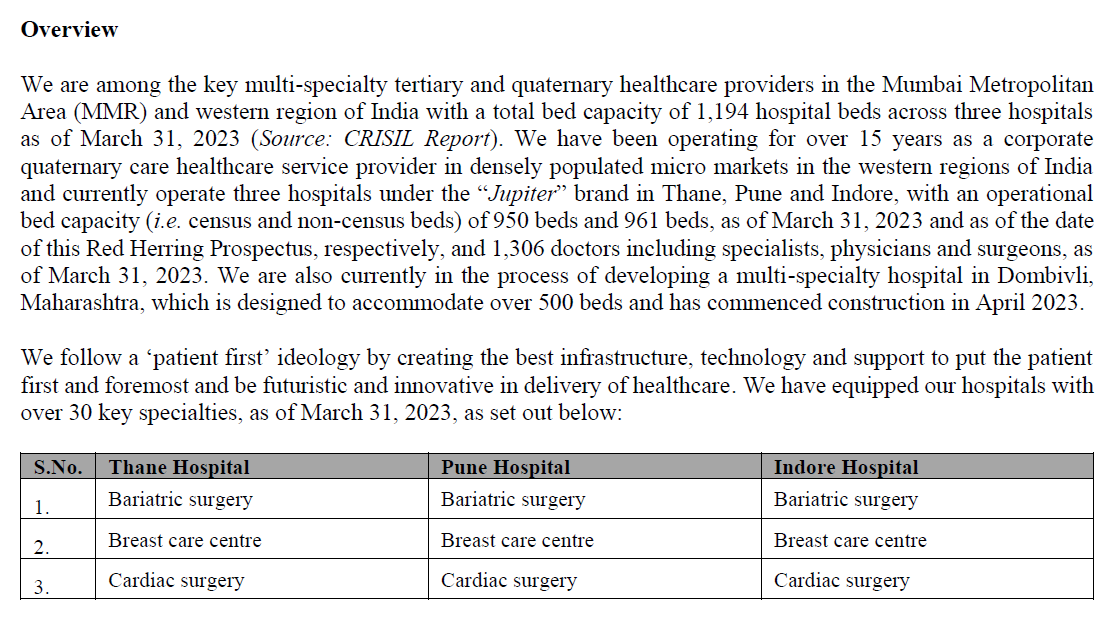

Jupiter Life Line Hospitals () #IPO. Engaged in providing Healthcare services currently operates 3 hospitals under the “Jupiter” brand in Thane, Pune & Indore.

.

jupiterhospital.com

icicisecurities.com/Upload/Article…

.

jupiterhospital.com

icicisecurities.com/Upload/Article…

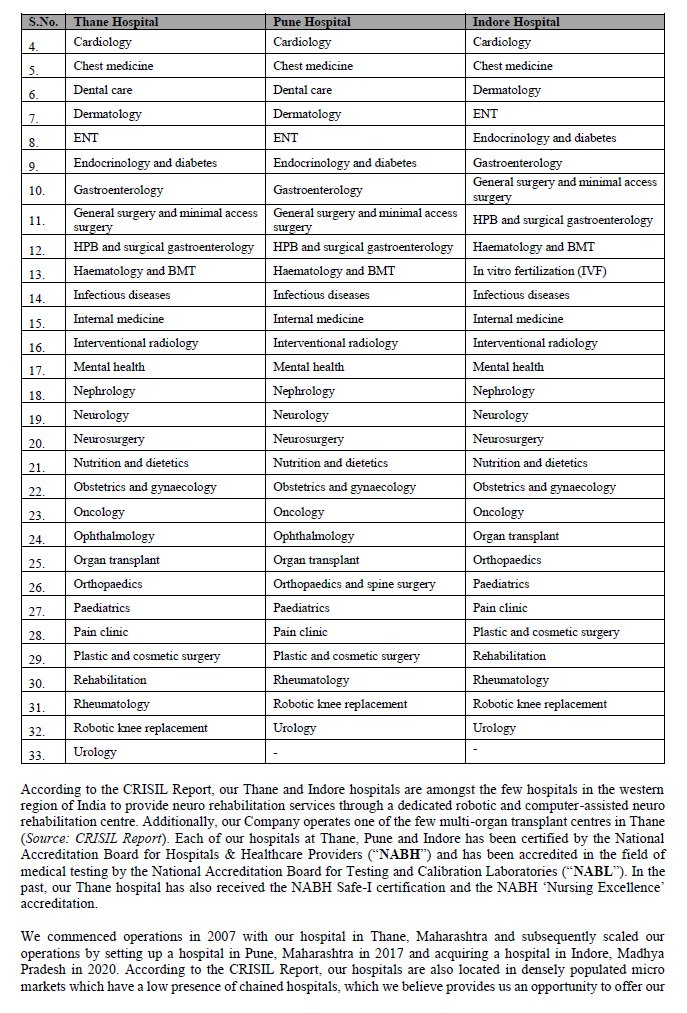

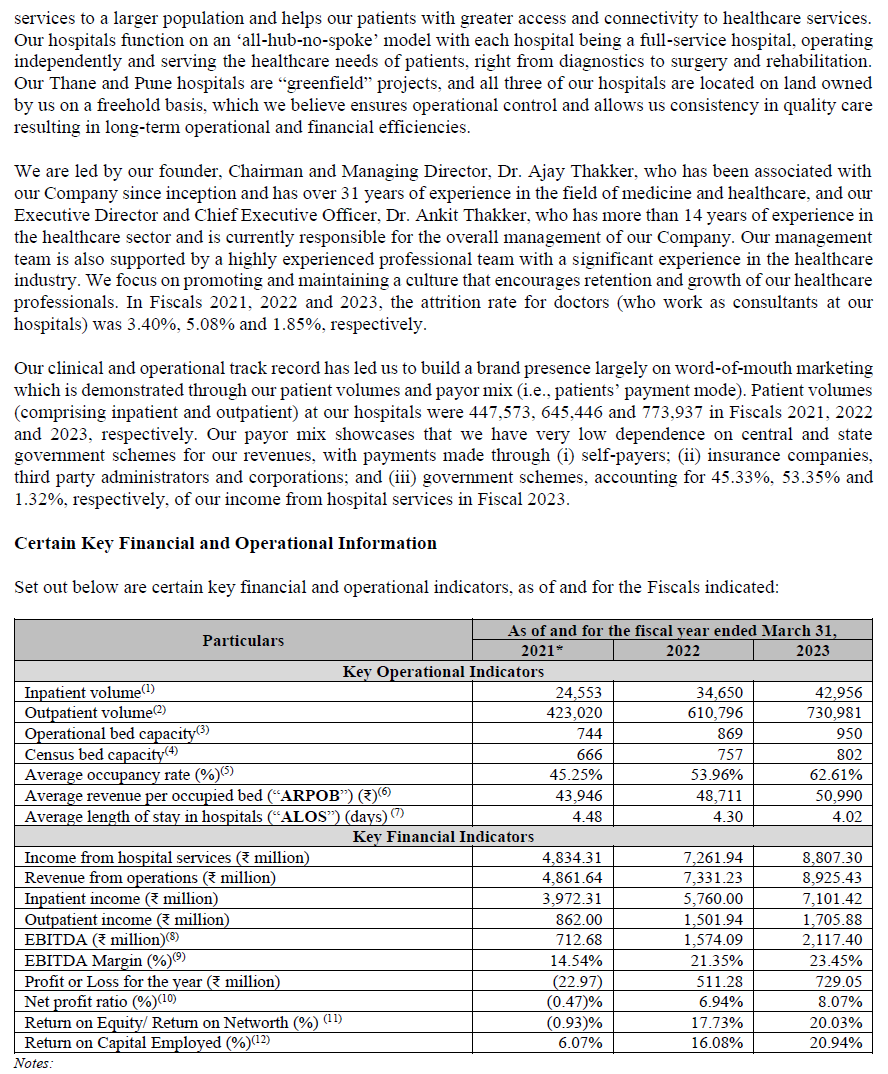

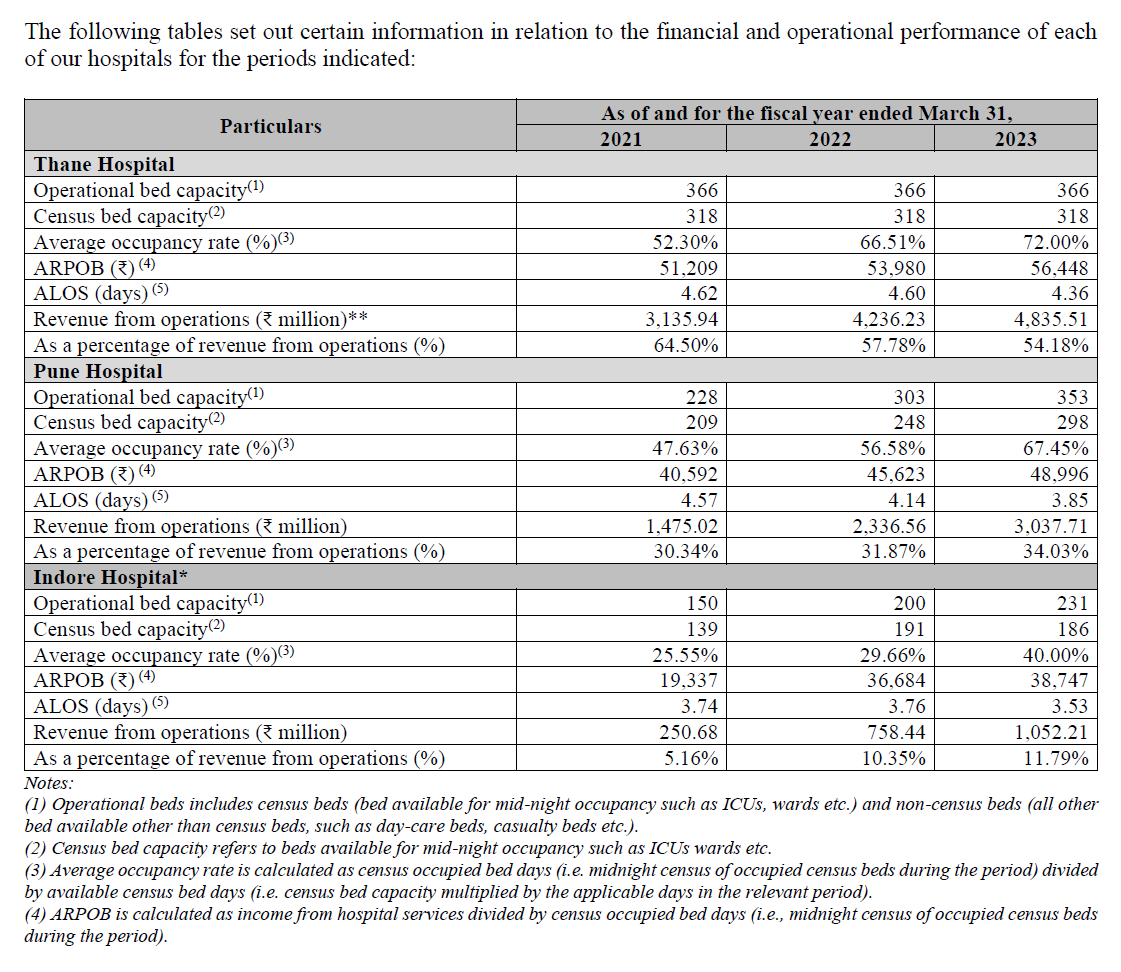

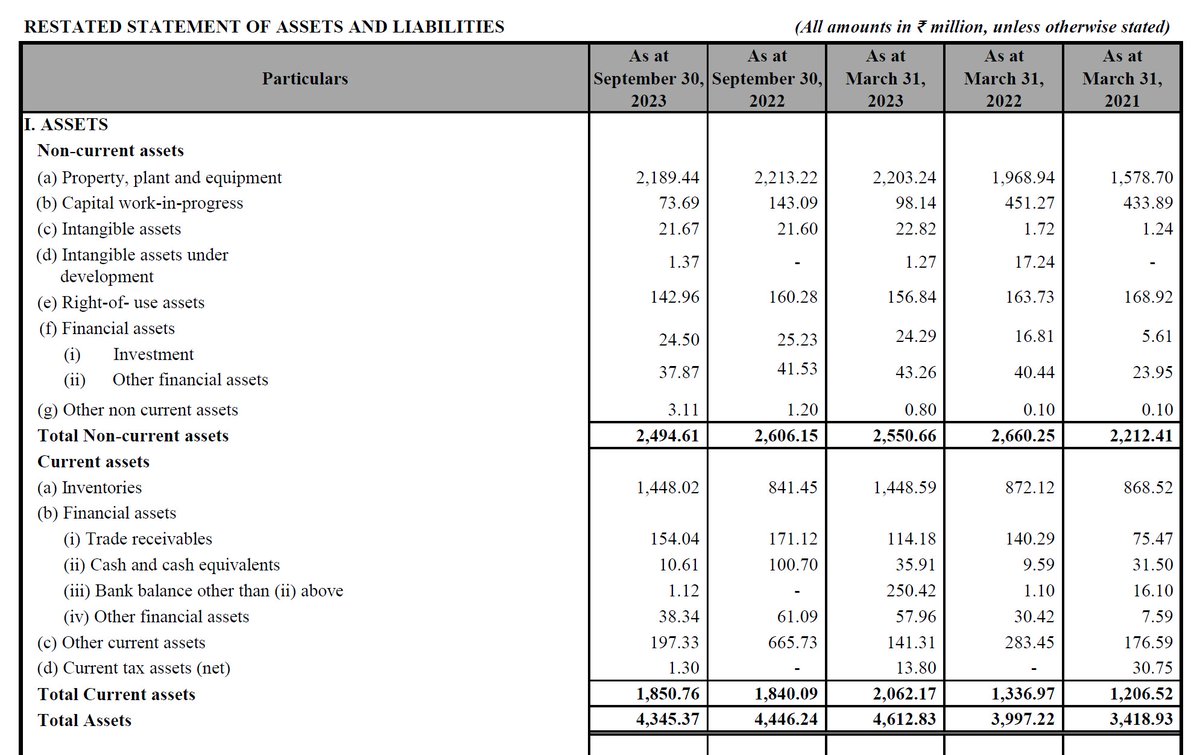

PLEASE read Industry Overview starting page #133, & Business Overview starting page #194 in detail. Fresh proceeds will go for repayment of debts, which is good from financial risk perspective. Company has consistently invested in building capacity.

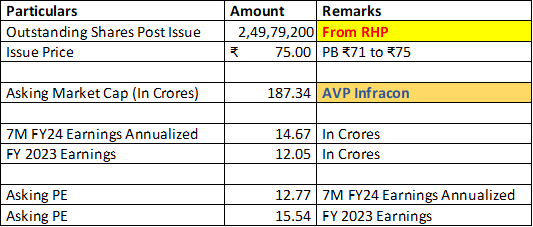

Asking valuation looks expensive whether you consider PE or bed count & PE still remains expensive even if I remove 100% of interest cost & add it to the bottom-line. NOTE that I've used non-census beds & Dombivli Hospital beds, which would come on stream far into future (~FY27).

Calculating bed cost using non-census beds (day care & other beds not for overnight stay usually meaning lesser revenue potential) and prospective upcoming beds of Dombivli hospital is the most optimistic valuation one can do. I don't see anything special here.

There's possibility of growth from current hospital for the near future but I feel that growth is baked into the price. Also, they increased the fund raise further by ₹500 Million. Monitor both related party transactions & management compensation post listing.

Overall, considering everything I find this GREEDILY PRICED & risky of opportunity cost being high. I WON'T APPLY.

.

PLEASE DO YOUR OWN DUE DILIGENCE, REVIEW ACCORDING TO YOUR INVESTMENT STYLE AND THEN TAKE A DECISION.

.

PLEASE DO YOUR OWN DUE DILIGENCE, REVIEW ACCORDING TO YOUR INVESTMENT STYLE AND THEN TAKE A DECISION.

• • •

Missing some Tweet in this thread? You can try to

force a refresh