Rug Puls: the stealthy menace that drained over $700 million in 2023 alone.

But don't worry, @dedotfi has a groundbreaking antidote.

Say goodbye to rug pull nightmares and protect your investments! 🧵

But don't worry, @dedotfi has a groundbreaking antidote.

Say goodbye to rug pull nightmares and protect your investments! 🧵

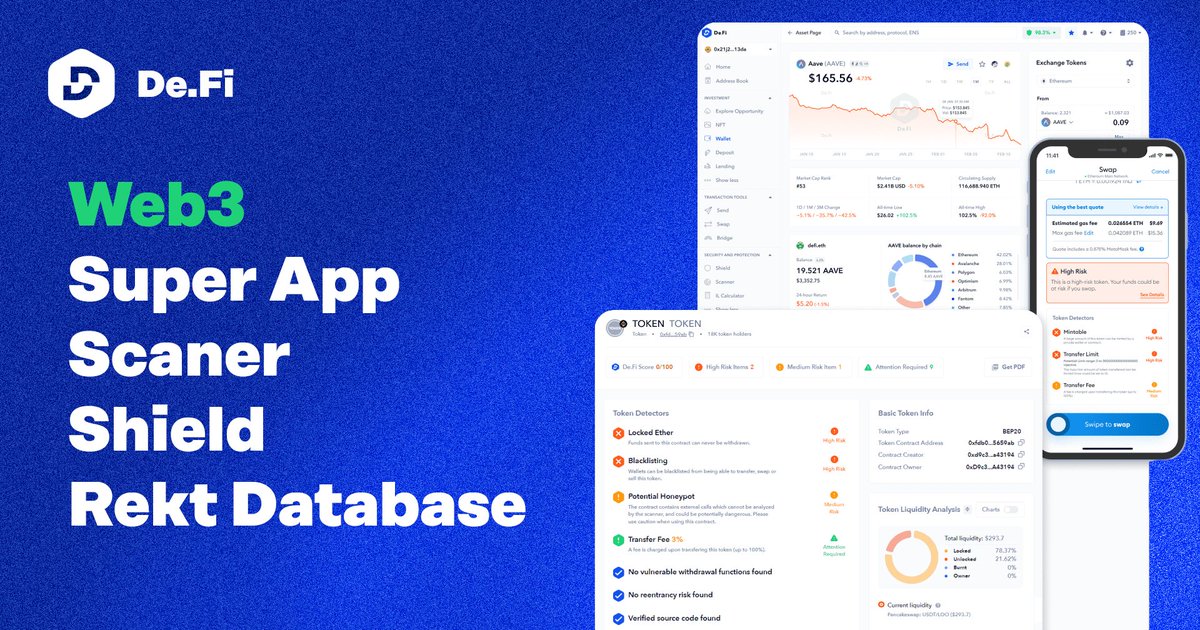

So, @dedotfi is a multifunctional Web3 Super App that combines all the necessary tools for safe work in the field of cryptocurrency.

In this discussion, we will focus on the Scaner, which offers:

• Risk scanning - reveals malicious smart contract functions

• Liquidity status - indicates the amount of locked funds

• Token ownership - displays the distribution of tokens

• Liquidity Ownership

• Risk scanning - reveals malicious smart contract functions

• Liquidity status - indicates the amount of locked funds

• Token ownership - displays the distribution of tokens

• Liquidity Ownership

To demonstrate the capability of the Scanner, let's examine a token that has experienced a recent rug pull.

Coin: $BTCchad

Token contract: 0xf150a90A10A8c101dc3AB41ee4710806bd9Af2b4

Rugpull chart:

Coin: $BTCchad

Token contract: 0xf150a90A10A8c101dc3AB41ee4710806bd9Af2b4

Rugpull chart:

To obtain an audit of a token, follow these steps:

1. Copy the contract address of the token.

2. Enter the contract address into the search bar.

3. Wait for the Scanner to display all the relevant information.

1. Copy the contract address of the token.

2. Enter the contract address into the search bar.

3. Wait for the Scanner to display all the relevant information.

As we see, the token received a low score of 37/100

The contract has 3 High-Risk Items:

- Locked Ether: Funds sent to this contract cannot be withdrawn

- Missing Liquidity: Token liquidity is not found

- Dump Risk: A private wallet owns a significant percentage of token's supply

The contract has 3 High-Risk Items:

- Locked Ether: Funds sent to this contract cannot be withdrawn

- Missing Liquidity: Token liquidity is not found

- Dump Risk: A private wallet owns a significant percentage of token's supply

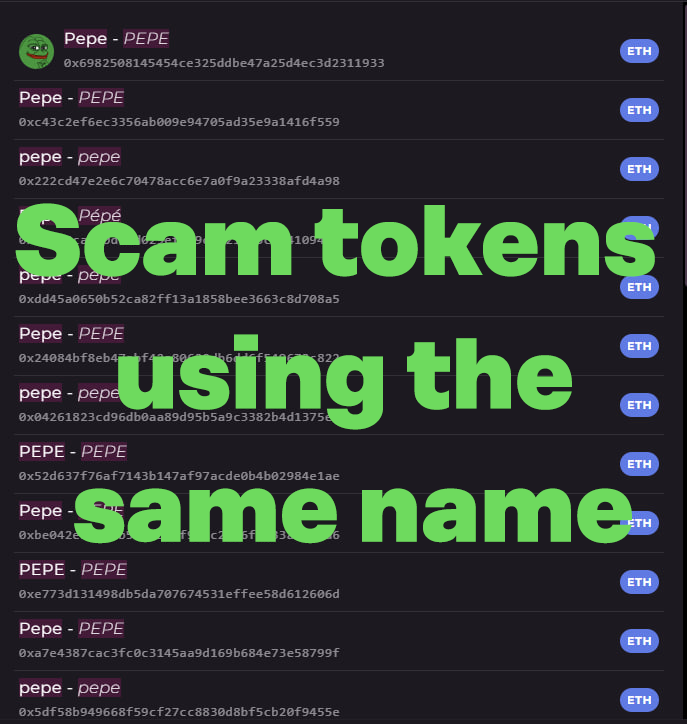

Scam tokens frequently masquerade as legitimate ones, sometimes even adopting identical names. Let's examine a case involving two tokens, both named $PEPE:

Original PEPE: 0x6982508145454ce325ddbe47a25d4ec3d2311933

Scam PEPE: 0x222cd47e2e6c70478acc6e7a0f9a23338afd4a98

Original PEPE: 0x6982508145454ce325ddbe47a25d4ec3d2311933

Scam PEPE: 0x222cd47e2e6c70478acc6e7a0f9a23338afd4a98

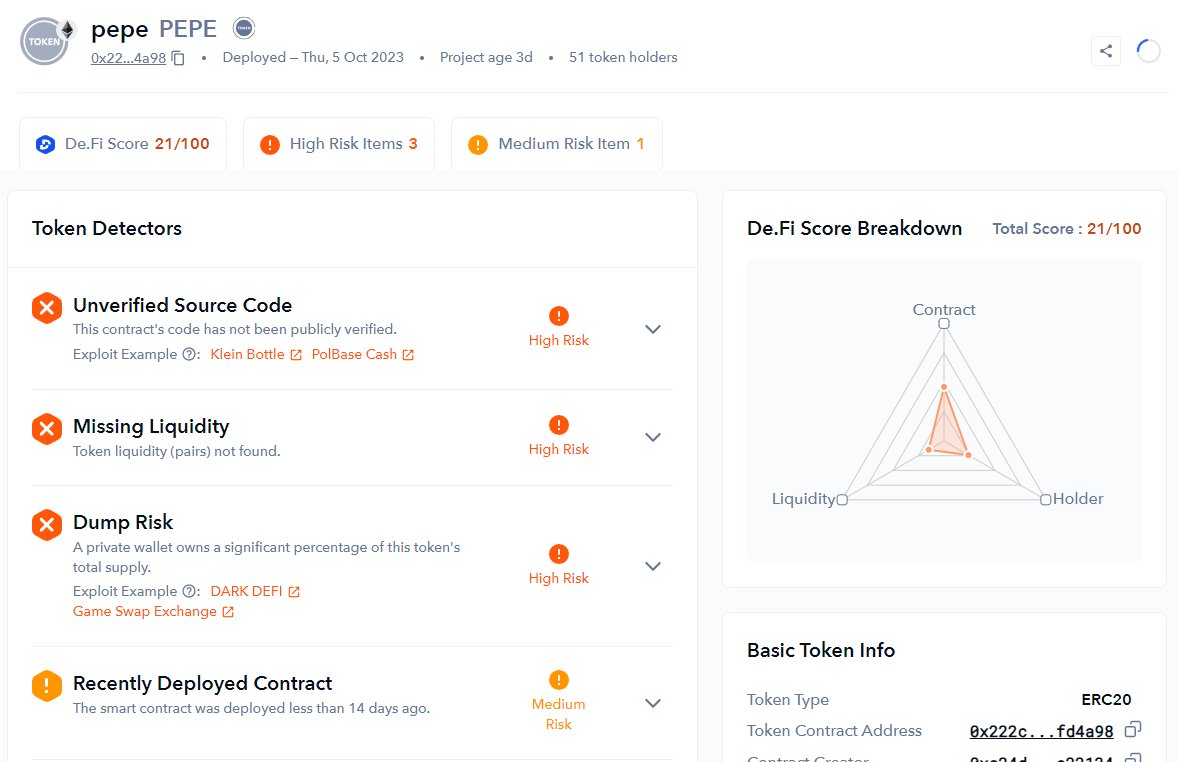

While analyzing a scam token, the Scanner revealed that the DeFi score is 21/100. The token carries several risks, including:

1. Unverified Source Code

2. Missing Liquidity

3. Dump Risk

4. Recently Deployed Contract

1. Unverified Source Code

2. Missing Liquidity

3. Dump Risk

4. Recently Deployed Contract

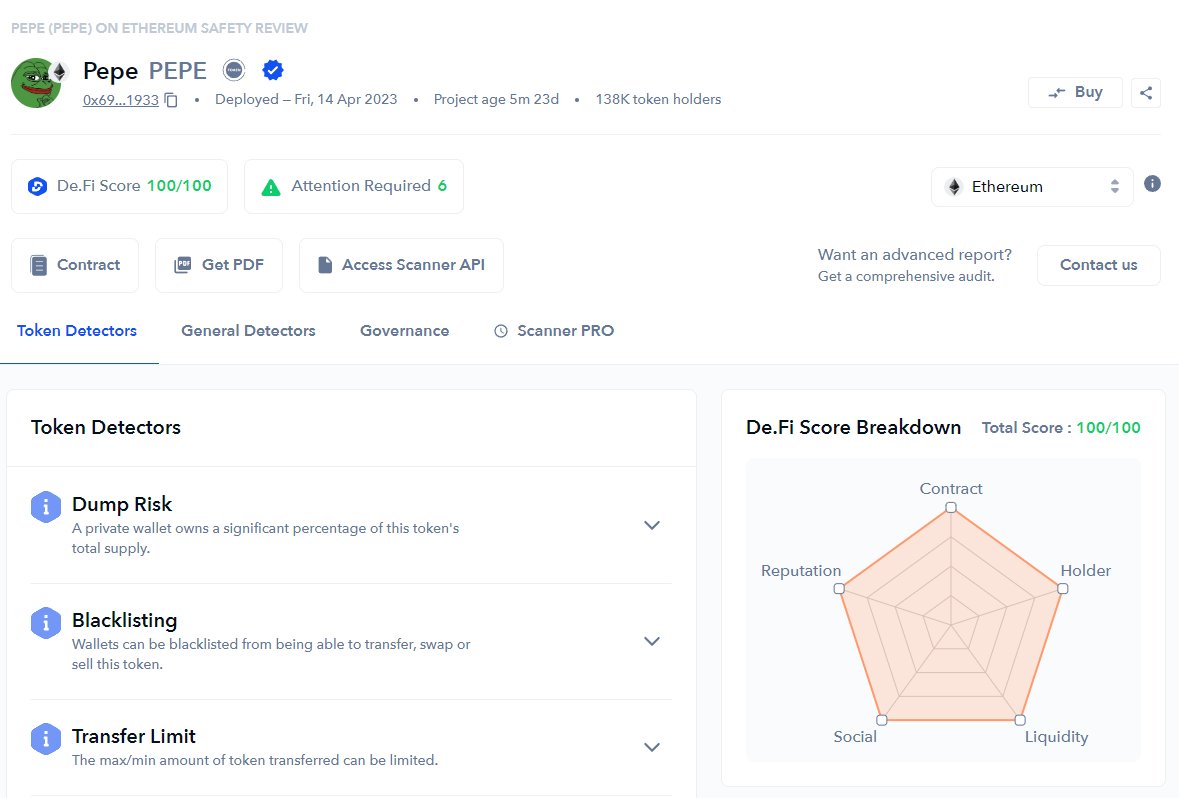

Now, let's review the audit of the original token $PEPE. As anticipated, we received a perfect score of 100/100, indicating no risks.

8/

8/

It's important to remember that the security of your assets is your responsibility.

Taking just three simple actions on the @dedotfi platform, which will only take a couple of minutes, can help you avoid falling victim to scammers.

Taking just three simple actions on the @dedotfi platform, which will only take a couple of minutes, can help you avoid falling victim to scammers.

Despite the fact that this thread is written in partnership, I must say that I find these free tools incredibly useful. The team's development is truly admirable, and I highly recommend their use to anyone involved in on-chain trading.

Moreover, there is an exciting announcement scheduled for tomorrow that deserves our attention.

https://twitter.com/DeDotFi/status/1704568286518587881

I hope you've found this thread helpful.

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

Follow me @wacy_time1 for more.

Like/Repost the quote below if you can:

https://twitter.com/wacy_time1/status/1711313659962741028

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter