DEFINING ICT WEEKLY RANGE PROFILES

We'll break down the market manipulation patterns for each day of the week and how to anticipate them.

A thread..🧵

We'll break down the market manipulation patterns for each day of the week and how to anticipate them.

A thread..🧵

1. Classic Tuesday Low Of Week:

Profile: Bullish

Manipulation: Hovers above HTF Discount Array on Monday, drops on Tuesday.

Anticipation: Watch for failure to drop into the Array; odds are a lower drive on Tuesday London/New York Session.

Profile: Bullish

Manipulation: Hovers above HTF Discount Array on Monday, drops on Tuesday.

Anticipation: Watch for failure to drop into the Array; odds are a lower drive on Tuesday London/New York Session.

2. Classic Tuesday High Of Week:

Profile: Bearish

Manipulation: Hovers below HTF Premium Array on Monday, rises on Tuesday.

Anticipation: Watch for failure to rise into the Array; odds are a higher drive on Tuesday London/New York Session.

Profile: Bearish

Manipulation: Hovers below HTF Premium Array on Monday, rises on Tuesday.

Anticipation: Watch for failure to rise into the Array; odds are a higher drive on Tuesday London/New York Session.

3. Wednesday Low Of Week:

Profile: Bullish

Manipulation: Hovers above HTF Discount Array on Mon & Tue, drops on Wed.

Anticipation: Look for failure to drop into the Array; odds are a lower drive on Wednesday London/New York Session.

Profile: Bullish

Manipulation: Hovers above HTF Discount Array on Mon & Tue, drops on Wed.

Anticipation: Look for failure to drop into the Array; odds are a lower drive on Wednesday London/New York Session.

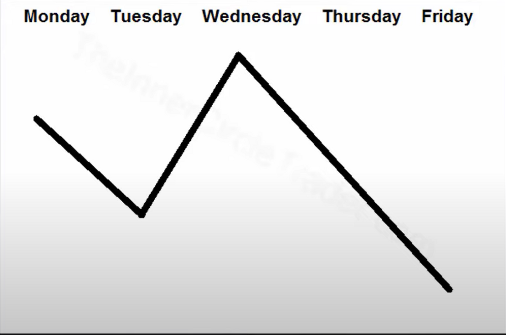

4. Wednesday High Of Week:

Profile: Bearish

Manipulation: Hovers below HTF Premium Array on Mon & Tue, rises on Wed.

Anticipation: Watch for failure to rise into the Array; odds are a higher drive on Wednesday London/New York Session.

Profile: Bearish

Manipulation: Hovers below HTF Premium Array on Mon & Tue, rises on Wed.

Anticipation: Watch for failure to rise into the Array; odds are a higher drive on Wednesday London/New York Session.

5. Consolidation Thursday Reversal (Bullish):

Profile: Bullish

Manipulation: Consolidates Mon-Wed, runs intra-week Low, and reverses.

Anticipation: No drop into the Array; odds are a lower drive on Thursday, possibly on Market Driver News or Rate release.

Profile: Bullish

Manipulation: Consolidates Mon-Wed, runs intra-week Low, and reverses.

Anticipation: No drop into the Array; odds are a lower drive on Thursday, possibly on Market Driver News or Rate release.

6. Consolidation Thursday Reversal (Bearish):

Profile: Bearish

Manipulation: Consolidates Mon-Wed, runs intra-week High, and reverses.

Anticipation: No rise into the Array; odds are a higher drive on Thursday, possibly on Market Driver News or Rate release.

Profile: Bearish

Manipulation: Consolidates Mon-Wed, runs intra-week High, and reverses.

Anticipation: No rise into the Array; odds are a higher drive on Thursday, possibly on Market Driver News or Rate release.

7. Consolidation Midweek Rally (Bullish):

Profile: Bullish

Manipulation: Consolidates Mon-Wed, runs intra-week High, expands higher into Fri.

Anticipation: Bullish market, hasn't reached Premium Array yet, and no Bearish Reversal. Expect an upward move for Premium Array.

Profile: Bullish

Manipulation: Consolidates Mon-Wed, runs intra-week High, expands higher into Fri.

Anticipation: Bullish market, hasn't reached Premium Array yet, and no Bearish Reversal. Expect an upward move for Premium Array.

8. Consolidation Midweek Decline (Bearish):

Profile: Bearish

Manipulation: Consolidates Mon-Wed, runs intraweek Low, expands lower into Fri.

Anticipation: Bearish market, hasn't reached Discount Array yet and no Bullish Reversal. Expect a downward move for the Discount Array.

Profile: Bearish

Manipulation: Consolidates Mon-Wed, runs intraweek Low, expands lower into Fri.

Anticipation: Bearish market, hasn't reached Discount Array yet and no Bullish Reversal. Expect a downward move for the Discount Array.

9. Seek & Destroy Bullish Friday:

Profile: Neutral — Low Probability

Manipulation: Consolidates Mon-Thu, runs intra-week High, expands higher on Fri.

Anticipation: Typically occurs awaiting Interest Rate Announcements or Non-Farm Payroll in July/August. Best to avoid trading

Profile: Neutral — Low Probability

Manipulation: Consolidates Mon-Thu, runs intra-week High, expands higher on Fri.

Anticipation: Typically occurs awaiting Interest Rate Announcements or Non-Farm Payroll in July/August. Best to avoid trading

10. Seek & Destroy Bearish Friday:

Profile: Neutral — Low Probability

Manipulation: Consolidates Mon-Thu, runs intra-week Low, expands lower on Fri.

Anticipation: Similar to 9, often seen in July/August. Avoid trading under these uncertain conditions.

Profile: Neutral — Low Probability

Manipulation: Consolidates Mon-Thu, runs intra-week Low, expands lower on Fri.

Anticipation: Similar to 9, often seen in July/August. Avoid trading under these uncertain conditions.

11. Wednesday Weekly Reversal (Bullish):

Profile: Bullish

Manipulation: Consolidates Mon-Tue, drives lower into HTF Discount array, then strongly reverses.

Anticipation: Look for institutional buying paired with Sell Stops Raid when the market is at a long-term or IT-Low.

Profile: Bullish

Manipulation: Consolidates Mon-Tue, drives lower into HTF Discount array, then strongly reverses.

Anticipation: Look for institutional buying paired with Sell Stops Raid when the market is at a long-term or IT-Low.

12. Wednesday Weekly Reversal (Bearish):

Profile: Bearish

Manipulation: Consolidates Mon-Tue, drives higher into HTF Premium array, then strongly reverses.

Anticipation: Look for institutional selling paired with Buy Stops Raid when the market is at a long-term or IT-high.

Profile: Bearish

Manipulation: Consolidates Mon-Tue, drives higher into HTF Premium array, then strongly reverses.

Anticipation: Look for institutional selling paired with Buy Stops Raid when the market is at a long-term or IT-high.

13. Understanding these weekly patterns and manipulations can help you anticipate market movements. Always stay informed and adapt your trading strategy accordingly

14. As a follow up I will be making a summary of the weekly profiling so that everybody can have a brief view of what every profile is doing and what you can expect.

15. If you like this content I would appreciate a Like + RT.

If you would like to see more from me and my colleagues make sure to follow @MNTrading_ !

If you would like to see more from me and my colleagues make sure to follow @MNTrading_ !

• • •

Missing some Tweet in this thread? You can try to

force a refresh