1/ There was a much more important fraud than SBF's embezzlement that took place in 2022. It was a fraud (allegedly) perpetrated by one of the oldest companies in the space, @DCGco and its CEO, @BarrySilbert.

Time for a thread 👇

Time for a thread 👇

2/ To fully understand the fraud and its repercussions we have to go back in time to 2013 when Barry Silbert started @Grayscale which offered the first fund that enabled investors to purchase #Bitcoin from their brokerage accounts.

3/ For several years GBTC was the only way for equity market capital to get #Bitcoin exposure and because it was structured as a trust (with no ETF-like redemption mechanism), GBTC traded above its NAV (net asset value) during its early history.

4/ This basically means that the value of the fund on the market was greater than its underlying assets (bitcoins). Equity investors didn't have much choice, so they were willing to pay a premium on GBTC just to get #Bitcoin exposure.

5/ Shares of GBTC were created by giving Grayscale bitcoins and then 6 months later you would receive the equivalent shares of GBTC.

Because GBTC traded at a premium to NAV (over 40% at one point), a very profitable arbitrage ("arb") trade became possible.

Because GBTC traded at a premium to NAV (over 40% at one point), a very profitable arbitrage ("arb") trade became possible.

6/ You could perform the arbitrage trade by shorting X bitcoins while giving X bitcoins to Grayscale. 6 months later you could cover your short by selling the GBTC (that traded at a premium to the X bitcoins). Farming the premium was called the GBTC premium arbitrage trade.

7/ Several market participants recognized how profitable and ostensibly riskless (since GBTC had always traded at a premium to NAV) this trade was and began piling in. Two such participants: hedge fund Three Arrows Capital (3AC) and lending platform BlockFi (both now bankrupt)

8/ Three Arrows Capital not only farmed the GBTC premium but turbocharged the trade with leverage. It didn’t just use its own capital but borrowed massive amounts of Bitcoin to multiply their returns. But who did they borrow from?

… enter Genesis.

… enter Genesis.

9/ Genesis was one of the portfolio of companies owned by DCG (DCG was a parent company created by Barry Silbert to mimic the corporate structure of Berkshire Hathaway and apply it to the crypto market). Along with Grayscale, Genesis was one of the crown jewels of DCG.

10/ Genesis was the largest, most important, and essentially only prime brokerage service in the crypto market. It had both a trading/derivatives arm (GGT) and a lending arm (GGC), but to outsiders it was just a single entity since they shared office space and even employees.

11/ Genesis sourced bitcoins from Bitcoin holders, large and small, by offering them an interest rate on their bitcoins. It lent those bitcoins out at a higher interest rate and profited on the spread. Who did Genesis lend to?

Three Arrows, BlockFi and Alameda, among others.😵

Three Arrows, BlockFi and Alameda, among others.😵

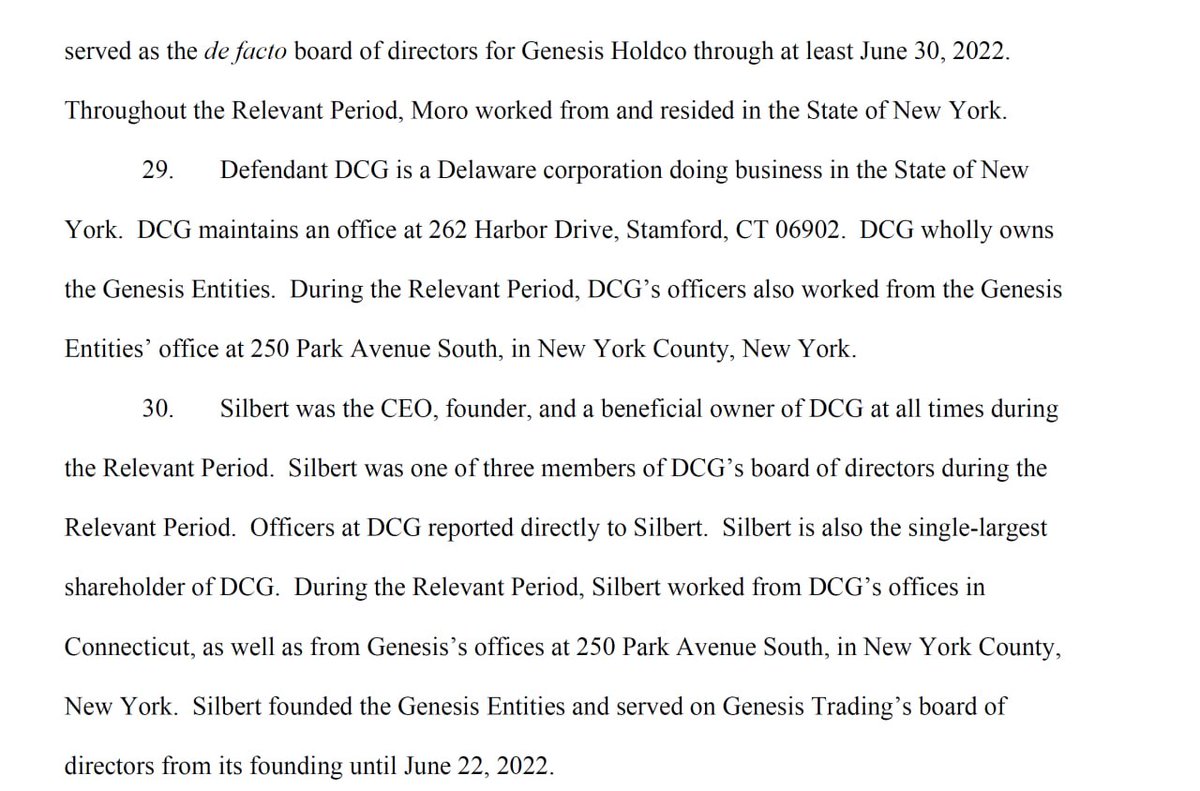

12/ At this point, it should be noted that DCG directly controlled GGT (Silbert was the chairman of its board from 2013 until July 2022) and GGC via GGT. GGC had no board until June of 2022, when a board was appointed with two out of three members coming from DCG.

13/ There was a massive incentive to encourage Genesis to make bitcoin loans that would be used for the GBTC arbitrage trade because those bitcoins would flow into Grayscale (DCG's other crown jewel) and would then be stuck there (since there was no ETF redemption mechanism)

14/ Once those bitcoins were stuck, Grayscale would collect a fat 2% per year fee for "managing the fund" (essentially doing nothing at all). Currently GBTC has over 620,000 bitcoin meaning Grayscale collects over 12,000 (TWELVE THOUSAND!) bitcoins in fees every year. 😮

15/ Profits from Grayscale flow up to its parent company DCG. Perhaps now you might be recognizing some important conflicts of interest between DCG, Grayscale and Genesis.

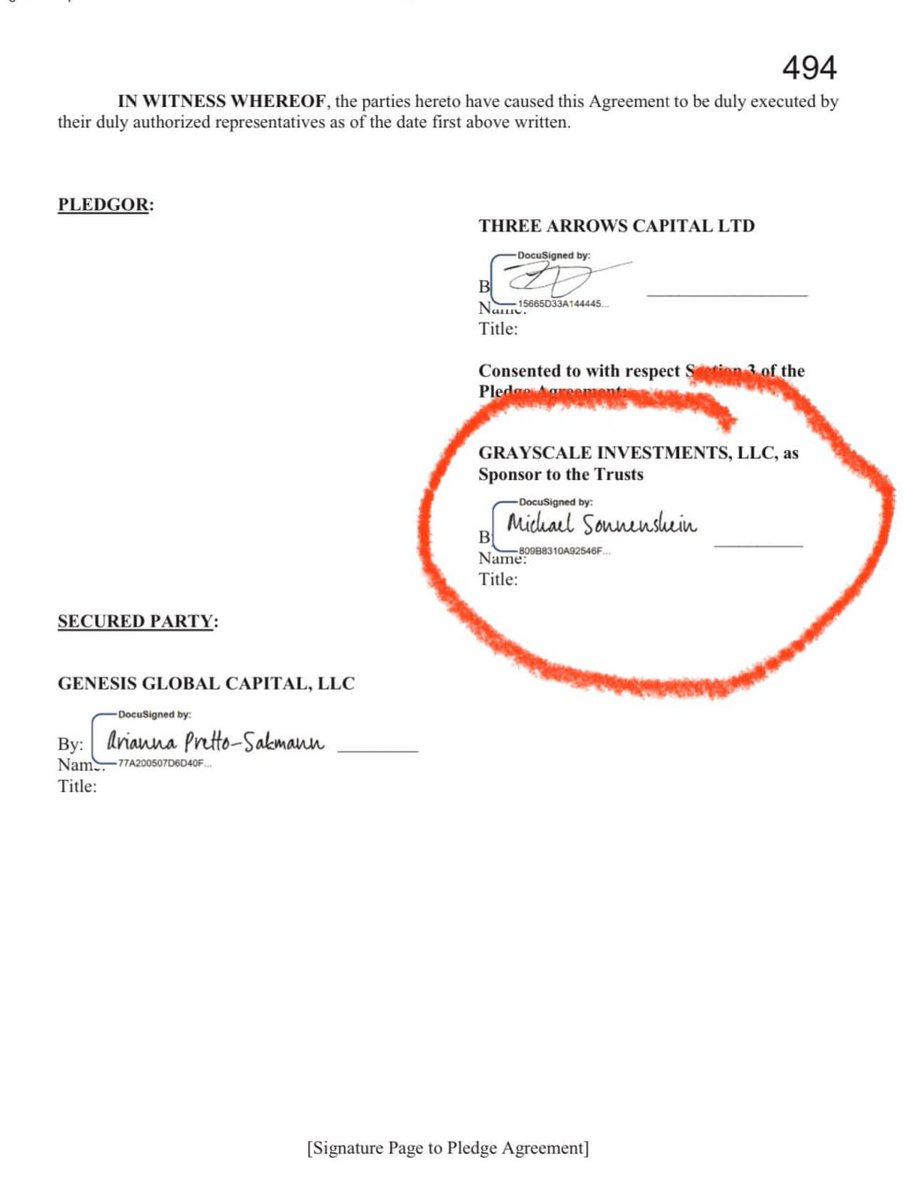

In fact, Grayscale even knew of the loans Genesis was making to fuel the flow of funds into GBTC

In fact, Grayscale even knew of the loans Genesis was making to fuel the flow of funds into GBTC

16/ In this image you can see that Michael @Sonnenshein (CEO of Grayscale) signed a loan that Genesis made to Three Arrows Capital.

The idea, stated by Barry Silbert, that these familial companies operated in an "arm's length" manner is laughable on its face.

The idea, stated by Barry Silbert, that these familial companies operated in an "arm's length" manner is laughable on its face.

17/ Over time, new means for getting Bitcoin exposure became available to the equity market (Microstrategy’s stock, futures ETFs, foreign spot ETFs). The new competition, along with the massive number of GBTC shares created by the arb trade, began to hit GBTC's premium.

18/ On February 23rd, 2021 GBTC's premium turned negative (i.e., became a discount) for the first time. It has never been positive since and the discount became as large as 49% at one point - that is, the fund was only worth HALF of its underlying assets. The arb trade was dead.

19/ With the end of the GBTC premium arb trade, Three Arrows Capital lost its most reliable and profitable way of making money. It then turned to another very risky trade: the TerraUSD carry trade. All the while, Genesis continued to lend to them.

20/ On May 7th, 2022 the Terra Luna ecosystem began its collapse, with both the LUNA and UST tokens essentially falling to zero within a few days. Given its use of leverage, the collapse of LUNA&UST was the final straw that broke Three Arrows Capital and made it deeply insolvent.

21/ Three Arrows’ insolvency created a huge hole for the companies that lent to it, the largest being Genesis which had a loan of 2.3B to Three Arrows. With proper risk management and use of collateral these kinds of risks could be managed. Genesis' risk management was abysmal.

22/ In mid-June, 2022, Three Arrows defaulted on the Bitcoin loan that Genesis had made to it. After liquidating the shockingly small amount of collateral in its possession, Genesis was left with a gaping 1.2 billion dollar hole in its balance sheet.

Now it was insolvent too.

Now it was insolvent too.

23/ At this point, if the lenders who had provided Genesis with bitcoins tried to withdraw them, Genesis would not have been able to meet its obligations.

The right thing to have done at this point would have been for Genesis CEO @michaelmoro to have declared bankruptcy.

The right thing to have done at this point would have been for Genesis CEO @michaelmoro to have declared bankruptcy.

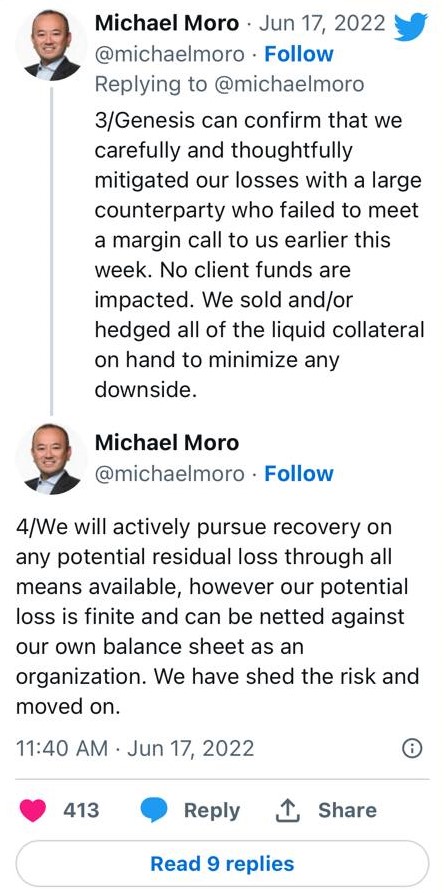

24/ Instead of declaring bankruptcy, Michael Moro hatched a plan with Barry Silbert, CEO of his parent company, to paper over the losses on Genesis' balance sheet. By doing so they were able to alleviate the concerns of Genesis lenders, thereby minimizing withdrawals.

25/ In exchange for Genesis' bankruptcy claims against Three Arrows (worth almost nothing because of the complete implosion of 3AC), DCG would give Genesis a 1.1 billion dollar “promissory note”.

Moro reassured the market that it had "thoughtfully mitigated its losses"

Moro reassured the market that it had "thoughtfully mitigated its losses"

26/ The promissory note was, in truth, a complete sham. Instead of injecting real capital to fill the hole in Genesis' balance sheet, Barry Silbert provided a piece of paper that paid a below-market interest rate and could not be redeemed for a decade.

27/ It's quite clear that Silbert knew the promissory note did not fix Genesis' insolvency because in Genesis' later bankruptcy he valued that same note at a tiny fraction of the 1.1billion that Genesis claimed that it was worth. The balance sheet hole was still wide open.

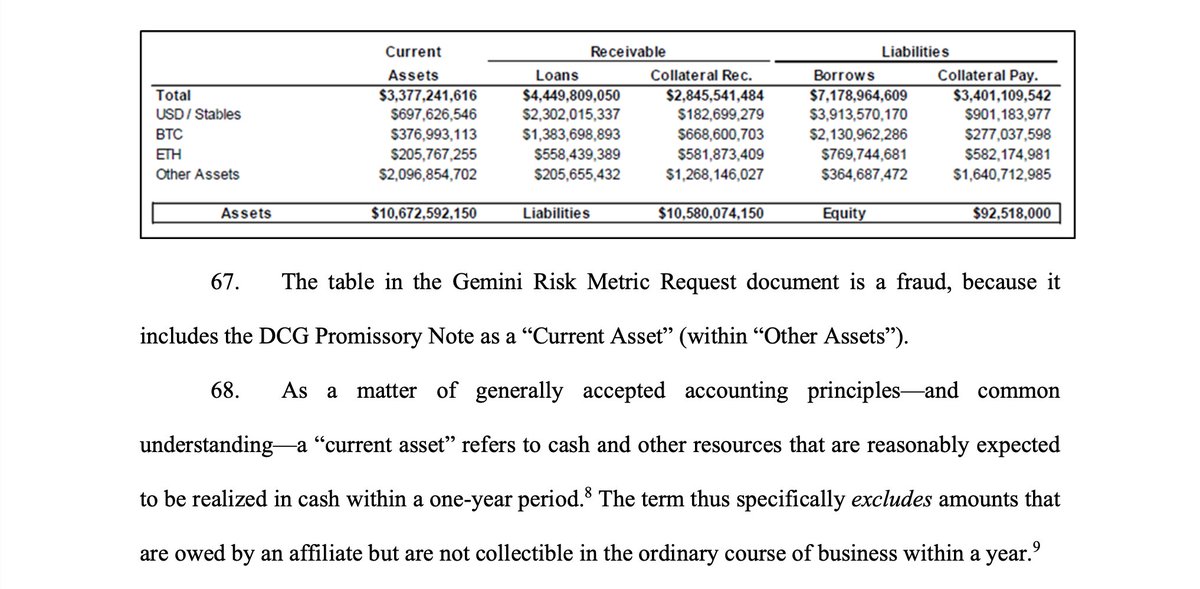

28/ After performing this act of financial chicanery, Genesis executives went into overdrive, working to convince its clients that it was solvent.

It falsely claimed that the promissory note it was given was a current asset (equivalent to cash).

It falsely claimed that the promissory note it was given was a current asset (equivalent to cash).

29/ This raises the question as to why DCG stepped in at all. Why take the risk of performing an act of criminal fraud when they could have let Genesis go bankrupt?

The answer: DCG was one of Genesis' biggest borrowers, using its portfolio company as its piggybank.

The answer: DCG was one of Genesis' biggest borrowers, using its portfolio company as its piggybank.

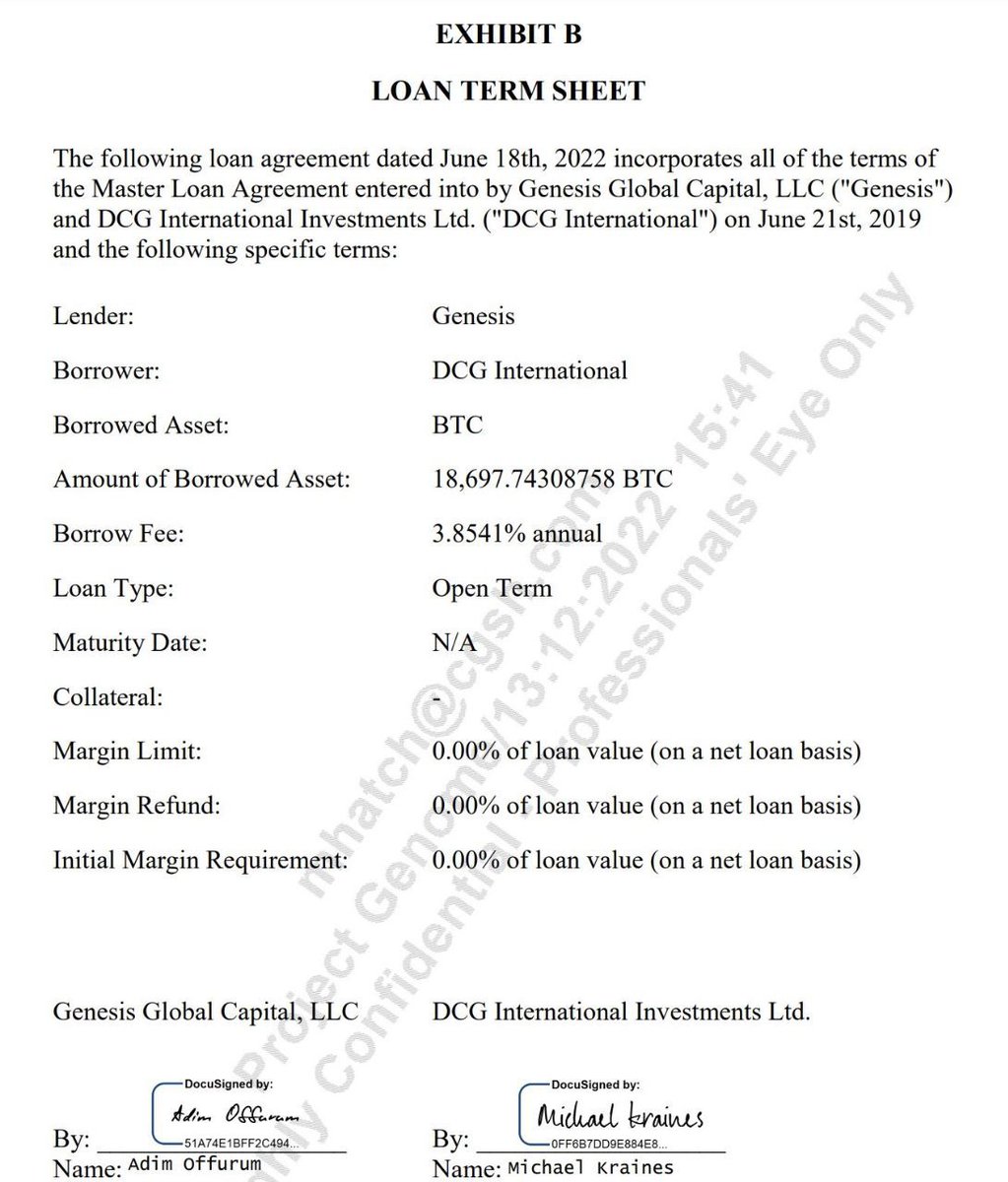

30/ In fact, right after the Three Arrows implosion blew a hole in Genesis’ balance sheet, on June 18th, DCG took a massive loan of 18,697 bitcoins from Genesis, a company that was insolvent.

DCG was running the GBTC arb trade too, but was now stuck with piles of underwater GBTC.

DCG was running the GBTC arb trade too, but was now stuck with piles of underwater GBTC.

31/ If DCG had let Genesis go bankrupt it would have been caught up in the bankruptcy process and would have been forced to repay the huge loans it had taken from its child company. Instead Barry Silbert and DCG chose to “extend and pretend.”

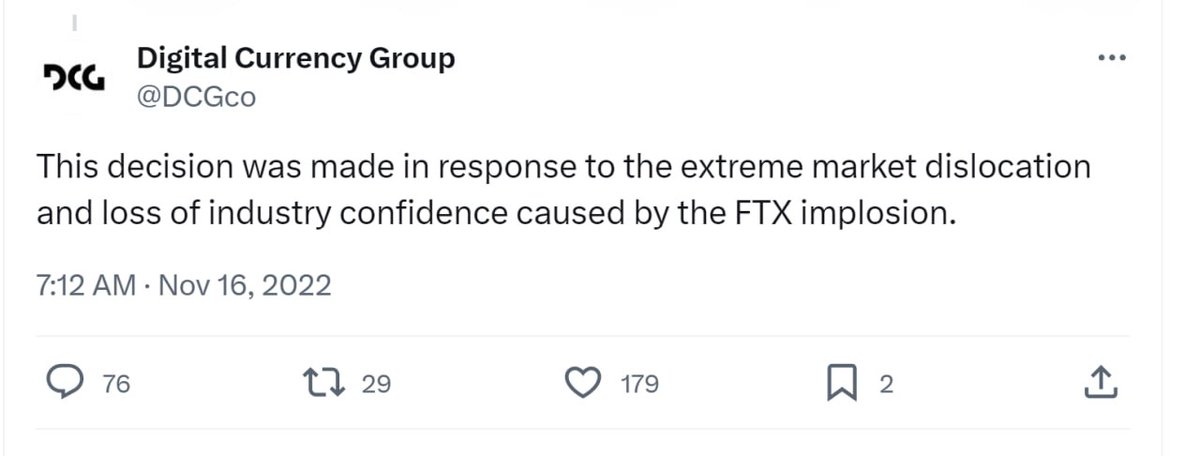

32/ Genesis’ insolvency was finally exposed in November 2022, when FTX imploded and customers across the entire space rushed to pull their bitcoins.

Genesis was not able to meet its customer withdrawal requests and froze withdrawals November 16th, 2022.

Genesis was not able to meet its customer withdrawal requests and froze withdrawals November 16th, 2022.

33/ At the time, DCG/Genesis falsely claimed that it was the FTX collapse and attendant market turmoil that had precipitated the “temporary” freeze of their clients’ funds. The truth was that Genesis has been insolvent since June of that year.

34/ Even after freezing withdrawals, Genesis claimed that it was not insolvent but just faced a “duration mismatch” issue. That is, it had enough capital to meet withdrawal requests, just not immediately on hand. This was deeply misleading.

35/ On January 19th, 2023, Genesis was forced to declare bankruptcy and slowly reveal the extent of its chicanery to its creditors. Creditors faced the painful realization that Genesis’ insolvency had never actually been fixed by DCG.

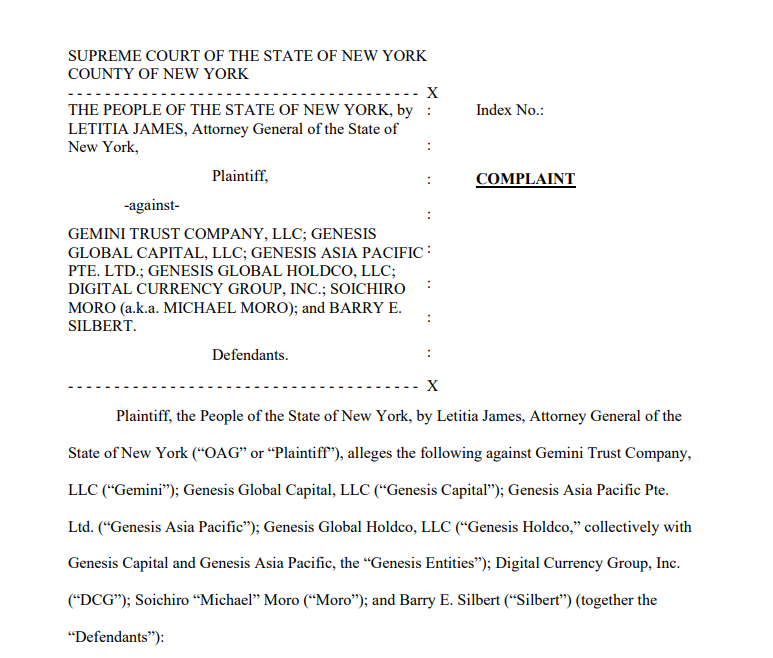

36/ On October 19, 2023 the New York Attorney General filed a civil complaint against Genesis, DCG and personally against Barry Silbert and Michael Moro.

The complaint is detailed and substantive and alleges a massive conspiracy to defraud hundreds of thousands of investors.

The complaint is detailed and substantive and alleges a massive conspiracy to defraud hundreds of thousands of investors.

37/ While the NYAG suit against Silbert et al. is civil, it’s very likely this case is picked up as a criminal case by either the South or Eastern districts of New York.

Many ordinary investors lost their life savings and DCG/Genesis were at the heart of the '22 market collapse.

Many ordinary investors lost their life savings and DCG/Genesis were at the heart of the '22 market collapse.

38/ The Genesis implosion has many striking parallels to the FTX fraud:

- Deceptive balance sheets

- False public statements used to reassure investors

- A small group of insiders perpetrating financial fraud

- A credulous financial media not bothering to ask hard questions

- Deceptive balance sheets

- False public statements used to reassure investors

- A small group of insiders perpetrating financial fraud

- A credulous financial media not bothering to ask hard questions

39/ This story is every bit as big and important as the FTX collapse, but has received very little public attention. The denouement of the story could be just as dramatic with both @BarrySilbert and @michaelmoro potentially joining SBF in prison.

@BarrySilbert @michaelmoro 40/ As the US attorney pointed out in the FTX trial, “𝘢𝘯𝘺 false or fraudulent statement to obtain or 𝘰𝘳 𝘦𝘷𝘦𝘯 𝘬𝘦𝘦𝘱 𝘱𝘰𝘴𝘴𝘦𝘴𝘴𝘪𝘰𝘯 𝘰𝘧 assets that were legitimately obtained is a felony.”

@BarrySilbert @michaelmoro 41/ The warning signs were there for those who paid close attention. Moro was forced out or jumped ship shortly after perpetrating the promissory note fraud. @LHSummers also quit his role as advisor to DCG, probably sensing something very fishy was going on internally.

@BarrySilbert @michaelmoro @LHSummers 42/ As the fraud is uncovered and litigated by the @NewYorkStateAG, and likely other Federal agencies, the small inner circle who knew what was happening at DCG/Genesis will become cooperating witnesses in the same way SBF’s inner circle turned on him.

@BarrySilbert @michaelmoro @LHSummers @NewYorkStateAG 43/ From the suit filed, the New York Attorney General already has a cooperating witness who worked as a director at Genesis during the period of the promissory note fraud.

44/ Unfortunately the financial media (bloomberg/reuters/CNBC) have been incredibly negligent in both the Genesis case and the FTX case that preceded it.

They display embarrassing credulity when given boilerplate responses to important questions (e.g., SBF claiming there were no conflicts of interest between FTX and Alameda).

They display embarrassing credulity when given boilerplate responses to important questions (e.g., SBF claiming there were no conflicts of interest between FTX and Alameda).

@BarrySilbert @michaelmoro @LHSummers @NewYorkStateAG 45/ It has been non-corporate journalists like @coffeebreak_YT and @laurashin who have been asking the hard questions and applying rational skepticism when presented with answers that don't make sense or don't pass the sniff test.

@BarrySilbert @michaelmoro @LHSummers @NewYorkStateAG @coffeebreak_YT @laurashin 46/ DCG is leaning hard into corporate double-speak when it says “this case has no merit”.

The case is substantial, detailed and backed by a proximate and knowledgeable witness.

DCG has yet to meaningfully refute a single claim made by the New York Attorney General.

The case is substantial, detailed and backed by a proximate and knowledgeable witness.

DCG has yet to meaningfully refute a single claim made by the New York Attorney General.

@BarrySilbert @michaelmoro @LHSummers @NewYorkStateAG @coffeebreak_YT @laurashin 47/ So who is going to step up and ask the hard questions? Hundreds of thousands of investors have lost their savings, many of them have been devastated, yet @BarrySilbert continues to sit on his throne.

I will leave you with a quote from the US attorney that prosecuted SBF:

I will leave you with a quote from the US attorney that prosecuted SBF:

• • •

Missing some Tweet in this thread? You can try to

force a refresh