For anyone here who hasn’t worked in corporate strategy at a Fortune 500 company and wants to understand how utterly bone-headed decisions—such as changing your customers’ cell-phone plans unless they proactively call to opt out—get made, here’s a quick explainer 👇

This chain of events typically starts during a quarterly board of directors meeting, during which an independent director (generally a current or retired CEO of a company in a different, non-competing industry) says that the company isn’t making enough money and that it’s the fault of the CEO, who is a supremely unqualified buffoon.

(Tangent: Every board director has his own pet favorite metric, be it growth (e.g., year-over-year sales), profitability (e.g., EBITDA margin), investor returns (e.g., change in share price if public, return on invested capital if private), or some byzantine metric that he used to love when he was the division president of a Ma Bell carve-out back in the 1980s (e.g., change in same-store gross profit divided by number of people on the sales team, raised to the power of pi and divided by 1998, which represents the year his current girlfriend was born). The exact metric doesn’t matter; what matters is that, by the standards thereof, the CEO sucks.)

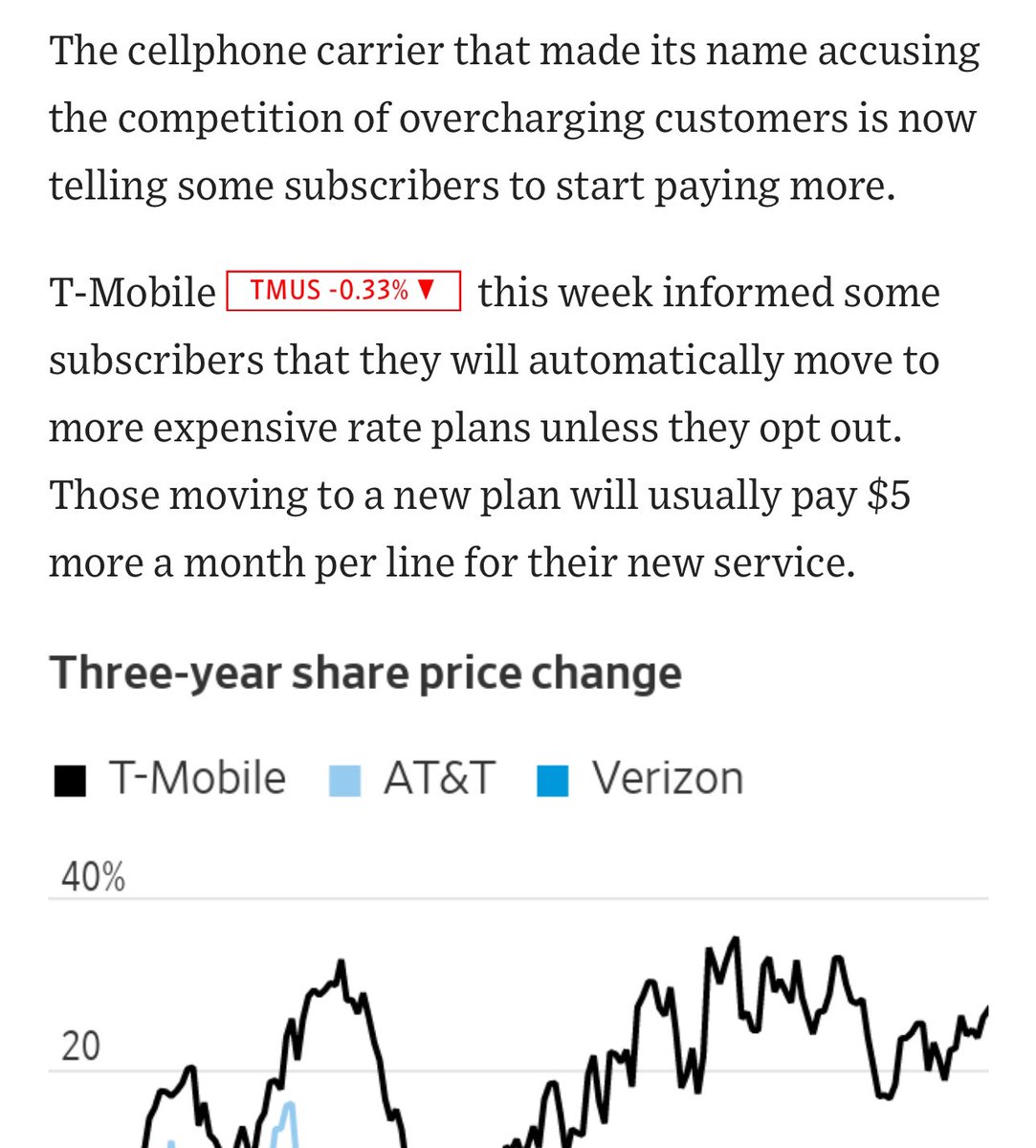

The independent director will then pull open the calculator app on his iPhone 7, punch some numbers in, and say something to the effect of, “If we can increase revenue per customer by just $5, our market cap will increase by billions. Get your strategy team to figure it out.”

From here, the CEO and the CFO will then set up a meeting with the SVP of corporate strategy for 7:15 AM the next morning, to be held in the locker room of the country-club whose $20k annual membership dues the company’s shareholders generously cover. Sitting in the sauna, buck naked save for bleached white towels barely sufficient for the mission to which they’ve been called, the executives will decide that the most prudent course of action is to call McKinsey and pay them approximately $2.5M to figure this out for them. (Note: The CFO will get a quote from his buddy at Deloitte or KPMG, just to be able to tell the board that they solicited competing bids, but everyone knows that the work is just going to end up with McKinsey. Or Bain.)

McKinsey will rapidly set up office in a large conference room on-site, as if it’s the makeshift command-and-control center of an air base in Kuwait on the eve of Operation Iraqi Freedom, and they’ll deploy a dozen MBAs with a weighted average age of 26.5 years across the company’s headquarters. The consultants will meticulously evaluate all levers for revenue growth, including M&A, organic growth from new customers, and organic growth from existing customers (either by reducing churn or just finding ways to get more money out of each one). M&A will quickly get crossed off the list, since McKinsey doesn’t want Goldman coming in and taking over, and new-customer growth is always just painful, so, by process of elimination, they’ll decide on getting more money from existing customers.

After performing an analysis called a customer segmentation, McKinsey will realize that the company has already squeezed every last dollar possible out of the company’s highest-paying customers, whose loyalty is already pushed to the limit. They will therefore instead try to figure out how to get more money from lower-paying customers.

Associate 1: How do we get more money from our cheapest customers?

Associate 2: Can we go back to selling ring tones, like we did in 1998?

Associate 1: I did a case study on that at HBS! Ten minutes go by. Anyway, that’s why it won’t work. What if we just… raised prices?

Associate 2: These customers are highly price-sensitive. We can’t do that unless the customers think they’re getting additional value.

[CONTINUED IN NEXT TWEET]

This chain of events typically starts during a quarterly board of directors meeting, during which an independent director (generally a current or retired CEO of a company in a different, non-competing industry) says that the company isn’t making enough money and that it’s the fault of the CEO, who is a supremely unqualified buffoon.

(Tangent: Every board director has his own pet favorite metric, be it growth (e.g., year-over-year sales), profitability (e.g., EBITDA margin), investor returns (e.g., change in share price if public, return on invested capital if private), or some byzantine metric that he used to love when he was the division president of a Ma Bell carve-out back in the 1980s (e.g., change in same-store gross profit divided by number of people on the sales team, raised to the power of pi and divided by 1998, which represents the year his current girlfriend was born). The exact metric doesn’t matter; what matters is that, by the standards thereof, the CEO sucks.)

The independent director will then pull open the calculator app on his iPhone 7, punch some numbers in, and say something to the effect of, “If we can increase revenue per customer by just $5, our market cap will increase by billions. Get your strategy team to figure it out.”

From here, the CEO and the CFO will then set up a meeting with the SVP of corporate strategy for 7:15 AM the next morning, to be held in the locker room of the country-club whose $20k annual membership dues the company’s shareholders generously cover. Sitting in the sauna, buck naked save for bleached white towels barely sufficient for the mission to which they’ve been called, the executives will decide that the most prudent course of action is to call McKinsey and pay them approximately $2.5M to figure this out for them. (Note: The CFO will get a quote from his buddy at Deloitte or KPMG, just to be able to tell the board that they solicited competing bids, but everyone knows that the work is just going to end up with McKinsey. Or Bain.)

McKinsey will rapidly set up office in a large conference room on-site, as if it’s the makeshift command-and-control center of an air base in Kuwait on the eve of Operation Iraqi Freedom, and they’ll deploy a dozen MBAs with a weighted average age of 26.5 years across the company’s headquarters. The consultants will meticulously evaluate all levers for revenue growth, including M&A, organic growth from new customers, and organic growth from existing customers (either by reducing churn or just finding ways to get more money out of each one). M&A will quickly get crossed off the list, since McKinsey doesn’t want Goldman coming in and taking over, and new-customer growth is always just painful, so, by process of elimination, they’ll decide on getting more money from existing customers.

After performing an analysis called a customer segmentation, McKinsey will realize that the company has already squeezed every last dollar possible out of the company’s highest-paying customers, whose loyalty is already pushed to the limit. They will therefore instead try to figure out how to get more money from lower-paying customers.

Associate 1: How do we get more money from our cheapest customers?

Associate 2: Can we go back to selling ring tones, like we did in 1998?

Associate 1: I did a case study on that at HBS! Ten minutes go by. Anyway, that’s why it won’t work. What if we just… raised prices?

Associate 2: These customers are highly price-sensitive. We can’t do that unless the customers think they’re getting additional value.

[CONTINUED IN NEXT TWEET]

[CONTINUATION]

Partner 1, dialing in from a McKinsey G6 en route to the biweekly partner offsite in Bermuda: Just change them over to an upgraded plan, add five bucks to their bills, and let them call to opt out if they don’t like it.

Associates 1 and 2, simultaneously: Sir, you’re brilliant!

The associates will go on to conduct a handful of focus groups to check the box and be able to tell the company that they won’t actually lose customers by doing this (side note: they’ll be wrong), and they’ll build a financial model showing that the loss in customers is offset by the higher average sales price (again, wrong). All of this will be summarized in no fewer than 80 PowerPoint slides in the main deck and another 120 in a deck of supplementary materials (no, that’s not an exaggeration), with enough charts to cause even the most hardcore of actuaries to reconsider his life and contemplate getting a job as a poolside bartender at Margaritaville.

Once finalized, the McKinsey partner and the SVP of strategy will present their work to the board, who will spend no more than 90 seconds discussing it before approving the changes over their second round of old fashioneds that afternoon.

And that’s why your phone bill keeps going up.

PS. Two years later, after the new strategy has been demonstrably proven not to work, McKinsey will once again get engaged to figure out a better approach.

Partner 1, dialing in from a McKinsey G6 en route to the biweekly partner offsite in Bermuda: Just change them over to an upgraded plan, add five bucks to their bills, and let them call to opt out if they don’t like it.

Associates 1 and 2, simultaneously: Sir, you’re brilliant!

The associates will go on to conduct a handful of focus groups to check the box and be able to tell the company that they won’t actually lose customers by doing this (side note: they’ll be wrong), and they’ll build a financial model showing that the loss in customers is offset by the higher average sales price (again, wrong). All of this will be summarized in no fewer than 80 PowerPoint slides in the main deck and another 120 in a deck of supplementary materials (no, that’s not an exaggeration), with enough charts to cause even the most hardcore of actuaries to reconsider his life and contemplate getting a job as a poolside bartender at Margaritaville.

Once finalized, the McKinsey partner and the SVP of strategy will present their work to the board, who will spend no more than 90 seconds discussing it before approving the changes over their second round of old fashioneds that afternoon.

And that’s why your phone bill keeps going up.

PS. Two years later, after the new strategy has been demonstrably proven not to work, McKinsey will once again get engaged to figure out a better approach.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter