@BananaGunBot 's popularity soared after announcing its token presale. Recent data reveals that #BananaGun 's user base and trading volume rival those of Unibot, intensifying the competition between the two. #GryphsisAcademy will delve into BananaGun's presale and key metrics.

https://twitter.com/1669901087531302912/status/1698778664991601111

1/n Introduction: Banana Gun, a Telegram trading bot, offers a unique sniper buying feature, enabling users to swiftly purchase newly launched tokens. This provides an advantage to early adopters seeking entry into new token projects. #TradingBot #DEX #MEME #TelegramBot

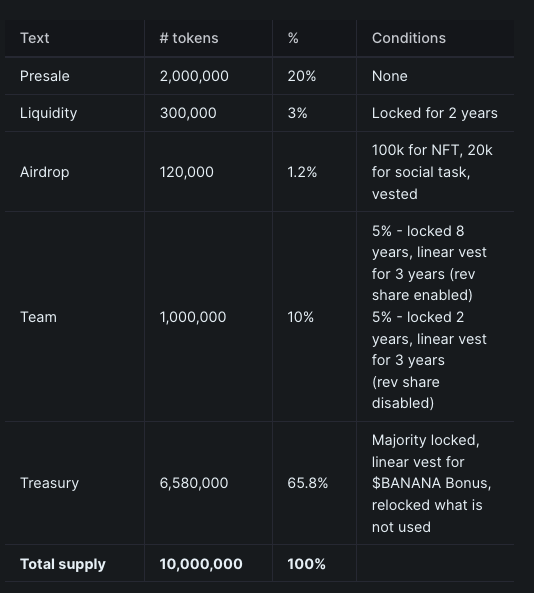

2/n PreSale: The presale raise targe is 800E, with a max allocation of 1E. The presale and launch price are set at $0.65. The starting market cap stands at $1.56m, with an FDV of $6.5m. The presale consists of four rounds with no vesting. #Presale #CyptoLaunch

3/n Airdrops: Banana Gun includes two airdrops. NFT holders will receive a 1% airdrop, while participants who complete social tasks will receive a 0.2% airdrop. The vesting period for these airdrops is two months on a linear schedule. #Airdrop #CryptoRewards

4/n Tokenomics: 20% presale, 3% liquidity poo, 1.2% airdrop, 10% team reservation, and a treasury reserve of 65.8% (mostly locked). The circulating token at launch is 24.2%. Opening pool size 120E. #Tokenomics

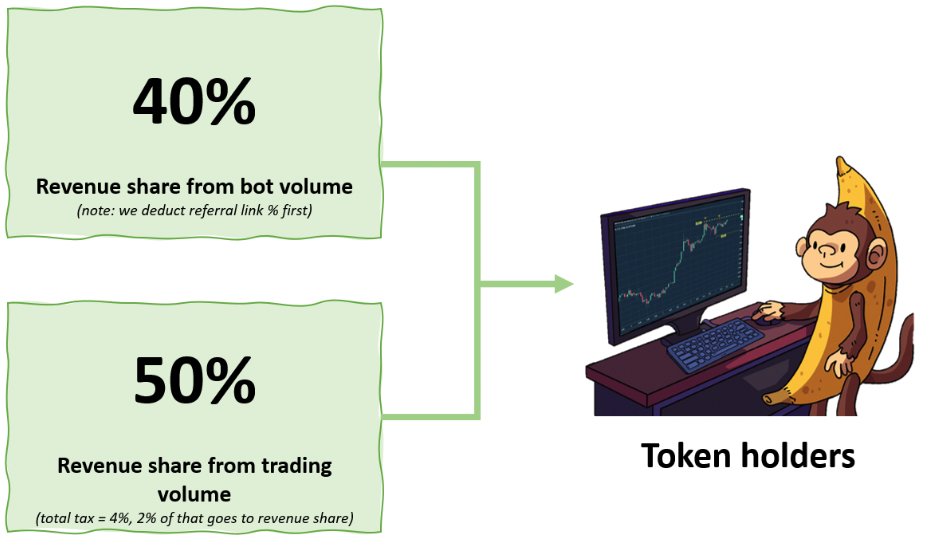

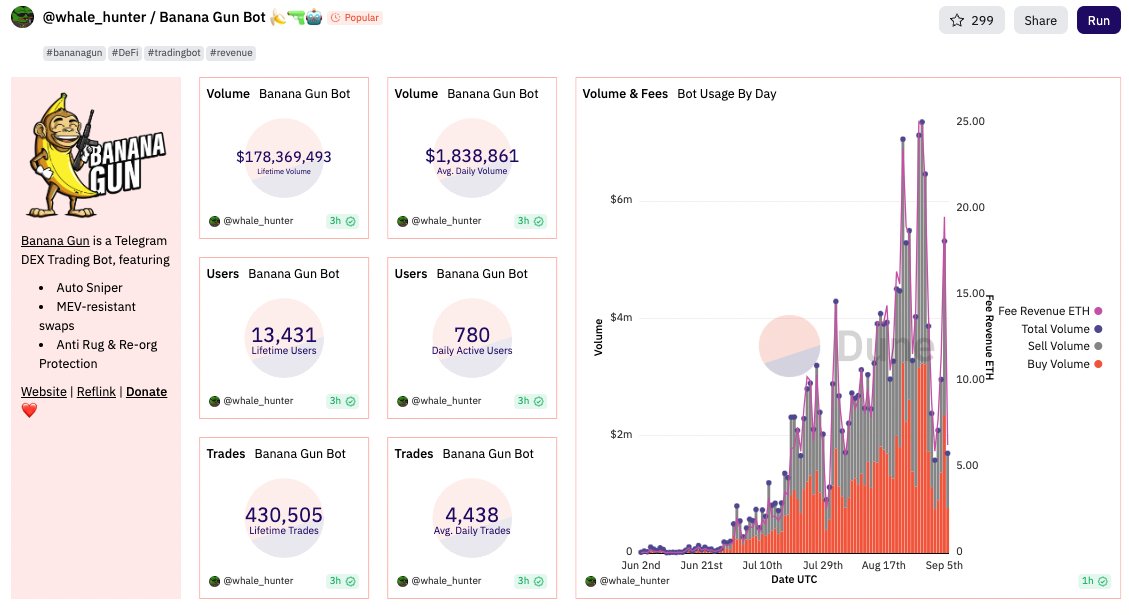

5/n Revenue Source: Banana Gun generates revenue primarily through its fee structure. The Autosniper feature incurs a 1% fee, while manual buying carries a 0.5% fee. Additionally, a 4% tax is applied to token transactions. #RevenueModel

6/n Profit Sharing: Token holders are eligible for profit sharing, with 50% of tax revenue and 40% of bot revenue allocated to them. These profits can be claimed through the dApp a few days after the launch. #ProfitSharing #CryptoCommunity

7/n Tax Distribution: The 4% tax is allocated as follows: 2% to token holders, 1% to the team, and 1% to the treasury. The treasury utilizes these funds for operational expenses, buybacks, and liquidity provisioning on exchanges when necessary. #TaxDistribution #TelegramBot

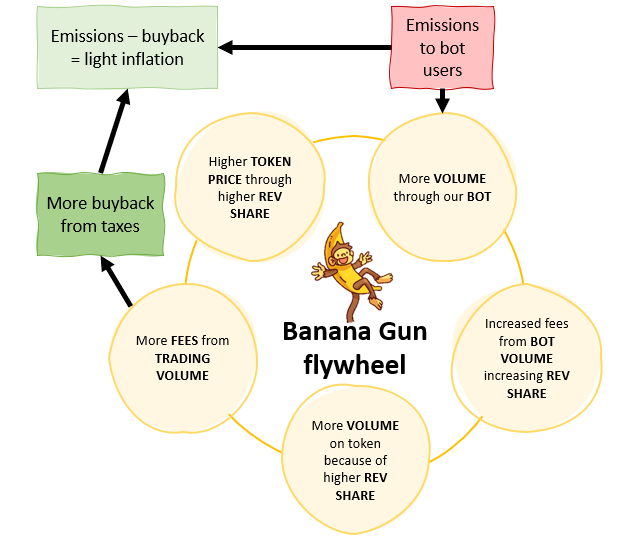

8/n Sustainability: #BananaGun aims to establish a positive feedback loop of revenue, profit-sharing, rewards, and buybacks. Users receive $BANANA tokens as rewards for transactions, and token buybacks are funded by tax. #SustainableCrypto #Tokenomics #Flywheel

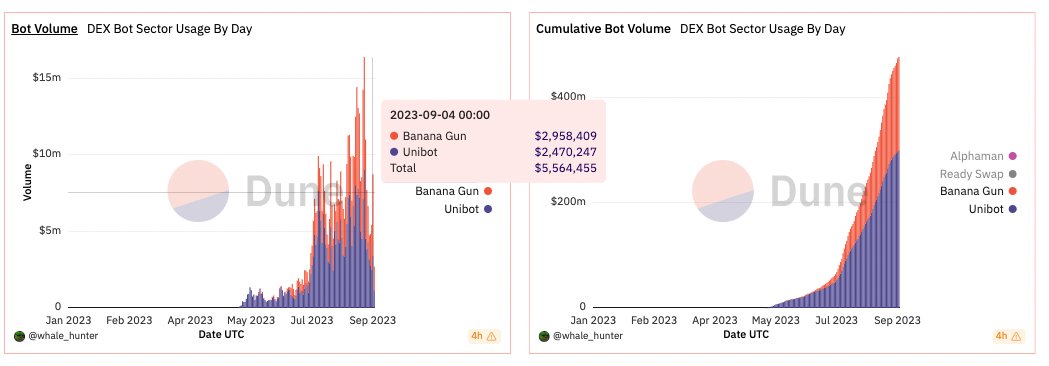

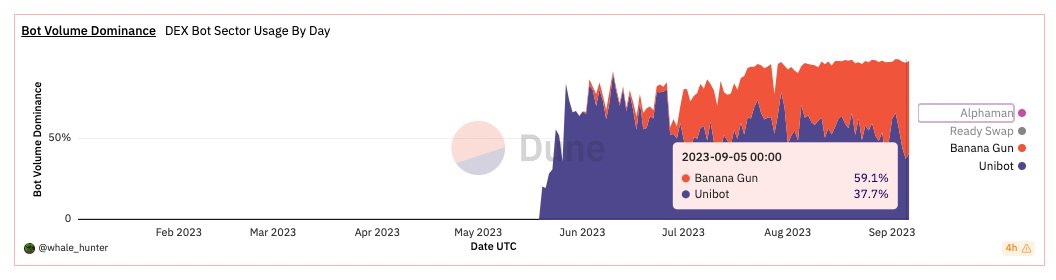

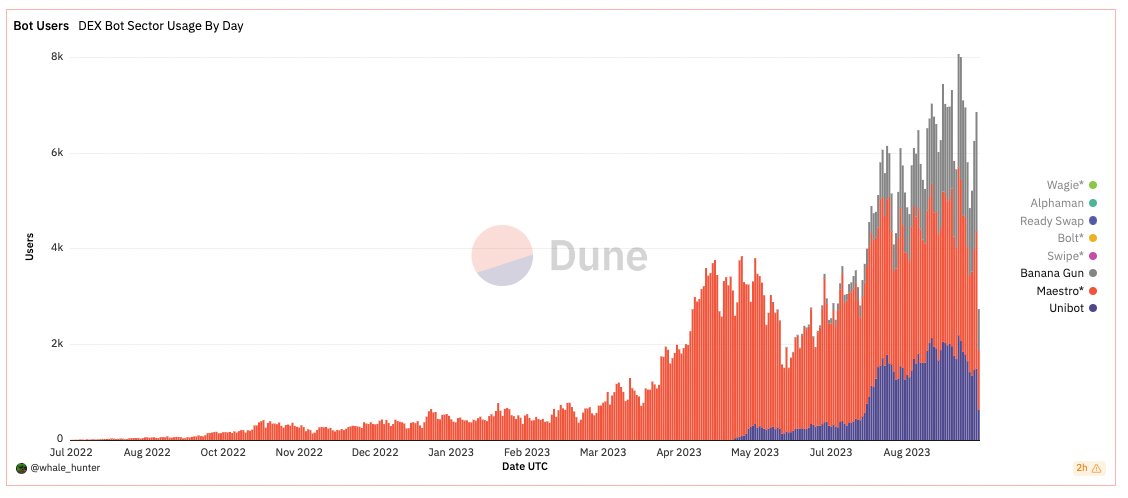

9/n Performances: @BananaGun_Bot has attracted significant user volume and trading activity, surpassing Unibot since the presale announcement. Cumulative users stand at 13,462 for BananaGun compared to 14,722 for Unibot. Dune Analytics from @whale_hunter_

10/n Liquidity: With a 25% liquidity-to-market cap ratio applied to ensure market stability and minimize slippage, Banana Gun provides initial liquidity of 300K $Banana tokens and $195K in ETH, totaling $390K for a starting market cap of $1.56m. #LiquidityManagement#CryptoMarket

11/n Thoughts: Trading bots are a game-changer for the general public, offering quick access to Web3. It provides functionalities that traditional DEXs lack, such as sniper buying, MEV protection, and rug pulls which were previously inaccessible to ordinary users. #Telegrambot

12/n Thoughts: #BananaGun has outperformed Unibot in terms of user volume, showcasing its growing popularity and potential. With a starting market cap of $1.56m, it appears attractive compared to Unibot's current market cap of $81m. #BananaGun #Unibot #CryptoCompetition

13/n Thoughts: The reward and burning mechanisms of Banana Gun's token seem well-designed, offering potential benefits for token holders. However, the actual income generation capability and sustainability of the platform still need to be validated through real trading. #Bot

14/n Thoughts: Popular newly launched tokens often attract the attention of investors who employ strategies fueled by substantial bribes. BananaGun emerged as the prevailing weapon for executing such maneuvers. It is intriguing to observe the measures to address this scenario.

15/n Thoughts: Trading bots like Banana Gun have opened doors for ordinary users, providing access to advanced features and leveling the playing field. The Web3 space is evolving rapidly, and it's exciting to see the possibilities that arise. Stay tuned for more updates! #Web3

That's a wrap!

If you enjoyed this thread:

1. Follow me @gryphsisacademy for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @gryphsisacademy for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1619539641178411008/status/1699603360515510526

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter