Madhusudan Masala () #IPOAlert. Engaged in manufacturing and processing more than 32 types of Spices under the brand names "DOUBLE HATHI" and "MAHARAJA". Company also sells products like: Tea and Other Grocery Products.

.

RHP: madhusudanmasala.com

reports.chittorgarh.com/ipo_notes/Madh…

.

RHP: madhusudanmasala.com

reports.chittorgarh.com/ipo_notes/Madh…

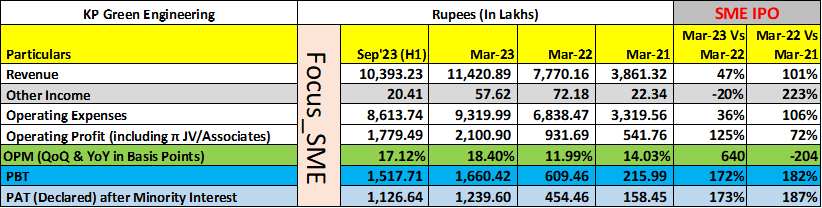

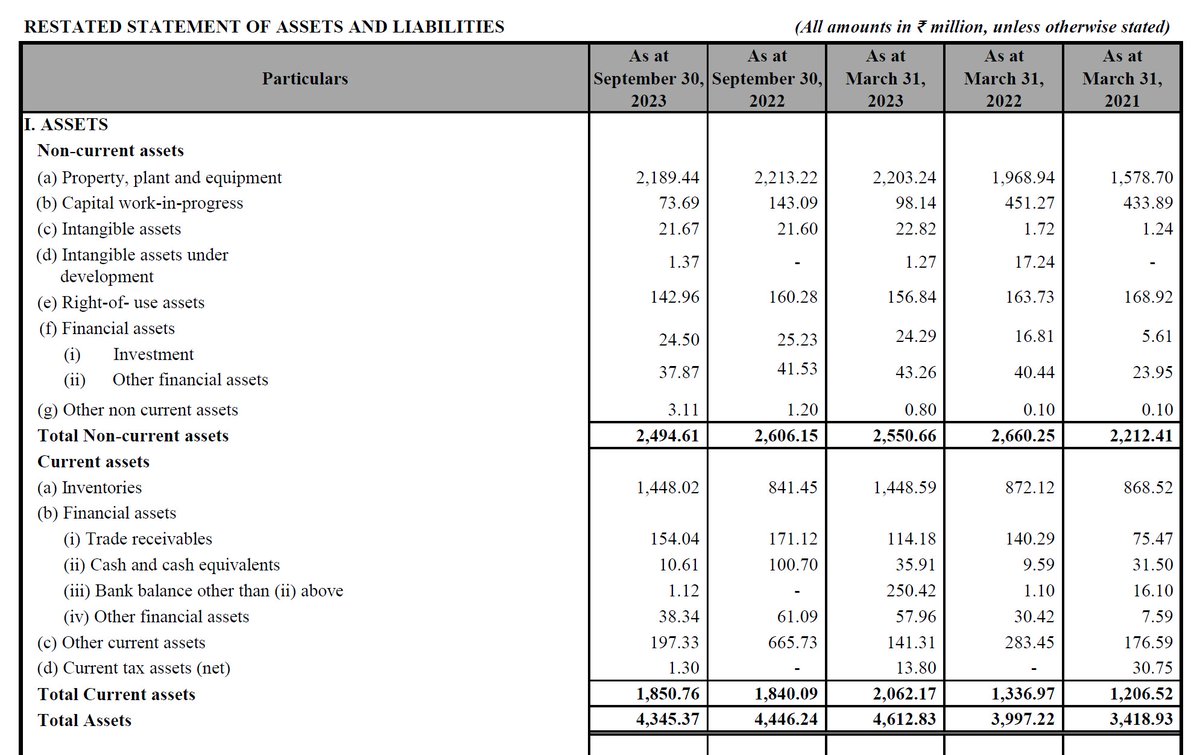

Sizeable amount of debts, inventories &receivables with ~1/2 of all borrowings are from related parties (interest bearing). Mar'23 shows a huge jump in finished goods inventory & that could be an issue. Huge amount of capacity available & CWIP is for a cold storage.

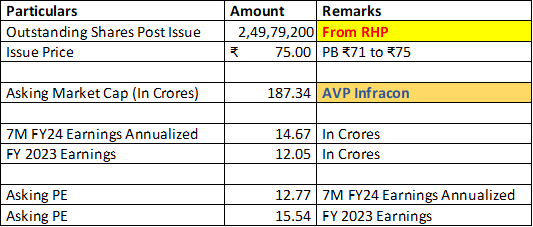

Company has reported exceptional performance in the IPO year with signs of window dressing of numbers & raising doubts on sustainability. Asking valuation looks reasonable. Monitor both related party transactions & management compensation post listing.

Overall, it looks average issue to me & needs periodic monitoring of Balance Sheet. I MAY NOT APPLY.

.

PLEASE DO YOUR OWN DUE DILIGENCE, REVIEW ACCORDING TO YOUR INVESTMENT STYLE AND THEN TAKE A DECISION.

.

PLEASE DO YOUR OWN DUE DILIGENCE, REVIEW ACCORDING TO YOUR INVESTMENT STYLE AND THEN TAKE A DECISION.

• • •

Missing some Tweet in this thread? You can try to

force a refresh