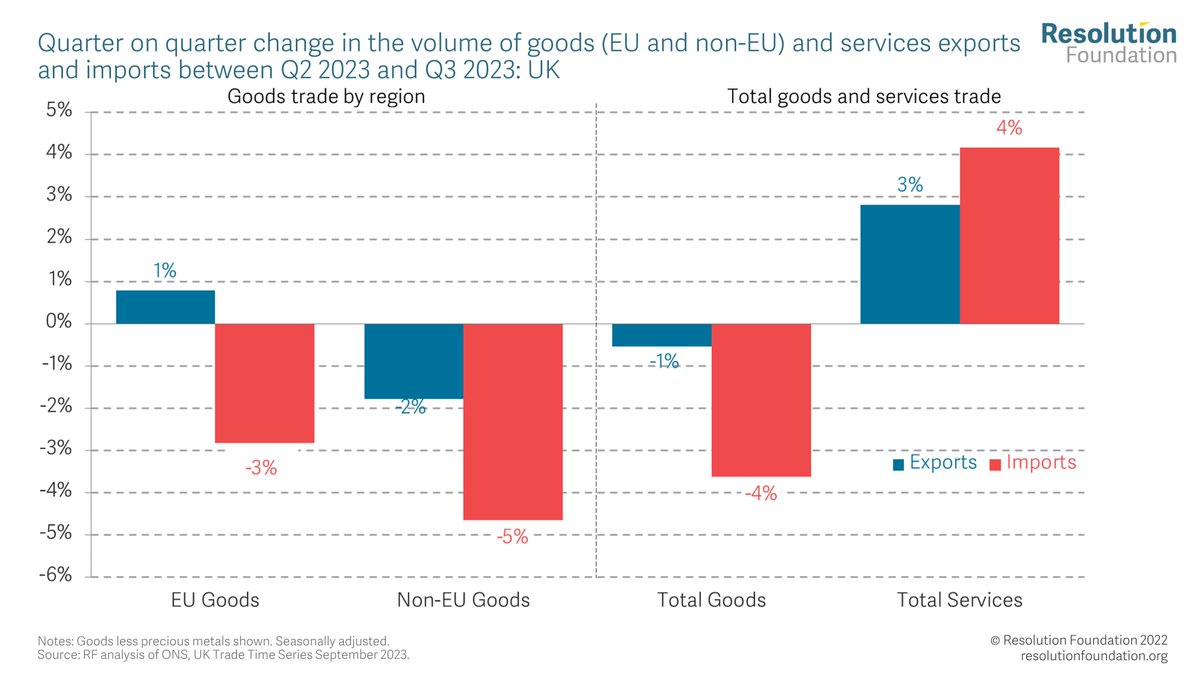

Trade data for Q3 2023 released by @ONS this morning shows quarter-on-quarter growth in the volume of services trade (3.4%) but a fall in goods trade (-2.4%). With attention this week back on the Brexit trade impact, this thread will explore what the latest trade data shows.

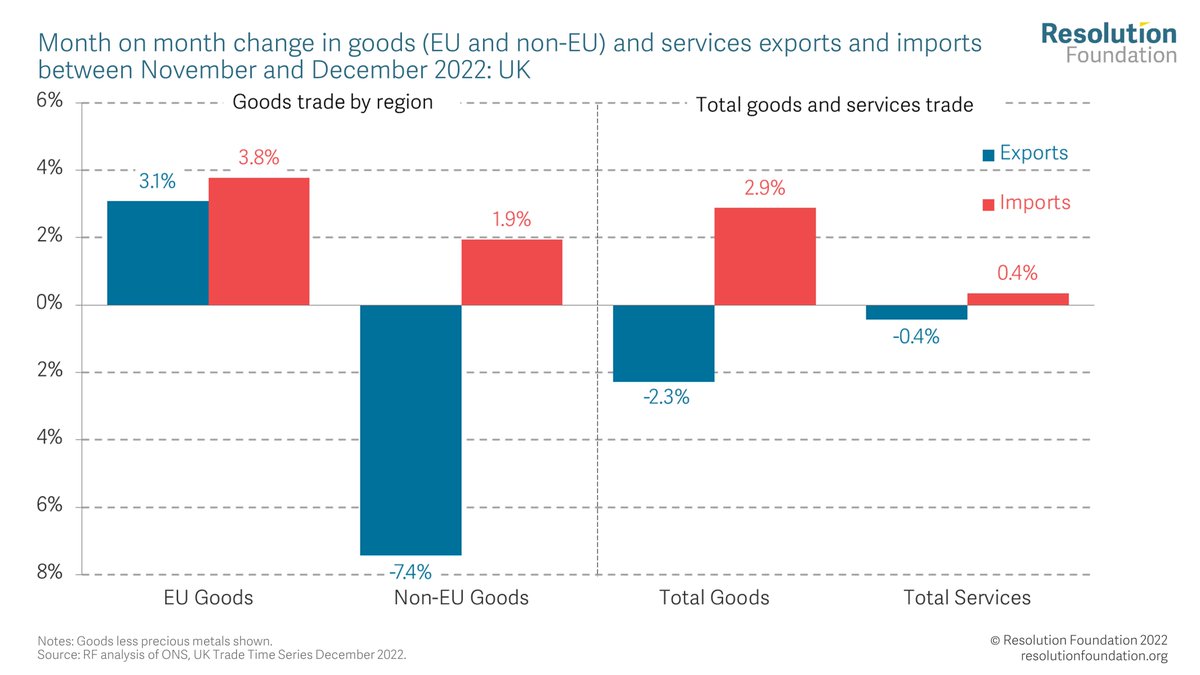

Starting with quarter on quarter trade performance, goods trade has been driven by substantial falls in the volume of imports to both the EU and non-EU, as well as a decline in non-EU exports. The volumes of both exports & imports of services trade grew, by 3% and 4% respectively

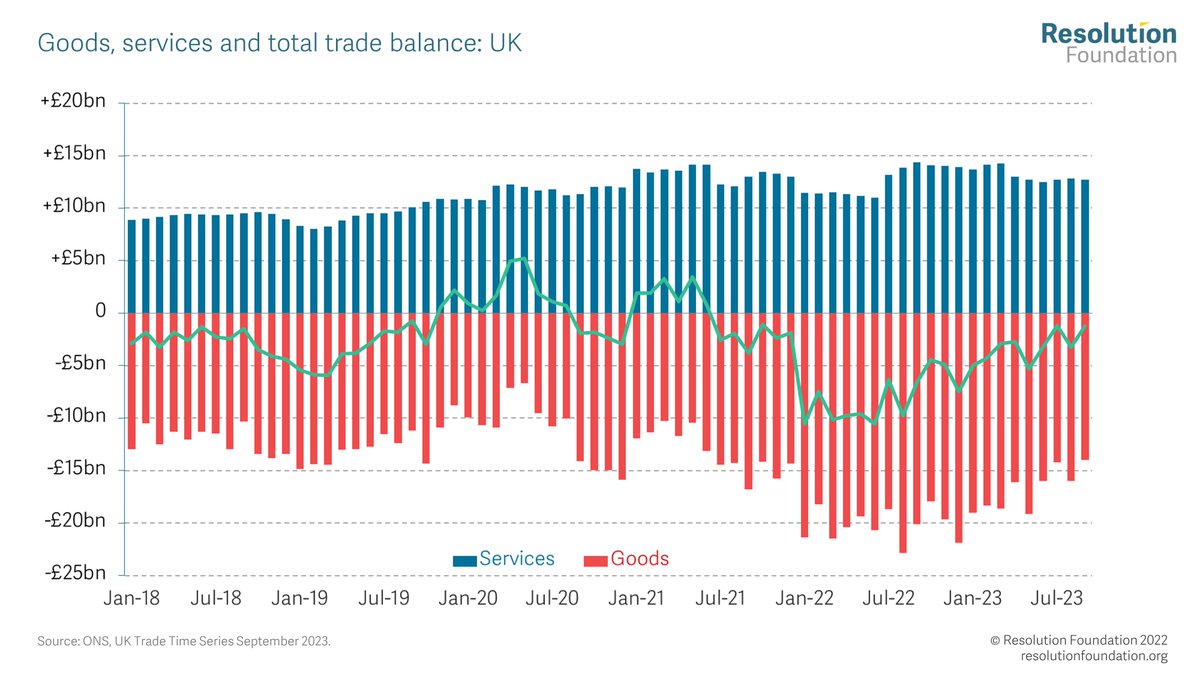

The good news, this has left the UK trade balance looking much closer to pre-2022 levels. This has mainly been driven by the fall in the goods deficit, largely due to the fall in the value of imported oil, but the services trade balance has also improved slightly.

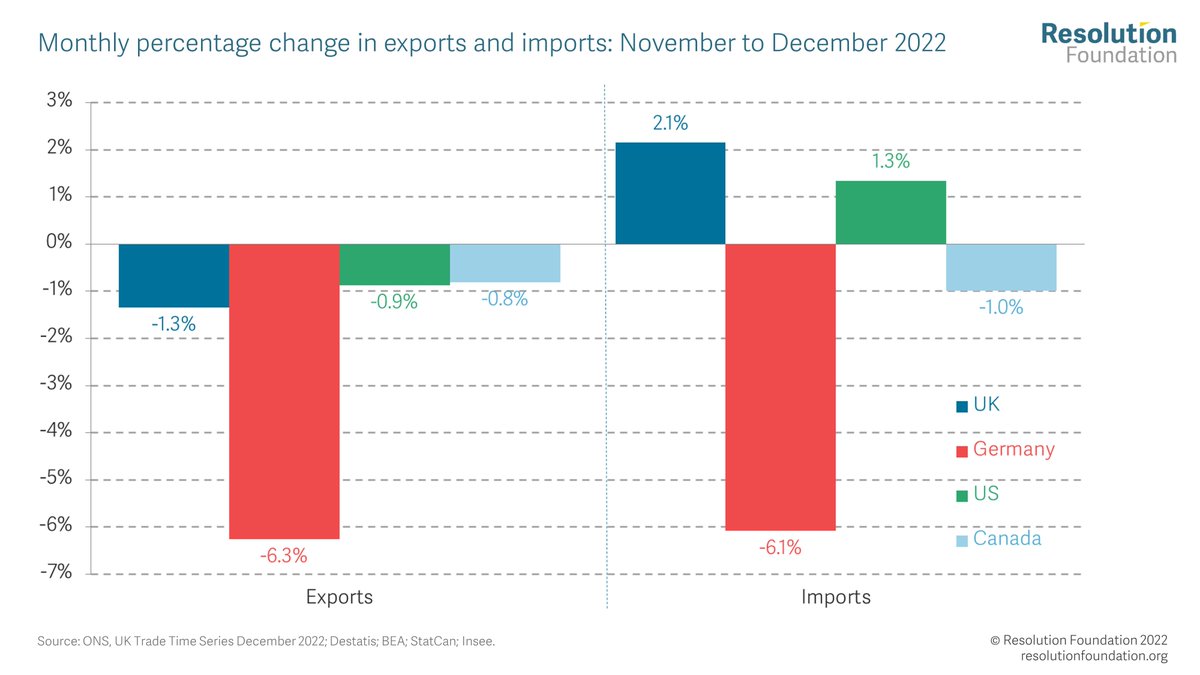

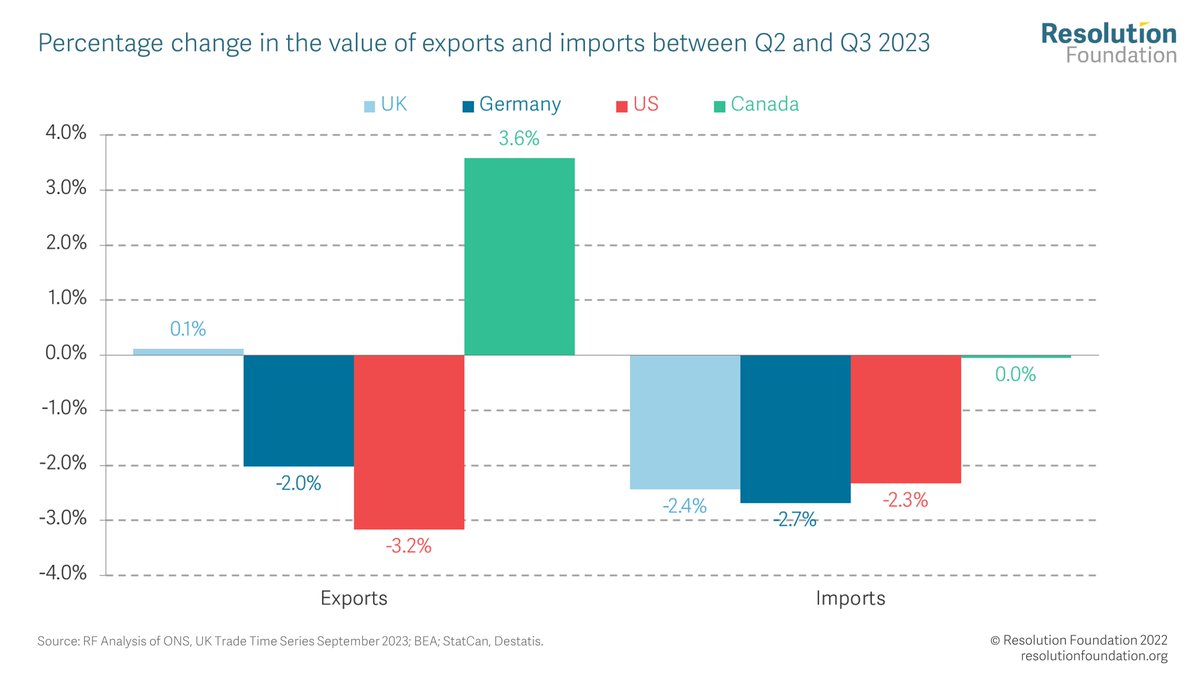

It is primarily the fall in the volume of imports, rather than strong export growth, driving the improved trade balance. However, QonQ fall in imports looks relatively similar to the US and Germany and although export growth was flat, this was stronger than the US and Germany.

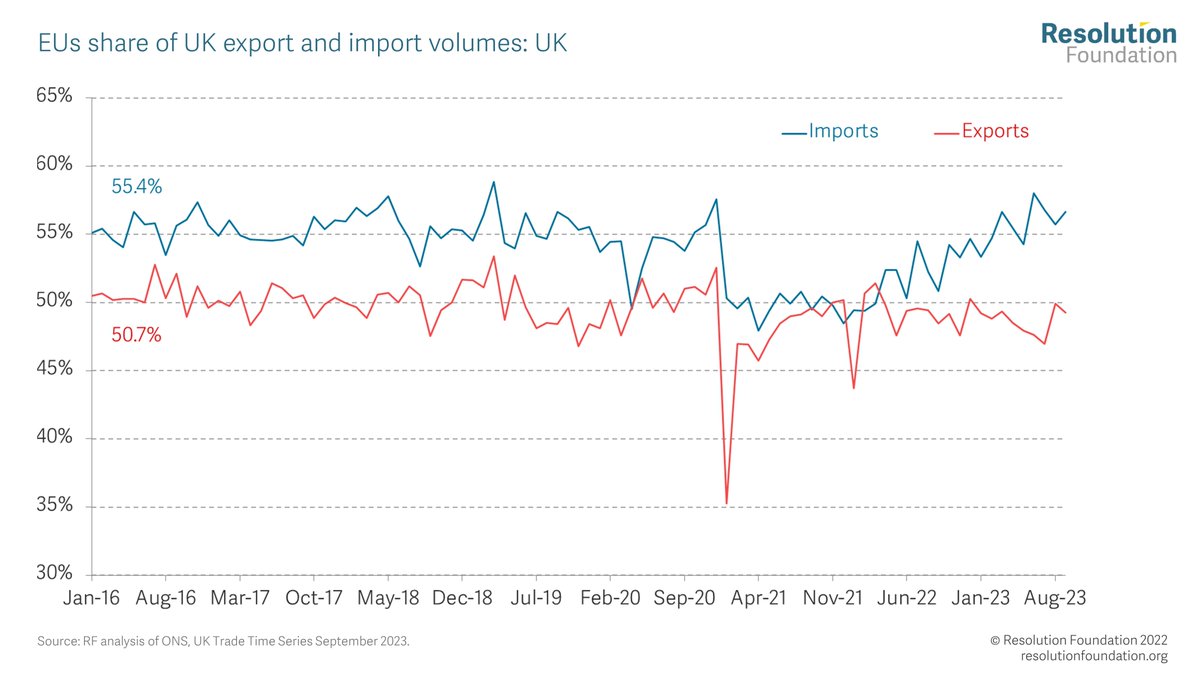

So where does this leave UK trade post-Brexit? The @iealondon paper suggested ‘Brexit leaves UK trade unscathed’ pointing to two areas UK trade has not responded as many expected. The share of exports to the EU did not fall and services exports have remained strong.

Looking first at the EU share of trade, the latest data shows the EU share of exports still remains around pre-Brexit levels. This also shows the share of EU imports seems to have also recovered in recent months.

This was explored in detail by @thom_sampson and co-authors in their excellent paper last year, here: cep.lse.ac.uk/pubs/download/…

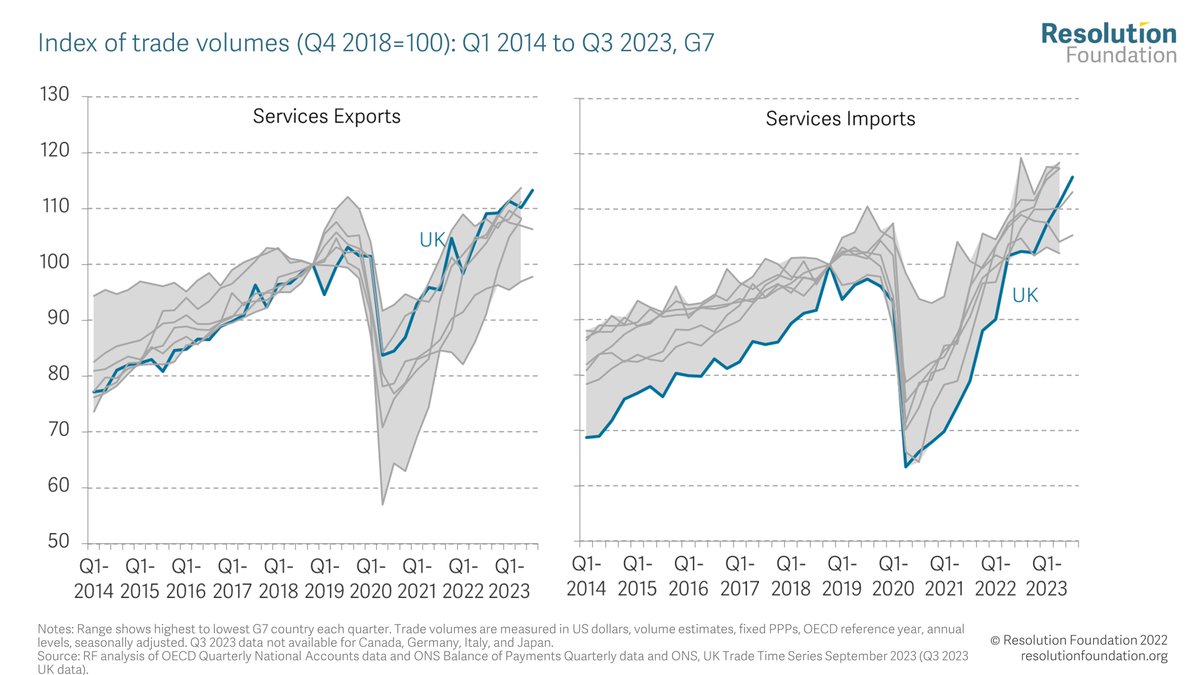

Services exports have also continued to perform comparatively well post-Brexit – as shown below the UK services exports remain among the strongest performers in the G7.

This is something we explored in our paper earlier this year: economy2030.resolutionfoundation.org/reports/open-f…

This is something we explored in our paper earlier this year: economy2030.resolutionfoundation.org/reports/open-f…

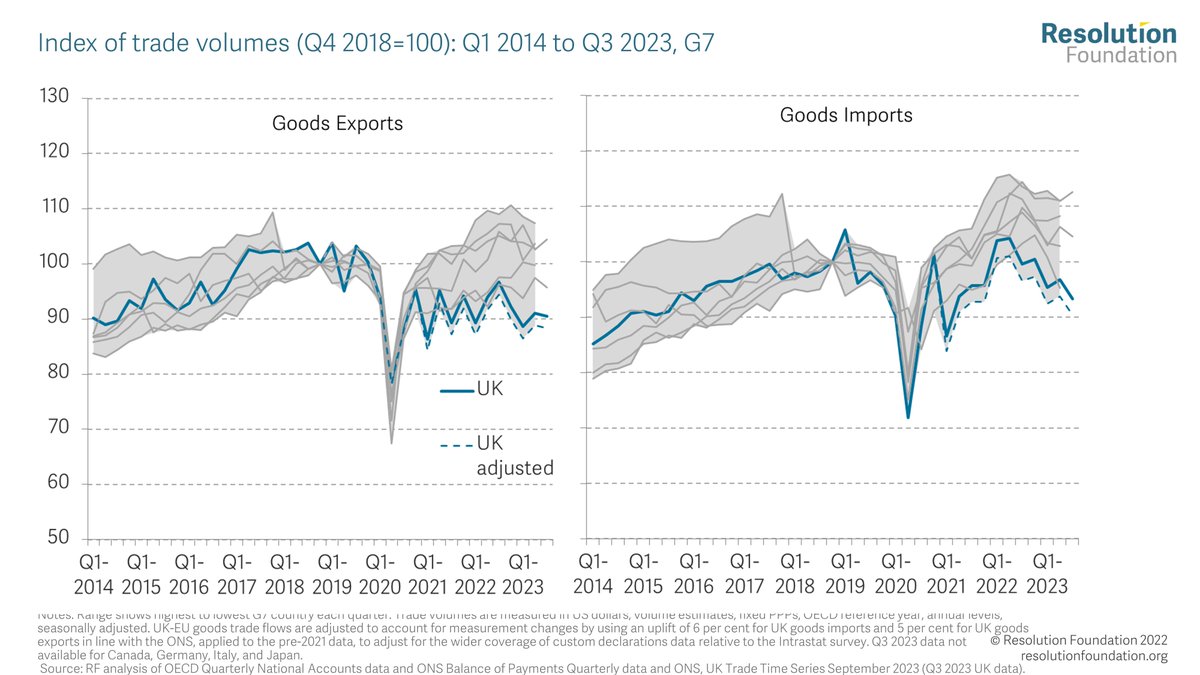

These still remain questions as we unpick the impacts of Brexit. But on many measures UK trade – and it’s important to consider both exports and imports – has underperformed post-Brexit. As shown below, the UK’s good trade has been trailing the rest of the G7 post-Brexit.

And @DennisNovy has been using the German trade data to track how the UK trade has been performing relative to similar German trading partners. And this too presents a pretty bleak picture of UK trade performance.

https://x.com/DennisNovy/status/1722301783513395575?s=20

@DennisNovy For a summary of post-Brexit trade performance @pmdfoster has you covered. Including our finding that UK trade openness was 3.6 pp down (H1 2019 to H1 2023), compared to a rise in trade openness of 0.2 points across the G7, excluding the UK.

ft.com/content/4ca9ae…

ft.com/content/4ca9ae…

@DennisNovy @pmdfoster Overall then Q3 2023 leaves the trade performance picture relatively unchanged, as the impacts of the oil price shock finish working their way through. Goods exports performance remain very weak, while services exports continue to be 'unexpectedly' strong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter