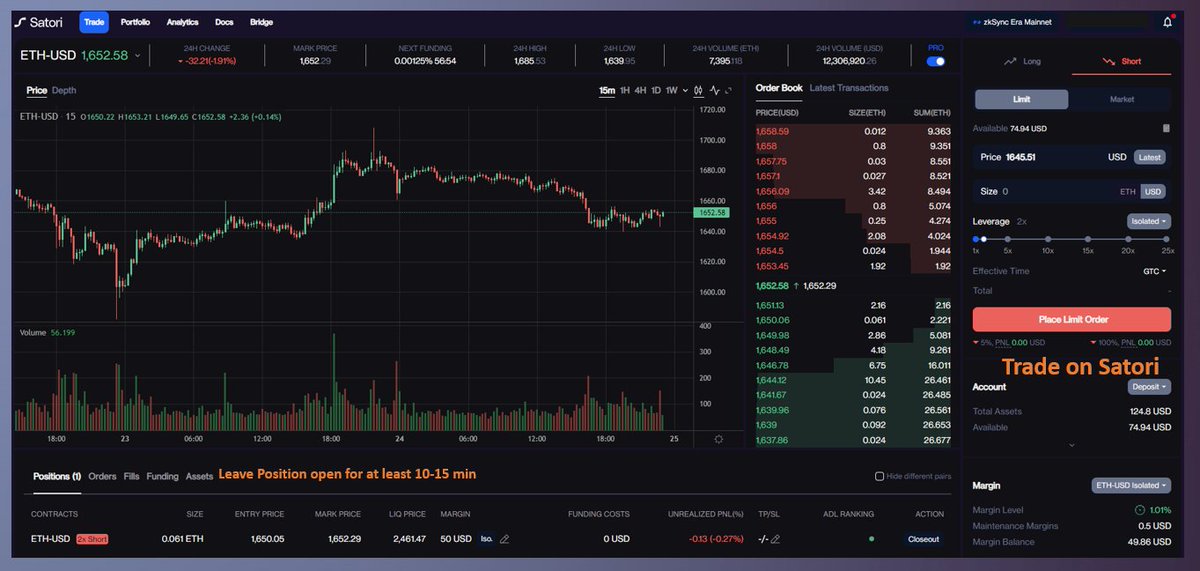

#11 Zerion

🔗–

• Swap WETH -> ETH

Optional: DL Mobile Zerion Wallet

Optional: Buy Genesis NFT

Use Bridge 1-2 / month

⚡Transacting on zkSync

💰Funding: $33M!

🪂 Airdrop Odds: $ZER is keen on 'decentralization' & knows about the advantages of airdrops. app.zerion.io/swap

🔗–

• Swap WETH -> ETH

Optional: DL Mobile Zerion Wallet

Optional: Buy Genesis NFT

Use Bridge 1-2 / month

⚡Transacting on zkSync

💰Funding: $33M!

🪂 Airdrop Odds: $ZER is keen on 'decentralization' & knows about the advantages of airdrops. app.zerion.io/swap

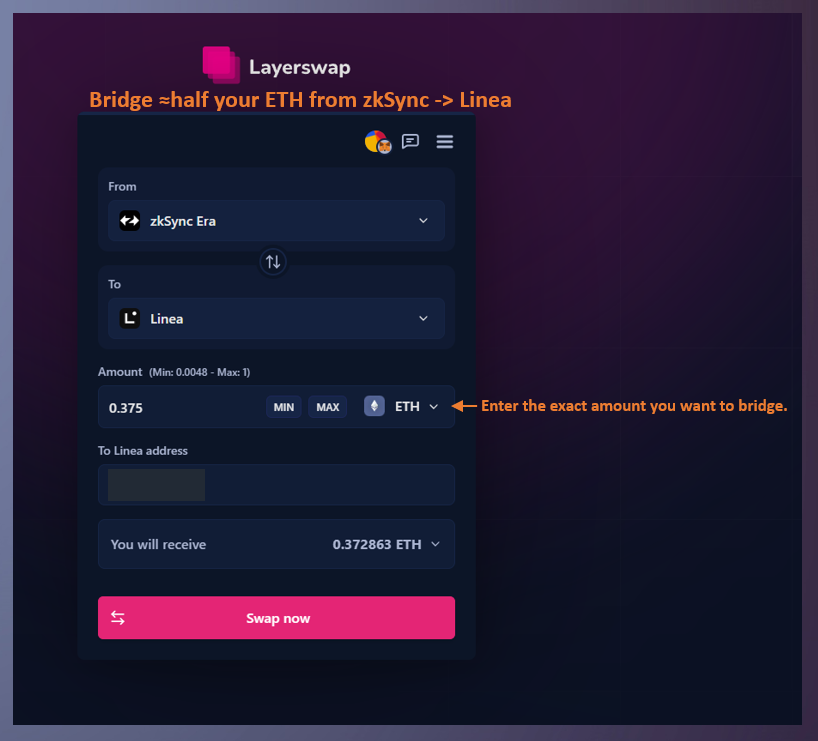

#12 Layerswap

🔗–

• Bridge half ETH zkSync -> Linea

⚡Transacting on zkSync, Linea

💰Funding: $2.2M

🪂 Airdrop Odds: Pretty low, but cheap bridge. Feel free to use @Orbiter_Finance instead or mix it up. layerswap.io/app

🔗–

• Bridge half ETH zkSync -> Linea

⚡Transacting on zkSync, Linea

💰Funding: $2.2M

🪂 Airdrop Odds: Pretty low, but cheap bridge. Feel free to use @Orbiter_Finance instead or mix it up. layerswap.io/app

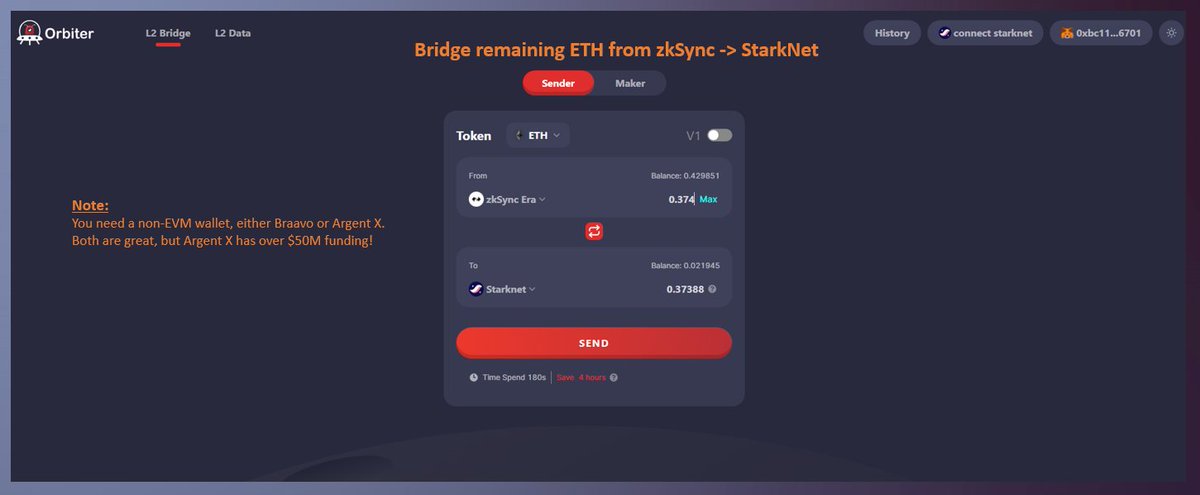

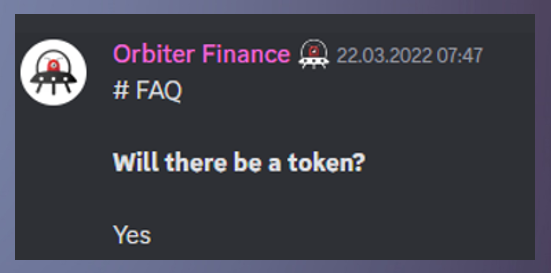

#13 Orbiter Finance

🔗–

• Bridge most of remaining ETH zkSync -> StarkNet

Note:

You need an Argent X or Braavo Wallet.

⚡Transacting on zkSync, StarkNet

💰Funding: $Undisclosed

🪂 Airdrop Odds: $ORB is confirmed! Overfarmed, but highly efficient. orbiter.finance

🔗–

• Bridge most of remaining ETH zkSync -> StarkNet

Note:

You need an Argent X or Braavo Wallet.

⚡Transacting on zkSync, StarkNet

💰Funding: $Undisclosed

🪂 Airdrop Odds: $ORB is confirmed! Overfarmed, but highly efficient. orbiter.finance

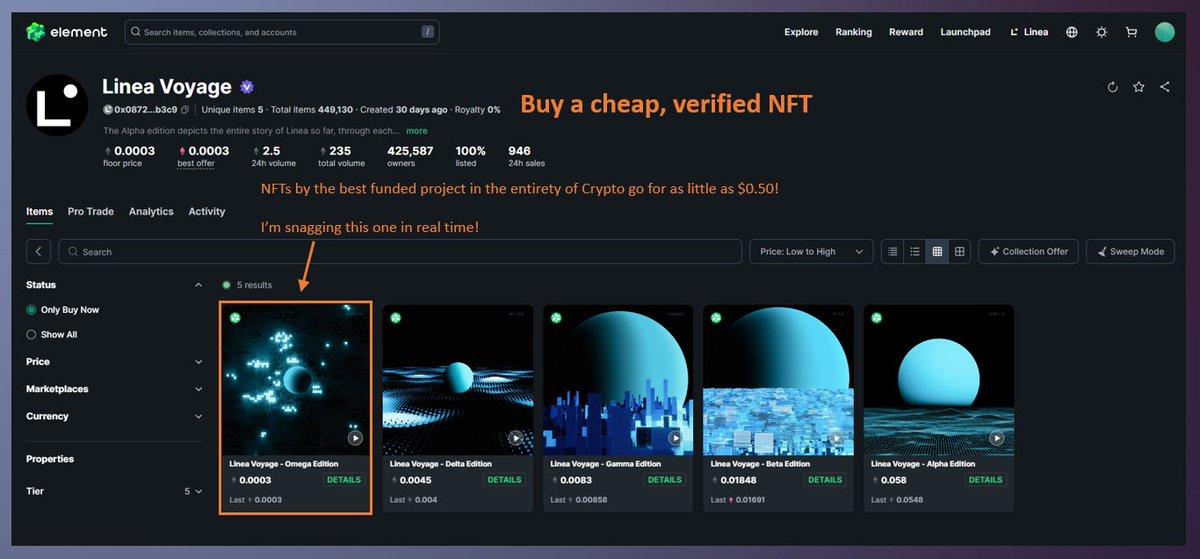

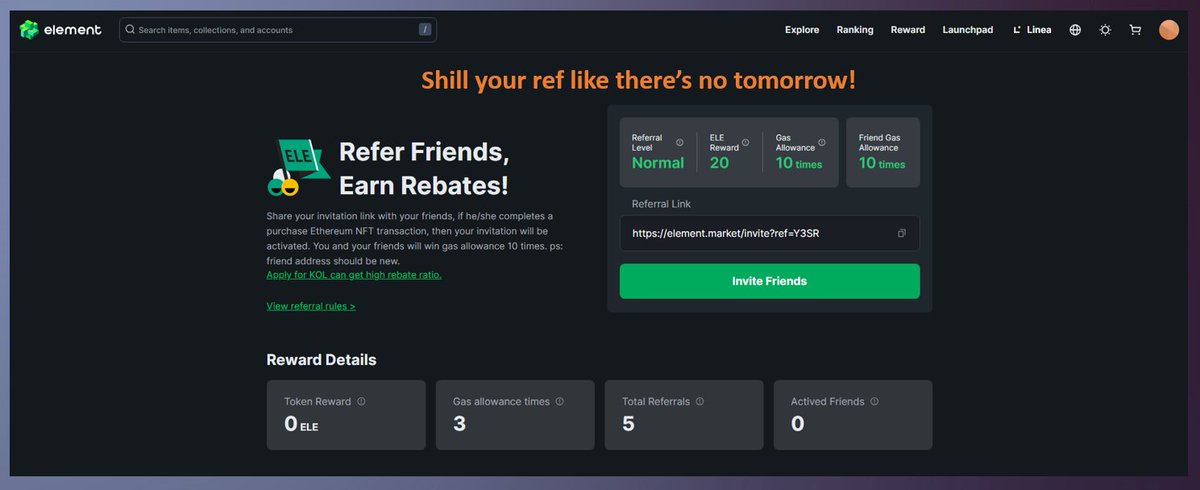

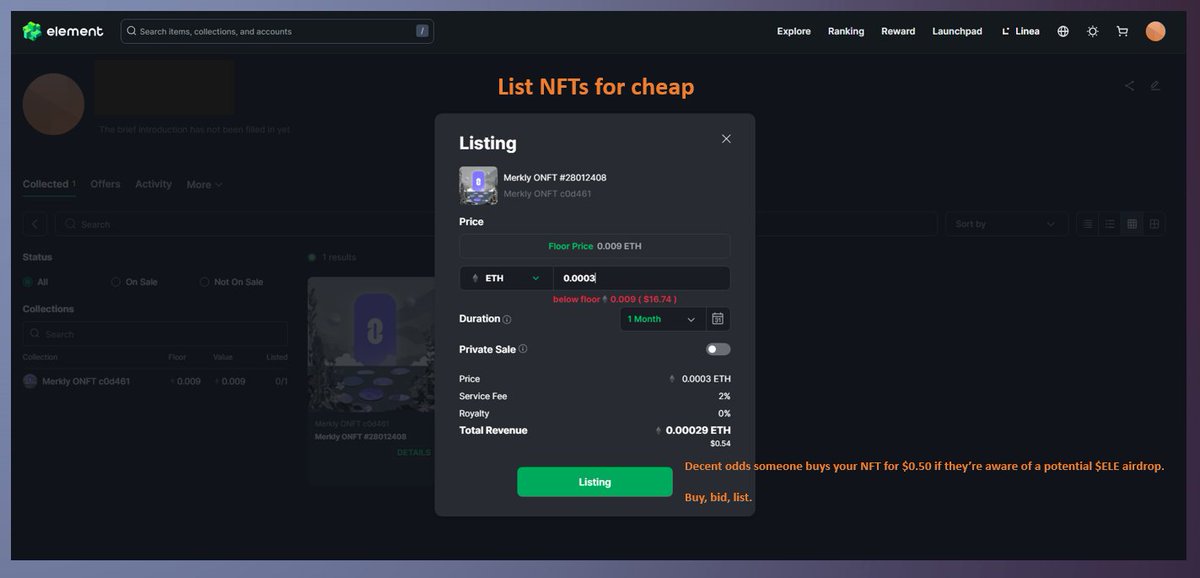

#14 Element [on Linea]

🔗–

• Buy a cheap, verified NFT

• Make people use your referral

• Optional: List your Merkly ONFT

⚡Transacting on Linea

💰Funding: $11.5M

🪂 Airdrop Odds: Token is confirmed! element.market/invite?ref=Y3SR

🔗–

• Buy a cheap, verified NFT

• Make people use your referral

• Optional: List your Merkly ONFT

⚡Transacting on Linea

💰Funding: $11.5M

🪂 Airdrop Odds: Token is confirmed! element.market/invite?ref=Y3SR

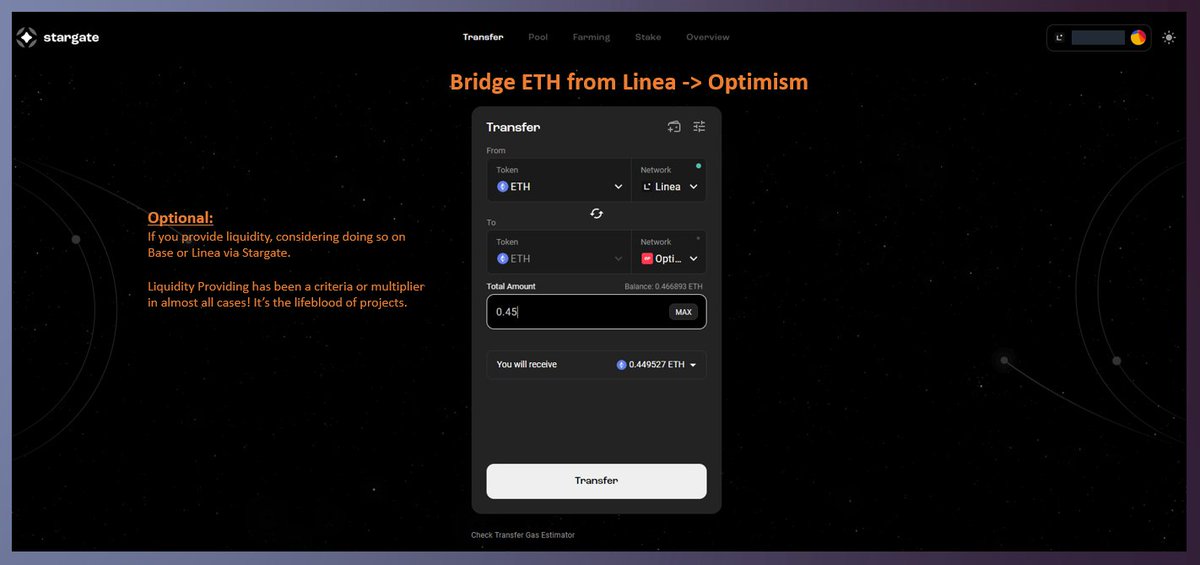

#15 Stargate

Not many promising, tokenless dapps on Linea; best to use Syncswap, Merkly & Element as they also reside on that chain.

Afterwards:

🔗–

• Bridge ETH back to Optimism

• Optional: LP on Stargate Linea

⚡Transacting on Linea, LayerZero stargate.finance

Not many promising, tokenless dapps on Linea; best to use Syncswap, Merkly & Element as they also reside on that chain.

Afterwards:

🔗–

• Bridge ETH back to Optimism

• Optional: LP on Stargate Linea

⚡Transacting on Linea, LayerZero stargate.finance

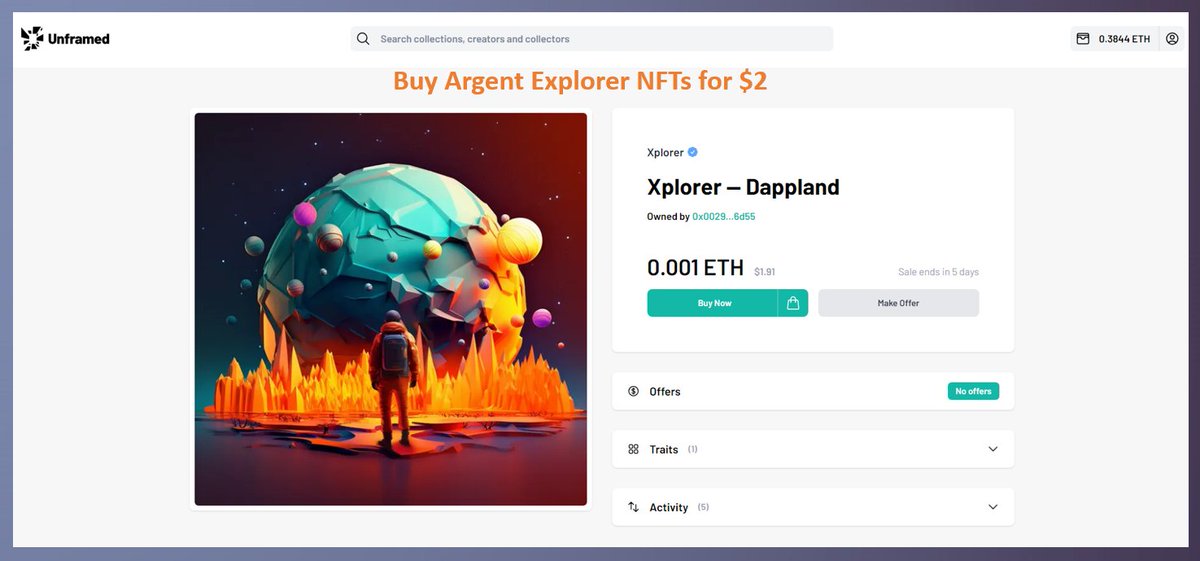

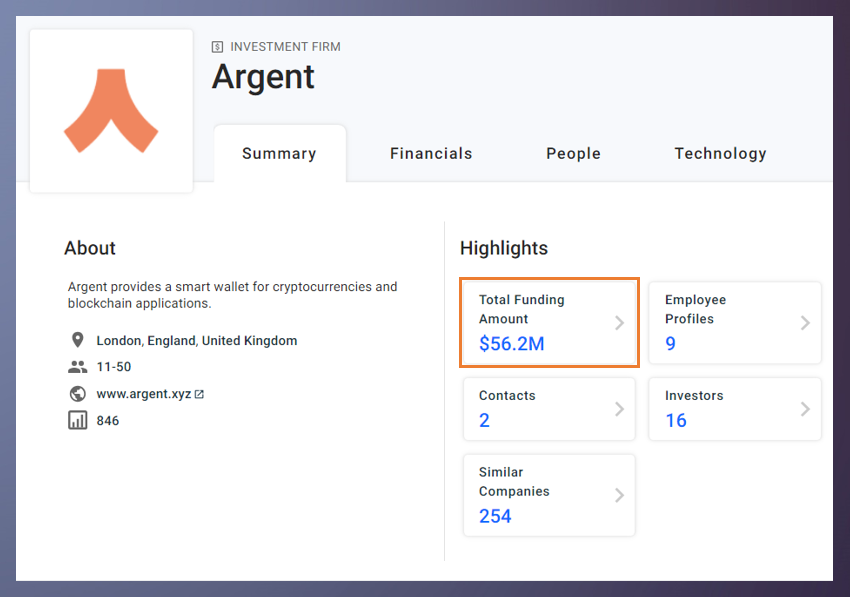

#16 Argent X [on Starknet]

🔗– @argentHQ

• Swap ETH -> USDT inside wallet

• Buy Argent Explorer NFT for $2:

⚡Transacting on Starknet

💰Funding: $56.2M!

🪂 Airdrop Odds: My prediction; eventually most wallets [MM, Zerion, Rabby etc] will have a token. unframed.co

🔗– @argentHQ

• Swap ETH -> USDT inside wallet

• Buy Argent Explorer NFT for $2:

⚡Transacting on Starknet

💰Funding: $56.2M!

🪂 Airdrop Odds: My prediction; eventually most wallets [MM, Zerion, Rabby etc] will have a token. unframed.co

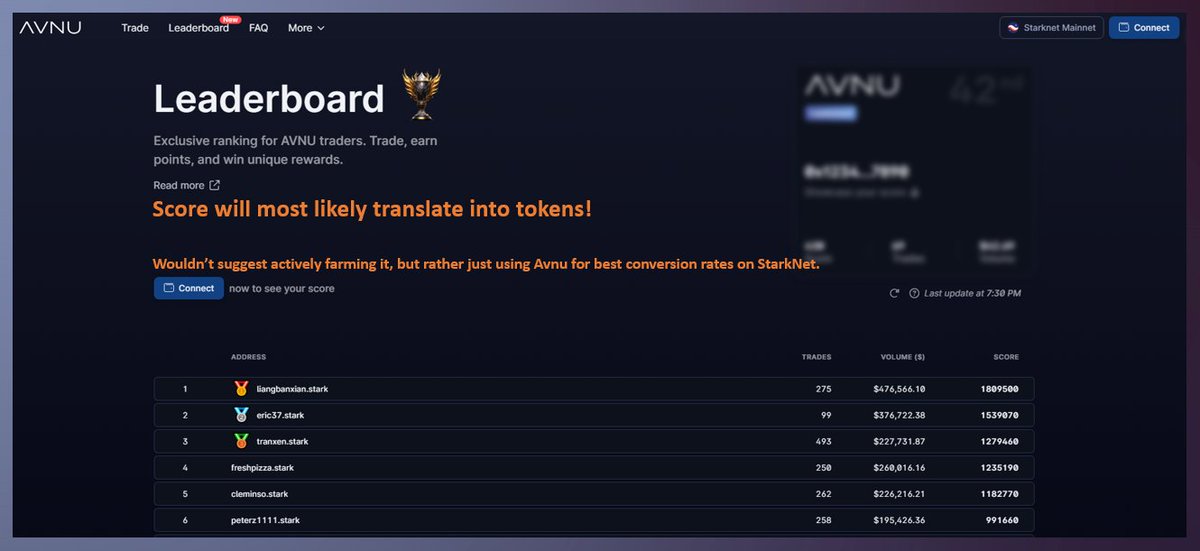

#17 Avnu Finance [on Starknet]

🔗–

• Swap ETH/USDT -> WBTC

• Optional: LP on:

Swap a few times / month

⚡Transacting on Starknet

💰Funding: Undisclosed

🪂 Airdrop Odds: Leaderboard Points will likely be converted into tokens. app.avnu.fi

app.jediswap.xyz/#/pool

🔗–

• Swap ETH/USDT -> WBTC

• Optional: LP on:

Swap a few times / month

⚡Transacting on Starknet

💰Funding: Undisclosed

🪂 Airdrop Odds: Leaderboard Points will likely be converted into tokens. app.avnu.fi

app.jediswap.xyz/#/pool

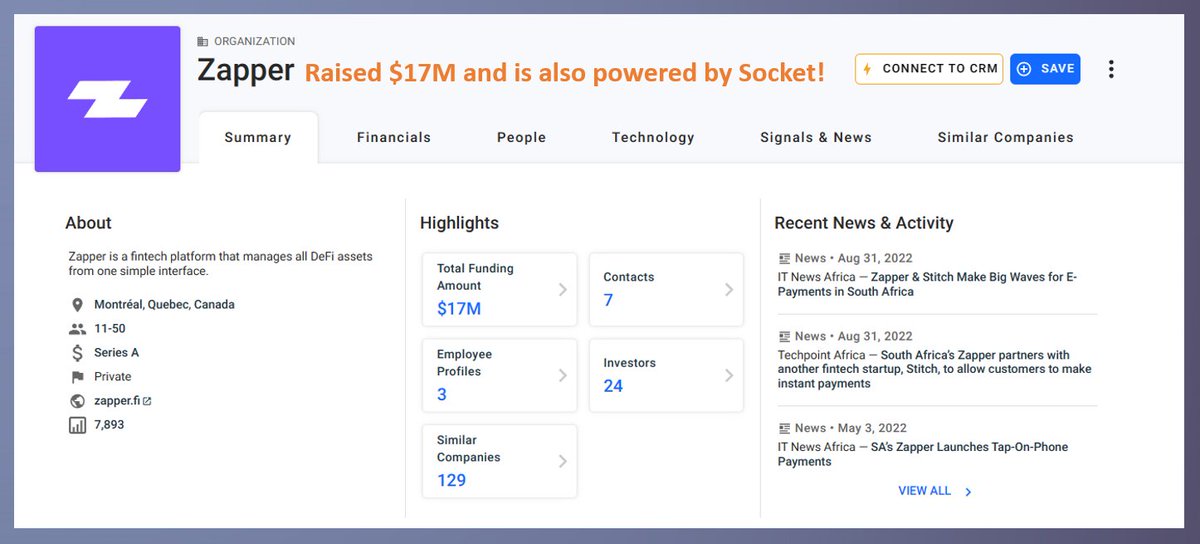

#18 Zapper [on Optimism]

🔗–

• Swap ETH -> USDC

Feel free to use DefiLlama for less slippage.

Use Zapper's bridge a few times too.

💰Funding: $17M

🪂 Airdrop Odds: Socket is confirmed! Zapper is powered by it and fits into interoperability narrative. zapper.xyz/exchange

🔗–

• Swap ETH -> USDC

Feel free to use DefiLlama for less slippage.

Use Zapper's bridge a few times too.

💰Funding: $17M

🪂 Airdrop Odds: Socket is confirmed! Zapper is powered by it and fits into interoperability narrative. zapper.xyz/exchange

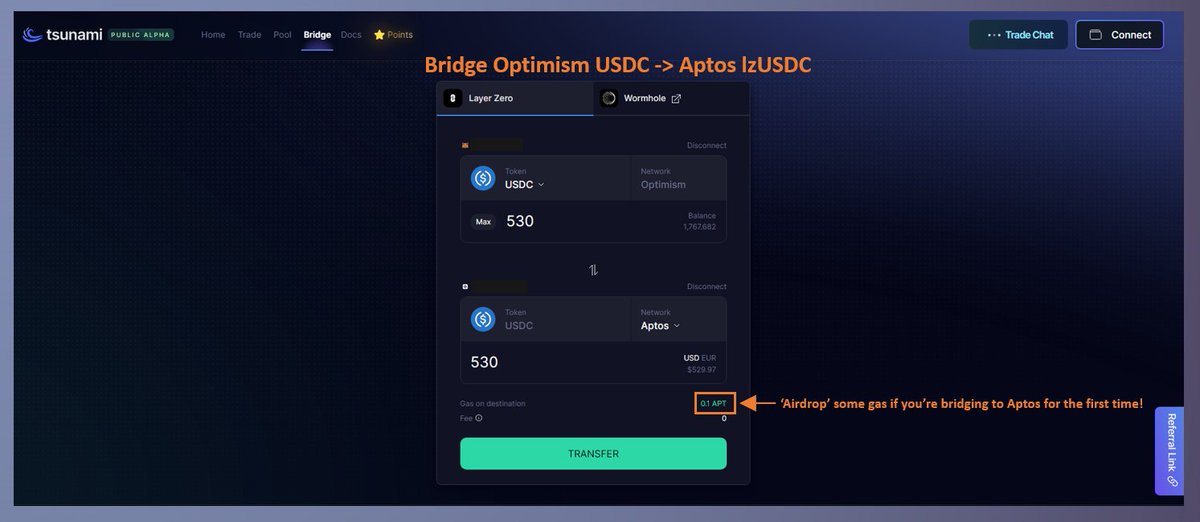

#19 Tsunami Finance

🔗–

• Bridge USDC -> Aptos

⚡Utilizes LayerZero, Aptos

💰Funding: $1.3M

🪂 Airdrop Odds: Only confirmed for traders! We mostly use the bridge for LayerZero anyway. tsunami.finance/bridge

🔗–

• Bridge USDC -> Aptos

⚡Utilizes LayerZero, Aptos

💰Funding: $1.3M

🪂 Airdrop Odds: Only confirmed for traders! We mostly use the bridge for LayerZero anyway. tsunami.finance/bridge

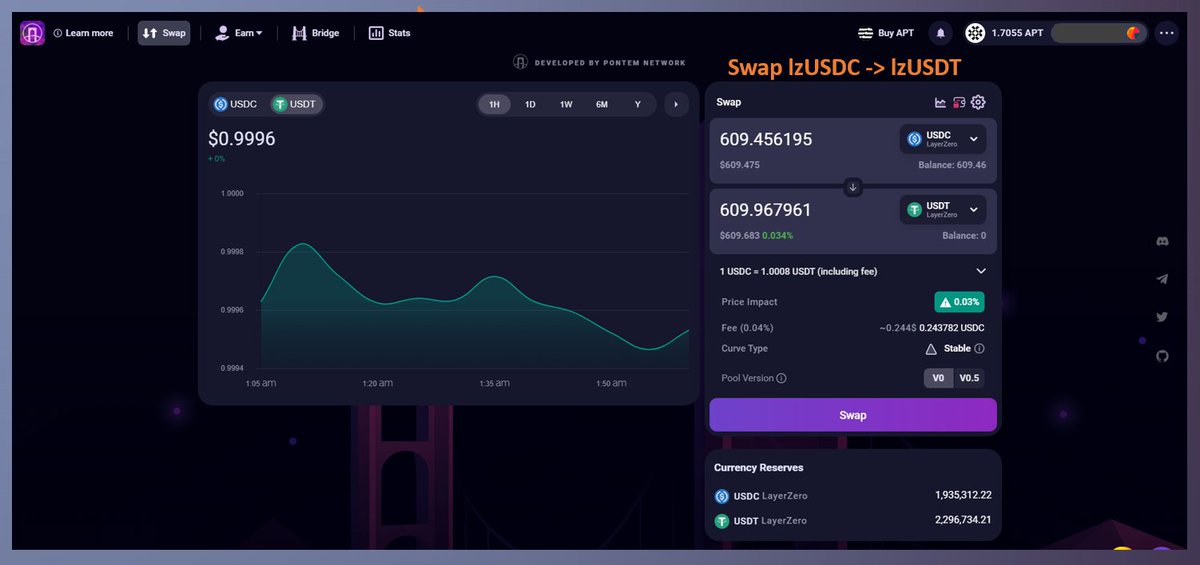

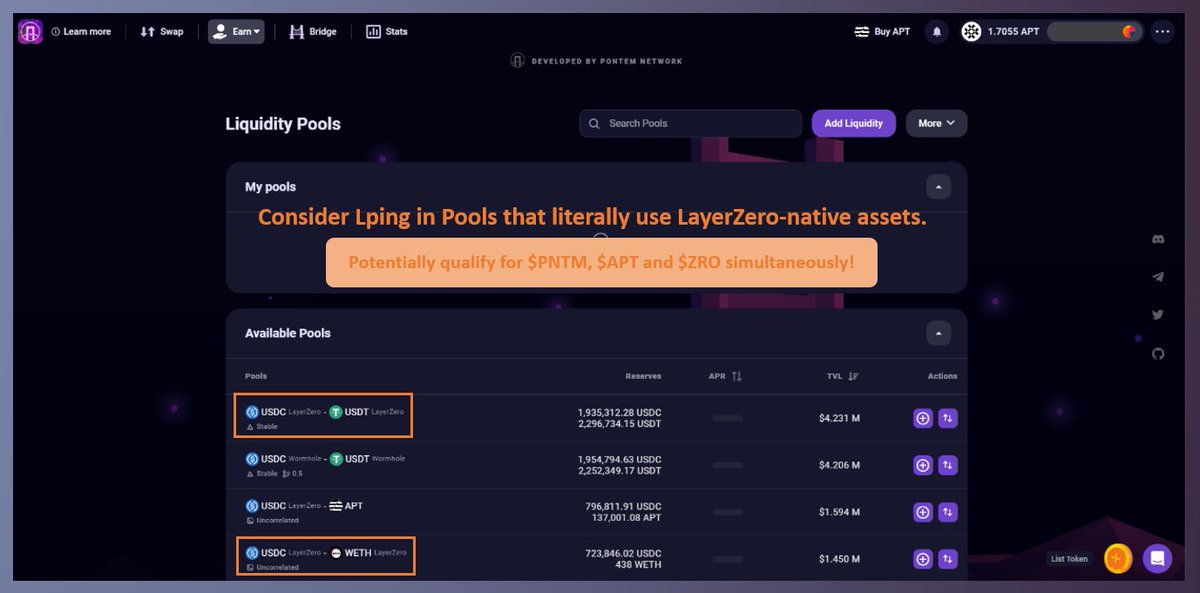

#20 Pontem Network

🔗–

• Swap lzUSDC -> lzUSDT

• When done farming Aptos, bridge out

• Optional: LP lzUSDC/lzUSDT

⚡Utilizes LayerZero, Aptos

💰Funding: $4.5M

🪂 Airdrop Odds: Unclear, but we can't pass up on additional LayerZero interactions! liquidswap.com/#/

🔗–

• Swap lzUSDC -> lzUSDT

• When done farming Aptos, bridge out

• Optional: LP lzUSDC/lzUSDT

⚡Utilizes LayerZero, Aptos

💰Funding: $4.5M

🪂 Airdrop Odds: Unclear, but we can't pass up on additional LayerZero interactions! liquidswap.com/#/

DONE✅

Following this megaguide will set you up nicely for potentially up to 26 Airdrops from some of the most promising projects in the entirety of Crypto!

Lots of clout will be claimed down the line.

Remember to remain consistent and repeat some tasks monthly.

CC2 out

Following this megaguide will set you up nicely for potentially up to 26 Airdrops from some of the most promising projects in the entirety of Crypto!

Lots of clout will be claimed down the line.

Remember to remain consistent and repeat some tasks monthly.

CC2 out

RESOURCES SECTION

Comprehensive LiFi Guide:

Longer Guide on Bungee:

Hyperliquid Bull Thesis by @GarrettZ

Aptos: 51% Tokens to Community. 1st Airdrop = 2%. 2nd Airdrop = Likely

tinyurl.com/2488b8nf

tinyurl.com/3skp3x6x

tinyurl.com/4j328y6w

tinyurl.com/3nxeyw2m

Comprehensive LiFi Guide:

Longer Guide on Bungee:

Hyperliquid Bull Thesis by @GarrettZ

Aptos: 51% Tokens to Community. 1st Airdrop = 2%. 2nd Airdrop = Likely

tinyurl.com/2488b8nf

tinyurl.com/3skp3x6x

tinyurl.com/4j328y6w

tinyurl.com/3nxeyw2m

And of course, my Mastodon #1 Thread.

Some printed $5K [Tensor]

Some rugged their community [Sei]

While #1 mentions a lot of promising projects, Mastodon #2 is 100x more alpha-generating as I drastically improved my Airdrop Hunting skills ever since.

Some printed $5K [Tensor]

Some rugged their community [Sei]

While #1 mentions a lot of promising projects, Mastodon #2 is 100x more alpha-generating as I drastically improved my Airdrop Hunting skills ever since.

https://twitter.com/CC2Ventures/status/1635141820085862400

Not sure why it says "connection unsafe" via my Hyperliquid ref link as I literally just tried it.

@KingJulianIAm please fix 🫡

@KingJulianIAm please fix 🫡

• • •

Missing some Tweet in this thread? You can try to

force a refresh