China is on the verge of a BoP crisis.

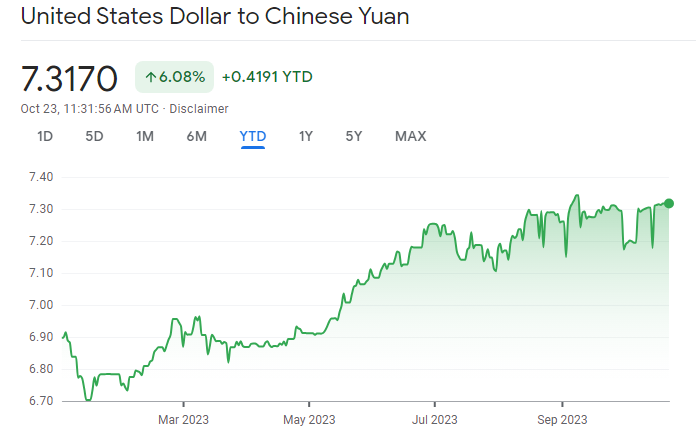

For weeks not the PBOC has held the line at 7.3 for weeks through the fix, intervention, and rate rises, but it is not working. Pressure is mounting for a more substantial FX move, likely on par with the stress seen in '15/16.

For weeks not the PBOC has held the line at 7.3 for weeks through the fix, intervention, and rate rises, but it is not working. Pressure is mounting for a more substantial FX move, likely on par with the stress seen in '15/16.

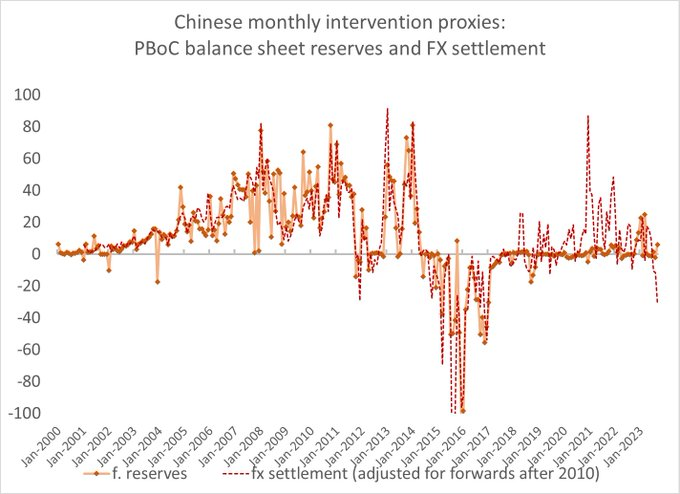

For the first time since that period we are starting to indications of selling of dollars to prop up the FX. The FX settlement numbers (good proxy for direct and indirect intervention by state banks) shows the first large scale activity in Sept since 16. @Brad_Setser

Facing these mounting pressures the PBOC is doing everything in its power to keep a lid on downward pressures. First, setting the fix at a level significantly above the actual value.

They have also let rates on the short-end rise 40bps in recent weeks despite the fact that the domestic conditions in the economy would likely call for easier policy instead.

Other indications of rate moves are even larger:

https://x.com/g_sobes/status/1715425504818262183?s=20

Typically a central bank would not be increasing rates on the short end if their stock market was experiencing relatively sharp declines.

These dynamics are much more closely aligned with a BoP style crisis dynamic where FX stability takes precedence over domestic conditions.

These dynamics are much more closely aligned with a BoP style crisis dynamic where FX stability takes precedence over domestic conditions.

Many think that there is no way that China could experience a BoP crisis style dynamic because it also has a trade surplus.

But capital moves much faster than trade to drive an FX. And China has become more reliant on foreign capital in recent years which is now leaving:

But capital moves much faster than trade to drive an FX. And China has become more reliant on foreign capital in recent years which is now leaving:

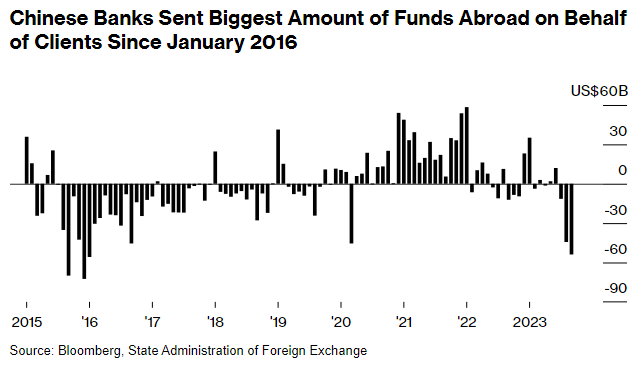

Chinese household and corporations also have the ability to move capital offshore given their so much income is generated abroad.

Sometimes this can even be 'passive' in the sense of just leaving in a foreign bank. But active flows are also back to '16 levels:

Sometimes this can even be 'passive' in the sense of just leaving in a foreign bank. But active flows are also back to '16 levels:

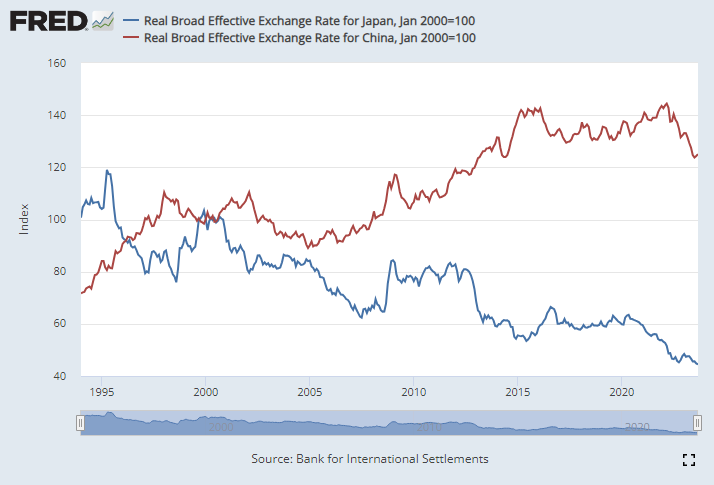

Tactical downward pressures like this can often be managed if the more secular dynamics are in good shape, but increasingly the structural Chinese global edge is weakening:

https://x.com/BobEUnlimited/status/1700194787951820849?s=20

So far it looks like the actions to prop up the fx are not causing pressure on the global asset markets as the PBOC can use cash/bills/fwds and other short-term assets to fund the interventions.

But persistent pressure could have global ramifications:

But persistent pressure could have global ramifications:

https://x.com/BobEUnlimited/status/1567489200831823877?s=20

China's currency difficulties are picking up steam. For now the downward impact remains relatively isolated to Chinese assets, but as we saw in '15, these sorts of dynamics can quickly escalate causing significant global implications causing a shock few had expected.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter