The jobs market will weaken from here.

1/9

1/9

2/9

A net 39.4% of US banks say they are tightening lending standards. This started rising in late 2021. The unemployment rate looks set to follow it higher.

A net 39.4% of US banks say they are tightening lending standards. This started rising in late 2021. The unemployment rate looks set to follow it higher.

3/9

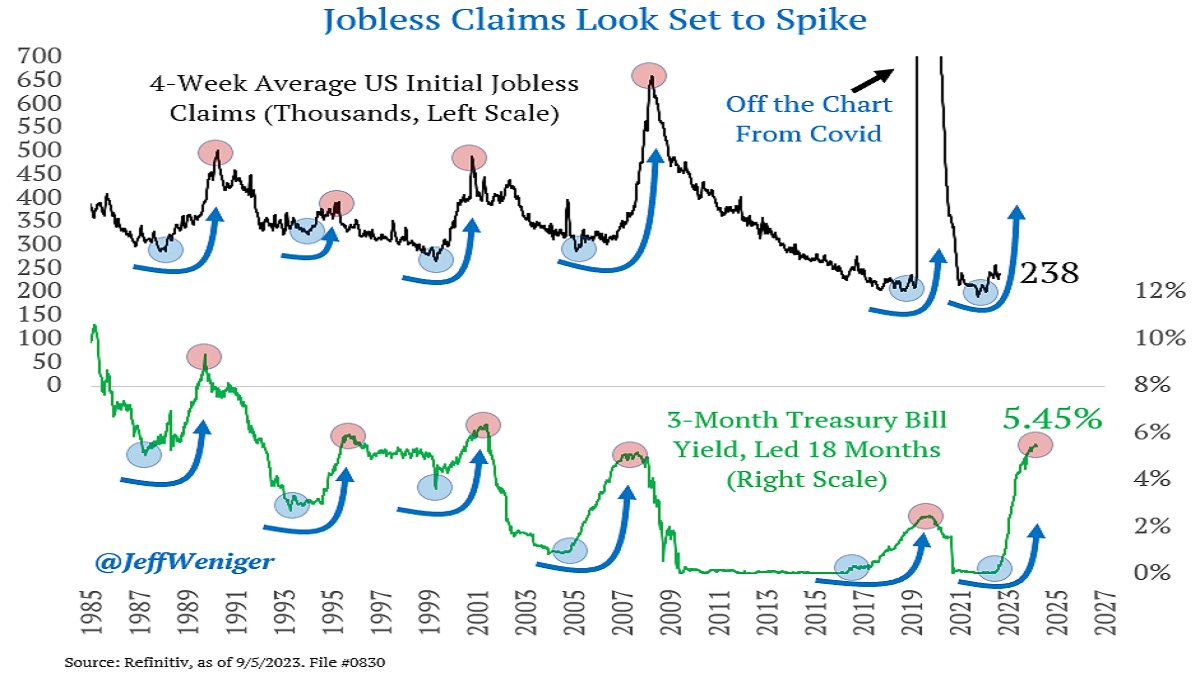

Treasury bills have risen from 0% to 5.45%, and it happened in a speedy manner. The next thing to head higher is initial jobless claims.

Treasury bills have risen from 0% to 5.45%, and it happened in a speedy manner. The next thing to head higher is initial jobless claims.

4/9

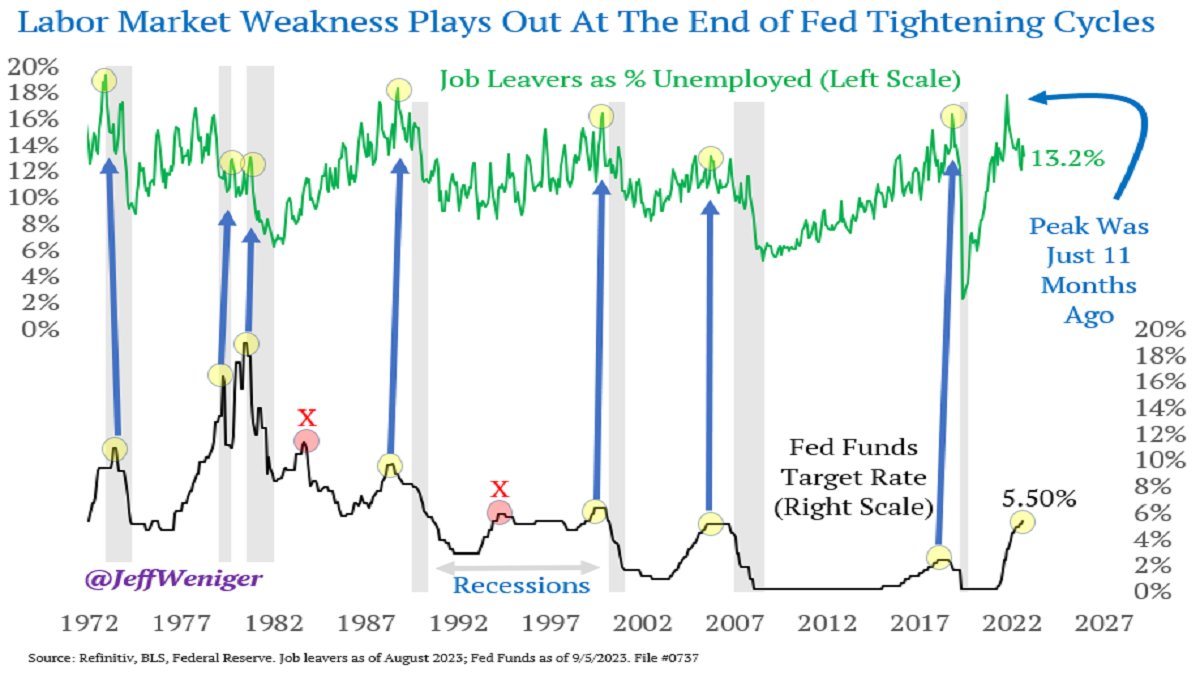

The end of Fed tightening cycles tends to point to peaks in the percentage of unemployed who are willing job leavers. These are people who chose to leave their job because they are confident that they can find another one. This is deteriorating.

The end of Fed tightening cycles tends to point to peaks in the percentage of unemployed who are willing job leavers. These are people who chose to leave their job because they are confident that they can find another one. This is deteriorating.

5/9

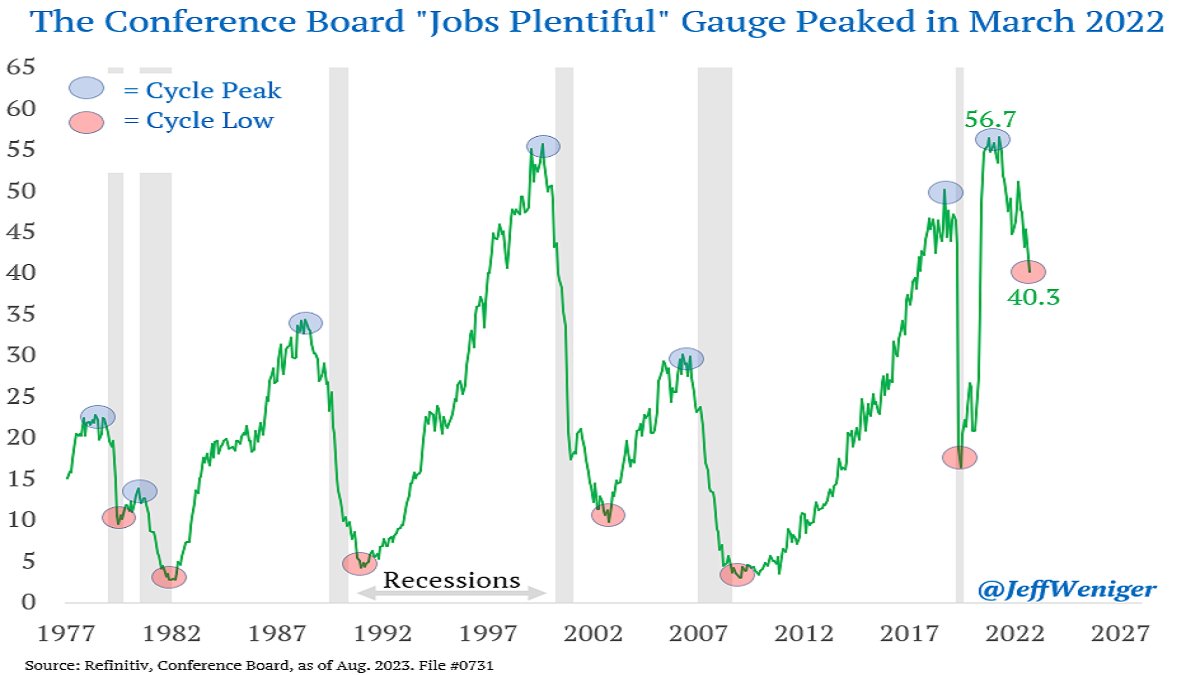

The "Jobs Plentiful" question in the Conference Board survey is also falling. The boldness of the move from 56.7 to 40.3, or about 16 points, is more than the amount that was needed to trigger prior recessions.

The "Jobs Plentiful" question in the Conference Board survey is also falling. The boldness of the move from 56.7 to 40.3, or about 16 points, is more than the amount that was needed to trigger prior recessions.

6/9

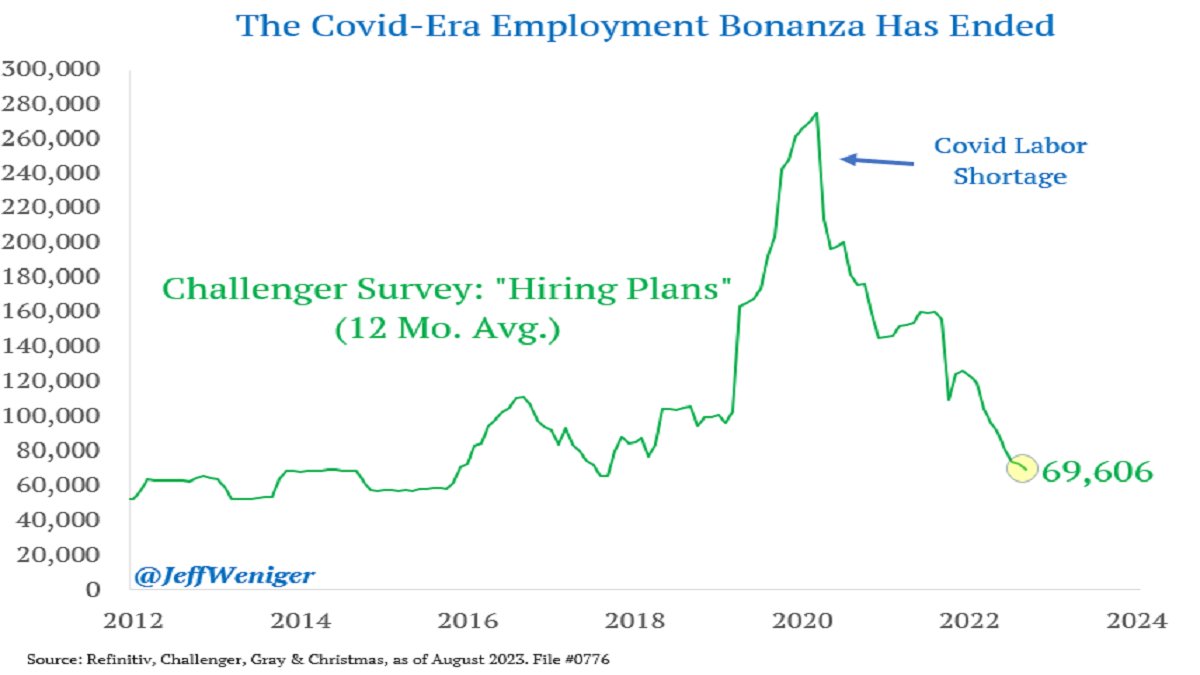

Running a business during Covid was tough, because employees were always quitting. Companies would hire a ton of people as "insurance." This hoarding of workers has ended. The Challenger survey shows us this.

Running a business during Covid was tough, because employees were always quitting. Companies would hire a ton of people as "insurance." This hoarding of workers has ended. The Challenger survey shows us this.

7/9

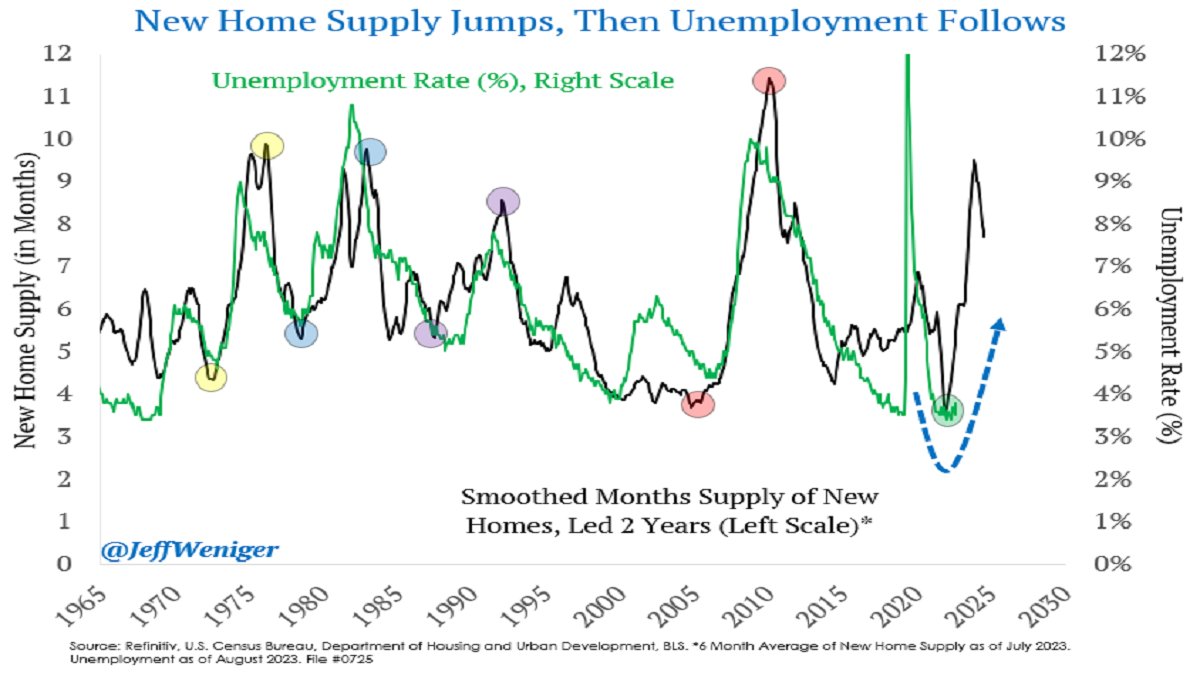

There has been a collapse in both home DEMAND and also home SUPPLY. Because the housing market is so broken, the data for the supply of New Homes has spiked due to a disappearance of buyers. The Housing Freeze is your key macro theme. Unemployment will rise.

There has been a collapse in both home DEMAND and also home SUPPLY. Because the housing market is so broken, the data for the supply of New Homes has spiked due to a disappearance of buyers. The Housing Freeze is your key macro theme. Unemployment will rise.

8/9

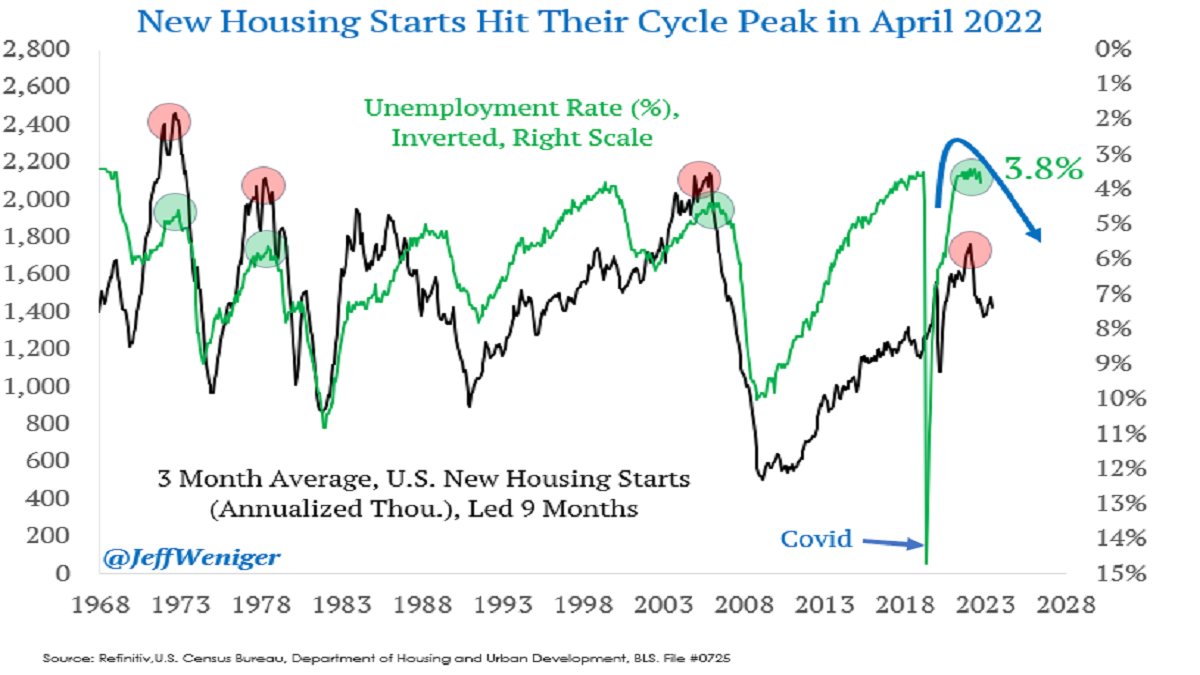

Meantime, New Housing Starts peaked way back in Spring 2022. When building activity starts falling like this, it shows up in the labor data thereafter. This cycle should witness much of the same. Note: the right axis is inverted.

Meantime, New Housing Starts peaked way back in Spring 2022. When building activity starts falling like this, it shows up in the labor data thereafter. This cycle should witness much of the same. Note: the right axis is inverted.

9/9

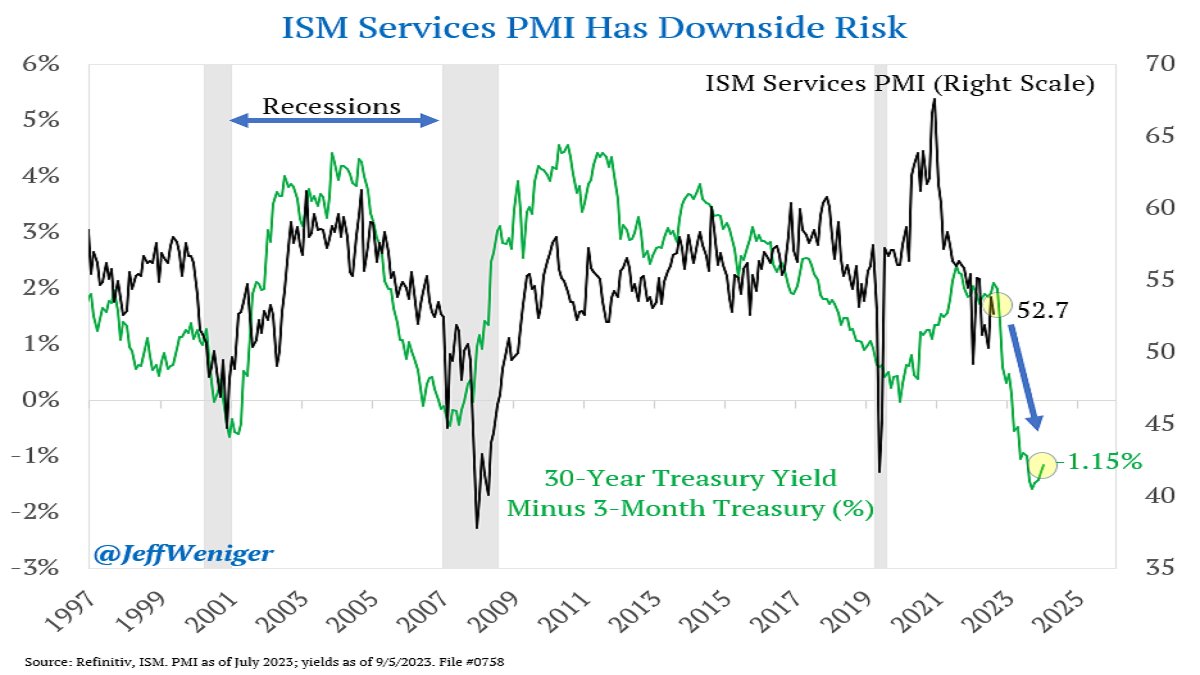

Finally, there is a notion that the Services sector will hold the economy together even though manufacturing has been in recession. The deep inversion of the yield curve tells a different story. ISM Services looks set to sink below 50 in due time, indicating contraction.

END

Finally, there is a notion that the Services sector will hold the economy together even though manufacturing has been in recession. The deep inversion of the yield curve tells a different story. ISM Services looks set to sink below 50 in due time, indicating contraction.

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh