Like many,I enjoyed reading @SethAckerman's piece on Brenner. He covers a lot of things that I've had a problem with and may eventually write up in a more comphrensive thing on profit rates (there's just a lot to do!) I have a few critical comments though

jacobin.com/2023/09/robert…

jacobin.com/2023/09/robert…

I want to emphasize here that I think the piece is good in a number of respects and my critical comments are not meant to reject the piece as a whole. I just care about a lot of issues tangential to the main point but which come up over the course of it.

1) The claim that "jobs programs" were part of the "second new deal" is without foundation and is extremely misleading.

2) Also as @_ericblanc pointed out, NiRA had a very important labor component- section 7(a)- which was part of the initial unionization push. The NLRA was a stronger codification of section 7(a) after SCOTUS struck NiRA down. So this is also misleading

laborpolitics.substack.com/p/liberals-get…

laborpolitics.substack.com/p/liberals-get…

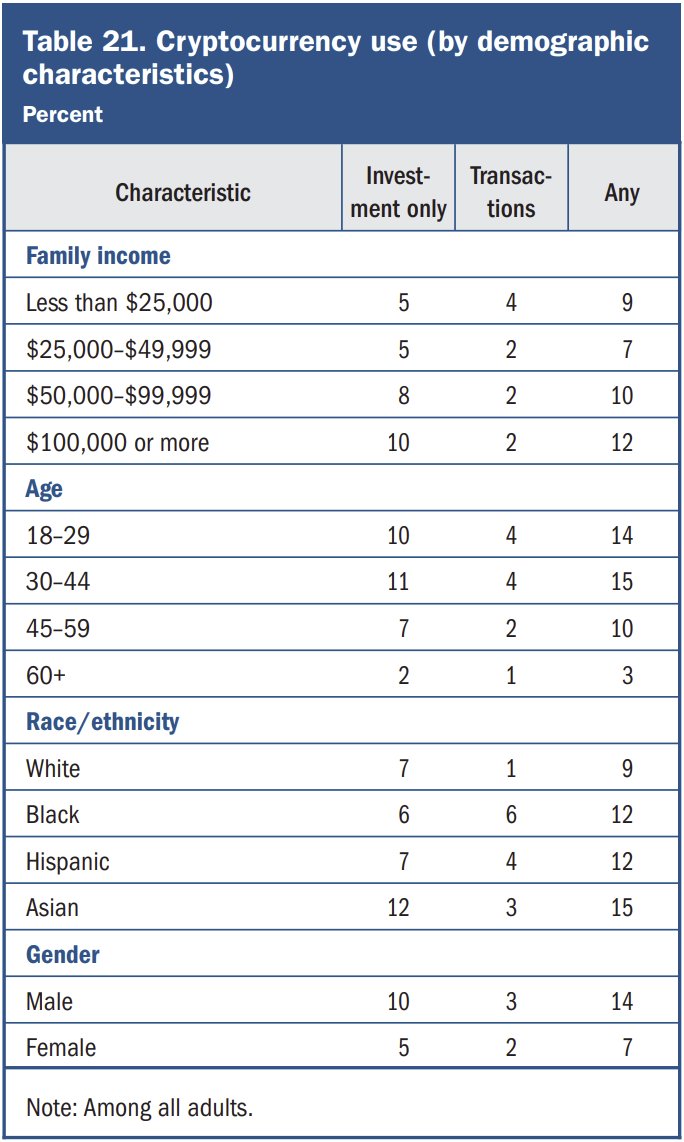

3) I am not going to get into the international comparisons because that involves all sorts of messy details but for the U.S. at least, this doesn't line up. The issue from the U.S. policymaker point of view was precisely that wages were **delinked** from economic conditions

I wrote about this last year but will comment on it more in the future. I think this is likely even more true elsewhere. crisesnotes.com/the-arthur-bur…

4) I'm really skeptical of this claim about Shaikh's book and its impact.Shaikh's book is interesting in various ways but its largely a collection of his previous papers & I certainly don't see the case for it being THE text putting Marxist economics on "firm theoretical ground

It's hard not to read this as a rhetorical move to sharpen the impact of the following section's deconstruction.

5) "The profit rate is the rate of return capitalists earn on their investments in physical capital: machines, buildings, raw materials"- It's worth saying that this is not Marx's definition. The Denominator for Marx is "total capital advanced" which includes wages.

This matters because it emphasizes that use of the capital stock data in the national accounts is a choice of convenience with no theoretical basis.

6) In general my concern with this section is it reinforces an uncritical understanding of the various categories involved for the sake of "finishing the job" on Brenner. I care more about the entire profit rate discourse than Brenner himself.

7) I'm skeptical of the idea that the tendency of the rate of profit to fall has anything to do with one's assumptions about competition, but Shaikh seems to indeed think this to a certain extent. So I'll leave that alone. That said...

this section is still misleading. Ackerman focuses on the lack of price cutting when the actual key to the argument, see e.g. the end of this short piece by Shaikh, is not about price cutting or not. It's about the level of investment.

anwarshaikhecon.org/sortable/image…

anwarshaikhecon.org/sortable/image…

As Shaikh says in that piece "the general rate of profit will tend to fall (as outlined above), provided that the new methods generally embody higher unit fixed costs". IOW, the argument is about whether firm behavior will keep "unit fixed costs" in balance with profits

Thus its not about overall profits per se, it's about the speed of growth of the denominator and the impact of assumptions about competition on that. This does not at all come out clearly in the piece.

8) Thus, the argument does not seem to me to hinge on the degree of price wars or not. This seems to me to be getting too caught up in the competition theory debates themselves which, at best, only overlap with TRPF

9) That said, the points about price wars are on target but its bizarre that Ackerman brings up this line of argument without discussing its main proponent- Fred Lee.

Lee even has a chapter on precisely this issue in the main edited collection about "Alternative Theories of Competition". It also suffuses all of his work.

routledge.com/Alternative-Th…

routledge.com/Alternative-Th…

What Ackerman is talking about is essentially "managed competition" and market governance. You can also read my chapter with @LDHerrine for more on this stuff. The point is far stronger drawing on a deep theoretical tradition than business consultants

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

10) That said, Ackerman than goes off the rails by suggesting that its not actually market governance (or generally, a strategic balance between businesses) preventing price wars but simply product differentiation as a "struggle against competition" rather than a competitive tool

Firms still have the ability to inflict unacceptable consequences on their competitors, product differentiation or not. Developing new products and dominating new markets is definitely how firms succeed but that's not a negation of competition.

11) Which leads us to the final issue. This issue is not so much one of Ackerman, but the literature it draws from. Marxist economists are generally not really familiar with business accounting practices and this is most stark in discussions of depreciation.

Ackerman here repeats the literatures conflation of machine wear and tear and depreciation. Depreciation is an accounting tool to recognize the expenditures on plant and equipment as a cost. It's not the **actual** state of machines.

The "amortization" period may be chosen to have some relation to the "average" life of machines,but only for planning purposes i.e. the depreciation reserves being adequate for replacement investment. And with accelerated depreciation allowances, clearly this has fallen away

Thus the debates over "depreciation" where the "data" is official statistical offices attempts to estimate wear and tear costs are utterly sterile and have nothing to do with anything. Now, this is cold comfort for Marxist economists who lean heavily on this data.

But I worry about reinforcing people's misunderstanding of this topic and making it a starting point for future arguments over this piece and Brenner when I think there are more fundamental issues involved. (lol this got so long I have to finish it after posting most of it)

As I said at the beginning, I think the piece is good in a lot of ways and has made a number of points I've meant to make about Brenner for a long time. These criticisms aren't meant to be some kind of "takedown" of the whole piece.

Oh one Postscript I forgot to include- I get the piece is already long but it seems strange to invoke Paul Sweezy in one place without acknowledging that he was an anti-reformist.

The central point of "Monopoly Capital" is that the tendency to stagnation is realized through the nature of the "Capitalist State". It is kind of strange to sidestep this issue since most of the debate over the Inflation Reduction Act has happened on the terrain of State Theory.

@basiloberholzer on your latter point, I don't really think so. I think the TRPF is abstracted from aggregate demand issues. It's supposed to apply to expanded reproduction with all value "realized" and in Marx's framework aggregate demand issues are "realization" issues.

@basiloberholzer I think what you're gesturing at is right and is the big weakness of the piece as a critique of Brenner- Brenner runs together aggregate demand issues and profit rate issues in a way not consistent with Marxist crisis theory. This to me is the central problem with his work.

@basiloberholzer This point is implicit in Ackerman's piece if you take it as a whole and read carefully, but to me you can skip a lot of the exegesis if you just focus on that central point.

@SethAckerman I've long hammered this. This piece in particular, while focused on neoclassicals, applies just as much to the relevance of profit rates for investment decisions as it does for interest rates.

crisesnotes.com/low-interest-r…

crisesnotes.com/low-interest-r…

@SethAckerman incidentally, I'm planning on doing a presentation entitled "Against Profit Rates" for the Eastern Economic Association conference next year.

@NicolasDVillar1 @SethAckerman This implies a combined flows plus stocks denominator for the rate of profit where the capital stock plus intermediate inputs plus total wages ("variable capital") form the denominator.

@NicolasDVillar1 @SethAckerman Also, if he meant this I don't think he would have called the stock of the means of production "fixed capital". He would have said something like "the mass of means of production only becomes capital when its value is transferred to the product i.e. when it becomes depreciation"

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter