Generative AI has spawned thousands of new products.

But outside of ChatGPT, what are everyday consumers using? What's growing, and what has flattened?

We crunched the numbers to find the top 50 consumer web products by monthly visits - here's our learnings ⬇️

But outside of ChatGPT, what are everyday consumers using? What's growing, and what has flattened?

We crunched the numbers to find the top 50 consumer web products by monthly visits - here's our learnings ⬇️

1/ ChatGPT is the 👑, representing 60% of traffic to the ENTIRE list.

But @character_ai is not far behind, with 21% of ChatGPT's traffic.

The rest of the top 10? Bard, @poe_platform, @TheQuillBot, @photoroom_app, @HelloCivitai, @midjourney, @huggingface, @perplexity_ai

But @character_ai is not far behind, with 21% of ChatGPT's traffic.

The rest of the top 10? Bard, @poe_platform, @TheQuillBot, @photoroom_app, @HelloCivitai, @midjourney, @huggingface, @perplexity_ai

2/ Compared to mainstream consumer products, even the biggest GenAI products are still fairly small.

Combining Web + app traffic, ChatGPT is around the same scale as Reddit, LinkedIn, and Twitch.

But it's still far below the “giants” (WhatsApp, YouTube, Facebook, etc.).

Combining Web + app traffic, ChatGPT is around the same scale as Reddit, LinkedIn, and Twitch.

But it's still far below the “giants” (WhatsApp, YouTube, Facebook, etc.).

3/ However, it's worth remembering that most GenAI products are very new - they have time to catch up!

Of the top 50 products, 80% didn't exist a year ago.

Nearly half are bootstrapped, and only 5% are part of big tech companies like Google.

Of the top 50 products, 80% didn't exist a year ago.

Nearly half are bootstrapped, and only 5% are part of big tech companies like Google.

4/ Another surprise? There's a sizable number of "GPT wrappers" on the list.

The top 50 is split almost evenly between products with:

(1) a proprietary model

(2) a fine-tune of an open source model

(3) a publicly accessible model from a third-party (e.g. GPT-4)

The top 50 is split almost evenly between products with:

(1) a proprietary model

(2) a fine-tune of an open source model

(3) a publicly accessible model from a third-party (e.g. GPT-4)

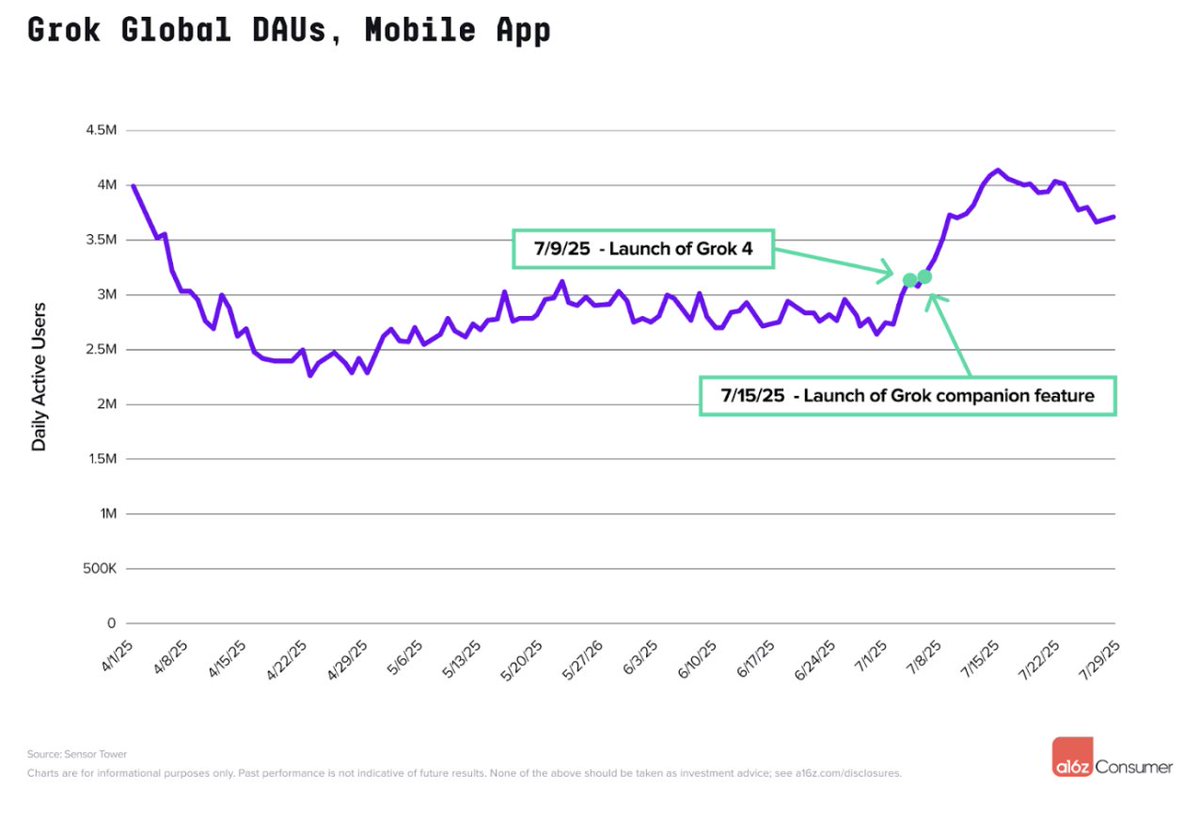

5/ Most products thus far are Web-first, with no mobile app or minimal app traffic.

ChatGPT launched an app in May, but it still represents <2% of the company's traffic.

The exceptions here are @photoroom_app (88% mobile), @character_ai (46%), and @Speechify_audio (20%).

ChatGPT launched an app in May, but it still represents <2% of the company's traffic.

The exceptions here are @photoroom_app (88% mobile), @character_ai (46%), and @Speechify_audio (20%).

6/ Companies that nail the mobile experience have a chance to garner outsized engagement.

Per @SensorTower data, CharacterAI sees an average of 38 sessions per user per month.

As a point of comparison - this exceeds Instagram, FB, and TikTok 🤯

Per @SensorTower data, CharacterAI sees an average of 38 sessions per user per month.

As a point of comparison - this exceeds Instagram, FB, and TikTok 🤯

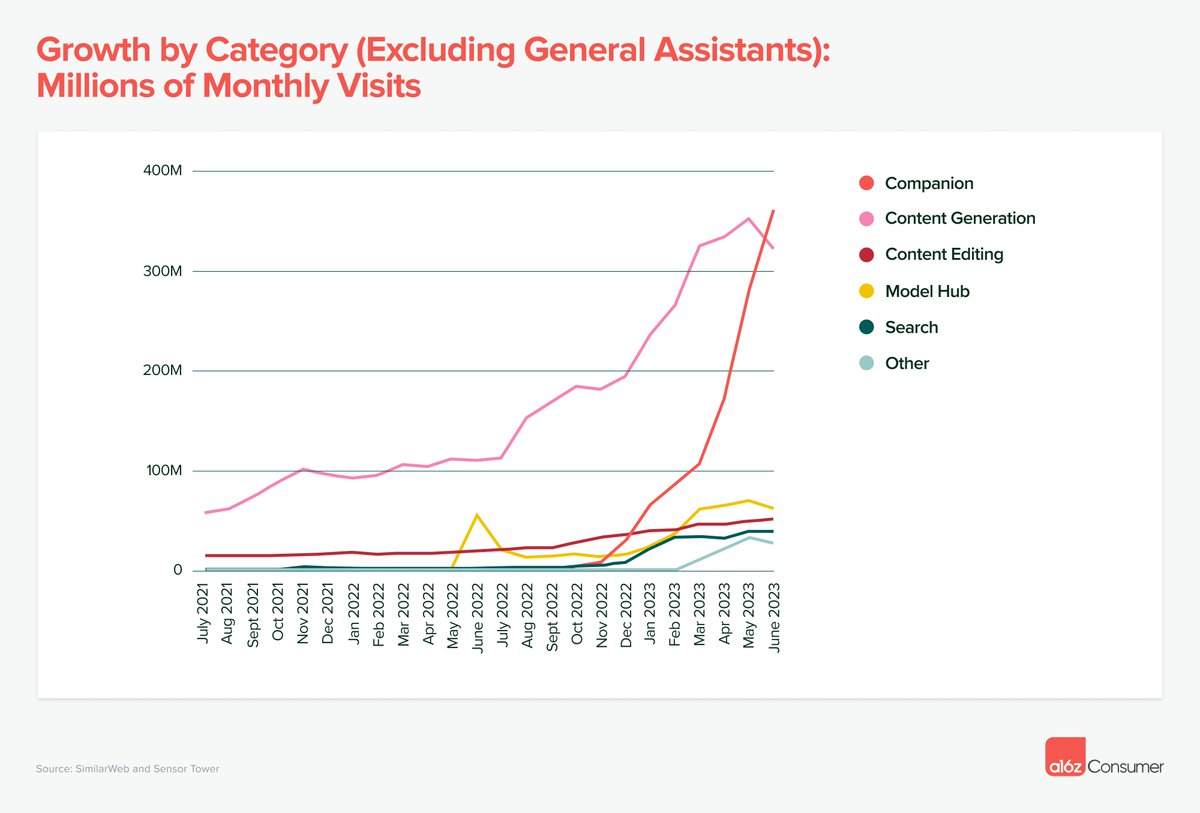

7/ On a category basis, "general assistant" products (ChatGPT, Bard, Poe) represent 70% of traffic.

But, two other categories are inflecting - companionship is now 13%, and content generation is 10%.

Content editing (3.7%) and model hubs (2.3%) round out the top five.

But, two other categories are inflecting - companionship is now 13%, and content generation is 10%.

Content editing (3.7%) and model hubs (2.3%) round out the top five.

8/ Most categories are still "up for grabs" - with the #1 player <2x ahead of the #2.

We're also seeing positive fragmentation, with products gaining steam for specific use cases.

Ex. in image gen, @LeonardoAi_ (for games) is growing alongside Midjourney.

We're also seeing positive fragmentation, with products gaining steam for specific use cases.

Ex. in image gen, @LeonardoAi_ (for games) is growing alongside Midjourney.

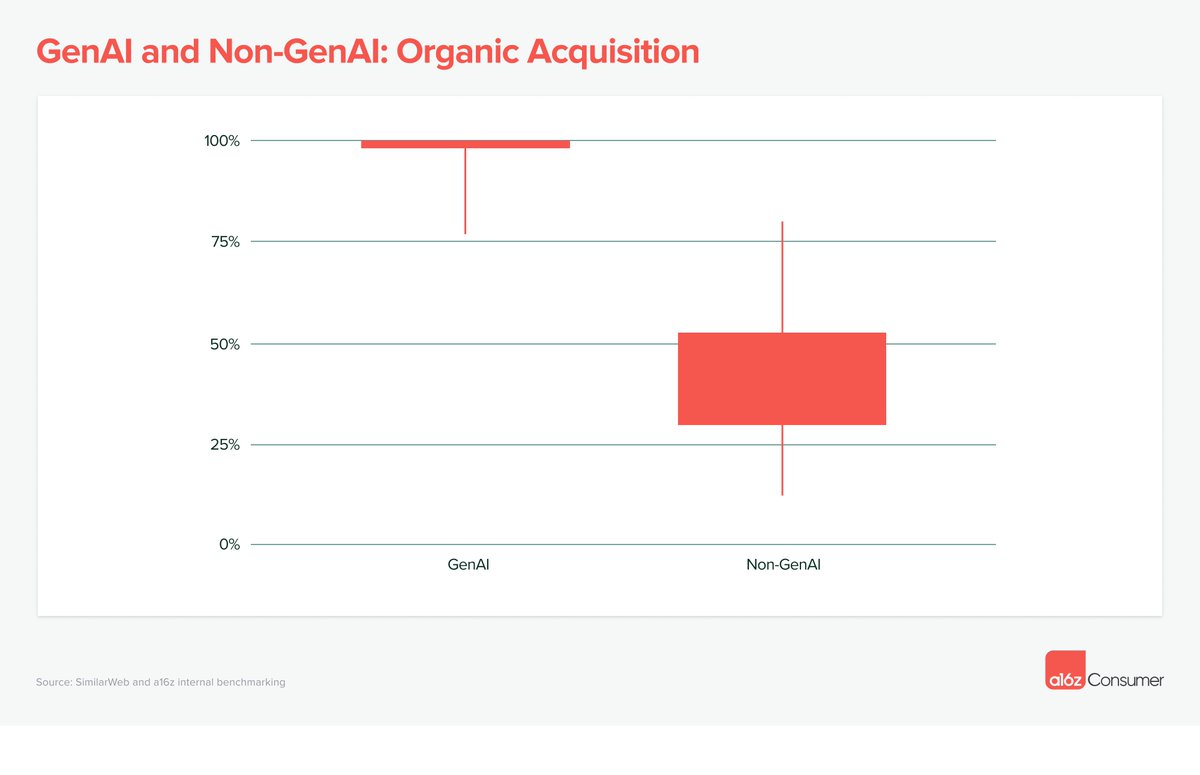

9/ How are companies getting traffic?

It's almost entirely organic. Between Reddit, Discord, newsletters, etc., there's lot of "free" acquisition.

The median product is seeing 99% organic acq, vs. a 52% median for pre-AI consumer subscription products.

It's almost entirely organic. Between Reddit, Discord, newsletters, etc., there's lot of "free" acquisition.

The median product is seeing 99% organic acq, vs. a 52% median for pre-AI consumer subscription products.

10/ And, 90% of cos on the list already have some sort of revenue, with the vast majority choosing subscription.

On average, they make $252/yr on the median plan, a significant ⬆️ vs. pre-AI subscriptions (more from @sarahdingwang and @martin_casado):

a16z.com/the-economic-c…

On average, they make $252/yr on the median plan, a significant ⬆️ vs. pre-AI subscriptions (more from @sarahdingwang and @martin_casado):

a16z.com/the-economic-c…

Lastly, a note on methodology.

We added app traffic, but companies qualified based on web visits - so app-only products were not eligible.

For products on Discord, our estimates only capture website visits, artificially deflating their "rank". This mostly impacts Midjourney.

We added app traffic, but companies qualified based on web visits - so app-only products were not eligible.

For products on Discord, our estimates only capture website visits, artificially deflating their "rank". This mostly impacts Midjourney.

For the full report, check out:

And if you're working on something in consumer genAI, reach out 👋 (and follow me for more data!)a16z.com/how-are-consum…

And if you're working on something in consumer genAI, reach out 👋 (and follow me for more data!)a16z.com/how-are-consum…

• • •

Missing some Tweet in this thread? You can try to

force a refresh