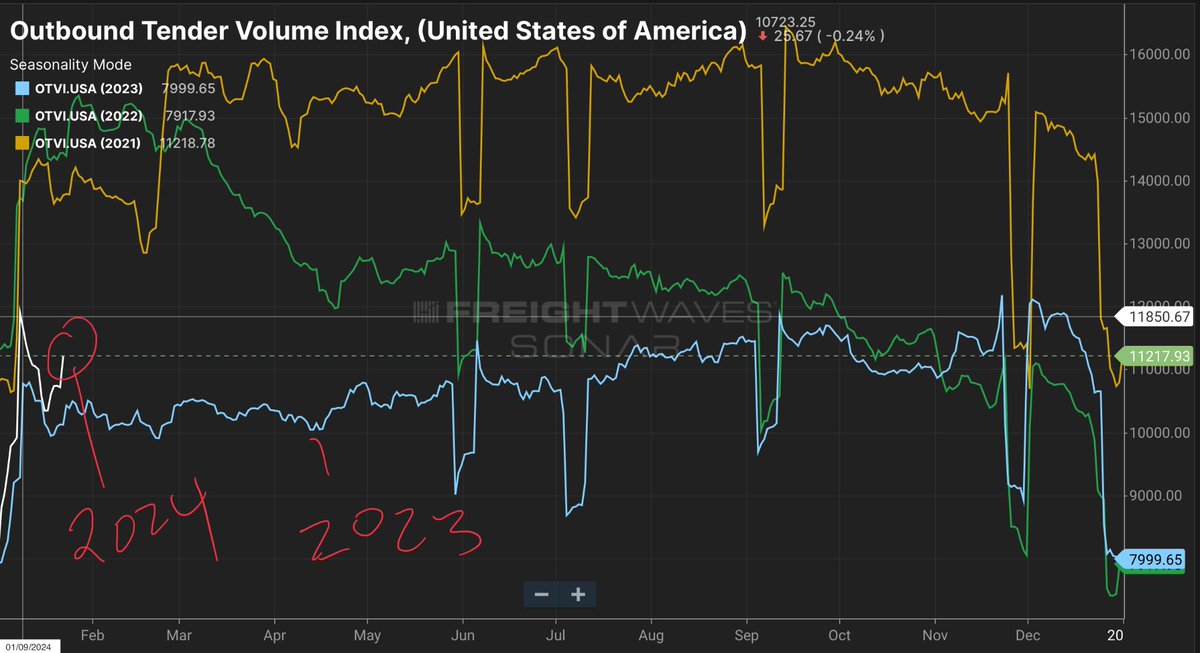

The freight market is experiencing a severe recession and bloodbath.

Here is a round-up of the doom and gloom headlines that have occurred in one of the worst downturns in freight market history.

Full articles and ongoing coverage on FreightWaves.

1/🧵

Here is a round-up of the doom and gloom headlines that have occurred in one of the worst downturns in freight market history.

Full articles and ongoing coverage on FreightWaves.

1/🧵

After the founder embezzles $25M to purchase a G-550 and $5M mansion in Texas, Goldman-backed Slync winds down operations 5/

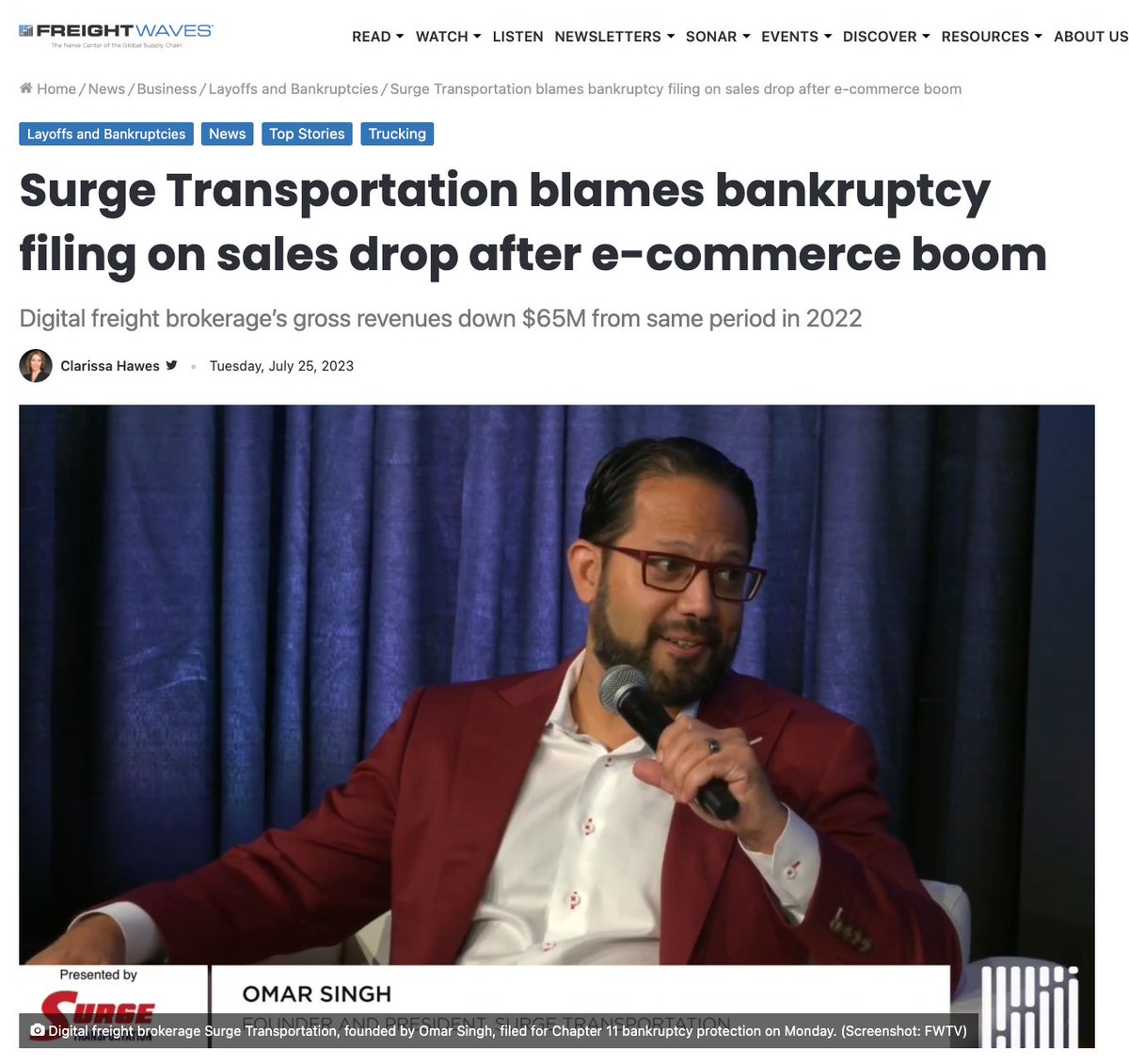

Freight broker with $200M in revenues files for bankruptcy as company experiences 30% drop in revenues 6/

Elite Transport fails to pay carriers since May, leaving many to expect an imminent bankruptcy filing 14/

Ameritrans, a postal contractor, files for bankruptcy leaving millions in unpaid wages and contractor payments 17/

Iowa-based Citizens Bank failed due to over-exposure to its commercial trucking portfolio 28/

https://twitter.com/JG_Nuke/status/1720878104317493750?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh