Application of Quarterly Theory & Standard Deviations.

An Educational Thread.

cc: @traderdaye & @TraderDext3r

like | repost | follow ↴

An Educational Thread.

cc: @traderdaye & @TraderDext3r

like | repost | follow ↴

Applying these concepts to time is important. Since that what it’s based on.

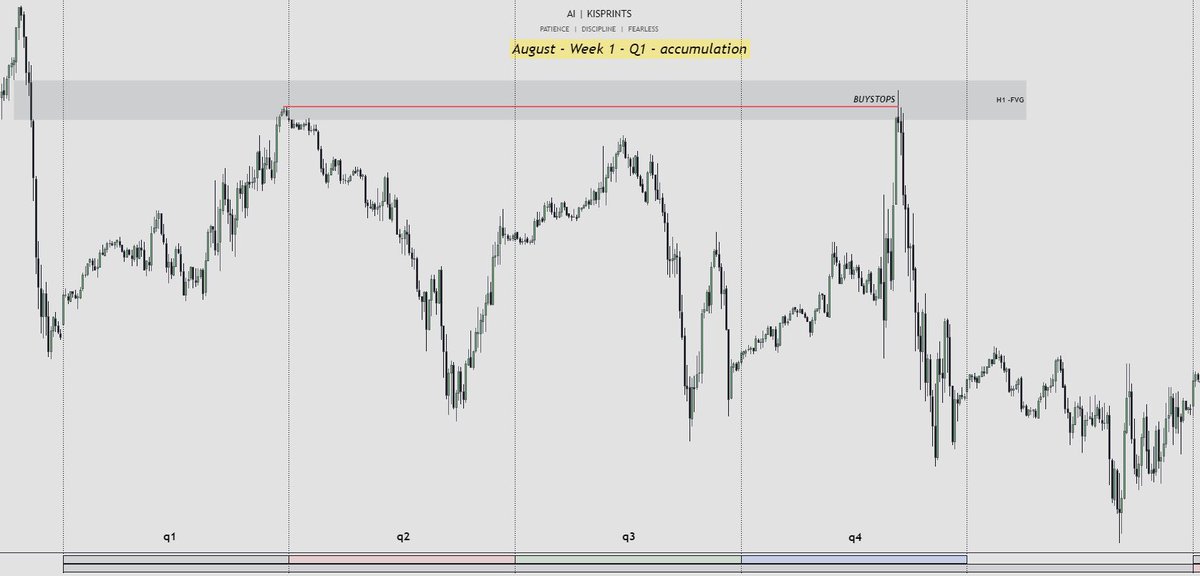

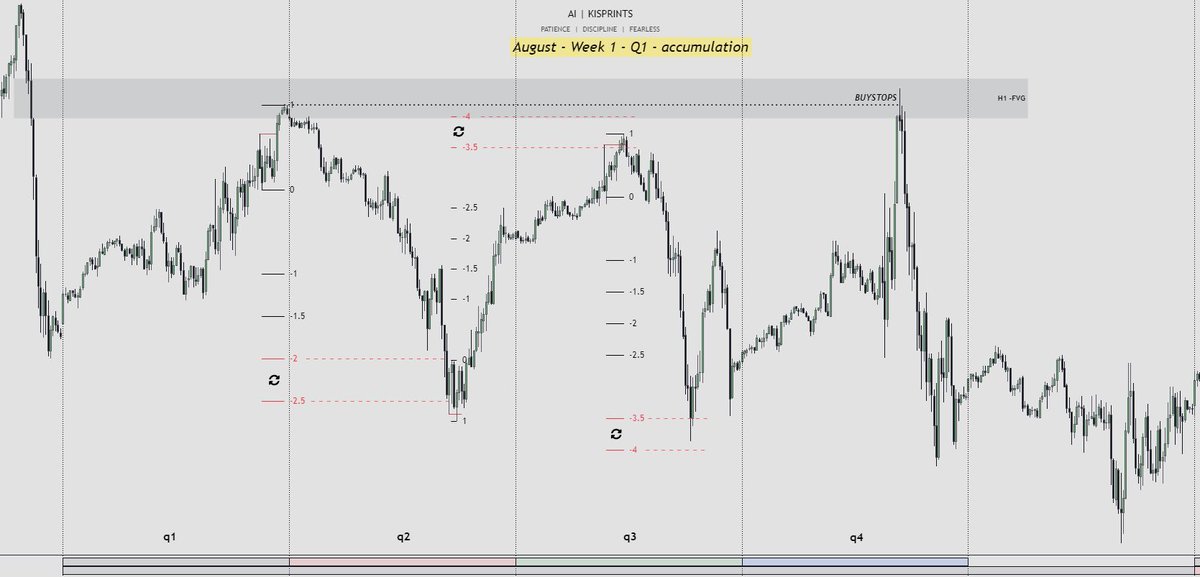

With that in mind, Lets apply the Quarterly Theory to the Month of August ‘23.

Notice the division of segments. Q1 - Q2 - Q3 - Q4

With that in mind, Lets apply the Quarterly Theory to the Month of August ‘23.

Notice the division of segments. Q1 - Q2 - Q3 - Q4

With everything in mind let’s dissect this month and discuss Quarter 1 IN-DEPTH using these concepts.

[1]

Starting with Q1.

- Since Time is Fractal, we can divide:

(Monthly) Q1

into

(weekly) q1-q4.

[1]

Starting with Q1.

- Since Time is Fractal, we can divide:

(Monthly) Q1

into

(weekly) q1-q4.

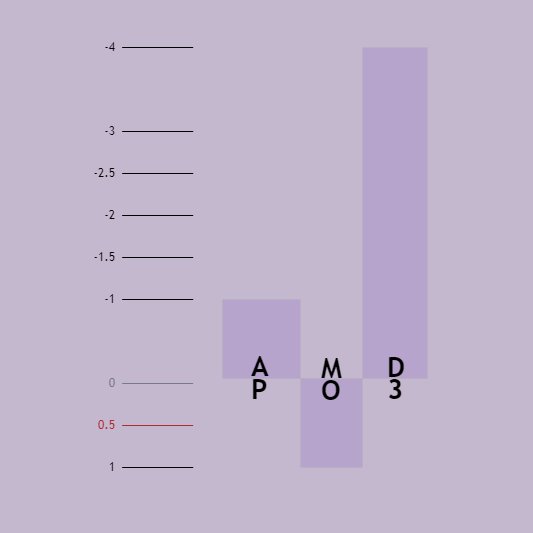

[2]

After back-testing each quarter:

Note how each Quarter Sweeps a significant High/Low.

Especially q2 - q3 (high probability)

What do we use when price manipulates / sweeps liquidity?

Standard Deviations.

Let’s apply them.

After back-testing each quarter:

Note how each Quarter Sweeps a significant High/Low.

Especially q2 - q3 (high probability)

What do we use when price manipulates / sweeps liquidity?

Standard Deviations.

Let’s apply them.

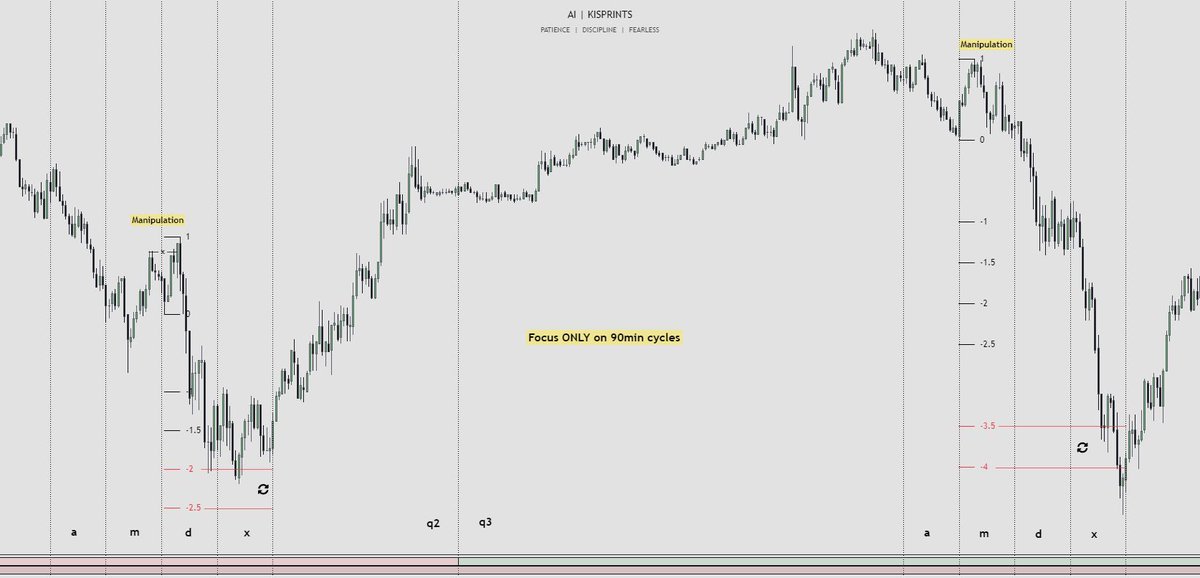

[3]

Since Time is Fractal,

Let’s zoom into q2 & q3

Lets find our NY AM 90min Cycles:

6:00am (A)

7:30am (M)

9:00am (D)

10:30am (X)

Since Time is Fractal,

Let’s zoom into q2 & q3

Lets find our NY AM 90min Cycles:

6:00am (A)

7:30am (M)

9:00am (D)

10:30am (X)

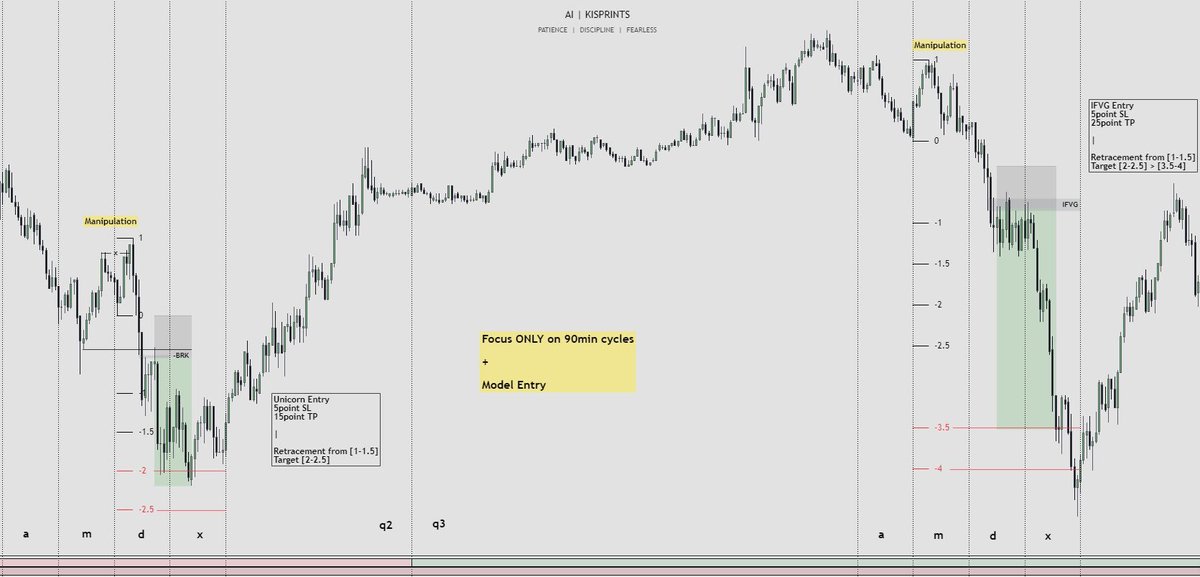

[4]

This is simply just the foundation.

Implementing your model is what matter to find entry.

Let’s use the same 90min Cycles Chart & Apply our model.

{Model + Quarterly Theory + Standard Deviations}

This is simply just the foundation.

Implementing your model is what matter to find entry.

Let’s use the same 90min Cycles Chart & Apply our model.

{Model + Quarterly Theory + Standard Deviations}

[5]

This is just a small data pull from the algo.

Imagine what you can do once applied to every timeframe.

Just saying... Here’s August Quarterly Theory Implementation.

This is just a small data pull from the algo.

Imagine what you can do once applied to every timeframe.

Just saying... Here’s August Quarterly Theory Implementation.

[6]

Recap:

- HTF to LTF Analysis

- Identify Quarterly Theory (amdx)

- Manipulation/ Liquidity Sweep?

- Implement Standard Deviations

- [1-1.5] Retracement to Model

- [2-2.5] Partial

- [3.5-4] Flatten

Here are LIVE intraday trade examples:

09-14-23

09-15-23

$ES

Recap:

- HTF to LTF Analysis

- Identify Quarterly Theory (amdx)

- Manipulation/ Liquidity Sweep?

- Implement Standard Deviations

- [1-1.5] Retracement to Model

- [2-2.5] Partial

- [3.5-4] Flatten

Here are LIVE intraday trade examples:

09-14-23

09-15-23

$ES

Thanks again to the founders of these concepts.

Make sure you follow them as these are their teachings.

Thank you for reading.

If you are interested in more Education & Daily Livestreams. Join the Discord Community ↯

discord.gg/YAHznS92MU

Make sure you follow them as these are their teachings.

Thank you for reading.

If you are interested in more Education & Daily Livestreams. Join the Discord Community ↯

discord.gg/YAHznS92MU

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter