10/34 $MVST’s claim to fame is the lithium titanium oxide (LTO) battery, once promising because of its fast-charging properties but now abandoned by the industry due to low energy density and propensity to catch fire.

11/34 The founder of $MVST “unfortunately chose the wrong technical route,” a Chinese battery scientist told us.

12/34 Chinese battery engineers don’t consider $MVST a competitor anymore. “There are very few lithium titanate batteries now,” a Chinese battery engineer told us. “Is anyone still doing this in China? Those companies should all be gone.”

13/34 Much of $MVST’s backlog is reportedly for the new 53.5Ah battery, and mostly for U.S. and European customers. But dozens of companies offer this technology. Even if the backlog were real - which we doubt, can MVST compete with companies like Panasonic and CATL?

14/34 In 2018, a blank-check company called Tuscan Holdings was launched, initially for cannabis. Tuscan went public March 5, 2019 as THCB but never found any good cannabis targets. In July 2021, Microvast merged with THCB, and the new MVST started to trade on Nasdaq.

15/34 MVST’s lead manager was EarlyBirdCapital. EarlyBird also ran the SPAC for FFIE and Clever Leaves Cannabis, Soundhound, Finnovate, and many more.

16/34 In September, Director Zheng Yanzhuan sold over 300,000 shares, about 15% of his holdings. On November 14, he sold another million shares. Public investors should think about selling too. jcapitalresearch.com/mvst.html

17/34 We question why $MVST holds over $100 mln in short-term debt (reported in China) plus restricted cash. Given the lack of visible activity, we question whether the cash is needed to fund operations and capital expenditures or only give the appearance of operations.

18/34 We obtained credit reports on MVST subsidiaries in China for 2021. The Chinese parent company, Microvast Power Systems Co., Ltd., had $126 mln in short term bank and notes payable borrowings at the end of that year.

19/34 This contrasted with U.S. filings, which reported only $74 mln in short-term debt by end 2021. What happened to the other $52 mln?

20/34 We think $MVST hid from investors that it had lost a $200 mln grant. We believe MVST knew of the revocation in February 2023 and did not disclose the information until it was published online by Reuters months later.

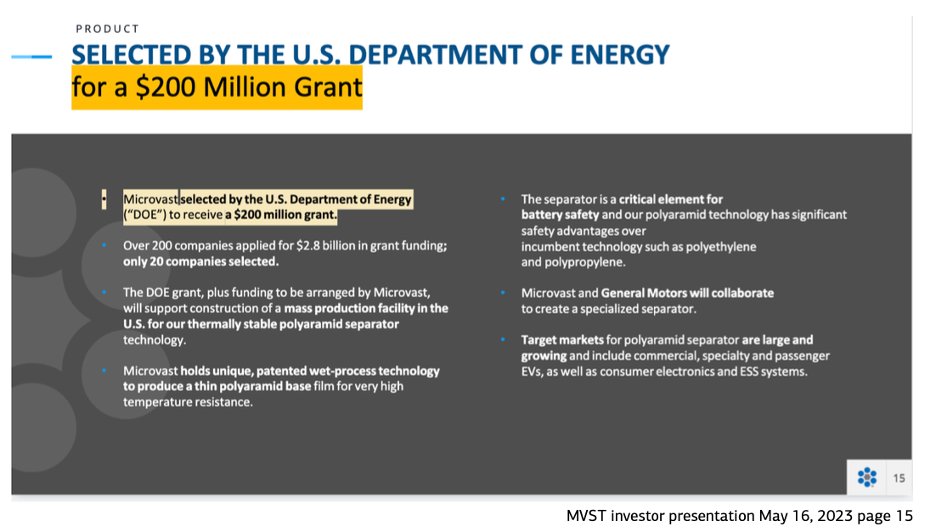

21/34 In November 2022, MVST announced that it had been selected for a $200 mln grant from the U.S. Department of Energy (DOE). The grant had been made specifically to fund a second plant in Clarksville, according to local news reports.

22/34 But in February 2023, MVST informed the town of Clarksville that it would not build a second plant there as promised despite having received the $200 mln grant. clarksvillenow.com/local/microvas…

23/34 That may have been because the DOE said that the grant was “under review.” Congress had prompted the DOE to reconsider on the grounds that MVST was actually Chinese.

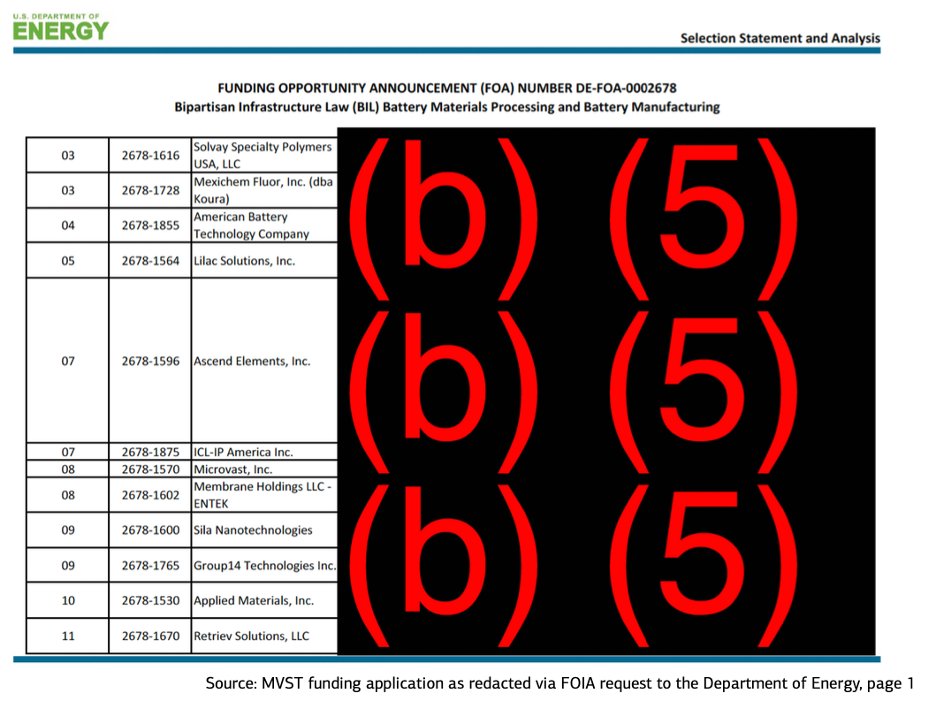

24/34 We sent Freedom of Information Act (FOIA) requests to various parts of the U.S. government seeking communications between DOE and MVST, but we received responses that were completely blacked out:

25/34 Given the vast paperwork surrounding this grant, we suspect MVST was likely directly informed about the grant revocation well in advance of Investor Day and possibly before the February communication with Clarksville.

26/34 Just two weeks after MVST changed its position on Clarksville, on February 16, 2023, Bloomberg reported as much, saying that “Microvast’s links to China have drawn outrage from lawmakers,” and “Funds are in ‘post-selection’ review.”

28/34 On May 23, 2023, MVST shares dropped by 36% after reports that the company had lost the grant. Several class-action suits are seeking information as to why MVST asserts it only received this news from the press.

29/34 On May 24, $MVST Chairman Wu Yang said: "the Company is surprised by the DOE’s decision to withdraw the grant.”

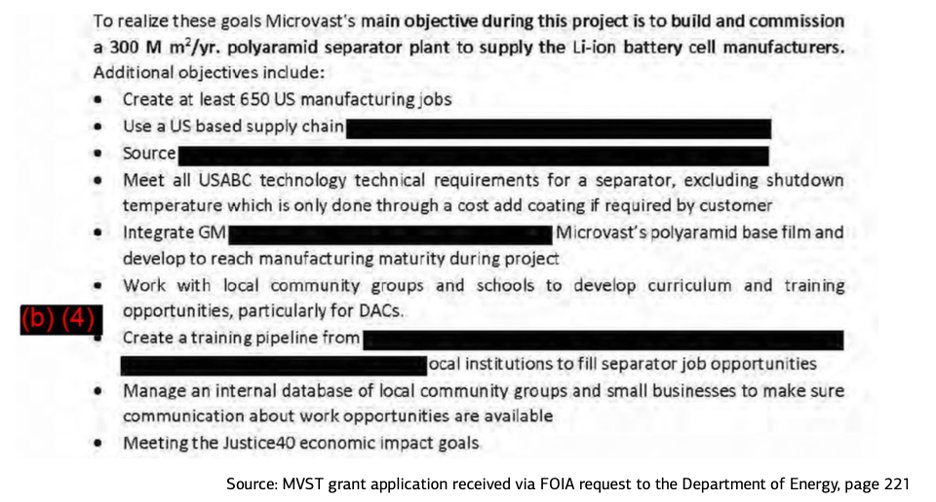

30/34 Back in May 2022, $MVST submitted a 240-page grant application and issued many interim announcements in the interim. As far as we can tell, the grant application did not mention China or say that 67% of revenue and assets were in China.

31/34 MVST has assured Clarksville that it is continuing to expand its first plant, even though plant 2 has been mothballed. But the video MVST has posted to demonstrate progress does not fill investors with confidence: nothing was inside the building as of June 2023.

32/34 Even the sales $MVST has made overseas have caused more problems than they solved, according to public reports. Is this part of why MVST abandoned its LTO battery technology?

33/34 In 2012, for example, $MVST’s batteries were deployed in London in 200 double-decker “New Routemaster” buses. In three years, 80 of the buses no longer used the batteries, according to the BBC. Ars Technica said; “The batteries just aren't fit for purpose."

34/34 The buses in the end emitted 74% more harmful particles than the buses they'd replaced, according to a report in Londonist. Read our report: jcapitalresearch.com/mvst.html

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter