Traders can make money even if they’re wrong 2 out of 3 times

5 principles to level up your trading game

A thread 🧵

5 principles to level up your trading game

A thread 🧵

2/ These are simple yet effective strategies that we’ve established for our trading strategy at Game of Trades

3/ Principle 1: Master one strategy

There are many trading patterns, indicators and strategy, but focus is key

The key to success is to refine a single strategy through relentless experimentation

If you're dabbling in new indicators daily, you're diluting your focus

There are many trading patterns, indicators and strategy, but focus is key

The key to success is to refine a single strategy through relentless experimentation

If you're dabbling in new indicators daily, you're diluting your focus

4/ We use “Divergence Trading” at Game of Trades and we know it inside out

We fine-tune details like:

- Trendline angles

- Divergence to expected return ratio

- Suitable indices

- Red flags in divergences

- Optimal stop-loss and risk management

We fine-tune details like:

- Trendline angles

- Divergence to expected return ratio

- Suitable indices

- Red flags in divergences

- Optimal stop-loss and risk management

5/ Principle 2: Time efficiency

Don't linger in trades. Find a promising setup and ensure quick materialization.

If trades stagnate post-entry, reconsider your approach

Don't linger in trades. Find a promising setup and ensure quick materialization.

If trades stagnate post-entry, reconsider your approach

6/ Stagnant trades tie up capital, they are what you call “dead money”

You need a trigger signal to get in and out of the trade

Quickly and successfully

You need a trigger signal to get in and out of the trade

Quickly and successfully

7/ All our trades have trigger signals, making sure we quickly capture the meat of the move

We operate with clear 'pending' and 'active' trade lists

Trades graduate from 'pending' to 'active' upon signal confirmation

We operate with clear 'pending' and 'active' trade lists

Trades graduate from 'pending' to 'active' upon signal confirmation

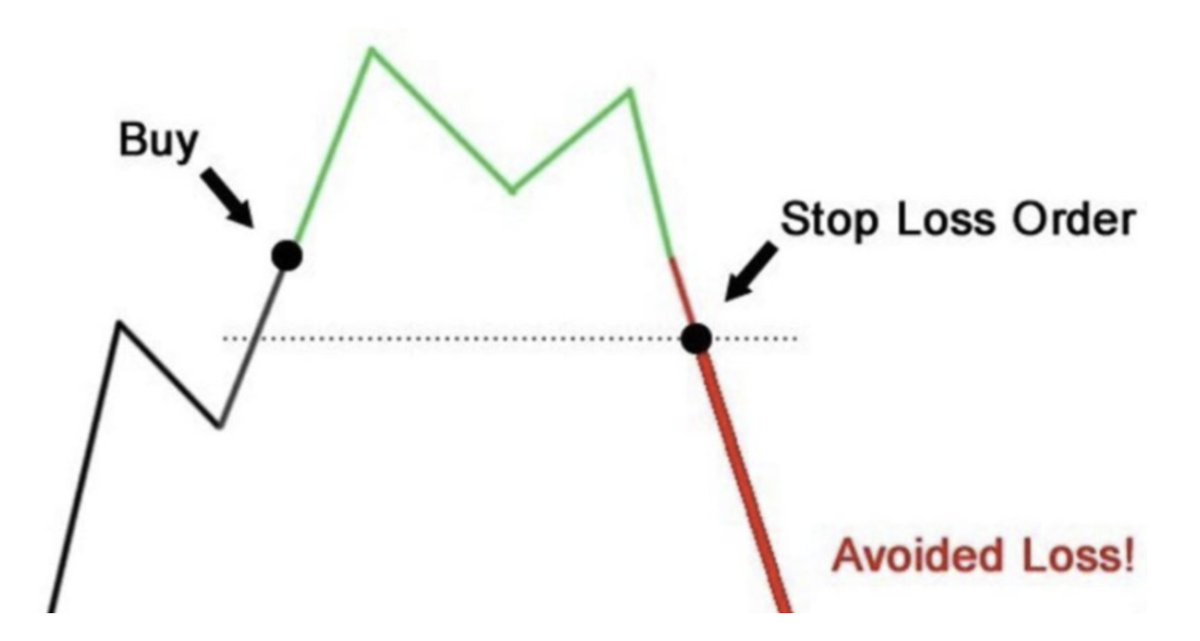

8/ Principle 3: Rigorous Risk Management

It’s common knowledge, yet often ignored.

If you are not cutting your losses, your exposure to risk is unlimited

It’s common knowledge, yet often ignored.

If you are not cutting your losses, your exposure to risk is unlimited

9/ Unlimited risk exposure skew the odds in favor of the house (not you)

Having consistent risk management does the opposite, it’s a cornerstone of successful trading

Having consistent risk management does the opposite, it’s a cornerstone of successful trading

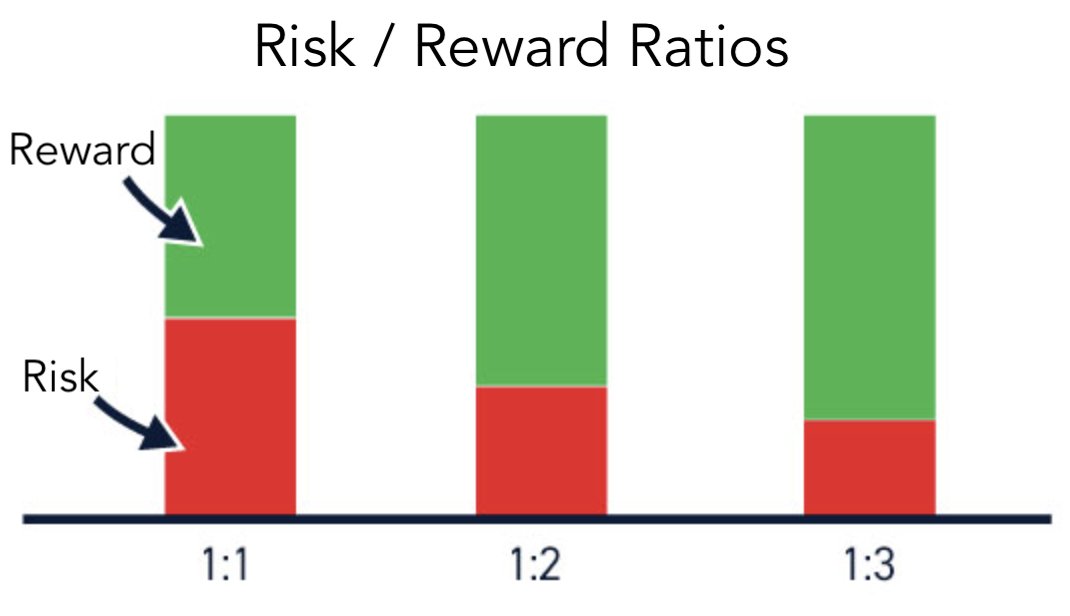

10/ You should be setting stop-losses in proportion to expected profits

For instance, aim for a 3:1 risk-reward ratio. If you anticipate a 9% gain, a stop-loss at 3% safeguards your position

This means you can be wrong about 2 trades but be right about 1 and still make a profit

For instance, aim for a 3:1 risk-reward ratio. If you anticipate a 9% gain, a stop-loss at 3% safeguards your position

This means you can be wrong about 2 trades but be right about 1 and still make a profit

11/ Risk management tips the odds in your favor

3:1 is the golden ratio between reward and risk we use for our strategy at Game of Trades

3:1 is the golden ratio between reward and risk we use for our strategy at Game of Trades

12/ Principle 4: Let Your Winners Run

Just as you should avoid having unlimited exposure to risk, make sure you have unlimited exposure to reward

That means letting your winners run

Just as you should avoid having unlimited exposure to risk, make sure you have unlimited exposure to reward

That means letting your winners run

13/ Price can run a lot further than you initially expected

Raise your stoploss as the trade proceeds or set a trailing stoploss

This removes the limit on your potential reward for each trade

Raise your stoploss as the trade proceeds or set a trailing stoploss

This removes the limit on your potential reward for each trade

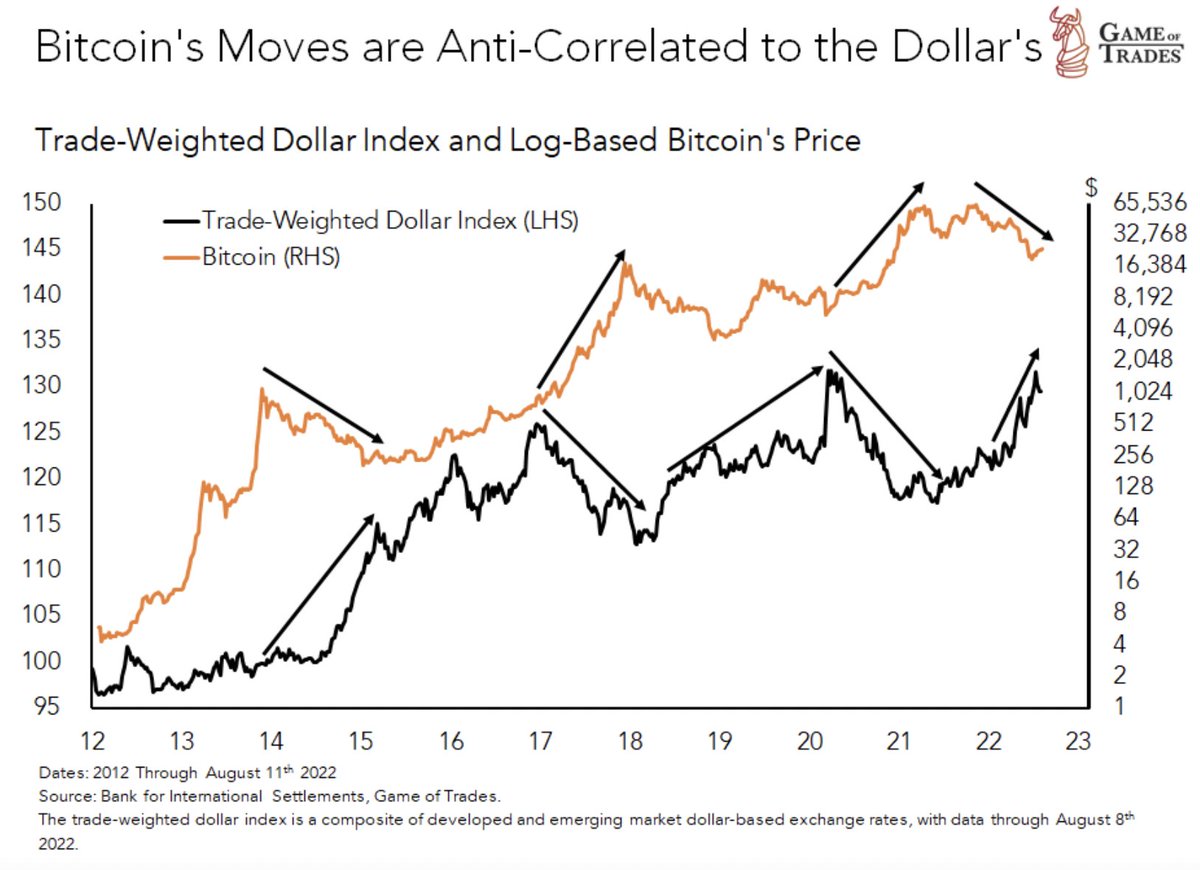

14/ Principle 5: Diversify Your Trades

Many assets and indices have a tight correlation or inverse correlation

If you have too many correlated trades, it can make you overly exposed to a macro variable

Fix this by watching a diversified universe of indices, stocks and futures

Many assets and indices have a tight correlation or inverse correlation

If you have too many correlated trades, it can make you overly exposed to a macro variable

Fix this by watching a diversified universe of indices, stocks and futures

15/ Our team scans a universe of around 80 different stocks, ETFs and futures for developing divergences

We select a diversified set of the best ones and communicate them in our Pending Setups Report

We select a diversified set of the best ones and communicate them in our Pending Setups Report

16/ We streamline the process of trading divergences for our clients

It gives you access to what we believe are the ideal trade setups based on the 5 principles above

We have a free trial, check it out

It gives you access to what we believe are the ideal trade setups based on the 5 principles above

We have a free trial, check it out

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter