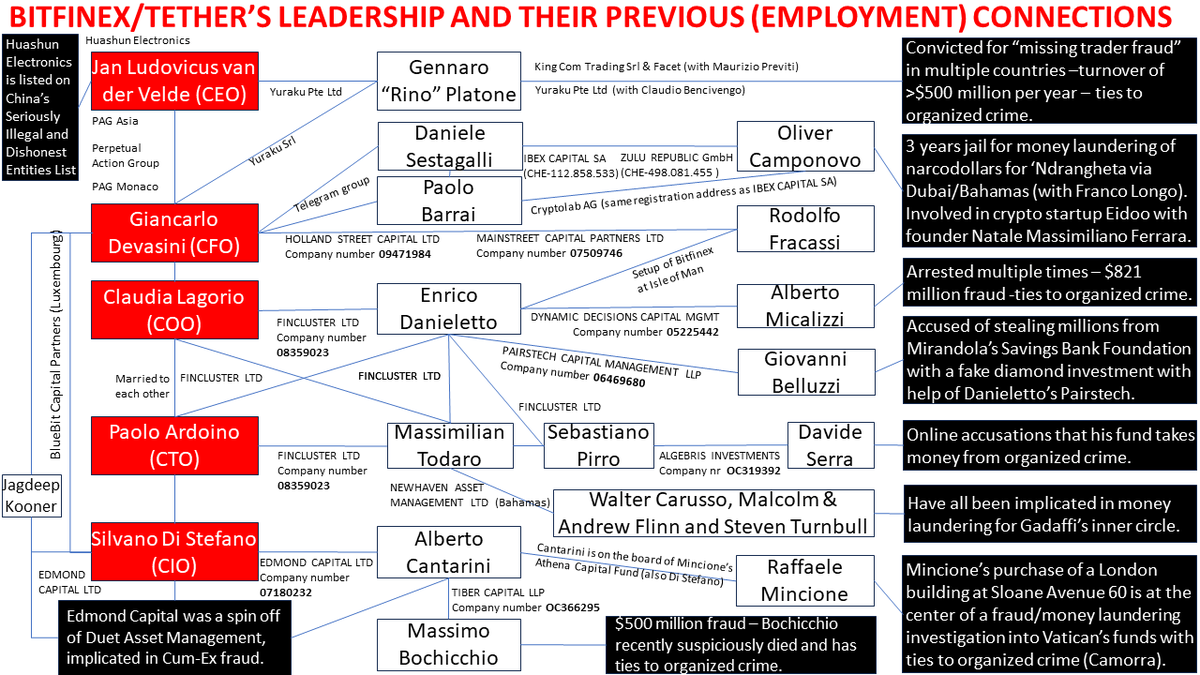

1/ Tether is the largest stablecoin owned by iFinex which also operates Bitfinex. As such, it’s a very important pillar underlying the crypto ecosystem. We mapped previous employment relationships of BitFinex/Tether’s CXOs and it shows a large network of financial fraud. A big🧵

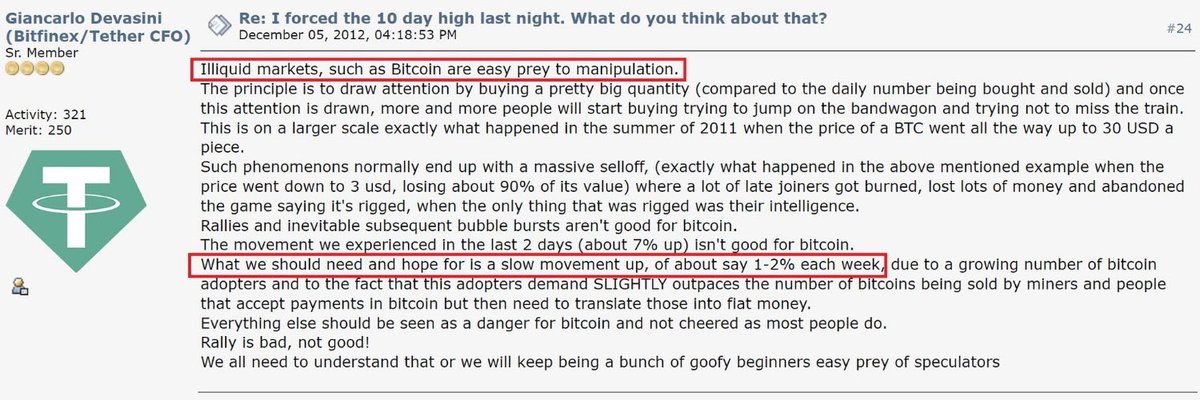

2/ That both main founders of Bitfinex/Tether have a checkered history was already known. Devasini, a former plastic surgeon, was involved in counterfeiting, patent infringement & commercial fraud. JL vd Velde is banned from ever starting a Chinese company after financial issues.

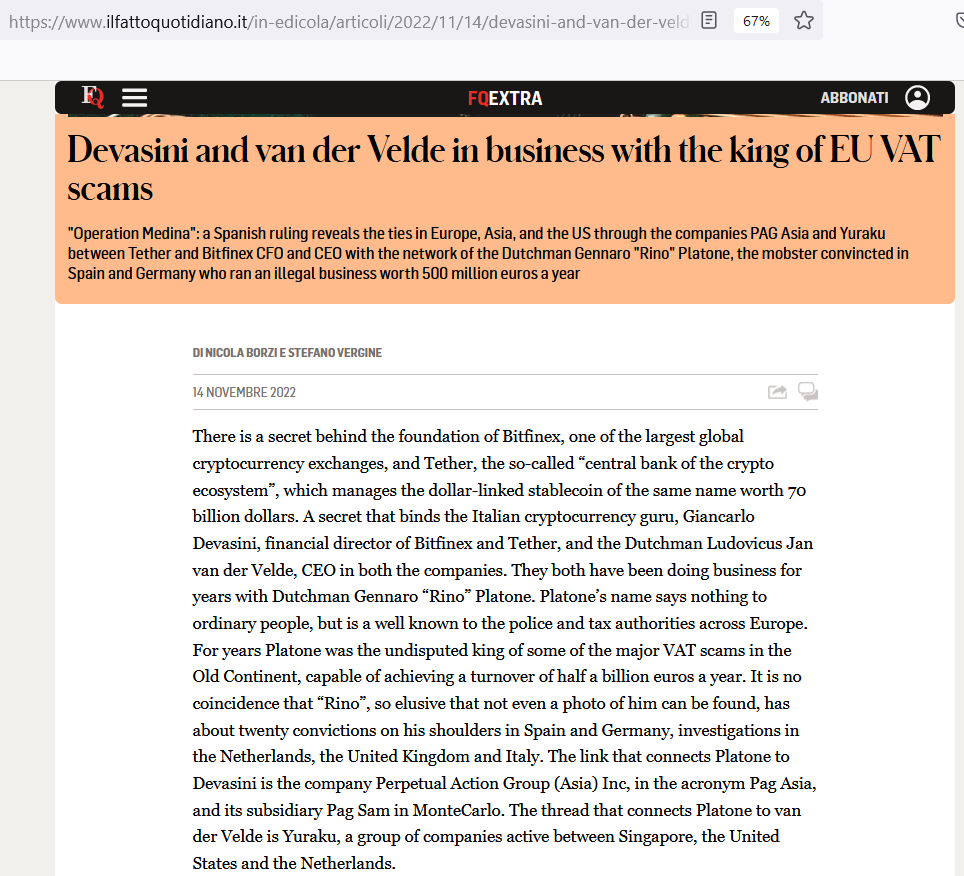

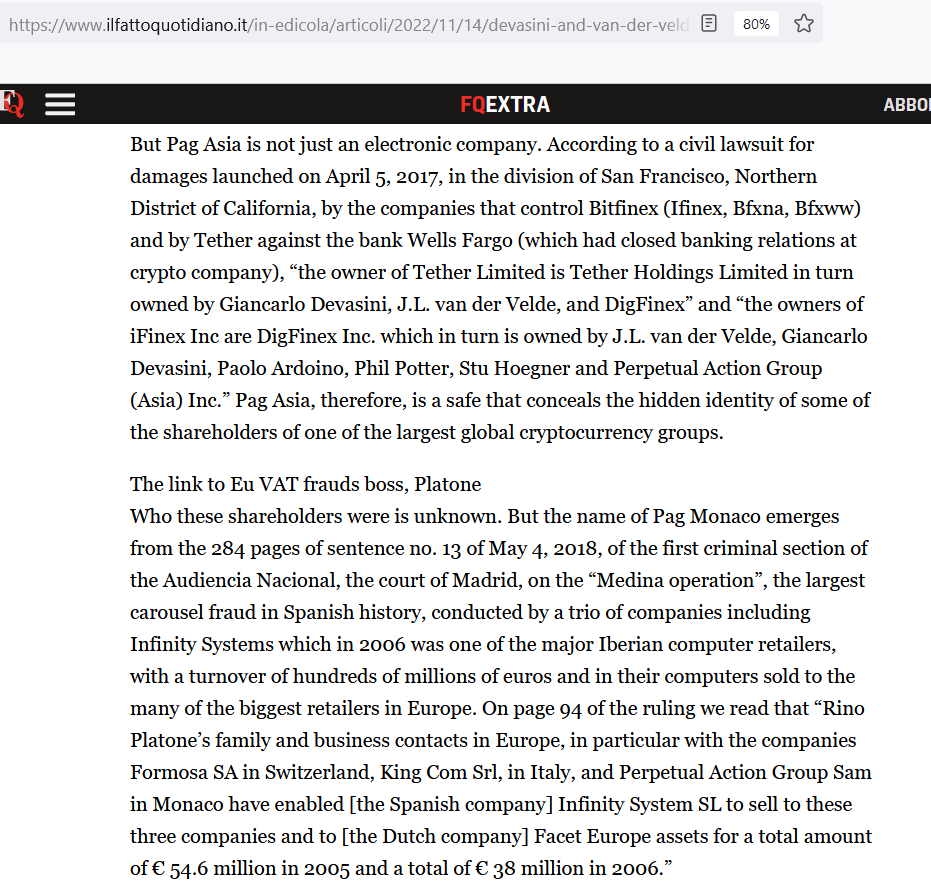

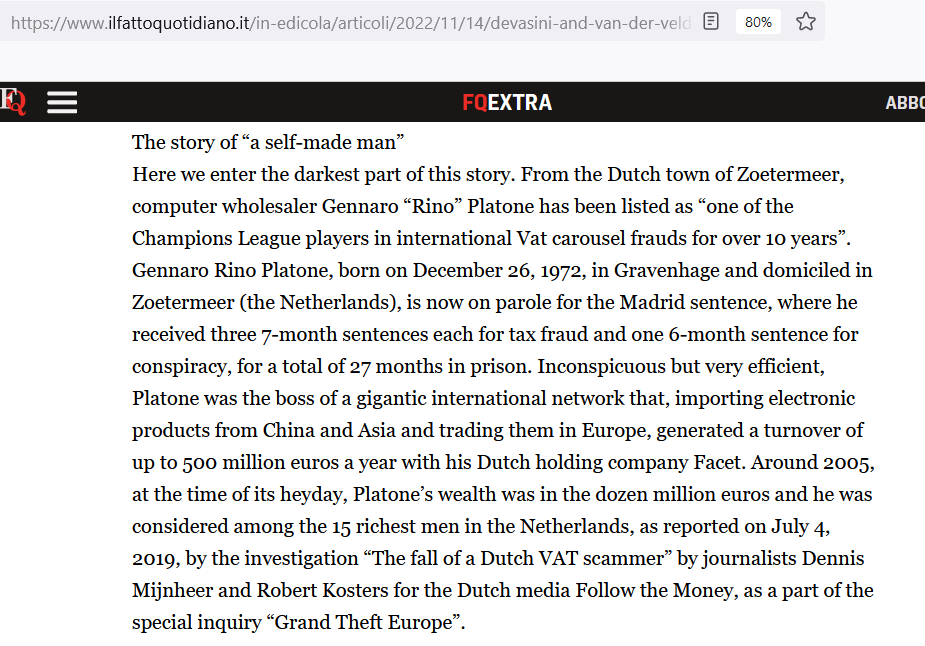

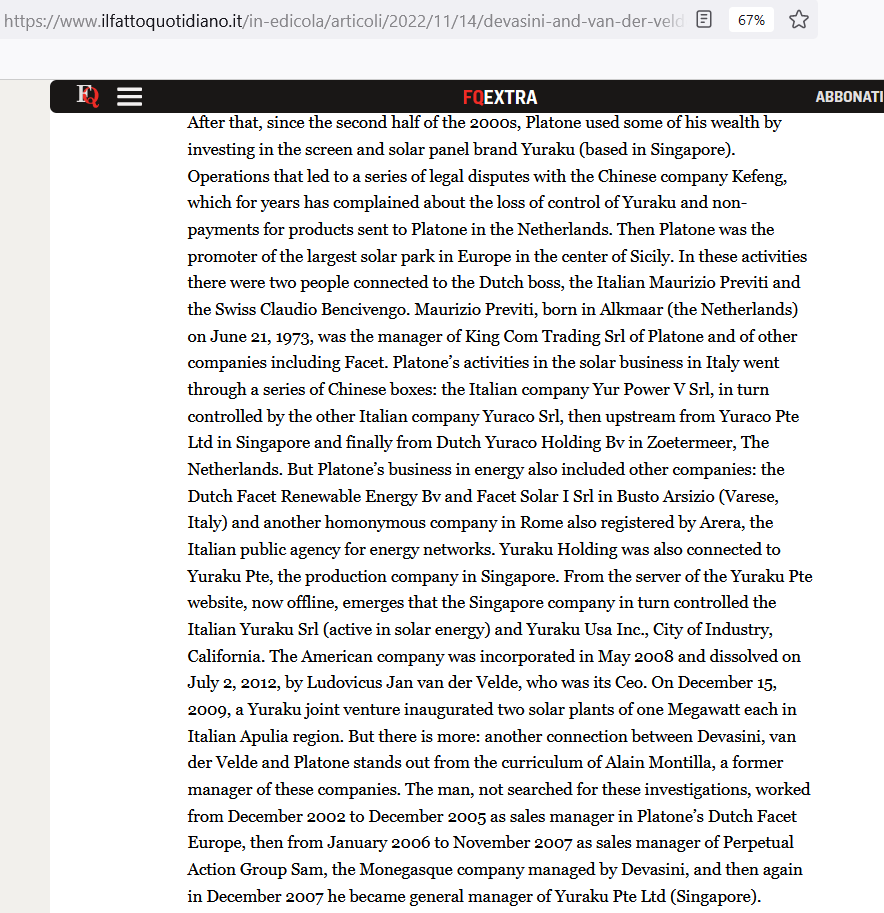

3/ Recently came to light that they both shared a company with the notorious VAT fraud Rino Platone, who has been convicted in Germany/Spain and had a revenue of over $500 million per year. But that is only one of many connections in a complex web with ties to organized crime.

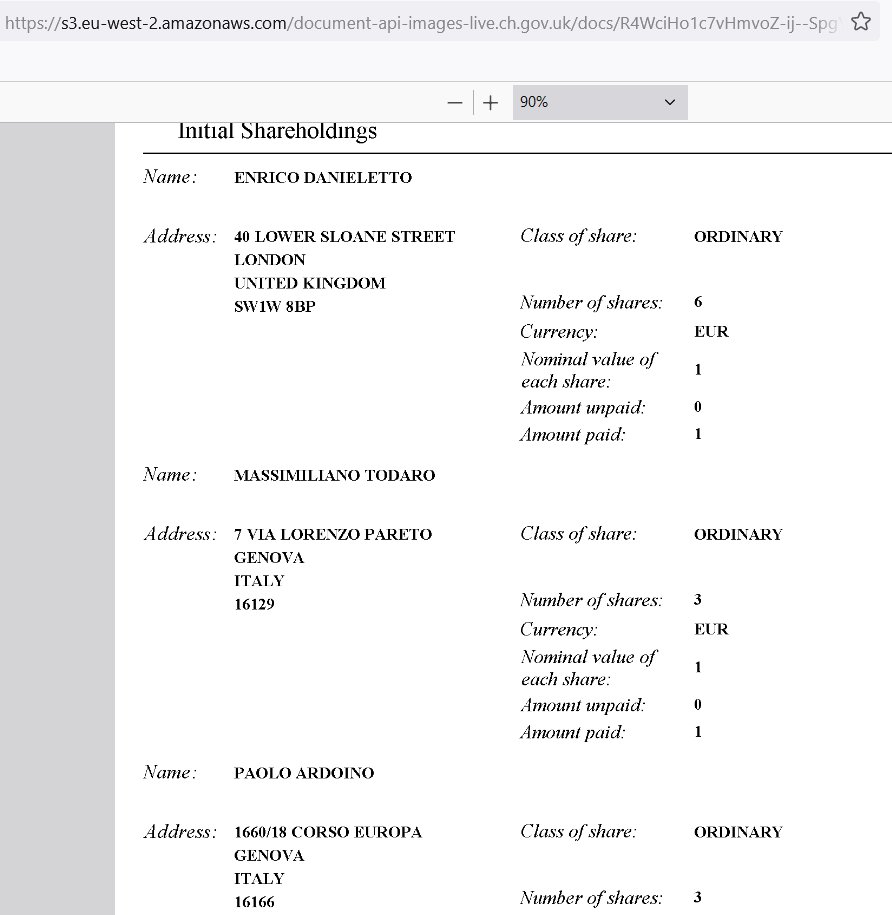

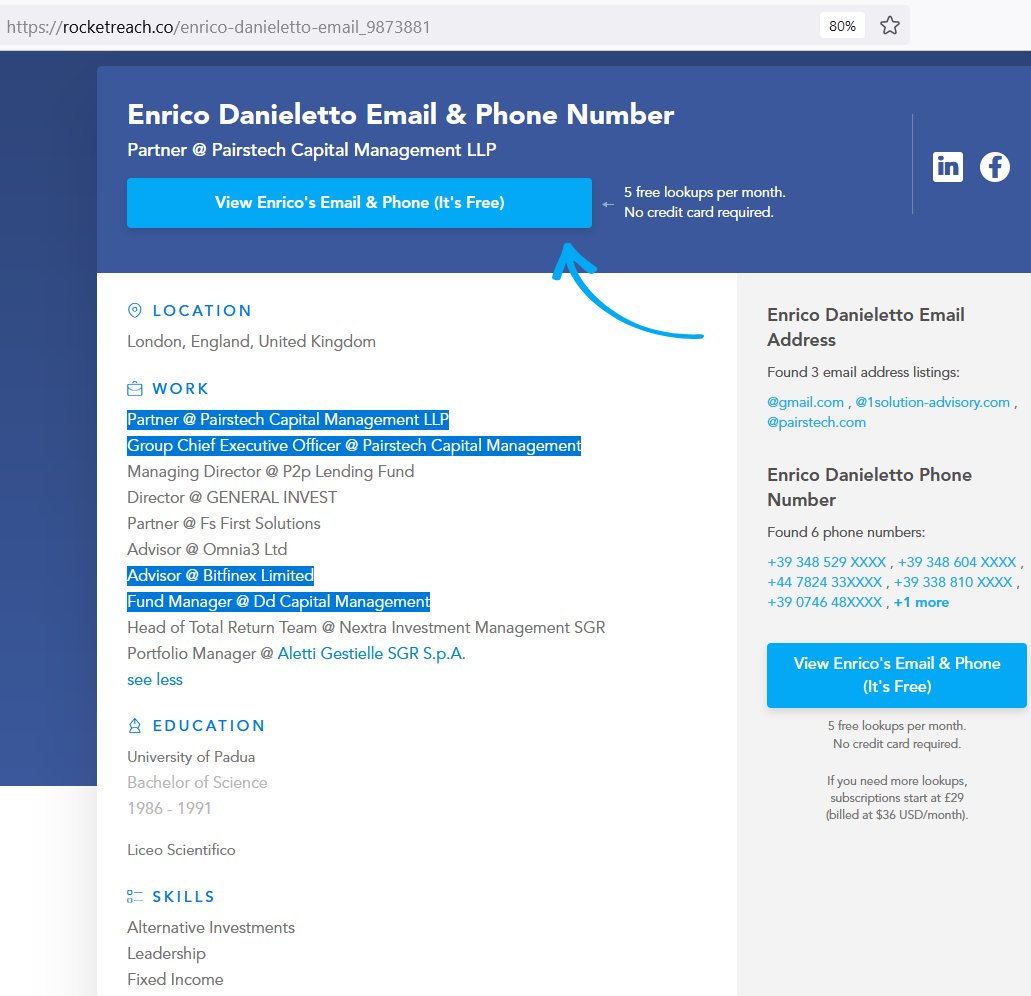

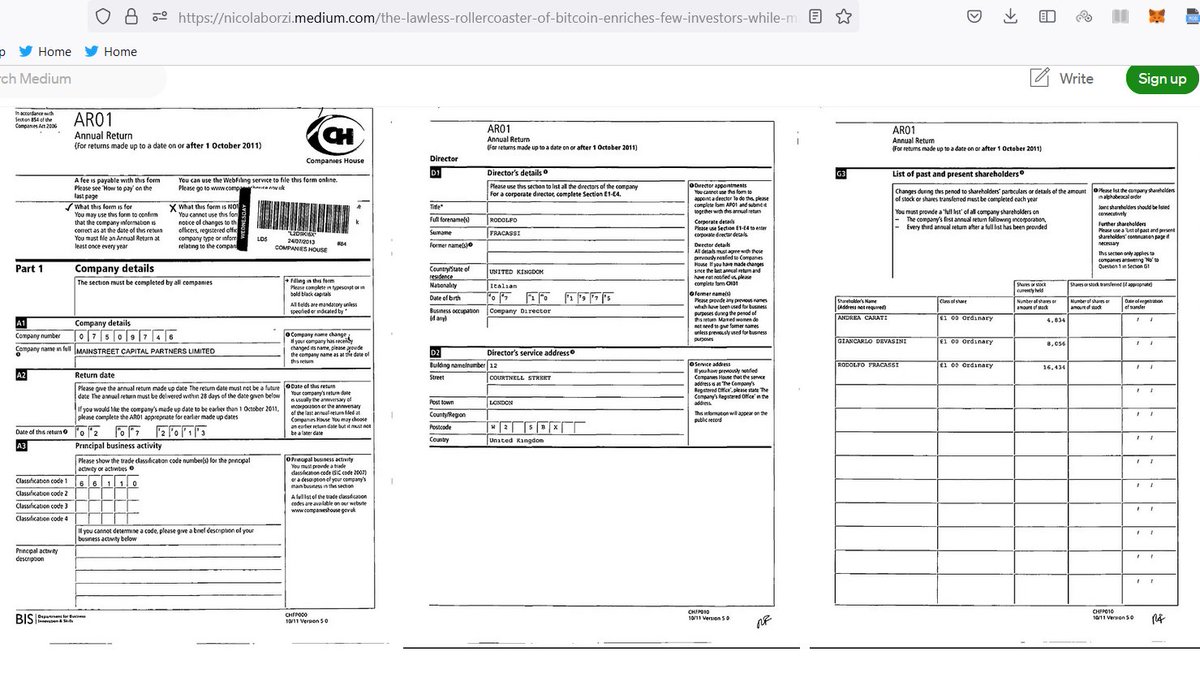

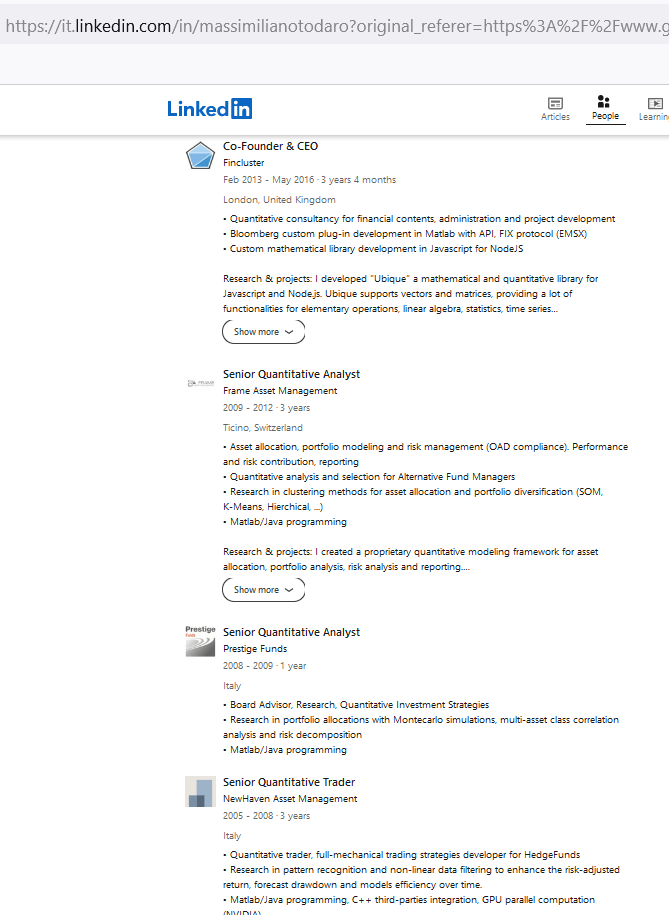

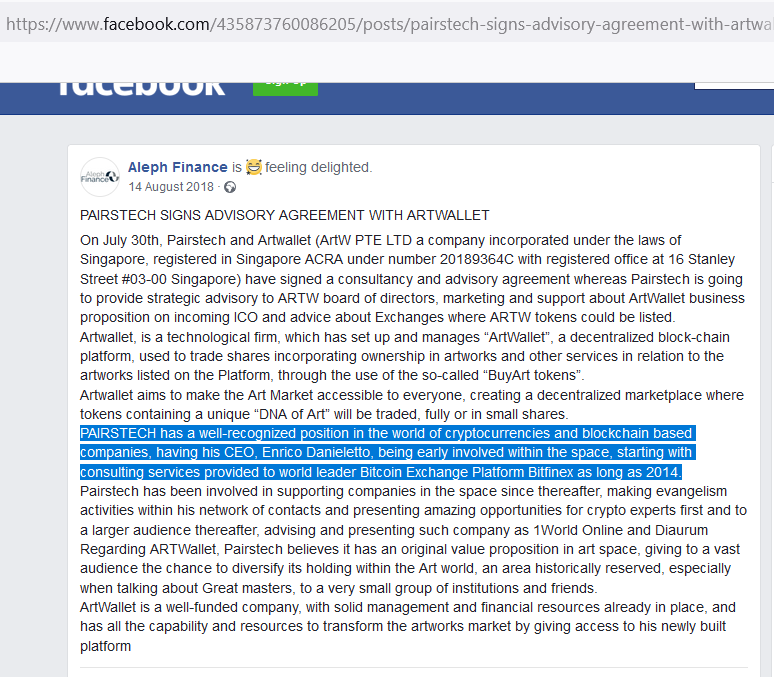

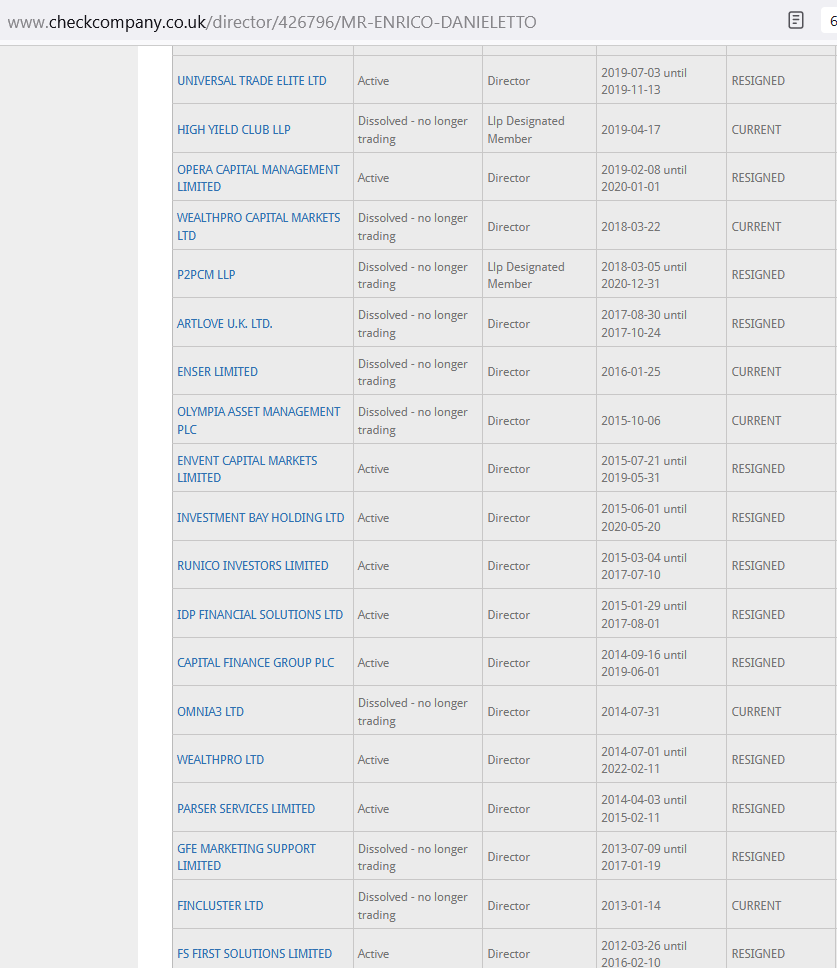

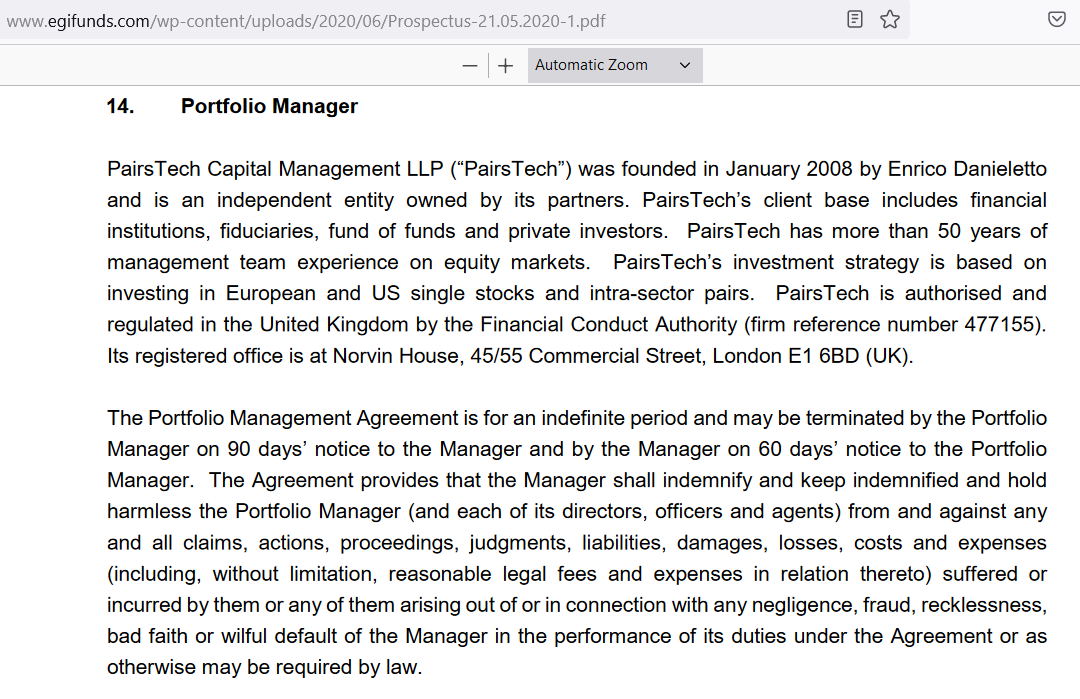

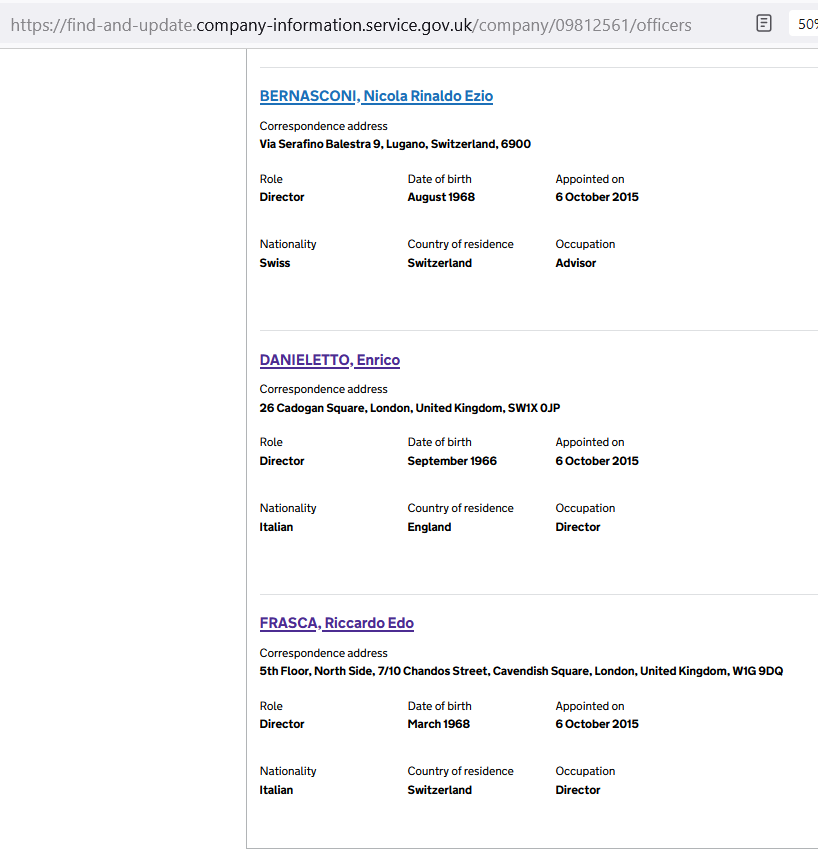

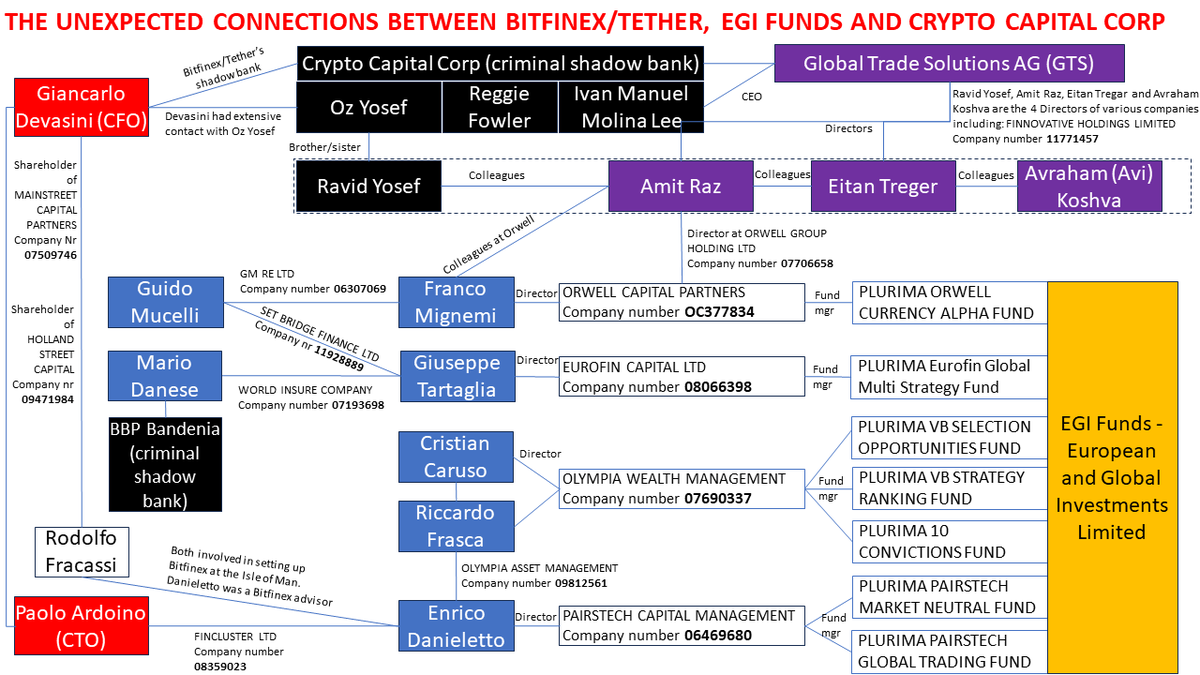

4/ Paolo Ardoino’s previous company was Fincluster that he founded with Enrico Danieletto, who was a BitFinex advisor and who set up Bitfinex in the Isle of Man with Rodolfo Fracassi, who owns 2 companies where Devasini was a shareholder (Holland Street Cap & Mainstreet Capital).

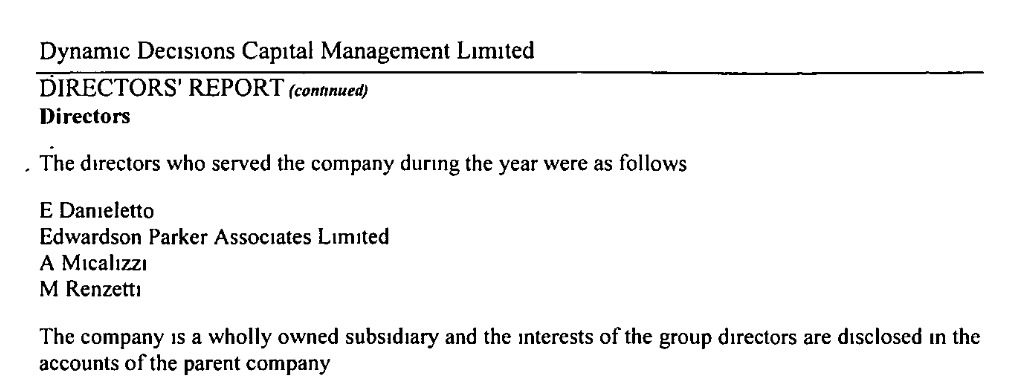

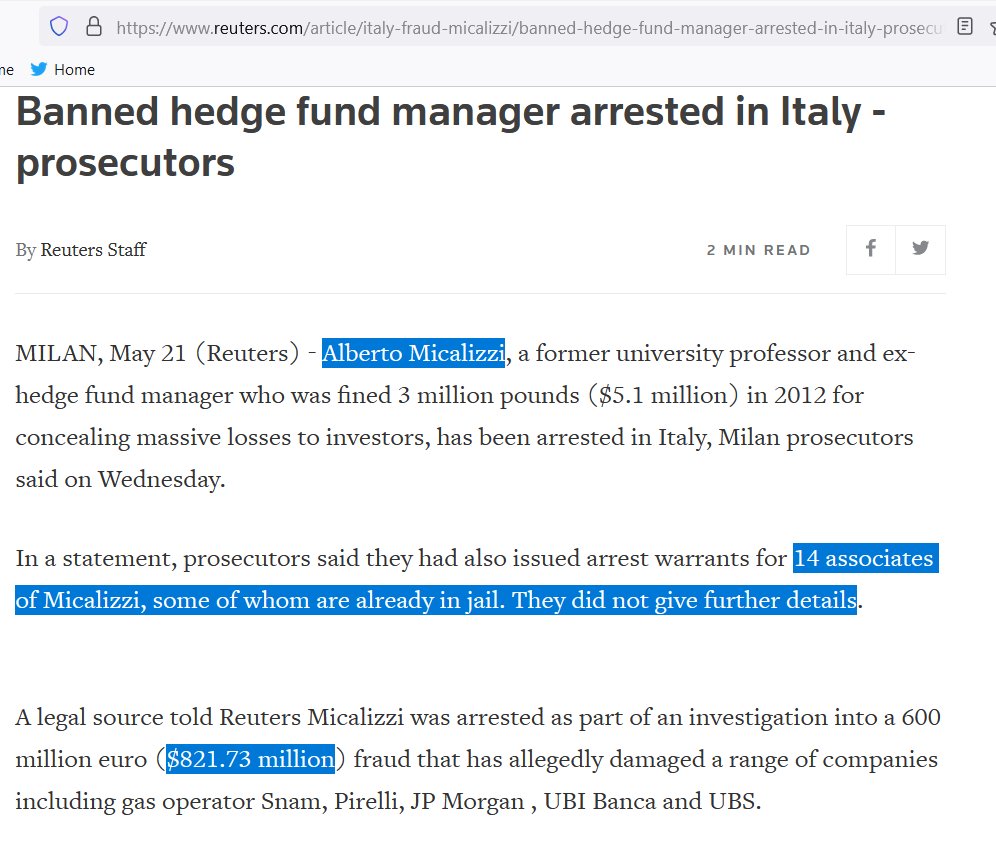

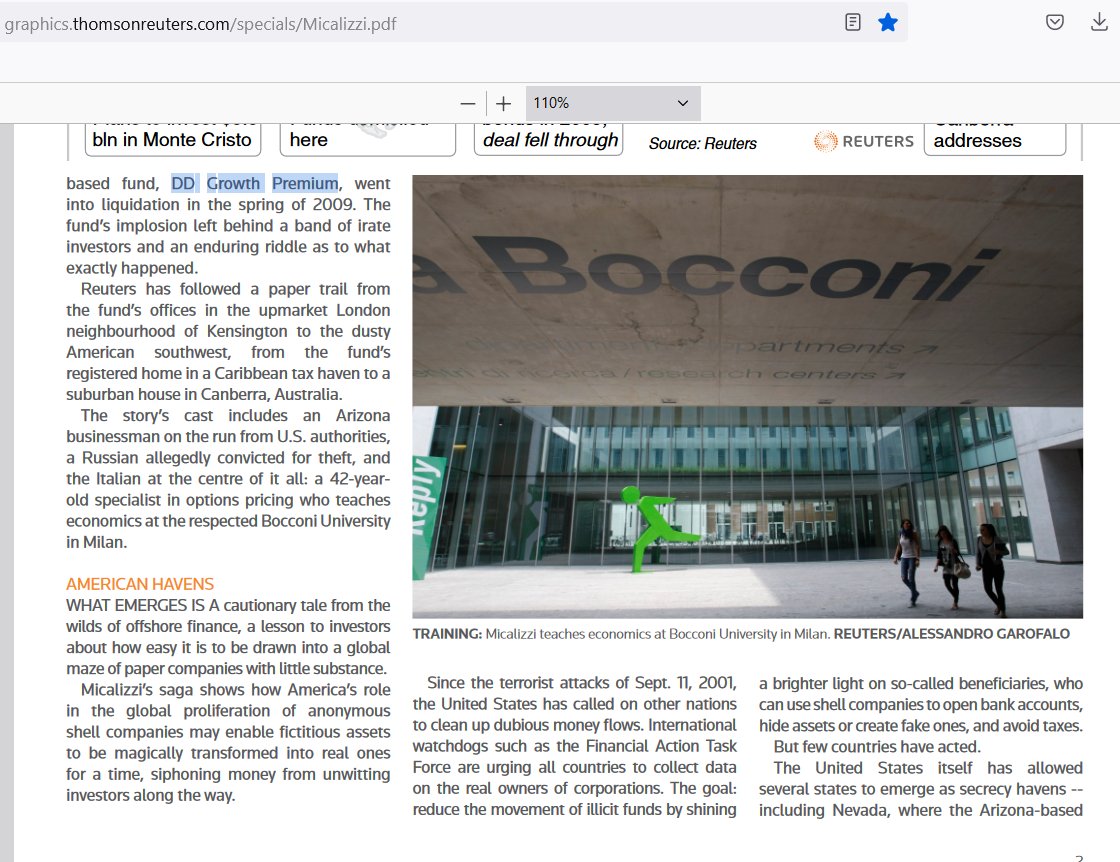

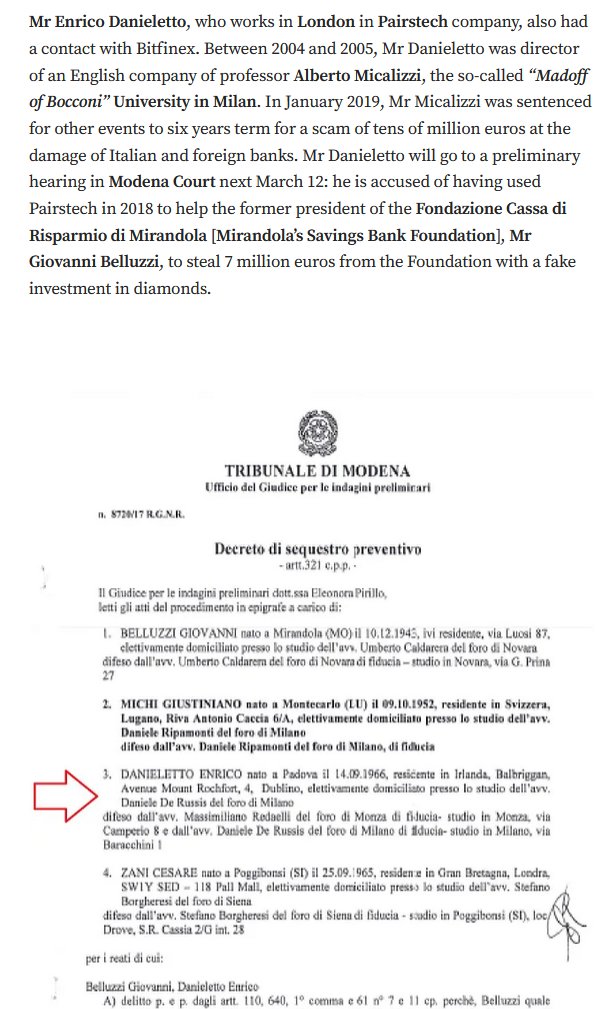

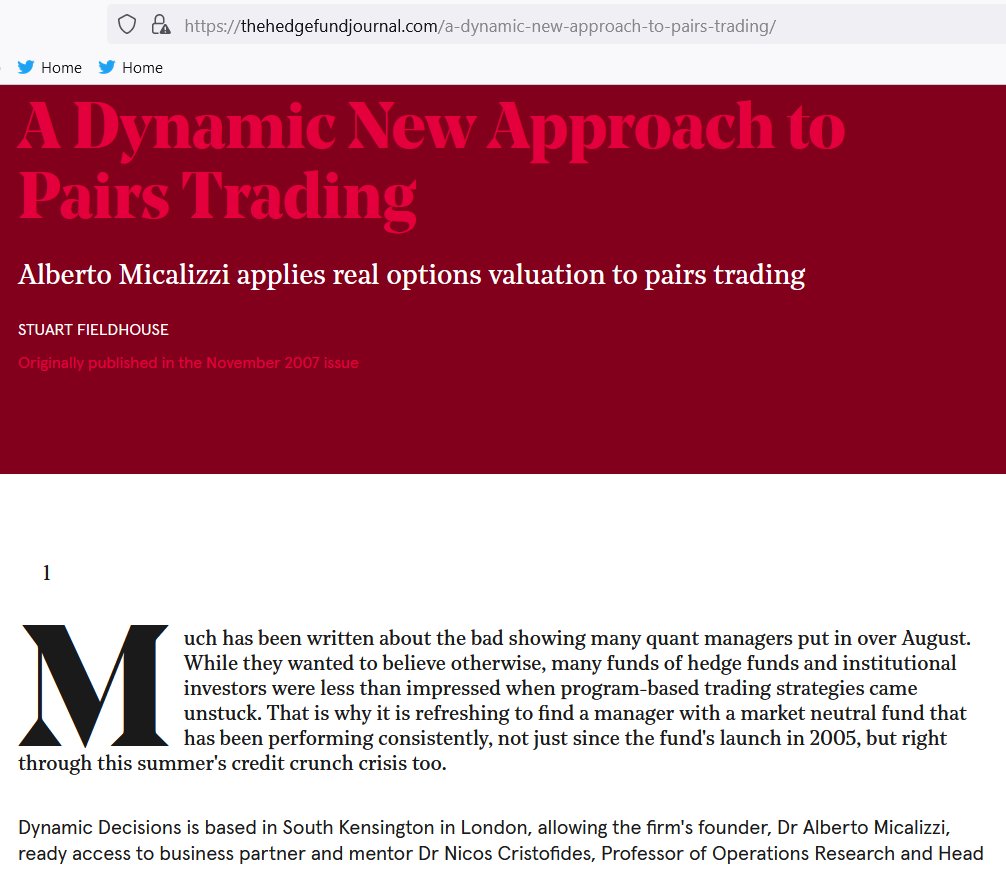

5/ Danieletto founded DD Capital Mgmt with the infamous professor Alberto Micalizzi, convicted for major financial fraud ($840 million) and is accused of having used his company to help Giovanni Belluzzi stealing millions from Mirandola’s Savings Bank Fnd. with a fake investment.

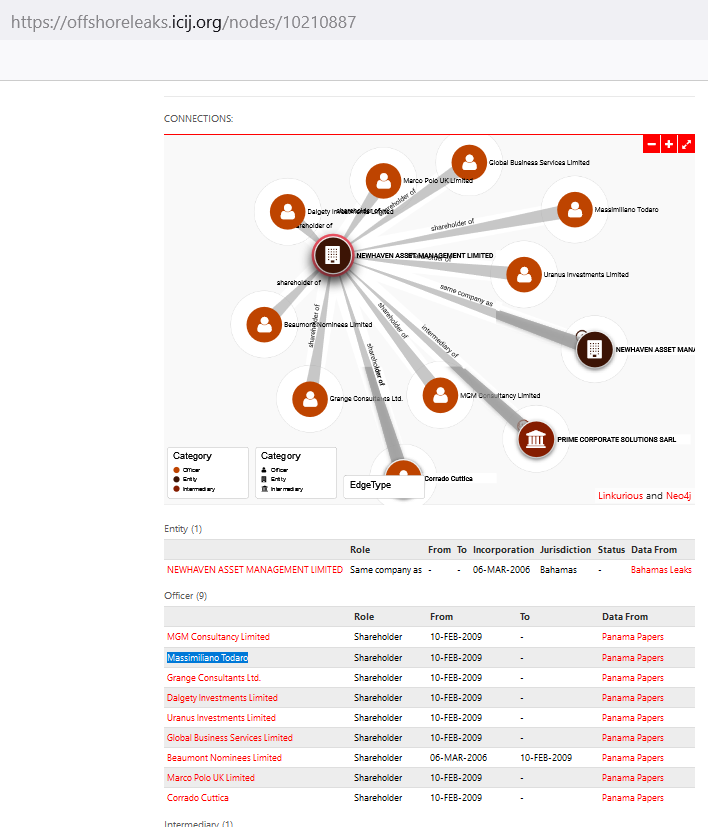

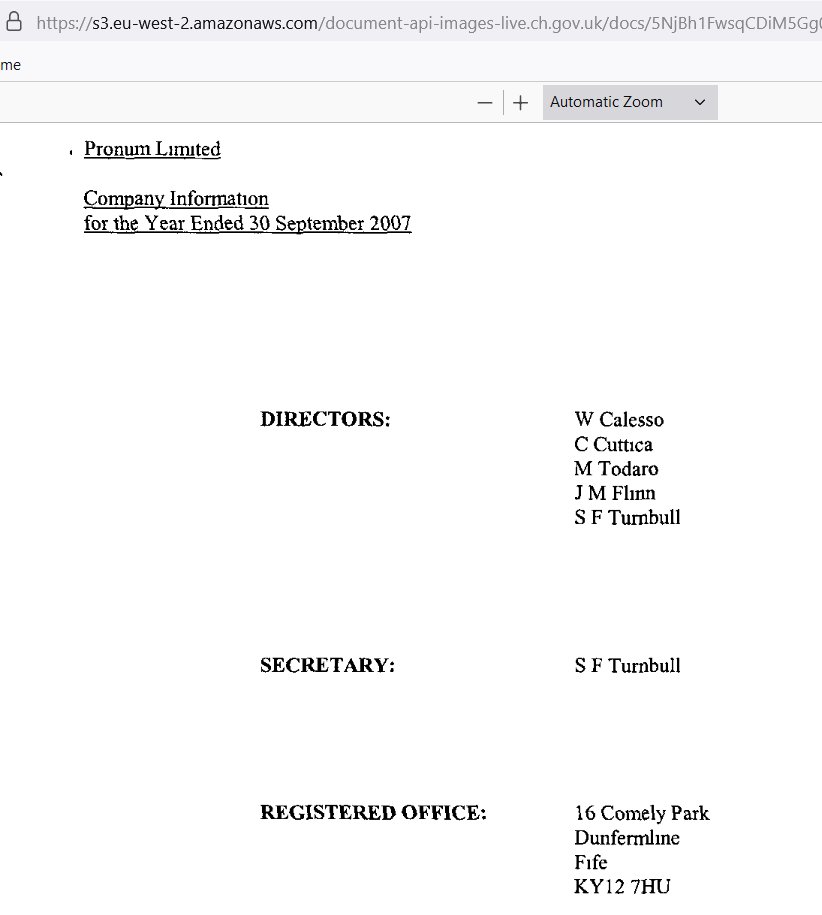

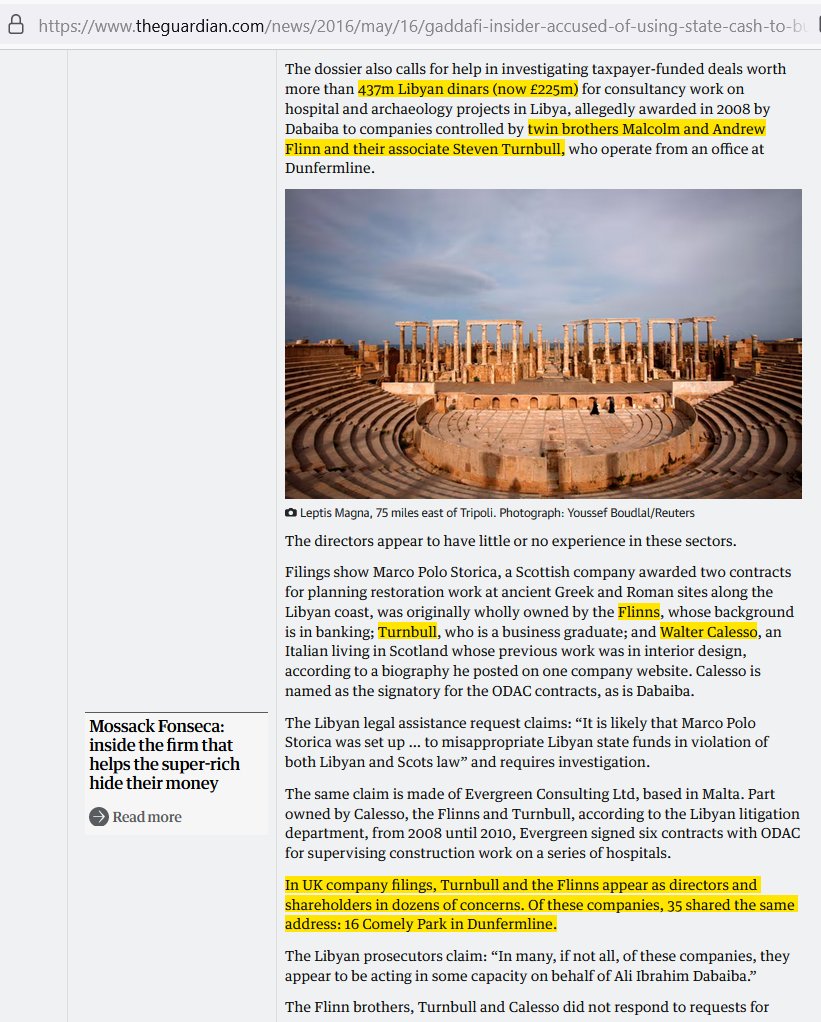

6/ Massimiliano Todaro, Ardoino’s other partner, was involved in companies with brothers Malcolm & Andrew Flinn and Steven Turnbull, who have been accused of money laundering > £225m Libyan funds for a Gaddafi friend. These people have registered over 100 companies in the UK.

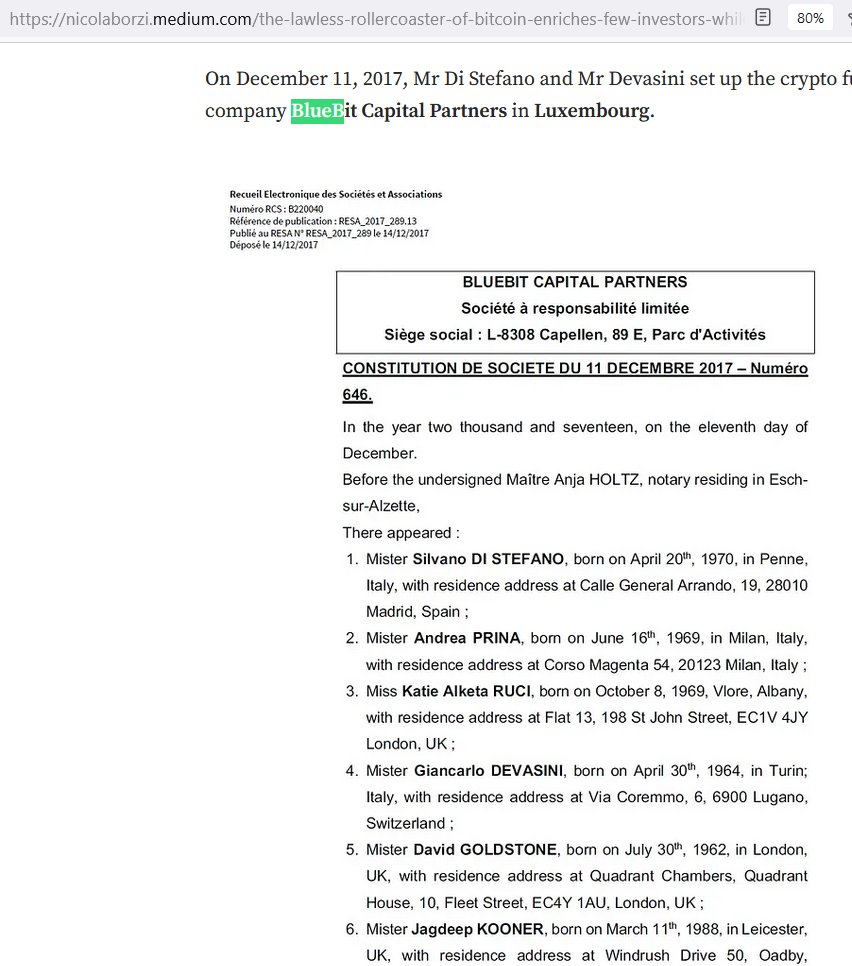

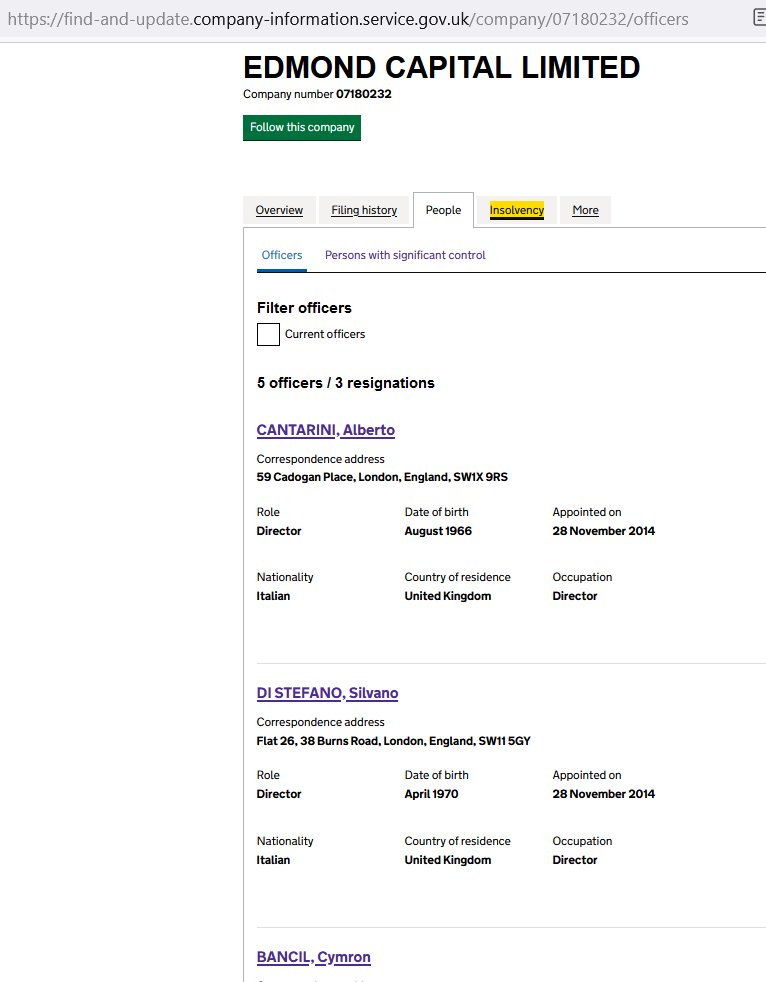

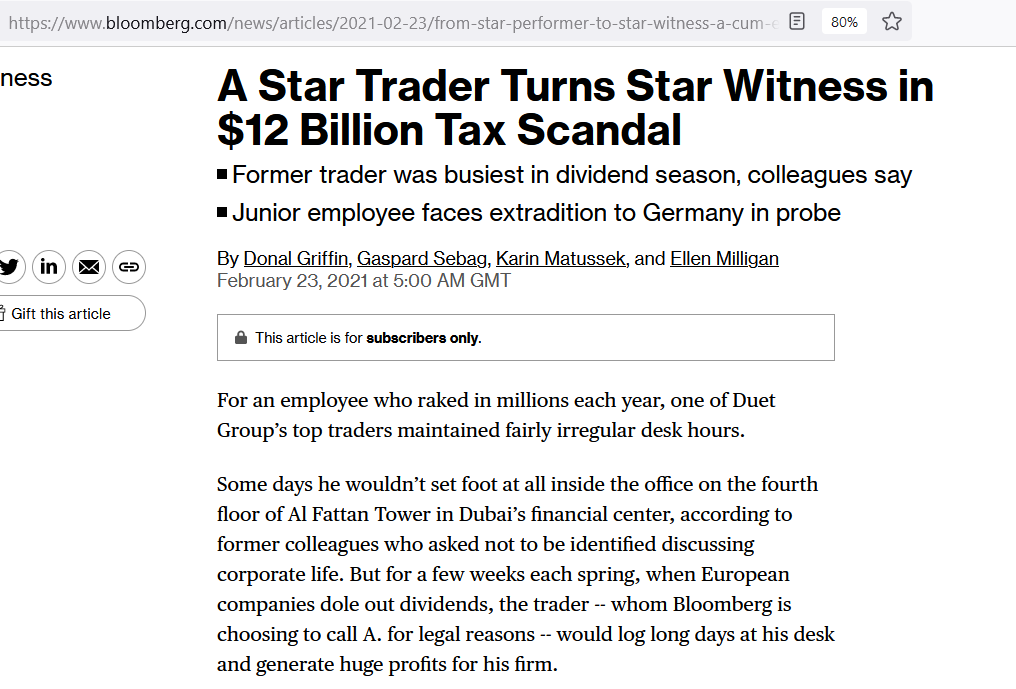

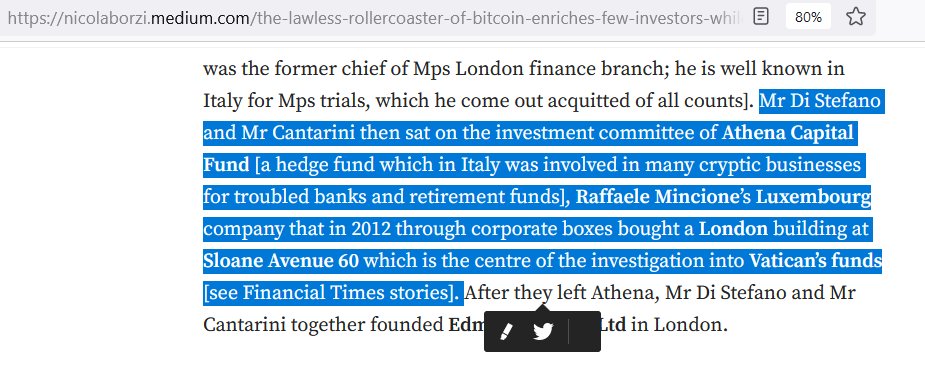

7/ Silvano di Stefano, Tether’s CIO, had a company with Devasini in Luxembourg called BlueBit Capital, together with Jag Kooner. Kooner & Di Stefano, together with Alberto Cantarini were part of Edmond Capital (now insolvent), a spin-off of Duet Group, implicated in Cum-Ex fraud.

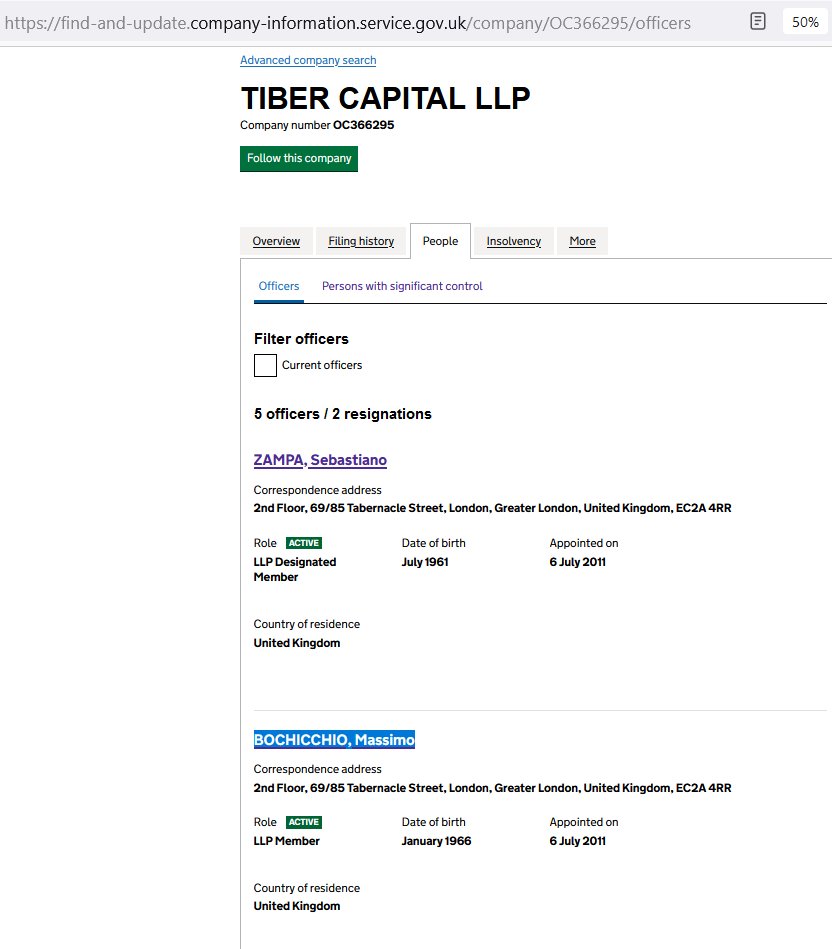

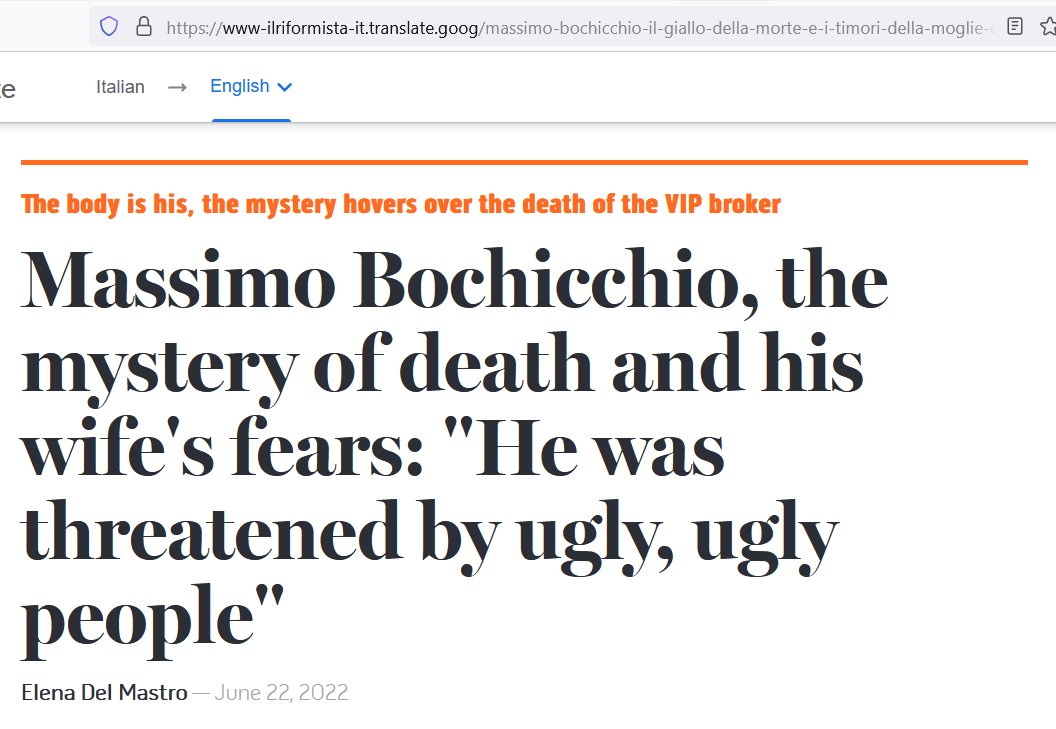

8/ Cantarini was most recently part of Tiber Capital, together with Massimo Bochicchio, a celebrity broker accused of stealing €500 million who recently suspiciously died in a motor accident. His wife mentioned he was threatened by “ugly, ugly people” (read: dangerous mobsters).

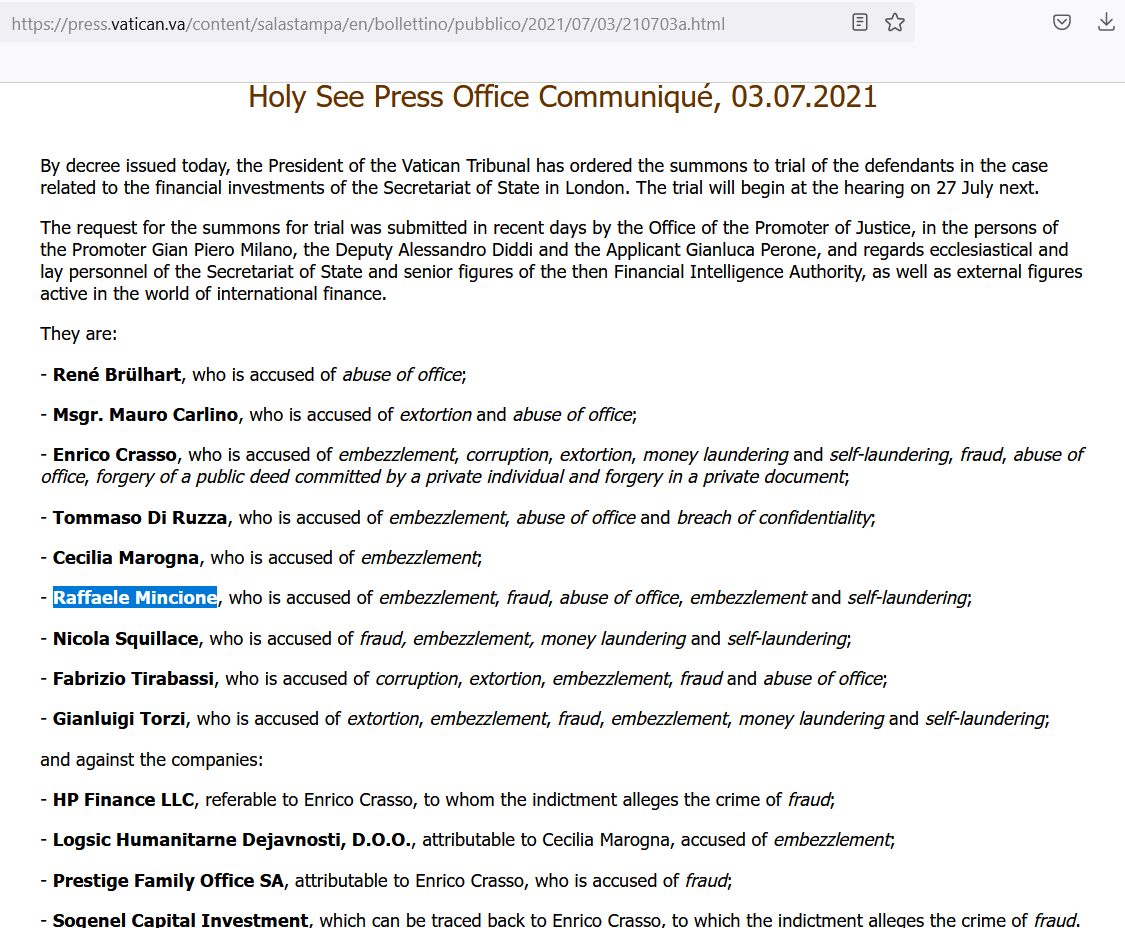

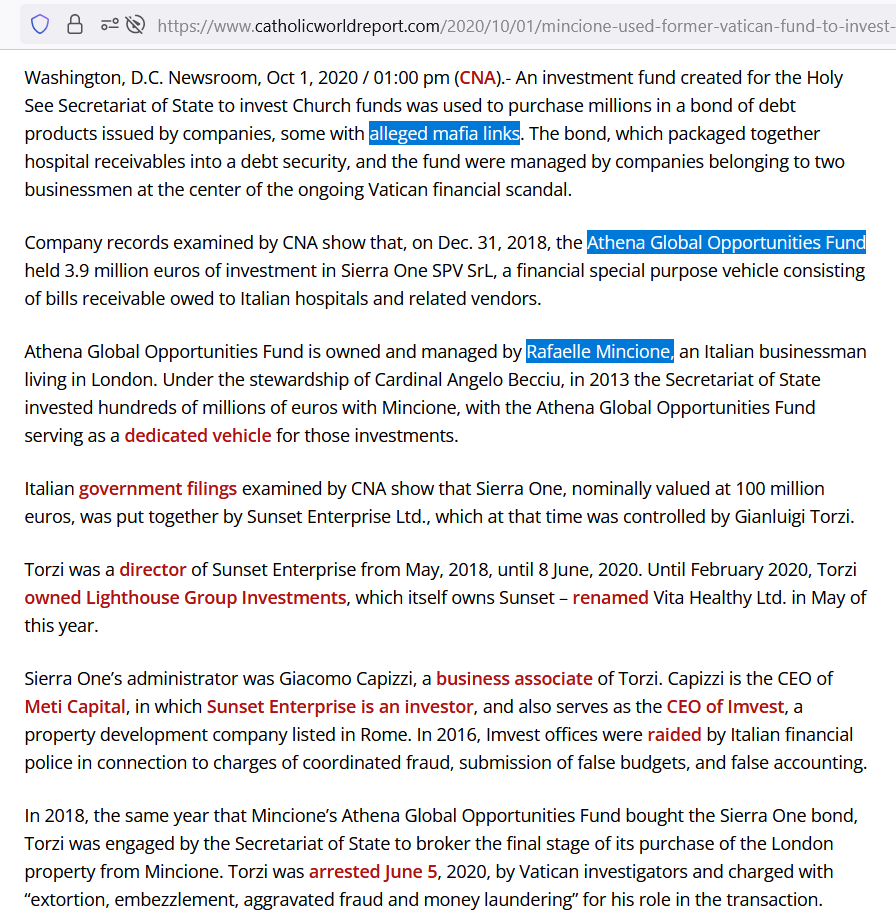

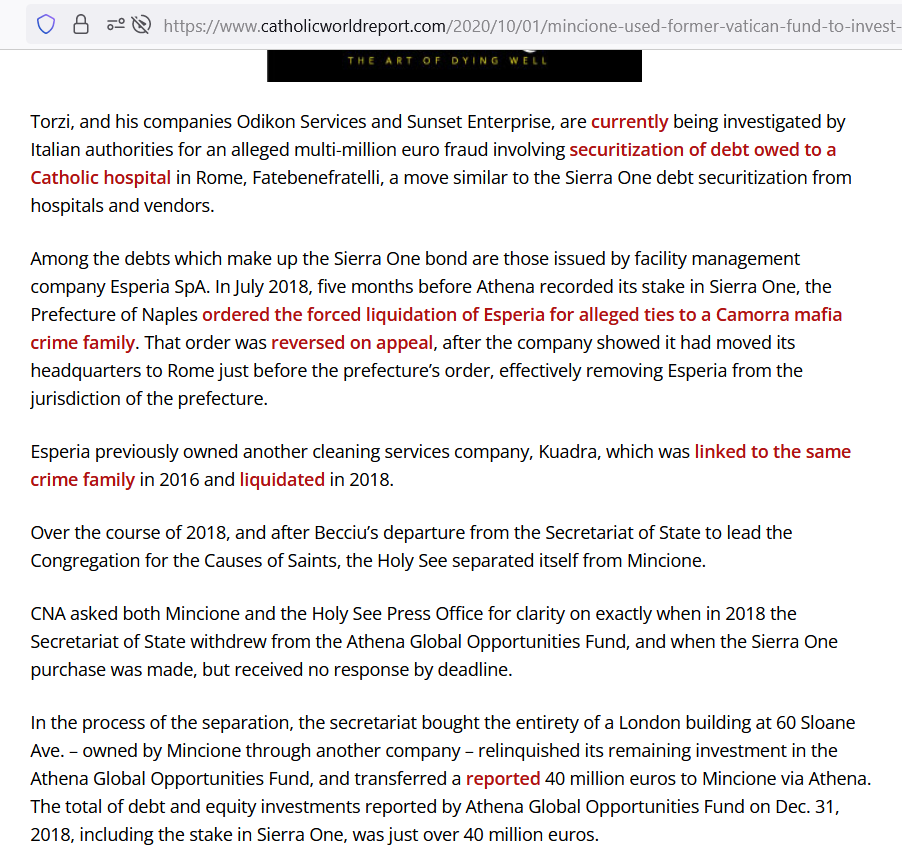

9/ Di Stefano and Cantarini were also part of Athena Capital Fund, managed by the controversial Raffaele Mincione, who has a checkered history and is deeply involved in a major real estate scandal with Vatican funds (fraud & money laundering), with deep ties to organized crime.

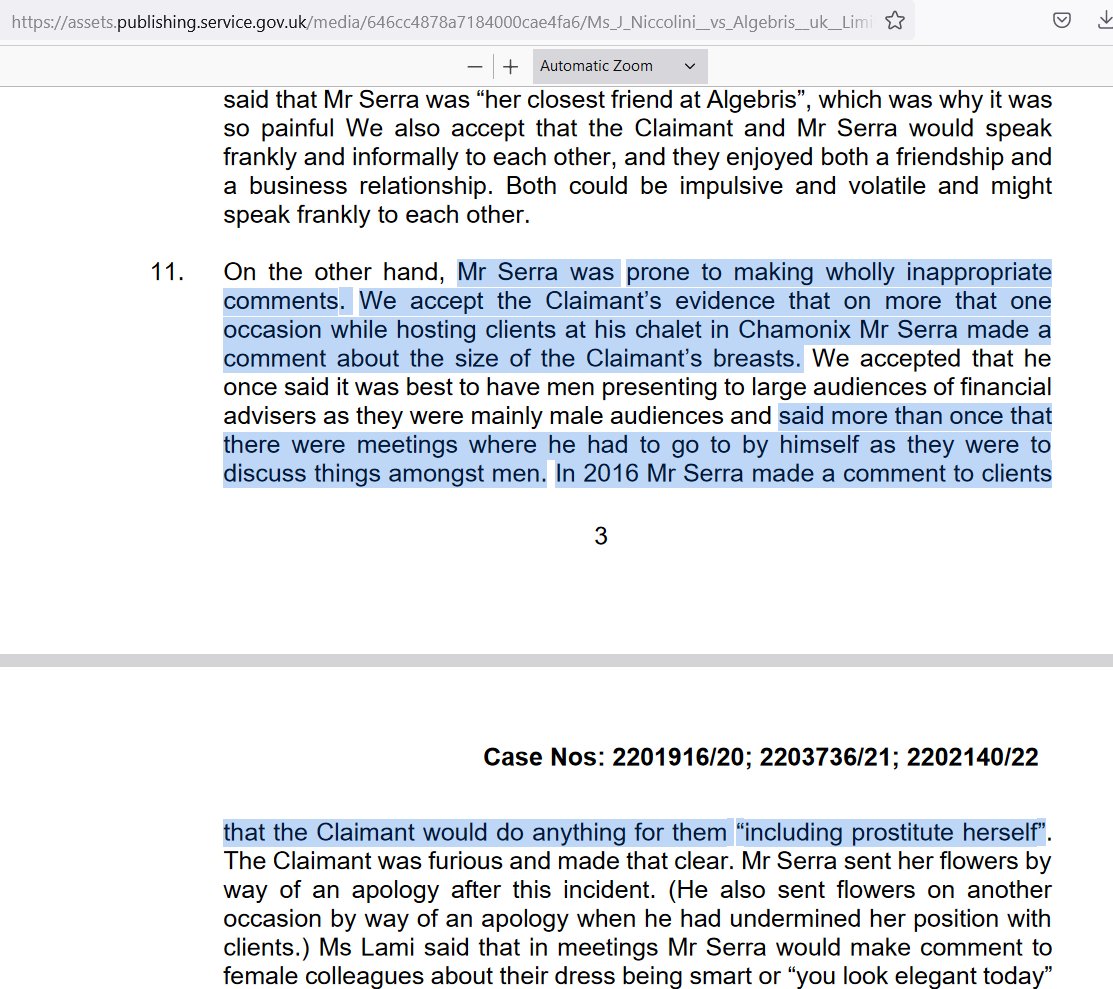

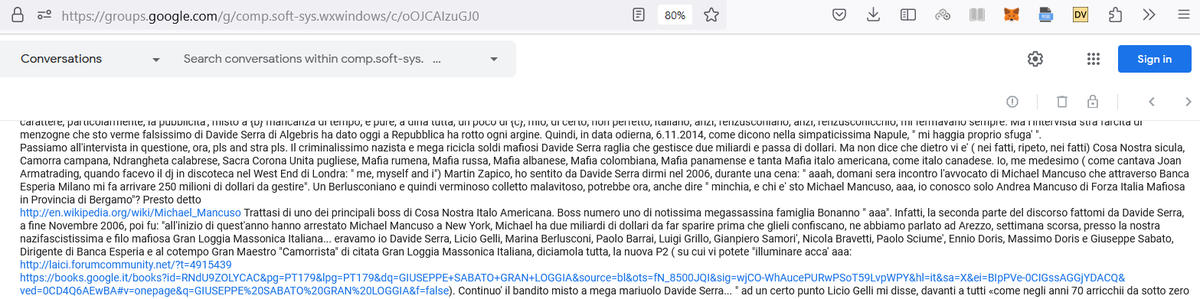

10/ Ardoino’s other partner, Sebastiano Pirro, is now part of Algebris Capital’s Mgmt, whose founder Davide Serra was recently involved in a lawsuit that showed some dubious practices. He is accused online of laundering large amounts of money for organized crime via his funds.

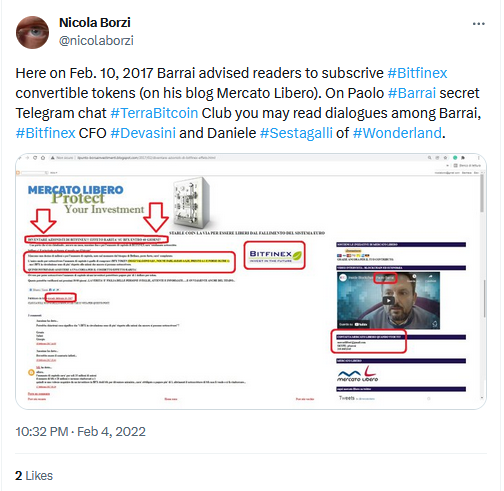

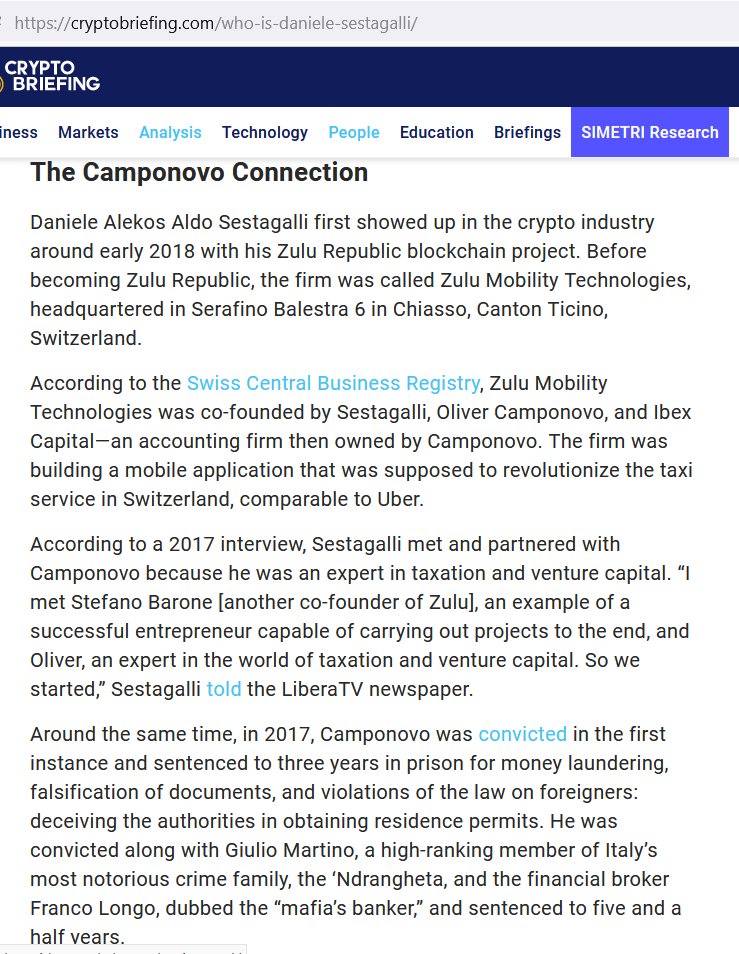

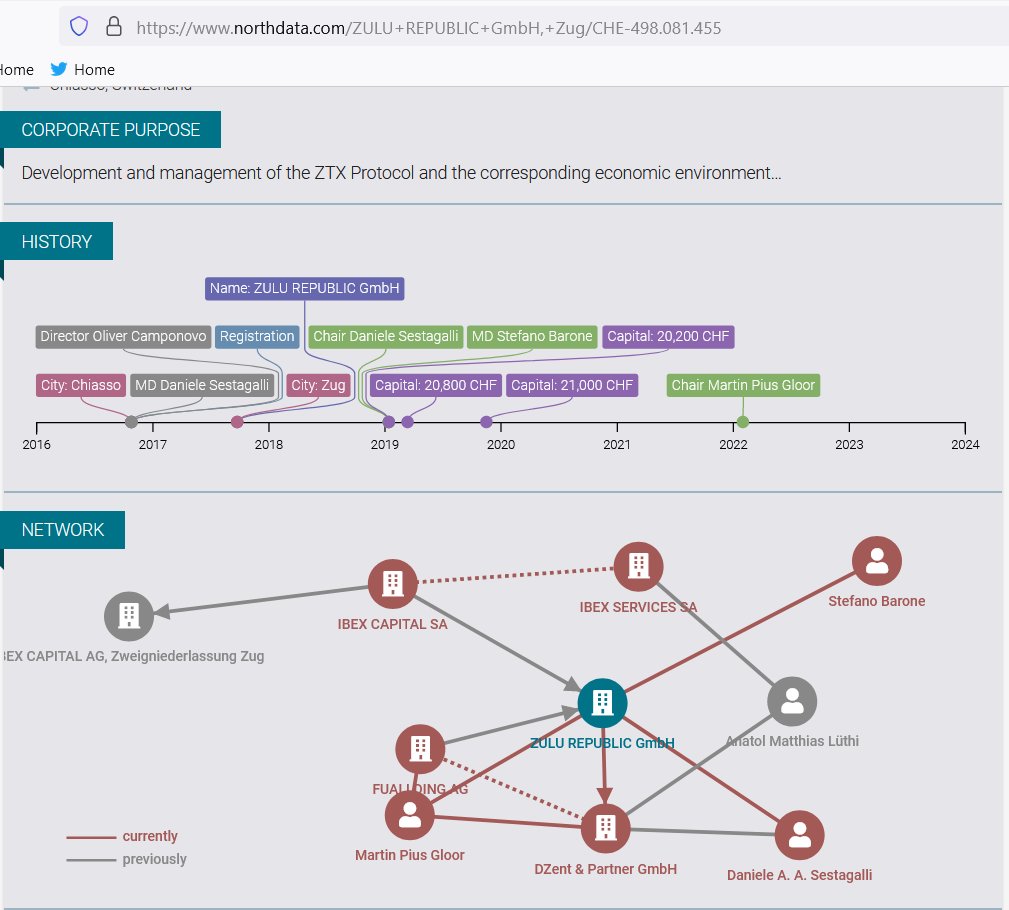

11/ Devasini is associated with Paolo Barrai, who introduced him to Wonderlands’s Daniele Sestagalli. Barrai & Sestagalli are connected via their companies to Oliver Camponovo, who was jailed for 3 years for money laundering of narcodollars for the ‘Ndrangheta via Dubai/Bahamas.

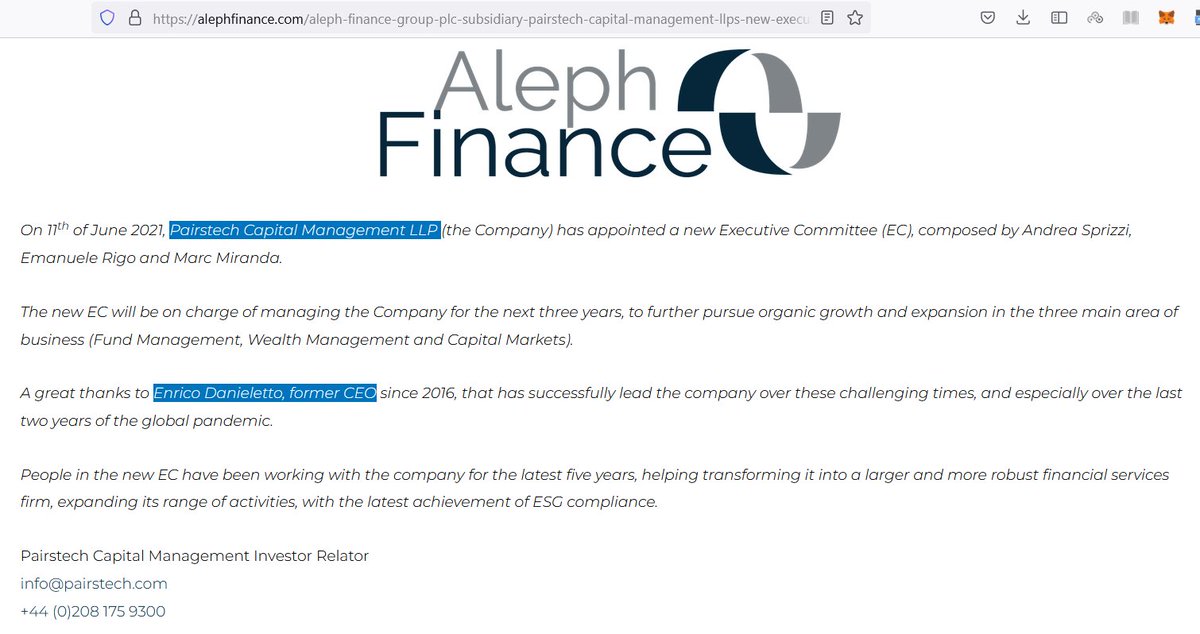

12/ We then zoom in on Danieletto as he was an early Bitfinex advisor & seems to be a spider in this web. He set up around 30 companies in the UK, including Pairstech, a name likely related to a strategy of pairs trading, an expertise of his mentor, the convicted prof. Micalizzi.

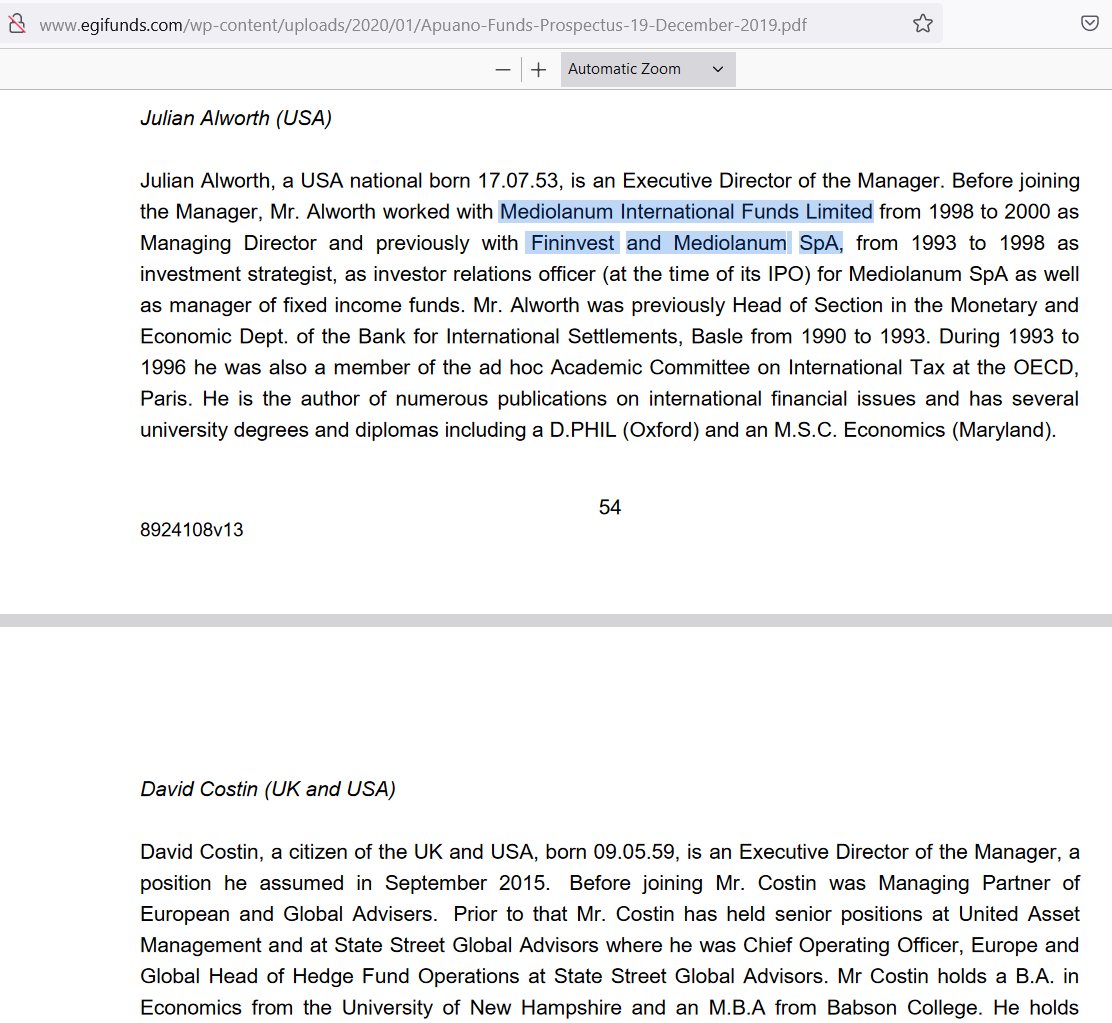

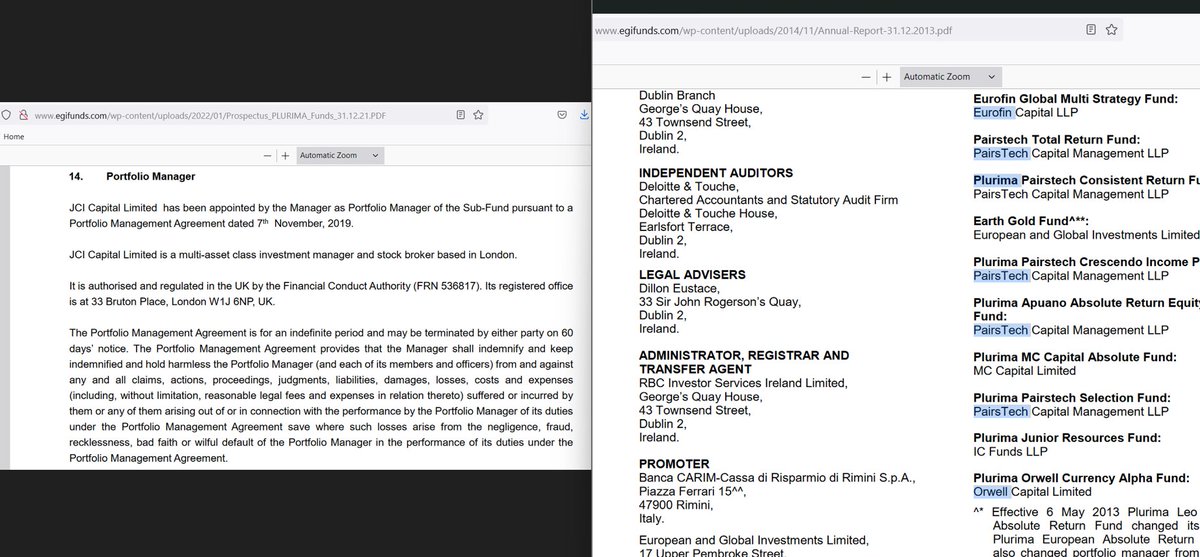

13/ We notice Pairstech is listed in the prospectus of an obscure fund management company called European and Global Investments (EGI), headed by an elusive US/Italian professor who worked for Fininvest, the holding company of Berlusconi, accused of money laundering & mafia ties.

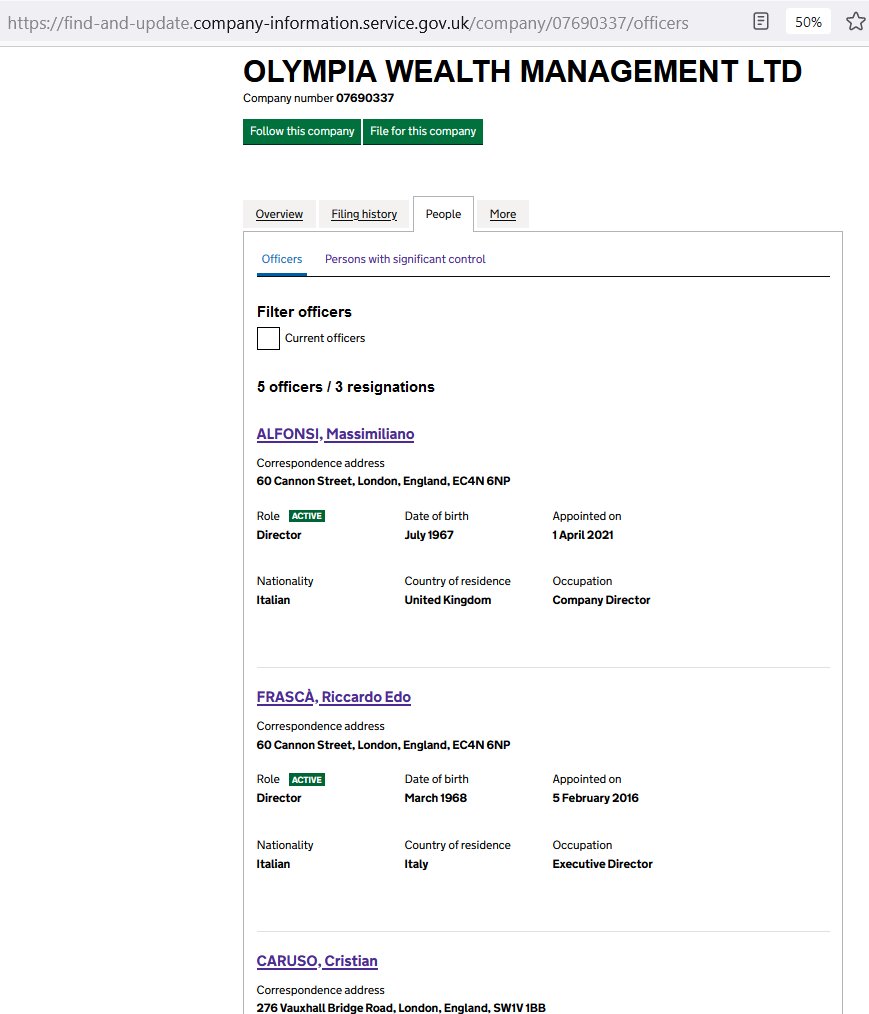

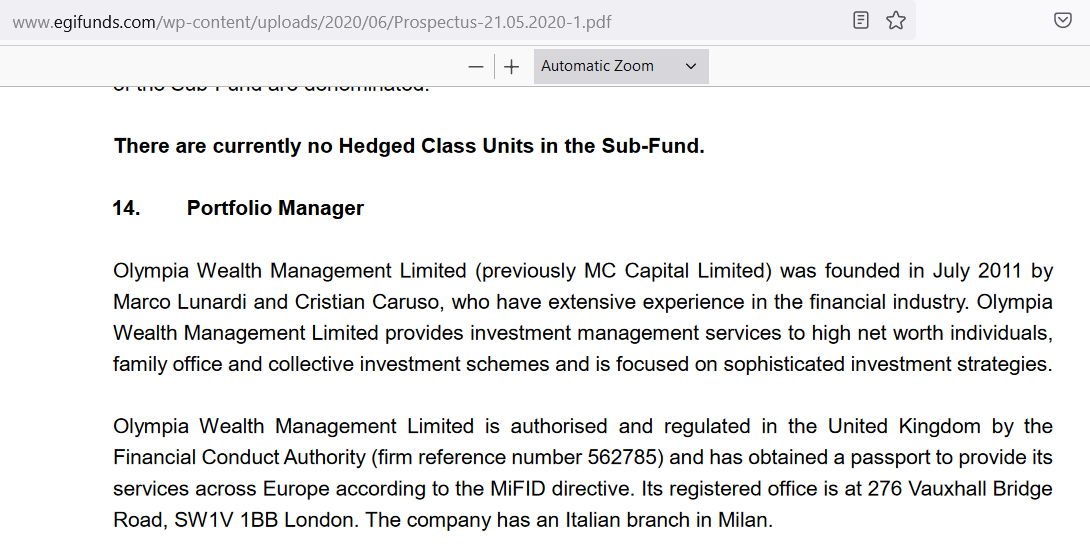

14/ Enrico Danieletto managed multiple EGI PLURIMA funds via his company Pairstech. A business partner of Danieletto, Riccardo Frasca (both part of Olympia Asset Mgmt) worked with Cristian Caruso for Olympia Wealth Management, also responsible for managing multiple EGI funds.

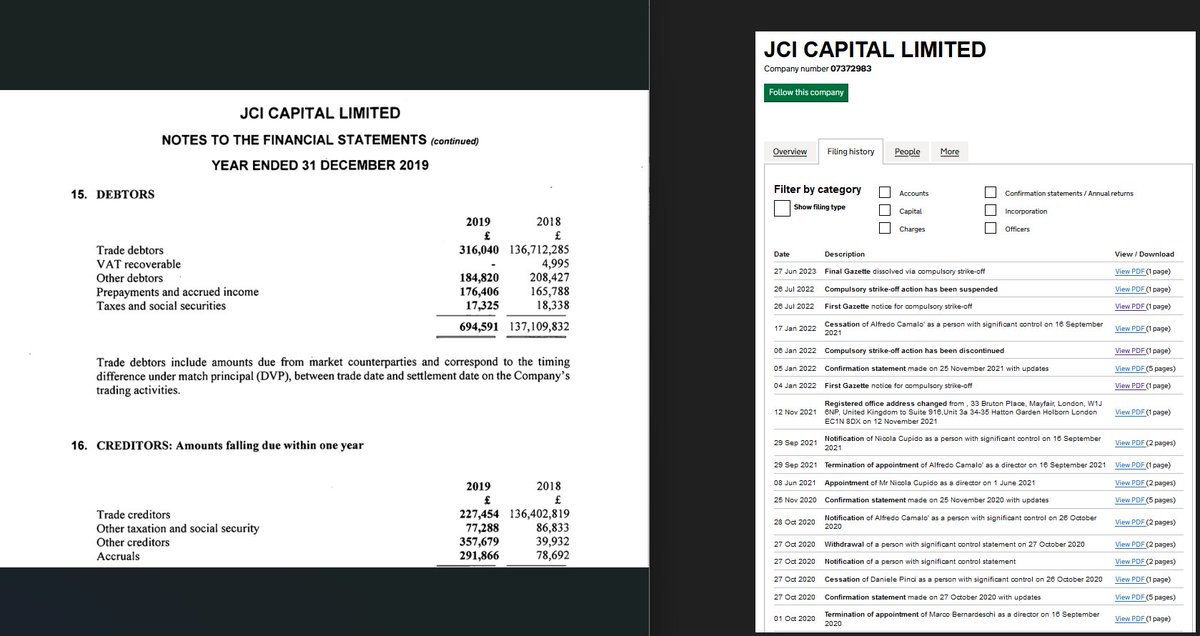

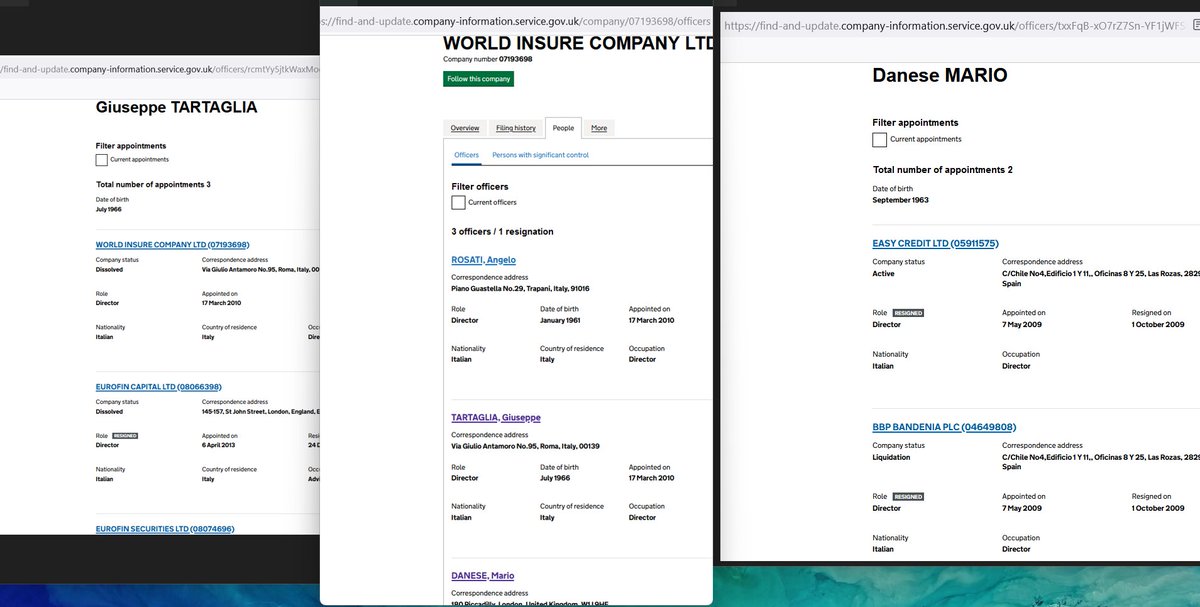

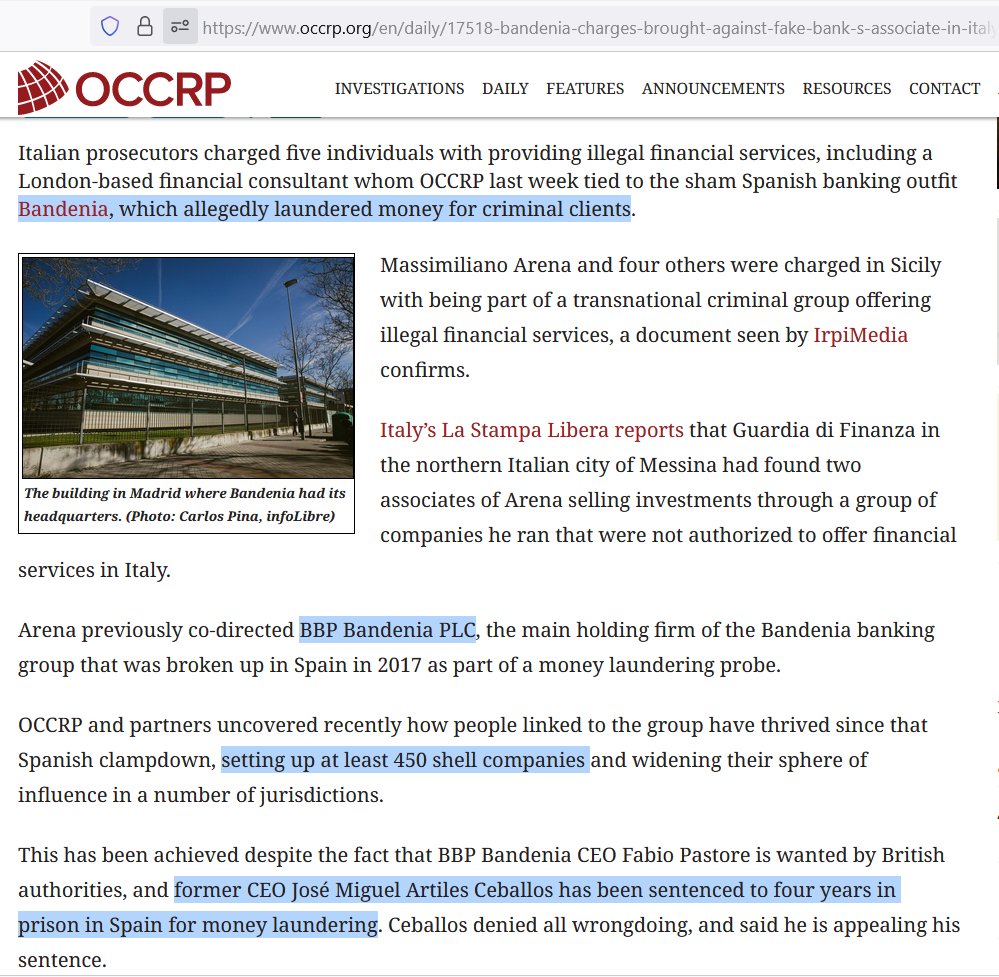

15/ Another EGI fund mgr, JCI Capital, also tied to Danieletto via R. Colapinto was recently struck off & its latest annual report shows a £130 million gap. Struck-off Eurofin Capital’s G. Tartaglia shares a company with M. Danese, who was part of the criminal BBP Bandenia bank.

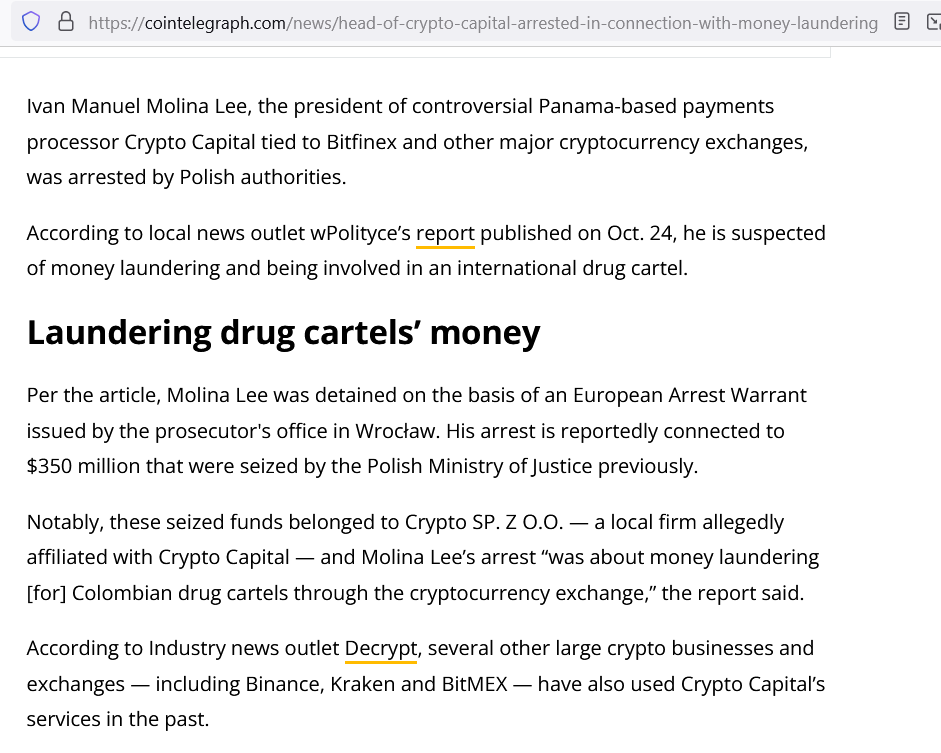

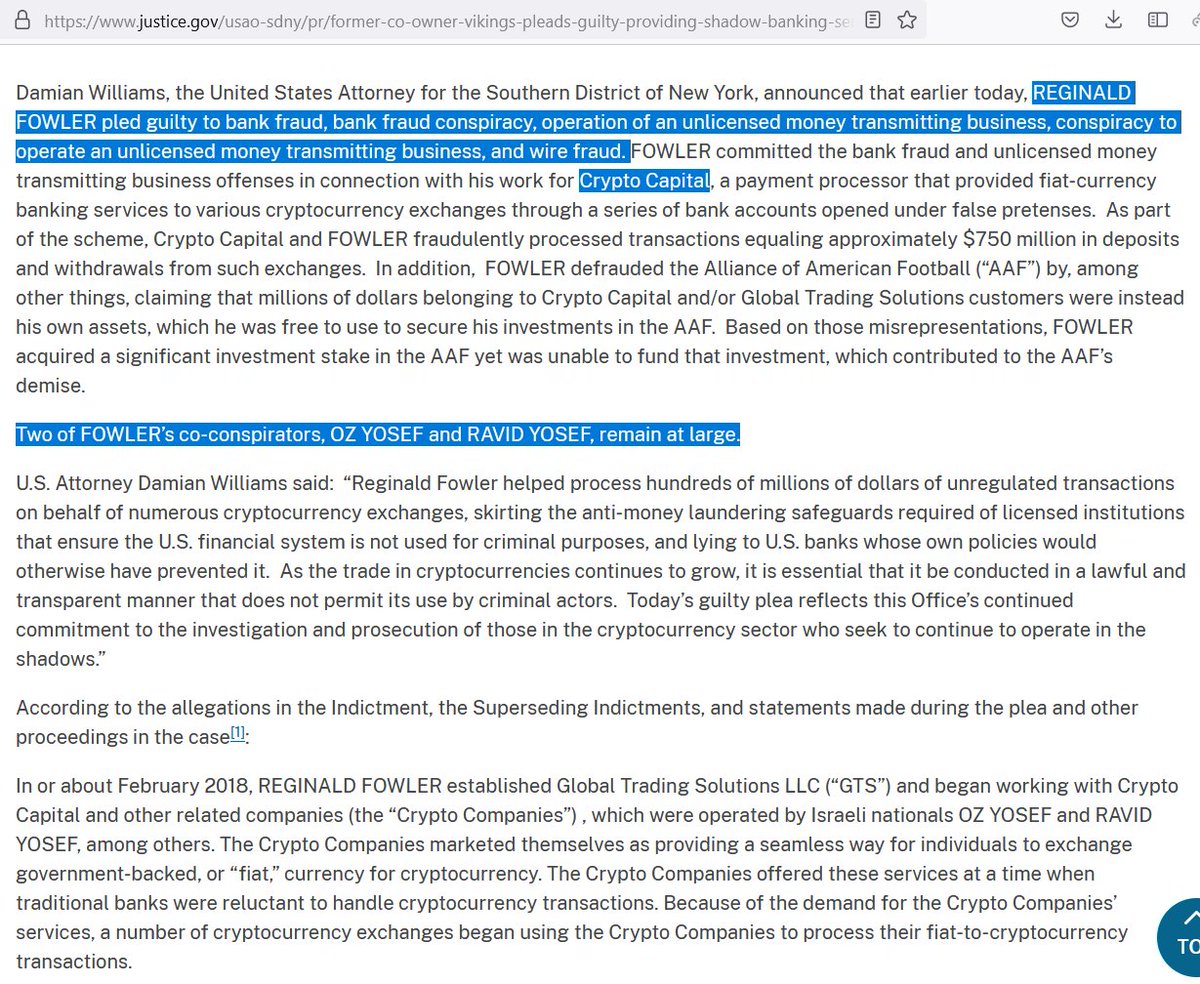

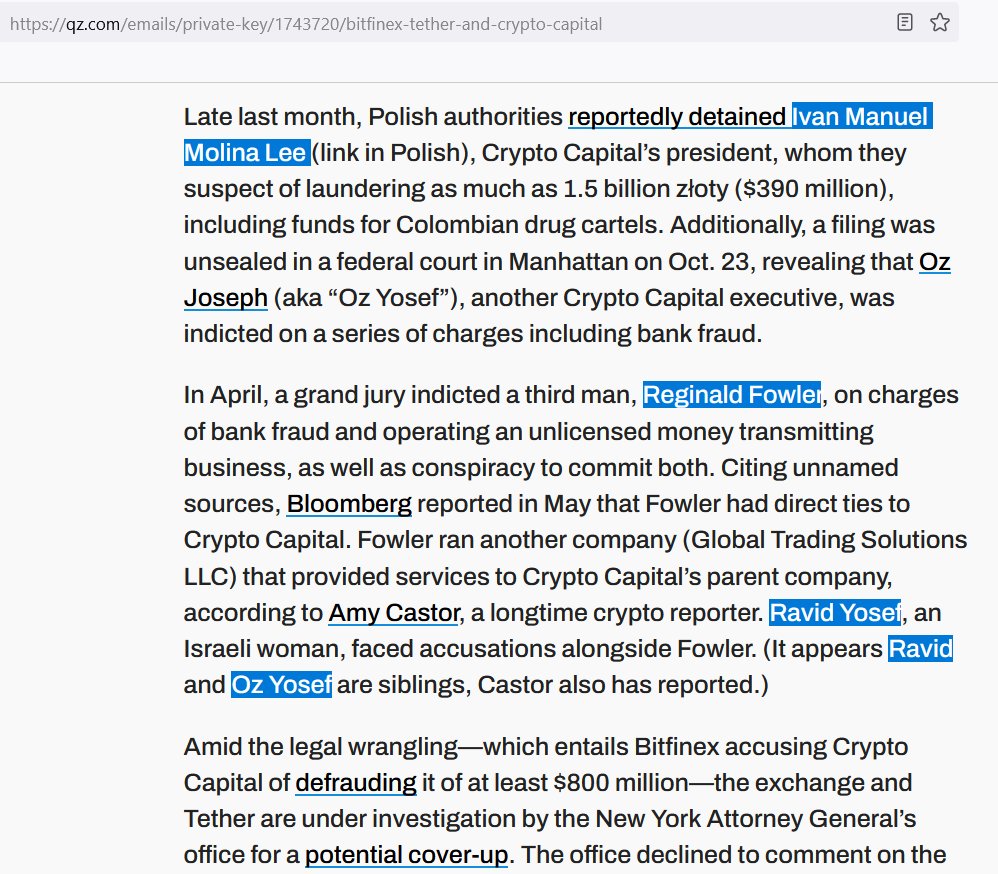

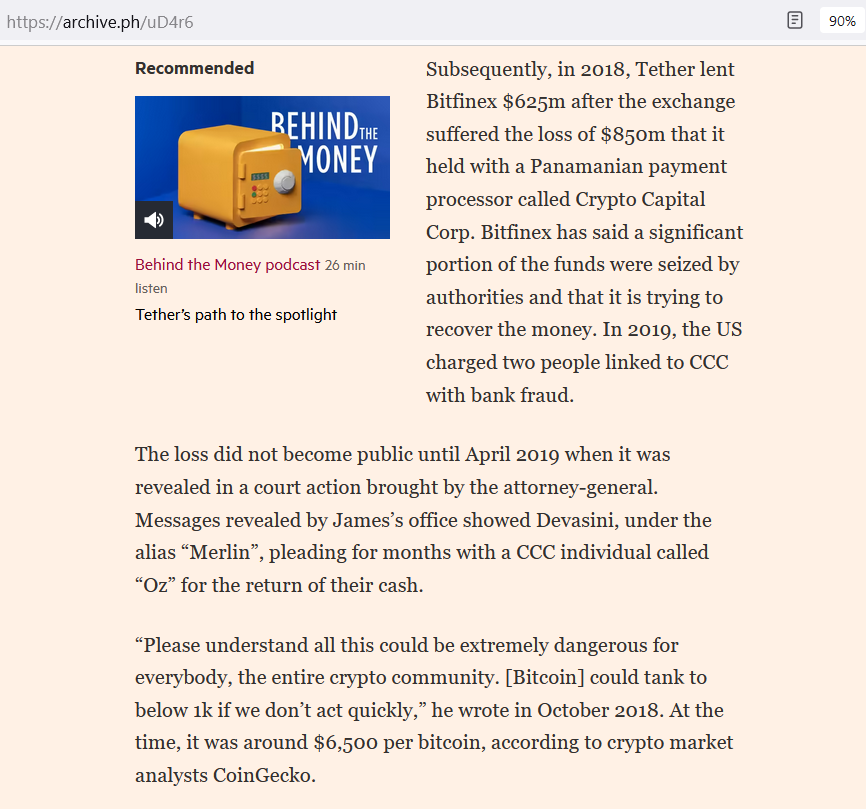

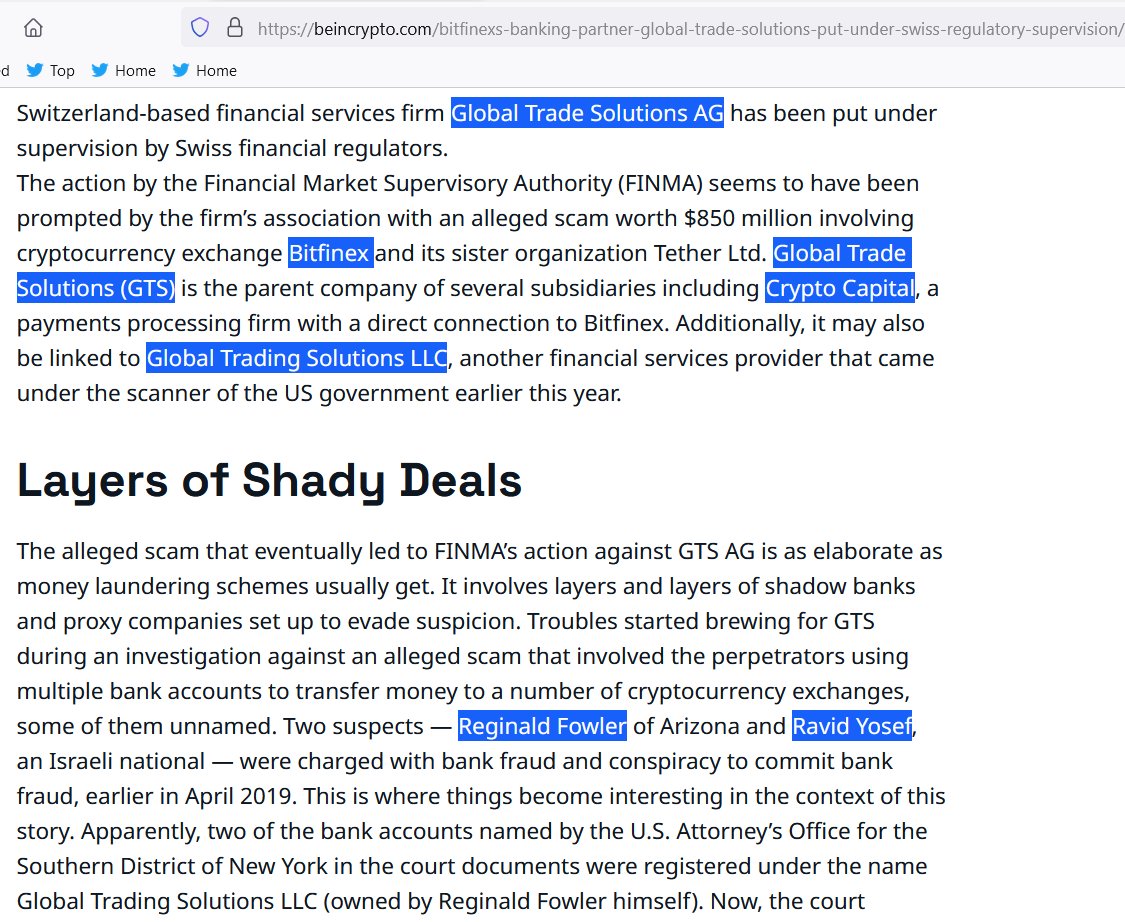

16/ Then we make a big discovery. We find a connection between an EGI fund and Crypto Capital Corp, Tether’s shadow bank. Its CEO, Ivan Manuel Molina Lee, was part of an international drug cartel laundering money with Reggie Fowler and Oz & Ravid Yosef. Oz was Devasini’s contact.

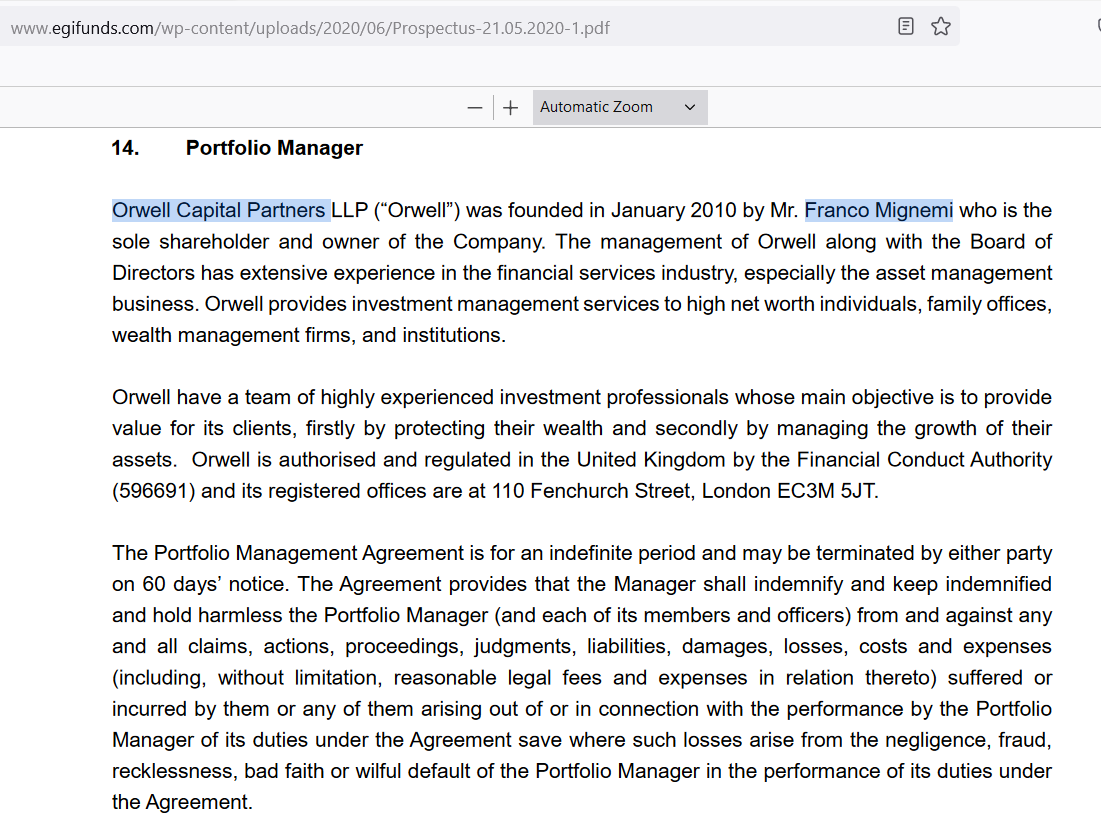

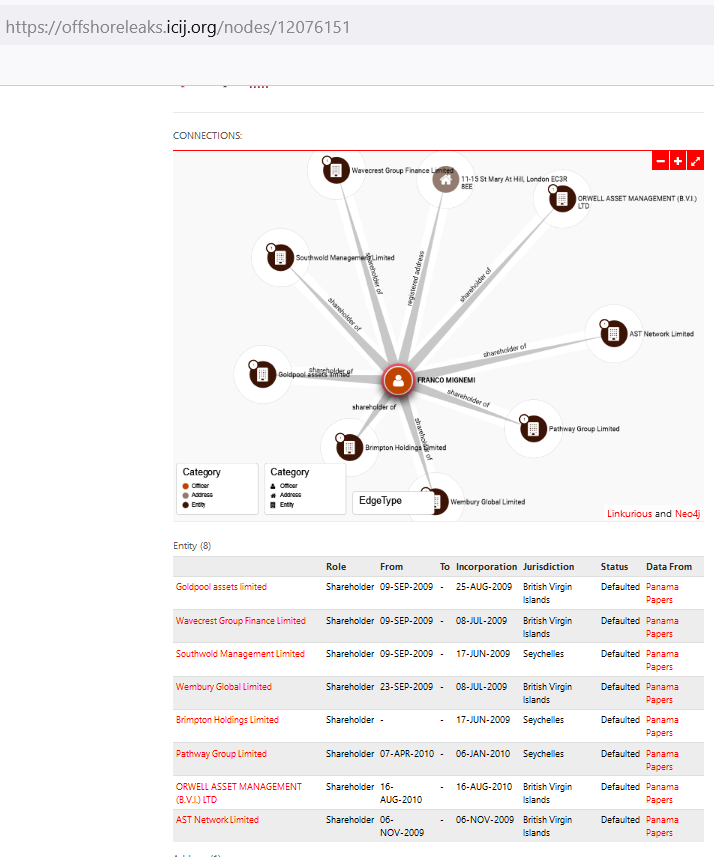

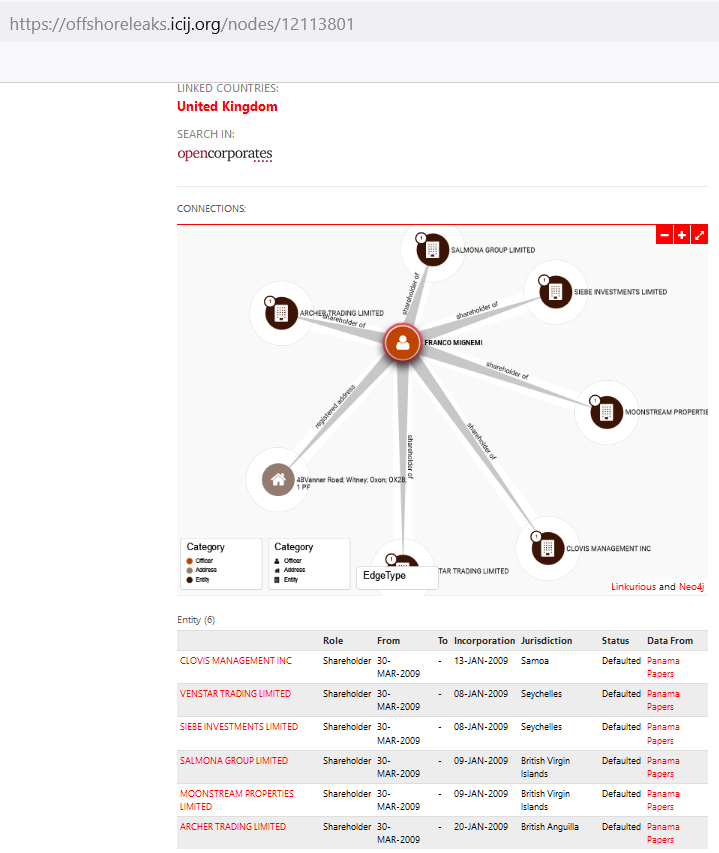

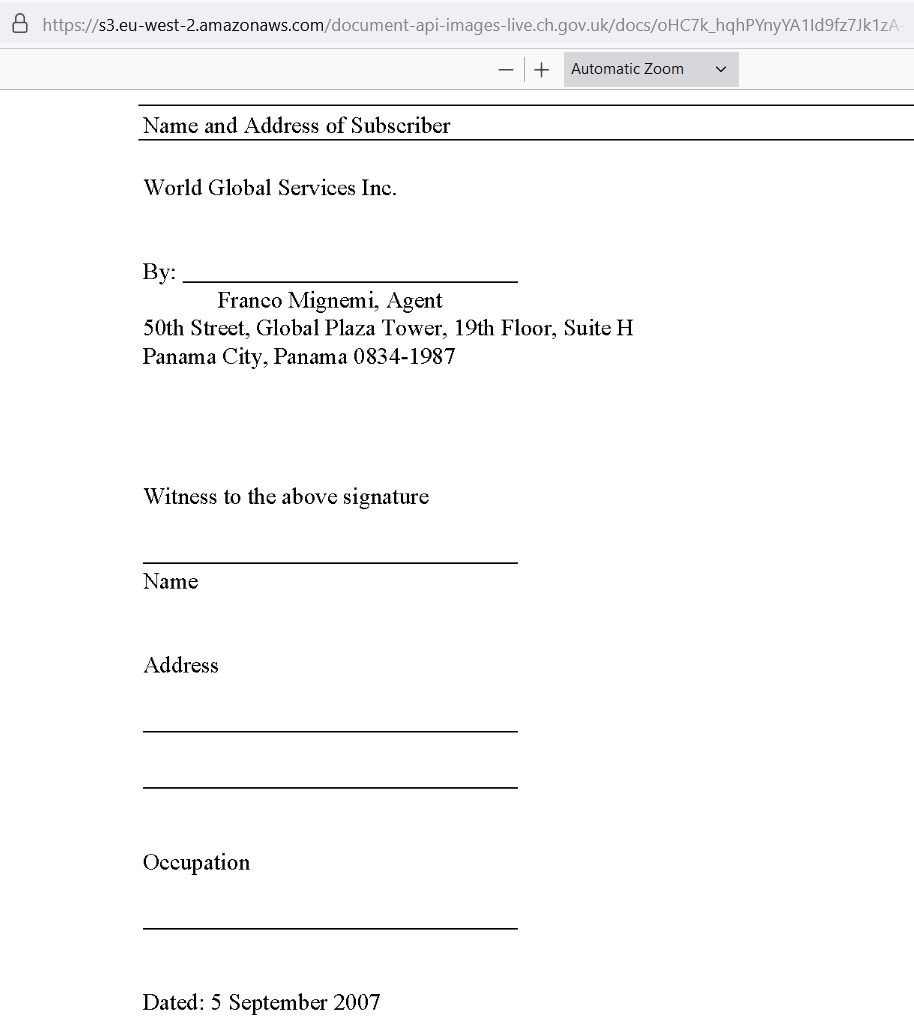

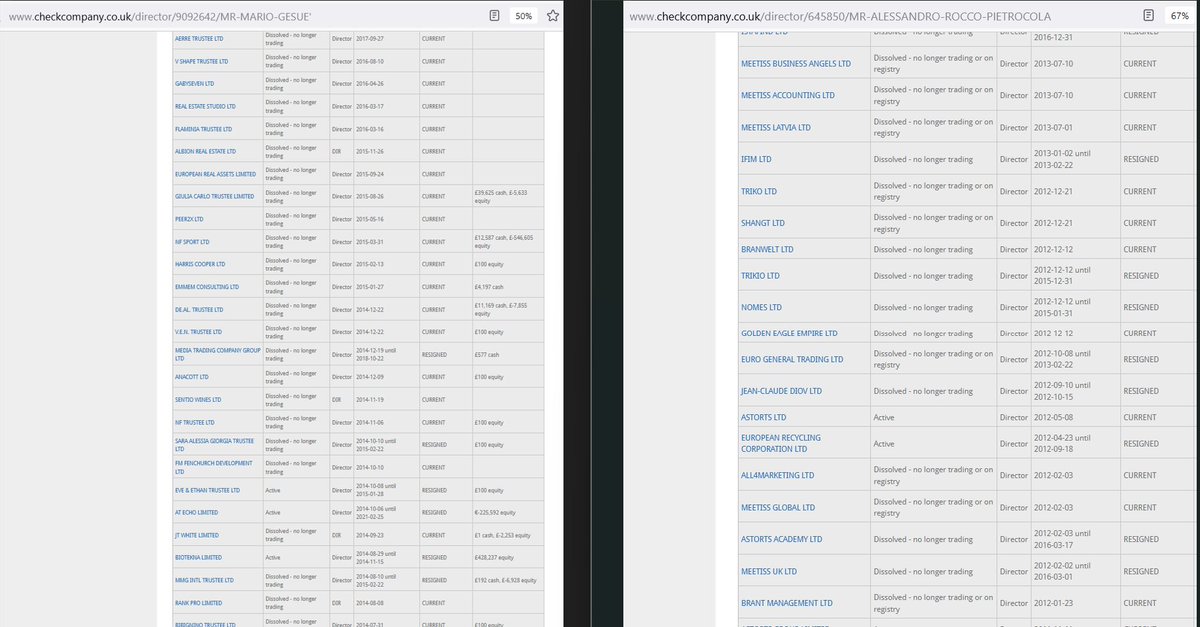

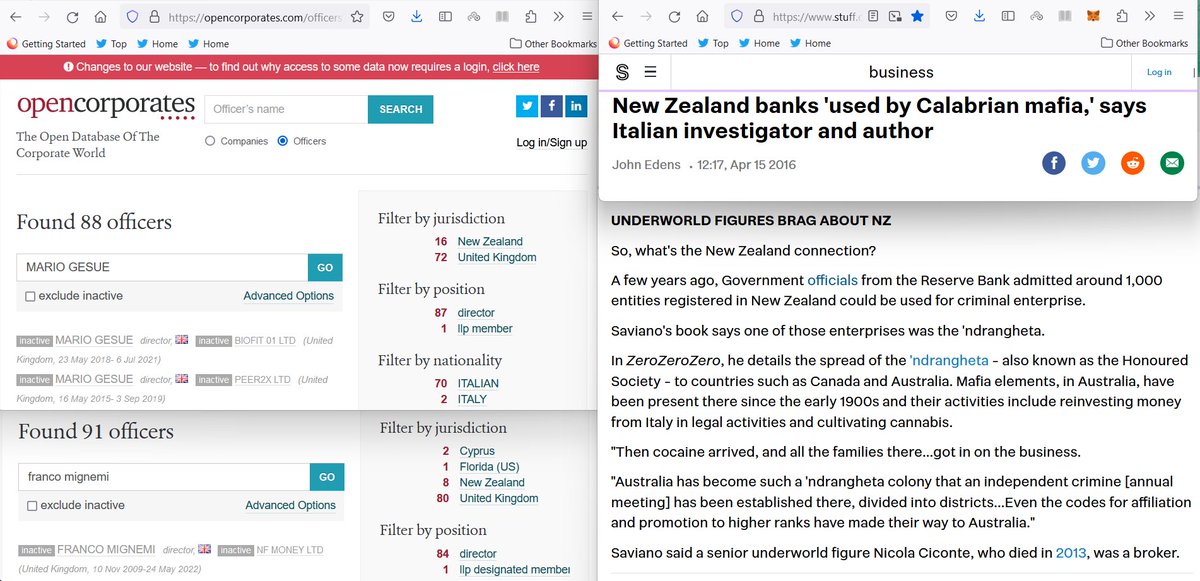

17/ Franco Mignemi, yet another EGI fund manager, who had lots of UK companies that have been struck off, and who is very prevalent in the ICIJ offshore database (Seychelles, Samoa, British Anguilla, BVI) was the CEO of Orwell Capital using a complex holding/trustee structure.

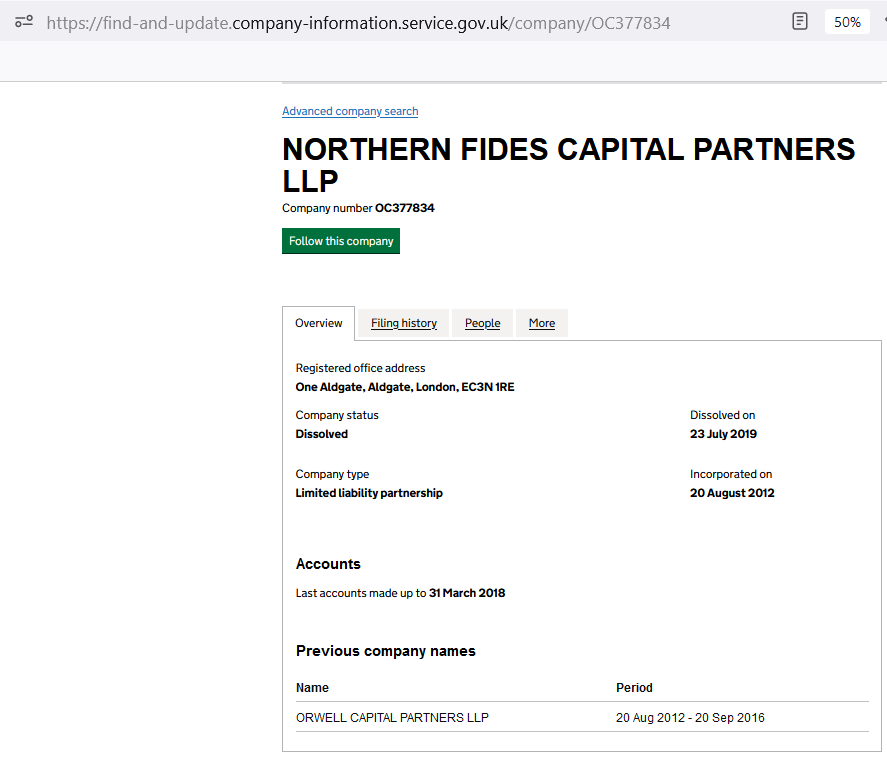

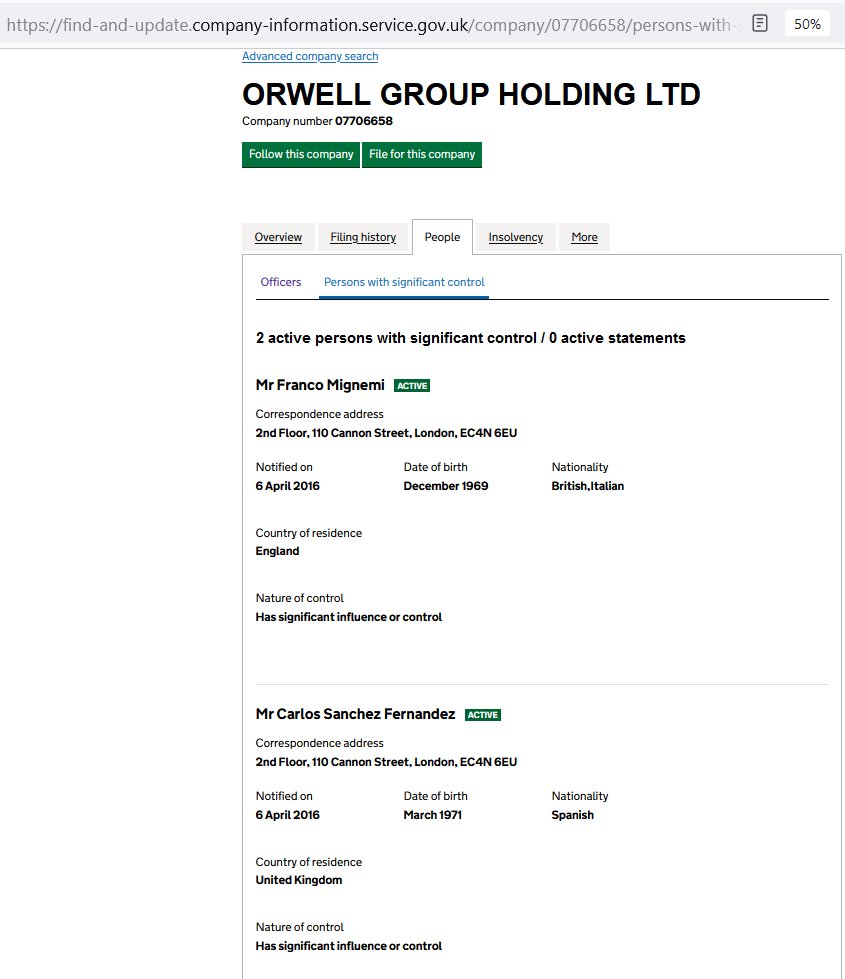

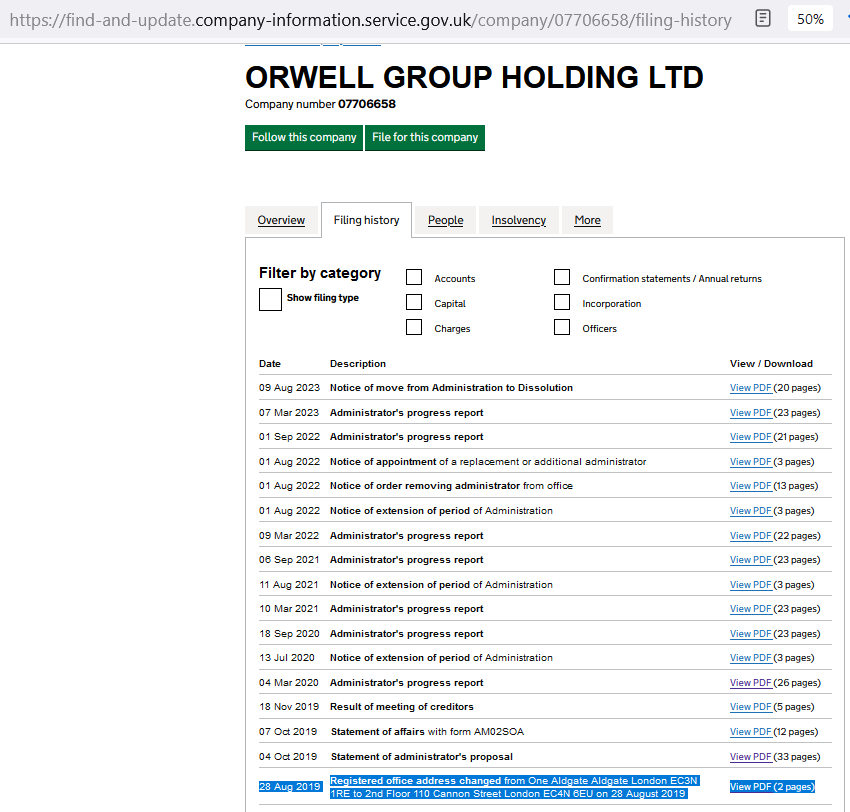

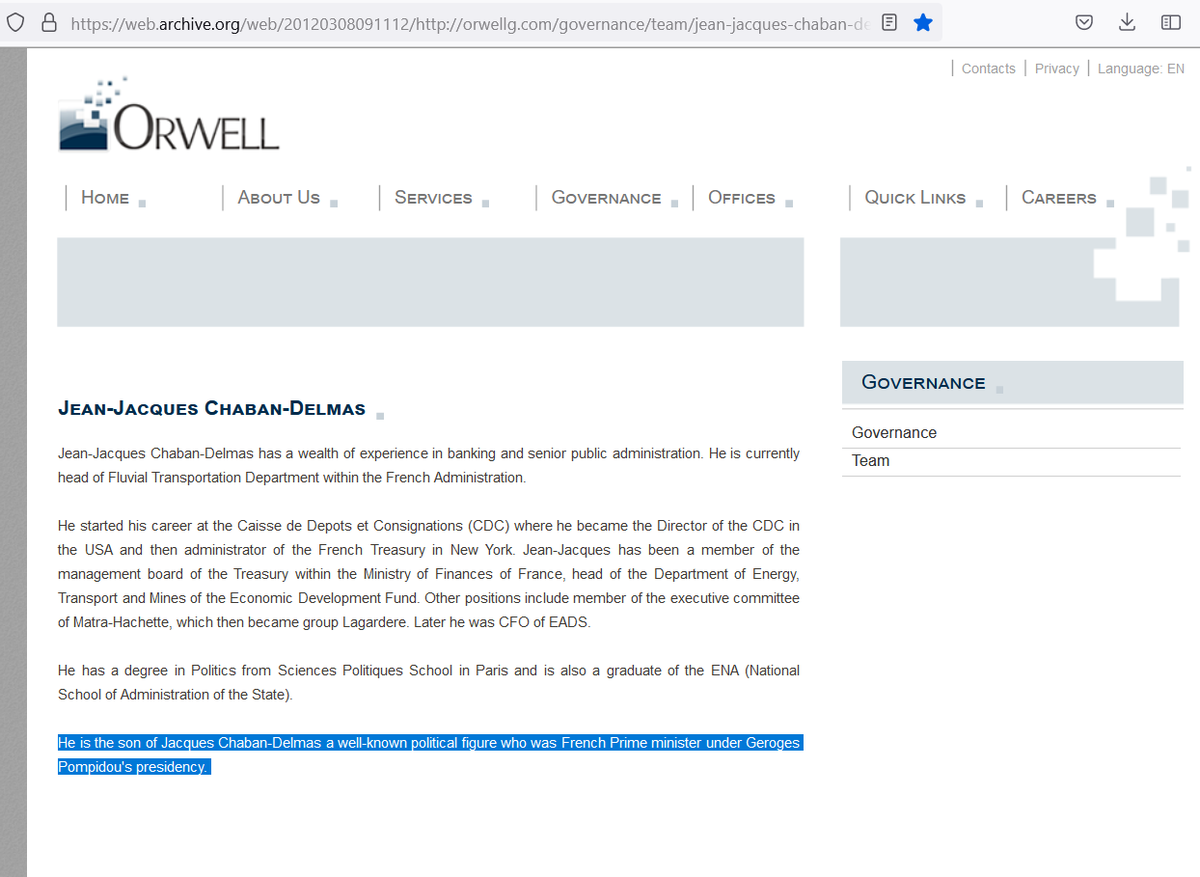

18/ Orwell Capital Part. was already renamed in 2016 & dissolved in 2019, but yet it appears in the EGI prospectus in 2020 (and as early as 2014). Orwell Capital Part. was part of Orwell Group Holding (now dissolved) and one of their directors was Amit Raz, who joined in Oct 2018

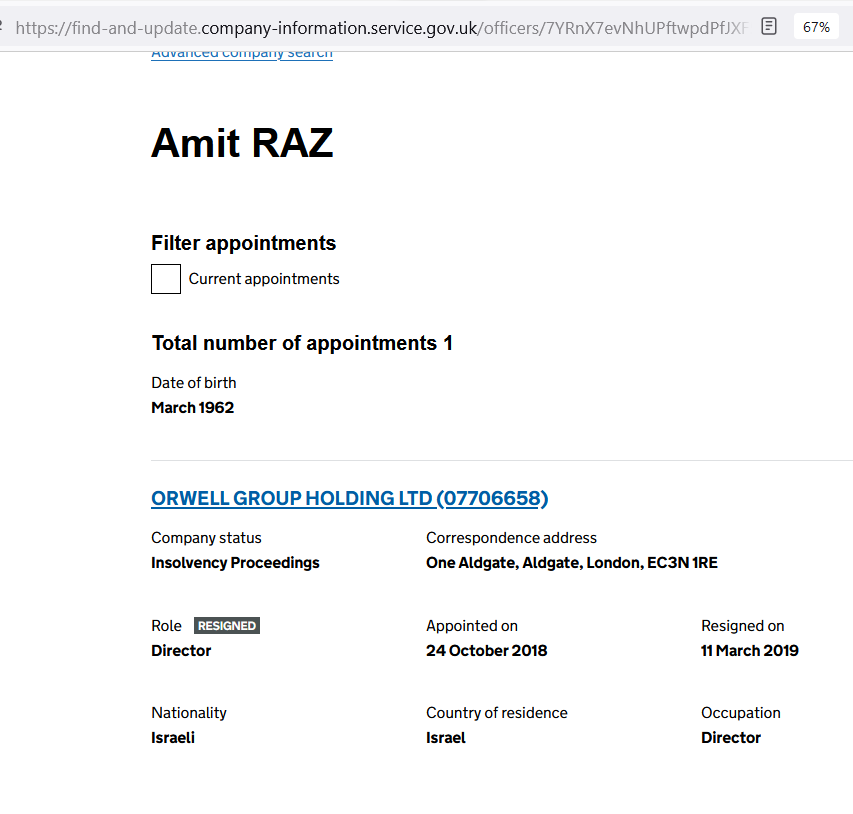

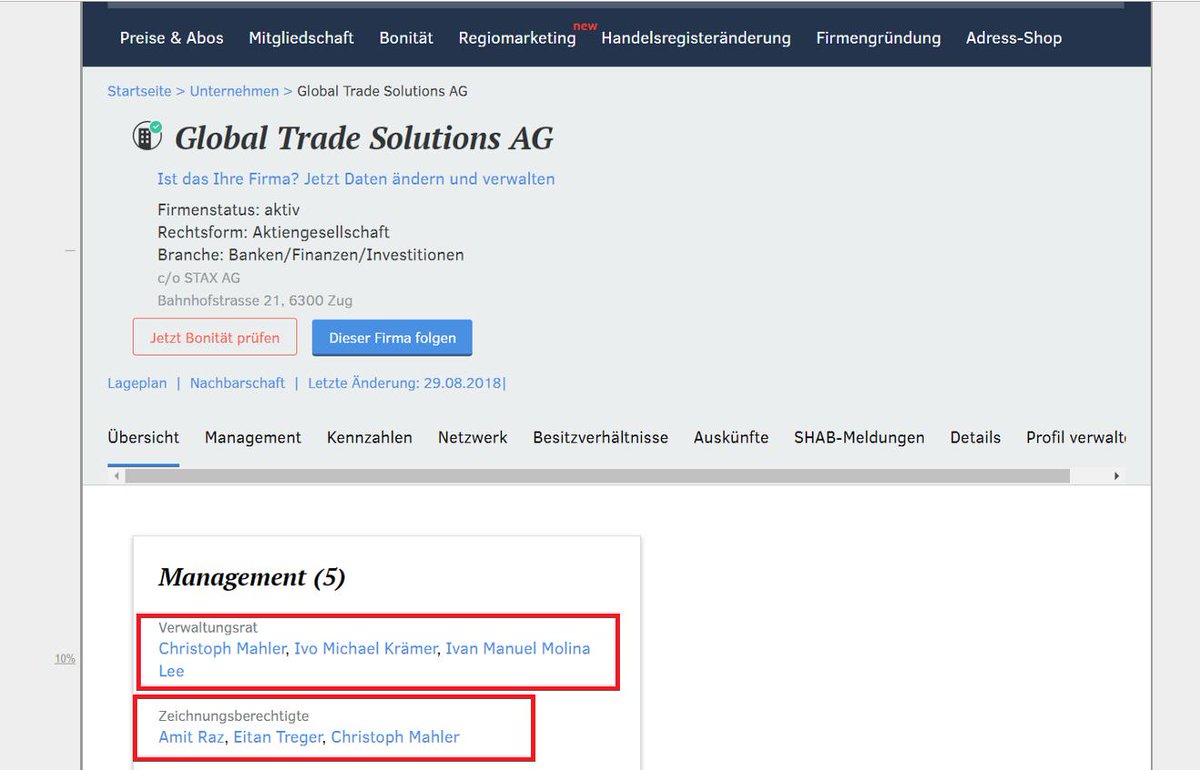

19/ Amit Raz, CEO of Delek Industries until Oct 2021 was part of a company with convicted fugitive Ravid Yosef prior to 2021: Finnovative Holdings (registered at the same address as Orwell Holding). And with Molina Lee at Global Trade Solutions, Crypto Capital's parent company.

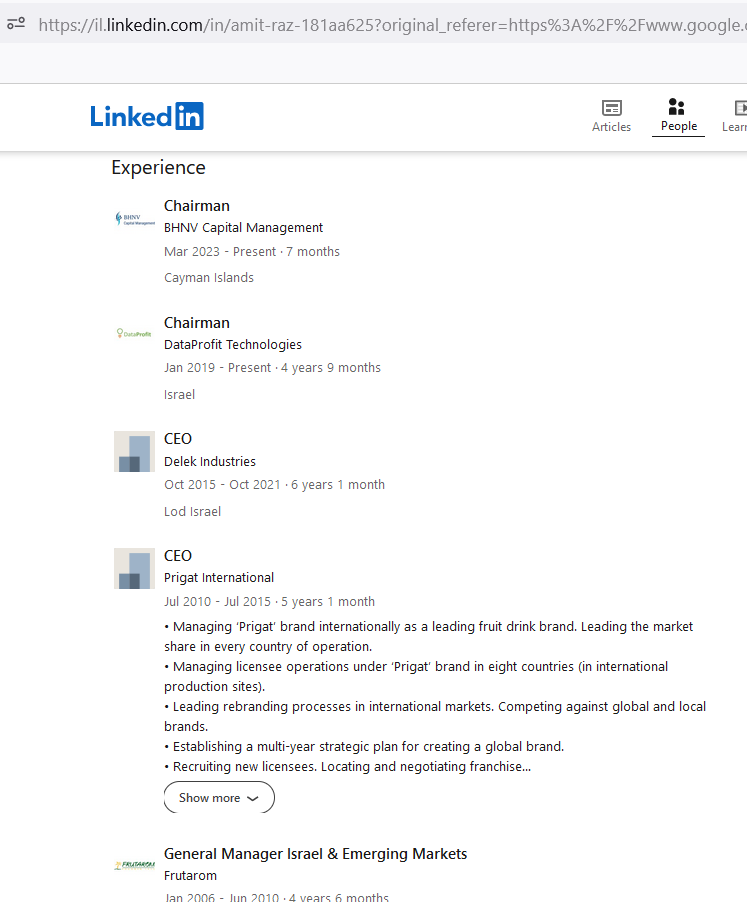

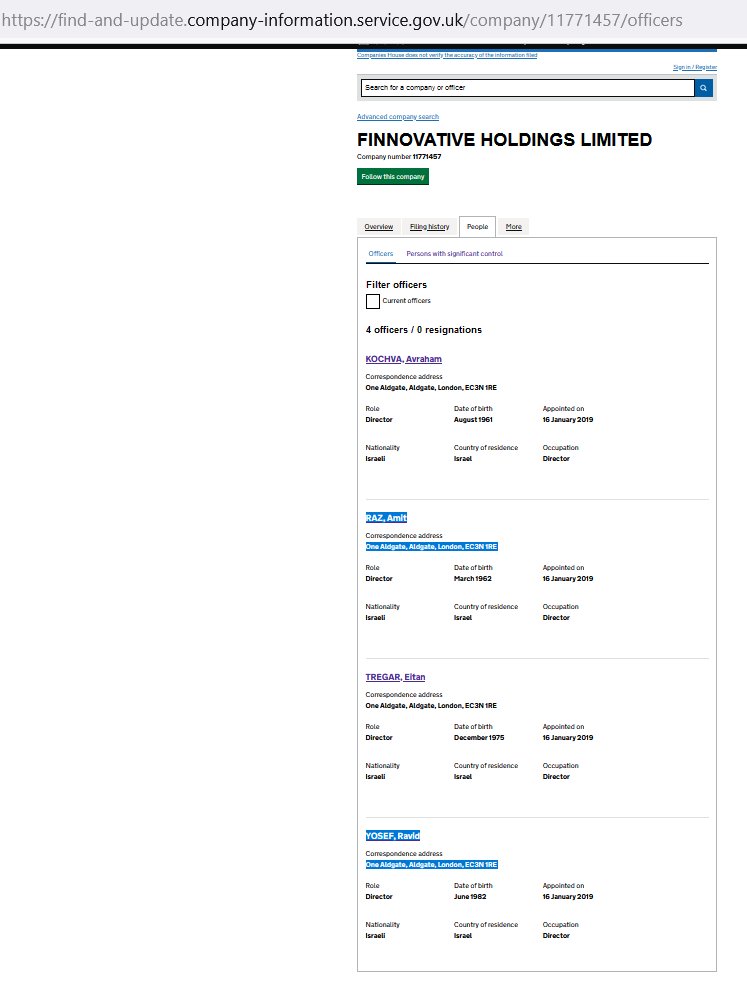

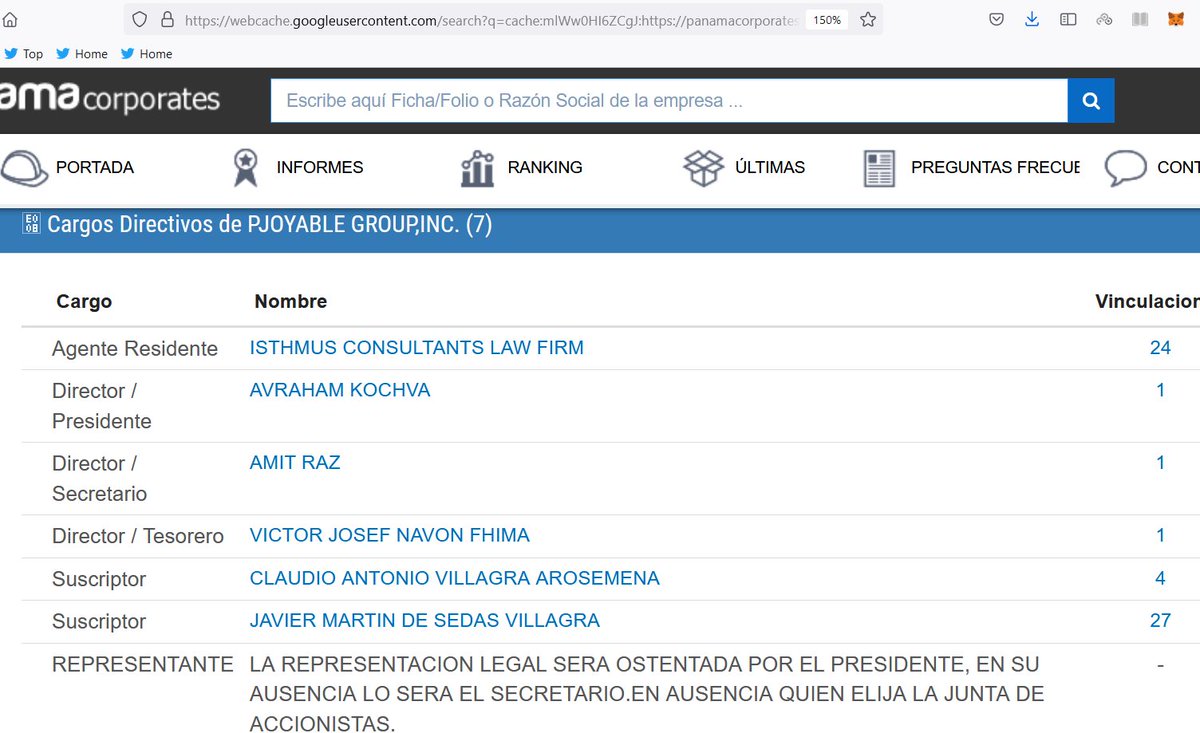

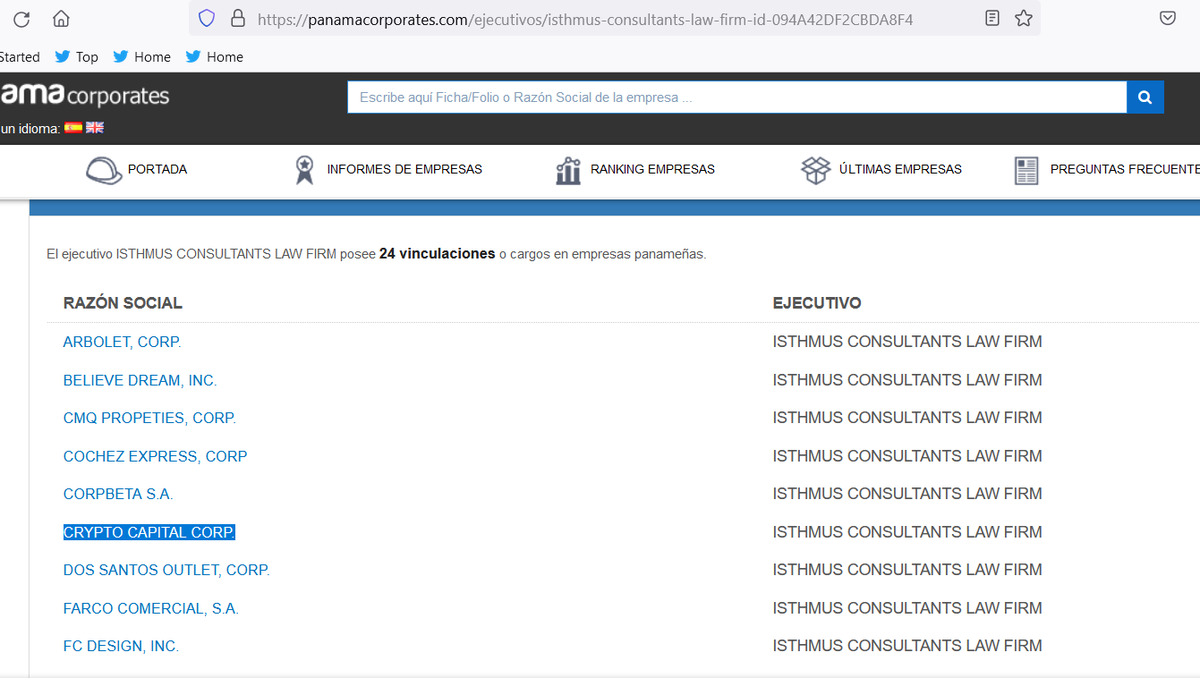

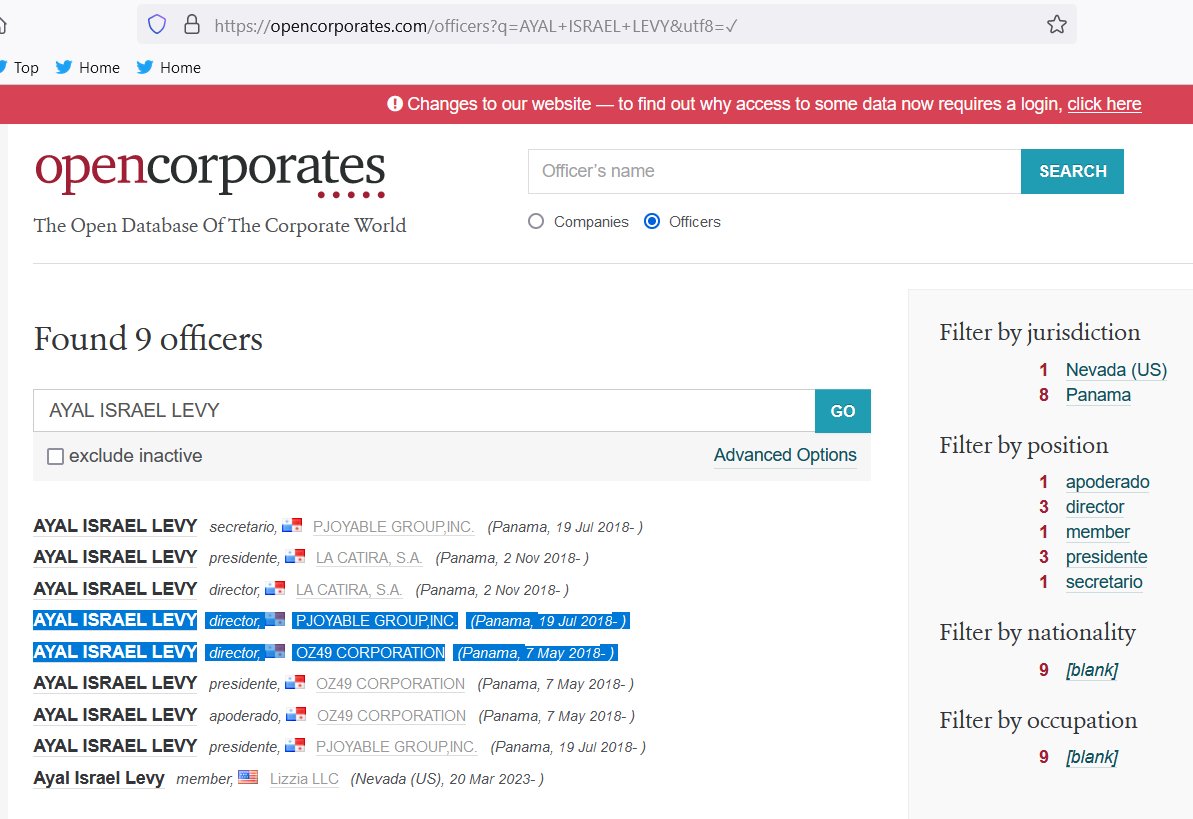

20/ Amit Raz is also part of Pjoyable Group and BHNV Capital Mgmt with the same people: Eitan Tragar & Avraham (Avi) Kochva. The law firm that set up Crypto Capital in Panama (Isthmus) also set up Pjoyable Group and shares a director with OZ49 Corporation (Oz Yosef’s company).

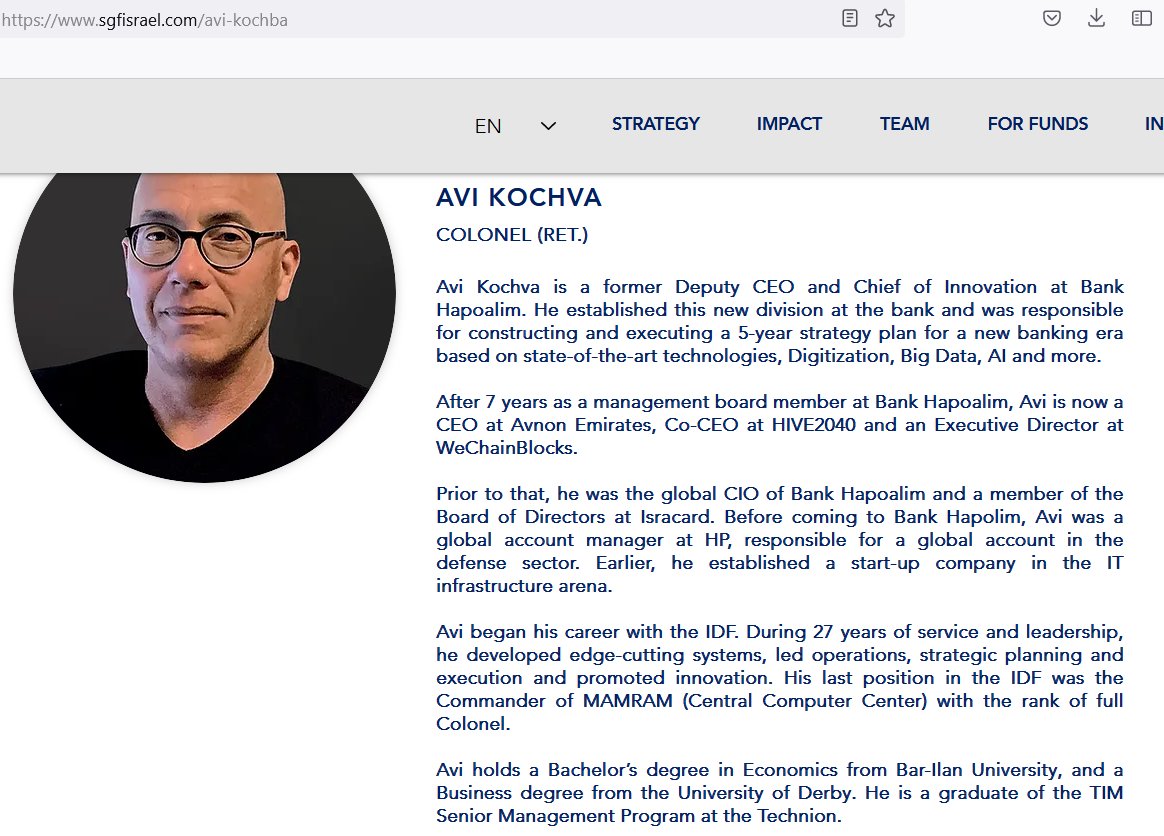

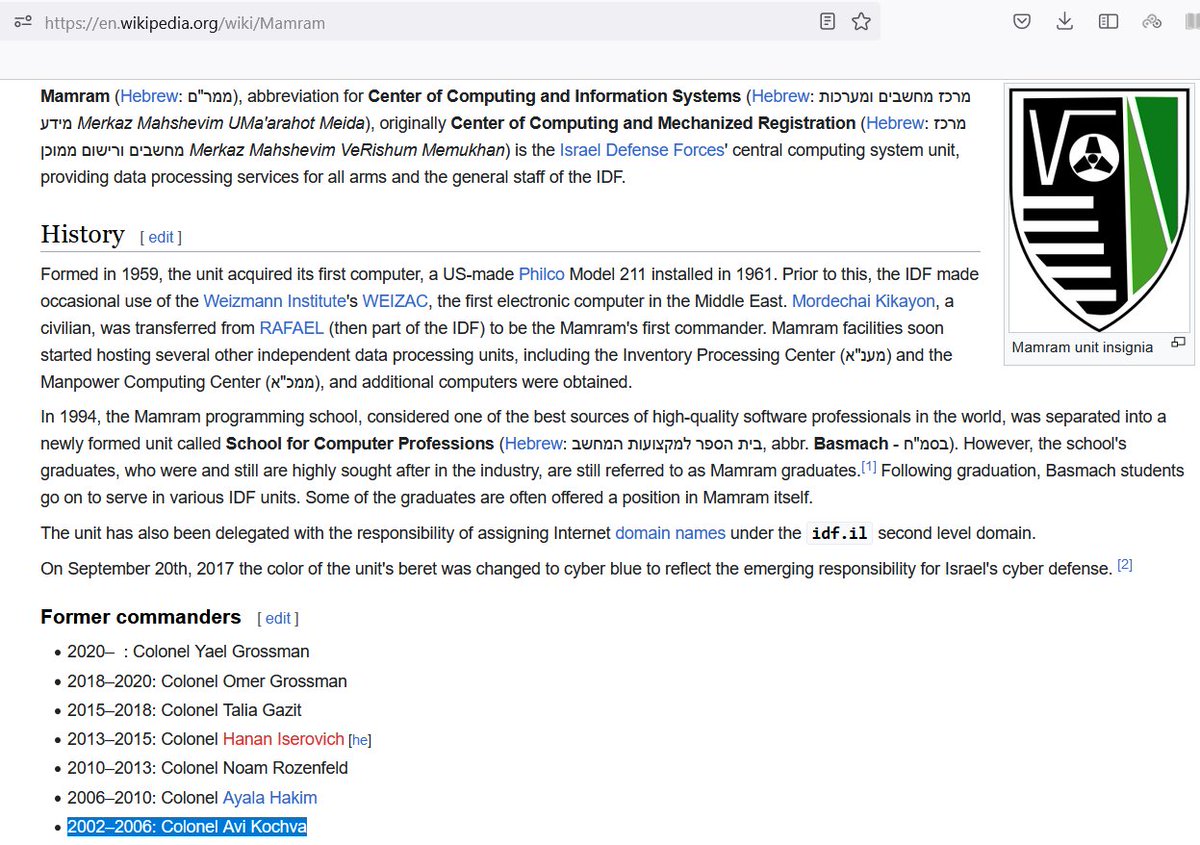

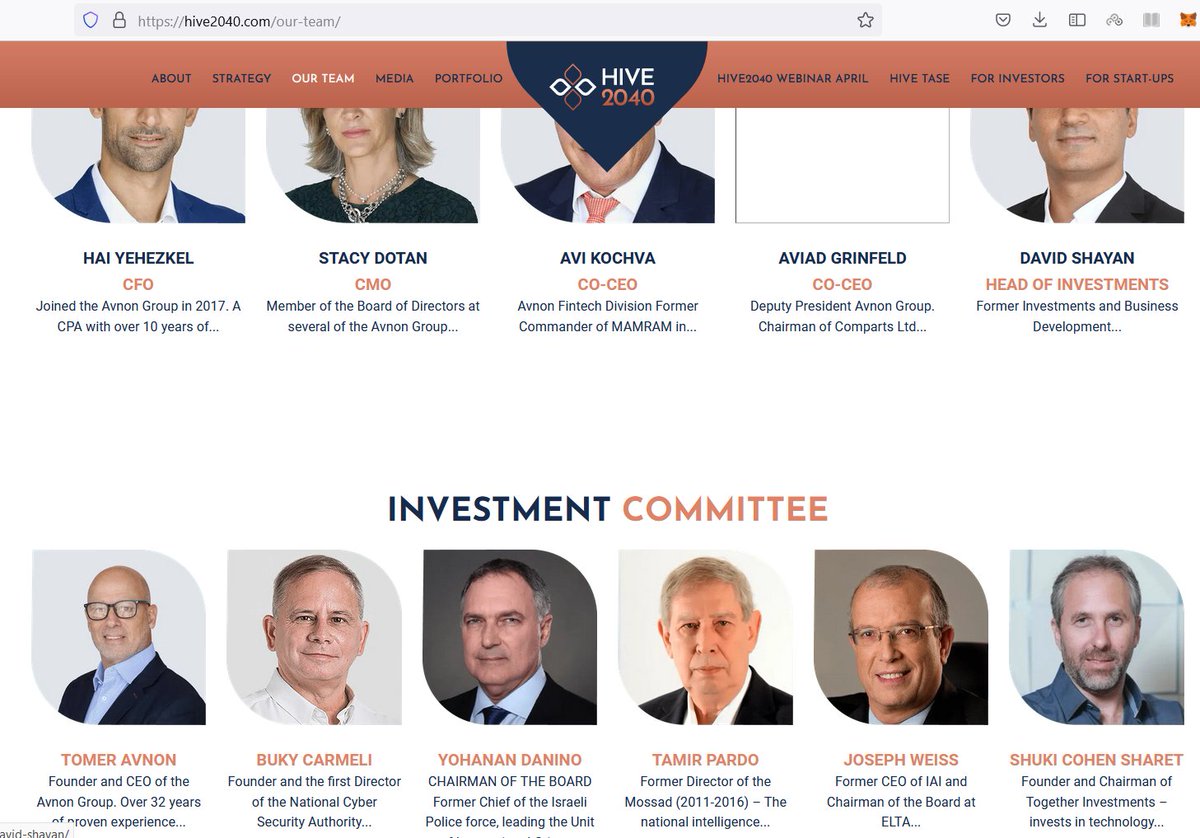

21/ Avi Kochva is not just someone, but the former deputy CEO of Israel’s largest bank, Bank Hapoalim and also the former commander of MAMRAM, IDF’s central computing system unit. Bank Hapoalim has been involved in big money laundering scandals & was fined ∼$900 million in 2020.

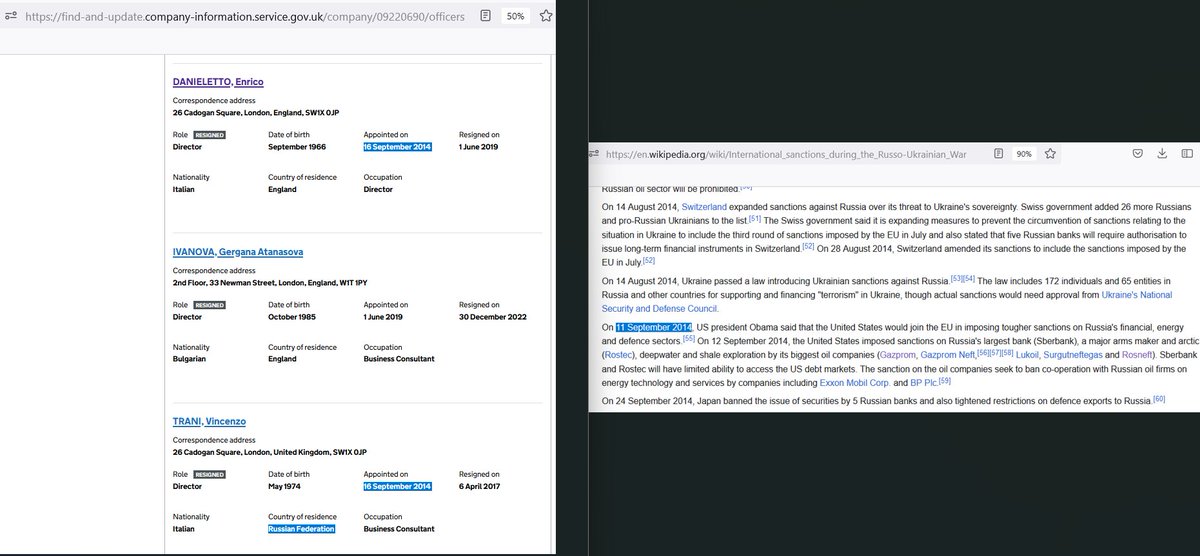

22/ Mignemi used to set up offshore companies & is well-connected (the son of a former French prime minister was on his board). So is Danieletto who set up a company with Vincenzo Trani (living in Moscow since 2001) 5 days after the US announced its heaviest Russian sanctions.

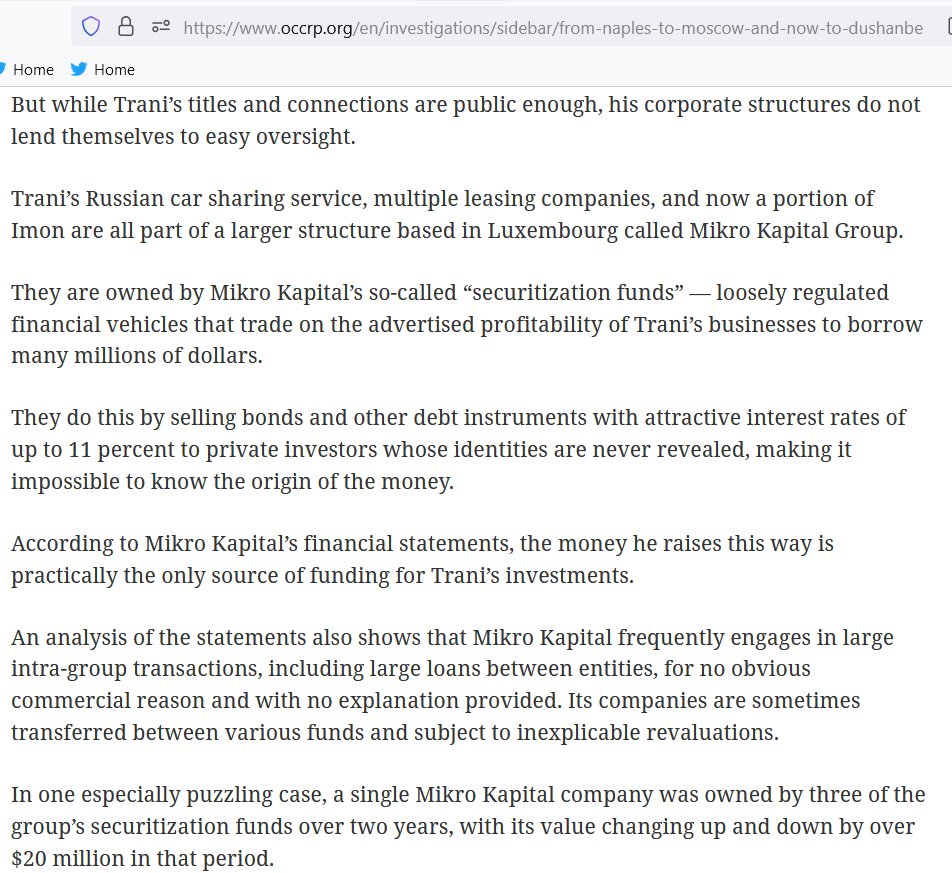

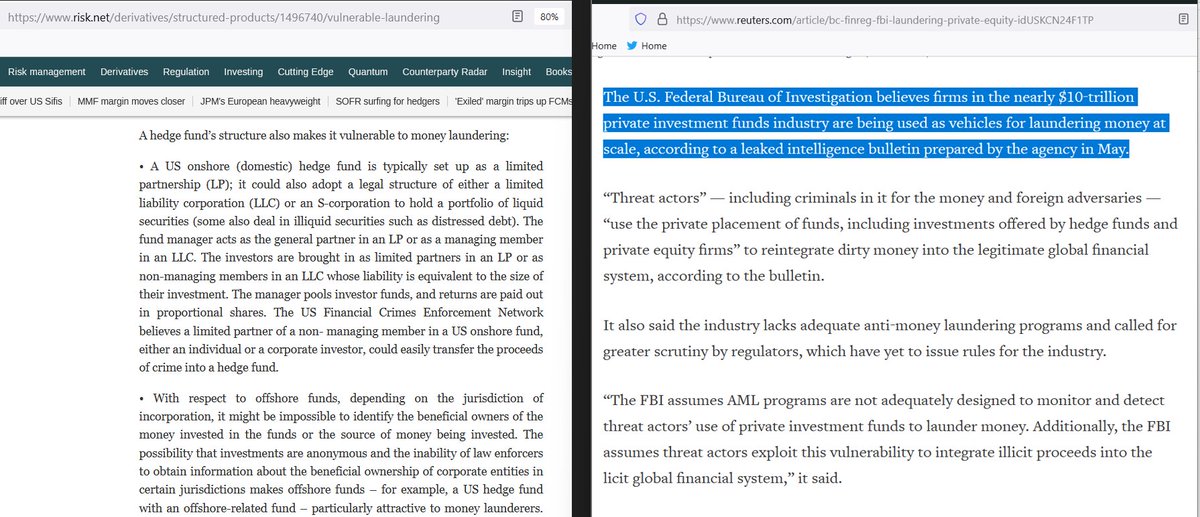

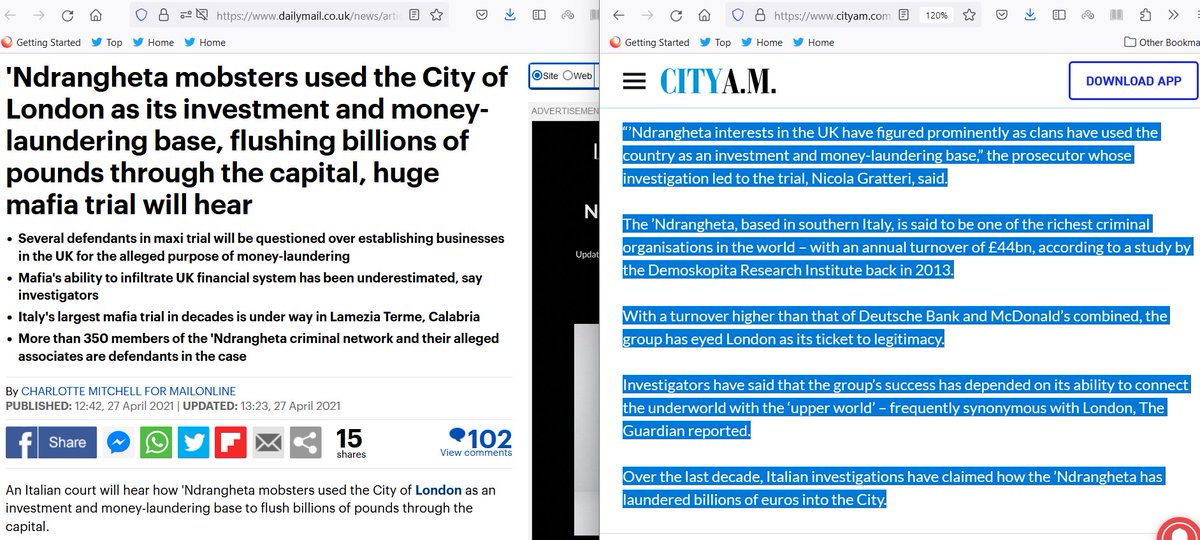

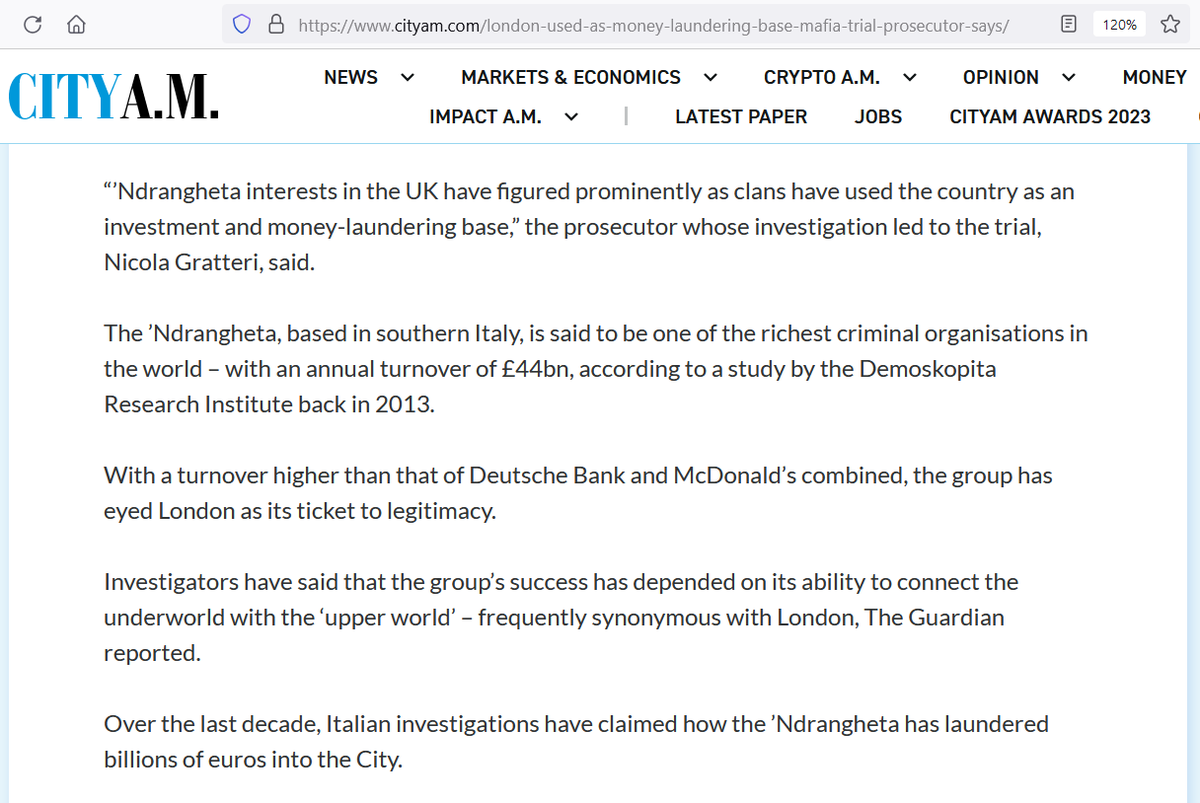

23/ Investment/hedge funds are notorious for money laundering and London is a famous hub for criminals to do that. This interconnected network consists of predominantly Italians (Alessandro Rocco Pietrocola, Mario Gesue, etc) setting up lots of companies including in New Zealand.

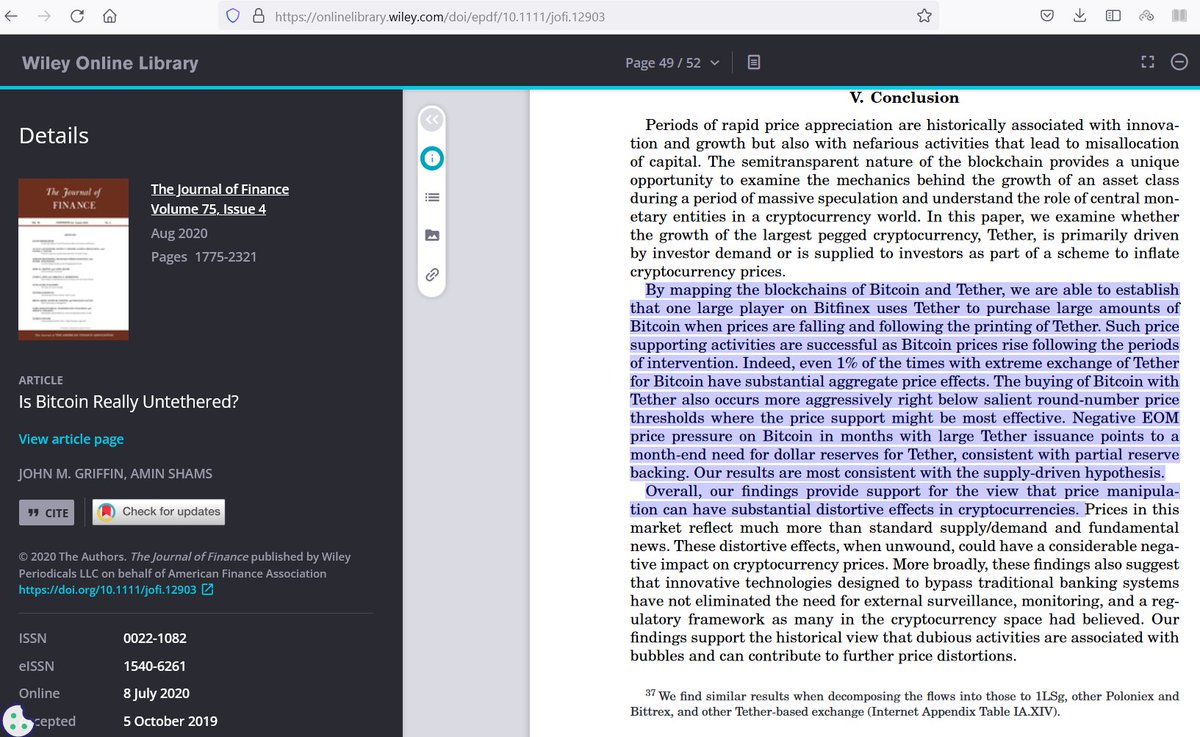

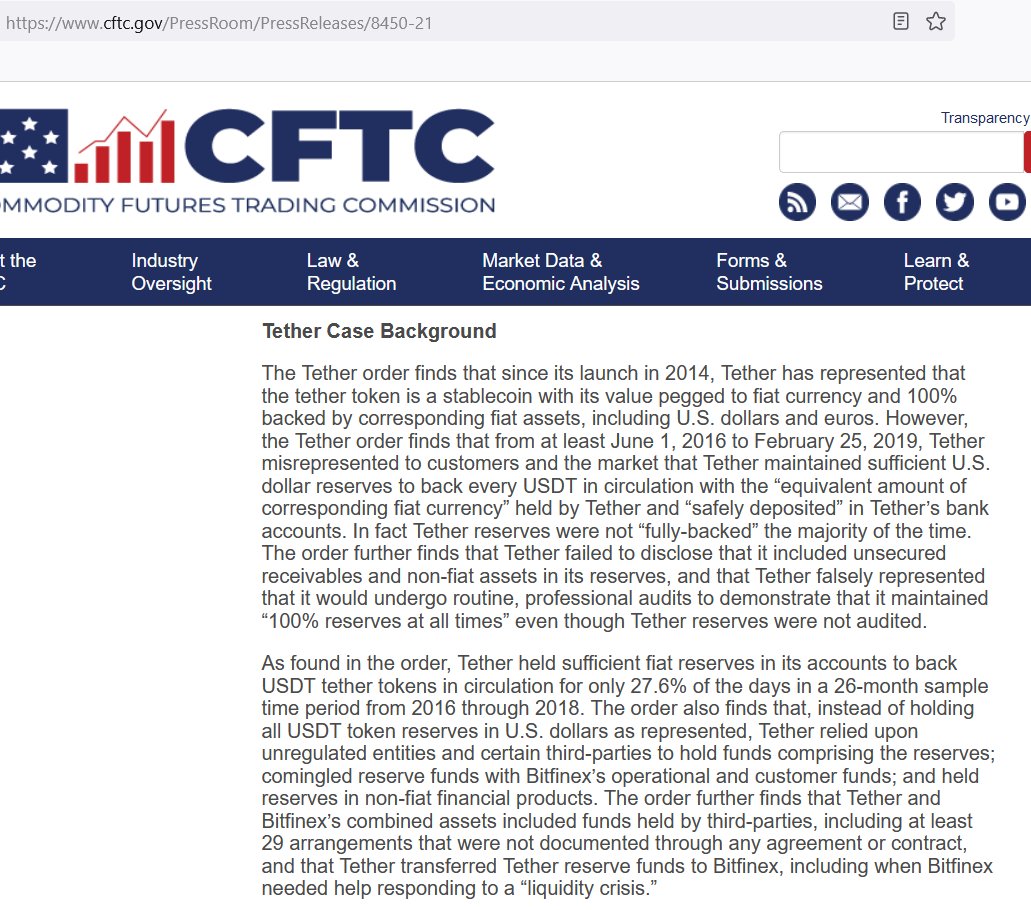

24/ Bitfinex/Tether is deeply routed in this network of people involved in financial misconduct tied to organized crime, indicating that the current crypto foundations seem to be hijacked by criminals who benefit the most by laundering money via USDT & manipulating the BTC price.

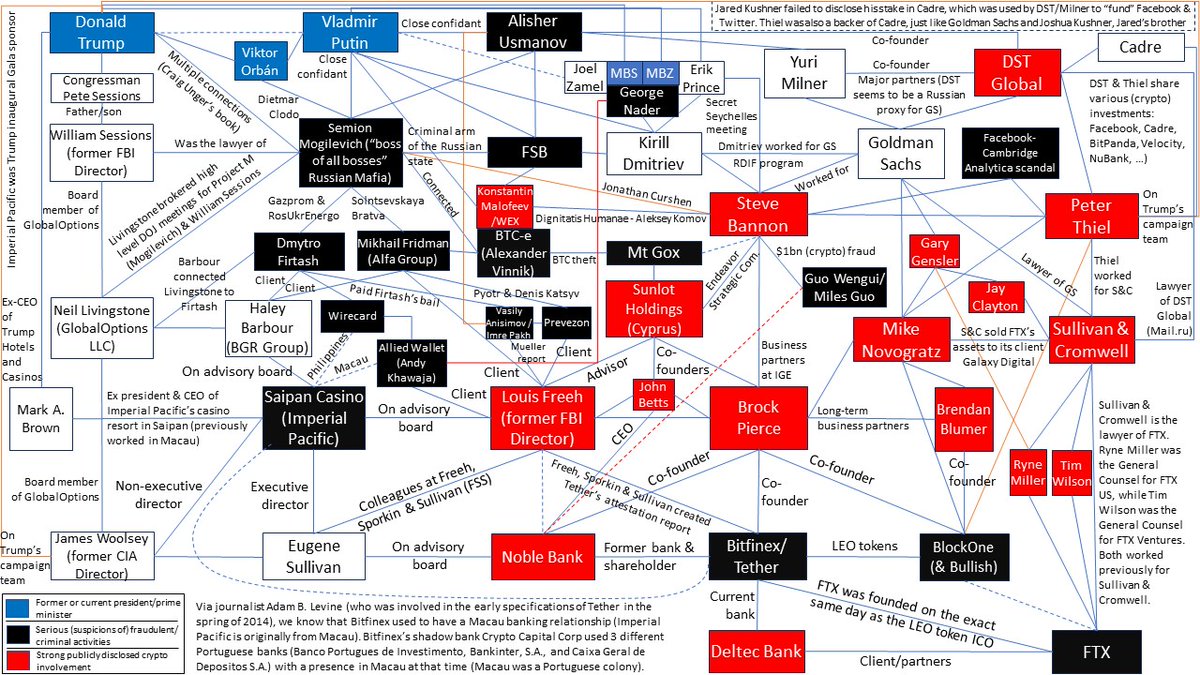

25/ The hidden power/wealth of transnational organized crime groups, their covert alliances with intelligence agencies & their entanglement with politics, finance/VCs and legitimate businesses via complex opaque constructions, poses an increasingly greater threat.

Summary chart:

Summary chart:

• • •

Missing some Tweet in this thread? You can try to

force a refresh