Before we start, I need to shout out VPA by Anna Coulling

This book gave me the foundation to understand volume & create my volume analysis system

Some of the info in this thread is based on her book

This book gave me the foundation to understand volume & create my volume analysis system

Some of the info in this thread is based on her book

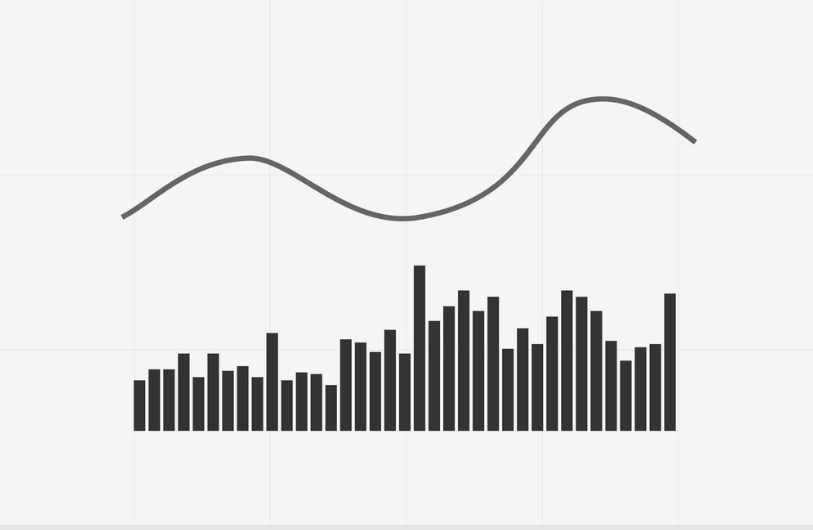

Volume Price Analysis Definition

VPA is the process of using both volume and price action to make inferences about the future price

Volume is the number of shares traded in a certain timeframe

Price action is simply the movement of a stocks current price

VPA is the process of using both volume and price action to make inferences about the future price

Volume is the number of shares traded in a certain timeframe

Price action is simply the movement of a stocks current price

VPA is a system used to find high probability trades. There are hundreds of different VPA setups, but I want to focus on the basics today

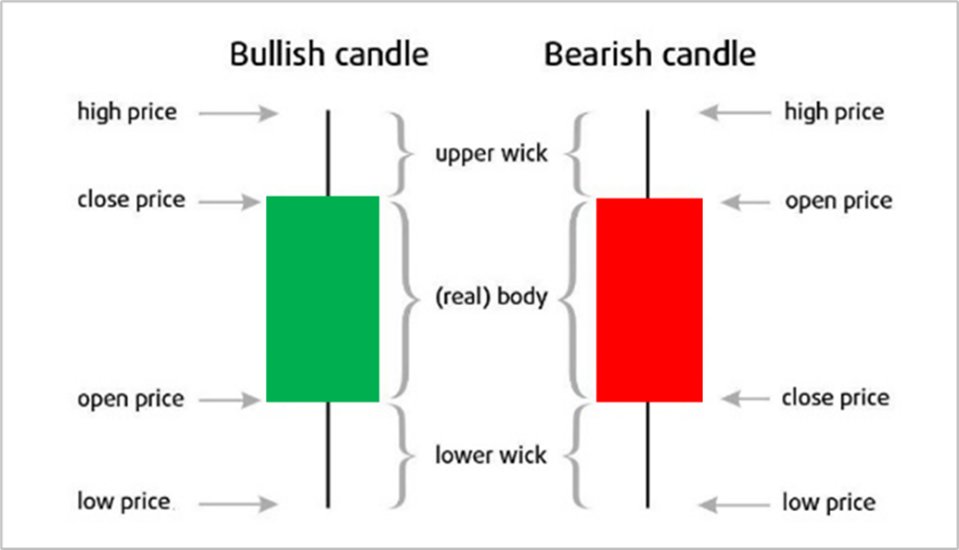

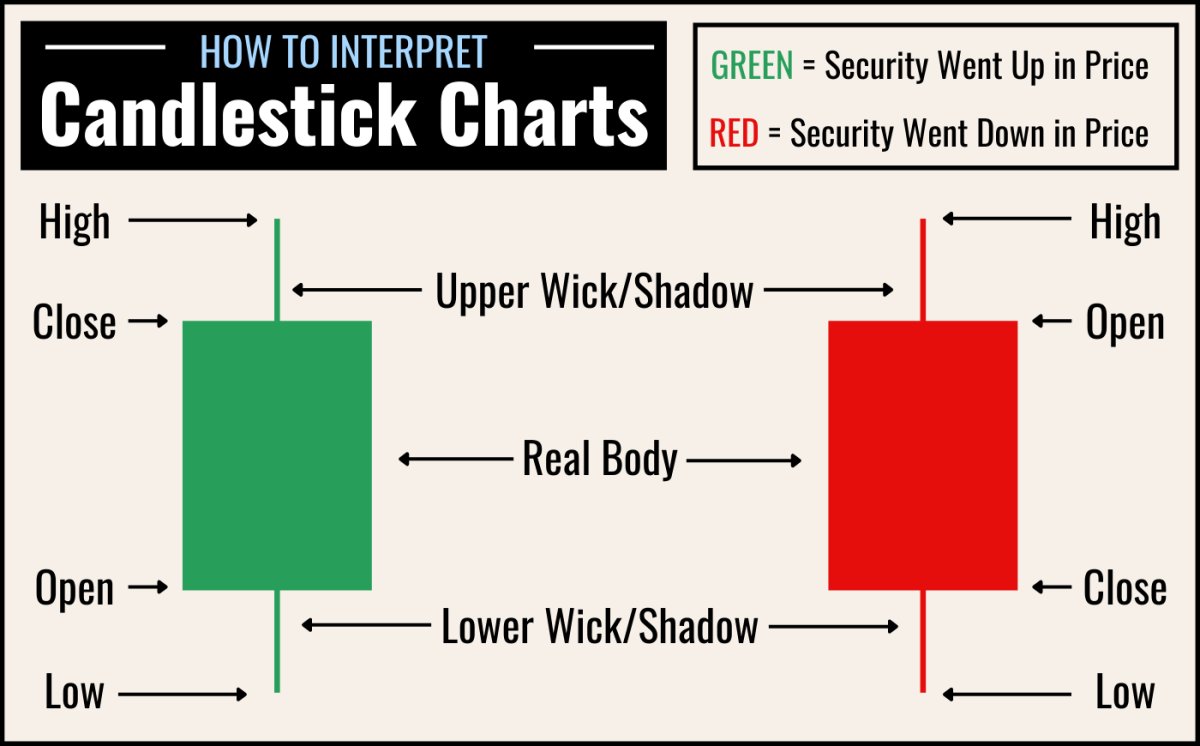

Candle Anatomy

Make sure you understand what wicks and bodies are. We will discuss them a lot in this thread

Make sure you understand what wicks and bodies are. We will discuss them a lot in this thread

Before we dive off the deep end, LIKE ALL THE TWEETS IN THIS THREAD

Show some love, these mfers take a long time to make

Show some love, these mfers take a long time to make

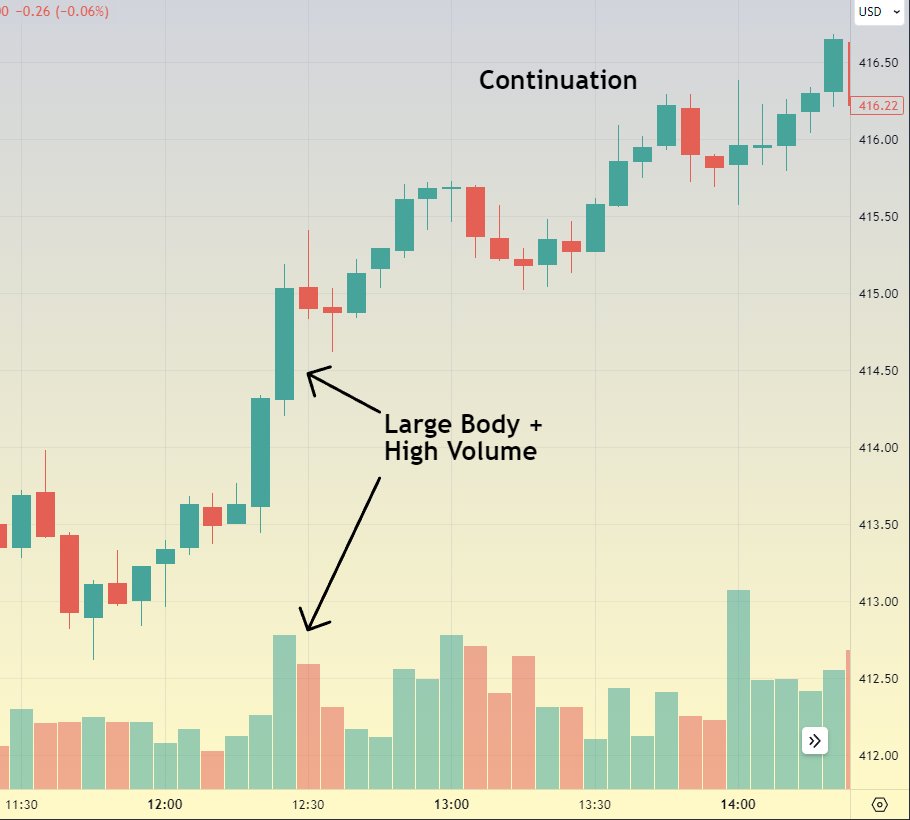

1) Large Body + No Wicks

High volume + Green = Strong Bullish move

High volume + Red = Strong Bearish move

Low volume + Green = Weak Bullish Move

Low Volume + Red = Weak Bearish Move

High volume + Green = Strong Bullish move

High volume + Red = Strong Bearish move

Low volume + Green = Weak Bullish Move

Low Volume + Red = Weak Bearish Move

The main function of number 1 is to determine whether a move is worth following/using as a trend

We want to ride strong waves, not weak ones

We want to ride strong waves, not weak ones

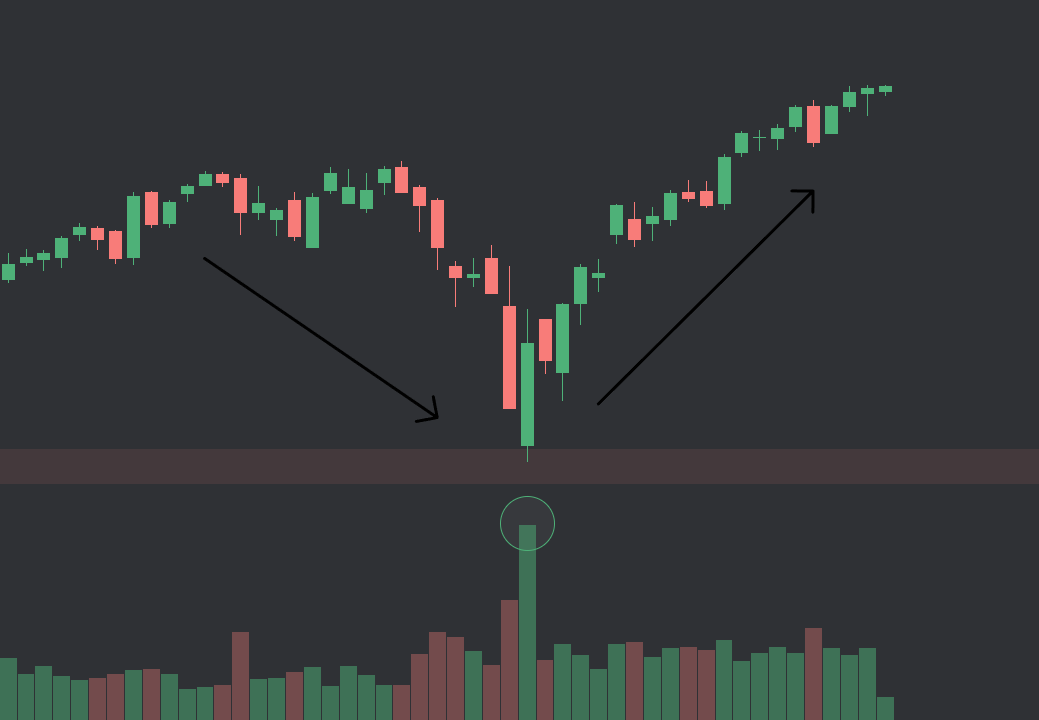

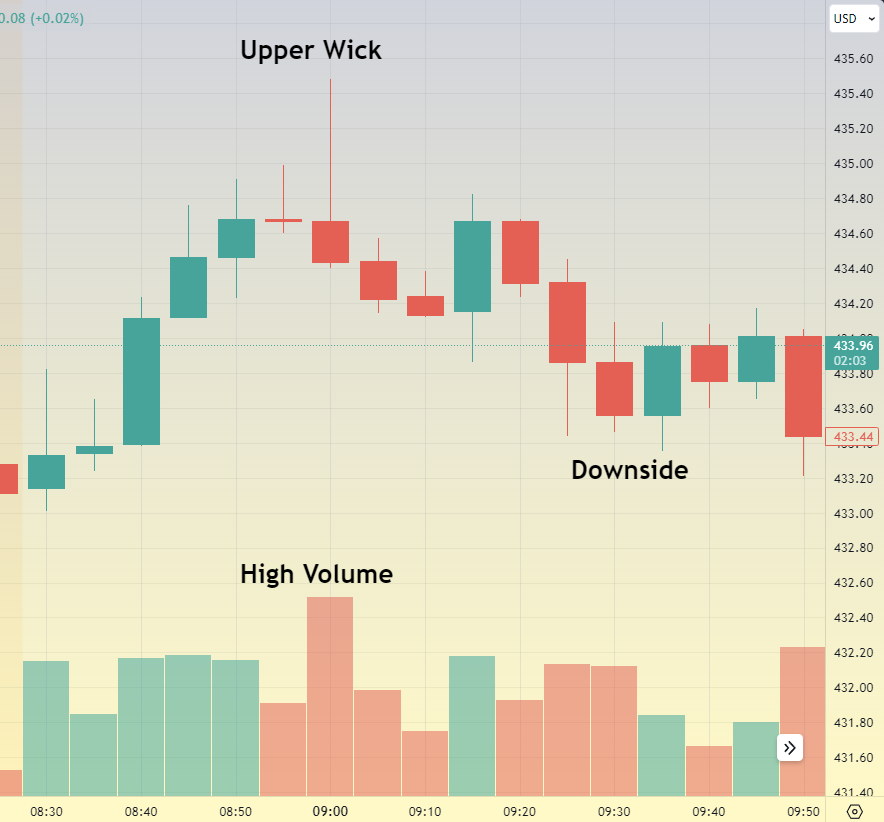

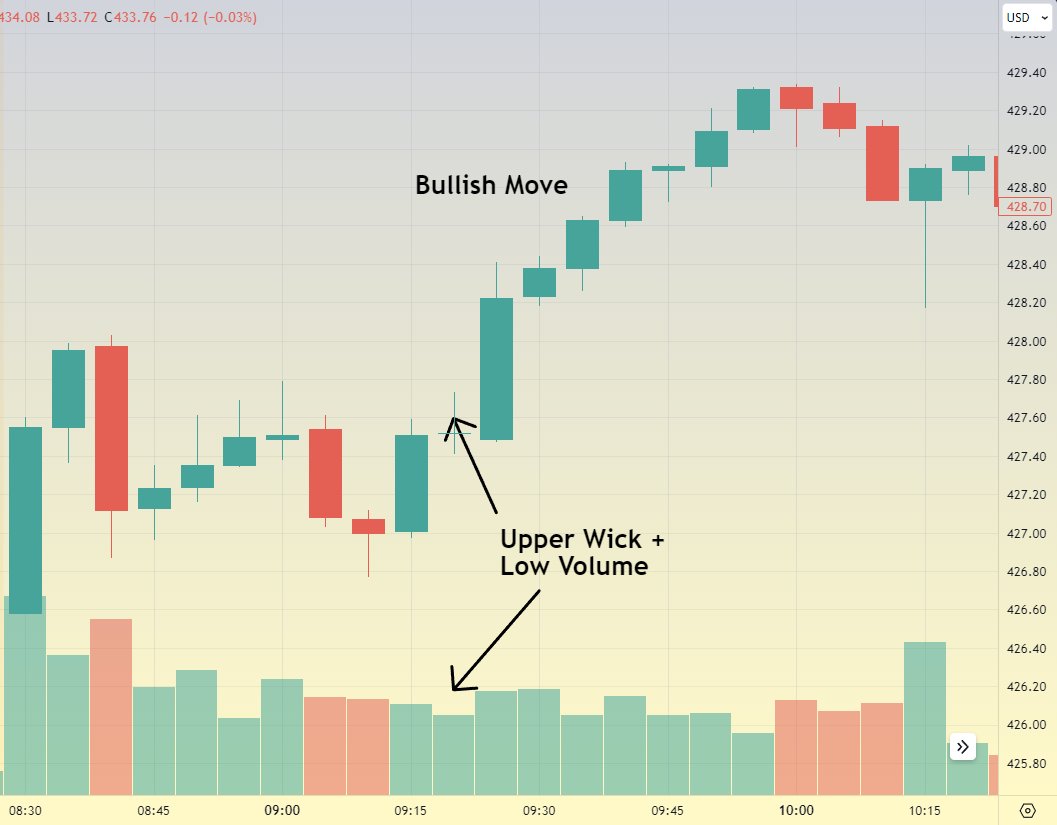

2) Small Body + Large Wick

High Volume + Lower Wick = Buyers stepping in

Low Volume + Lower Wick = No significant buyers

High Volume + Upper Wick = Sellers stepping in

Low Volume + upper Wick = No significant sellers

High Volume + Lower Wick = Buyers stepping in

Low Volume + Lower Wick = No significant buyers

High Volume + Upper Wick = Sellers stepping in

Low Volume + upper Wick = No significant sellers

The main function of number 2 is to inform you when sellers or buyers are stepping in to create a new trend

High volume wicks are one of my favorite setups

High volume wicks are one of my favorite setups

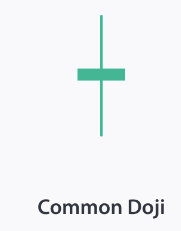

3) Small Body + 2 Wicks (doji candle)

High Volume + Doji = Important battle zone

Trend + High Volume + Doji = Trend is weak

Low Volume + doji = No significant information

High Volume + Doji = Important battle zone

Trend + High Volume + Doji = Trend is weak

Low Volume + doji = No significant information

The main function of number 3 is to show you when bulls & bears have reached an important level

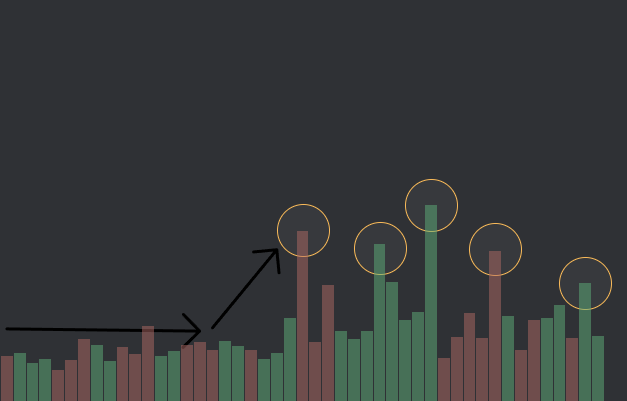

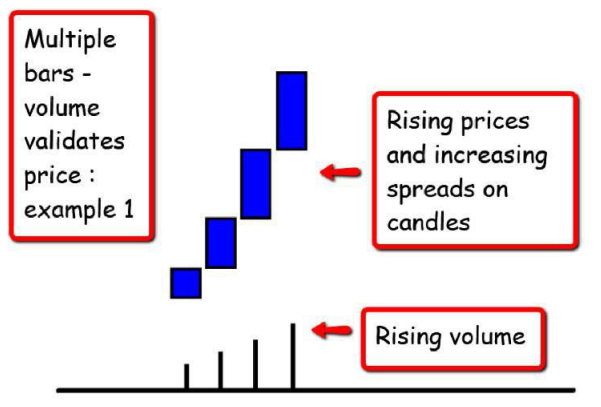

4) Validating Price Action With Volume

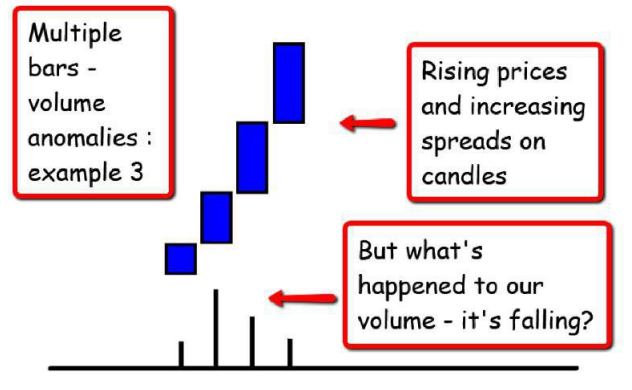

Increasing Candle Size + Increasing Volume = Validated

Increasing Candle Size + Decreasing Volume = Invalidated

Increasing Candle Size + Increasing Volume = Validated

Increasing Candle Size + Decreasing Volume = Invalidated

The function of number 4 is to highlight when price action is acting 'normal' and when something might be wrong (a trap or fake move)

I love to fade low volume moves, usually the other side is able to reject them quickly

I love to fade low volume moves, usually the other side is able to reject them quickly

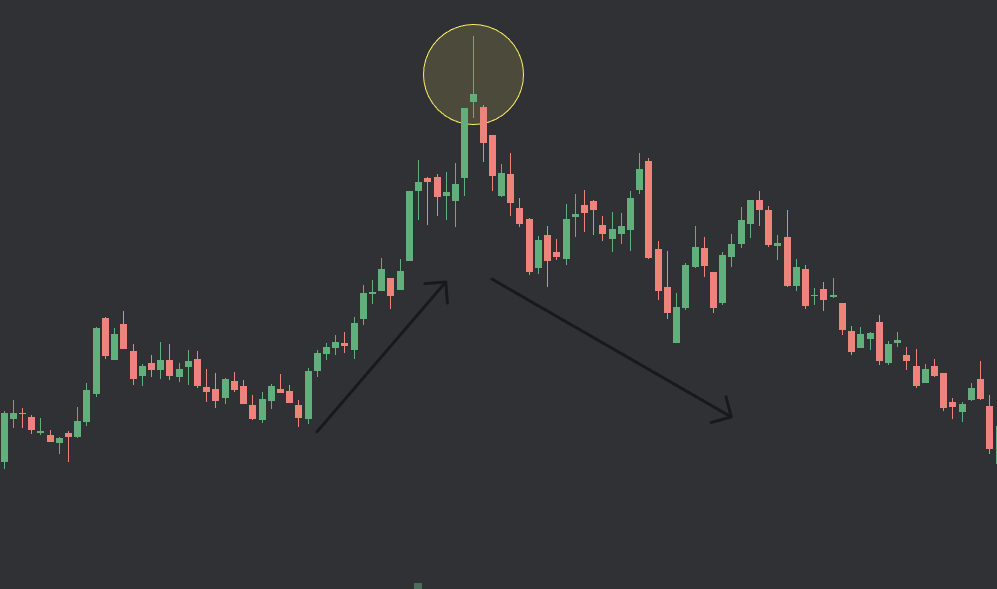

The main function of number 5 is to notice when relative volume is high, but results are not high

This shows us that the current price is likely to reverse the trend

This shows us that the current price is likely to reverse the trend

The main function of number 6 is to help you avoid fake breakouts & bank on real breakouts

The main function of number 7 is making sure we buy real pullbacks and not reversals

Low volume pullbacks are another one of my top setups

Low volume pullbacks are another one of my top setups

Key VPA Ideas

High volume usually means that candle is significant

Low volume candles are usually insignificant

VPA should tell you about what buyers and sellers are doing/who is in control

Candles should either be validated or invalidated by volume

High volume usually means that candle is significant

Low volume candles are usually insignificant

VPA should tell you about what buyers and sellers are doing/who is in control

Candles should either be validated or invalidated by volume

My Thoughts

VPA is the best tool I have. I use it everyday

Once you isolate VPA setups that work well for you it's game over for MMs

The best way to find those setups is looking at charts and taking trades based on VPA (even if you don't win)

VPA is the best tool I have. I use it everyday

Once you isolate VPA setups that work well for you it's game over for MMs

The best way to find those setups is looking at charts and taking trades based on VPA (even if you don't win)

I hope this thread helped y'all understand VPA🙏

If you're looking for a trading community, consider checking out my discord. The link is in my bio♥️

If you're looking for a trading community, consider checking out my discord. The link is in my bio♥️

• • •

Missing some Tweet in this thread? You can try to

force a refresh