1/ Bear market rallies are notoriously violent and abrupt. And last week was among the most violent and abrupt of them all. While implied vol cratered over the week, and betrayed zero interest in hedging for the weekend, the price behavior left us searching for analogs.

2/ One of the more interesting charts that came out of our weekend work was the behavior of skew for the $NDX.

3/ Remember that skew is a measure of how "non-normal" a distribution is. A normal distribution does a oor job of describing equity returns; they tend to exhibit "fat tails" as popularized by Nassim Taleb in his work.

4/ Inevitably, we focus on the left tail dynamics. But occasionally, markets become extremely RIGHT-tail skewed – especially during secular bear markets.

That's right. We said it.

That's right. We said it.

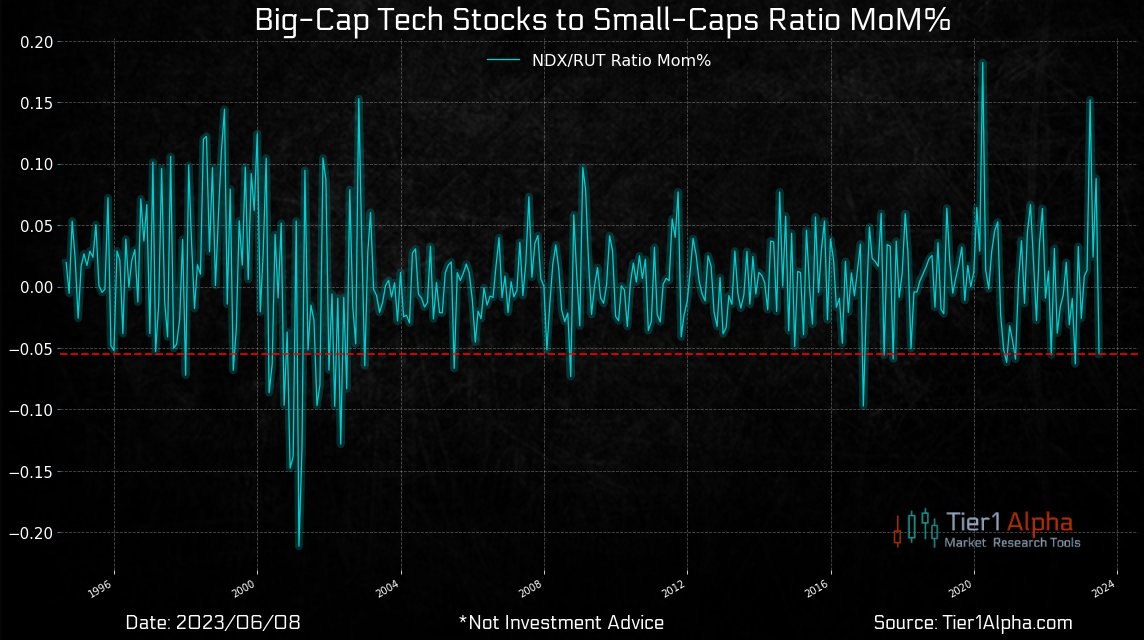

5/ In the 1998-2001 "skew bull," markets rose in a nearly uninterrupted manner, causing skew to "gain" both from dropping off the events of 1998 AND from an increasingly "right-tailed" bias.

6/ While we think it's important to note that the NDX of 1998-2001 had a large element of "meme" stock to it, the general outline looks similar (just imagine switching to ARKK in 2020-21):

7/ And while we're switching indices to $SPX in this next chart, the character of distributions of returns has shifted markedly despite similarities in skew.

8/ From June 1998- Dec 2001, the S&P500 was totally unchanged; from Dec 2019-Nov 6, 2023 the S&P500 is up 35% cumulatively. The difference in the return distributions is night and day, however:

9/ Unfortunately, this fits with the theories of @profplum99 on the influence of passive and simply raises the risks that the next stage in this market is a reintroduction of negative skew. Hold on to your butts.

@peter_s1981

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter