Successful rollups are super profitable.

zksync has made a total of ~$20M in revenues from its rollup (excl. cost)

Arbitrum ~ $11.87M

Optimism ~ $8.90M

Base ~ $5.14M

Yet, most of us still don't know how rollups generate revenues ⚠️.

A 3 mins thread on the Rollup economics 🧵

zksync has made a total of ~$20M in revenues from its rollup (excl. cost)

Arbitrum ~ $11.87M

Optimism ~ $8.90M

Base ~ $5.14M

Yet, most of us still don't know how rollups generate revenues ⚠️.

A 3 mins thread on the Rollup economics 🧵

1/

In this thread 🧵, I will talk about:

1️⃣ WTF is rollup?

2️⃣ The 3 players in a rollup economic

3️⃣ Rollup costs

4️⃣ Rollup revenues

5️⃣ A summary of the rollup economic

Without further ado, let's dive into the rollup party 🏄.

In this thread 🧵, I will talk about:

1️⃣ WTF is rollup?

2️⃣ The 3 players in a rollup economic

3️⃣ Rollup costs

4️⃣ Rollup revenues

5️⃣ A summary of the rollup economic

Without further ado, let's dive into the rollup party 🏄.

2/

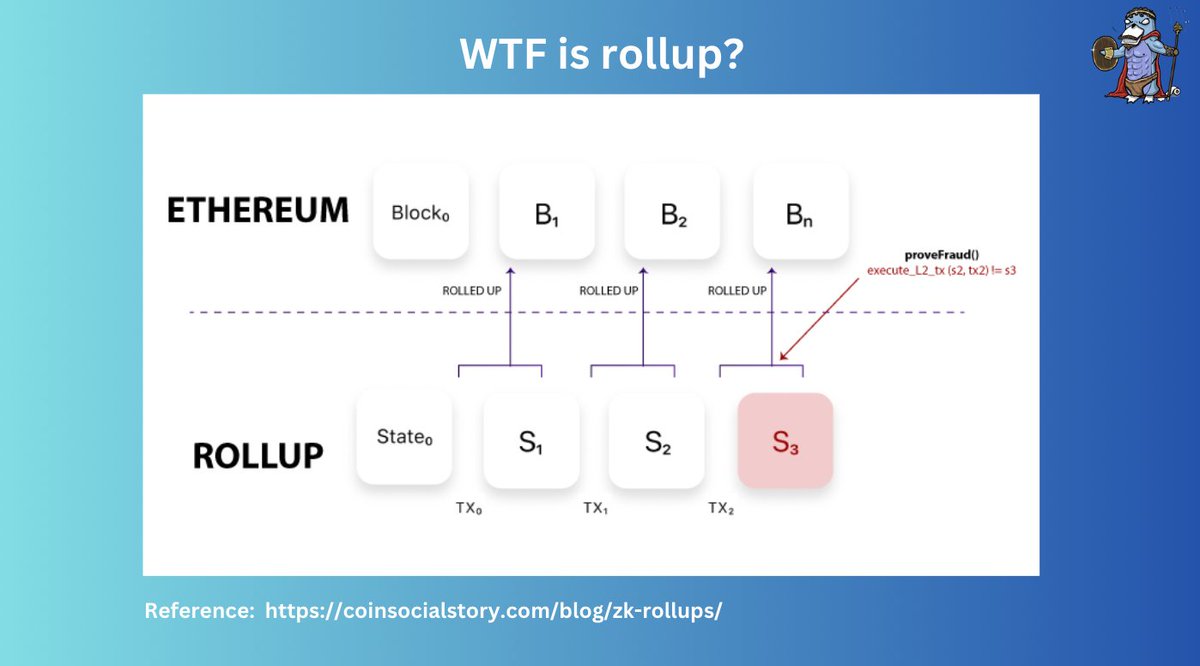

1️⃣ WTF is a rollup?

First, a rollup is a scaling solution that bundles txs off-chain and then sends this bundle back to the L1 / base later for settlement 🧣.

There are two popular types of rollups:

🔴 Optimistic Rollups

🟡 ZK Rollups

1️⃣ WTF is a rollup?

First, a rollup is a scaling solution that bundles txs off-chain and then sends this bundle back to the L1 / base later for settlement 🧣.

There are two popular types of rollups:

🔴 Optimistic Rollups

🟡 ZK Rollups

3/

Despite their differences in the proof method, they share a common goal:

Striking a balance between the rollup costs and revenues 👈 .

To understand how they do it, we first need a basic understanding of the rollup economics ✅.

Despite their differences in the proof method, they share a common goal:

Striking a balance between the rollup costs and revenues 👈 .

To understand how they do it, we first need a basic understanding of the rollup economics ✅.

4/

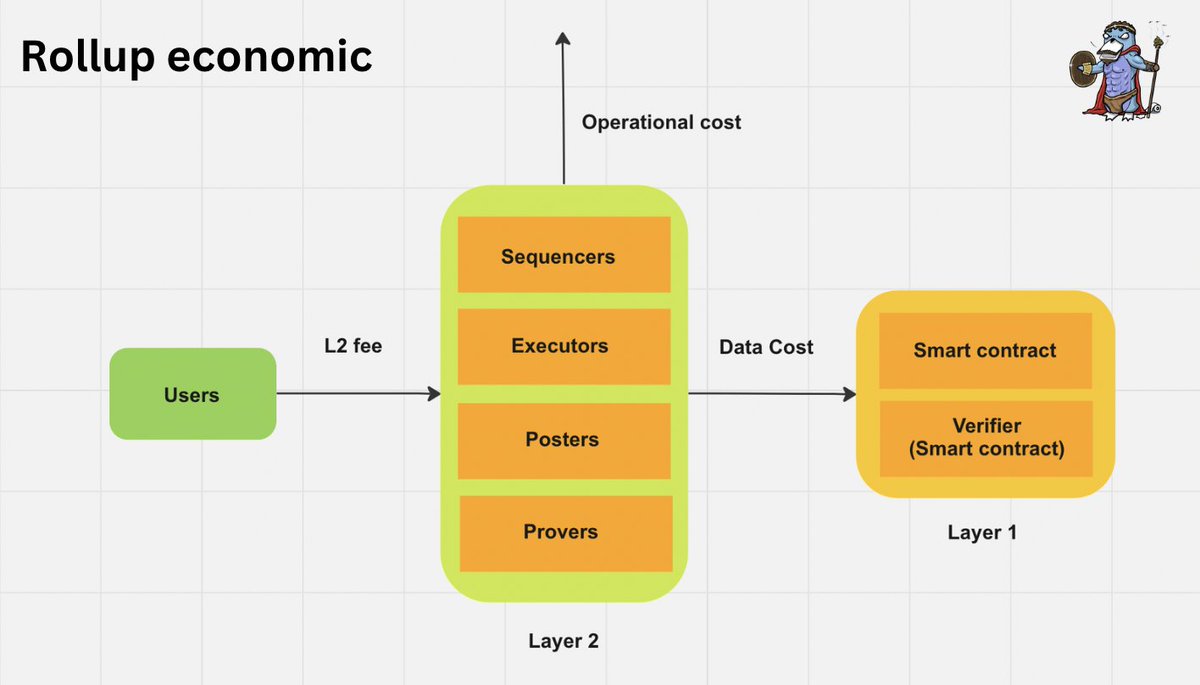

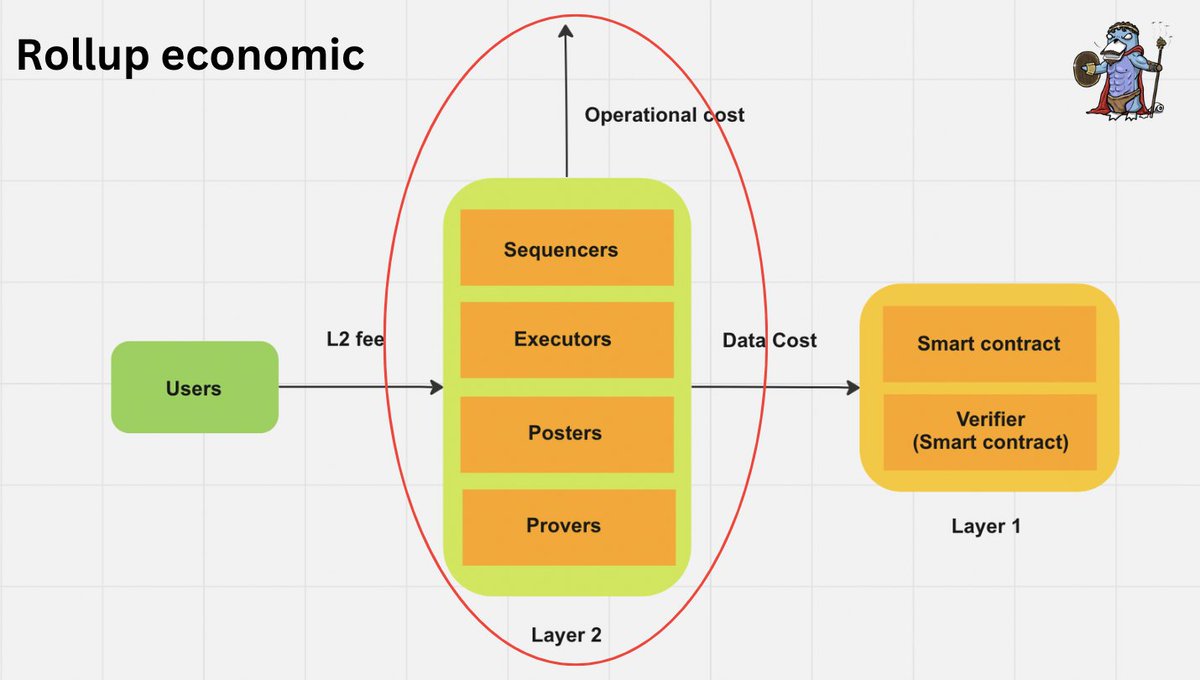

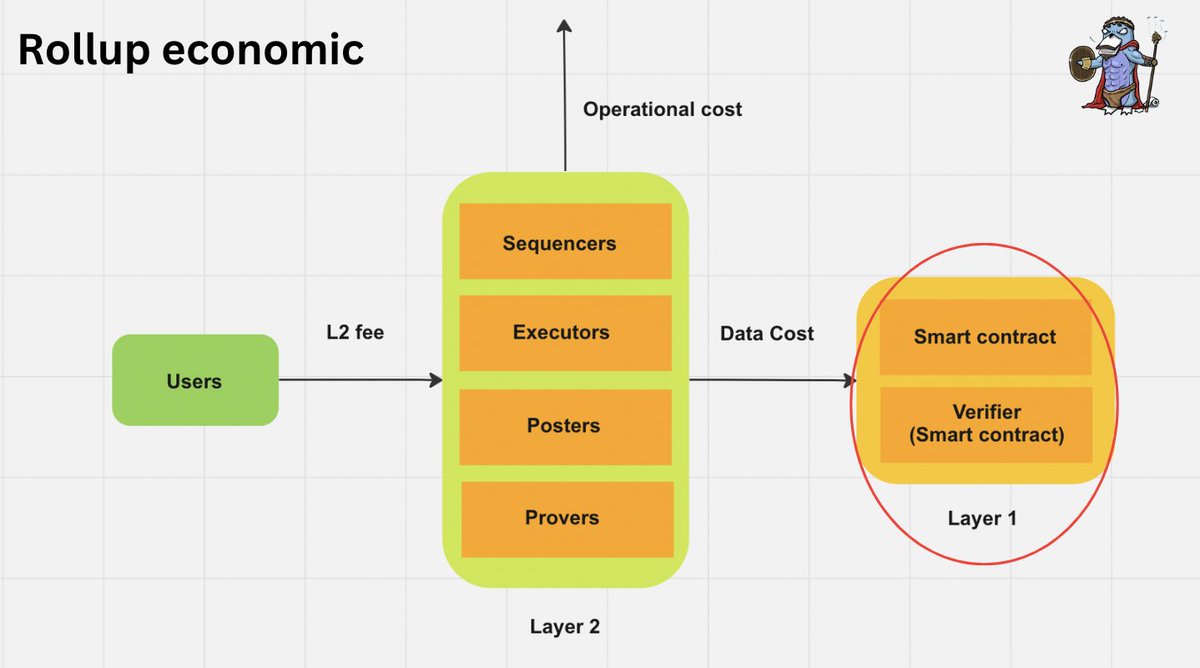

2️⃣ The 3 players in a rollup economic

First, there are 3 major parties in a rollups:

👥 Users

👷 Operators

🌐 Ethereum/Base Layer

Each of these parties represents a part of the value flow within a rollup.

2️⃣ The 3 players in a rollup economic

First, there are 3 major parties in a rollups:

👥 Users

👷 Operators

🌐 Ethereum/Base Layer

Each of these parties represents a part of the value flow within a rollup.

5/

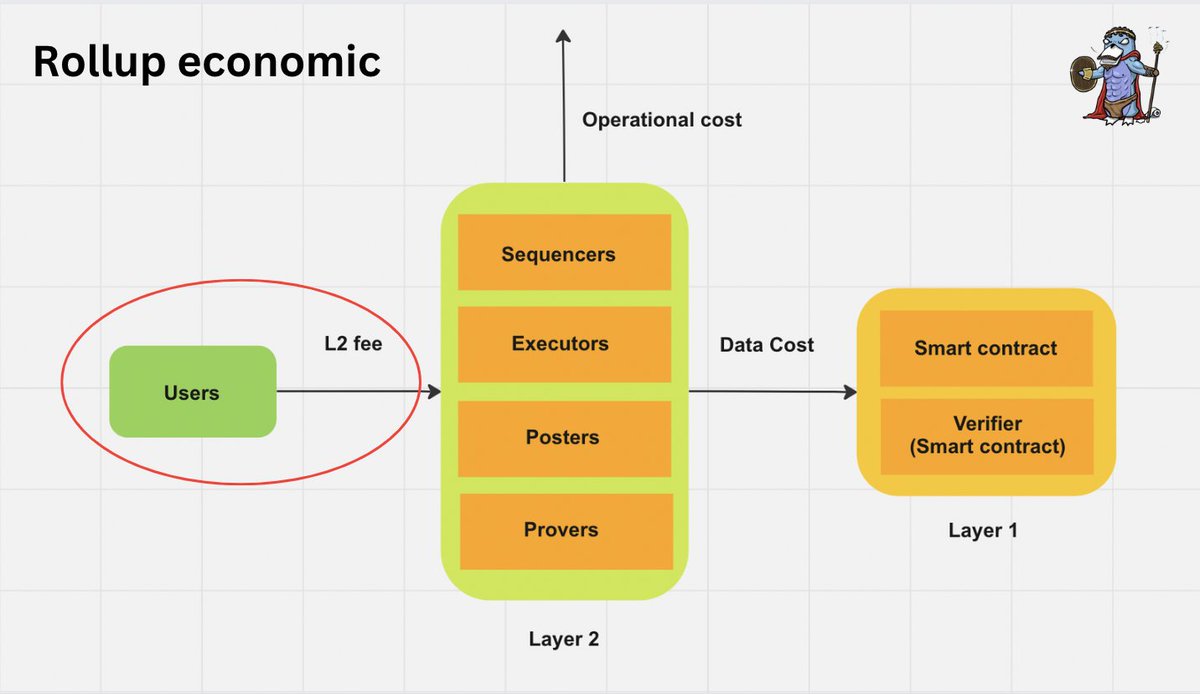

👥 Users

Rollup relies on users to survive.

Users pay gas fee to execute txs on rollup / layer 2 💰.

These fees is one of the major sources of income for L2. The details of revenues will be discussed later in the thread.

👥 Users

Rollup relies on users to survive.

Users pay gas fee to execute txs on rollup / layer 2 💰.

These fees is one of the major sources of income for L2. The details of revenues will be discussed later in the thread.

6/

👷 Operators

The fees paid by users go to rollup's operators that are responsible for sequencing, bundling, producing batch, or provers that need to compute the validity proof 👨💻.

These are the computational resources that are necessary to run the infrastructure behind 👀.

👷 Operators

The fees paid by users go to rollup's operators that are responsible for sequencing, bundling, producing batch, or provers that need to compute the validity proof 👨💻.

These are the computational resources that are necessary to run the infrastructure behind 👀.

7/

🌐 Base layer

Lastly, the compressed txs or messages from the rollup need to be posted on the base layer for settlement, which is the most expensive part out of all steps 🔑.

Meanwhile, running a system inevitably incurs costs

And revenues that motivate each party to work.

🌐 Base layer

Lastly, the compressed txs or messages from the rollup need to be posted on the base layer for settlement, which is the most expensive part out of all steps 🔑.

Meanwhile, running a system inevitably incurs costs

And revenues that motivate each party to work.

8/

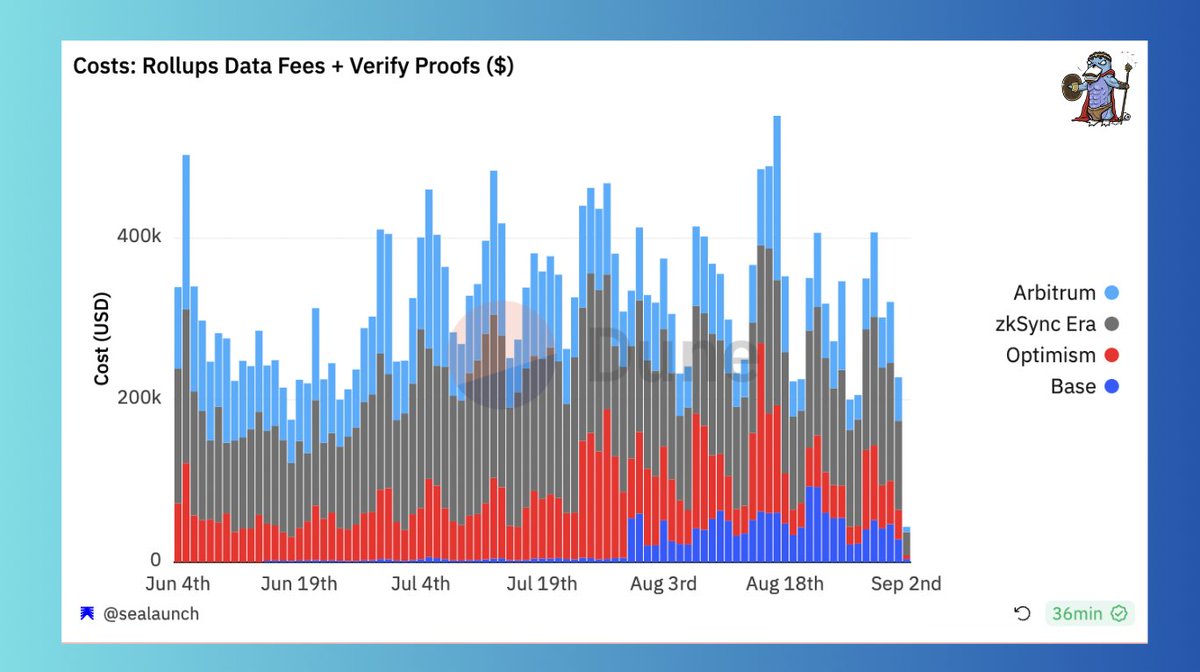

In just 3 months,

@zksync has paid > $13M for It's DA & proving costs, followed by @arbitrum at $8.3M and @optimismFND at $6.5M.

But what are the sources of these costs 🧐?

3 major components that caused it:

🔹 Operator costs

🔹 Data availability costs (DA)

🔹 Proving costs

In just 3 months,

@zksync has paid > $13M for It's DA & proving costs, followed by @arbitrum at $8.3M and @optimismFND at $6.5M.

But what are the sources of these costs 🧐?

3 major components that caused it:

🔹 Operator costs

🔹 Data availability costs (DA)

🔹 Proving costs

9/

3️⃣ Rollup costs

🔹 Operator costs

Operator costs involve the cost of sequencing batches, validating txs, producing blocks, etc.

Since most rollup operators are centralized these days, the costs are handled by the protocol itself or partnered parties.

3️⃣ Rollup costs

🔹 Operator costs

Operator costs involve the cost of sequencing batches, validating txs, producing blocks, etc.

Since most rollup operators are centralized these days, the costs are handled by the protocol itself or partnered parties.

10/

🔹 DA Costs:

DA cost is the cost for batch submission.

Once an operator accumulated enough data, it publishes the data to the base layer in the form of "CALLDATA".

The cost of publishing data is incurred by base layer, and the market price of data is governed by EIP-1559.

🔹 DA Costs:

DA cost is the cost for batch submission.

Once an operator accumulated enough data, it publishes the data to the base layer in the form of "CALLDATA".

The cost of publishing data is incurred by base layer, and the market price of data is governed by EIP-1559.

11/

🔹 Proving Cost:

In zkrollup, nodes on L2 need to submit a validity proof to prove the correctness of the changes 🪬.

This process requires a proving cost whenever a change in state is required 🫰.

🔹 Proving Cost:

In zkrollup, nodes on L2 need to submit a validity proof to prove the correctness of the changes 🪬.

This process requires a proving cost whenever a change in state is required 🫰.

12/

4️⃣ Rollup revenues

Now we understand the major cost of a rollup, and there must be corresponding revenues to offset these ✅.

Revenues for Rollups rely on 2 major sectors:

🔸 Transactions fee

🔸 Token Issuance

4️⃣ Rollup revenues

Now we understand the major cost of a rollup, and there must be corresponding revenues to offset these ✅.

Revenues for Rollups rely on 2 major sectors:

🔸 Transactions fee

🔸 Token Issuance

13/

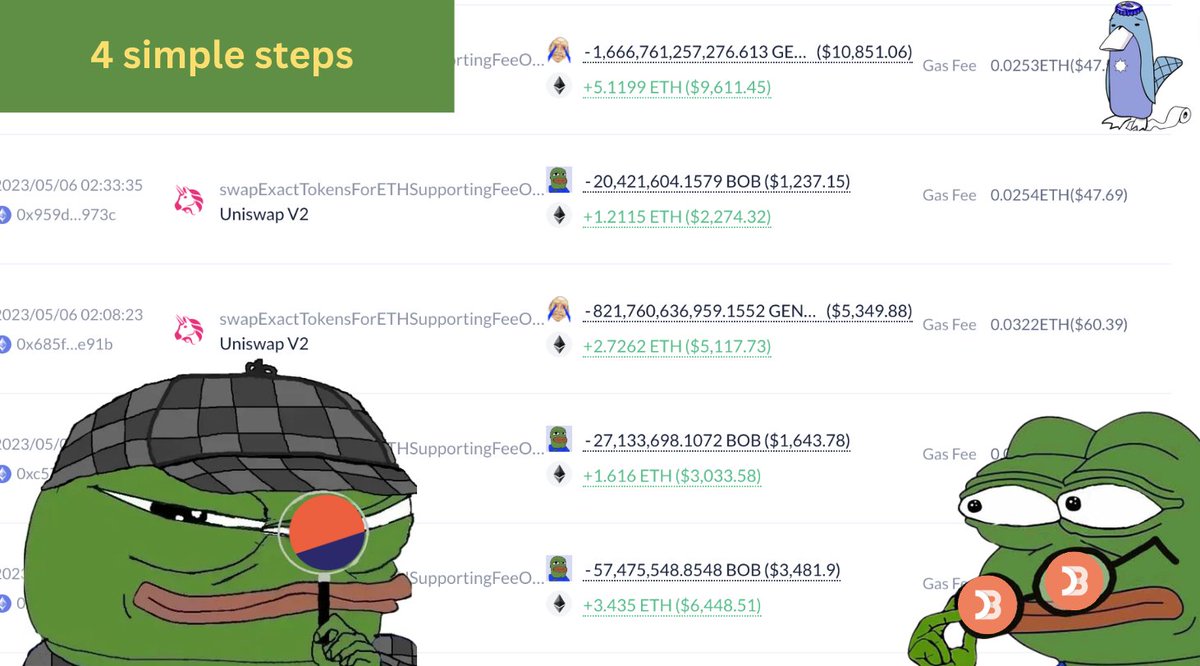

🔸 Transaction Fees:

Whenever a user makes a txs on a rollup, a fee is collected from that transaction.

In addition, rollups can also generate revenue from congestion fees (in the sequencers) as well as from extracting MEV from trades.

🔸 Transaction Fees:

Whenever a user makes a txs on a rollup, a fee is collected from that transaction.

In addition, rollups can also generate revenue from congestion fees (in the sequencers) as well as from extracting MEV from trades.

14/

🔸 Token Issuance

Launching a native L2 token can be an important source of income for the team.

Token help cover infrastructure costs, while aligning incentives among operators & investors, and even facilitate decentralization in terms of shared service (The future of L2).

🔸 Token Issuance

Launching a native L2 token can be an important source of income for the team.

Token help cover infrastructure costs, while aligning incentives among operators & investors, and even facilitate decentralization in terms of shared service (The future of L2).

15/

Excluding revenues from token issuance & fundraising

zkSync still dominates the chart by earning ~$20M in total from txs fees, profiting $6.87M after subtracting the cost 👑

Meanwhile, both Base and Arb are profiting $3.5M each, sharing the 2nd rank among the others .

Excluding revenues from token issuance & fundraising

zkSync still dominates the chart by earning ~$20M in total from txs fees, profiting $6.87M after subtracting the cost 👑

Meanwhile, both Base and Arb are profiting $3.5M each, sharing the 2nd rank among the others .

16/

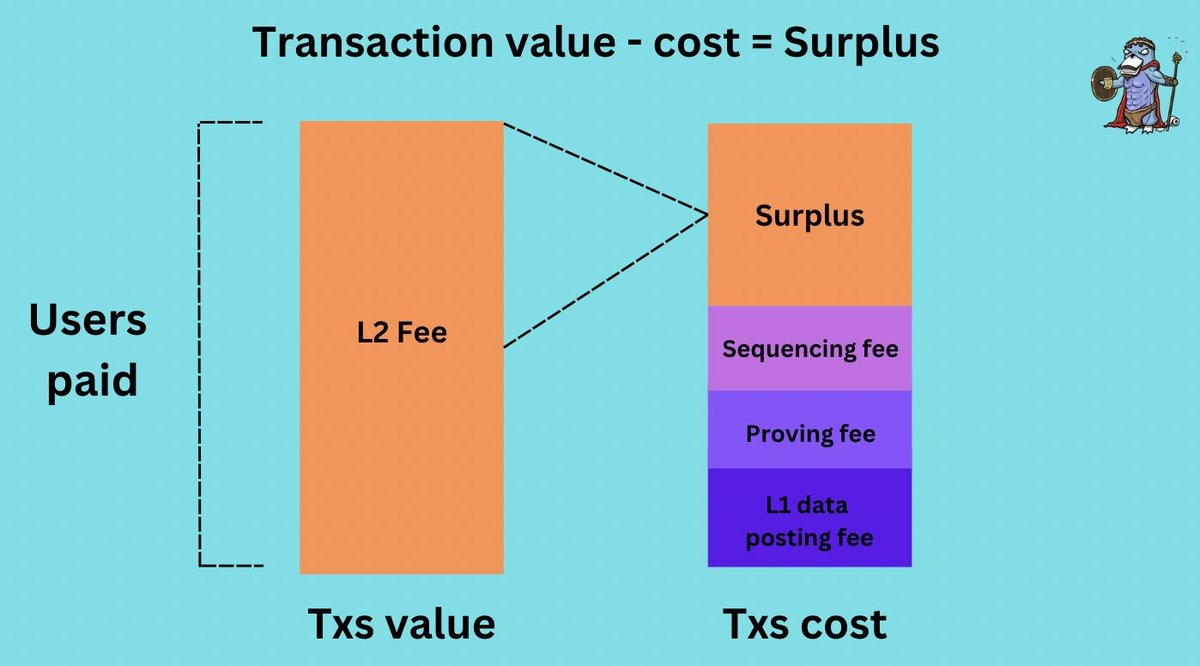

5️⃣ A Summary

To sum up, a rollup involves 3 major players: Users, Operators and L1.

The costs of running this system are Operator costs, DA costs, and Proving costs (mostly in zkRollup).

To offset these costs, rollup revenues relies on transaction fees and token issuance.

5️⃣ A Summary

To sum up, a rollup involves 3 major players: Users, Operators and L1.

The costs of running this system are Operator costs, DA costs, and Proving costs (mostly in zkRollup).

To offset these costs, rollup revenues relies on transaction fees and token issuance.

17/

Digging deeper, the value flow between users and operators can be summarized by the following equations:

🐞 First, User needs to pay for = L1 DA cost + operator cost + L2 congestion fee

🐞 Second, Operator cost = L1 DA cost + cost of maintaining the operators

Digging deeper, the value flow between users and operators can be summarized by the following equations:

🐞 First, User needs to pay for = L1 DA cost + operator cost + L2 congestion fee

🐞 Second, Operator cost = L1 DA cost + cost of maintaining the operators

18/

🐞 Thirdly, Operator revenues = L2 User Fees + MEV in Sequencers

🐞 Operator Surplus = Operator revenues - Operator costs

With these primary school mathematics, we can reckon the profitability of operators in different rollup.

🐞 Thirdly, Operator revenues = L2 User Fees + MEV in Sequencers

🐞 Operator Surplus = Operator revenues - Operator costs

With these primary school mathematics, we can reckon the profitability of operators in different rollup.

19/

With that said, maintaining a budget balance / surplus is still the primary goal of each L2 now.

Hence, many L2 are experimenting with different economic designs, including:

• Reducing posting costs to L1 via strategic posting

• Optimising L2 congestion fees

and more...

With that said, maintaining a budget balance / surplus is still the primary goal of each L2 now.

Hence, many L2 are experimenting with different economic designs, including:

• Reducing posting costs to L1 via strategic posting

• Optimising L2 congestion fees

and more...

20/

We are only at the tip of the iceberg.

There is so much more to discuss about rollup economics.

To dig deeper, I recommend reading this:

barnabe.substack.com/p/understandin…

We are only at the tip of the iceberg.

There is so much more to discuss about rollup economics.

To dig deeper, I recommend reading this:

barnabe.substack.com/p/understandin…

21/

Tagging rollup expert for discussion

@ayyyeandy /@TheDeFISaint /@0xSalazar / @expctchaos

@Axel_bitblaze69 / @Tanaka_L2 /@Route2FI /@Okpara081

@nobrainflip /@CryptoIsCute /@hmalviya9 /@mztacat

@yanneth_eth /@Kaffchad /@CryptoGideon_ /@monosarin

@0xTindorr /@TheDefiDog

Tagging rollup expert for discussion

@ayyyeandy /@TheDeFISaint /@0xSalazar / @expctchaos

@Axel_bitblaze69 / @Tanaka_L2 /@Route2FI /@Okpara081

@nobrainflip /@CryptoIsCute /@hmalviya9 /@mztacat

@yanneth_eth /@Kaffchad /@CryptoGideon_ /@monosarin

@0xTindorr /@TheDefiDog

22/

Tagging CT frens for the alpha

@0xnocta /@DegenCamp /@2lambro /@crypticdegen22 /@OvrCldJonny

@Deebs_DeFi /@tomwanhh /@stacy_muur /@0xkhan_ /@ArsalanSartaj

@hmalviya9 / @francescoweb3 / @ShivanshuMadan/ @jinglingcookies

@VirtualKenji/ @FarmerTuHao/ @0xFinish/ @0xAlunara

Tagging CT frens for the alpha

@0xnocta /@DegenCamp /@2lambro /@crypticdegen22 /@OvrCldJonny

@Deebs_DeFi /@tomwanhh /@stacy_muur /@0xkhan_ /@ArsalanSartaj

@hmalviya9 / @francescoweb3 / @ShivanshuMadan/ @jinglingcookies

@VirtualKenji/ @FarmerTuHao/ @0xFinish/ @0xAlunara

@0xnocta @DegenCamp @2lambro @crypticdegen22 @OvrCldJonny @Deebs_DeFi @tomwanhh @stacy_muur @0xkhan_ @ArsalanSartaj @hmalviya9 @francescoweb3 @ShivanshuMadan @jinglingcookies @VirtualKenji @FarmerTuHao @0xFinish @0xAlunara That's a wrap of the rollup economic.

If you agree that 👇

Rollup Surplus = L2 Fees - Operational Cost - Data Cost

1️⃣ Please like & RT or..

2️⃣ Follow me and tell your friends that a man call poopman is back to writing.

If you agree that 👇

Rollup Surplus = L2 Fees - Operational Cost - Data Cost

1️⃣ Please like & RT or..

2️⃣ Follow me and tell your friends that a man call poopman is back to writing.

https://twitter.com/poopmandefi/status/1697973247181238538

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter