VWAP is one of the most common indicators, and most traders have a strong opinion about it

I made a basic thread to help y'all understand it🧵⬇️

I made a basic thread to help y'all understand it🧵⬇️

VWAP is short for Volume-Weighted Average Price

VWAP measures a stock's average price during a time period, adjusted for volume

VWAP measures a stock's average price during a time period, adjusted for volume

Traders commonly use VWAP in 2 ways

1) Sentiment tracking

2) Support and resistance

1) Sentiment tracking

2) Support and resistance

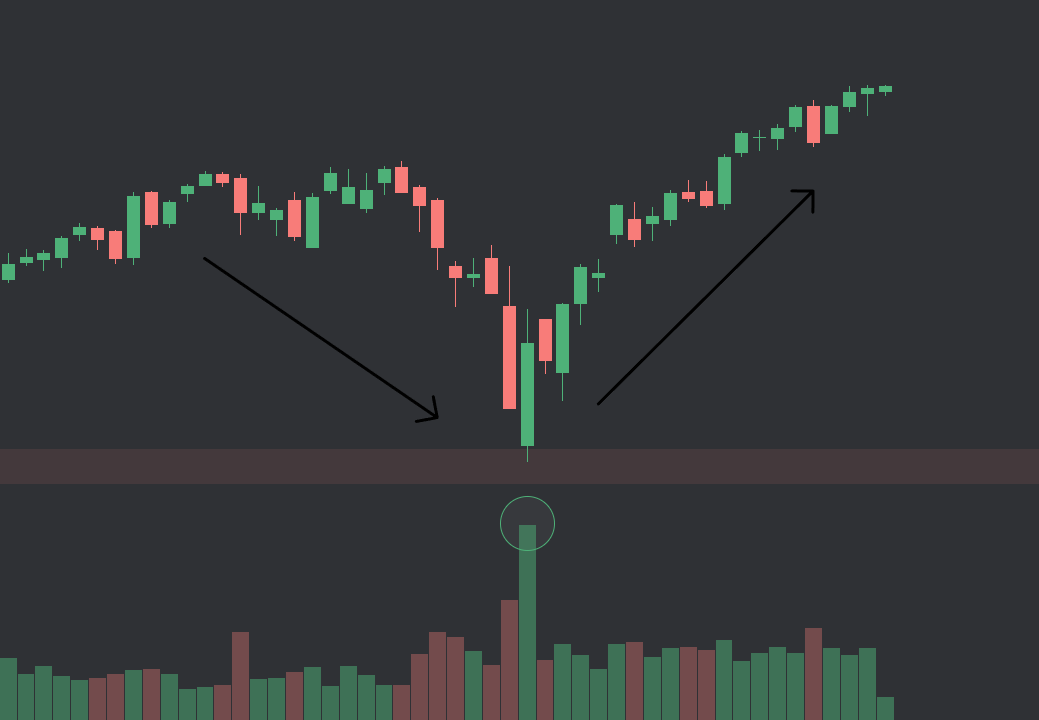

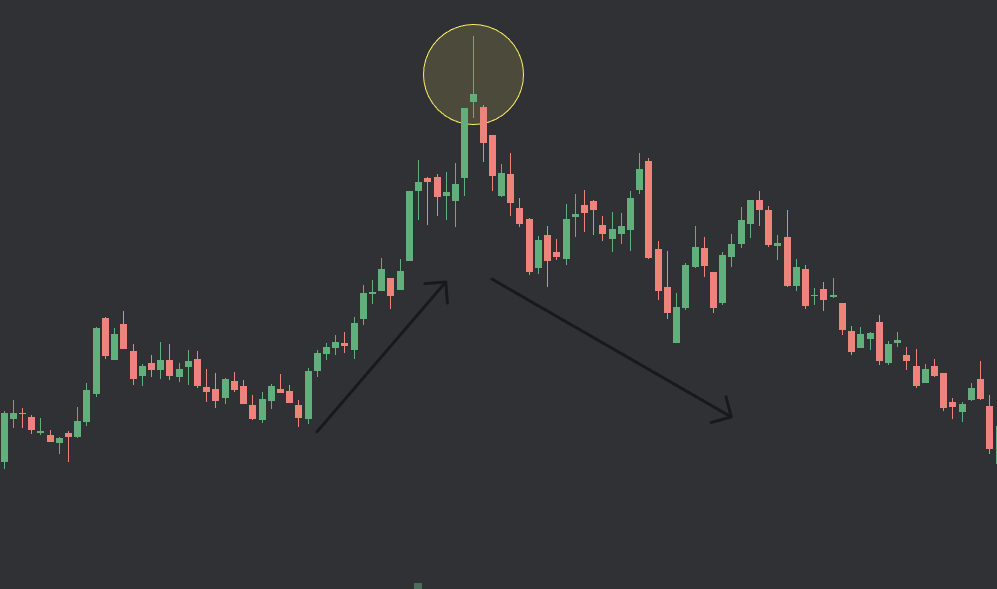

VWAP as a sentiment tracker

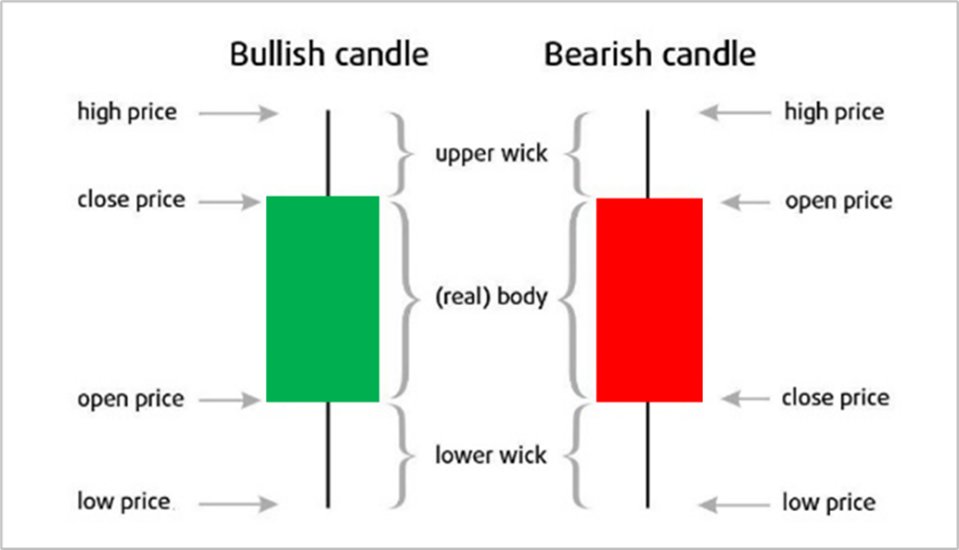

When price is above VWAP, it can be considered 'strong'

When price is below VWAP, it can be considered 'weak'

This works on trend days, but can be dangerous on range days

When price is above VWAP, it can be considered 'strong'

When price is below VWAP, it can be considered 'weak'

This works on trend days, but can be dangerous on range days

VWAP as support and resistance

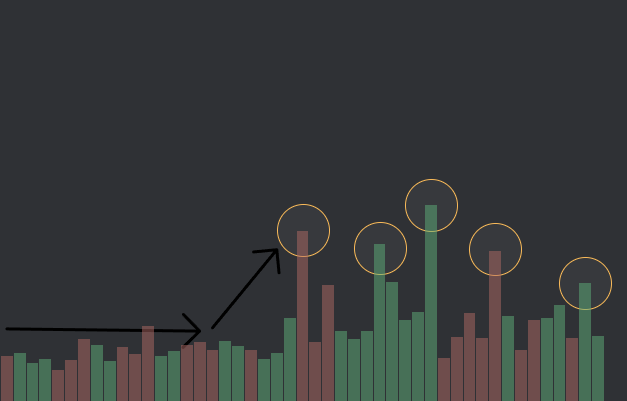

Similar to an EMA, lots of traders view a VWAP touch as a buying opportunity. If the trend has been bullish and we pullback to VWAP, many will buy long.

Lots of traders also view VWAP as tough resistance to break, and will take profit near VWAP

Similar to an EMA, lots of traders view a VWAP touch as a buying opportunity. If the trend has been bullish and we pullback to VWAP, many will buy long.

Lots of traders also view VWAP as tough resistance to break, and will take profit near VWAP

VWAP settings

I'm pretty sure this is default (or close) but here are my VWAP settings on TradingView

I'm pretty sure this is default (or close) but here are my VWAP settings on TradingView

My opinion on VWAP

I think VWAP is something you can use if you need more key levels, but isn't a necessity

It's very useful for small caps, but that sector isn't particularly hot right now

I prefer to use it like an EMA, don't overcomplicate it

I think VWAP is something you can use if you need more key levels, but isn't a necessity

It's very useful for small caps, but that sector isn't particularly hot right now

I prefer to use it like an EMA, don't overcomplicate it

Hope this helped y'all understand VWAP🤝

Check out my discord if you need a small trading group to learn and grow with👇

upgrade.chat/slappy-central…

Check out my discord if you need a small trading group to learn and grow with👇

upgrade.chat/slappy-central…

• • •

Missing some Tweet in this thread? You can try to

force a refresh