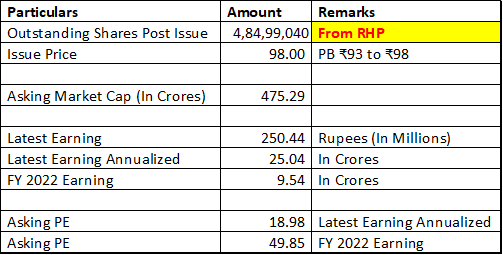

Ratnaveer Precision Engineering () IPO. Manufactures stainless steel finished sheets, washers, solar roofing hooks, pipes, and tubes.

.

RHP: ratnaveer.com

reports.chittorgarh.com/ipo_notes/RATN…

.

RHP: ratnaveer.com

reports.chittorgarh.com/ipo_notes/RATN…

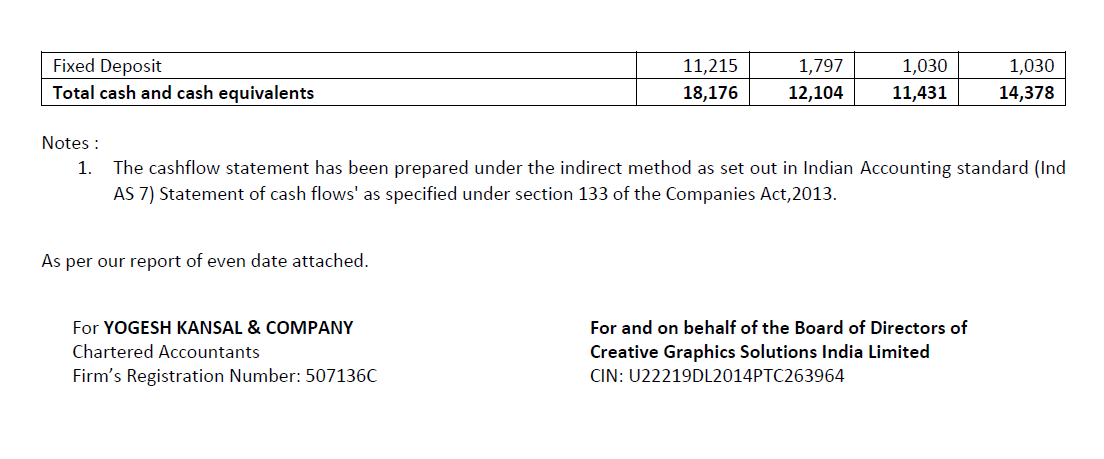

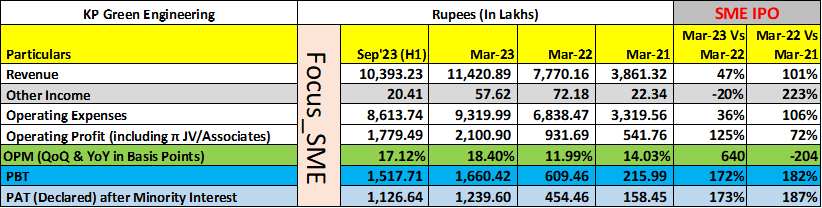

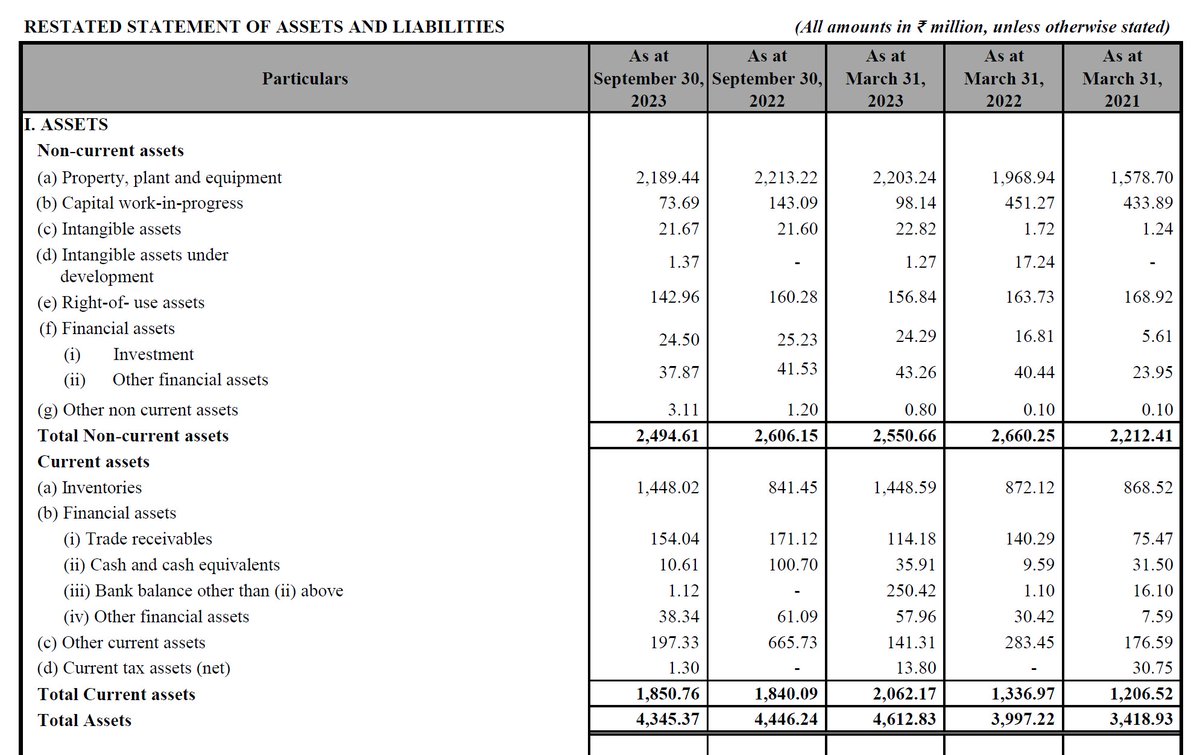

Financial trend looks good. Cash flow looks average to poor I feel. Working capital heavy business with sizeable amount of debts, some of which are quite expensive IMO at 13%. There does exist scope from growth from existing capacity & high margin products may aid margins.

H2 will be heavy for the sector & seen from bifurcation of numbers. Monitor related party transactions & management compensation post listing.

.

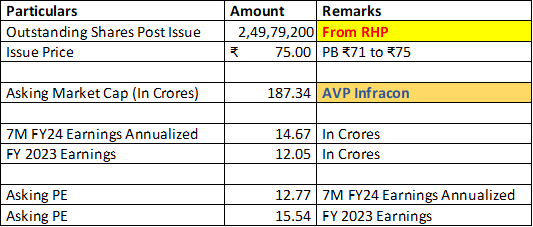

NOTE: It will go to T2T category on listing & may romance with ESM framework given asking Market Capitalization of less than 500 Cr.

.

NOTE: It will go to T2T category on listing & may romance with ESM framework given asking Market Capitalization of less than 500 Cr.

Overall, this looks average to me but may do well & would prefer to monitor post listing. I WON'T APPLY FOR NOW.

.

PLEASE DO YOUR OWN DUE DILIGENCE, REVIEW ACCORDING TO YOUR INVESTMENT STYLE AND THEN TAKE A DECISION.

.

PLEASE DO YOUR OWN DUE DILIGENCE, REVIEW ACCORDING TO YOUR INVESTMENT STYLE AND THEN TAKE A DECISION.

• • •

Missing some Tweet in this thread? You can try to

force a refresh