"But CoreWeave came out of nowhere"

They were aggressively buying Nvidia A40 GPUs in ... August of 2021

They were aggressively buying Nvidia A40 GPUs in ... August of 2021

"But CoreWeave must be a scam because they grew so fast"

Ever consider perhaps that they were doing something right?

The acquisition of Conductor Technologies enabled them to scale quickly into visual effects offerings, a sizable area of cloud GPU usage.

Ever consider perhaps that they were doing something right?

The acquisition of Conductor Technologies enabled them to scale quickly into visual effects offerings, a sizable area of cloud GPU usage.

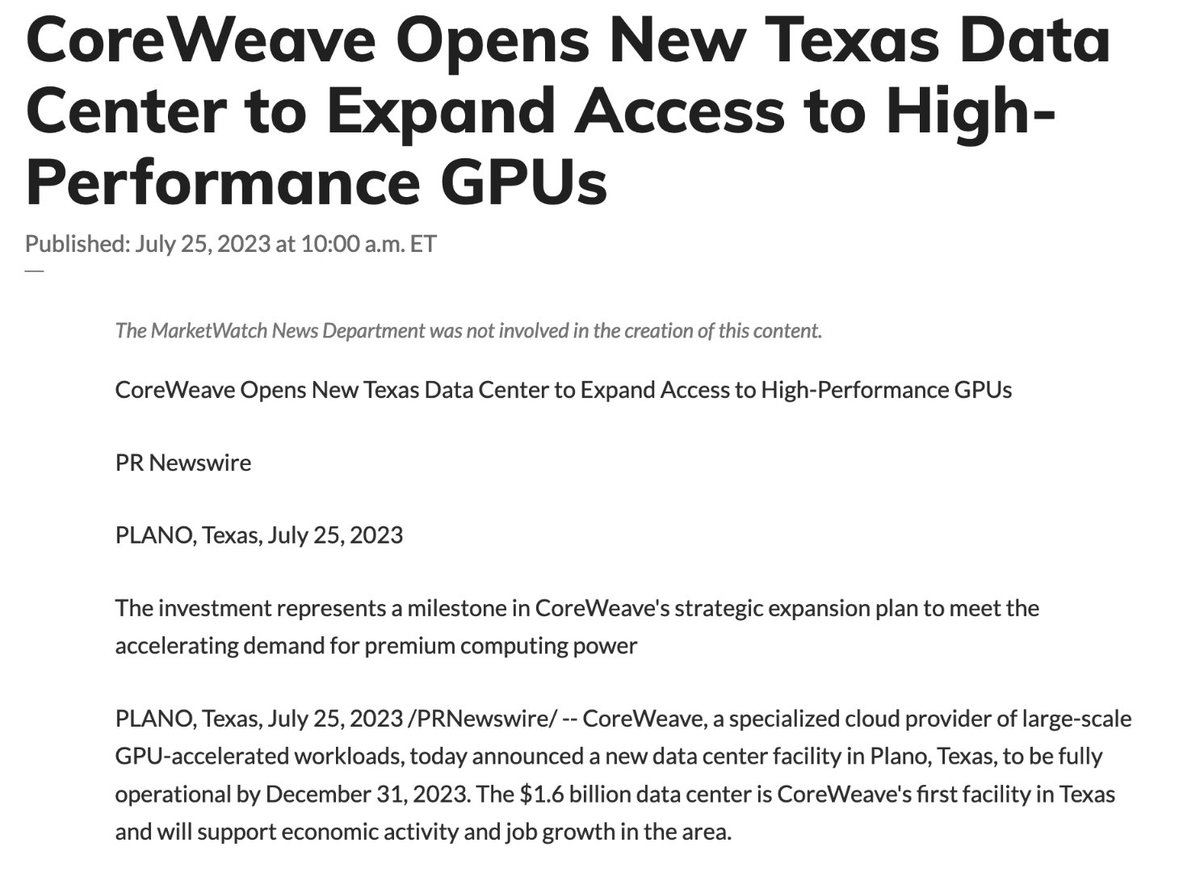

"But CoreWeave doesn't even have an office"

I suppose opening another new data center, to be operational by the end of this year, doesn't count either?

I suppose opening another new data center, to be operational by the end of this year, doesn't count either?

"But CoreWeave's business must be a fraud because ___insert reason here___"

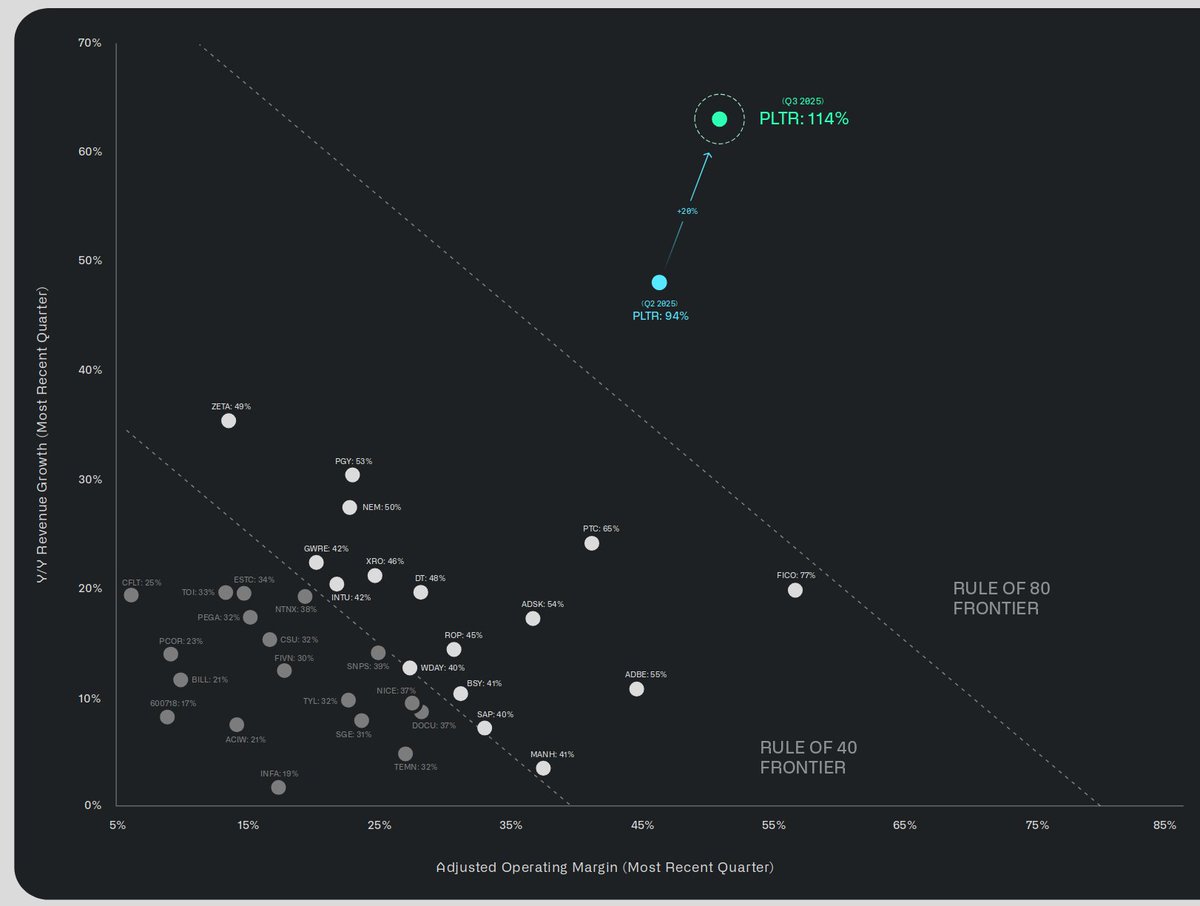

The reality is that all signs point to a company that is actually hyperscaling.

You don't have to like it, or even understand it. But it does help to at least do a little research.

The reality is that all signs point to a company that is actually hyperscaling.

You don't have to like it, or even understand it. But it does help to at least do a little research.

If only there were a rational explanation for the CoreWeave growth story.

1) One of the first vendors to offer H100s in the cloud

2) Much of their GPU inventory to lease is already allocated to existing clients

3) They can't get their hands on enough chips to meet demand

1) One of the first vendors to offer H100s in the cloud

2) Much of their GPU inventory to lease is already allocated to existing clients

3) They can't get their hands on enough chips to meet demand

Hard to imagine why a company that was among the first to offer H100s would have any kind of lead in the GPU-accelerated cloud space, right?

.... right?

.... right?

• • •

Missing some Tweet in this thread? You can try to

force a refresh