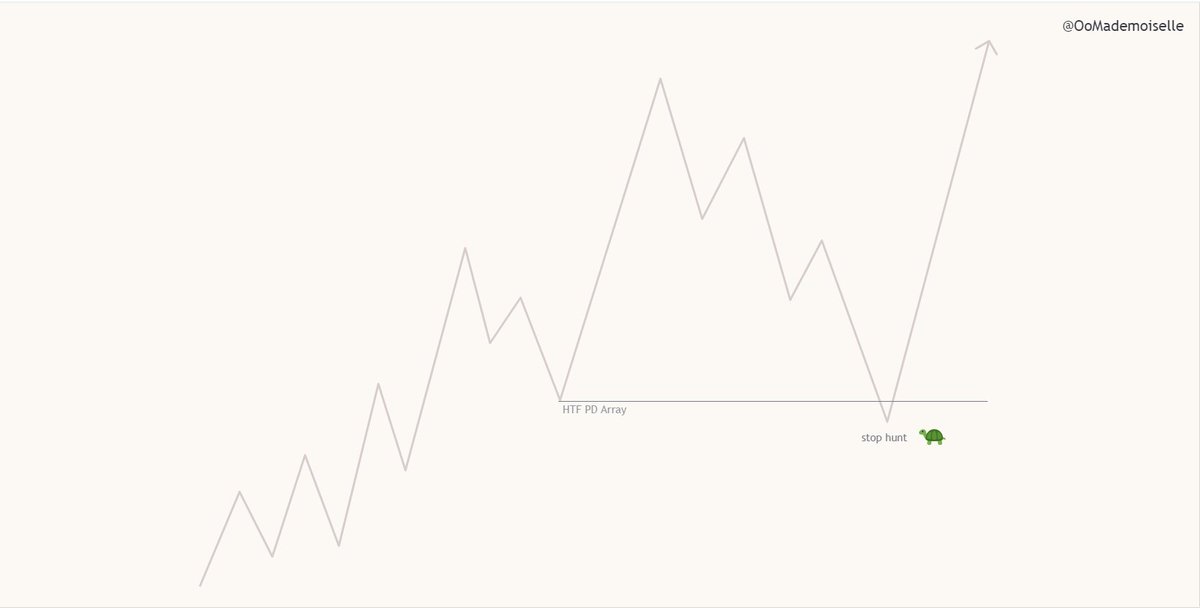

Why do we use discount/premium?

It shows us where is R:R more favourable for positioning into trade.

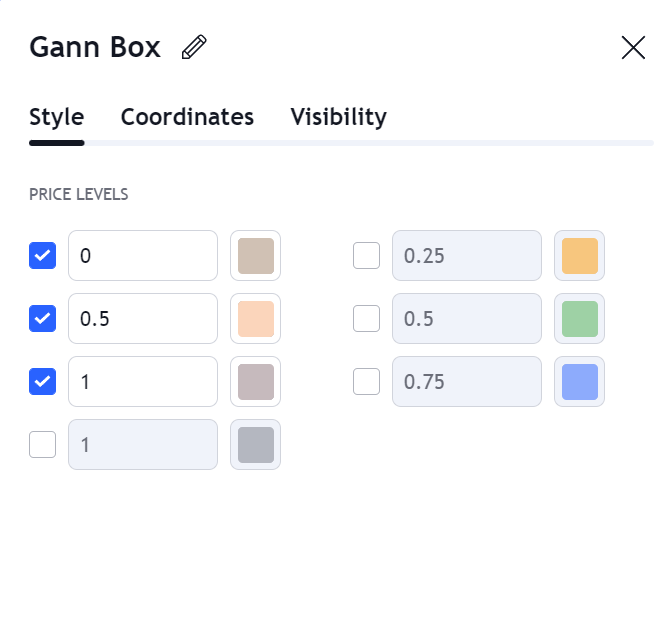

I use Gann Box tool in trading view for it.

Settings for price levels are 0, 0.5 and 1.

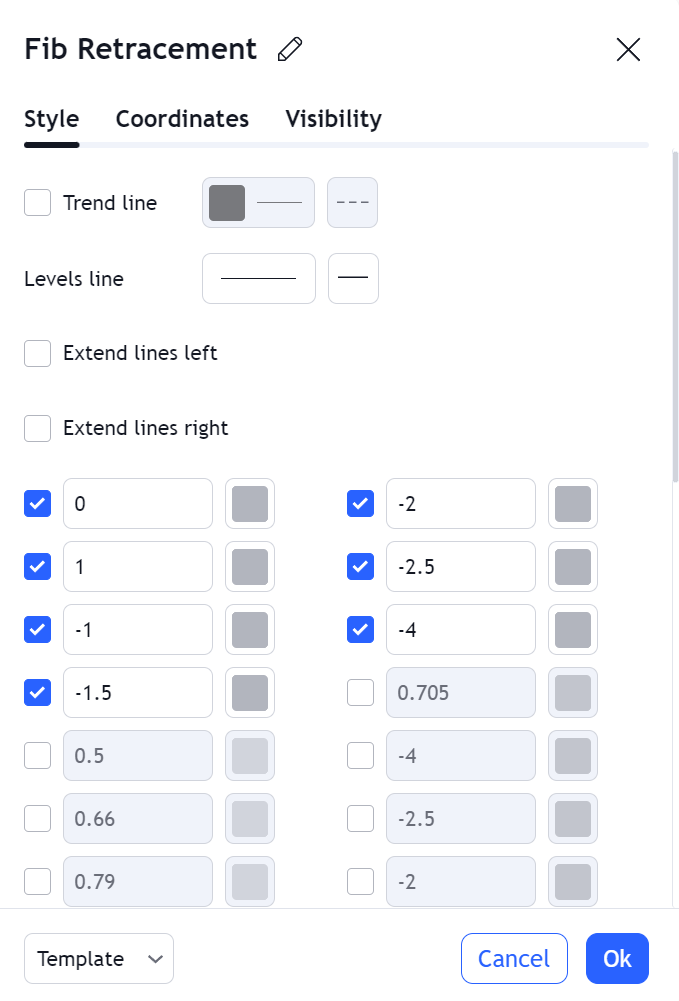

You can also use Fibonacci retracement tool & have it all in one place with OTE fibs.

It shows us where is R:R more favourable for positioning into trade.

I use Gann Box tool in trading view for it.

Settings for price levels are 0, 0.5 and 1.

You can also use Fibonacci retracement tool & have it all in one place with OTE fibs.

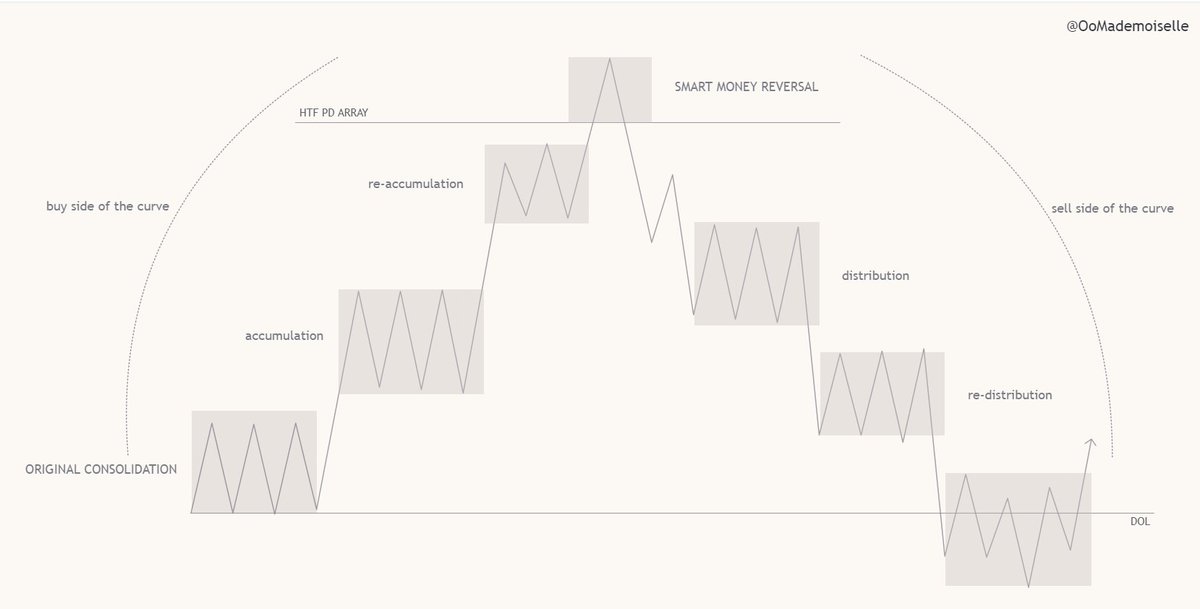

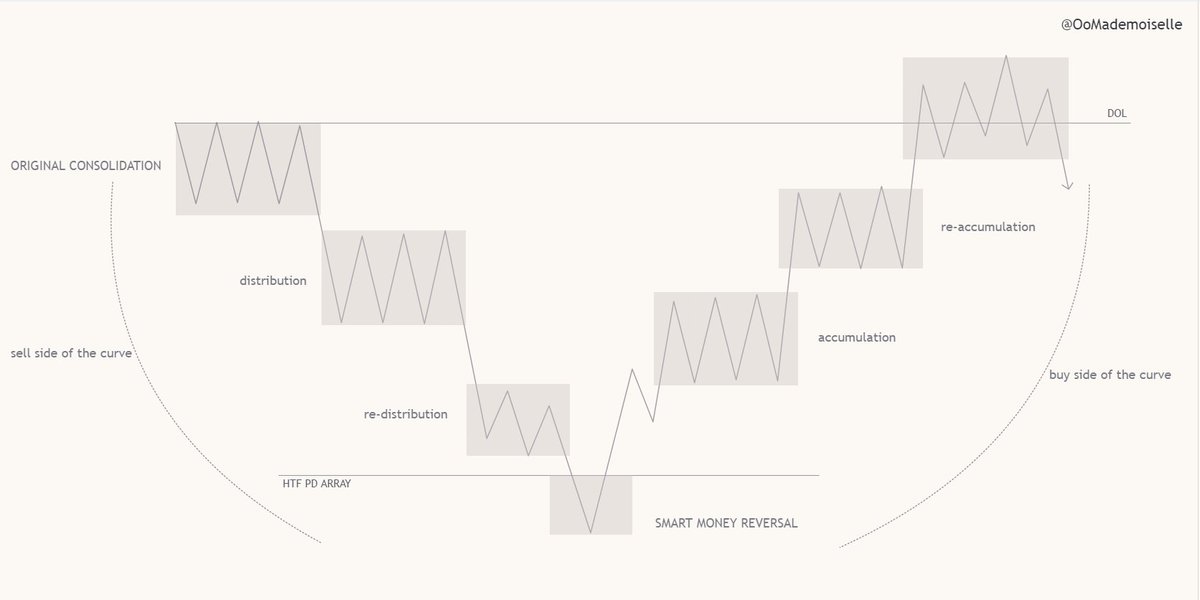

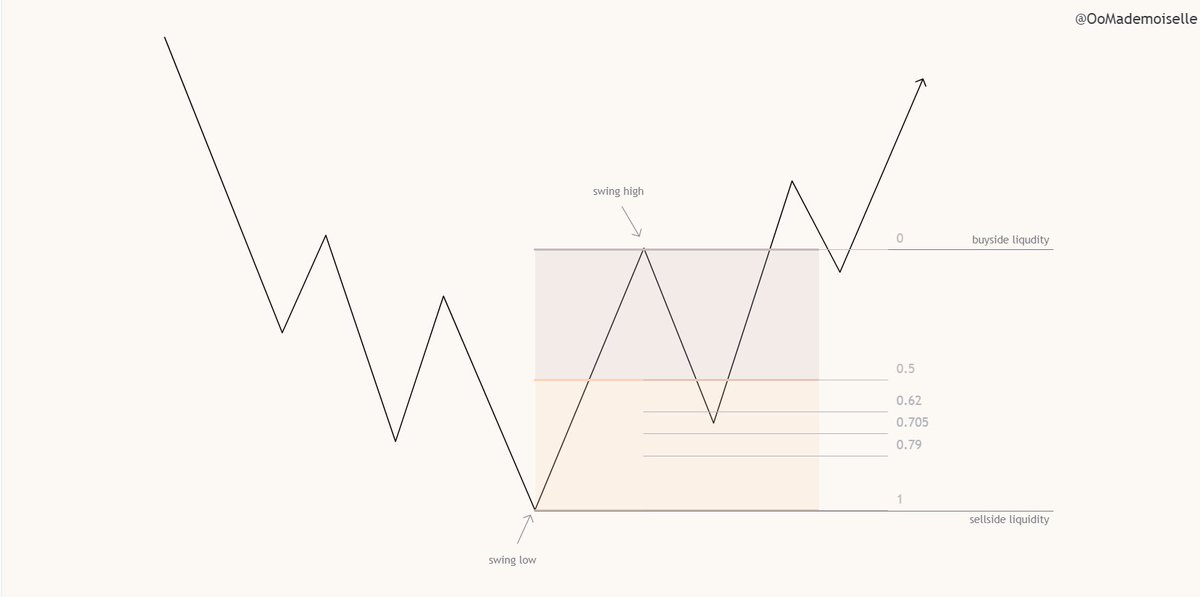

First we need to understand of where sellside and buyside liqudity lies.

Then we identify our range from swing high to swing low (there are multiple ranges within the range &you can apply premium/discount also to them).

Then we identify our range from swing high to swing low (there are multiple ranges within the range &you can apply premium/discount also to them).

How do we use it for positioning ourselves using discount and premium?

Long position - we are looking for entry in discount area.

Short position - we are looking for entry in premium area.

We dont long in premium and we don't short in discount.

Long position - we are looking for entry in discount area.

Short position - we are looking for entry in premium area.

We dont long in premium and we don't short in discount.

Also note this should be used with other confluences met for entering a position.

I personaly use this for entries when there is fvg inside premium/discount and with OTE (optimal trade entry) technique.⬇️

I personaly use this for entries when there is fvg inside premium/discount and with OTE (optimal trade entry) technique.⬇️

What is optimal trade entry (OTE)?

Technique that helps you indentify best entry by using Fibonacci retracement tool.

Fibs that represent OTE are 0.62, 0.705 and 0.79.

You can also add to fib retracment tool 0, 0.5 and 1 and use it for identifying premium and discount.

Technique that helps you indentify best entry by using Fibonacci retracement tool.

Fibs that represent OTE are 0.62, 0.705 and 0.79.

You can also add to fib retracment tool 0, 0.5 and 1 and use it for identifying premium and discount.

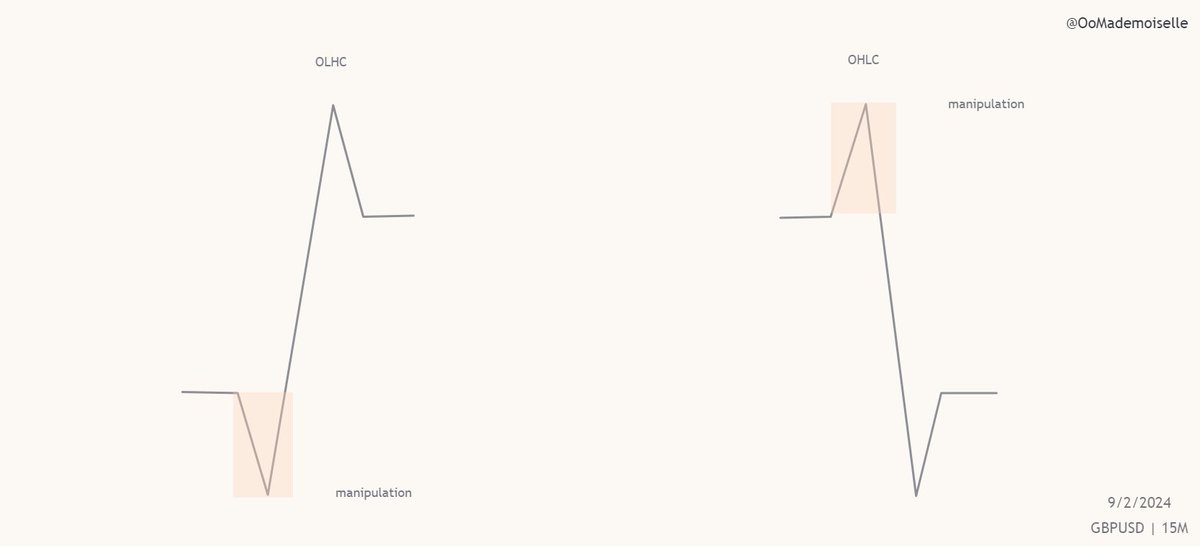

How to use Fibonacci retracment drawing tool?

First we look for swing low and swing high.

Bearish scenario - we draw it from swing high to swing low.

Bullish scenario - we draw it from swing low to swing high.

First we look for swing low and swing high.

Bearish scenario - we draw it from swing high to swing low.

Bullish scenario - we draw it from swing low to swing high.

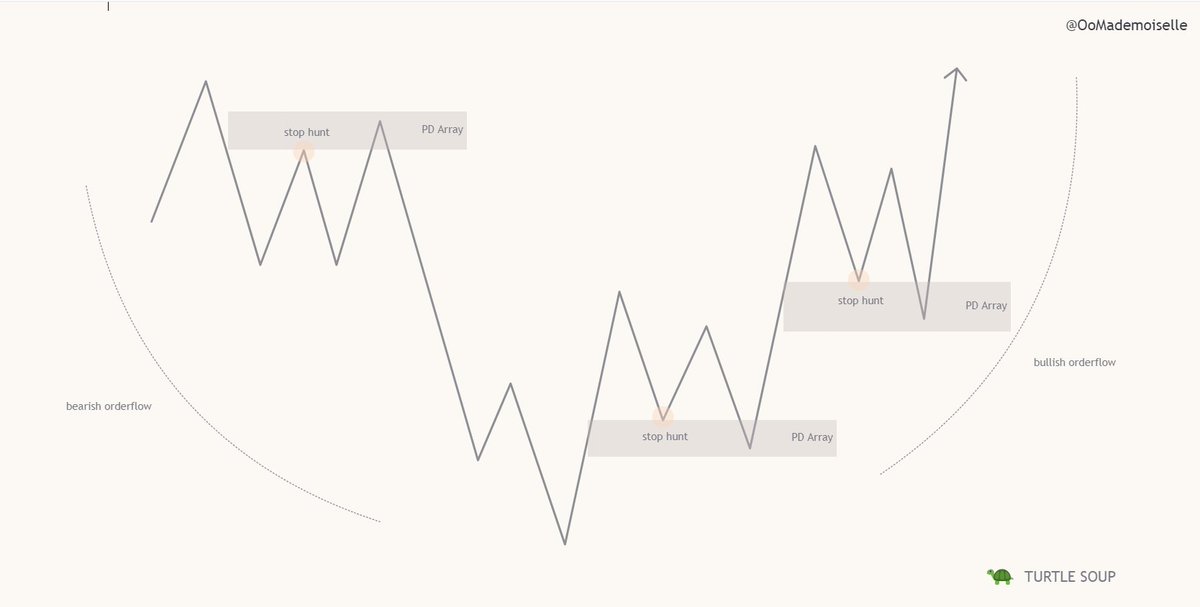

So what is the process?

First we identify range and swing high/swing low so we can determine premium/discount area.

Then we use Fibonacci retracment tool.

Lastly we look for imbalance (fvg) in the premium/discount zone where OTE fibs are.

First we identify range and swing high/swing low so we can determine premium/discount area.

Then we use Fibonacci retracment tool.

Lastly we look for imbalance (fvg) in the premium/discount zone where OTE fibs are.

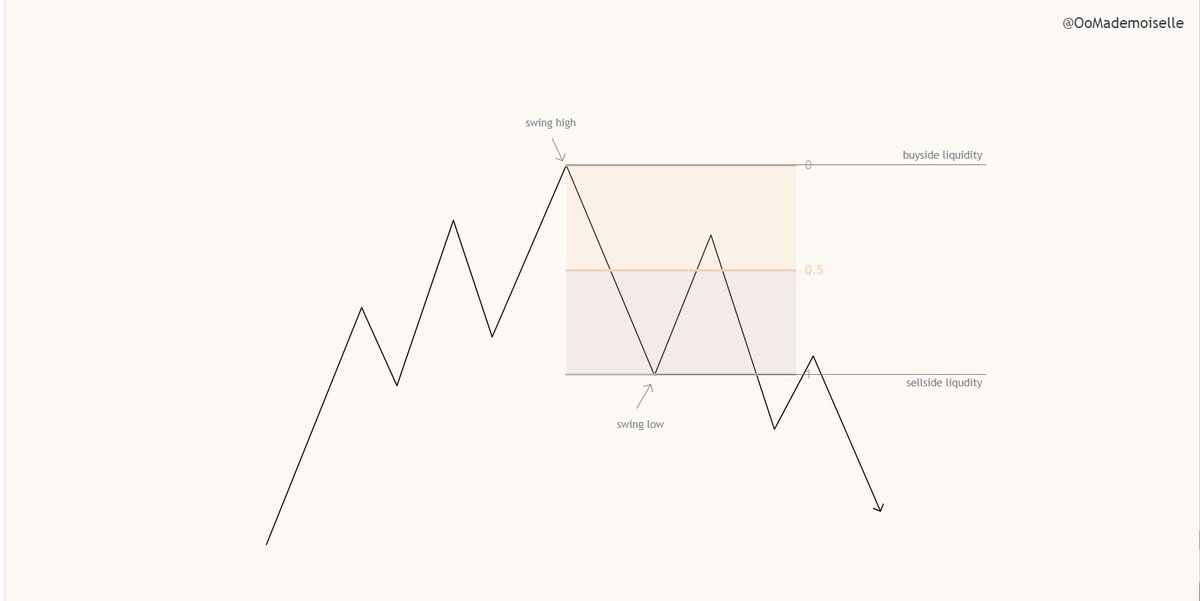

Example 1: short position

- we identify the range,

- mark swing high & swing low,

- then we use same swing high & swing low to draw OTE & discount/premium,

- we search for imbalance (fvg) in premium area,

- if all 3 conditions are met we position ourselves according to that.

- we identify the range,

- mark swing high & swing low,

- then we use same swing high & swing low to draw OTE & discount/premium,

- we search for imbalance (fvg) in premium area,

- if all 3 conditions are met we position ourselves according to that.

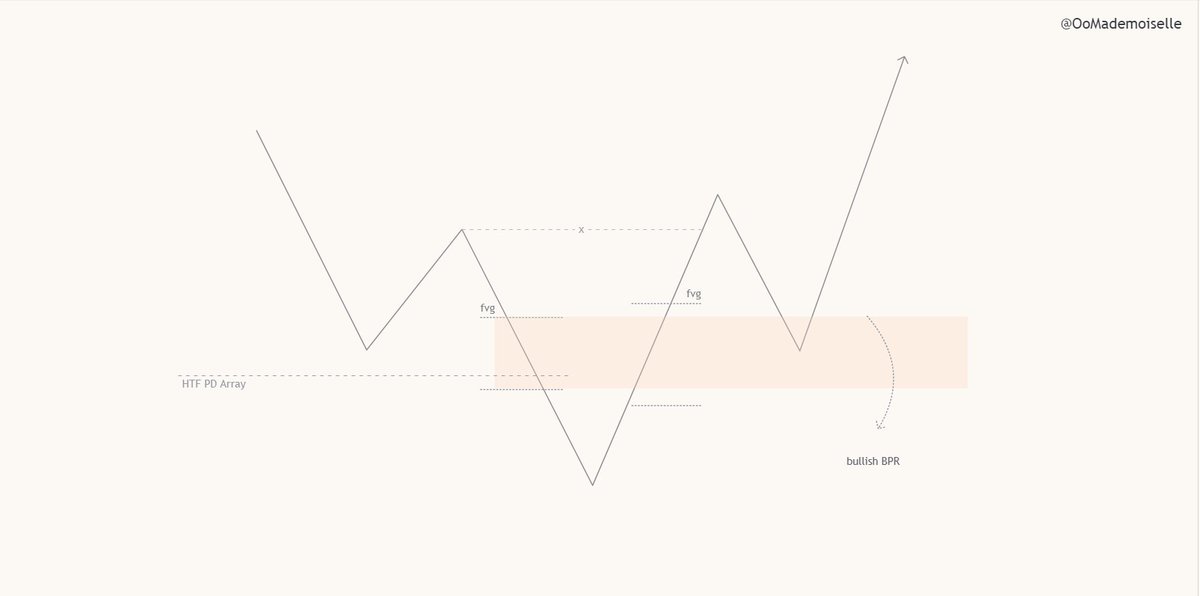

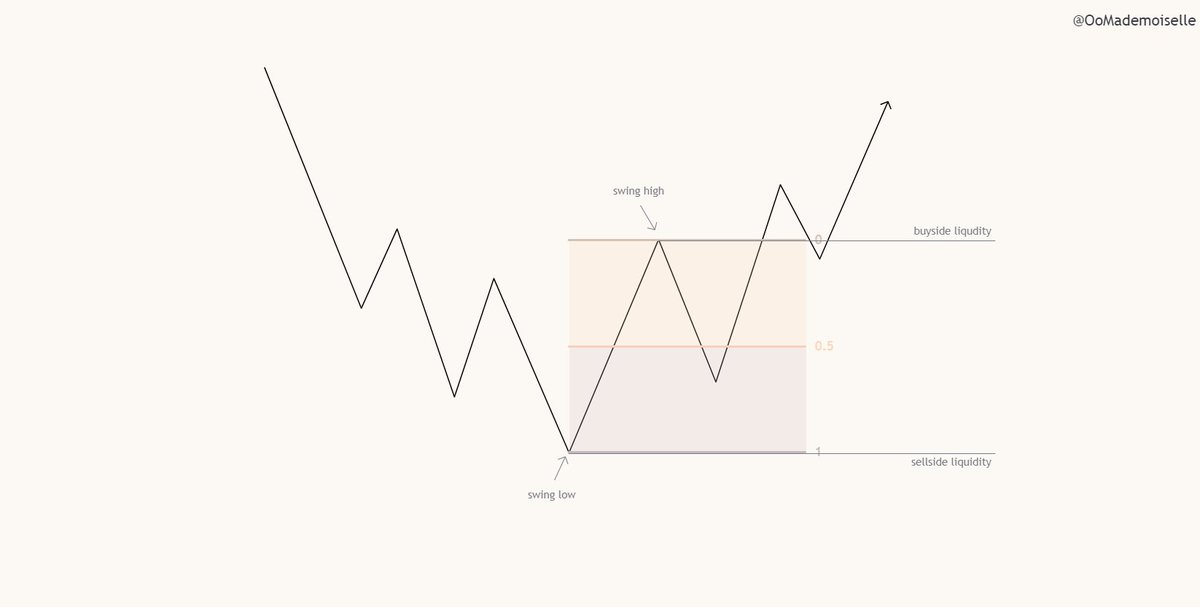

Example 2: long position

- we identify range,

- mark swing high and swing low,

- then we use same swing high and swing low to draw OTE & discount/premium

- we search for imbalance (fvg) in discount area,

- if all 3 conditions are met we position ourselves according to that.

- we identify range,

- mark swing high and swing low,

- then we use same swing high and swing low to draw OTE & discount/premium

- we search for imbalance (fvg) in discount area,

- if all 3 conditions are met we position ourselves according to that.

Thanks for taking time and going over the thread🫶

Hope you enjoyed the reading!

Hope you enjoyed the reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh