ULTIMATE THREAD To Learn My Trading Model🧵

🔸Bias (Draw on Liquidity)

🔸Narrative

🔸Liquidity

🔸Market Structure

🔸Entry Model

🔸Risk/Reward

🔸Preparation, Execution, Management

🔸Time & Economic Calendar

🧡&🔁

🔸Bias (Draw on Liquidity)

🔸Narrative

🔸Liquidity

🔸Market Structure

🔸Entry Model

🔸Risk/Reward

🔸Preparation, Execution, Management

🔸Time & Economic Calendar

🧡&🔁

In simple terms my trading model starts with #TheStrat for HTF quarterly/monthly directional bias. Once I know this I move down to the weekly/daily timeframes and use #mondayrange, #MMXM, #PO3/#AMD to get my bias for the week and day.

https://twitter.com/Dangstrat/status/1638512776413863936?s=20

When you understand the narrative and see that there's a clear draw on liquidity for your A+ setup, then it becomes very easy to execute the trade on M1-M5/M15 once there's a significant raid and shift in market structure.

https://twitter.com/Dangstrat/status/1644666366480338945?s=20

People refer to the 'unicorn' when there's a confluence in entry models (ex: fvg within brk), but the real alpha is when there's a confluence in narrative (ex: PO3 forming within MMXM & Monday Range). Maybe I'll come up with a name for this.

https://twitter.com/Dangstrat/status/1643928026864910336?s=20

My model starts with #TheStrat for HTF quarterly/Monthly directional bias using the OHLC/OLHC. If you don't know what The Strat is here is a cheat sheet to read candlesticks.

Rest In Peace to @RobInTheBlack, the creator of #TheStrat

Rest In Peace to @RobInTheBlack, the creator of #TheStrat

When one of these Strat reversal forms, ICT calls it the three bar pattern meaning a swing high or low has formed. Same concepts just different language.

https://twitter.com/Dangstrat/status/1684940953746853888?s=20

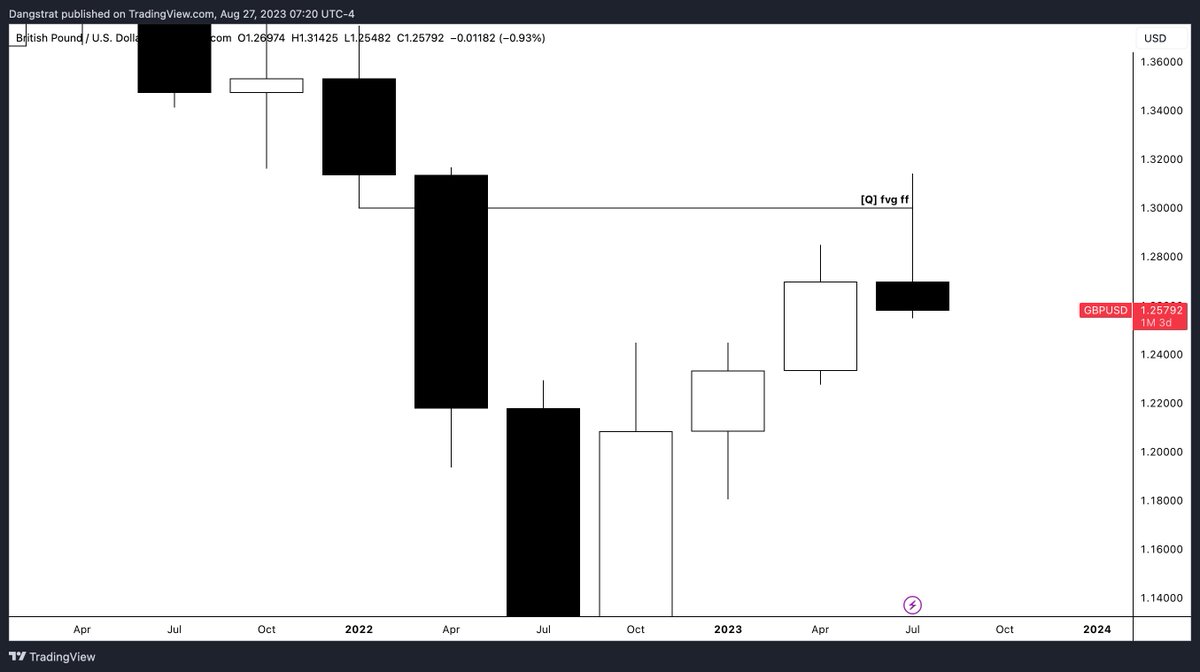

Im going to use $GU for my example.

Quarterly TF

Going into last week GU had already fully filled the quarterly fvg and we saw that the quarterly chart started to form a shooter which means there was a price rejection once the imbalance was filled.

Quarterly TF

Going into last week GU had already fully filled the quarterly fvg and we saw that the quarterly chart started to form a shooter which means there was a price rejection once the imbalance was filled.

Monthly TF

Since GU fully filled the quarterly FVG in July and closed the month with a shooter, my bias is that in August price takes out PML to trigger the 2-2 month bearish reversal. So now after looking at Q/M charts my HTF analysis was bearish for the entire month of August.

Since GU fully filled the quarterly FVG in July and closed the month with a shooter, my bias is that in August price takes out PML to trigger the 2-2 month bearish reversal. So now after looking at Q/M charts my HTF analysis was bearish for the entire month of August.

And then if you look at $DXY for HTF confluence you can see that it was in alignment with GU. My bias on DXY 7/23 was that we would see distribution/expansion to upside to the monthly FVG after we saw a deviation of April Low for manipulation.

After I understand the bias on the monthly and quarterly timeframes I move down to the weekly, daily, and H4 timeframe to continue my top down analysis. These timeframes are still considered HTF.

https://twitter.com/Dangstrat/status/1643200528090898436?s=20

Looking at the H4 TF compared to the daily & weekly it was showing a clear MMSM forming. So the H4 TF MMSM narrative was in alignment with my quarterly & monthly bearish bias. From my squiggly lines you can see that I was looking for a retracement to the daily fvg then a dump.

Fast forward to present time this is how it played out

🔸SMR + SMT Divergence after D/Q fvg ff

🔸H4 mss + daily fvg distribution

🔸H4 bos + daily fvg redistribution

🔸DOL = Original Consolidation/SSL

🔸SMR + SMT Divergence after D/Q fvg ff

🔸H4 mss + daily fvg distribution

🔸H4 bos + daily fvg redistribution

🔸DOL = Original Consolidation/SSL

Now that I understand that the HTF bias is bearish I use Monday's range & the economic calendar to look for what the weekly profile could potentially be. Look for the largest liquidity pool is. If it's SSL then look for price to induce higher before taking out SSL & vice versa.

Typically Monday is an accumulation day for the week. Depending on what day high impact news is, im looking for H.O.W or L.O.W to form sometime in the middle of the week which is manipulation. After manipulation we can expect expansion towards our HTF draw on liquidity.

In terms of OHLC/OLHC of weekly candle, I treat Monday's Range as the weekly open, When high or low of week gets created and goes back within Monday's range (deviation), this is the wick that forms. Once wick forms now look for expansion to create the body of the weekly candle.

In simple terms for weekly profile this is what i'm looking for:

🔸Monday's Range = Accumulation

🔸Deviation of Monday's high or low middle of the week = Manipulation

🔸Price leg back back through Monday's range = Distribution/Expansion

🔸Monday's Range = Accumulation

🔸Deviation of Monday's high or low middle of the week = Manipulation

🔸Price leg back back through Monday's range = Distribution/Expansion

Now lets put it all together & look how to analysis price action going into the new week after we let Monday's range get created.

- Q/M TF directional bias is bearish

- H4 TF narrative is MMSM

- Largest liquidity pool is SSL due to EQL, LRLR, & Original Consolidation from MMSM

- Q/M TF directional bias is bearish

- H4 TF narrative is MMSM

- Largest liquidity pool is SSL due to EQL, LRLR, & Original Consolidation from MMSM

Now that Monday's range (accumulation) is created we look for price to induce higher or lower taking out liquidity by either deviating above Monday's high or below Monday's low. You will see that price takes out PWH and goes back within Monday's range and has MSS to downside.

After price takes out liquidity, has a MSS to downside, and goes back within Monday's high that is confirmed a deviation of Monday's range aka manipulation. Now we look distribution to target SSL objectives.

Fast forward you can see every single SSL objective was met and that the H4 MMSM was completed. This is an example of using confluence in HTF narratives.

In this example you have H4 MMSM + PO3/AMD + Monday's range all in alignment, making it an A+ setup with a clear DOL.

In this example you have H4 MMSM + PO3/AMD + Monday's range all in alignment, making it an A+ setup with a clear DOL.

HTF narrative & DOL is very clear so now here is how you can execute 2r trades on LTF & HTF throughout the week

Setup #1: Tuesday LOKZ high of week

- PWH + fu raid

- M5 mss + fvg retracement

- 2r to Asia Low

Setup #1: Tuesday LOKZ high of week

- PWH + fu raid

- M5 mss + fvg retracement

- 2r to Asia Low

Setup #2 Wednesday LOKZ & NYKZ

- H2 fvg ff HTF entry

- Stop Loss at high of week for invalidation

- TP = PWL for 3r

- H2 fvg ff HTF entry

- Stop Loss at high of week for invalidation

- TP = PWL for 3r

Setup #3 Thursday LOKZ

- SMT Divergence w/ EU

- M5/M15 mss

- M5 fvg retracement entry

- Monday low rejection

- 2r to H1 fvg

- SMT Divergence w/ EU

- M5/M15 mss

- M5 fvg retracement entry

- Monday low rejection

- 2r to H1 fvg

Setup #4 Friday TGIF & PO3/AMD on $EU

- [D] +ob & fu raid

- M5 inversion = mss (entry)

- 2r to BSL

Lastly notice how every single setup or entry forms within either LOKZ & NYKZ. Super important to be taking your trades at these specific times.

- [D] +ob & fu raid

- M5 inversion = mss (entry)

- 2r to BSL

Lastly notice how every single setup or entry forms within either LOKZ & NYKZ. Super important to be taking your trades at these specific times.

The market doesn't always give an A+ setup everyday like this but when there's a clear DOL it will provide plenty of setups and that's when you have to execute. When there's no clear DOL you must learn how to sit on your hands because all it takes is 1-2 setups per week to make $

Sign up for my Lifetime+ Membership to get live access to my real time trade signals & follow closely along my journey to 1M in funded capital. whop.com/dangstrat/

Here is my Notion link to access more free educational content from me. ossified-ground-684.notion.site/Dangstrat-Trad…

If this thread helped, please like and retweet the original tweet for more educational content and for others to see! Thank you for your support🧡dangstrat.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter