You can outperform most venture funds by buying LEGO.

I analyzed the last 20 years of secondhand LEGO pricing data, and found randomly purchasing sets will match most VC's returns

if you're somewhat intentional about what you buy-- you massively outperform even the best firms

I analyzed the last 20 years of secondhand LEGO pricing data, and found randomly purchasing sets will match most VC's returns

if you're somewhat intentional about what you buy-- you massively outperform even the best firms

I pulled data on 16,000 LEGO releases since the year 2000. I dropped any promotional items, duplicate items, or any other oddballs. This got me down to 10k or so.

For each, I then pulled in resell data from bricklink for each item to get current market price (ebay prices higher)

For each, I then pulled in resell data from bricklink for each item to get current market price (ebay prices higher)

This allowed me to calculate a net IRR, assuming you bought it at release, and held it until 2023.

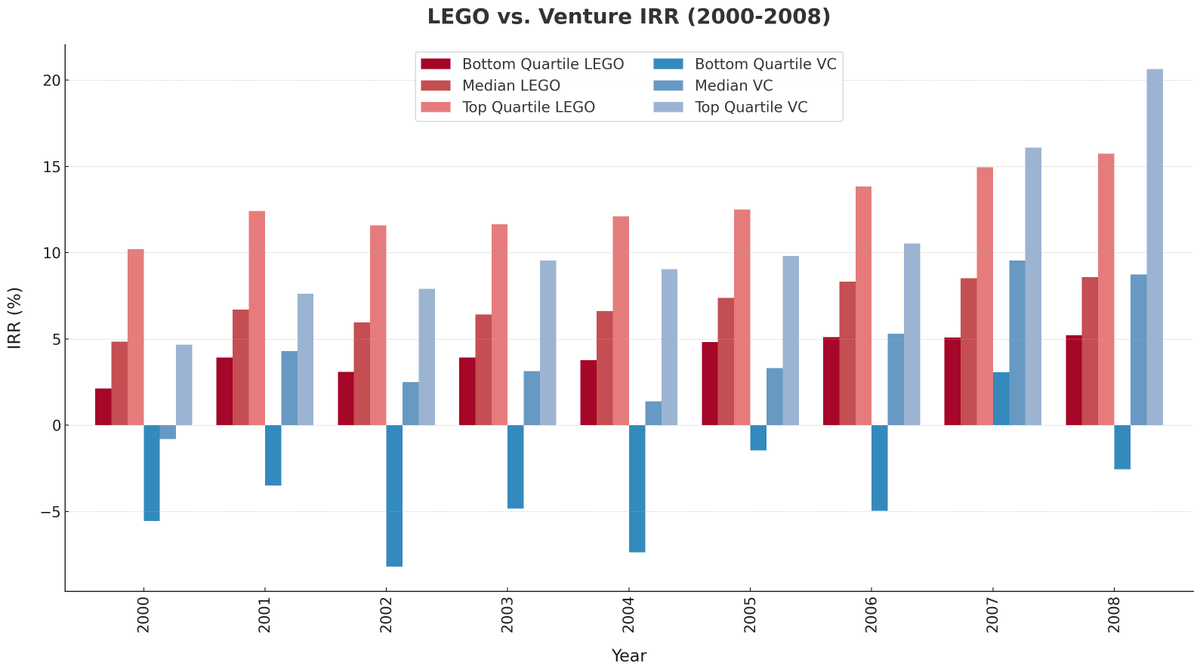

The VC benchmark data is sourced from the Cambridge Associates

recent years are iffy because of extreme paper markups (30%+ mean IRR). The data seems best through 2010/2015

The VC benchmark data is sourced from the Cambridge Associates

recent years are iffy because of extreme paper markups (30%+ mean IRR). The data seems best through 2010/2015

In most years, random purchasing rivaled the returns of the median venture fund.

If you just blindly bought certain themes, you can consistently generate double digit IRR across all vintages. For most, resale was high enough at EOY1 that these strategies would be obvious.

If you just blindly bought certain themes, you can consistently generate double digit IRR across all vintages. For most, resale was high enough at EOY1 that these strategies would be obvious.

Dollar value, and piece count, seem to have less effect on present resale value.

But other strategies seem possible.

Applying modest statistical methods, on like two years of data, leads to finding strategies producing 20%+ irr over 10y+

But other strategies seem possible.

Applying modest statistical methods, on like two years of data, leads to finding strategies producing 20%+ irr over 10y+

the world of super alternative assets is hilariously vast and probably deeply unexplored.

there are paths towards transcendence (a hamptons compound w/ a 1974 Land Rover Series III) that involve deploying capital at things other than b2b software

there are paths towards transcendence (a hamptons compound w/ a 1974 Land Rover Series III) that involve deploying capital at things other than b2b software

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter